Utilizing a standardized structure for reporting financial activity offers several advantages. It ensures consistency in reporting, simplifying analysis and comparisons over time. A well-designed template can also improve financial transparency, boosting stakeholder confidence. Furthermore, it streamlines the reporting process, reducing the time and effort required for preparation and facilitating compliance with regulatory requirements.

This article will delve deeper into the specific components of a typical statement of activities, exploring best practices for its creation and utilization. Further discussion will cover variations in templates and how to choose the most appropriate format for specific organizational needs.

1. Revenues

Accurate revenue reporting is fundamental to a nonprofit’s statement of activities. A clear understanding of revenue streams and their proper categorization is essential for financial transparency and informed decision-making. This section explores key facets of revenue reporting within the context of a nonprofit’s financial statement.

- Individual ContributionsIndividual donations, often the lifeblood of many nonprofits, encompass one-time gifts, recurring donations, and planned giving. Accurately recording these contributions, distinguishing between restricted and unrestricted funds, is vital for demonstrating responsible stewardship and maintaining donor trust. For example, a donation earmarked for a specific program must be tracked separately from general operating funds.

- GrantsGrants from foundations, corporations, and government agencies often come with specific reporting requirements. Tracking grant revenue and aligning it with associated expenses allows nonprofits to demonstrate compliance and ensure continued funding eligibility. This may involve detailed reporting on program outcomes and the effective use of grant funds.

- Program Service RevenueIncome generated through fees for services provided, such as membership dues or workshop fees, constitutes program service revenue. Properly accounting for this revenue stream helps assess program effectiveness and sustainability. Comparing program service revenue with related expenses provides valuable insights into program financial viability.

- Investment IncomeNonprofits may generate revenue from investments in endowments or other financial instruments. This income, while often a smaller portion of overall revenue, requires careful tracking and reporting, particularly when subject to specific restrictions or investment policies. Transparency regarding investment income demonstrates responsible financial management.

A comprehensive understanding of these revenue streams and their proper classification within a statement of activities template allows stakeholders to assess the organization’s financial health, diversification of funding sources, and long-term sustainability. Accurate revenue reporting strengthens accountability and informs strategic planning for future growth and impact.

2. Expenses

Accurate and detailed expense tracking is critical for nonprofit financial management and transparency. A well-structured statement of activities template provides the framework for categorizing and analyzing expenses, enabling stakeholders to understand how resources are utilized. This detailed breakdown facilitates informed decision-making, strengthens accountability, and demonstrates responsible stewardship to funders and the public. Understanding the relationship between expenses and the statement of activities is essential for effective nonprofit financial management.

Several key expense categories typically appear within a nonprofit statement of activities. Program expenses, directly related to fulfilling the organization’s mission, might include salaries of program staff, materials, and facility costs. Administrative expenses encompass overhead costs necessary for daily operations, such as office rent, utilities, and administrative staff salaries. Fundraising expenses represent the costs associated with securing donations and grants, including marketing campaigns and development staff salaries. For instance, a youth development organization might categorize after-school program staff salaries as program expenses, while rent for the administrative office would fall under administrative expenses. Costs associated with a fundraising gala would be classified as fundraising expenses. Properly allocating these costs within the template allows for a clear understanding of resource allocation across different organizational functions.

Careful expense tracking within a standardized template offers several significant advantages. It facilitates analysis of spending trends, allowing organizations to identify areas for potential cost savings or efficiency improvements. Comparing program expenses to outcomes helps assess program effectiveness and cost-effectiveness. Transparent expense reporting builds trust with donors, demonstrating how contributions are utilized to achieve the organization’s mission. Furthermore, accurate expense reporting is crucial for compliance with regulatory requirements and maintaining tax-exempt status. Failing to accurately categorize and report expenses can lead to financial mismanagement, damage to reputation, and potential legal repercussions. Therefore, a comprehensive understanding of expense categorization within the context of a nonprofit’s statement of activities is crucial for long-term financial health and organizational sustainability.

3. Reporting Period

The reporting period defines the timeframe covered by a non-profit’s statement of activities. This defined timeframe provides a consistent basis for analyzing financial performance and making comparisons. A clear understanding of the reporting period’s significance is essential for accurate interpretation and effective utilization of the statement of activities. Selecting an appropriate reporting period is crucial for meaningful financial analysis and informed decision-making.

- Fiscal YearMany non-profits operate on a fiscal year that may not align with the calendar year. A fiscal year consists of 12 consecutive months and provides a consistent timeframe for financial reporting. For example, a non-profit’s fiscal year might run from July 1st to June 30th. Using a consistent fiscal year allows for year-over-year comparisons of financial performance and facilitates budget planning.

