Utilizing such a resource offers several advantages. It allows individuals to familiarize themselves with the structure and content of an official document without needing to access their account or request a copy. This can save time and effort, especially for tasks like mock budgeting or software testing. Furthermore, it can serve as a valuable educational tool for understanding financial statements and developing responsible financial habits.

This understanding of a structured financial record’s format and benefits leads naturally to discussions about broader personal finance topics, including budgeting techniques, expense tracking, and financial planning strategies.

1. Accessibility

Accessibility, in the context of a complimentary replica of a financial document issued by a specific financial institution, refers to the ease with which individuals can obtain and utilize this resource. This ease of access is crucial for maximizing the benefits of such a tool, particularly for educational or practice purposes. Several facets contribute to the overall accessibility of these resources.

- Immediate AvailabilityOften available online, these replicas can be downloaded or accessed instantly, eliminating delays associated with requesting official documents. This immediacy facilitates spontaneous learning and practice, allowing users to engage with the material whenever convenient. This contrasts with the potential wait times associated with retrieving official records.

- Cost-EffectivenessThe complimentary nature of these resources removes financial barriers that might otherwise prevent individuals from accessing them. This is particularly beneficial for those exploring personal finance management on a limited budget or seeking educational resources without incurring costs. This aspect democratizes access to valuable learning tools.

- Format CompatibilityTypically available in widely compatible formats (e.g., PDF, spreadsheets), these replicas can be readily used across various devices and software applications. This broad compatibility ensures that users can utilize the resources regardless of their preferred technology platform. This adaptable nature enhances usability and accessibility.

- Simplified LanguageWhile mimicking the structure of official documents, these replicas often employ simpler language, enhancing comprehension for individuals unfamiliar with financial jargon. This simplified language makes the information more accessible to a wider audience, including those new to personal finance concepts. This clarity aids in understanding complex financial structures.

The accessibility of these resources empowers individuals to explore financial concepts, practice budgeting techniques, and familiarize themselves with bank statement structures without the constraints of accessing their personal accounts or incurring costs. This readily available tool contributes significantly to improved financial literacy and responsible financial management.

2. Practice Tool

A complimentary replica of a financial document issued by a specific financial institution serves as a valuable practice tool for various financial management tasks. This allows individuals to develop and refine skills related to budgeting, expense tracking, and financial analysis in a risk-free environment. The ability to manipulate figures and explore different scenarios without affecting actual accounts fosters a deeper understanding of financial dynamics. For instance, one might use such a template to practice categorizing expenses, creating a budget based on projected income and expenses, or testing different saving strategies.

The practical applications of this practice tool extend to software proficiency. Individuals can utilize these replicas to familiarize themselves with personal finance software or online banking platforms. Importing the template into budgeting apps or spreadsheet programs allows users to explore the software’s functionalities and learn how to effectively manage financial data. This hands-on experience proves particularly beneficial when transitioning to new financial management tools or seeking to maximize the utility of existing ones. Furthermore, these templates can be instrumental in educational settings, offering students practical experience with financial documents and concepts.

In summary, the value of a complimentary replica of a financial document issued by a specific financial institution as a practice tool lies in its ability to bridge the gap between theory and practice. It provides a safe and accessible environment for skill development, software exploration, and educational application, ultimately contributing to improved financial literacy and more effective financial management. This hands-on experience is crucial for navigating the complexities of personal finance and making informed financial decisions.

3. Educational Resource

A complimentary replica of a financial document issued by a specific financial institution holds significant value as an educational resource. It provides a tangible representation of a complex financial instrument, allowing individuals to dissect its components and understand its purpose without the complexities of real-world financial data. This removes the potential for confusion or intimidation that might arise when confronting an actual bank statement containing sensitive personal information. The simplified format allows learners to focus on structural elements and terminology, fostering a foundational understanding of financial recordkeeping. For example, educational modules can utilize these replicas to illustrate the difference between debits and credits, explain transaction coding, or demonstrate how account balances are calculated. This practical application reinforces theoretical concepts and promotes financial literacy.

Furthermore, these replicas can be instrumental in developing essential financial skills. Budgeting exercises can incorporate these templates, allowing individuals to practice allocating funds, tracking expenses, and projecting future balances based on hypothetical scenarios. This practical application builds confidence and competence in managing personal finances. In educational settings, instructors can leverage these resources to simulate real-world financial activities, providing students with valuable hands-on experience. This bridges the gap between theoretical knowledge and practical application, preparing individuals for responsible financial decision-making. For example, students can use the template to create a budget based on a hypothetical salary, allocate funds for various expenses, and track their simulated spending throughout a hypothetical month. This exercise provides a tangible understanding of budgeting principles and reinforces the importance of financial planning.

