Utilizing a standardized structure for this financial reporting offers numerous advantages. It facilitates consistent tracking of performance, enabling trend analysis and informed decision-making. A well-designed framework simplifies financial reporting requirements and improves communication with stakeholders such as investors, lenders, and management. Furthermore, it provides a benchmark for comparing performance against industry averages and identifying areas for improvement or growth.

The subsequent sections will delve into the key components of this financial statement, providing practical guidance on its creation and interpretation for service-oriented businesses.

1. Revenue Streams

Revenue streams form the foundation of a profit and loss statement for service businesses. Accurately categorizing and recording these streams is crucial for understanding profitability and making informed financial decisions. Different service offerings may generate distinct revenue streams. For example, a consulting firm might categorize revenue by project type (e.g., strategy consulting, operations management), while a software-as-a-service (SaaS) business might distinguish between subscription fees, setup fees, and support services. This detailed breakdown allows businesses to analyze the performance of individual service offerings and identify areas for growth or potential decline. It also facilitates accurate revenue forecasting and budget allocation.

A granular understanding of revenue streams is essential for effective cost management and pricing strategies. By comparing revenue generated by specific services against the costs associated with delivering them, businesses can determine the profitability of each service offering. This analysis can reveal whether pricing adjustments are necessary to maintain profitability or if certain services are underperforming and require operational improvements. For instance, if a particular service generates substantial revenue but has disproportionately high delivery costs, the business can explore strategies to streamline operations, negotiate better supplier rates, or adjust pricing accordingly.

Clear documentation of revenue streams within the profit and loss statement provides valuable insights for stakeholders. Investors and lenders rely on this information to assess a company’s financial health and growth potential. Management uses this data to track performance against targets, identify trends, and make strategic decisions regarding resource allocation and future investments. A well-structured profit and loss statement, with detailed revenue stream information, enhances transparency and promotes informed decision-making at all levels.

2. Operating Expenses

Operating expenses represent the costs incurred in the day-to-day running of a service business. Accurate tracking and categorization of these expenses are crucial for generating a comprehensive profit and loss statement. Understanding these costs is essential for profitability analysis, cost management, and informed financial planning.

- Direct CostsDirect costs are directly attributable to service delivery. Examples include salaries of service delivery personnel, materials used in providing the service, and software licenses required for specific projects. Accurately allocating these costs is essential for determining the profitability of individual services and setting appropriate pricing.

- Indirect Costs (Overhead)Indirect costs, or overhead, are not directly tied to a specific service but support overall business operations. These include rent, utilities, administrative salaries, marketing and advertising expenses, and insurance. While not directly tied to service delivery, these costs are essential to the business’s functioning and must be factored into the profit and loss statement to provide a complete financial picture.

- Variable CostsVariable costs fluctuate with the volume of services provided. Examples include commissions paid to sales staff based on sales volume, travel expenses related to client meetings, and freelance contractor fees for project-based work. Understanding these costs allows businesses to predict profitability at different service delivery levels and make informed decisions about resource allocation.

- Fixed CostsFixed costs remain constant regardless of service volume. Examples include rent, salaries of permanent employees, and depreciation of equipment. These costs represent a consistent financial obligation and must be covered by revenue to ensure profitability. Analyzing fixed costs in relation to revenue can inform decisions about pricing, expansion, and overall business strategy.

Careful analysis of operating expenses within the profit and loss statement provides key insights into a service business’s cost structure and efficiency. This understanding is fundamental for optimizing profitability, identifying areas for cost reduction, and making informed decisions about resource allocation and future investments. Comparing operating expenses to industry benchmarks can further illuminate areas for potential improvement and competitive advantage.

3. Gross Profit

Gross profit represents the financial gain remaining after deducting the direct costs associated with providing services from the total revenue generated. Within the context of a profit and loss statement for a service business, gross profit serves as a key performance indicator, revealing the efficiency and profitability of core operations. Calculating gross profit requires accurate tracking of both revenue streams and direct costs. For instance, a consulting firm would subtract the direct costs of consultants’ salaries, project-related travel expenses, and software licenses from the revenue generated by consulting projects.

Analyzing gross profit trends over time provides valuable insights into a service business’s financial health. A declining gross profit margin, even with increasing revenue, could signal escalating direct costs, potentially indicating inefficiencies in service delivery or unfavorable pricing negotiations with suppliers. Conversely, a healthy and growing gross profit margin suggests effective cost management and strong pricing strategies. Understanding this relationship allows businesses to identify areas for improvement, optimize resource allocation, and implement cost-saving measures. For example, if a software development company experiences a shrinking gross profit margin due to rising software licensing costs, it might explore alternative software solutions or renegotiate contracts with vendors.

