Utilizing such a structure offers several advantages. It enables better budgeting by providing a visual representation of spending habits, which can highlight areas for potential savings. This, in turn, can help individuals gain control over their finances, make informed decisions about their money, and work towards specific financial goals, like debt reduction or investing. Moreover, a documented financial overview can be invaluable for tax preparation and other financial planning activities.

This understanding of personal financial management forms the basis for exploring broader topics such as budgeting strategies, debt management techniques, and effective investment planning. These related concepts are crucial for achieving long-term financial stability and security.

1. Income

Accurate income recording is fundamental to a functional personal cash flow statement. A comprehensive view of income allows for realistic budgeting and informed financial decision-making. Understanding its various forms and properly documenting them is crucial for managing personal finances effectively.

- Earned IncomeThis constitutes the most common income source, encompassing salaries, wages, commissions, and bonuses received from employment. For example, a salaried employee would record their gross pay, while a freelancer might track individual project payments. Accurate recording of earned income is essential for calculating taxes and projecting future earnings.

- Investment IncomeThis includes dividends from stocks, interest earned on savings accounts and bonds, rental income from properties, and capital gains from the sale of assets. Tracking investment income separately allows for assessing investment performance and making informed adjustments to investment strategies. For instance, comparing dividend yields across different stocks can guide portfolio diversification.

- Passive IncomeThis represents income generated with minimal active involvement, such as royalties from intellectual property, income from a business in which one is not actively involved, or affiliate marketing revenue. Understanding passive income streams allows for exploring opportunities to diversify income sources and build long-term financial stability. For example, creating and selling an online course generates passive income after the initial development phase.

- Other IncomeThis category encompasses any income not falling into the previous categories. Examples include gifts, inheritances, alimony payments, and government benefits. While often less predictable, tracking other income sources provides a complete picture of all incoming funds, facilitating more accurate budgeting and financial planning. For instance, receiving a tax refund would be categorized under this section.

By meticulously categorizing and recording all income streams within a cash flow statement, individuals gain a comprehensive understanding of their financial resources, enabling more effective budgeting, informed financial goal setting, and ultimately, a more secure financial future.

2. Expenses

Accurate and detailed expense tracking is crucial for a comprehensive understanding of personal cash flow. Categorizing expenditures within a structured template provides insights into spending habits and informs effective budgeting strategies. This analysis allows for identifying areas of potential overspending and optimizing financial resource allocation.

- Fixed ExpensesThese recurring, predictable expenses remain relatively constant over time. Examples include mortgage or rent payments, insurance premiums, and loan repayments. Understanding fixed expenses allows for accurate budgeting and highlights the portion of income committed to essential obligations. Consistent tracking within a template reveals long-term trends and potential areas for cost reduction, such as refinancing a mortgage or switching to a more affordable insurance plan.

- Variable ExpensesThese fluctuate based on consumption habits and individual choices. Examples include groceries, utilities, transportation costs, and entertainment. Tracking variable expenses within a template reveals spending patterns and highlights areas where adjustments can significantly impact overall cash flow. For example, analyzing monthly grocery bills can identify opportunities to reduce food waste or explore more cost-effective shopping strategies.

- Discretionary ExpensesThese non-essential expenses represent spending on wants rather than needs. Examples include dining out, travel, hobbies, and luxury goods. While contributing to quality of life, discretionary expenses can significantly impact cash flow. Tracking these expenditures within a template allows for prioritizing spending and aligning discretionary choices with financial goals. For instance, evaluating entertainment spending might reveal opportunities to reallocate funds towards debt reduction or investment.

- Periodic ExpensesThese occur irregularly, often involving larger sums. Examples include annual property taxes, car repairs, or medical bills. While less frequent, periodic expenses can significantly impact cash flow if not anticipated. Incorporating these expenses within a template, even through estimated provisions, allows for better financial planning and avoids unexpected financial strain. For example, setting aside a monthly amount for anticipated car maintenance can mitigate the impact of a large, unexpected repair bill.

Categorizing and consistently tracking all expenses within a structured template provides a comprehensive view of spending habits. This detailed analysis facilitates informed budgeting decisions, identifies opportunities for cost optimization, and ultimately contributes to more effective financial management.