- Interim ReportingIn addition to annual reporting, non-profits may generate statements of activities for shorter periods, such as quarterly or monthly. Interim reports offer more frequent insights into financial performance, enabling timely adjustments and more proactive management. For instance, a quarterly report might reveal a significant drop in donations, prompting the organization to implement a mid-year fundraising campaign.

- Comparison and AnalysisConsistent reporting periods facilitate meaningful comparisons of financial data across different periods. Analyzing trends in revenue and expenses over multiple fiscal years helps identify areas of growth or concern. This comparison can inform strategic planning and resource allocation decisions. Consistent reporting periods are also crucial for benchmarking against other organizations in the same sector.

- Regulatory RequirementsSpecific reporting periods might be mandated by regulatory bodies or funding agencies. Adhering to these requirements ensures compliance and maintains eligibility for grants and other funding opportunities. Understanding and adhering to these requirements is essential for maintaining good standing and avoiding potential penalties.

The reporting period selected significantly impacts the information presented in the statement of activities. Choosing and consistently applying the appropriate reporting period ensures accurate financial analysis, informed decision-making, and compliance with regulatory requirements. This consistency strengthens transparency and accountability, enhancing stakeholder trust and supporting the organization’s long-term financial health.

4. Standardized Format

A standardized format is fundamental to the efficacy of a non-profit statement of activities template. Consistency in presentation allows for straightforward analysis, comparison, and interpretation of financial data. A standardized structure ensures key information is readily accessible to stakeholders, promoting transparency and accountability. This section explores key facets of standardized formatting within the context of non-profit financial reporting.

- Consistent Chart of AccountsA standardized chart of accounts provides a predefined list of categories for classifying financial transactions. This consistency ensures revenues and expenses are categorized uniformly across reporting periods, facilitating accurate tracking and analysis of financial trends. For example, all donations, regardless of source, would be classified under a specific “Donations” account within the chart. This uniformity allows for easy aggregation and analysis of donation data over time.

- Defined Reporting SectionsClear delineation of sections within the statement of activities, such as revenues, expenses, and net assets, ensures a logical flow of information. This structured presentation enhances readability and comprehension for stakeholders. For instance, separating program expenses from administrative expenses allows for clear analysis of resource allocation across different organizational functions. This clear delineation supports informed decision-making.

- Standard TerminologyConsistent use of financial terminology throughout the statement ensures clarity and avoids ambiguity. Using standard terms like “unrestricted revenue” and “restricted revenue” clarifies the nature of different funding sources. Consistent terminology also facilitates comparisons with other non-profits and industry benchmarks. This promotes transparency and understanding across stakeholders.

- Accessibility and ComparabilityA standardized format improves the accessibility of financial information for a wide range of stakeholders, including board members, donors, and regulatory bodies. Consistent presentation allows for easy comparison of financial performance across different reporting periods and against other organizations. This comparability strengthens accountability and supports informed decision-making. Furthermore, accessible financial information promotes transparency and builds trust with stakeholders.

Adhering to a standardized format within a non-profit statement of activities template enhances financial transparency, facilitates analysis, and supports informed decision-making. Consistent presentation ensures key information is readily accessible and comparable, promoting accountability and strengthening stakeholder trust. Ultimately, a standardized approach to financial reporting contributes to the long-term financial health and sustainability of the organization.

5. Transparency and Accountability

Transparency and accountability are cornerstones of effective non-profit governance. A well-structured statement of activities template plays a crucial role in fostering both. By providing a clear and consistent view of financial performance, the template enables stakeholders to understand how resources are generated and utilized. This transparency builds trust and strengthens public confidence in the organization’s operations. This section explores key facets of transparency and accountability within the context of a non-profit statement of activities template.

- Public TrustOpen communication about financial performance, facilitated by a clear statement of activities, cultivates public trust. When stakeholders can readily access and understand financial information, they are more likely to support the organization’s mission. For example, publishing an easily accessible annual report that includes a detailed statement of activities demonstrates a commitment to transparency, encouraging continued donor support and public engagement.

- Stewardship of FundsA detailed statement of activities demonstrates responsible stewardship of donated funds. By clearly outlining how resources are allocated across different programs and administrative functions, the template provides evidence of responsible financial management. For instance, demonstrating a low percentage of administrative overhead relative to program expenses reassures donors that their contributions are primarily directed towards fulfilling the organization’s mission.

