Utilizing such a structure offers several advantages. It allows for easy organization and analysis of financial data, facilitating better personal finance management. This can be particularly useful for identifying spending patterns, tracking progress towards financial goals, or providing necessary documentation for loan applications, tax preparation, or other financial matters. Furthermore, a consistent format simplifies the process of comparing financial information across different time periods.

This foundation in understanding the structure and benefits of standardized financial documents paves the way for a more detailed exploration of topics such as interpreting transaction details, utilizing the information for budgeting and planning, and understanding the different types of statements available.

1. Structure

The structure of a standardized financial document from this institution plays a vital role in its usability and the clarity of presented information. A well-defined structure ensures consistent presentation of key data points, enabling efficient comprehension and analysis. This structure typically follows a chronological order, grouping transactions by date and often further categorizing them by type. Consistent placement of account information, such as account number and account holder name, facilitates quick identification and reduces the risk of errors. A clear delineation of opening and closing balances provides a concise summary of the account’s financial status over the statement period.

For example, the consistent placement of debit transactions in one column and credit transactions in another allows for rapid assessment of cash flow. Similarly, the clear labeling of fees and interest charges ensures transparency and aids in budget reconciliation. Imagine trying to reconcile expenses without a clearly structured document; the process would be significantly more time-consuming and error-prone. The structured nature of these documents simplifies tasks such as tracking recurring payments, identifying unusual activity, and verifying the accuracy of recorded transactions.

In conclusion, a well-defined structure is fundamental to the efficacy of these standardized financial documents. This structure facilitates clear communication of financial information, enabling effective analysis, informed financial decisions, and ultimately, better financial management. Understanding this structure is a prerequisite for leveraging the full potential of these documents for personal or business financial planning.

2. Transactions

Transactions form the core of any financial statement, providing a detailed record of all financial activities within a given period. Within the context of a standardized financial document from this institution, transactions represent the individual debits and credits applied to an account. Understanding the nuances of transaction details is essential for accurate account reconciliation, effective budget management, and identification of potential discrepancies.

- Transaction TypeEach transaction is categorized by type, such as purchases, payments, deposits, withdrawals, or fees. This categorization allows for quick identification of spending patterns and facilitates efficient budget analysis. For instance, distinguishing between debit card purchases and online bill payments provides a granular view of spending habits. This categorization also simplifies the process of identifying specific transactions, like tracking down the source of a recurring subscription charge.

- Transaction DateAccurate transaction dates are crucial for maintaining an accurate record of financial activity. These dates enable chronological tracking of transactions, allowing for the reconstruction of spending timelines and facilitating comparisons with other financial records. For example, verifying the date of a mortgage payment against the corresponding bank statement entry ensures accurate record keeping and helps prevent missed payments.

- Transaction AmountThe transaction amount represents the value of each debit or credit applied to the account. Accurate recording and verification of these amounts are essential for maintaining an accurate account balance and identifying any unauthorized or erroneous transactions. For example, comparing the amount charged on a receipt with the corresponding transaction amount on the statement helps identify potential billing errors.

- Transaction DescriptionThe transaction description provides additional context about the transaction. This description can include merchant names, transaction locations, or other identifying details that aid in recognizing and categorizing transactions. For example, a transaction description might include the name of a restaurant, enabling easy identification of dining expenses. These details are crucial for effectively categorizing expenses and creating a comprehensive picture of spending habits.

A thorough understanding of these transaction details within the framework of a standardized financial document from this institution provides a robust foundation for sound financial management. By carefully examining each aspect of recorded transactions, individuals can gain valuable insights into their spending patterns, maintain accurate financial records, and effectively manage their financial resources. This understanding is essential for leveraging the full potential of these documents for informed financial decision-making.

3. Balances

Balances represent a critical component within the structure of a standardized financial document from this institution, providing key insights into the financial status of an account. Two primary balance typesopening and closingserve distinct yet interconnected roles. The opening balance reflects the state of the account at the beginning of the statement period, setting the baseline for all subsequent transactions. The closing balance, representing the account’s state after all transactions within the statement period have been applied, signifies the net result of financial activity. Accurately reflecting the flow of funds, these balances offer a concise summary of an account’s financial health over a specific timeframe. For instance, a consistently increasing closing balance over several statements might suggest effective financial management, while a declining trend could indicate potential budgetary concerns requiring further analysis.