3. Net Flow

Net flow, the difference between total income and total expenses, represents the core output of an individual cash flow statement template. This crucial metric provides a concise snapshot of financial health, indicating whether an individual is accumulating surplus funds or operating at a deficit. Understanding net flow is fundamental for effective financial planning and achieving financial goals.

- SurplusA positive net flow indicates a surplus, meaning income exceeds expenses. This favorable financial position allows for saving, investing, and debt reduction. For example, a surplus can be allocated to an emergency fund, retirement contributions, or paying down a mortgage faster. Consistent surpluses contribute to long-term financial security and create opportunities for wealth building.

- DeficitA negative net flow indicates a deficit, meaning expenses exceed income. This situation requires careful analysis to identify areas for cost reduction and potential adjustments to income streams. For example, a deficit might necessitate reducing discretionary spending, exploring ways to increase income, or consolidating high-interest debt. Ignoring a persistent deficit can lead to accumulating debt and jeopardize long-term financial stability.

- Balancing Net FlowAchieving a balanced net flow, where income and expenses are equal, represents a neutral position. While not necessarily negative, it limits opportunities for significant progress towards financial goals. Strategies for improving net flow include increasing income through career advancement or side hustles, and optimizing expenses through budgeting and mindful spending habits. Regularly reviewing and adjusting a cash flow statement is essential for maintaining or achieving a positive net flow.

- Net Flow and Financial GoalsNet flow directly impacts the ability to achieve financial goals. Whether the goal is saving for a down payment on a house, funding higher education, or retiring comfortably, a positive and growing net flow is essential. Utilizing a cash flow statement template allows individuals to track progress towards these goals, make informed adjustments to spending and saving habits, and ensure alignment between current financial status and future aspirations. For instance, projecting future net flow can help determine the feasibility of reaching a specific savings target within a desired timeframe.

Analyzing net flow within the context of an individual cash flow statement template provides a powerful tool for assessing financial health and making informed decisions. By understanding and actively managing net flow, individuals can gain control over their finances, work towards their financial goals, and build a more secure financial future. Regularly reviewing and updating the template ensures that financial decisions remain aligned with long-term objectives and that any deviations from the desired net flow are addressed proactively.

4. Regular Tracking

Regular tracking forms the cornerstone of effective utilization of an individual cash flow statement template. Consistent monitoring of income and expenses provides a dynamic view of financial health, enabling proactive adjustments and informed decision-making. Without regular updates, the template becomes a static document, failing to reflect current financial reality and hindering its utility in achieving financial goals. For example, an unexpected medical expense, if not tracked, can disrupt a carefully planned budget and necessitate reactive, potentially less optimal, financial decisions. Consistent engagement with the template transforms it from a simple record-keeping tool into an instrument of financial control.

The frequency of tracking depends on individual circumstances and financial complexity. Some may find weekly updates sufficient, while others might benefit from daily or monthly reviews. The key is to establish a sustainable routine that allows for timely identification of trends and potential issues. For instance, regularly tracking grocery expenses can reveal creeping increases in food costs, prompting a review of shopping habits or exploration of alternative food sources. This proactive approach allows for adjustments before small discrepancies escalate into significant budgetary challenges. Furthermore, regular tracking fosters financial awareness, promoting a deeper understanding of spending patterns and enabling more informed financial choices.

Integrating regular tracking into financial management practices maximizes the value of an individual cash flow statement template. It empowers individuals to anticipate financial challenges, adapt to changing circumstances, and make informed decisions aligned with their financial goals. The discipline of regular tracking, while requiring consistent effort, yields substantial benefits in terms of financial control, stability, and ultimately, achieving long-term financial well-being. Neglecting this crucial aspect undermines the template’s effectiveness, reducing it to a passive record rather than a dynamic tool for financial progress.

5. Financial Health

Financial health represents the overall state of one’s personal finances. A robust financial position allows for navigating unexpected expenses, pursuing financial goals, and building long-term security. An individual cash flow statement template serves as a crucial diagnostic tool for assessing and improving financial health. By providing a structured framework for tracking income and expenses, the template facilitates informed decision-making and proactive financial management. Consistent use of this tool empowers individuals to gain control over their finances and work towards a healthier financial future.