- Regulatory ComplianceAccurate and transparent financial reporting, as facilitated by a standardized template, is crucial for complying with regulatory requirements. A clear statement of activities simplifies audits and demonstrates adherence to accounting standards. This compliance safeguards the organization’s tax-exempt status and avoids potential legal issues. For example, accurately reporting lobbying expenses ensures compliance with IRS regulations governing non-profit lobbying activities.

- Informed Decision-MakingA readily accessible and understandable statement of activities empowers stakeholders to make informed decisions. Board members can use the information to guide strategic planning and resource allocation, while donors can assess the impact of their contributions. Transparent financial information supports data-driven decisions that advance the organization’s mission and ensure long-term sustainability. For instance, analyzing trends in program expenses and outcomes helps inform decisions about program effectiveness and future funding priorities.

The non-profit statement of activities template serves as a vital tool for promoting transparency and accountability. By providing a clear, consistent, and accessible view of financial performance, the template strengthens public trust, demonstrates responsible stewardship, ensures regulatory compliance, and supports informed decision-making. These factors collectively contribute to the organization’s long-term financial health and sustainability, enabling it to effectively fulfill its mission and serve its constituents.

Key Components of a Non-Profit Statement of Activities Template

A well-structured statement of activities template provides a standardized framework for presenting a non-profit’s financial performance. Understanding the key components is crucial for accurate interpretation and effective utilization of this financial statement.

