Utilizing this standardized form promotes financial clarity and reduces the potential for disputes during closing. By offering a detailed breakdown of expenses, it empowers both parties to make informed decisions and avoid unexpected costs. This detailed accounting promotes a smoother, more efficient closing process.

Understanding the components and significance of this standardized financial document is essential for anyone involved in a property sale or purchase. The following sections will delve deeper into specific aspects, offering practical guidance and valuable insights.

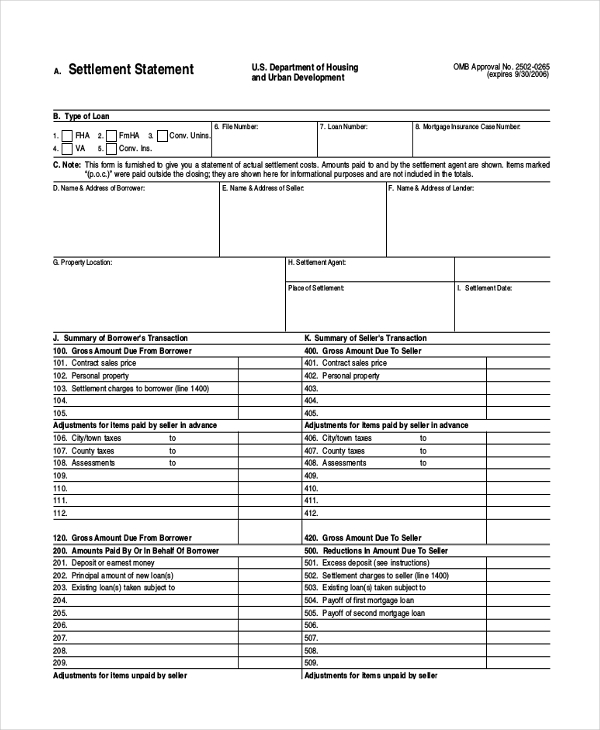

1. Standardized Form

Standardization in real estate settlement procedures is essential for clarity, consistency, and legal compliance. The standardized form of a settlement statement template serves as a crucial tool in achieving these objectives. It ensures all parties involved in the transaction are presented with the same comprehensive information, minimizing ambiguity and potential misunderstandings. This structure allows for efficient comparisons across transactions and simplifies regulatory oversight.

- Uniformity and TransparencyUniformity ensures consistent presentation of key financial details across all transactions, fostering transparency and enabling straightforward comparisons. This standardized approach simplifies complex financial information, making it accessible to all parties involved, regardless of their real estate expertise. Clear and consistent presentation reduces the risk of overlooking critical figures and promotes informed decision-making.

- Legal Compliance and Regulatory OversightAdherence to a standardized format facilitates compliance with federal and state regulations governing real estate closings. The standardized structure simplifies regulatory review and auditing processes, ensuring adherence to legal requirements. This compliance safeguards all parties involved and minimizes the risk of legal challenges.

- Simplified Data Analysis and ComparisonThe standardized format facilitates efficient data analysis for industry professionals and researchers. Comparative analysis across multiple transactions becomes easier, enabling market trend identification and pricing analysis. This data-driven insight benefits lenders, real estate agents, and policymakers.

- Reduced Errors and MisinterpretationsA standardized structure minimizes the potential for errors and misinterpretations. Clear labeling and consistent placement of information reduce confusion and facilitate accurate data entry. This precision is essential for preventing costly mistakes during closing.

The standardized form of the settlement statement template plays a crucial role in promoting transparency, efficiency, and legal compliance within the real estate industry. By providing a consistent framework for presenting complex financial information, it empowers buyers, sellers, and other stakeholders to navigate the closing process with confidence and clarity.

2. Comprehensive Cost Overview

A comprehensive cost overview within a real estate settlement statement template provides transparency and clarity for all parties involved in a property transaction. This detailed breakdown of expenses ensures informed decision-making and minimizes the potential for disputes arising from unexpected charges. Understanding the various components of this overview is crucial for a smooth and efficient closing process.

- Loan CostsLoan costs encompass various fees associated with securing financing for the property. These may include origination fees, appraisal fees, and discount points. For instance, a buyer might encounter a 1% origination fee on a $300,000 loan, totaling $3,000. Clear disclosure of these costs within the settlement statement allows buyers to compare loan offers and understand the true cost of borrowing.

