Utilizing a no-cost, pre-designed format for tracking real estate finances offers several advantages. It can streamline accounting processes, saving time and effort. Accessibility to such resources allows individuals and businesses to monitor profitability more effectively, supporting informed decision-making regarding investments and operational strategies. Furthermore, these templates can enhance transparency and accountability, enabling better communication with stakeholders and potential investors.

This understanding of financial tools designed for real estate ventures provides a foundation for exploring broader topics within the field. Key considerations include analyzing market trends, implementing effective management practices, and leveraging available resources for optimizing investment returns.

1. Accessibility

Accessibility is a crucial aspect of free real estate profit and loss statement templates. Widespread availability empowers a broader range of users, from individual investors managing single properties to larger firms overseeing extensive portfolios, to benefit from structured financial tracking. Previously, such tools may have been limited to those with the resources to purchase specialized software or hire financial professionals. Free, readily available templates democratize access to sophisticated financial management practices, fostering greater financial literacy and informed decision-making across the real estate sector. For example, a new investor with limited capital can leverage a free template to track income and expenses just as effectively as a seasoned professional. This levels the playing field, fostering greater market participation and potential for success.

The ease of access also translates to faster adoption and implementation of sound financial practices. Templates can be downloaded and utilized immediately, eliminating delays associated with procurement processes or the need for extensive training. This immediate usability enables users to quickly gain insights into property performance, identify potential issues, and make timely adjustments to their strategies. Consider a property manager handling multiple units. Access to a free template allows for rapid assessment of each property’s profitability, enabling efficient allocation of resources and proactive management of underperforming assets.

Ultimately, the accessibility of free real estate profit and loss statement templates contributes to a more transparent and efficient real estate market. By lowering the barrier to entry for sound financial management, these resources empower individuals and organizations to operate more strategically and sustainably. This benefits not only individual stakeholders but also the broader market by promoting stability and informed investment decisions. Challenges remain in ensuring consistent usage and accurate data entry, but the widespread availability of these tools represents a significant step toward broader financial literacy and improved practices within the real estate industry.

