Free S Corp Meeting Minutes Template

An S corporation, also known as an S subchapter corporation, is a type of corporation that is specifically recognized by the Internal Revenue Service (IRS) for tax purposes. S corporations allow business owners to avoid double taxation and receive pass-through taxation, meaning that the profits and losses of the business are passed through to the individual shareholders and reported on their personal tax returns.

Meeting minutes are an essential part of any S corporation’s record-keeping. They provide a written record of the decisions made at each meeting, including the date, time, location, attendees, and any actions taken. Meeting minutes can be used to protect the corporation in the event of a legal dispute, and they can also be helpful for tax purposes.There are many free S corp meeting minutes templates available online. These templates can be customized to meet the specific needs of your corporation. When choosing a template, it is important to select one that is up-to-date with the current IRS regulations.

Benefits of Using a Free S Corp Meeting Minutes Template

There are many benefits to using a free S corp meeting minutes template, including:

• Saves time: Using a template can save you time by providing a pre-formatted document that you can simply fill in with the specific details of your meeting.

• Ensures accuracy: Templates can help you ensure that your meeting minutes are accurate and complete by providing a checklist of items to include.

• Protects your corporation: Meeting minutes can help protect your corporation in the event of a legal dispute by providing a written record of the decisions made at each meeting.

• Helps with tax purposes: Meeting minutes can also be helpful for tax purposes by providing a record of the corporation’s income and expenses.

Main Article Topics

How to Use a Free S Corp Meeting Minutes Template

Tips for Writing Effective Meeting Minutes

Common Mistakes to Avoid When Writing Meeting Minutes

Conclusion

Key Components of a Free S Corp Meeting Minutes Template

Meeting minutes are an essential part of any S corporation’s record-keeping. They provide a written record of the decisions made at each meeting, including the date, time, location, attendees, and any actions taken. Meeting minutes can be used to protect the corporation in the event of a legal dispute, and they can also be helpful for tax purposes.