The relationship between these balances and the overall structure of the statement is crucial. They provide context for all recorded transactions, allowing for a comprehensive understanding of how individual debits and credits impact the overall account status. For example, consider a scenario where numerous transactions occur during the statement period. Without clear opening and closing balances, assessing the net impact of these transactions would be significantly more challenging. Furthermore, these balances are often used for reconciliation purposes, verifying the accuracy of recorded transactions and ensuring consistency with other financial records. Imagine reconciling a business account without clear balance information; the process would be considerably more complex and prone to errors.

In summary, balances within a standardized financial document from this institution are not merely static figures; they are dynamic indicators of financial health, providing crucial context for all recorded transactions. Understanding their significance and their relationship to the overall statement structure is essential for accurate financial analysis, effective budget management, and informed financial decision-making. A thorough grasp of these concepts empowers individuals and businesses to leverage the full potential of these documents for achieving financial goals and maintaining financial stability.

4. Dates

Dates within a standardized financial document from this institution provide the temporal framework for understanding financial activity. Accurate and clearly presented dates are crucial for reconstructing transaction timelines, identifying trends, and performing accurate reconciliations. They provide context for each transaction, enabling users to understand when specific debits and credits occurred. This temporal context is essential for effective financial management and analysis.

- Statement PeriodThe statement period defines the timeframe covered by the document, typically one month. This defined period allows for analysis of financial activity within a specific timeframe, facilitating comparisons between different periods and identification of spending patterns over time. For instance, comparing spending during the holiday season with spending during other months of the year can reveal valuable insights into spending habits.

- Transaction Posting DateThe transaction posting date signifies when a transaction was officially recorded on the account. This date may differ from the transaction authorization date, particularly for transactions like debit card purchases where authorization occurs at the time of purchase but posting may occur later. Understanding the distinction between these dates is crucial for accurate reconciliation and tracking of available funds.

- Check Clearing DateFor check transactions, the clearing date indicates when the funds were withdrawn from the account. This date is essential for accurate cash flow management and reconciliation. Discrepancies between check issue dates and clearing dates can impact account balances and necessitate careful monitoring.

- Interest Accrual DateFor interest-bearing accounts, the interest accrual date specifies when interest is calculated and applied to the account. Understanding this date is essential for accurately tracking earnings and projecting future account growth.

The accurate and consistent presentation of dates within a standardized financial document from this institution is fundamental to its utility. These dates provide the temporal context necessary for interpreting transactions, analyzing trends, and performing accurate reconciliations. Understanding the various types of dates and their implications empowers individuals and businesses to effectively manage their financial resources and make informed financial decisions. A thorough grasp of these concepts is crucial for leveraging the full potential of these documents for comprehensive financial analysis and planning.

5. Account Details

Account details within a standardized financial document from this institution provide essential identifying information, linking the document to a specific account and account holder. These details are crucial for ensuring the integrity of the document and facilitating accurate record-keeping. They provide the context necessary to interpret the financial information presented, ensuring that transactions and balances are correctly attributed.

- Account NumberThe account number serves as a unique identifier for the specific account. This number is essential for distinguishing between multiple accounts held by the same individual or within the same organization. Accurate recording and verification of the account number are critical for ensuring that transactions are applied to the correct account. For example, when making a deposit, verifying the account number on the deposit slip against the account number on the statement ensures that funds are deposited into the intended account.

- Account Holder NameThe account holder name identifies the individual or entity responsible for the account. This information is crucial for verifying account ownership and ensuring that financial documents are accessed and utilized by authorized parties. Accurate representation of the account holder name helps prevent fraud and ensures proper accountability.

- Statement DateThe statement date indicates the date the statement was generated. This date is distinct from the transaction dates and provides a reference point for understanding the period covered by the statement. The statement date is essential for organizing and archiving financial records.

- Contact InformationContact information, typically including the financial institution’s customer service number and website address, provides a point of contact for inquiries or discrepancies. This information allows account holders to readily access support and resolve any issues related to the account or the statement itself. Access to readily available contact information facilitates prompt resolution of potential problems.

Accurate and clearly presented account details are fundamental to the utility and integrity of a standardized financial document from this institution. These details establish the context for the financial information presented, linking transactions and balances to a specific account and account holder. A thorough understanding of these details is essential for accurate record-keeping, effective financial management, and ensuring the security of financial information. This understanding empowers individuals and businesses to utilize these documents effectively for financial planning, analysis, and decision-making.

6. Data Organization

Data organization within a standardized financial document from this institution plays a crucial role in its usability and the effectiveness of financial analysis. A well-organized structure facilitates clear communication of financial information, enabling efficient interpretation and informed decision-making. The following facets illustrate the key components of data organization within these documents.

