Utilizing such a structured form offers several advantages. It facilitates consistent record-keeping, simplifies financial analysis by providing a standardized format, and aids in identifying potential discrepancies or errors. Furthermore, it empowers users to proactively manage their finances through simulations and projections, ultimately promoting better financial health and informed decision-making.

Understanding the structure and function of this type of document lays the groundwork for exploring related topics such as personal finance management, budgeting techniques, and the importance of accurate financial record keeping. This exploration will further delve into the practical applications and benefits of utilizing these tools for improved financial control and stability.

1. Structure Replication

Structure replication, in the context of a Bank of America statement template, refers to the precise duplication of the format, layout, and organization of an official bank statement. This includes replicating fields for dates, transaction descriptions, debit and credit amounts, and running balances. The accuracy of this replication is crucial for several reasons. It ensures compatibility with data analysis tools, facilitates accurate comparisons with authentic statements, and provides a familiar framework for users accustomed to the official document’s structure. Consider the implications of a misaligned template: data might be misinterpreted, formulas could malfunction, and valuable time could be wasted correcting errors. Accurate structure replication, therefore, forms the foundation for effective utilization of the template.

This precise mirroring of the official statement structure enables several practical applications. For instance, businesses might use replicated statements for internal training purposes, educating staff on how to interpret and analyze financial data. Individuals can utilize templates to create projected statements, exploring the potential impact of financial decisions. Furthermore, accurate replication simplifies the process of comparing projected or recreated statements against official bank records, streamlining reconciliation efforts and highlighting any discrepancies quickly. These examples demonstrate the tangible benefits derived from meticulous structure replication.

In conclusion, structure replication is not merely a cosmetic feature of a Bank of America statement template; it is a fundamental requirement for its effective utilization. It ensures data integrity, facilitates meaningful analysis, and supports various practical applications from training to forecasting. Failure to prioritize accurate structure replication undermines the template’s utility and potentially leads to misinterpretations or inaccuracies in financial analysis. A deep understanding of this principle is essential for leveraging the full potential of these templates for informed financial management.

2. Data Organization

Data organization is paramount when utilizing a template replicating a Bank of America statement. Effective organization allows for efficient analysis, accurate reporting, and informed financial decision-making. Without a structured approach to data management, the template’s potential benefits diminish significantly.

- CategorizationCategorizing transactions within the template, such as differentiating between purchases, payments, and deposits, is fundamental. This allows for granular analysis of spending habits and income streams. For example, categorizing all grocery expenses allows for precise tracking of monthly food costs. Without categorization, spending patterns remain obscured, hindering effective budgeting and financial planning.

- Chronological OrderMaintaining chronological order within the template mirrors the structure of an official bank statement, simplifying reconciliation and trend analysis. Observing transactions in the order they occurred reveals patterns and potential irregularities. Imagine trying to understand cash flow if transactions were randomly arranged. Chronological order provides a clear timeline of financial activity.

- Data ConsistencyConsistent data entry, using standardized formats for dates, descriptions, and amounts, ensures data integrity. Inconsistencies can lead to errors in calculations and misinterpretations of financial data. For instance, using varying date formats can complicate sorting and analysis. Consistent formatting promotes accuracy and reliability.

- Data IntegrityProtecting data integrity involves ensuring accuracy and completeness within the template. Regularly verifying entered data against official bank records helps identify and rectify discrepancies. Consider the impact of an incorrect transaction amount: it could skew budget projections and lead to inaccurate financial decisions. Maintaining data integrity safeguards against such errors.

These facets of data organization are crucial for leveraging the full potential of a Bank of America statement template. By implementing these practices, individuals and businesses can gain deeper insights into their financial activities, facilitating more informed decision-making and contributing to greater financial stability. Neglecting data organization, conversely, limits the templates effectiveness and potentially leads to flawed analysis and inaccurate financial projections.

3. Financial Analysis

Financial analysis relies heavily on accurate and organized data. A template replicating a Bank of America statement provides a structured framework for organizing financial transactions, facilitating in-depth analysis. This structure allows for the application of various analytical techniques, from calculating key financial ratios to identifying spending trends. For example, by inputting transaction data into a template, one can easily calculate metrics like the debt-to-income ratio or track monthly expenditures on specific categories. This structured approach enables a more comprehensive understanding of financial health than reviewing disorganized raw data. The ability to manipulate and analyze data within a familiar format empowers informed financial decision-making.

The template’s consistent format allows for historical analysis, trend identification, and forecasting. By comparing data across multiple statement periods, one can observe changes in spending patterns, income fluctuations, and overall financial performance. This historical perspective is crucial for identifying potential financial risks and opportunities. For example, consistently increasing expenses in a particular category might signal a need for budget adjustments. Analyzing trends within the structured template provides actionable insights for improving financial management and achieving financial goals. This predictive capability is crucial for proactive financial planning.

