A predefined format designed for organizing and presenting cash inflows and outflows within a specific period facilitates financial analysis. This structured approach categorizes cash activities into operations, investing, and financing, offering a clear picture of how a business generates and uses its funds.

Utilizing this pre-structured format provides several advantages. It simplifies the process of creating these crucial financial documents, ensuring consistency and accuracy. This consistency allows for easy comparison across different periods, enabling trend analysis and informed decision-making. Furthermore, a clear presentation of cash flow data assists stakeholders, including investors and creditors, in assessing financial health and stability.

This understanding of a structured approach to cash flow reporting forms the basis for exploring the specific components, creation methods, and practical applications in various business contexts.

1. Standardized Format

A standardized format is fundamental to the utility of a statement of cash flow template. Consistency ensures comparability across reporting periods and between different entities. This standardization facilitates analysis and allows stakeholders to quickly grasp the financial health of an organization.

-

Consistent Structure

A predefined structure ensures all essential elements are included and presented uniformly. This typically involves sections for operating activities, investing activities, and financing activities. Consistent placement of these sections allows for rapid identification and comparison of key figures, such as net cash flow from operations.

-

Uniform Terminology

Standard terminology prevents ambiguity and ensures clarity in reporting. Using consistent terms like “net income,” “depreciation,” and “capital expenditures” avoids confusion and facilitates understanding across different financial statements. This clarity is essential for accurate interpretation by investors and analysts.

-

Comparable Reporting

A standardized format enables comparison of cash flow performance over time. Analyzing trends in operating cash flow, for instance, can reveal insights into a company’s operational efficiency. Consistent reporting also allows for benchmarking against industry peers, providing a context for evaluating performance.

-

Regulatory Compliance

Adherence to a standardized format ensures compliance with accounting standards and regulations. Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) provide frameworks for presenting cash flow information, ensuring transparency and reliability for external stakeholders.

These facets of a standardized format contribute significantly to the effectiveness of a statement of cash flow template. By providing a consistent, clear, and comparable framework for reporting cash flows, the template enables informed financial analysis, sound decision-making, and regulatory compliance.

2. Categorized Activities

A core principle of a statement of cash flow template lies in the categorization of cash flows into distinct activities. This structured approach provides a granular view of how a business generates and utilizes cash, enabling a deeper understanding of its financial performance beyond net income figures. Categorization facilitates insightful analysis and informed decision-making by segregating cash flows into operations, investing, and financing activities.

-

Operating Activities

This category encompasses cash flows directly related to the core business operations. Examples include cash received from customers, cash paid to suppliers, and cash paid for salaries and wages. Analyzing operating cash flow reveals the profitability and efficiency of core business functions. Consistently positive operating cash flow indicates a healthy business capable of generating cash from its primary activities.

-

Investing Activities

Investing activities reflect cash flows associated with the acquisition and disposal of long-term assets. Examples include purchasing property, plant, and equipment (PP&E), acquiring other businesses, and selling investments. These cash flows provide insights into a company’s strategic capital allocation decisions and future growth prospects. Significant investments in PP&E might signal expansion plans, while divestitures could indicate a shift in strategic focus.

-

Financing Activities

Financing activities pertain to cash flows related to the company’s capital structure. Examples include issuing debt or equity, repurchasing shares, and paying dividends. Analyzing financing activities provides insights into a company’s financial leverage and its approach to distributing returns to shareholders. A reliance on debt financing could suggest higher financial risk, while consistent dividend payments may indicate financial stability and shareholder-friendly policies.

-

Importance of Categorization

The clear segregation of these activities allows analysts to assess the sustainability and quality of earnings. For example, a company reporting positive net income but negative operating cash flow may be using aggressive accounting practices. Conversely, strong operating cash flow combined with strategic investments can signal long-term growth potential. Understanding the interplay between these categories is crucial for a comprehensive assessment of financial health.

By categorizing activities, a statement of cash flow template offers a comprehensive and nuanced view of a companys financial dynamics. This structured approach facilitates a more thorough analysis than simply reviewing the net income, providing a more accurate assessment of financial health and sustainability.

3. Simplified Reporting

A statement of cash flow template contributes significantly to simplified reporting. The structured format inherent in the template streamlines the process of organizing and presenting complex cash flow data. This simplification benefits both preparers and users of financial statements. By providing a predefined framework, the template reduces the risk of errors and omissions, ensuring consistent and accurate reporting.