2. Financial Clarity

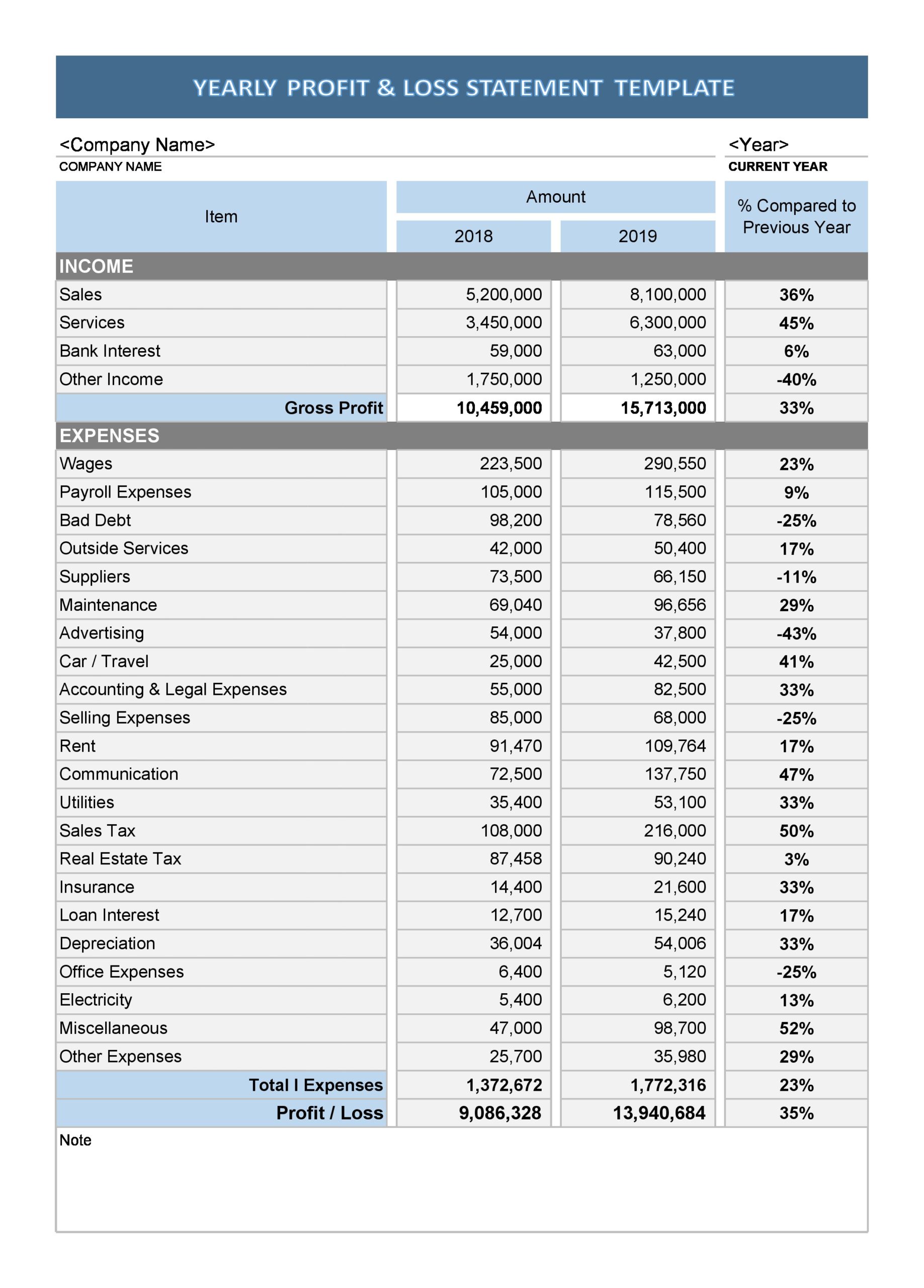

Financial clarity is paramount in real estate investment and management. Utilizing a free real estate profit and loss statement template directly contributes to achieving this clarity. The structured format of these templates ensures consistent categorization of income and expenses. This standardization allows stakeholders to quickly grasp the financial health of a property or portfolio, facilitating informed decision-making. For instance, clearly delineated operating expenses, such as property taxes and maintenance costs, alongside rental income, provide a transparent view of profitability. Without such a structured approach, critical financial details can become obscured, potentially leading to misinformed investment strategies or overlooked operational inefficiencies.

Furthermore, the use of a template promotes a more proactive approach to financial management. Regularly updating the statement, even with a free template version, fosters a disciplined approach to tracking income and expenses. This regular engagement allows for timely identification of trends, both positive and negative. For example, consistently rising maintenance costs, readily apparent within a well-maintained statement, might signal the need for preventative repairs or capital improvements. Early identification of such trends allows for timely interventions, potentially mitigating larger financial setbacks in the future. Such proactive management is often a direct result of the readily available financial insights a structured template provides.

In conclusion, the connection between financial clarity and the utilization of a free real estate profit and loss statement template is undeniable. While free versions may lack some features of paid software, their standardized format and accessibility offer significant benefits. The resulting clarity empowers informed decision-making, promotes proactive financial management, and ultimately contributes to more successful real estate ventures. Challenges in maintaining accurate records and consistent usage remain, but the fundamental value of these tools in fostering financial clarity remains crucial for effective real estate operations.

3. Simplified Tracking

Simplified tracking is a key benefit derived from using a free real estate profit and loss statement template. These templates provide a pre-built structure for recording financial transactions, eliminating the need to design a system from scratch. This structured approach streamlines the process of categorizing income and expenses, reducing the likelihood of errors and omissions. For example, a property manager dealing with multiple rental units can easily categorize rent payments, maintenance expenses, and property taxes within the designated sections of the template. This structured approach facilitates accurate record-keeping and minimizes the risk of overlooking critical financial details. The simplified tracking process also allows for quicker generation of reports, providing timely insights into financial performance.