In summary, the educational value of a complimentary replica of a financial document issued by a specific financial institution lies in its ability to demystify complex financial instruments and provide a risk-free environment for skill development. By offering a simplified, accessible format, these resources empower individuals to build a strong foundation in financial literacy, cultivate responsible financial habits, and navigate the complexities of personal finance with greater confidence and competence. This foundational understanding is crucial for informed financial decision-making and long-term financial well-being.

4. Format Familiarity

Format familiarity, concerning complimentary replicas of financial documents issued by specific financial institutions, plays a crucial role in bridging the gap between theoretical financial concepts and practical application. Understanding the structure and layout of such documents allows individuals to navigate real-world financial statements with greater ease and confidence. This familiarity reduces the cognitive load associated with interpreting complex financial information, enabling more efficient and accurate analysis. For example, recognizing the sections dedicated to transaction details, account summaries, and fee disclosures allows users to quickly locate and process relevant information within an actual statement. This efficiency is especially valuable when managing multiple accounts or reviewing detailed transaction histories.

The practical significance of format familiarity extends beyond simply understanding the structure of a document. It fosters a deeper understanding of the information presented. Knowing where to locate specific data points, such as interest earned, fees charged, or transaction dates, empowers individuals to track their financial activity effectively and identify potential discrepancies. This proactive approach to financial management can help prevent errors, identify fraudulent activity, and facilitate informed financial decisions. For instance, consistent exposure to the format of a specific institution’s statement through the use of a complimentary replica can enable quicker detection of unauthorized transactions or unexpected fees.

In summary, format familiarity, achieved through the utilization of complimentary replicas, serves as a crucial stepping stone towards effective financial management. It demystifies the structure of financial documents, empowering individuals to interpret information accurately, track their finances diligently, and make informed decisions. This foundational understanding contributes significantly to improved financial literacy and fosters responsible financial behavior, ultimately leading to greater financial well-being. The ability to readily navigate and comprehend financial statements is a cornerstone of sound financial practice.

5. Financial Planning Aid

A complimentary replica of a financial document issued by a specific financial institution can serve as a valuable aid in financial planning. While not a substitute for professional financial advice or utilizing actual account statements, these templates offer a structured framework for developing, refining, and practicing various financial planning strategies. They enable individuals to explore hypothetical scenarios, experiment with different budgeting techniques, and visualize the potential impact of financial decisions without the risk associated with real-world finances.

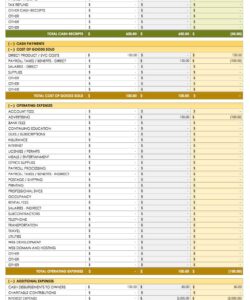

- Budgeting and ForecastingTemplates facilitate the creation of detailed budgets by providing a structured format for categorizing income and expenses. Users can input hypothetical figures or estimated values to project future financial outcomes and assess the feasibility of financial goals. This process allows for the exploration of various saving and spending scenarios, fostering a proactive approach to financial management.

- Scenario PlanningThe flexibility of a template allows for the creation of multiple scenarios, reflecting different potential financial outcomes. This “what-if” analysis enables individuals to assess their financial resilience in the face of unexpected events or changes in income. For instance, one might create scenarios reflecting a potential job loss, unexpected medical expenses, or a sudden increase in income, thereby developing strategies to mitigate financial risks and capitalize on opportunities.

- Goal Setting and TrackingBy utilizing a template to project future financial states, individuals can establish concrete financial goals and track their progress toward achieving them. Visualizing progress within the familiar format of a financial statement reinforces positive financial behaviors and provides motivation for continued adherence to financial plans. This visualization can be particularly effective in tracking progress towards goals such as saving for a down payment on a house, paying off debt, or accumulating retirement funds.

- Educational Tool for Financial LiteracyTemplates offer a risk-free environment for experimenting with financial concepts and developing a deeper understanding of financial statements. This practical application complements theoretical learning and fosters financial literacy, empowering individuals to make informed financial decisions. For example, individuals can use a template to explore the impact of compound interest on investments or visualize the long-term effects of different debt repayment strategies.