Consider a business with numerous transactions across various departments. Without a template, compiling cash flow information could become a cumbersome and error-prone task. A template pre-categorizes inflows and outflows, simplifying data entry and aggregation. For instance, cash received from customers automatically falls under operating activities, while proceeds from a loan are categorized under financing activities. This automation reduces manual effort and minimizes the potential for misclassification, ultimately leading to more accurate and reliable financial reporting.

Furthermore, simplified reporting through a template facilitates easier interpretation and analysis by stakeholders. Investors, creditors, and management can readily understand the company’s cash position and performance due to the consistent presentation of information. This transparency enhances trust and allows for more informed decision-making. For example, a clear presentation of operating cash flow trends enables stakeholders to assess the company’s ability to generate cash from its core business activities, which is critical for evaluating financial health and sustainability.

Moreover, simplified reporting through standardized templates aids in compliance with accounting regulations. Templates typically incorporate the required classifications and disclosures mandated by standards like GAAP or IFRS. This adherence to regulatory requirements reduces the risk of non-compliance and ensures the reliability and comparability of financial reports across different entities.

In conclusion, a statement of cash flow template directly facilitates simplified reporting, benefiting both the preparation and interpretation of financial information. By providing a standardized framework, it streamlines the reporting process, enhances accuracy, and facilitates informed decision-making by various stakeholders. This simplification is crucial for efficient financial management, transparent communication with stakeholders, and compliance with regulatory requirements.

4. Enhanced Analysis

A statement of cash flow template provides a structured framework that significantly enhances financial analysis. By organizing cash flow data into consistent categories, the template allows for deeper insights into an organization’s financial performance, going beyond the limitations of accrual-based accounting. This enhanced analysis facilitates better understanding of financial health, improved decision-making, and more effective communication with stakeholders.

-

Trend Identification

Templates facilitate the identification of trends in cash flow over time. By comparing cash flow statements from different periods, analysts can identify patterns in operating, investing, and financing activities. For example, consistently increasing operating cash flow might indicate improving profitability and operational efficiency, while declining cash flow from investing activities could suggest a slowdown in capital expenditures and potential future growth constraints. These trends offer valuable insights into the long-term trajectory of an organization’s financial health.

-

Performance Evaluation

The standardized format of a template enables benchmarking against industry peers and competitors. Comparing key metrics like operating cash flow margin and free cash flow allows for a relative assessment of financial performance. For instance, a company with a higher operating cash flow margin than its competitors might be considered more efficient in managing its working capital and generating cash from core operations. This comparative analysis provides valuable context for evaluating a company’s strengths and weaknesses.

-

Predictive Capabilities

Analyzing historical cash flow data within a template can enhance predictive capabilities. By understanding past cash flow patterns and drivers, financial professionals can develop more accurate forecasts of future cash flows. For instance, analyzing historical trends in accounts receivable and inventory turnover can help predict future working capital needs and inform cash flow projections. This forward-looking perspective is crucial for effective financial planning and resource allocation.

-

Investment Assessment

Templates facilitate a more robust assessment of investment opportunities. By analyzing the projected cash flows of potential investments within the standardized framework of a cash flow statement, organizations can make more informed capital budgeting decisions. Evaluating metrics like payback period, net present value, and internal rate of return using projected cash flow data enhances the rigor of investment analysis and reduces the risk of making suboptimal investment choices.

In summary, the structured approach offered by a statement of cash flow template unlocks enhanced analytical capabilities. By facilitating trend identification, performance evaluation, predictive modeling, and informed investment assessment, the template empowers stakeholders to gain a deeper understanding of an organization’s financial health and make more effective decisions. This enhanced analysis is crucial for driving sustainable growth and long-term financial success.

5. Improved Decision-Making

A structured approach to cash flow analysis, facilitated by a statement of cash flow template, directly contributes to improved decision-making within an organization. The template provides a clear and comprehensive view of cash inflows and outflows, enabling stakeholders to make more informed judgments across various business functions. This informed decision-making process is crucial for optimizing financial performance, mitigating risks, and achieving strategic objectives. Cause and effect relationships become clearer through this structured analysis. For example, if the template reveals consistently negative cash flow from operating activities despite positive net income, it signals a potential issue with revenue recognition or expense management. This insight prompts investigation and corrective action, leading to improved profitability and financial stability.

