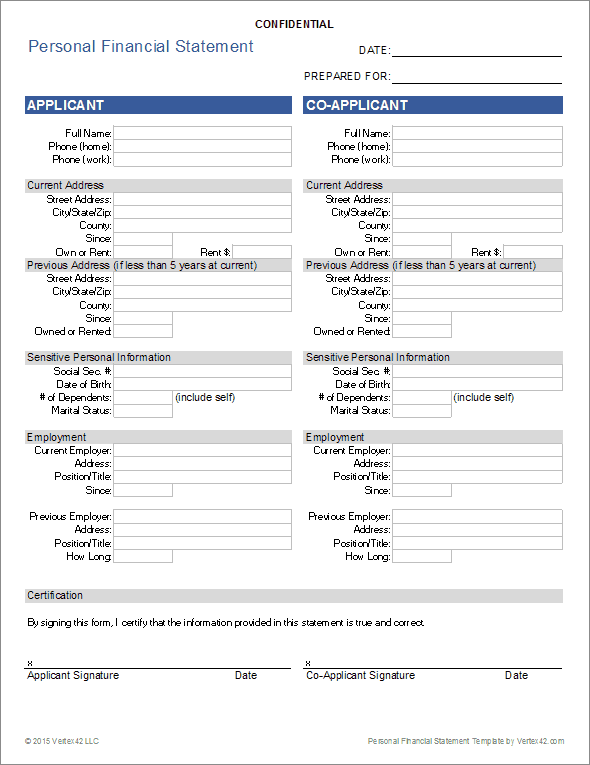

Utilizing a pre-designed structure offers several advantages. It simplifies the process of organizing financial information, ensuring consistency and completeness. This standardized approach enables easier analysis and comparison, allowing individuals to track progress over time and identify areas for improvement. It can also prove invaluable when seeking financial advice or applying for loans, providing a readily available and comprehensive overview for third parties.

This foundation provides a springboard for deeper exploration into related topics such as budgeting, debt management, investment strategies, and retirement planning. Understanding the components and implications of this financial summary is crucial for achieving financial well-being and long-term security.

1. Assets

Assets, representing items of owned economic value, form a crucial component of a standardized personal financial statement. Accurate asset documentation is essential for determining net worth and understanding overall financial health. Assets are categorized into liquid assets, such as cash and easily convertible securities; and non-liquid assets, like real estate or retirement accounts. For example, an individual might list $5,000 in a checking account as a liquid asset, while a home valued at $300,000 would be a non-liquid asset. The specific categorization impacts financial planning, as liquid assets are readily available for short-term needs, whereas non-liquid assets contribute to long-term stability and wealth building. Accurately representing these values provides a realistic picture of one’s financial resources.

The detailed breakdown of assets within the standardized template allows for a nuanced understanding of financial standing. This detailed view facilitates informed decision-making regarding investments, debt management, and other financial strategies. For instance, a high concentration of assets in illiquid holdings might signal a need for increased liquidity to meet short-term obligations or opportunities. Conversely, a significant amount of liquid assets might suggest potential for higher-return investments. The template, therefore, serves as a valuable tool for strategic financial planning.

Accurate asset reporting within a standardized personal financial statement provides a clear foundation for effective financial management. This structured approach allows individuals to leverage their resources effectively, identify areas for improvement, and make sound financial decisions aligned with their goals. Challenges may include accurately valuing certain assets, such as collectibles or privately held businesses. Seeking professional guidance, when necessary, ensures a comprehensive and reliable representation of one’s financial position within the statement’s framework.

2. Liabilities

Liabilities, representing outstanding financial obligations, form a critical counterpart to assets within a standardized personal financial statement. Accurate accounting of liabilities is essential for determining net worth and gaining a comprehensive understanding of one’s financial position. A clear grasp of liabilities enables informed decision-making regarding debt management, budgeting, and overall financial planning.