- CategorizationTransactions are typically categorized by type (e.g., purchases, payments, deposits, withdrawals). This categorization allows for a rapid overview of spending patterns and simplifies the process of identifying specific transactions. For instance, categorizing all grocery purchases allows for easy calculation of monthly food expenditures. This granular view of spending empowers informed budget adjustments and facilitates the identification of potential areas for cost savings.

- Chronological OrderPresenting transactions in chronological order provides a clear timeline of financial activity. This chronological structure facilitates the reconstruction of spending patterns over time and aids in identifying recurring transactions or unusual activity. For example, reviewing transactions chronologically can reveal a pattern of increasing monthly subscription fees, prompting a review of these services and potential cancellations.

- SummarizationSummarization techniques, such as providing monthly totals for specific transaction categories or calculating overall account activity summaries, condense large amounts of data into manageable and insightful overviews. For instance, a monthly summary of all dining expenses can provide a quick snapshot of spending habits, facilitating adjustments to dining budgets.

- Clear LabelingClear and consistent labeling of data points, such as transaction descriptions, dates, and amounts, ensures unambiguous interpretation of the information presented. For example, clearly labeling a transaction as “Mortgage Payment” eliminates ambiguity and ensures accurate categorization of expenses. This clear labeling is crucial for efficient reconciliation and analysis of financial data.

Effective data organization is essential for extracting meaningful insights from standardized financial documents provided by this institution. The described facets work together to provide a clear, concise, and comprehensive overview of financial activity. This structured presentation of data empowers individuals and businesses to effectively manage their financial resources, track spending patterns, identify potential areas for improvement, and make informed financial decisions. A thorough understanding of data organization within these documents is a cornerstone of sound financial management.

Key Components of a Capital One Bank Statement Template

Understanding the core components of a standardized financial document from this institution is crucial for effective financial management. The following elements provide a framework for comprehending these documents.