- Taxes and Government FeesThis section details property taxes, transfer taxes, and recording fees imposed by governmental entities. Transfer taxes, for example, can vary significantly based on local regulations. Accurate representation of these charges in the settlement statement ensures both buyers and sellers understand their respective tax obligations.

- Prepaid ItemsPrepaid items often include homeowner’s insurance and prepaid property taxes. For example, a seller might have prepaid property taxes for the year. The settlement statement calculates the prorated share owed to the seller for the remaining portion of the year. This clear accounting prevents discrepancies and ensures fair allocation of expenses.

- Title and Escrow FeesTitle insurance protects against defects in the property’s title, while escrow fees cover services provided by a neutral third party managing the closing process. These fees, while essential, can vary depending on the provider and location. Transparency in the settlement statement allows for comparison shopping and informed selection of service providers.

The comprehensive cost overview within the settlement statement template functions as a critical tool for ensuring a transparent and legally sound real estate transaction. By providing a detailed account of all expenses, it empowers buyers and sellers to make informed decisions, minimizing the potential for disputes and facilitating a smooth closing process. Accurate completion and careful review of this section contribute significantly to the overall success of the transaction.

3. Buyer/Seller Clarity

Clarity for both buyer and seller stands as a cornerstone of successful real estate transactions. The settlement statement template plays a pivotal role in achieving this clarity by providing a detailed and transparent account of all financial obligations. This shared understanding of costs minimizes potential disputes and fosters a smoother closing process. A clear delineation of who pays whatfor example, distinguishing between buyer and seller responsibilities for transfer taxes or prepaid property taxesprevents misunderstandings and ensures equitable distribution of expenses. Without this clarity, transactions can become mired in disputes, potentially leading to delays or even deal cancellations.

Consider a scenario where the settlement statement clearly outlines the proration of property taxes. The seller has prepaid taxes for the year, and the closing occurs mid-year. The statement precisely calculates the amount the buyer owes the seller for the remaining tax period. This transparent calculation prevents disagreements and ensures a fair distribution of the prepaid amount. Conversely, a lack of clarity on this point could lead to contention and delay the closing process. Another example involves clearly itemizing closing costs, such as loan origination fees, appraisal fees, and title insurance premiums. This detailed breakdown enables both buyer and seller to understand the total cost of the transaction and avoid unexpected surprises at closing.

In summary, the settlement statement template serves as an essential tool for fostering buyer/seller clarity. This transparency is fundamental for mitigating disputes, building trust, and ensuring a successful and efficient closing. Accurate completion and careful review of the statement by all parties contribute significantly to a positive transaction experience. Lack of clarity, on the other hand, can undermine trust, create conflict, and ultimately jeopardize the successful completion of the real estate transaction. Therefore, prioritizing clear and comprehensive documentation through the settlement statement template is crucial for all stakeholders.

4. Financial Transparency

Financial transparency forms the bedrock of trust and informed decision-making in real estate transactions. The settlement statement template serves as a crucial instrument in achieving this transparency by providing a comprehensive and detailed account of all costs associated with the transaction. This open access to financial information empowers both buyers and sellers to understand their obligations and make informed decisions, ultimately contributing to a smoother and more equitable closing process. Without such transparency, the potential for disputes, misunderstandings, and ultimately, failed transactions increases significantly.

- Full Disclosure of CostsComplete disclosure of all costs, including loan fees, taxes, insurance, and title charges, is paramount. For example, a buyer needs to understand not only the mortgage principal and interest but also the associated closing costs, such as loan origination fees, appraisal fees, and prepaid property taxes. Hidden or undisclosed fees can lead to significant financial strain and erode trust between parties. The settlement statement template mandates the explicit itemization of all these costs, ensuring no hidden surprises at closing.

- Clear Presentation of FeesClear presentation of fees, categorized logically and explained in plain language, is essential for comprehension. A settlement statement should clearly differentiate between recurring costs, like property taxes and homeowner’s insurance, and one-time fees, like transfer taxes or recording fees. This clear categorization facilitates understanding and allows for informed budgeting and financial planning. A convoluted or unclear presentation can create confusion and lead to misinterpretations of financial obligations.