The inherent simplicity of these templates also contributes to improved data accuracy. A clearly defined structure minimizes ambiguity, guiding users to input data consistently. This consistency is crucial for generating reliable reports and making informed decisions based on accurate financial information. Imagine comparing the performance of two similar properties. Consistent data entry across both properties, facilitated by the template’s structure, ensures a meaningful comparison, enabling accurate identification of the more profitable investment. Without this structured approach, inconsistencies in data entry can lead to distorted comparisons and potentially flawed investment decisions.

In summary, simplified tracking, facilitated by free real estate profit and loss statement templates, offers significant advantages. Streamlined data entry processes enhance accuracy and efficiency, while pre-built structures minimize the risk of errors and omissions. This ultimately contributes to better-informed decision-making and more effective financial management within the real estate sector. Challenges remain in ensuring consistent usage and accurate data entry, but the inherent simplicity of these tools offers a valuable resource for improved financial tracking practices. Their adoption contributes to a more transparent and efficient approach to real estate investment and management.

4. Informed Decisions

Informed decisions are crucial for success in real estate. A free real estate profit and loss statement template plays a significant role in facilitating these decisions. By providing a clear and organized overview of income and expenses, these templates empower stakeholders with the necessary financial insights to make sound judgments. Consider a scenario where an investor is evaluating the potential purchase of a rental property. Utilizing a free template to analyze the projected income and expenses allows for a data-driven assessment of potential profitability and return on investment. This informed approach minimizes the risk of making impulsive decisions based on incomplete or inaccurate financial information. Conversely, operating without such a tool increases the likelihood of financial missteps, potentially leading to negative returns or missed investment opportunities.

Furthermore, the insights gleaned from a well-maintained profit and loss statement, even a free version, extend beyond initial investment decisions. Ongoing monitoring of income and expenses allows for proactive adjustments to operational strategies. For instance, a consistent increase in maintenance costs, readily apparent within the statement, might prompt an investigation into the underlying causes. This could lead to the identification of necessary repairs, preventative maintenance measures, or even the decision to divest from an underperforming asset. Without the readily available financial data provided by the template, such trends might go unnoticed, potentially leading to escalating costs and diminished returns. The accessibility of free templates empowers stakeholders at all levels to make data-driven decisions, optimizing financial outcomes throughout the investment lifecycle.

In conclusion, the link between informed decisions and the utilization of a free real estate profit and loss statement template is fundamental. While free versions may lack some features of paid software, they provide essential financial insights, empowering stakeholders to make sound judgments regarding investments, operations, and overall financial strategies. Challenges remain in ensuring consistent usage and accurate data entry, but the readily available data provided by these tools forms the bedrock of informed decision-making in real estate. Their adoption contributes significantly to a more data-driven and strategically sound approach to real estate investment and management.

5. Time Efficiency

Time efficiency is a significant advantage offered by free real estate profit and loss statement templates. Manual creation and maintenance of financial statements can be time-consuming, requiring significant effort to organize and categorize data. Pre-designed templates eliminate this manual process, providing a ready-to-use structure that significantly reduces the time required for data entry and analysis. Consider the case of a property manager overseeing multiple properties. Utilizing a template allows for streamlined data entry, enabling faster generation of financial reports for each property, freeing up time for other essential management tasks. This efficiency translates to cost savings, as less time is spent on administrative tasks, and allows for more rapid responses to changing market conditions. The time saved can be redirected towards more strategic activities, such as property improvements or market analysis, ultimately enhancing profitability.

Furthermore, the automated calculations within these templates contribute significantly to time savings. Instead of manually calculating totals and percentages, users can input the raw data, and the template automatically generates key financial metrics. This automation minimizes the risk of calculation errors and significantly reduces the time required for analysis. For example, calculating net operating income (NOI) becomes a matter of data entry, rather than a manual calculation process. This efficiency allows for quicker identification of trends and potential issues, enabling more timely and effective responses. The rapid access to accurate financial data facilitates agile decision-making, a crucial advantage in the dynamic real estate market.