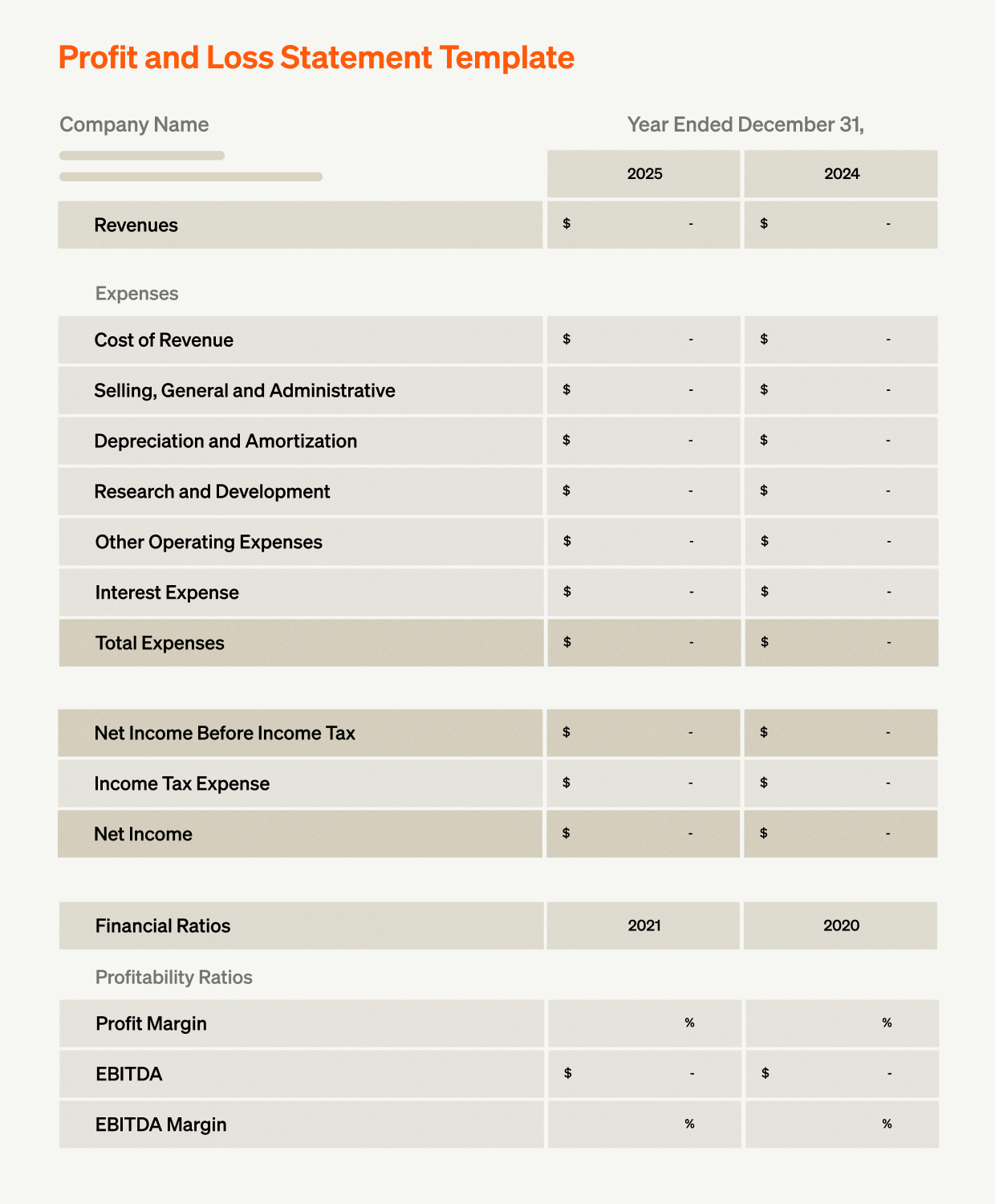

1. Revenues: This section details all income generated by the organization. Categorization typically includes individual contributions, grants, program service revenue, and investment income. Accurate revenue reporting is fundamental to demonstrating financial health and sustainability.

2. Expenses: This section outlines all expenditures incurred by the organization. Categorization typically includes program expenses, administrative expenses, and fundraising expenses. Detailed expense tracking allows for analysis of spending trends and assessment of program effectiveness.

3. Reporting Period: This defines the timeframe covered by the statement, typically a fiscal year. Consistent reporting periods are crucial for making accurate comparisons and analyzing financial trends over time. Interim reporting, such as quarterly or monthly statements, can provide more frequent insights into financial performance.

4. Standardized Format: A consistent format, including a standardized chart of accounts and defined reporting sections, ensures clarity and comparability. Standard terminology and a logical structure enhance readability and facilitate analysis by various stakeholders.

5. Transparency and Accountability: A clear and accessible statement of activities promotes transparency and demonstrates accountability to stakeholders. This open communication builds trust with donors, funders, and the public, fostering confidence in the organization’s financial management.

These components work together to provide a comprehensive overview of a non-profit’s financial performance. Accurate and consistent reporting within this framework enables informed decision-making, strengthens accountability, and supports the organization’s long-term financial health and sustainability.

How to Create a Non-Profit Statement of Activities

Creating a clear and effective statement of activities requires careful planning and adherence to established accounting principles. The following steps outline the process of developing a template for a non-profit organization.

1. Define the Reporting Period: Establish the specific timeframe the statement will cover, typically a fiscal year. Consistent reporting periods are crucial for year-over-year comparisons and trend analysis.

2. Establish a Chart of Accounts: Develop a standardized chart of accounts that categorizes all revenues and expenses. This ensures consistent tracking and facilitates accurate reporting. The chart of accounts should align with the organization’s specific programs and activities.

3. Design the Template Structure: Create a clear and logical structure for the statement, including sections for revenues, expenses, and net assets. Use clear headings and subheadings to enhance readability and comprehension.

4. Incorporate Key Metrics: Include relevant financial metrics, such as total revenues, total expenses, and net operating income. These metrics provide a snapshot of the organization’s financial performance.

5. Ensure Compliance: Adhere to generally accepted accounting principles (GAAP) and any applicable regulatory requirements. Accurate and compliant reporting is essential for maintaining transparency and accountability.

6. Review and Refine: Regularly review and refine the template to ensure it remains relevant and effective. As the organization evolves, adjustments may be necessary to reflect changes in programs, funding sources, or reporting requirements.

7. Implement Internal Controls: Establish internal controls to ensure the accuracy and integrity of financial data. These controls might include segregation of duties, regular reconciliations, and independent reviews.

8. Seek Professional Advice: Consult with a qualified accountant or financial advisor to ensure the template meets best practices and regulatory requirements. Professional guidance can help optimize the template’s design and implementation.

A well-designed template, adhering to these steps, provides a consistent and transparent framework for reporting financial activity. This standardized approach enables effective analysis, strengthens accountability, and supports informed decision-making, contributing to the organization’s long-term financial health and sustainability.

Effective financial management is crucial for non-profit organizations to fulfill their missions and maintain public trust. A well-designed statement of activities template provides the framework for transparent and accountable financial reporting. Standardized reporting ensures consistency, facilitates analysis, and enables informed decision-making. Understanding the key components of such a templaterevenues, expenses, reporting periods, standardized formatting, and the importance of transparency and accountabilityempowers organizations to manage resources effectively and demonstrate responsible stewardship to stakeholders.

Accurate and consistent financial reporting is not merely a compliance requirement; it is an essential tool for organizational health and sustainability. By embracing best practices in financial management and utilizing a robust statement of activities template, non-profit organizations can strengthen their financial footing, build trust with stakeholders, and effectively pursue their missions. Continued focus on financial transparency and accountability will be critical for navigating the evolving landscape of the non-profit sector and ensuring long-term impact.