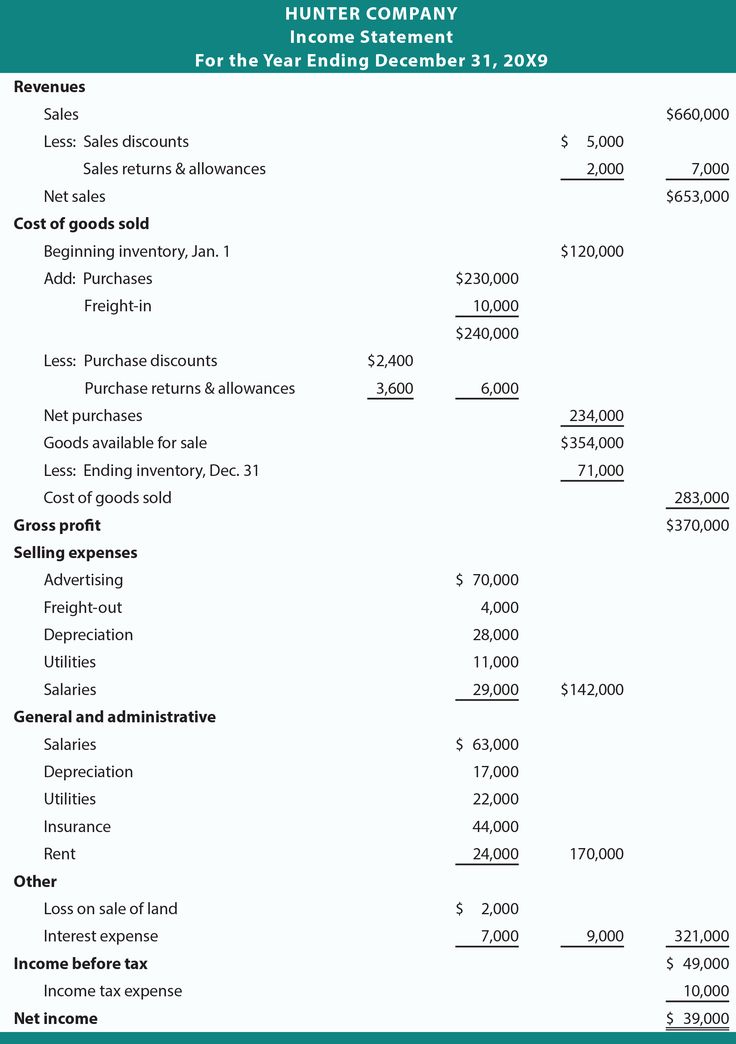

A structured financial report presents revenue, expenses, and profits or losses over a specified period, using multiple stages to calculate net income. This detailed format separates operating revenues and expenses from non-operating activities, such as interest income or losses from investments. It provides a clearer view of a company’s core profitability by distinguishing between results derived from primary business operations and those arising from secondary sources.

Using this structured approach offers several advantages. It enables stakeholders to assess a company’s operational efficiency and profitability separate from its other financial activities. This detailed breakdown facilitates a more comprehensive understanding of financial performance and allows for more informed decision-making by management, investors, and creditors. Furthermore, it aids in identifying areas for potential improvement and cost optimization within core business operations.

This enhanced understanding of financial performance facilitates informed strategic planning and resource allocation. The following sections delve deeper into the key components and practical applications of this valuable financial tool.

1. Operating Revenue

Operating revenue forms the foundation of the multi-step income statement. Its accurate representation is crucial for evaluating core business profitability and overall financial health. Understanding its components and their impact provides valuable insights for stakeholders.

-

Sales Revenue:

This represents income generated from the sale of goods or services. For a manufacturing company, this would be the revenue from selling finished products. In a service-based business, it represents income earned from providing services. Accurate sales revenue recognition is paramount for a reliable income statement. It directly influences gross profit and subsequent calculations.