Consider a business evaluating a potential acquisition. Analyzing the target company’s cash flow statement, prepared using a standardized template, provides crucial insights into its ability to generate cash. This informs the valuation process and helps determine a reasonable acquisition price. Similarly, when deciding on capital expenditures, the template allows for the projection of future cash flows associated with the investment, facilitating a more robust assessment of its financial viability. For example, a manufacturer considering investing in new equipment can use the template to project the increased cash flows from higher production capacity, aiding in the justification of the investment.

Furthermore, the insights derived from a statement of cash flow template enhance strategic planning. Understanding historical cash flow trends and their underlying drivers allows for more accurate forecasting and budgeting. This informed approach to financial planning enables management to allocate resources effectively, anticipate potential cash flow shortfalls, and develop contingency plans. For example, if the template reveals seasonal fluctuations in cash flow, management can proactively arrange for short-term financing during periods of low cash inflow. The ability to anticipate and address potential challenges is a direct result of improved decision-making facilitated by the template.

In conclusion, the improved decision-making facilitated by a statement of cash flow template is not merely a byproduct but a central component of its utility. The template empowers stakeholders with the information necessary to make sound financial judgments across various contexts. From evaluating investment opportunities to optimizing working capital management and making strategic planning decisions, the template’s contribution to informed decision-making is essential for long-term financial success and organizational stability. Overcoming the challenge of consistently applying this structured approach to cash flow analysis can yield significant benefits in terms of financial performance and risk management.

Key Components of a Statement of Cash Flow Template

A comprehensive understanding of the key components within a statement of cash flow template is essential for accurate financial reporting and analysis. These components provide a structured framework for organizing and presenting cash flow data, enabling stakeholders to gain insights into an organization’s financial health and performance.

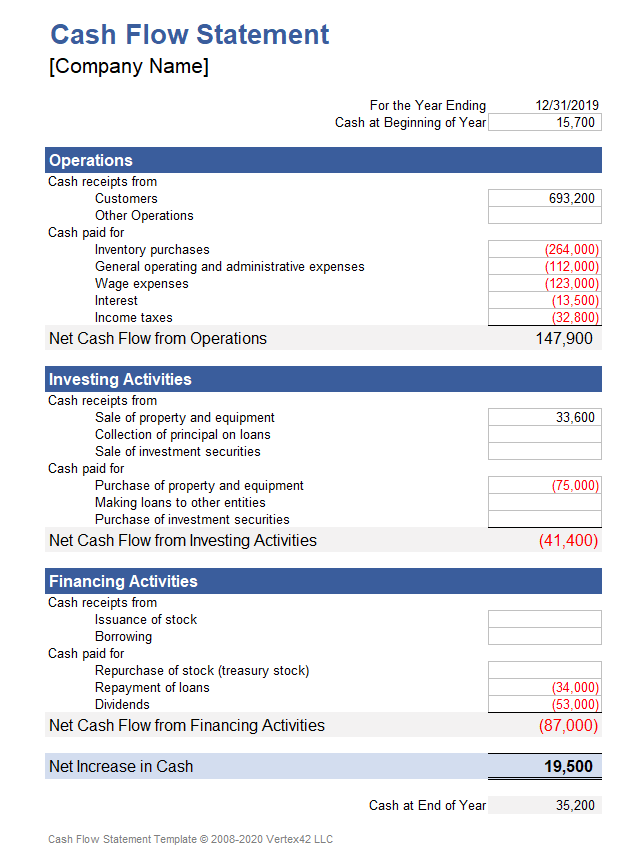

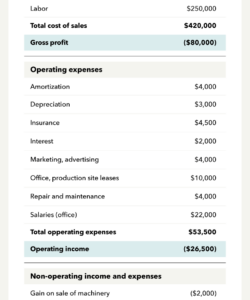

1. Operating Activities: This section details cash flows generated from the core business operations. Key elements include cash received from customers, cash paid to suppliers, and cash paid for salaries and wages. This section reveals the profitability and efficiency of the core business functions.

2. Investing Activities: This section captures cash flows related to the acquisition and disposal of long-term assets. Key elements include purchases of property, plant, and equipment (PP&E), acquisitions of other businesses, and proceeds from the sale of investments. This section provides insights into strategic capital allocation decisions.