Gross profit plays a crucial role in subsequent calculations within the profit and loss statement, ultimately contributing to the determination of net income. It serves as the foundation upon which operating expenses, interest, and taxes are applied to arrive at the final net profit or loss figure. Therefore, a clear understanding of gross profit and its implications is essential for interpreting the overall financial performance of a service business and making strategic decisions for sustainable growth and profitability. Monitoring gross profit empowers businesses to identify and address operational challenges promptly, ultimately contributing to long-term financial success. This understanding, coupled with analysis of other key components of the profit and loss statement, provides a comprehensive view of the business’s financial health and informs strategic decision-making.

4. Net Income/Loss

Net income/loss represents the bottom line of a profit and loss statement, indicating a service business’s overall profitability after all revenues and expenses are accounted for. This crucial figure serves as a key indicator of financial performance and plays a central role in informing strategic decision-making. A thorough understanding of net income/loss and its contributing factors is essential for evaluating the financial health and sustainability of any service-based enterprise. Within the framework of a profit and loss statement template, net income/loss provides a concise summary of the period’s financial results.

- Calculating Net Income/LossNet income/loss is derived by subtracting total expenses (including direct costs, operating expenses, interest, and taxes) from total revenues. A positive result signifies net income, indicating profitability, while a negative result represents a net loss. Accurate calculation requires meticulous tracking and categorization of all financial transactions throughout the reporting period. For example, a marketing agency would subtract all its expenses, including salaries, office rent, software subscriptions, and advertising costs, from its revenue generated from client projects to arrive at its net income/loss figure.

- Interpreting Net Income/LossAnalyzing net income/loss trends over time provides critical insights into a business’s financial trajectory. Consistent net income growth demonstrates financial strength and sustainable business practices, while persistent losses may indicate underlying operational inefficiencies or unsustainable pricing strategies. Comparing net income/loss figures against industry benchmarks provides further context for evaluating performance and identifying areas for improvement.

- Impact on Financial DecisionsNet income/loss significantly influences key financial decisions. Profitable businesses may consider reinvesting profits in expansion, research and development, or talent acquisition, while businesses experiencing losses might need to implement cost-cutting measures, reassess pricing strategies, or explore alternative revenue streams. Understanding the factors influencing net income/loss is crucial for making informed decisions about resource allocation and future investments.

- Stakeholder CommunicationNet income/loss figures are essential for communicating financial performance to stakeholders, including investors, lenders, and management. This metric provides a clear and concise summary of the business’s financial health and its ability to generate profits. Transparent reporting of net income/loss fosters trust and enables informed decision-making at all levels.

Within the structure of a profit and loss statement template for service businesses, net income/loss serves as the culminating figure, encapsulating the overall financial outcome of the reporting period. Analyzing this figure in conjunction with other key components of the statement, such as revenue streams, gross profit, and operating expenses, provides a comprehensive understanding of the business’s financial performance and informs strategic planning for future growth and sustainability. A well-structured profit and loss statement, culminating in a clear net income/loss figure, is an invaluable tool for managing and optimizing the financial health of any service-oriented business.

5. Financial Health

A service business’s financial health represents its overall economic well-being and stability, reflecting its ability to generate profits, manage expenses, and meet financial obligations. A profit and loss statement template provides a structured framework for assessing this health, offering insights into revenue streams, cost structures, and overall profitability. Analyzing this statement allows stakeholders to gauge the business’s financial performance and identify areas for improvement or potential risks.

- Profitability AnalysisProfitability analysis utilizes the profit and loss statement to determine a company’s ability to generate profit from its services. Key metrics like gross profit margin and net profit margin, derived from the statement, provide insights into the efficiency of operations and pricing strategies. Consistently low or declining profitability may indicate unsustainable business practices, requiring adjustments to pricing, cost management, or service delivery models. For example, a consistently low net profit margin might necessitate a review of pricing strategies or operational efficiency.

- Liquidity AssessmentWhile not directly reflected in the profit and loss statement, liquiditya company’s ability to meet short-term financial obligationsis indirectly influenced by its profitability. Consistent profitability contributes to positive cash flow, enhancing liquidity and enabling the business to meet immediate expenses. Conversely, persistent losses can strain liquidity, potentially leading to difficulties in covering operational costs and meeting debt obligations. A thorough understanding of profitability, as revealed by the profit and loss statement, is therefore crucial for maintaining healthy liquidity.

- Operational EfficiencyThe profit and loss statement provides insights into a business’s operational efficiency by revealing the relationship between revenue and operating expenses. A high ratio of operating expenses to revenue might suggest inefficiencies in service delivery or resource allocation. Analyzing the statement allows businesses to identify areas for cost optimization and process improvement, thereby enhancing operational efficiency and contributing to increased profitability. For instance, a high proportion of administrative expenses might indicate opportunities for streamlining administrative processes.