In conclusion, while a complimentary replica cannot replace the insights derived from professional financial advice or the analysis of actual financial records, it serves as a valuable tool for enhancing financial literacy, practicing essential financial planning skills, and fostering a proactive approach to personal finance management. This structured framework empowers individuals to explore various financial scenarios, set realistic goals, and develop effective strategies for achieving long-term financial well-being.

Key Components of a Complimentary Bank Statement Replica

Understanding the core components of a complimentary replica of a financial document issued by a specific financial institution is essential for maximizing its utility. These components mirror those found in actual bank statements, providing a realistic framework for practice and analysis.

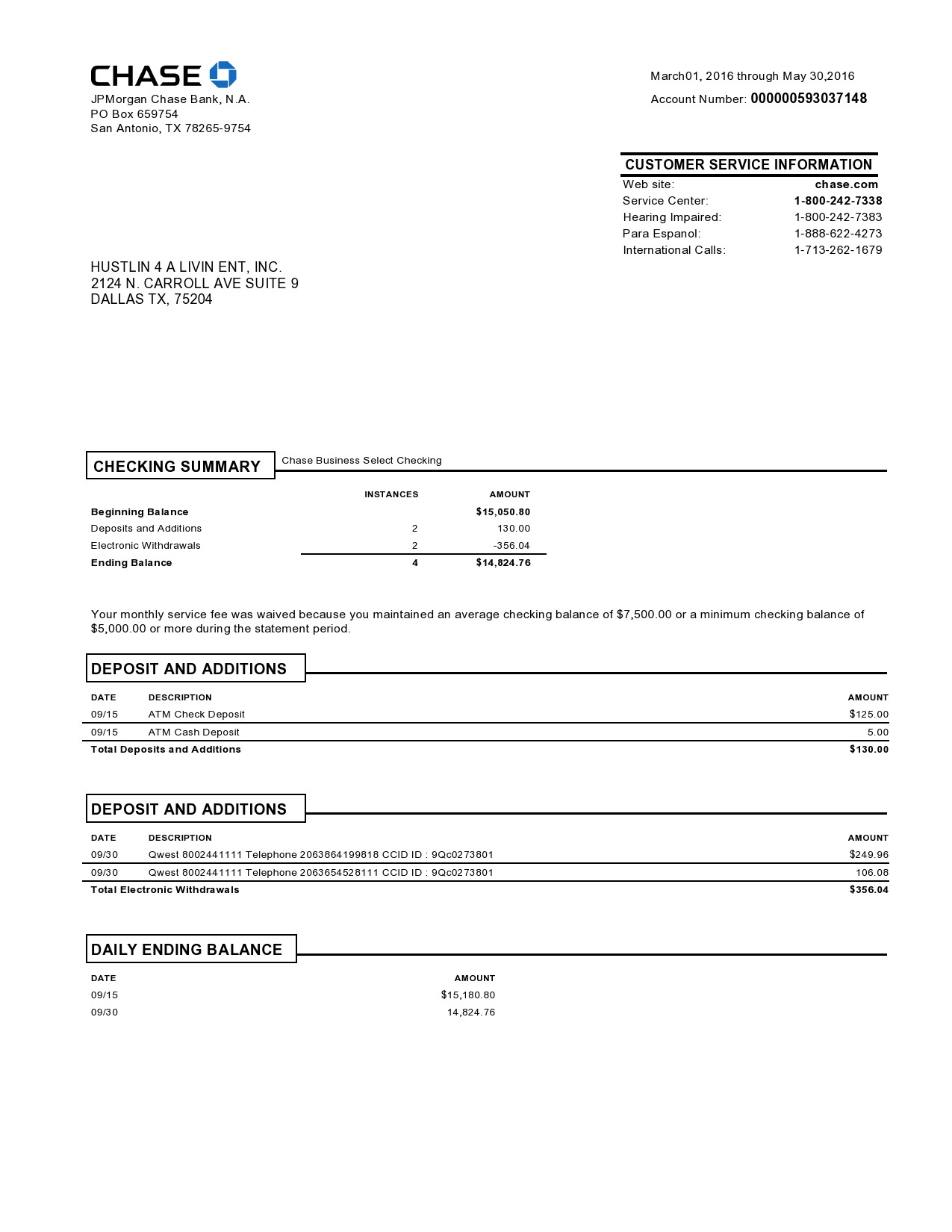

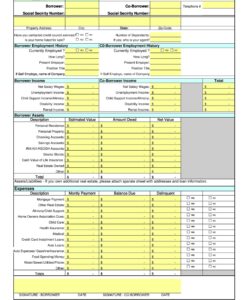

1. Account Information: This section typically includes the account holder’s name, account number, and the statement period covered. Accurate representation of this information is crucial for maintaining realism in practice scenarios.