Leveraging a Bank of America statement template for financial analysis provides significant advantages. The structured format promotes accurate data entry and organization, simplifying complex analytical processes. This, in turn, enables more effective financial planning, risk management, and ultimately, improved financial outcomes. However, the accuracy of the analysis remains dependent on the quality and integrity of the data entered. Ensuring data accuracy is crucial for deriving meaningful insights and making sound financial decisions based on the analysis. Therefore, while the template provides a valuable tool, its effectiveness relies on meticulous data management.

4. Budgeting and Forecasting

Budgeting and forecasting are essential financial planning processes intrinsically linked to the effective use of a Bank of America statement template. The template provides a structured framework for organizing financial data, which forms the foundation for creating realistic budgets and accurate forecasts. Without a clear understanding of past financial activity, as presented in a structured format like a bank statement, developing effective budgets and forecasts becomes significantly more challenging. The template serves as a crucial tool for bridging the gap between historical financial data and future financial planning.

- Historical Data AnalysisA Bank of America statement template facilitates the analysis of historical spending patterns. By inputting transaction data into the template, users can categorize expenses, identify trends, and understand where their money is going. This historical perspective is fundamental for creating realistic budgets. For instance, by analyzing past spending on groceries, individuals can set a more accurate grocery budget for the upcoming month. Without this data-driven approach, budgeting becomes guesswork, increasing the likelihood of overspending and financial instability.

- Expense ProjectionTemplates enable expense projection by providing a structured format for extrapolating future costs based on historical data. By analyzing past spending patterns within the template, users can anticipate future expenses and allocate resources accordingly. For example, businesses can project future operating costs based on previous expenses recorded in the template, allowing for informed resource allocation and strategic planning. This forward-looking approach empowers proactive financial management.

- Income ForecastingWhile a bank statement primarily focuses on expenses, a template replicating its structure can also be adapted to incorporate income data. This allows users to forecast future income based on historical patterns, providing a more complete picture of their financial outlook. For freelancers or individuals with variable income, this feature can be particularly valuable for planning and managing cash flow effectively. Accurate income forecasting, combined with expense projections, enables more realistic budgeting and financial planning.

- Scenario PlanningA template facilitates scenario planning by allowing users to model different financial situations. By adjusting income or expense figures within the template, individuals and businesses can explore the potential impact of various financial decisions. For example, one could model the impact of a salary increase or a significant purchase on their overall financial health. This flexibility enables proactive financial management and informed decision-making.

In essence, a Bank of America statement template empowers informed budgeting and forecasting by providing a structured framework for organizing, analyzing, and projecting financial data. This data-driven approach enables more realistic financial planning, improved resource allocation, and greater financial stability. By leveraging the template’s capabilities, individuals and businesses can gain a deeper understanding of their financial position, facilitating more informed decision-making and contributing to long-term financial success.

5. Error Identification

Error identification represents a critical function facilitated by the utilization of a template replicating a Bank of America statement. This function plays a crucial role in maintaining financial accuracy and preventing potential financial losses. Discrepancies between a recreated statement and an official bank statement often reveal errors. These errors can range from simple data entry mistakes, such as an incorrect transaction amount, to more complex issues like unauthorized transactions or bank processing errors. A template provides a structured environment for meticulous comparison, increasing the likelihood of detecting such discrepancies. For instance, a user meticulously entering transactions into a template might discover a small, recurring unauthorized charge that could otherwise go unnoticed. Early identification of such errors allows for prompt corrective action, minimizing potential financial damage. Conversely, neglecting regular reconciliation increases the risk of overlooking errors, potentially leading to significant financial consequences.

Several factors contribute to the occurrence of errors in financial records. Human error, including typos and miscalculations, represents a common source. Technical glitches within banking systems can also introduce errors. Furthermore, fraudulent activity can manifest as unauthorized transactions, requiring immediate attention. A template, by facilitating detailed comparisons, provides a crucial tool for identifying errors regardless of their origin. Consider a scenario where a bank mistakenly credits a user’s account twice. Reconciling against a meticulously maintained template would quickly reveal this error, allowing for prompt rectification. Without this structured approach, such errors might persist, leading to complications and potential financial repercussions.

Effective error identification through the use of a template contributes significantly to maintaining accurate financial records, safeguarding against financial loss, and promoting financial stability. By diligently comparing recreated statements against official bank records, individuals and businesses can identify and rectify errors promptly, minimizing their impact. This practice fosters greater financial control and allows for more informed financial decision-making. Failing to prioritize error identification, conversely, increases vulnerability to financial inaccuracies and potential losses. Understanding the importance of error identification as a key function of a statement template is, therefore, essential for sound financial management.

Key Components of a Bank of America Statement Template

Understanding the core components of a document mirroring a Bank of America statement is crucial for leveraging its full potential. These components work together to provide a structured framework for managing financial information effectively.