- Long-Term SustainabilitySustained profitability, reflected in consistent net income generation within the profit and loss statement, is essential for long-term business sustainability. This profitability allows for reinvestment in growth initiatives, research and development, and talent acquisition, fostering future success. Conversely, persistent losses can jeopardize long-term viability, potentially hindering a business’s ability to adapt to market changes, invest in innovation, and compete effectively. Therefore, utilizing the profit and loss statement to monitor and analyze profitability is critical for ensuring long-term financial health and sustainability.

By providing a structured view of revenues, costs, and profitability, the profit and loss statement offers valuable insights into a service business’s financial health. Analyzing these elements individually and collectively provides a comprehensive understanding of the business’s current financial standing, its ability to generate profits, and its potential for future growth and sustainability. This information empowers stakeholders to make informed decisions regarding resource allocation, strategic planning, and overall financial management, contributing to the long-term success of the service-based enterprise. Regular review and analysis of the profit and loss statement, within the context of a robust financial management strategy, are therefore critical for maintaining and improving the financial health of any service business.

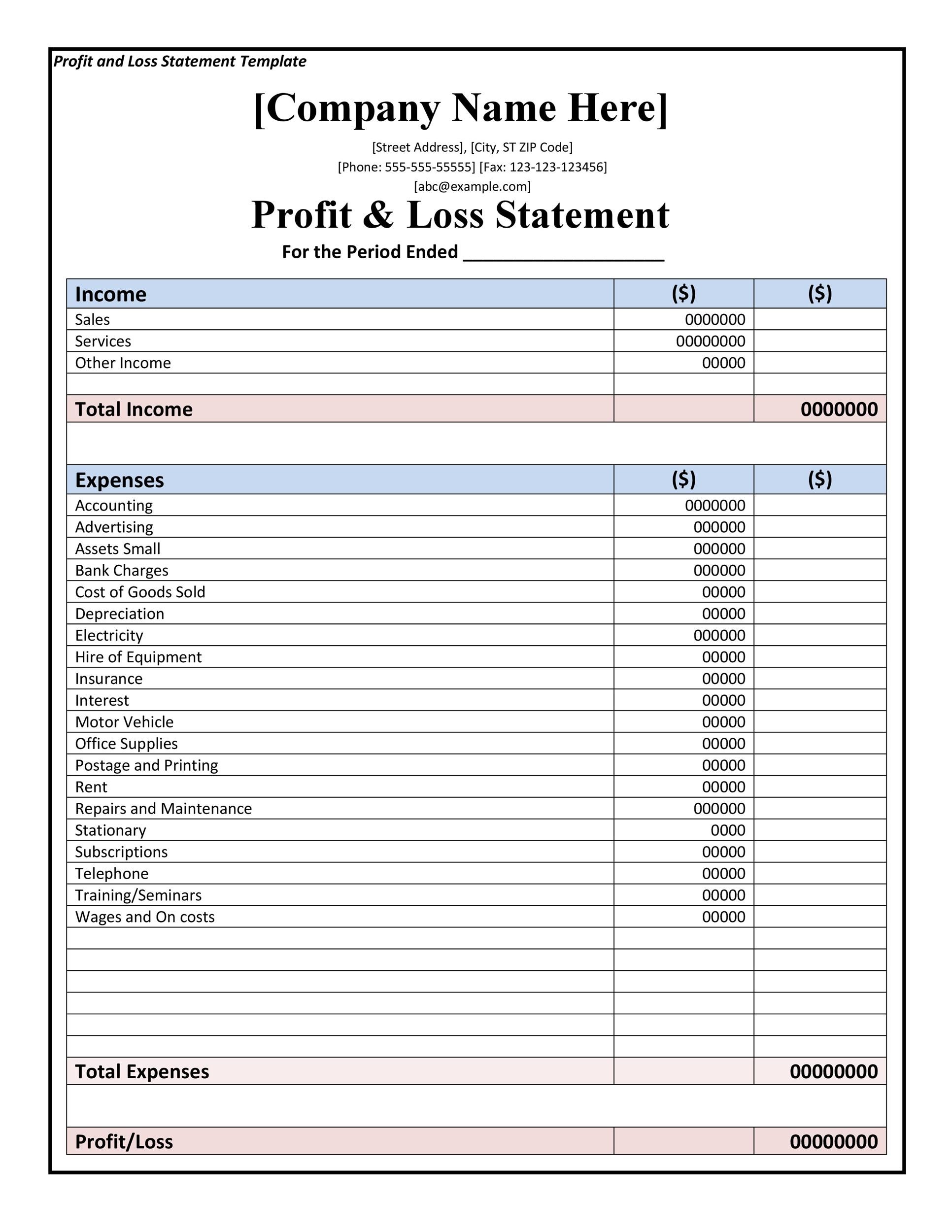

Key Components of a Profit and Loss Statement for Service Businesses

A well-structured profit and loss statement provides a comprehensive overview of a service business’s financial performance. Several key components contribute to this overview, each offering valuable insights into distinct aspects of financial operations.

