Utilizing a structured representation of a billing summary offers several advantages. It allows users to familiarize themselves with the layout and terminology employed by this financial institution, simplifying the process of understanding their monthly bills. The predictable format enables easy comparison of spending patterns across different billing cycles, promoting better financial management. Furthermore, having a readily available framework can be invaluable for reconciling accounts and detecting any discrepancies or unauthorized charges.

Understanding the structure and benefits of standardized billing summaries is crucial for effective personal finance management. This exploration will delve deeper into specific aspects of these documents, including common sections, interpreting key figures, and practical applications for personal and business use.

1. Structure

The structure of a Capital One credit card statement template is fundamental to its readability and utility. A well-defined structure ensures consistent presentation of information, facilitating efficient review and analysis of financial data. This organized format enables users to quickly locate specific details and understand the relationships between different elements of the statement.

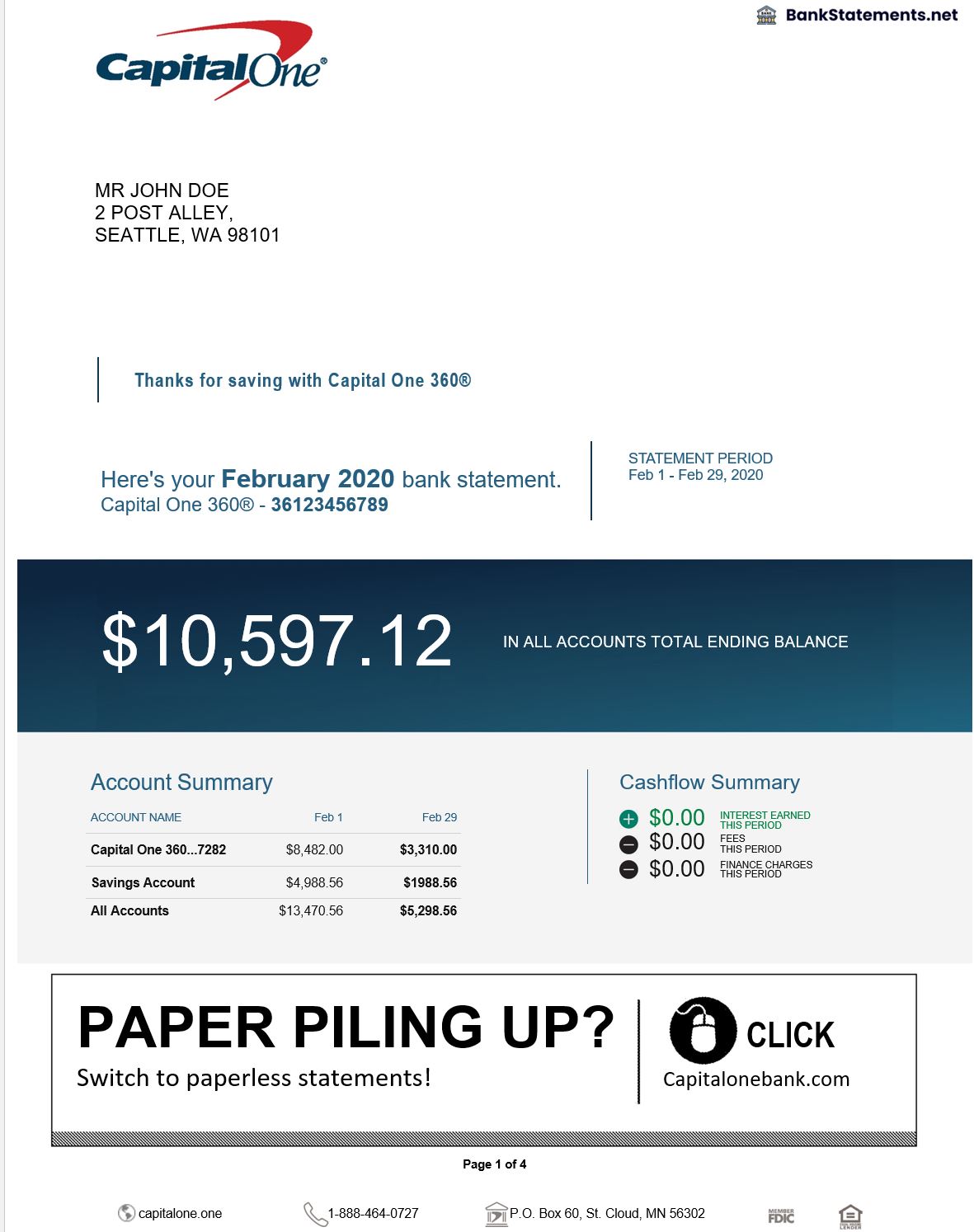

- Account SummaryThis section typically appears at the top of the statement and provides a snapshot of key account information, including the account number, billing period, previous balance, payment received, new balance, and minimum payment due. This overview allows for immediate assessment of account status.