In conclusion, the impact of free real estate profit and loss statement templates on time efficiency is substantial. Streamlined data entry, automated calculations, and readily available reporting capabilities contribute to significant time savings. This efficiency allows real estate professionals to focus on more strategic activities, enhancing productivity and ultimately contributing to improved financial outcomes. While challenges remain in ensuring data accuracy and consistent template usage, the time-saving benefits represent a compelling argument for their adoption within the real estate industry. This efficiency empowers more informed, data-driven decision-making and contributes to a more agile and responsive approach to real estate management.

6. Standardized Format

Standardized format is a critical aspect of free real estate profit and loss statement templates. This consistent structure provides a common framework for organizing and interpreting financial data, enabling comparability across different properties, portfolios, and time periods. This standardization facilitates more effective analysis, benchmarking, and communication among stakeholders. Without a standardized format, comparing financial performance becomes challenging, hindering effective decision-making and potentially obscuring critical trends.

- ComparabilityA standardized format enables direct comparison of financial performance across different properties or portfolios. This is crucial for investors evaluating investment opportunities or property managers assessing the relative performance of managed assets. For example, standardized reporting allows for easy comparison of net operating income (NOI) across multiple properties, facilitating identification of top performers and underperforming assets. This comparability enables data-driven decisions regarding resource allocation and investment strategies. Without a standardized format, such comparisons become complex and potentially misleading.

- BenchmarkingStandardized financial statements facilitate benchmarking against industry averages or competitors. This allows real estate professionals to assess their performance relative to market standards, identify areas for improvement, and implement best practices. For instance, comparing operating expense ratios against industry benchmarks can reveal areas of potential cost savings or inefficiencies. This benchmarking provides valuable insights for optimizing operational strategies and enhancing profitability. Without a standardized format, meaningful benchmarking becomes difficult, hindering efforts to improve performance and competitiveness.

- CommunicationA standardized format enhances communication among stakeholders. Investors, lenders, and other parties involved in real estate transactions can readily understand and interpret financial information presented in a consistent format. This clarity promotes transparency and facilitates informed decision-making. For example, presenting financial data in a standardized format simplifies loan applications and investor presentations, enhancing credibility and facilitating communication. Without a standardized format, misinterpretations and communication breakdowns become more likely, potentially hindering successful transactions and partnerships.

- Trend AnalysisConsistent data organization within a standardized format facilitates trend analysis over time. Tracking key financial metrics, such as revenue growth and expense fluctuations, within a consistent structure allows for easier identification of emerging trends and potential issues. This enables proactive adjustments to strategies and mitigates potential financial risks. For instance, consistently rising operating expenses, easily identifiable within a standardized format, might signal the need for preventative maintenance or operational adjustments. Without a standardized format, identifying such trends becomes more challenging, potentially delaying crucial interventions and increasing financial risks.

In conclusion, the standardized format of free real estate profit and loss statement templates provides significant benefits. Comparability, benchmarking, clear communication, and effective trend analysis are all enhanced by this consistent structure. While free templates may lack some features of paid software, their standardized format contributes significantly to improved financial management practices within the real estate sector. This standardization fosters transparency, facilitates informed decision-making, and ultimately contributes to more successful real estate ventures. The consistent structure provides a solid foundation for financial analysis, empowering stakeholders to navigate the complexities of the real estate market with greater confidence and effectiveness.

Key Components of a Real Estate Profit and Loss Statement

A comprehensive real estate profit and loss statement, even a free template version, includes key components essential for understanding financial performance. These components provide a structured overview of income and expenses, enabling informed decision-making.

1. Property Information: This section identifies the specific property or portfolio being analyzed. Inclusion of the property address, unit numbers (if applicable), and reporting period ensures clarity and facilitates accurate record-keeping.

2. Revenue/Income: This section details all sources of income generated by the property. Typical entries include rental income, late fees, parking fees, and any other ancillary income streams. Accurate recording of all revenue sources is crucial for assessing overall profitability.