-

Service Revenue:

This applies specifically to businesses primarily providing services. Examples include consulting fees, subscription fees for software, or maintenance contracts. Tracking service revenue separately allows for precise analysis of service-related profitability and performance. Its inclusion within the operating revenue section highlights the core nature of these activities for service-oriented entities.

-

Rent Revenue:

Companies owning and leasing properties recognize rental income as operating revenue. This reflects the income stream generated from these assets. For real estate businesses, rent revenue constitutes a primary income source. Distinguishing it within operating revenue allows for evaluation of the core property management operations.

-

Other Operating Revenue:

This category encompasses any other revenue directly related to core business operations, excluding the categories mentioned above. Examples include late fees, delivery charges, or royalties. While often smaller than primary revenue streams, these components contribute to the overall operational picture. Their inclusion ensures a complete and accurate representation of income generated from core business activities.

Accurate categorization and reporting of these revenue streams are fundamental for a robust multi-step income statement. This detailed breakdown facilitates a deeper understanding of revenue generation, aiding in performance evaluation and strategic decision-making.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a multi-step income statement template, COGS plays a crucial role in determining gross profit, a key indicator of operational efficiency. Accurately calculating COGS is essential for a reliable representation of profitability. This figure encompasses direct material costs, direct labor, and manufacturing overhead. For a manufacturer, raw materials, labor involved in production, and factory overhead contribute to COGS. A retailer’s COGS comprises the purchase price of goods sold. Understanding this distinction allows for a more accurate interpretation of financial performance across different business models.

The relationship between COGS and revenue is vital for understanding profitability. A higher COGS relative to revenue indicates lower gross profit margins, potentially signaling inefficiencies in production or procurement. For example, if a company’s revenue is $1 million and its COGS is $800,000, the gross profit margin is 20%. A competitor with the same revenue but a COGS of $600,000 achieves a 40% margin. This comparison highlights the impact of COGS on profitability and the importance of managing these costs effectively. Analyzing COGS trends over time can reveal valuable insights into operational efficiency and pricing strategies.

Accurate COGS calculation is critical for informed financial decision-making. Misrepresenting COGS can distort profitability metrics, leading to inaccurate assessments of business performance. Furthermore, proper COGS accounting ensures compliance with reporting standards and facilitates meaningful comparisons with industry benchmarks. By understanding the direct link between COGS and profitability within the multi-step income statement, businesses can make more informed decisions about pricing, production, and resource allocation. This knowledge allows for better cost control, improved profitability, and enhanced overall financial health.

3. Operating Expenses

Operating expenses represent the costs incurred from a company’s normal day-to-day business operations but are separate from direct production costs. Within a multi-step income statement template, these expenses are deducted from gross profit to arrive at operating income. A detailed understanding of operating expenses is crucial for evaluating a company’s efficiency and profitability.

-

Selling, General, and Administrative Expenses (SG&A):

SG&A encompasses costs related to sales, marketing, administration, and general corporate overhead. Examples include salaries of sales and marketing personnel, advertising expenditures, office rent, and utilities. High SG&A relative to revenue can indicate potential inefficiencies and warrant further investigation. Effective management of SG&A is crucial for optimizing profitability.

-

Research and Development (R&D) Expenses:

R&D expenses represent investments in developing new products or improving existing ones. These costs are expensed as incurred and are essential for long-term growth and competitiveness. While R&D can be a significant investment, its impact on future revenue generation is a key consideration. Analyzing R&D trends can provide insights into a company’s innovation focus and growth potential.

-

Depreciation and Amortization:

These non-cash expenses reflect the allocation of the cost of long-term assets over their useful lives. Depreciation applies to tangible assets like buildings and equipment, while amortization applies to intangible assets like patents and copyrights. Including these expenses in the income statement provides a more accurate representation of the cost of using these assets in generating revenue.

-

Impairment Charges:

Impairment charges reflect a reduction in the carrying value of an asset when its fair market value falls below its book value. These charges represent a non-recurring expense and can significantly impact profitability in the period they are recognized. Understanding the reasons behind impairment charges is crucial for evaluating a company’s asset management and financial health.