- Transaction DetailsThis section presents a chronological listing of all transactions during the billing cycle. Each entry typically includes the transaction date, description of the purchase or payment, and the amount. This detailed record enables tracking of spending patterns and identification of individual transactions.

- Interest Charges and FeesThis section details any interest accrued during the billing cycle, often broken down by purchase APR, balance transfer APR, and cash advance APR. Fees, such as late payment fees or annual fees, are also listed here. Understanding this section is crucial for managing the cost of credit.

- Payment InformationThis section summarizes payment activity, including the date and amount of payments received. It also typically includes information about the next payment due date and the minimum payment amount. This section is vital for tracking payment history and ensuring timely payments.

These structural components work together to provide a comprehensive overview of account activity. Consistent organization across different statements allows for straightforward comparison of spending habits and financial trends over time, promoting better financial management and informed decision-making.

2. Data Fields

Data fields within a Capital One credit card statement template serve as the core informational components, providing granular details about account activity and financial status. These fields, organized within the structure of the statement, collectively represent a comprehensive record of transactions, payments, charges, and account balances. Understanding the purpose and content of each data field is crucial for accurate interpretation and effective utilization of the statement information. The relationship between data fields and the overall template structure is essential: the structure provides the framework, and the data fields populate it with specific information.

Specific data fields within a typical template include transaction date, posting date, merchant name, transaction amount, payment amount, current balance, available credit, and interest charges. Each field contributes to a comprehensive understanding of account activity. For example, discrepancies between transaction dates and posting dates can sometimes explain delays in reflecting payments or purchases. Analyzing transaction amounts in conjunction with merchant names allows for tracking spending patterns and identifying potential areas for budgeting adjustments. The interplay between payment amounts, interest charges, and current balance is essential for understanding the overall cost of credit and managing debt effectively.

Accurately interpreting these data fields empowers informed financial decisions. Recognizing the significance of each data field, from transaction details to balance summaries, enables effective account monitoring, expense management, and proactive identification of potential issues. Failure to understand these fields can lead to misinterpretations of account status, potentially resulting in missed payments, unnecessary fees, and an incomplete understanding of one’s financial position. This knowledge provides a foundation for sound financial practices and informed credit utilization.

3. Transactions

The “Transactions” section of a Capital One credit card statement template provides a chronological record of all account activity within a given billing cycle. This detailed account of purchases, payments, credits, and other debits forms the core of the statement, offering crucial insights into spending patterns and overall account usage. Understanding this section is fundamental to managing finances and ensuring accurate record-keeping.

- Purchase TransactionsThese entries represent purchases made using the credit card. Each purchase transaction typically includes the date of the transaction, the merchant name, and the purchase amount. Examples include retail purchases, online transactions, and restaurant bills. Analyzing purchase transactions allows cardholders to track spending habits, identify recurring expenses, and monitor for unauthorized charges. Within the statement template, these entries provide granular detail contributing to the overall balance calculation.

- Payment TransactionsThese entries reflect payments made towards the credit card balance. Each payment transaction includes the date of the payment and the payment amount. Payments can include online transfers, checks, or automatic payments. Tracking payment transactions within the statement ensures accurate reconciliation of payments made against the outstanding balance and helps verify that payments are processed correctly. This data is essential for understanding the impact of payments on interest accrual and the overall account balance.

- Credit TransactionsThese entries represent credits applied to the account, reducing the outstanding balance. Credits can arise from returns, refunds, or promotional offers. Each credit transaction includes the date of the credit and the credit amount. Understanding credit transactions is important for verifying that returns and refunds are processed correctly and are accurately reflected in the account balance. Within the statement template, these credits offset debit transactions, contributing to the overall balance calculation.

- Other Debit TransactionsThis category encompasses transactions other than purchases, such as cash advances, balance transfers, and fees. Each entry details the date of the transaction, the type of transaction, and the associated amount. These entries are crucial for understanding the full scope of account activity and its impact on the overall balance. For example, cash advances and balance transfers often accrue interest at different rates than standard purchases, impacting the overall cost of credit. Fees, such as late payment fees or annual fees, also contribute to the total balance due.

The detailed record of transactions provided within the Capital One credit card statement template is critical for effective financial management. By analyzing the various transaction typespurchases, payments, credits, and other debitscardholders gain a comprehensive understanding of their spending behavior, payment history, and the factors influencing their overall account balance. This information empowers informed financial decisions, promotes responsible credit usage, and facilitates accurate financial planning.