- Awareness and ControlA cash flow statement fosters awareness of spending habits and income streams. This understanding is fundamental to gaining control over finances. For example, tracking expenses reveals areas of overspending, such as dining out or subscription services, allowing for adjustments to align spending with financial goals. This informed control enables proactive financial management rather than reactive responses to financial challenges. Without this awareness, provided by the template, individuals may remain unaware of inefficient spending patterns, hindering their ability to improve financial health.

- Goal Setting and AchievementFinancial goals, whether short-term like building an emergency fund or long-term like retirement planning, require a clear understanding of cash flow. The template provides a framework for setting realistic goals based on current income and expenses. For instance, analyzing net flow can determine the feasibility of saving a specific amount each month for a down payment on a house. Tracking progress within the template provides a visual representation of progress towards goals, motivating continued adherence to financial plans and enhancing the likelihood of achievement.

- Debt Management and ReductionManaging and reducing debt is a key component of financial health. A cash flow statement helps identify the proportion of income allocated to debt servicing. This awareness allows for prioritizing debt reduction strategies. For example, by identifying areas of discretionary spending within the template, individuals can reallocate funds towards paying down high-interest debt more aggressively. This targeted approach, facilitated by the template, accelerates debt reduction and improves overall financial health.

- Resilience and SecurityA healthy financial position provides resilience against unforeseen events. A cash flow statement, by promoting consistent saving and budgeting, strengthens financial security. For instance, maintaining an emergency fund, tracked within the template, provides a buffer against unexpected job loss or medical expenses. This financial cushion, built through disciplined tracking and planning facilitated by the template, mitigates the impact of financial shocks and contributes to long-term financial stability.

These facets of financial health are intricately linked to the consistent and effective utilization of an individual cash flow statement template. By providing a structured approach to tracking income and expenses, the template empowers individuals to gain control over their finances, make informed decisions, and work towards achieving their financial goals. Regular engagement with the template transforms it from a simple record-keeping tool into a powerful instrument for building and maintaining long-term financial well-being. The template, therefore, serves not merely as a reflection of financial health but as an active contributor to its improvement and sustainability.

Key Components of a Personal Cash Flow Statement

A well-structured personal cash flow statement provides a comprehensive overview of an individual’s financial status. Several key components contribute to this detailed financial picture, enabling informed decision-making and effective financial management.

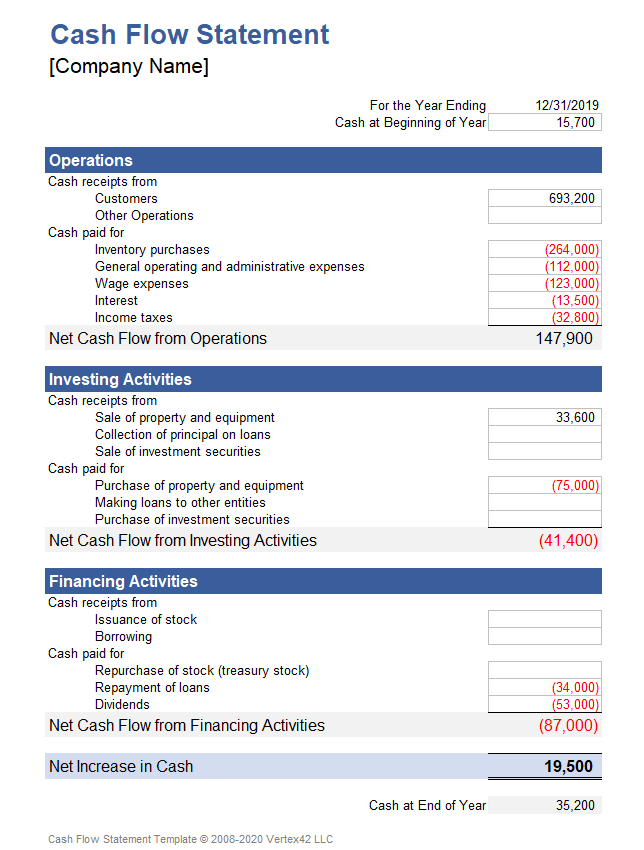

1. Income: All sources of income must be meticulously documented. This includes earned income (salaries, wages, commissions), investment income (dividends, interest, capital gains), passive income (royalties, business income), and other income (gifts, inheritances). Accurate income tracking provides the foundation for realistic budgeting and financial planning.