Careful analysis of operating expenses within the context of a multi-step income statement offers valuable insights into a company’s cost structure and operational efficiency. Comparing these expenses with industry benchmarks and tracking them over time allows stakeholders to identify areas for potential cost optimization and improved profitability. This granular view of expenses is essential for strategic decision-making and achieving sustainable financial performance.

4. Non-Operating Income

Non-operating income encompasses revenue and expenses unrelated to a company’s core business operations. Within a multi-step income statement template, it holds a distinct position, providing insights into financial performance derived from secondary sources. This categorization allows for a clearer delineation between core profitability and gains or losses arising from peripheral activities. Understanding its components is crucial for a comprehensive financial assessment.

Common examples of non-operating income include:

- Investment Income: This represents returns generated from investments in other companies or financial instruments, such as dividends from stock holdings or interest earned on bonds. For example, a manufacturing company might hold investments in other businesses, generating dividend income. This income, while contributing to overall profitability, is distinct from the core manufacturing operations.

- Interest Income: This refers to interest earned on cash held in bank accounts or other interest-bearing instruments. While a regular component of financial activity, it’s not directly tied to the primary revenue-generating operations.

- Gains/Losses on Asset Sales: This reflects profits or losses realized from the sale of assets not typically held for sale in the ordinary course of business, such as land or equipment. For instance, if a company sells a piece of unused land for more than its book value, the gain would be recorded as non-operating income.

- Interest Expense: This represents the cost of borrowing money, such as interest paid on loans or bonds. While a financing activity, it’s distinct from the operating expenses directly related to core business functions.

The inclusion of non-operating income in the multi-step format allows analysts to discern the core business’s operational strength. By segregating these items, stakeholders gain a more accurate picture of a company’s performance independent of ancillary activities. This is particularly valuable when comparing companies within the same industry but with differing investment portfolios or capital structures. Furthermore, understanding the composition of non-operating income can provide insights into management’s financial strategies and risk tolerance. Fluctuations in non-operating income warrant careful analysis as they can signal changes in investment returns or financing costs. This detailed breakdown ultimately facilitates more informed decision-making by providing a comprehensive view of all income streams and expenses, both operational and non-operational.

5. Net Income

Net income represents the culmination of the multi-step income statement template, reflecting a company’s overall profitability after all revenues and expenses have been considered. It’s derived by subtracting all expenses, including cost of goods sold, operating expenses, and non-operating expenses, from total revenues. This bottom-line figure is a crucial indicator of a company’s financial performance and its ability to generate profit for its shareholders. A multi-step income statement facilitates a granular understanding of how net income is derived, unlike a single-step statement which merely subtracts total expenses from total revenues. This detailed presentation clarifies the relationships between different revenue and expense categories, offering deeper insights into operational efficiency and profitability.

Consider a retail company. Its multi-step income statement would first calculate gross profit (revenue less cost of goods sold), then operating income (gross profit less operating expenses), and finally net income (operating income plus/minus non-operating items). This structured approach allows stakeholders to analyze profitability at different levels. For example, a decline in net income despite steady gross profit might indicate issues with operating expenses, such as rising administrative costs or increased marketing spend. This detailed breakdown wouldn’t be apparent in a single-step income statement. Another example is a manufacturing firm with a significant investment portfolio. The multi-step format separates investment income from operating income, providing a clearer picture of the company’s core manufacturing profitability and its performance as an investor. This segmentation allows for a more accurate comparison with other manufacturing companies that may not have substantial investment holdings.

Understanding the components of a multi-step income statement and their impact on net income provides crucial information for financial analysis and decision-making. This granular view of profitability enables stakeholders to identify strengths and weaknesses within a company’s operations, evaluate management’s performance, and make more informed investment decisions. Furthermore, the detailed breakdown facilitates comparisons with industry peers and historical trends, offering a comprehensive assessment of financial health and sustainability. While a single-step income statement provides a simplified overview, the multi-step format offers the depth and clarity necessary for strategic analysis and robust financial planning.