- Short-Term LiabilitiesThese obligations are typically due within one year and include credit card balances, utility bills, and short-term loans. For example, an outstanding credit card balance of $1,000 would be classified as a short-term liability. Managing these debts effectively is crucial for maintaining a healthy credit score and avoiding financial strain. Within the template, short-term liabilities provide insights into immediate financial demands.

- Long-Term LiabilitiesThese debts extend beyond one year and often involve significant financial commitments, such as mortgages, student loans, and auto loans. A 15-year mortgage with a remaining balance of $200,000 would be a long-term liability. Understanding the long-term implications of these obligations is vital for effective financial planning, as they represent substantial future financial commitments impacting available resources for other goals.

- Secured vs. Unsecured DebtLiabilities can be classified as secured or unsecured. Secured debt is backed by collateral, such as a car loan secured by the vehicle itself. Unsecured debt, like credit card debt, lacks such collateral. This distinction impacts the consequences of default, with secured creditors having a claim on the collateral. Within the template, this categorization provides a deeper understanding of the nature of one’s obligations and associated risks.

- Impact on Net WorthThe magnitude of liabilities directly affects net worth. Higher liabilities reduce net worth, while lower liabilities contribute to a stronger financial position. Accurately documenting all liabilities within the standardized format is essential for determining a true and accurate net worth figure. This accurate reflection enables realistic financial assessments and facilitates informed financial planning based on a clear understanding of one’s overall financial health.

The comprehensive representation of liabilities within a standardized personal financial statement offers a crucial perspective on financial health. Understanding the nuances of different liability types, their impact on net worth, and their implications for future financial decisions empowers individuals to develop effective strategies for debt management and overall financial well-being. By juxtaposing liabilities against assets, the template provides a holistic overview facilitating informed financial planning and goal setting.

3. Net Worth

Net worth, a pivotal component of a standardized personal financial statement, represents the residual value of one’s assets after deducting all liabilities. Calculated as Assets – Liabilities = Net Worth, this figure provides a concise summary of an individual’s overall financial health at a specific point in time. Understanding this key metric is essential for effective financial planning and informed decision-making.

The statement serves as the primary tool for calculating and contextualizing net worth. By organizing assets and liabilities in a structured format, the statement facilitates an accurate net worth calculation. Consider an individual with $250,000 in assets and $100,000 in liabilities. Their net worth, as reflected on the statement, would be $150,000. This quantifiable measure provides a clear benchmark for evaluating financial progress and setting realistic financial goals. Tracking net worth over time reveals the effectiveness of financial strategies, highlighting areas for improvement. An increasing net worth generally signifies positive financial trajectory, while a declining net worth signals a need for adjustments in spending, saving, or investment strategies.

Net worth provides more than just a snapshot of current financial standing; it serves as a crucial indicator of long-term financial health and stability. A positive and growing net worth provides greater financial security, expands options for future investments and significant purchases, and enhances overall financial well-being. While a negative net worth indicates a need to address debt and implement strategies for building assets. Regular review and analysis of the statement, focusing on net worth trends, empowers individuals to make informed adjustments to their financial strategies and work towards achieving their financial objectives. This structured approach to assessing and managing one’s financial resources is essential for achieving long-term financial security and achieving financial goals.

4. Snapshot in Time

A key characteristic of a generic personal financial statement template is its representation of financial standing at a specific moment. This “snapshot in time” functionality is crucial for accurate assessment and subsequent financial planning. The data capturedassets, liabilities, and net worthreflects the financial position only on the date specified. This characteristic distinguishes it from other financial documents like budgets or income statements, which typically cover a period. For example, a statement generated on January 1, 2024, accurately portrays one’s financial status on that date but does not account for fluctuations occurring afterward, such as a salary increase in February or a significant purchase in March. This time-specific nature underscores the importance of regular updates to maintain an accurate view of financial progress.