4. Payments

The “Payments” section within a Capital One credit card statement template provides a crucial record of all payments applied to the account during the billing cycle. This section is essential for understanding how payments impact the outstanding balance, interest accrual, and overall account standing. Accurate interpretation of payment information is vital for responsible credit management and maintaining a healthy credit score. Analysis of this section allows cardholders to verify that payments are processed correctly and to track their payment history over time.

- Payment Posting DateThis date indicates when a payment was credited to the account. It’s crucial to distinguish this date from the date the payment was initiated. For instance, an online payment initiated on a Friday might not post until the following Monday. This distinction is important for understanding how interest is calculated and avoiding potential late payment fees. The payment posting date determines which billing cycle a payment applies to within the statement template.

- Payment AmountThis field specifies the total amount of each payment applied to the account. This information is essential for reconciling payments with bank records and ensuring that the correct amounts are credited. Within the template, the payment amount directly reduces the outstanding balance and influences the calculation of interest charges for the following billing cycle.

- Payment MethodThis field identifies how the payment was made, such as online transfer, check, or automatic payment. Understanding the payment method can be helpful for troubleshooting payment issues or optimizing payment strategies. For example, tracking processing times for different payment methods can help ensure timely payments and avoid late fees. This information, while not always explicitly detailed in the statement template itself, is often available through online account access, complementing the statement’s payment information.

- Impact on Balance and InterestPayments directly impact the outstanding balance and the amount of interest accrued. Timely and sufficient payments reduce the principal balance, minimizing interest charges. Conversely, late or insufficient payments can lead to increased interest charges and potential late payment fees. Analyzing payment data within the statement template allows cardholders to understand the relationship between payment behavior, interest accrual, and the overall cost of credit.

The “Payments” section within the statement template provides critical data for effective account management. By understanding the details of each paymentposting date, amount, method, and impact on balance and interestcardholders can maintain accurate financial records, optimize payment strategies, and minimize the cost of borrowing. This detailed record within the statement template empowers informed financial decisions and promotes responsible credit utilization.

5. Balances

The “Balances” section of a Capital One credit card statement template provides a crucial overview of the account’s financial standing. This section details various balance types, each representing a different aspect of the credit account’s status. Understanding these balances is essential for managing credit utilization, monitoring spending, and ensuring accurate financial record-keeping. The relationship between the “Balances” section and the overall statement template is symbiotic: the template provides the structure, and the balance information populates it with real-time financial data, providing a snapshot of the account’s health.

Several key balances typically appear within this section. The previous balance reflects the account’s status at the beginning of the billing cycle. Payments and credits reduce this balance, while purchases and other debits increase it, leading to the new balance, which represents the total amount owed at the end of the billing cycle. The available credit represents the remaining credit line accessible for use. For instance, a cardholder with a $5,000 credit limit and a $1,000 new balance has $4,000 in available credit. Another important figure, the statement balance, is the amount due on the due date. The relationship between these different balances provides a comprehensive view of account activity and available spending power. Monitoring these balances allows cardholders to assess their credit utilization ratio, a key factor influencing credit scores. High utilization ratios can negatively impact creditworthiness, while maintaining low utilization demonstrates responsible credit management.

Accurate interpretation of the “Balances” section is fundamental to responsible credit card usage. Misunderstanding balance types, such as confusing the new balance with the minimum payment due, can lead to financial missteps, including late payments and increased interest charges. Conversely, a clear understanding of the balances, their interrelationships, and their practical implications empowers informed financial decisions, contributing to a healthy financial profile. Regular review of this section facilitates proactive management of credit utilization, enabling cardholders to make informed choices about spending and payments. This practice reinforces responsible credit habits and contributes to long-term financial well-being.

6. Interest Charges

The “Interest Charges” section within a Capital One credit card statement template details the cost of borrowing money. This section is crucial for understanding the true cost of credit card usage and managing debt effectively. Interest charges represent a significant component of the overall balance for cardholders who carry a balance from month to month. The placement and prominence of this section within the statement template underscores its importance in assessing the financial implications of credit card usage. Interest charges are a direct consequence of unpaid balances. When a cardholder does not pay the statement balance in full by the due date, interest accrues on the remaining balance, increasing the total amount owed. This compounding effect can significantly increase the cost of purchases over time. For example, a $1,000 purchase left unpaid can quickly accumulate substantial interest charges depending on the applicable annual percentage rate (APR). The statement template typically details the different APRs applied to various transaction types, such as purchases, balance transfers, and cash advances. Understanding these distinctions is crucial for managing the overall cost of credit.