3. Operating Expenses: This section encompasses all costs associated with operating the property. Common entries include property taxes, insurance, maintenance, repairs, utilities, property management fees, and advertising expenses. Detailed tracking of operating expenses is essential for identifying areas of potential cost savings and understanding the true cost of ownership.

4. Net Operating Income (NOI): This key metric represents the difference between total revenue and operating expenses. NOI provides a clear picture of the property’s profitability before accounting for financing costs and other non-operating expenses. It serves as a crucial indicator of financial performance and is often used in property valuations.

5. Depreciation and Amortization: This section accounts for the decrease in value of assets over time (depreciation) and the gradual reduction of loan balances (amortization). While not actual cash outflows, these non-cash expenses impact overall profitability and tax liabilities.

6. Net Income/Loss: This bottom-line figure represents the final profit or loss after accounting for all income and expenses, including depreciation and amortization. It provides a comprehensive overview of the property’s financial performance during the reporting period. Net income serves as a critical indicator of investment success and informs future financial strategies.

Accurate and consistent tracking of these components provides a clear and comprehensive understanding of real estate financial performance. This structured approach facilitates informed decision-making, enabling effective management and optimization of investment returns.

How to Create a Free Real Estate Profit and Loss Statement Template

Creating a free real estate profit and loss statement template involves structuring a document to effectively track income and expenses. This enables clear financial analysis for informed decision-making.

1. Software Selection: Choose a suitable software application. Spreadsheet software offers flexibility and readily available formulas for automated calculations. Word processing software allows for customized formatting and integration with other documents.

2. Property Identification: Clearly identify the property or portfolio being analyzed. Include the property address, unit numbers (if applicable), and the reporting period. This ensures clarity and facilitates accurate record-keeping.

3. Income Section: Establish a dedicated section for recording all sources of income. Categorize income streams, such as rental income, late fees, parking fees, and other ancillary income. Utilize clear labels for each category.

4. Expense Section: Create a detailed expense section, categorizing all operating costs. Include common expenses like property taxes, insurance, maintenance, repairs, utilities, management fees, and advertising. Ensure comprehensive coverage of all expense categories relevant to the property.

5. Calculation Section: Develop formulas to automatically calculate key metrics. Calculate Net Operating Income (NOI) by subtracting total operating expenses from total revenue. Include calculations for gross profit, net income, and other relevant financial indicators.

6. Formatting and Design: Format the template for clarity and readability. Utilize clear headings, consistent fonts, and appropriate spacing. Consider color-coding for visual distinction between income and expense categories. Ensure a professional and organized presentation.

7. Testing and Refinement: Test the template with sample data to ensure accuracy and functionality. Verify the accuracy of formulas and calculations. Refine the template based on testing results to optimize usability and effectiveness.

8. Regular Updates: Review and update the template periodically to reflect changes in operating costs, income streams, or reporting requirements. This ensures the template remains relevant and provides accurate financial insights.

A well-structured template provides a consistent framework for tracking income and expenses, facilitating clear financial analysis and informed decision-making in real estate management.

Access to complimentary profit and loss statement templates specifically designed for real estate ventures offers significant advantages. These resources empower stakeholders to track income and expenses effectively, leading to informed financial decisions. Standardized formats promote clarity, enabling meaningful comparisons across properties and portfolios. Automated calculations streamline analysis, saving time and reducing the risk of errors. Ultimately, leveraging these readily available tools contributes to improved financial management practices within the real estate industry, fostering greater transparency and efficiency. However, the effectiveness of these tools relies on consistent and accurate data entry, highlighting the importance of user diligence in maintaining data integrity.

Effective financial management is crucial for success in the dynamic real estate landscape. Leveraging available resources, such as free profit and loss statement templates, provides a practical pathway to achieving financial clarity and informed decision-making. Adoption of these tools, combined with diligent data management practices, positions stakeholders to navigate the complexities of real estate investment and management more effectively, optimizing financial outcomes and contributing to long-term success. Continued development and refinement of these resources promise further enhancements to financial management practices within the real estate sector.