Utilizing such a framework offers significant advantages. It saves time and resources by eliminating the need to create these documents from scratch. The standardized format improves professionalism, enhances communication clarity, and ensures essential information is consistently presented. This promotes transparency and strengthens the business-client relationship by providing a clear overview of financial interactions.

This foundation allows for a deeper exploration of specific elements, such as key components, best practices for customization, and legal considerations, which are crucial for effective implementation and utilization.

1. Clear Communication

Clear communication is paramount for effective financial documentation. Within the context of account statements, clarity ensures clients can readily understand their financial obligations and transactions, fostering trust and minimizing potential misunderstandings. A well-designed template facilitates this clarity by providing a structured framework for presenting information.

- Unambiguous LanguageUsing precise and straightforward language avoids confusion. Jargon and technical terms should be minimized or clearly defined. For example, instead of “EOM balance,” using “Balance at the end of the month” improves comprehension. This clarity reduces inquiries and potential disputes.

- Logical OrganizationInformation should be presented in a logical, easy-to-follow sequence. Grouping related items, such as all transactions within a given date range, simplifies review. A clear visual hierarchy, using headings and subheadings, further enhances readability and understanding.

- Concise PresentationAvoiding unnecessary verbosity keeps the document focused and digestible. Presenting information concisely, while retaining essential details, respects the client’s time and promotes efficient review. This can be achieved through clear tables and the strategic use of bullet points.

- Consistent FormattingMaintaining a consistent format across all statements enhances readability and professionalism. Consistent fonts, spacing, and date formats create a cohesive document that is easy to navigate and interpret. This consistency reduces cognitive load and promotes a sense of order and reliability.

These elements of clear communication, when integrated into a statement of account template, create a document that is not only informative but also accessible and user-friendly. This contributes to a positive client experience and reinforces professional credibility.

2. Accurate Details

Accuracy in financial documentation, particularly within statements of account, forms the bedrock of trust and effective financial management. A template designed for these statements must prioritize the inclusion and proper formatting of critical details to ensure clarity and prevent potential disputes. The impact of inaccuracies can range from minor inconveniences to significant financial repercussions, highlighting the crucial role of precision in these documents.

Consider a scenario where an invoice number is incorrectly recorded within a statement. This seemingly small error can lead to confusion during reconciliation, delaying payments and potentially damaging the client relationship. Similarly, an inaccurate transaction date can disrupt cash flow projections and create discrepancies in financial records. Conversely, a well-designed template with fields for precise data entry minimizes such errors. Pre-defined fields for invoice numbers, transaction dates, payment amounts, and outstanding balances ensure consistent and accurate recording of information. This structured approach reduces the likelihood of human error and promotes efficient processing.

The practical significance of accurate details extends beyond individual transactions. Accurate statements contribute to reliable financial reporting, enabling businesses to make informed decisions based on verifiable data. They also facilitate audits and regulatory compliance, minimizing potential legal and financial risks. Therefore, a robust template serves not only as a tool for client communication but also as a cornerstone of sound financial practice. By prioritizing accuracy, businesses cultivate trust with clients, maintain accurate financial records, and promote operational efficiency.

3. Professional Format

A professional format is essential for a statement of account letter template, enhancing credibility and ensuring clear communication. It reflects attention to detail and reinforces the seriousness of the financial information presented. A consistent and well-structured format promotes efficient processing and minimizes misunderstandings, contributing to a positive client experience.

- Company BrandingIncorporating company branding, such as logos and color schemes, reinforces brand identity and professionalism. A consistent visual identity across all communications strengthens brand recognition and promotes a cohesive image. For example, including a company logo in the header of the statement reinforces brand presence and adds a touch of professionalism.

- Clear LayoutA clear and organized layout facilitates easy navigation and comprehension of the information presented. Using distinct sections for different data types, such as account details, transaction history, and payment information, improves readability. For instance, separating current charges from previous balances with clear headings and spacing prevents confusion and promotes efficient review.

- Font ConsistencyConsistent use of professional and legible fonts enhances readability and maintains a polished appearance. Using a standard font throughout the document, such as Times New Roman or Arial, ensures a cohesive and professional look. Avoid decorative or overly stylized fonts, which can detract from the document’s credibility.