- Accessibility of InformationAccessibility of information to all parties involved is crucial for ensuring a level playing field. Both buyers and sellers should have access to the settlement statement template well in advance of closing, allowing ample time for review and clarification of any questions. This timely access promotes informed decision-making and prevents last-minute surprises that could derail the transaction. Restricting access or providing information at the last minute can create an imbalance of power and hinder informed consent.

- Opportunity for VerificationProviding an opportunity for verification of all charges ensures accuracy and accountability. Buyers and sellers should be encouraged to review the settlement statement carefully, compare it with other documentation, and seek clarification from their respective real estate professionals. This verification process safeguards against errors and ensures that all parties agree on the financial details. A lack of opportunity for verification can lead to discrepancies, disputes, and potential legal challenges.

The settlement statement template, through its emphasis on these facets of financial transparency, promotes trust, facilitates informed decision-making, and ultimately contributes to the successful completion of real estate transactions. By ensuring all parties have access to clear, comprehensive, and verifiable financial information, the template minimizes the potential for disputes and fosters a more equitable and efficient closing process. Its standardized format further strengthens transparency by providing a consistent framework for presenting complex financial data, enabling straightforward comparisons across transactions and promoting greater accountability within the real estate industry.

5. Dispute Mitigation

Dispute mitigation stands as a critical function of the real estate settlement statement template. By providing a clear, comprehensive, and standardized account of all transaction costs, the template minimizes the potential for disagreements between buyers and sellers. This proactive approach to transparency fosters a smoother, more efficient closing process and reduces the likelihood of costly legal disputes arising from financial misunderstandings.

- Clear Delineation of ResponsibilitiesClear delineation of financial responsibilities for each partybuyer and selleris essential for preventing disputes. The template explicitly outlines who pays for specific costs, such as transfer taxes, title insurance, and prepaid property taxes. For instance, clearly stating whether the buyer or seller is responsible for the homeowner’s association fees for the month of closing eliminates ambiguity and potential conflict. This clarity ensures both parties understand their financial obligations from the outset.

- Preemptive Identification of DiscrepanciesThe detailed nature of the template allows for preemptive identification of potential discrepancies. By itemizing all costs and providing a comprehensive overview, it enables both parties to review the figures carefully and identify any inconsistencies before closing. For example, if the appraisal fee listed on the statement differs from the fee quoted by the appraiser, this discrepancy can be addressed and rectified before it escalates into a larger dispute. This early identification prevents delays and fosters a more collaborative closing process.

- Documented Agreement on TermsThe signed settlement statement serves as documented agreement on the financial terms of the transaction. This written record provides a crucial reference point should any disputes arise after closing. For example, if a question arises later regarding the amount paid for property taxes, the settlement statement provides definitive proof of the agreed-upon amount. This documented agreement minimizes the potential for future disagreements and provides a solid foundation for resolving any discrepancies that may arise.

- Facilitation of Informed NegotiationThe template facilitates informed negotiation by providing both parties with a clear understanding of the financial implications of the transaction. This transparency empowers buyers and sellers to negotiate more effectively, addressing any concerns or discrepancies proactively. For instance, if the buyer believes certain closing costs are excessive, they can use the information presented in the statement to negotiate with the seller or lender. This informed negotiation fosters a more collaborative and equitable outcome.

Through these mechanisms, the real estate settlement statement template serves as a powerful tool for dispute mitigation. By promoting transparency, facilitating informed negotiation, and providing a documented agreement on terms, the template minimizes the potential for conflict, streamlines the closing process, and contributes significantly to a successful and amicable real estate transaction. The resulting clarity and shared understanding fostered by the template ultimately benefit all stakeholders involved.

Key Components of a Real Estate Settlement Statement

Understanding the core components of a real estate settlement statement is crucial for transparent and legally sound property transactions. These components provide a structured overview of the financial obligations for both buyers and sellers.

1. Loan Information: This section details the terms of the mortgage loan, including the loan amount, interest rate, and loan term. It also specifies any associated loan fees, such as origination fees, discount points, and appraisal fees. Clarity regarding these figures is crucial for buyers to understand the true cost of financing.

2. Payoffs and Credits: Existing mortgages or liens on the property are detailed here, along with any credits applied to the transaction. This ensures transparency regarding outstanding debts and how they impact the final settlement figures.