2. Expenses: Comprehensive expense tracking requires categorization into fixed expenses (rent, mortgage, insurance), variable expenses (groceries, utilities, transportation), discretionary expenses (entertainment, dining out), and periodic expenses (property taxes, repairs). Detailed expense tracking reveals spending patterns and identifies areas for potential cost optimization.

3. Net Flow: Calculated as the difference between total income and total expenses, net flow indicates whether an individual has a surplus or deficit. This crucial metric provides a snapshot of financial health and informs decisions regarding saving, investing, and debt management.

4. Timing: The chosen timeframe, whether monthly, quarterly, or annually, influences the scope of the cash flow statement. A monthly statement provides a granular view of short-term financial activity, while an annual statement offers a broader perspective on long-term trends and financial progress.

5. Savings and Investments: While not strictly income or expenses, tracking savings and investment contributions within the cash flow statement provides a comprehensive picture of financial allocation and progress toward long-term financial goals.

These components, when combined within a structured template, provide a powerful tool for assessing, managing, and ultimately improving personal finances. Regularly updating and analyzing these elements allows individuals to gain control over their financial situation and make informed decisions aligned with their long-term financial objectives.

How to Create an Individual Cash Flow Statement

Creating a personalized cash flow statement involves a structured approach to organizing financial information. This process facilitates a clear understanding of income, expenses, and overall financial health. A well-constructed statement empowers informed financial decision-making and contributes to achieving financial goals.

1. Choose a Timeframe: Select a timeframe relevant to financial goals and tracking preferences. Monthly statements provide granular detail, while quarterly or annual statements offer broader overviews. The chosen timeframe should align with the frequency of income and expense tracking.

2. Document Income Sources: Meticulously record all sources of income. Categorize income into earned income (salary, wages), investment income (dividends, interest), passive income (rental income, royalties), and other income (gifts, inheritances). Ensure accurate figures for each income source.

3. Categorize Expenses: Systematically categorize all expenses. Differentiate between fixed expenses (mortgage, rent, insurance), variable expenses (groceries, utilities), discretionary expenses (entertainment, dining out), and periodic expenses (property taxes, car repairs). Accurate expense categorization enables a detailed understanding of spending patterns.

4. Calculate Net Flow: Subtract total expenses from total income to determine net flow. A positive net flow signifies a surplus, while a negative net flow indicates a deficit. This crucial metric provides insight into overall financial health.

5. Track Savings and Investments: Include contributions to savings accounts, investment portfolios, and retirement plans. While not strictly income or expenses, tracking these contributions offers a comprehensive view of financial allocation and progress toward long-term goals.

6. Utilize a Template or Spreadsheet: Employ a template or spreadsheet software to organize information effectively. This structured approach simplifies data entry, calculations, and analysis. Numerous free templates and spreadsheet applications are readily available.

7. Regularly Review and Update: Regularly review and update the statement to reflect current financial activity. Consistent monitoring enables proactive adjustments to spending habits and ensures alignment with financial goals. The frequency of updates should correspond with the chosen timeframe.

Consistent application of these steps provides a dynamic tool for managing personal finances. Regularly reviewing and updating the statement facilitates informed financial decisions, promotes proactive adjustments, and ultimately contributes to achieving long-term financial well-being. This structured approach empowers informed financial control and supports a path toward financial security and success.

A structured approach to personal finance management, facilitated by an individual cash flow statement template, provides crucial insights into income, expenses, and overall financial health. Meticulous tracking, categorization, and analysis of financial data empower informed decision-making regarding budgeting, saving, investing, and debt management. Regular engagement with this tool allows for proactive adjustments to spending habits and ensures alignment with financial goals, fostering financial stability and control. Understanding and utilizing this framework offers a pathway toward achieving long-term financial well-being.

Effective financial management requires consistent effort and disciplined tracking. Utilizing a cash flow statement template provides the structure necessary for success in navigating complex financial landscapes. The consistent application of this tool empowers individuals to take control of their financial destinies, build a secure financial foundation, and work towards achieving long-term prosperity. Embracing this structured approach to personal finance is an investment in a more secure and fulfilling financial future.