- High-Quality Printing (If Applicable)If physical copies are used, high-quality printing on appropriate paper stock conveys professionalism and attention to detail. Using quality paper and ensuring crisp, clear printing demonstrates respect for the recipient and reinforces the importance of the document. This is particularly relevant for formal statements or those requiring signatures.

These elements of professional formatting, when integrated into a statement of account letter template, contribute to a document that is not only visually appealing but also functional and effective in conveying important financial information. This reinforces the business’s credibility and promotes a positive and efficient interaction with clients. A professional presentation builds trust, reduces misinterpretations, and ultimately contributes to stronger client relationships.

4. Timely Delivery

Timely delivery of statements of account is crucial for maintaining positive client relationships and facilitating sound financial practices. A well-designed template contributes to timely delivery by streamlining the creation and distribution process. Automated generation of statements based on predefined templates reduces manual effort and ensures consistent, prompt delivery. When statements are consistently delivered on time, clients can effectively manage their finances, make informed decisions, and address any discrepancies promptly.

Consider a scenario where a business relies on manual processes to create and send statements. This can lead to delays, particularly during peak periods, potentially impacting client satisfaction and cash flow. In contrast, utilizing a template allows for automated generation and distribution, ensuring statements reach clients promptly and consistently, regardless of workload fluctuations. For example, a template configured to automatically generate and send statements on the first of each month eliminates the need for manual intervention, reducing delays and ensuring predictable delivery. This predictability empowers clients to integrate payment schedules into their financial planning, contributing to a smoother and more efficient financial relationship.

The benefits of timely delivery extend beyond client satisfaction. Prompt delivery of accurate statements facilitates timely payments, improving cash flow and reducing the risk of late payments or outstanding balances. This, in turn, contributes to the overall financial health of the business. Moreover, consistent and timely communication strengthens the business-client relationship, fostering trust and transparency. Therefore, incorporating timely delivery as a key consideration within the design and implementation of a statement of account letter template contributes not only to efficient operations but also to stronger client relationships and improved financial outcomes.

5. Dispute Resolution

A well-designed statement of account letter template plays a crucial role in facilitating efficient dispute resolution. Clear and accurate information within the statement minimizes the likelihood of disputes arising in the first place. When discrepancies do occur, the statement serves as a valuable reference point for identifying the source of the disagreement. A template that includes clear contact information for inquiries and a designated process for raising disputes streamlines communication and facilitates prompt resolution. For instance, a statement that clearly outlines payment due dates, applied payments, and outstanding balances reduces ambiguity and provides a shared understanding of the financial transactions between parties. This transparency minimizes the potential for misunderstandings that could escalate into disputes.

Consider a scenario where a client questions a specific charge on their statement. A well-structured template allows both the client and the business to quickly pinpoint the transaction in question, review supporting details, and collaboratively resolve the issue. This avoids protracted disagreements and preserves the business-client relationship. Furthermore, a designated section within the template outlining the dispute resolution process, including contact information and escalation procedures, empowers clients to address concerns efficiently. This proactive approach to dispute management demonstrates a commitment to customer service and fosters trust. Including a clear explanation of the billing cycle, payment terms, and any applicable fees within the template further reduces the potential for misunderstandings.

Effective dispute resolution contributes to positive client relationships, reduces financial losses associated with unresolved disputes, and enhances operational efficiency. Therefore, integrating dispute resolution considerations into the design of a statement of account letter template is not merely a best practice but a crucial component of sound financial management and client relationship management. A proactive approach to dispute resolution, facilitated by a comprehensive and well-designed statement template, minimizes disruptions, strengthens client relationships, and contributes to a more stable and predictable business environment. The template becomes a tool for preventing disputes and, when they inevitably arise, resolving them efficiently and effectively.

Key Components of a Statement of Account Letter Template

Essential elements ensure a comprehensive and effective statement of account, facilitating clear communication and accurate record-keeping.

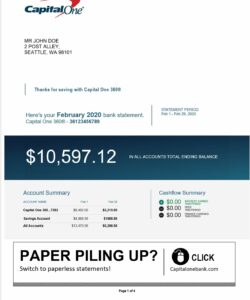

1. Company Information: Clear identification of the issuing business, including name, address, contact information, and logo, establishes credibility and facilitates communication. This allows clients to readily identify the source of the statement and contact the business with any inquiries.