2. Opening/Closing Balance: These figures represent the account balance at the beginning and end of the statement period. Understanding the relationship between these balances and the transactions listed is fundamental to financial analysis.

3. Transaction History: This section details all transactions processed during the statement period, including deposits, withdrawals, and fees. The transaction history provides the raw data necessary for budgeting, expense tracking, and financial analysis.

4. Transaction Details: Each transaction typically includes details such as the date, description, and amount. These details provide context for the transaction and enable accurate categorization and analysis.

5. Interest Earned (if applicable): For interest-bearing accounts, this section details the amount of interest earned during the statement period. Understanding how interest accrues is crucial for financial planning and maximizing returns.

6. Fees Charged (if applicable): This section outlines any fees incurred during the statement period, such as maintenance fees or overdraft charges. Awareness of potential fees is essential for responsible financial management.

7. Summary Information: This section might include summary statistics such as total deposits, total withdrawals, and net change in account balance. These summaries provide a high-level overview of account activity during the statement period.

Careful examination of these components provides a comprehensive understanding of the structure and content of a financial statement, laying the groundwork for effective financial management practices. This structured information allows for informed decision-making and contributes to improved financial literacy.

How to Create a Complimentary Bank Statement Replica

Creating a complimentary replica of a bank statement involves replicating the structure and key components of an official document. While specific design elements may vary depending on the intended use, several fundamental elements should be included for optimal functionality and realism. This process allows for practice with financial management software, development of budgeting skills, and enhanced understanding of statement components.

1. Software Selection: Choose a software application suitable for creating structured documents. Spreadsheet software, word processors, or dedicated financial software can be utilized. Selecting the appropriate software depends on the desired level of complexity and the intended use of the template. Spreadsheet software provides flexibility for calculations and financial modeling, while word processors offer greater control over formatting and text-based elements.

2. Header Creation: Replicate the header section of a typical bank statement, including placeholder fields for account information such as account holder name, account number, and statement period. Accurate representation of these elements enhances the realism and practical utility of the template.

3. Transaction Table Construction: Create a table to house transaction details. Columns should include date, description, debit/credit indicators, and transaction amount. This structured format facilitates accurate record-keeping and allows for detailed analysis of financial activity.

4. Balance Calculation: Incorporate formulas or functions to calculate running balances based on transactions. This automated calculation ensures accuracy and provides a realistic representation of account activity. For spreadsheet software, built-in functions can streamline this process.

5. Summary Section: Include a summary section reflecting key financial metrics such as opening balance, closing balance, total debits, and total credits. This summarized information provides a concise overview of account activity during the statement period.

6. Placeholder Data: Populate the template with placeholder data for practice or illustrative purposes. This allows users to interact with the template as they would with a real bank statement, practicing data entry, analysis, and other financial management tasks.

7. Customization (Optional): Consider customizing the template to match the specific format of a particular financial institution’s statements. This enhances realism for practice scenarios and allows for targeted skill development related to interpreting specific statement layouts.

8. Review and Refinement: Thoroughly review the completed template for accuracy and completeness. Ensure all formulas and functions are working correctly and that the template accurately reflects the intended structure and content. Refinement through testing and feedback enhances the template’s utility and effectiveness as a learning or practice tool.

By following these steps, a functional and realistic replica can be created, serving as a valuable tool for practicing financial management tasks, enhancing understanding of bank statement components, and developing essential financial skills. This structured approach facilitates improved financial literacy and informed financial decision-making.

Careful consideration of a complimentary replica of a financial document issued by a specific financial institution reveals its significant potential as a tool for enhancing financial literacy and promoting responsible financial practices. Its accessibility, combined with its capacity to serve as a practice tool, educational resource, and aid in financial planning, underscores its value for individuals seeking to improve their understanding and management of personal finances. The structured format facilitates familiarity with key components found in actual bank statements, empowering individuals to navigate complex financial information with greater confidence. Utilizing such resources allows for risk-free exploration of budgeting techniques, expense tracking, and financial goal setting.

Ultimately, leveraging resources that provide structured insights into financial documentation contributes to informed financial decision-making and fosters a proactive approach to personal finance management. This empowerment lays the foundation for long-term financial well-being and encourages continued engagement with responsible financial practices. The potential benefits extend beyond individual financial health, contributing to a more financially literate and empowered population.