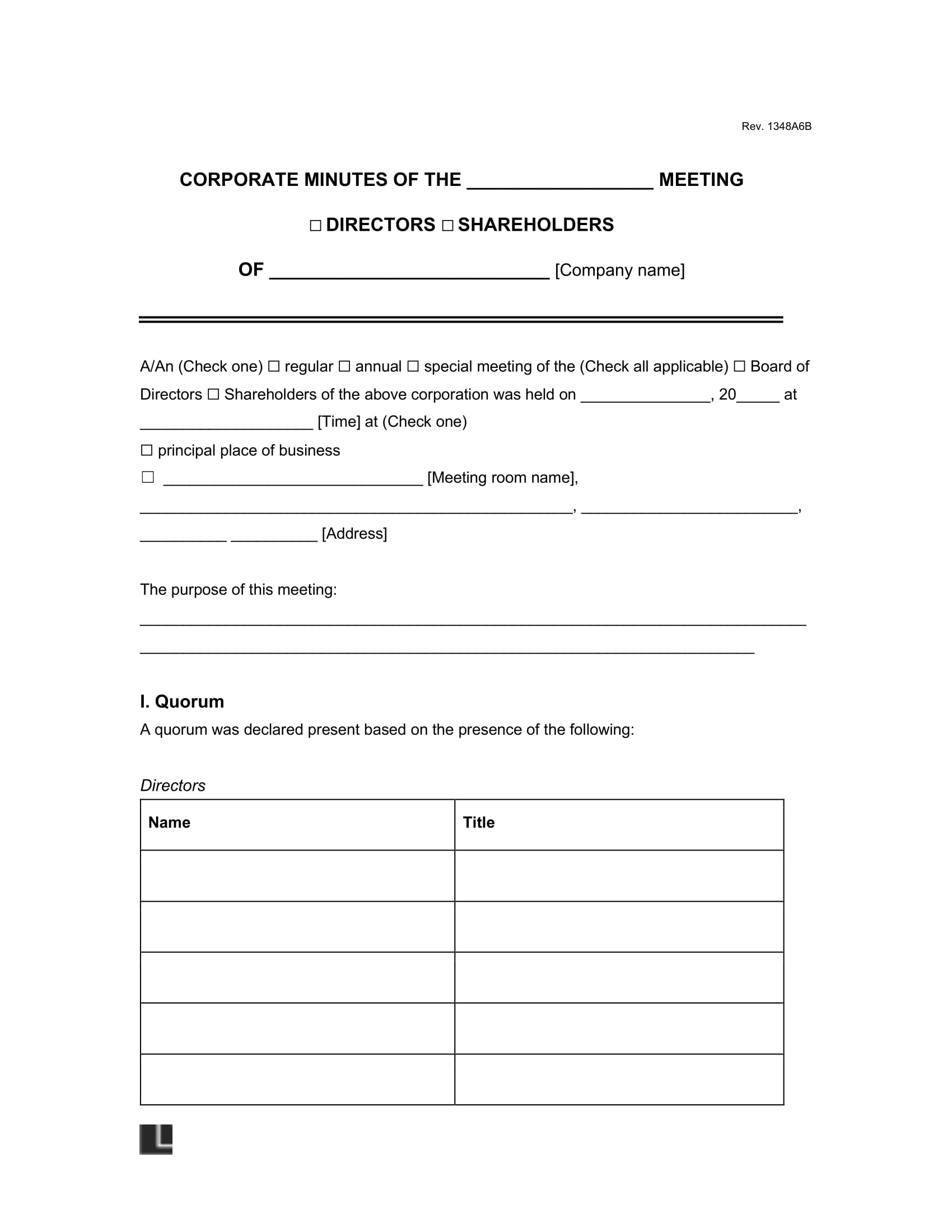

1: Meeting Header

The meeting header should include the name of the corporation, the date of the meeting, the time of the meeting, and the location of the meeting. It should also include the names of the attendees and the names of any absent board members.

2: Call to Order

The call to order is a statement that the meeting has begun. It should be followed by a statement of the time that the meeting was called to order.

3: Approval of Minutes

The approval of minutes is a vote to approve the minutes of the previous meeting. The minutes should be reviewed and approved by the board of directors.

4: Officer Reports

The officer reports are reports from the officers of the corporation. These reports may include financial reports, operational reports, or other reports that are relevant to the business of the corporation.

5: Old Business

Old business is business that was discussed at a previous meeting but was not resolved. Old business may be discussed and voted on at the current meeting.

6: New Business

New business is business that is being discussed for the first time at the current meeting. New business may be discussed and voted on at the current meeting.

7: Adjournment

The adjournment is a statement that the meeting has ended. It should be followed by a statement of the time that the meeting was adjourned.

How to Create a Free S Corp Meeting Minutes Template

Meeting minutes are an essential part of any S corporation’s record-keeping. They provide a written record of the decisions made at each meeting, including the date, time, location, attendees, and any actions taken. Meeting minutes can be used to protect the corporation in the event of a legal dispute, and they can also be helpful for tax purposes.

1: Use a Template

There are many free S corp meeting minutes templates available online. These templates can be customized to meet the specific needs of your corporation. When choosing a template, it is important to select one that is up-to-date with the current IRS regulations.

2: Include the Essential Components

Meeting minutes should include the following essential components:

- Meeting header

- Call to order

- Approval of minutes

- Officer reports

- Old business

- New business

- Adjournment

3: Be Clear and Concise

Meeting minutes should be clear and concise. They should accurately reflect the decisions made at the meeting, but they should not be overly detailed. It is important to use precise language and avoid jargon.

4: Distribute the Minutes Promptly

Meeting minutes should be distributed to all attendees promptly after the meeting. This will help to ensure that everyone is aware of the decisions that were made.

Summary

Creating a free S corp meeting minutes template is a simple process. By following these steps, you can create a template that will meet the specific needs of your corporation and help you to keep accurate and complete meeting minutes.

In conclusion, a free S corp meeting minutes template is an essential tool for any S corporation. It provides a structured and efficient way to record the decisions made at each meeting. By using a template, S corporations can ensure that their meeting minutes are accurate, complete, and up-to-date with the current IRS regulations.

Meeting minutes can be used to protect the corporation in the event of a legal dispute, and they can also be helpful for tax purposes. By keeping accurate and complete meeting minutes, S corporations can avoid costly mistakes and ensure that their business is run in a compliant and professional manner.