Key Components of a Multi-Step Income Statement

A multi-step income statement provides a detailed view of a company’s financial performance by breaking down revenues and expenses into distinct categories. Understanding these key components is crucial for a thorough analysis of profitability and operational efficiency.

1. Operating Revenues: Represent income generated from a company’s primary business activities. This includes sales revenue, service revenue, and any other income directly related to core operations.

2. Cost of Goods Sold (COGS): Represents the direct costs associated with producing goods sold by a company. This includes direct materials, direct labor, and manufacturing overhead.

3. Gross Profit: Calculated by subtracting COGS from operating revenues. This metric reflects the profitability of a company’s core products or services before considering operating expenses.

4. Operating Expenses: Encompass costs incurred from running the day-to-day business operations, excluding COGS. This category includes selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation and amortization.

5. Operating Income: Determined by subtracting operating expenses from gross profit. This key figure reflects the profitability of a company’s core business operations.

6. Non-Operating Income and Expenses: Include revenue and expenses not directly related to core business operations. Examples include interest income, investment income, gains or losses on asset sales, and interest expense.

7. Income Before Taxes: Calculated by adding non-operating income and subtracting non-operating expenses from operating income.

8. Income Tax Expense: Represents the expense associated with income taxes.

9. Net Income: The final result of the income statement, representing the company’s profit after all revenues and expenses have been accounted for. This is calculated by subtracting income tax expense from income before taxes. This bottom-line figure is a key indicator of a company’s overall financial performance.

Analyzing these components provides a comprehensive understanding of a company’s financial health, enabling stakeholders to assess profitability, efficiency, and identify areas for potential improvement.

How to Create a Multi-Step Income Statement

Creating a multi-step income statement requires a systematic approach to organize financial data and calculate key performance indicators. The following steps outline the process:

1. Gather Financial Data: Collect all relevant financial records for the specific accounting period, including sales invoices, purchase orders, expense reports, and bank statements. This comprehensive data collection ensures accuracy and completeness in subsequent calculations.

2. Calculate Net Sales Revenue: Determine gross sales revenue and deduct any sales returns, allowances, and discounts to arrive at net sales revenue. This represents the actual revenue earned from sales after accounting for adjustments.

3. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

4. Calculate Gross Profit: Subtract COGS from net sales revenue to arrive at gross profit. This figure represents the profitability of core products or services before considering operating expenses.

5. Itemize Operating Expenses: Categorize and list all operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation, and amortization. Detailed categorization facilitates analysis of cost structure.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This metric reflects the profitability of core business operations.

7. Account for Non-Operating Items: Include any non-operating income and expenses, such as interest income, investment gains/losses, and interest expense. This provides a comprehensive view of profitability from all sources.

8. Calculate Income Before Taxes: Add non-operating income and subtract non-operating expenses from operating income to arrive at income before taxes. This represents earnings before accounting for tax obligations.

9. Determine Income Tax Expense: Calculate the applicable income tax expense based on prevailing tax rates and regulations. Accurate tax accounting is essential for determining net income.

10. Calculate Net Income: Subtract income tax expense from income before taxes to arrive at net income, the bottom-line profit figure reflecting overall financial performance after all revenues and expenses have been considered.

A well-structured multi-step income statement presents a comprehensive analysis of financial performance, enabling informed decision-making through a clear understanding of profitability at various levels of operation.

Careful analysis using a multi-step income statement template offers a crucial understanding of financial performance beyond a simple bottom line. Its structured approach illuminates the relationships between revenue streams, production costs, operational expenditures, and non-operating activities, ultimately leading to a more transparent and insightful profit calculation. This detailed breakdown empowers stakeholders to dissect a company’s profitability at various levels, identify strengths and weaknesses within core operations, and gain a clearer perspective on overall financial health.

Leveraging this comprehensive financial tool equips businesses with the insights necessary for data-driven decision-making, strategic planning, and performance optimization. Its adoption fosters greater transparency and accountability, paving the way for sustainable growth and enhanced financial outcomes. A thorough grasp of this reporting method remains essential for informed financial management and effective communication with investors and stakeholders.