The “snapshot in time” nature provides a baseline for measuring progress and evaluating the effectiveness of financial strategies. By comparing statements generated at different intervals, one can identify trends in net worth, asset growth, and debt reduction. For instance, comparing a January 1, 2024 statement with one from July 1, 2024, reveals the net effect of financial activities during the intervening six months. This comparative analysis allows for informed adjustments to financial plans, ensuring alignment with long-term goals. Without this time-bound perspective, assessing the impact of financial decisions would be significantly more challenging. Regularly generated statements offer a historical record of financial development, facilitating more effective long-term financial planning.

Understanding the “snapshot in time” principle is essential for interpreting and utilizing the information within a generic personal financial statement template effectively. Recognizing that the data reflects a specific moment underscores the need for consistent updates and informed analysis. While the statement itself doesn’t predict future financial performance, the historical data it provides forms a critical foundation for sound financial planning, decision-making, and achieving long-term financial goals. This understanding emphasizes the iterative nature of financial management and the importance of the template as a tool for continuous monitoring and improvement.

5. Standardized Format

A standardized format is fundamental to the utility of a generic personal financial statement template. This consistent structure ensures comparability, simplifies analysis, and facilitates clear communication of financial information to third parties. Standardization allows for consistent tracking of financial progress over time and provides a common framework for financial professionals to interpret individual financial data.

- Organization of InformationStandardized templates organize information into distinct categories: assets, liabilities, and net worth. This structured presentation ensures all essential financial data is captured consistently, making it easy to locate and analyze specific information. For example, all assets, whether liquid or non-liquid, are grouped within the designated asset section, enabling quick calculation of total asset value. This consistent organization facilitates clear understanding and efficient analysis.

- Comparability Over TimeThe standardized format allows for straightforward comparison of financial statements generated at different times. This comparability is crucial for tracking financial progress and identifying trends. By comparing net worth, asset growth, or debt reduction over specific periods, individuals can assess the effectiveness of their financial strategies. For example, comparing consecutive annual statements can reveal whether net worth is increasing as planned. This longitudinal perspective is essential for evaluating financial health and making informed adjustments to strategies.

- Ease of InterpretationA standardized format promotes consistent interpretation of financial data by financial advisors, lenders, and other stakeholders. This clarity reduces ambiguity and ensures all parties are working with the same understanding of an individual’s financial position. When applying for a loan, for example, a standardized statement readily communicates the applicant’s financial health to the lender, facilitating efficient processing and informed decision-making.

- Simplified Data Entry and AnalysisThe structured layout of a standardized template simplifies data entry and subsequent analysis using financial software or tools. This efficiency saves time and reduces the likelihood of errors, promoting accurate representation of financial data. Many financial planning software applications are designed to import data directly from standardized templates. This compatibility streamlines analysis, generating reports and visualizations that offer deeper insights into financial trends and opportunities.

The standardized format of a generic personal financial statement template underpins its value as a tool for effective financial management. By ensuring consistency, comparability, and ease of interpretation, the standardized format promotes accurate financial assessment, facilitates informed decision-making, and empowers individuals to take control of their financial well-being. This structured approach provides a solid foundation for achieving financial goals and building long-term financial security.

Key Components of a Personal Financial Statement

A comprehensive personal financial statement requires several key components to provide a thorough overview of an individual’s financial position. These components, working in concert, offer a structured and standardized approach to understanding one’s financial health.

1. Assets: Assets represent items of economic value owned by an individual. These can range from liquid assets like cash and checking accounts to non-liquid assets such as real estate, vehicles, and investments. Accurate valuation and categorization of assets are crucial for a realistic portrayal of financial resources.

2. Liabilities: Liabilities encompass all outstanding financial obligations or debts. These are typically categorized as short-term (due within one year) or long-term (extending beyond one year). Examples include mortgages, credit card balances, student loans, and auto loans. A clear understanding of liabilities is essential for effective debt management.

3. Net Worth: Net worth is the difference between total assets and total liabilities. This key metric provides a concise summary of one’s overall financial standing. A positive net worth indicates that assets exceed liabilities, while a negative net worth signifies the opposite. Tracking net worth over time provides valuable insights into financial progress.