2. Client Information: Accurate client details, including name, address, and account number, ensure the statement reaches the correct recipient and allows for proper record-keeping. This personalization reinforces the business-client relationship.

3. Statement Period: A clearly defined date range specifies the period covered by the statement, providing context for the transactions listed. This clarifies the timeframe for the financial activity being reported.

4. Transaction Details: A detailed breakdown of individual transactions, including date, description, invoice number, and amount, provides a comprehensive record of financial activity. This transparency allows clients to reconcile the statement with their own records.

5. Payment Information: Recording payments received, including date and amount, allows for accurate tracking of outstanding balances. This clarity minimizes potential discrepancies and facilitates reconciliation.

6. Outstanding Balance: Clearly displaying the total amount owed at the end of the statement period provides clients with a concise summary of their financial obligations. This promotes timely payments and effective financial management.

7. Payment Terms: Including payment terms, such as due dates and accepted payment methods, clarifies expectations and facilitates timely payments. This contributes to a smoother and more efficient financial relationship.

8. Dispute Resolution Information: Providing contact information and procedures for resolving discrepancies demonstrates a commitment to customer service and facilitates prompt resolution of any issues. This proactive approach builds trust and strengthens the business-client relationship.

These components work together to create a comprehensive and informative document that promotes transparency, facilitates reconciliation, and supports effective financial management for both the business and the client. A well-structured statement of account fosters clear communication and contributes to a positive business-client relationship.

How to Create a Statement of Account Letter Template

Creating a professional and effective statement of account letter template requires careful planning and consideration of key elements. A well-structured template ensures clarity, accuracy, and efficiency in communicating financial information to clients. The following steps outline the process of developing a comprehensive template.

1. Define the Purpose: Clarify the specific objectives of the statement. Determine the target audience and the information they require to understand their financial standing. Consider the overall tone and level of formality appropriate for the business context.

2. Gather Required Information: Identify the essential data points to include. This typically includes company information, client details, statement period, transaction details, payment information, outstanding balance, payment terms, and dispute resolution procedures. Ensure access to reliable data sources for populating these fields.

3. Choose a Format: Select a suitable format, whether digital or physical, considering accessibility and client preferences. Digital formats offer flexibility and automation, while physical copies may be necessary for certain legal or regulatory requirements.

4. Design the Layout: Create a clear and organized layout that facilitates easy navigation and comprehension. Group related information logically, using headings and subheadings to improve readability. Consider using tables or charts for presenting complex data.

5. Incorporate Branding: Integrate company branding elements, such as logos and color schemes, to reinforce brand identity and maintain a professional appearance. Ensure consistency with other business communications.

6. Implement Automation (If Applicable): For digital templates, explore automation options for generating and distributing statements. Automated processes reduce manual effort, improve efficiency, and ensure timely delivery.

7. Test and Refine: Thoroughly test the template with sample data to identify any errors or areas for improvement. Gather feedback from relevant stakeholders, such as accounting personnel and client representatives, to refine the design and ensure clarity.

8. Document and Train: Document the template’s usage and functionality for future reference and training purposes. Provide clear instructions on how to populate the template, generate statements, and distribute them to clients. This ensures consistent and accurate usage across the organization.

A well-designed template, incorporating these elements, streamlines the creation and distribution of statements, promotes transparency, and contributes to positive client relationships. Regular review and updates ensure the template remains relevant and effective in meeting evolving business needs and client expectations.

Effective management of financial communications is crucial for maintaining strong client relationships and ensuring smooth business operations. A well-designed statement of account letter template provides the framework for clear, concise, and accurate reporting of financial transactions. Key components, such as accurate transaction details, clear payment information, and a professional format, contribute to a transparent and efficient communication process. Furthermore, timely delivery and a clear dispute resolution process enhance client trust and contribute to a positive business environment. Proper implementation and utilization of such a template streamlines accounting procedures, minimizes discrepancies, and fosters positive client interactions.

The strategic implementation of a comprehensive template represents an investment in clarity, efficiency, and professionalism. This proactive approach to financial communication not only strengthens client relationships but also contributes to the long-term financial health and stability of an organization. Continual review and refinement of templates, adapting to evolving business needs and best practices, ensures sustained effectiveness and optimal communication in the financial landscape. This ongoing commitment to clarity and accuracy in financial reporting fosters trust, promotes stability, and contributes to a more robust and transparent business environment.