1. Revenue: This section details all income generated from services rendered. Accurate revenue recognition is crucial for a reliable financial picture. Categorizing revenue by service type allows for detailed analysis of performance and identification of key revenue drivers.

2. Direct Costs: These costs are directly associated with service delivery, including personnel, materials, and software directly used in providing services. Accurate allocation of direct costs is essential for determining the profitability of individual services.

3. Gross Profit: Calculated as revenue less direct costs, gross profit represents the profit generated from core service operations before accounting for overhead and other indirect expenses. This metric provides insight into the efficiency and profitability of service delivery.

4. Operating Expenses: These encompass all indirect costs necessary to run the business, including rent, utilities, marketing, and administrative salaries. Careful management of operating expenses is crucial for maintaining profitability.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the business after accounting for both direct and indirect costs associated with core operations. This metric is a key indicator of overall operational efficiency.

6. Other Income/Expenses: This category includes income or expenses not directly related to core operations, such as interest income, investment gains or losses, and one-time expenses. These items provide a complete picture of the businesss financial activities beyond its primary service offerings.

7. Income Before Taxes: This figure represents the business’s earnings before accounting for income tax obligations. It serves as an important metric for evaluating profitability before the impact of taxes.

8. Net Income/Loss: The final and perhaps most important figure, net income/loss, represents the overall profit or loss after all revenues and expenses, including taxes, are accounted for. This figure serves as the ultimate measure of a service business’s financial performance.

Careful analysis of these components provides stakeholders with a robust understanding of a service businesss financial performance, supporting informed decision-making and strategic planning for future growth and sustainability.

How to Create a Profit and Loss Statement for a Service Business

Creating a profit and loss (P&L) statement for a service business requires a systematic approach to accurately capture financial performance. The following steps outline the process of building a P&L statement, providing a clear framework for understanding a company’s financial health.

1. Choose a Reporting Period: Select a specific timeframe for the P&L statement, such as a month, quarter, or year. Consistent reporting periods facilitate trend analysis and performance comparisons.

2. Calculate Total Revenue: Sum all revenue generated from services rendered during the chosen period. Ensure accurate revenue recognition principles are followed. Itemize revenue streams for a more granular analysis. For example, separate consulting revenue from training revenue.

3. Determine Direct Costs: Identify and quantify all costs directly associated with providing services. These typically include personnel costs, materials, and software directly used in service delivery. Accurate cost allocation is crucial for assessing individual service profitability.

4. Calculate Gross Profit: Subtract direct costs from total revenue to arrive at gross profit. This figure represents the profit generated from core service operations before accounting for overhead.

5. Itemize Operating Expenses: List and quantify all indirect costs necessary for running the business, including rent, utilities, marketing, administrative salaries, and depreciation. Categorizing operating expenses allows for detailed cost analysis and control.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This figure represents the profit generated from core business operations after accounting for both direct and indirect costs.

7. Account for Other Income/Expenses: Include any income or expenses not directly related to core operations, such as interest income or one-time expenses. This provides a holistic view of the companys financial activities.

8. Calculate Net Income/Loss: Subtract income taxes (and other non-operating expenses) from income before taxes to arrive at net income or loss. This final figure represents the overall profitability of the business during the reporting period.

A well-constructed P&L statement provides a clear and concise overview of a service business’s financial performance. This structured approach to financial reporting facilitates informed decision-making, performance evaluation, and strategic planning for future growth. Regular review and analysis of the statement are essential for maintaining financial health and achieving business objectives.

A standardized profit and loss statement template provides a crucial framework for understanding the financial performance of service-based businesses. From revenue streams and direct costs to operating expenses and net income, each component contributes to a comprehensive financial picture. Utilizing such a template facilitates consistent tracking, analysis, and informed decision-making. A clear grasp of these elements empowers service businesses to identify areas for improvement, optimize resource allocation, and enhance profitability.

Effective financial management hinges on accurate and insightful reporting. Regularly generating and analyzing profit and loss statements, utilizing a consistent template, is essential for long-term financial health and sustainable growth within the service industry. This practice enables businesses to adapt to market dynamics, make informed strategic decisions, and navigate the complexities of the financial landscape, ultimately contributing to long-term success and stability.