4. Income: Income represents all sources of revenue, including salaries, wages, investment income, and any other regular cash inflow. Accurate income reporting is essential for assessing financial stability and planning for future expenses.

5. Expenses: Expenses encompass all costs incurred, categorized as fixed (consistent, recurring costs like rent or mortgage payments) or variable (fluctuating costs like groceries or entertainment). Detailed expense tracking is crucial for budgeting and identifying areas for potential savings.

Accurate and comprehensive documentation of these components provides a robust foundation for financial planning, analysis, and decision-making. This structured approach enables individuals to gain a clear understanding of their current financial position, set realistic financial goals, and develop strategies to achieve long-term financial security.

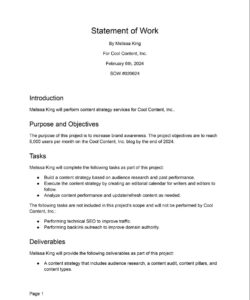

How to Create a Generic Personal Financial Statement

Creating a personal financial statement involves systematically organizing financial information to provide a clear overview of one’s assets, liabilities, and net worth. This structured approach facilitates informed financial decision-making and promotes effective financial management.

1. Gather Necessary Documents: Collect all relevant financial documents, including bank statements, investment account summaries, loan documents, and recent pay stubs. This comprehensive collection ensures accurate data entry and a complete representation of financial standing.

2. Choose a Template or Software: Select a pre-designed template (either electronic or printable) or utilize personal finance software. These tools offer a structured format for organizing data and often include built-in calculation functionalities.

3. List Assets: Itemize all owned assets, categorizing them as liquid (easily convertible to cash) or non-liquid. Provide accurate valuations for each asset. Examples include cash, checking and savings accounts, investments, real estate, vehicles, and personal property.

4. List Liabilities: Document all outstanding debts and financial obligations. Categorize liabilities as short-term (due within one year) or long-term. Examples include mortgages, student loans, auto loans, credit card balances, and personal loans.

5. Calculate Net Worth: Subtract total liabilities from total assets to determine net worth. This key figure represents overall financial health at a specific point in time. Regularly tracking net worth helps monitor financial progress.

6. Record Income and Expenses (Optional): While not strictly part of a balance sheet-style statement, including income and expense information provides a more holistic financial overview. List all sources of income and categorize expenses. This additional information is valuable for budgeting and financial planning.

7. Review and Update Regularly: Financial situations can change frequently. Regularly review and update the statement, ideally at least annually or whenever significant financial events occur, to maintain an accurate and relevant overview of one’s financial position.

A well-constructed personal financial statement offers a clear and organized snapshot of ones financial health. This structured approach empowers informed decision-making regarding budgeting, debt management, investments, and other crucial financial strategies. Regular updates and thoughtful analysis of the statement facilitate effective progress towards financial goals and contribute to long-term financial security.

A standardized personal financial statement template provides a structured framework for organizing crucial financial data, encompassing assets, liabilities, and net worth. Its standardized format facilitates clear, concise snapshots of one’s financial position at specific points in time, enabling effective tracking of progress and informed decision-making. Understanding the components and their interrelationships empowers individuals to assess their financial health accurately and develop strategies for improvement. The template serves as a valuable tool for communicating financial information to third parties, such as financial advisors or lenders, promoting transparency and facilitating informed interactions.

Regular utilization of this template fosters financial awareness and promotes proactive financial management. By diligently tracking financial data and analyzing trends, individuals can identify areas for improvement, optimize resource allocation, and make sound financial decisions aligned with their long-term goals. This structured approach to personal finance empowers individuals to take control of their financial well-being and build a secure financial future. Ultimately, consistent engagement with a standardized personal financial statement template equips individuals with the knowledge and insights necessary to navigate the complexities of personal finance and achieve lasting financial stability.