3. Taxes and Government Fees: This section outlines property taxes, transfer taxes, recording fees, and other government-imposed charges. Accurate calculation and allocation of these fees are crucial for compliance and prevent future disputes.

4. Prepaid Items: Homeowner’s insurance, prepaid property taxes, and other prepaid items are detailed in this section. Prorated calculations ensure fair allocation of these expenses between buyer and seller based on the closing date.

5. Title Charges: Costs associated with title insurance, title search, and other title-related services are outlined here. Title insurance protects against potential defects in the property’s title, safeguarding the buyer’s investment.

6. Escrow and Closing Costs: Fees for escrow services, closing agents, and other settlement services are itemized. These fees cover the administrative aspects of the transaction and ensure a smooth closing process.

7. Adjustments and Prorations: This section accounts for adjustments and prorations of various expenses, such as property taxes and homeowner’s association dues, ensuring equitable distribution between buyer and seller based on the closing date. These calculations prevent one party from unfairly bearing the financial burden of expenses covering periods before or after their ownership.

8. Final Closing Figures: The final section presents the total amount due from the buyer and the net proceeds due to the seller. This summary provides a clear and concise overview of the final financial obligations for each party, culminating in the successful transfer of ownership.

Accurate and comprehensive documentation of these components ensures a transparent and legally sound transaction, protecting the interests of both buyers and sellers and contributing to a smooth and efficient closing process.

How to Create a Real Estate Settlement Statement

Creating a precise and comprehensive real estate settlement statement is crucial for a transparent and legally sound transaction. While standardized forms are readily available and often preferred, understanding the key elements and steps involved in their creation ensures accurate reflection of all transaction details.

1. Identify the Parties Involved: Clearly identify the buyer, seller, lender, and any other relevant parties involved in the transaction. Accurate identification ensures proper allocation of costs and responsibilities.

2. Loan Details: If a mortgage loan is involved, specify the loan amount, interest rate, loan term, and any associated fees, such as origination fees, discount points, or appraisal fees. This information is crucial for calculating the buyer’s total financing costs.

3. Existing Payoffs: Document any existing mortgages or liens on the property that need to be paid off as part of the transaction. Include payoff amounts and account information to ensure accurate disbursement of funds.

4. Tax and Government Fee Calculations: Calculate and itemize all applicable taxes, including property taxes, transfer taxes, and recording fees. Ensure accurate figures and proper allocation between buyer and seller based on local regulations and closing date.

5. Prepaid Item Proration: Determine any prepaid items, such as homeowner’s insurance or property taxes, and calculate the proration based on the closing date. This ensures a fair allocation of prepaid expenses between buyer and seller.

6. Title and Escrow Fees: Include all charges related to title insurance, title search, escrow services, and other closing fees. Clearly specify each fee and the responsible party.

7. Adjustments and Other Costs: Account for any other adjustments or credits, such as homeowner’s association dues or utility bills. These adjustments ensure an accurate reflection of outstanding balances and prevent disputes after closing.

8. Final Figures Calculation: Calculate the total amount due from the buyer and the net proceeds due to the seller. This final calculation summarizes all financial obligations and ensures accurate disbursement of funds at closing.

Accurate and detailed completion of these steps ensures a transparent and comprehensive settlement statement, minimizing the potential for disputes and facilitating a smooth closing process. Utilizing standardized forms and seeking professional guidance when necessary further enhances accuracy and compliance.

Accurate and transparent accounting of financial obligations in real estate transactions is paramount. A standardized form facilitates this transparency by providing a comprehensive overview of all costs associated with the purchase or sale of a property. Understanding the components within this standardized formloan details, tax calculations, prepaid items, title charges, and closing feesempowers both buyers and sellers to navigate the complexities of closing with confidence. Meticulous attention to detail and adherence to standardized procedures contribute significantly to a smooth, efficient, and legally sound closing process, minimizing potential disputes and fostering trust between all parties.

Diligence in utilizing and comprehending this standardized form safeguards against financial misunderstandings and contributes to the integrity of the real estate transaction. This meticulous approach to financial documentation ultimately benefits all stakeholders, promoting a more equitable and transparent real estate market. Careful review and thorough understanding of this document remain essential for anyone involved in a property transaction, ensuring a successful and legally sound transfer of ownership.