Several factors influence the calculation of interest charges. The most significant factor is the APR, which represents the annual interest rate. Higher APRs result in higher interest charges. The daily periodic rate, calculated by dividing the APR by 365, is applied to the average daily balance. The average daily balance is calculated by summing the outstanding balances for each day of the billing cycle and dividing by the number of days in the cycle. Therefore, carrying a higher balance for a longer period results in greater interest charges. For example, making a large purchase early in the billing cycle and not paying it off immediately will result in a higher average daily balance and, consequently, higher interest charges. The statement template may provide details on the average daily balance calculation, allowing cardholders to understand how interest is computed. Analyzing these details can empower cardholders to make informed decisions regarding payment strategies and credit utilization.

Careful review and understanding of the “Interest Charges” section are vital for responsible credit management. Ignoring this section can lead to escalating debt and an incomplete understanding of the true cost of credit. By analyzing the APR, daily periodic rate, average daily balance, and the resulting interest charges, cardholders can make informed financial decisions, minimize the cost of borrowing, and maintain a healthy financial outlook. The information presented in this section of the statement template provides a valuable tool for managing credit effectively and avoiding the pitfalls of accumulating high-cost debt.

Key Components of a Capital One Credit Card Statement Template

Understanding the core components of a Capital One credit card statement template is crucial for effective financial management. These components provide a structured overview of account activity, enabling informed decision-making regarding spending, payments, and overall credit utilization.

1. Account Summary: This section provides a snapshot of key account information, including account number, billing period, previous balance, payment received, new balance, and minimum payment due. This overview allows for immediate assessment of account status.

2. Transaction Details: This section presents a chronological listing of all transactions during the billing cycle, including purchase date, merchant name, and transaction amount. This detailed record enables tracking of spending patterns.

3. Payment Information: This section summarizes payment activity, detailing payment dates, amounts, and methods. It typically includes information about upcoming payment due dates and minimum payment amounts.

4. Interest Charges and Fees: This section details interest accrued during the billing cycle, often broken down by purchase APR, balance transfer APR, and cash advance APR. Fees, such as late payment fees or annual fees, are also listed here.

5. Balances Summary: This section presents key balance information, including previous balance, new balance, available credit, and statement balance. Understanding these balances is crucial for managing credit utilization and making informed financial decisions.

6. Credit Limit and Available Credit: This section clearly states the total credit line extended to the cardholder and the portion currently available for use, factoring in outstanding balances and pending transactions.

These components work together to provide a comprehensive view of account activity, facilitating responsible credit management and informed financial decision-making. Regular review and analysis of these components enable proactive monitoring of spending habits, efficient tracking of payments, and effective management of credit utilization, contributing to overall financial well-being.

How to Create a Capital One Credit Card Statement Template

Creating a template resembling a Capital One credit card statement requires careful attention to structure and data fields. While replicating an exact statement is legally prohibited, a model for educational or testing purposes can be developed. This process involves outlining key sections and incorporating relevant data placeholders.

1. Define the Scope: Specify the template’s purpose. Is it for educational materials, software testing, or personal finance tracking? This clarifies the level of detail required.

2. Header Section: Include fields for account information: account number (masked for privacy), statement date, and billing period.

3. Account Summary: Incorporate fields for previous balance, payment received, new balance, minimum payment due, and due date.

4. Transactions Section: Create a table with columns for transaction date, posting date, merchant name, and transaction amount. Include rows for different transaction types (purchases, payments, credits).

5. Interest Charges and Fees Section: Designate areas for interest charges, specifying different APRs for purchases, balance transfers, and cash advances. Include fields for any applicable fees.

6. Balances Section: Include fields for key balances: previous balance, new balance, available credit, and statement balance.

7. Footer Section: Include contact information for customer service and any disclaimers or legal notices.

8. Data Population (Optional): For testing or educational purposes, populate the template with realistic but fictional data. Ensure data privacy by avoiding real account information.

A well-structured template facilitates understanding of key statement components. By incorporating relevant data placeholders, the template becomes a practical tool for learning, analysis, or testing. Regular review and refinement of the template ensure accuracy and relevance.

Careful examination of a Capital One credit card statement template reveals its importance as a comprehensive financial tool. Its structured format, encompassing account summaries, detailed transaction records, payment information, interest calculations, and balance overviews, provides valuable insights into spending habits and credit utilization. Understanding each sectionfrom transaction details to interest chargesempowers informed financial decisions.

Effective management of personal finances requires diligent review and accurate interpretation of credit card statements. Leveraging the information provided within these documents enables proactive monitoring of spending, timely payments, and ultimately, a healthier financial outlook. This knowledge fosters greater financial responsibility and contributes to long-term financial well-being.