3. Financing Activities: This section presents cash flows related to changes in the company’s capital structure. Key elements include proceeds from issuing debt or equity, repurchases of shares, and dividend payments. This section offers insights into a company’s financial leverage and its distribution of returns to shareholders.

4. Beginning Cash Balance: This crucial starting point represents the cash available at the beginning of the reporting period. It serves as the foundation upon which cash inflows and outflows are applied to determine the ending cash balance.

5. Ending Cash Balance: This figure represents the cash available at the end of the reporting period. It is derived by adding net cash flow from operating, investing, and financing activities to the beginning cash balance. This figure is a key indicator of an organization’s liquidity and its ability to meet short-term obligations.

6. Non-Cash Transactions: While not directly impacting cash flow, certain significant non-cash transactions are disclosed in a separate note or schedule accompanying the statement. Examples include converting debt to equity or exchanging assets. This disclosure provides a more complete picture of the organization’s financial activities.

7. Supplemental Disclosures: Further details and explanations regarding specific items within the statement are often provided through supplemental disclosures. These disclosures offer additional context and transparency, enabling users to gain a deeper understanding of the organization’s financial position.

These components, when presented within a standardized template, provide a comprehensive view of an organization’s cash flow dynamics, supporting informed financial analysis, strategic planning, and effective decision-making.

How to Create a Statement of Cash Flow Template

Creating a statement of cash flow template requires a structured approach to ensure consistency and accuracy. The following steps outline the process of developing a template suitable for various business needs.

1. Define Reporting Period: Establish the specific time frame covered by the statement, whether monthly, quarterly, or annually. A consistent reporting period allows for accurate comparisons and trend analysis across different periods. Clarity in the reporting period is fundamental for meaningful interpretation.

2. Structure Main Sections: Create distinct sections for operating activities, investing activities, and financing activities. This categorization is crucial for organizing cash flows and providing a clear picture of how a business generates and uses its funds.

3. Categorize Cash Flows: Within each section, categorize specific cash inflows and outflows. For example, under operating activities, list cash receipts from customers and cash payments to suppliers. Precise categorization is essential for accurate analysis.

4. Include Beginning and Ending Balances: Clearly state the beginning cash balance at the start of the reporting period and calculate the ending cash balance based on net cash flows from all activities. These balances provide context and demonstrate the change in cash position over the period.

5. Incorporate Formulas for Calculations: Embed formulas to automate calculations, such as net cash flow from each activity and the overall net change in cash. Automated calculations ensure accuracy and efficiency in generating the statement.

6. Add a Section for Non-Cash Transactions: Include a dedicated area to disclose significant non-cash transactions, such as debt-to-equity conversions or asset exchanges, which provide a more complete overview of financial activities.

7. Format for Clarity and Readability: Format the template with clear labels, consistent font styles, and appropriate spacing. A well-formatted template ensures easy readability and interpretation for all stakeholders.

8. Test and Refine: Before widespread use, test the template with sample data to verify its accuracy and functionality. Refine the template based on testing results to ensure its effectiveness and usability.

A well-designed template ensures consistent reporting, facilitates accurate analysis, and supports informed decision-making within an organization. Adhering to these steps allows for the creation of a robust and effective statement of cash flow template, providing a crucial tool for managing financial performance and achieving strategic objectives.

Accurate and insightful financial reporting is paramount for organizational success. A statement of cash flow template provides the crucial framework for organizing, presenting, and analyzing cash flow data. By categorizing cash flows into operations, investing, and financing activities, the template allows stakeholders to understand the sources and uses of cash, enabling informed assessments of financial performance, liquidity, and solvency. Standardized templates ensure consistency, comparability, and efficiency in reporting, supporting effective communication with investors, creditors, and other stakeholders. Furthermore, the insights derived from a well-structured statement of cash flow empower management to make strategic decisions regarding capital allocation, financing, and operational efficiency.

Effective utilization of a statement of cash flow template represents a commitment to financial transparency and sound fiscal management. This commitment is essential not only for navigating current financial challenges but also for building a sustainable foundation for future growth and prosperity. Consistent application of this structured approach to cash flow analysis, combined with careful interpretation of the insights derived, is crucial for achieving long-term financial stability and realizing strategic objectives. The ability to effectively manage cash flow remains a critical determinant of organizational success in any economic environment.