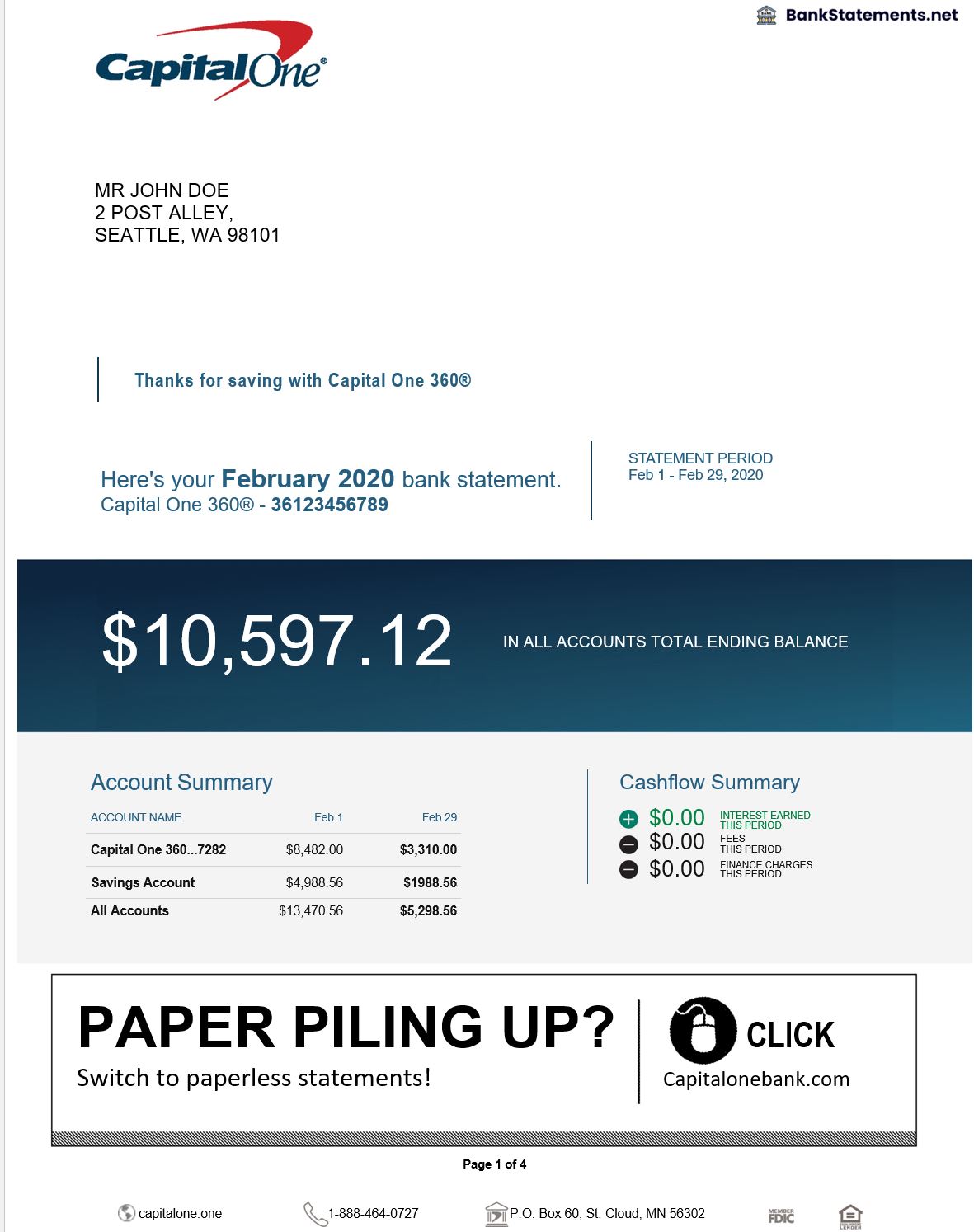

1. Account Identification: This section typically includes the account number, account holder name, and statement period. Accurate account identification ensures that the information pertains to the correct individual and timeframe.

2. Opening and Closing Balances: These figures represent the account’s starting and ending balance for the given statement period. They provide a snapshot of the overall financial status within that timeframe.

3. Transaction Details: This section comprises the bulk of the statement, detailing each transaction’s date, description, and amount. Transactions are typically categorized (e.g., purchases, payments, deposits) to facilitate analysis.

4. Interest and Fees: This section details any interest earned or fees charged during the statement period. Understanding these charges is critical for accurate account reconciliation.

5. Account Summary: This section often provides a summarized view of account activity, including total debits and credits, as well as any significant changes in account status.

6. Contact Information: This section usually includes contact information for the financial institution, providing a resource for inquiries or assistance regarding the statement or account activity.

These elements work in concert to provide a comprehensive overview of account activity. Accurate interpretation of these components allows for informed financial decision-making, effective budget management, and proactive identification of potential discrepancies.

How to Create a Capital One Bank Statement Template

Recreating the format of a bank statement can be valuable for budgeting, forecasting, or record-keeping purposes. While precisely duplicating an official document is not recommended due to security and legal implications, creating a template that mirrors its structure and key data points is achievable. Several approaches offer varying levels of complexity and customization.

1: Spreadsheet Software: Spreadsheet applications offer a readily accessible method. Columns can represent data fields like date, description, debit, credit, and balance. Formulas can automate balance calculations. This approach allows for manual entry and manipulation of data.

2: Word Processing Software: Word processors can create a template using tables to structure data fields similarly to a spreadsheet. While less conducive to automated calculations, this approach might suit users prioritizing visual formatting and presentation.

3: Dedicated Template Software: Specialized software designed for creating templates offers advanced features like pre-built financial templates and automated data population. This option may require an investment but provides significant time savings and enhanced functionality.

4: Online Template Resources: Numerous online resources offer downloadable templates, often in spreadsheet or word processing formats. These resources can provide a starting point, although customization may be necessary to match specific requirements.

5: Replicating Key Data Points: Regardless of the method chosen, certain data points are essential. These include the date, transaction description, debit and credit amounts, running balance, and statement period. Additional fields like transaction type or check number can enhance the template’s utility.

6: Data Input and Management: Once the template structure is established, data can be entered manually or imported from other sources. Regular updates and accurate data entry are crucial for maintaining the template’s value and reliability.

Creating a template offers a structured approach to managing financial information. Selecting the appropriate method depends on individual needs and technical proficiency. Regardless of the chosen approach, accurate data entry and consistent updates are essential for maintaining a useful and reliable resource.

Careful examination of the structure and data within these standardized financial documents reveals their importance for effective financial management. From the detailed transaction records to the summary of account balances, each element contributes to a comprehensive overview of financial activity. Understanding the organization and significance of information within these documents, such as transaction types, dates, and account details, allows for informed analysis, accurate reconciliation, and proactive identification of potential discrepancies. This knowledge empowers informed financial decisions and facilitates better financial health.

Leveraging the insights gained from these documents is crucial for navigating the complexities of personal or business finance. Consistent review and analysis of these statements enable proactive financial management, facilitating the identification of trends, optimization of spending habits, and achievement of financial goals. This proactive approach to financial management is essential for long-term financial stability and success.