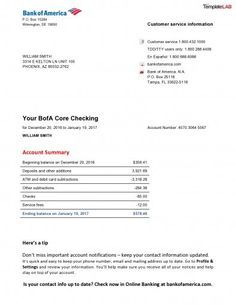

1. Account Information: This section typically includes the account holder’s name, account number, and statement period. Accurate account information ensures proper identification and association with the correct financial records. This is essential for maintaining organized records and preventing confusion.

2. Transaction Details: This component comprises the core of the statement, detailing individual transactions. Essential elements include transaction dates, descriptions, posting dates, and amounts. Clear and comprehensive transaction details are crucial for accurate record-keeping and subsequent analysis.

3. Running Balance: The running balance displays the account balance after each transaction. This dynamic record allows users to track the flow of funds and understand the impact of individual transactions on their overall financial position. Monitoring the running balance facilitates proactive financial management.

4. Summary Information: This section provides a consolidated overview of the statement period. It typically includes beginning and ending balances, total deposits, and total withdrawals. Summary information facilitates quick assessment of overall financial activity during a specific period.

5. Additional Information: Depending on the specific needs and purpose of the template, additional sections might include details such as interest earned, fees charged, or other relevant financial information. This flexibility allows for customization based on individual requirements.

Accurate representation of these components within the template enables comprehensive financial management, encompassing tracking, analysis, and planning. The structured layout facilitates efficient data entry, analysis, and comparison with official bank statements. This promotes informed financial decision-making and contributes to overall financial well-being.

How to Create a Bank of America Statement Template

Creating a template that accurately reflects a Bank of America statement requires careful attention to detail and a structured approach. The following steps outline the process:

1: Software Selection: Choose appropriate software. Spreadsheet applications like Microsoft Excel or Google Sheets offer robust functionality for creating and managing structured financial data. Their grid-based format readily accommodates the structure of a bank statement. Word processing software, while less ideal, can also be utilized, although it requires more manual formatting.

2: Replicate Header: Replicate the header section found on an authentic Bank of America statement. This typically includes the bank’s logo, the account holder’s name and address, and the statement period. Accuracy in this section is crucial for proper identification and record-keeping.

3: Establish Columns: Establish columns for essential transaction details. These columns should include the date of the transaction, a description of the transaction, the posting date (if different from the transaction date), the debit amount, the credit amount, and the running balance. Clear and concise column headers are essential for clarity.

4: Format Columns: Format the columns appropriately. Date columns should be formatted as dates to facilitate sorting and filtering. Currency columns should be formatted as currency to ensure accurate calculations and displays. Consistent formatting enhances readability and professionalism.

5: Incorporate Formulas: Incorporate formulas for automated calculations. The running balance column should utilize a formula that adds credits and subtracts debits from the previous balance. Automating this calculation minimizes the risk of manual errors and ensures accuracy.

6: Summary Section: Include a summary section at the bottom of the template. This section should calculate and display the beginning balance, total deposits, total withdrawals, and ending balance for the statement period. This summary provides a convenient overview of financial activity.

7: Testing and Refinement: Test the template thoroughly. Enter sample transaction data and verify the accuracy of formulas and calculations. Refine the template as needed to ensure its functionality and usability. Thorough testing ensures the template’s reliability.

8: Regular Updates: Bank of America might periodically update its statement format. Review official statements regularly and update the template accordingly to maintain its accuracy and relevance. Regular updates ensure the template remains aligned with the official statement structure.

Meticulous creation of a template replicating a Bank of America statement provides a valuable tool for managing financial information. Accurate replication of the statement’s structure, coupled with robust formulas and clear formatting, empowers users to effectively track, analyze, and reconcile their financial transactions, contributing to informed financial decision-making.

Templates replicating the structure of financial documents issued by specific institutions offer a powerful tool for enhancing financial management. From meticulous record-keeping and detailed analysis to informed budgeting and forecasting, these templates provide a structured framework for organizing and interpreting financial data. Accurate replication of the official document’s structure is paramount for ensuring compatibility and reliable analysis. Furthermore, the ability to identify errors through meticulous comparison safeguards against financial discrepancies and promotes financial stability. Understanding the core components, including account information, transaction details, and running balances, empowers users to leverage these templates effectively. The potential benefits extend beyond individual use; businesses can utilize these templates for training, forecasting, and internal financial analysis. Ultimately, consistent and diligent utilization of these tools fosters a deeper understanding of financial activity, enabling more informed decision-making and contributing to greater financial control.

Effective financial management hinges on accurate data and insightful analysis. Leveraging structured templates represents a proactive step towards achieving financial clarity and control. The ability to recreate, analyze, and project financial information empowers individuals and businesses to make informed decisions, mitigate risks, and pursue financial goals with greater confidence. As financial landscapes continue to evolve, embracing tools that promote clarity and accuracy becomes increasingly crucial for navigating complexities and achieving long-term financial stability. These templates, therefore, represent not just a tool for organizing data but a strategic asset for achieving financial success.