Utilizing a structured prediction of finances offers several key advantages. It enables proactive management of liquidity, supporting informed decision-making regarding investments, borrowing, and operational adjustments. This proactive approach strengthens financial stability by allowing businesses to anticipate potential shortfalls and capitalize on opportunities. Furthermore, it serves as a crucial tool for securing funding from investors and lenders, demonstrating financial viability and responsible planning.

Understanding the structure and benefits of projecting future financial status is fundamental to effective financial management. This knowledge forms the basis for exploring related topics such as budgeting, variance analysis, and strategic financial planning, each of which contributes to overall financial health and sustainable growth.

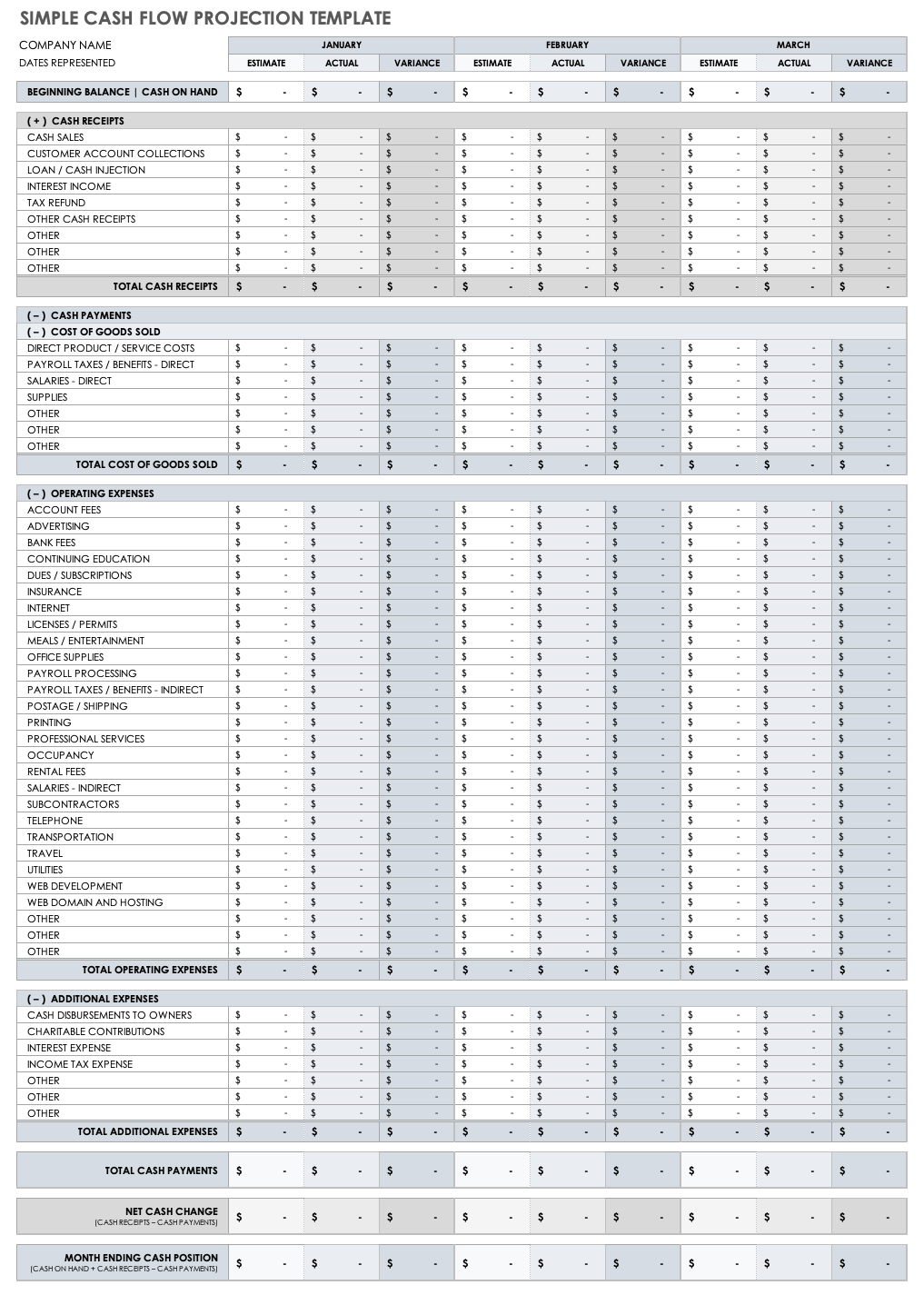

1. Projected Future Cash Inflows

Projected future cash inflows form a critical component of a structured prediction of future finances. Accurately forecasting these inflows is essential for a realistic and reliable projection. These inflows represent the anticipated cash a business expects to receive from various sources. Primary sources typically include sales revenue, but other sources, such as investments, loans, or asset sales, are also relevant. The accuracy of these projections directly impacts the reliability of the overall financial forecast. For instance, overestimating sales revenue can lead to overly optimistic projections, potentially resulting in inadequate liquidity management. Conversely, underestimating inflows can lead to missed investment opportunities or unnecessarily conservative financial strategies. A robust forecasting process, incorporating historical data, market trends, and sales pipeline analysis, is crucial for generating reliable inflow projections.

Consider a manufacturing company launching a new product. Projecting future cash inflows requires careful consideration of anticipated market demand, pricing strategies, and production capacity. Realistic sales projections, combined with anticipated payment terms from customers, inform the inflow projections within the structured prediction of future finances. These projections, in turn, influence decisions related to production scaling, inventory management, and marketing expenditures. Similarly, a service-based business might project inflows based on contracted service agreements, considering potential contract renewals and new client acquisitions. The accuracy of these projections is paramount for effectively managing operational expenses and making informed decisions about hiring and resource allocation.

Accurate inflow projections are fundamental to sound financial planning. They inform decisions related to capital expenditures, debt management, and overall financial strategy. Challenges in accurately projecting inflows can arise from unpredictable market conditions, changing customer behavior, and internal operational factors. Mitigating these challenges requires diligent monitoring of key performance indicators, adapting forecasting methodologies as needed, and incorporating sensitivity analysis to assess the impact of potential variations in projected inflows. Ultimately, robust inflow projections contribute significantly to a reliable and actionable financial forecast, facilitating informed decision-making and enhancing the likelihood of achieving financial objectives.

2. Projected Future Cash Outflows

Projected future cash outflows represent the anticipated expenses and disbursements within a defined period. Accurately forecasting these outflows is crucial for a comprehensive and reliable projection of future finances, informing strategic decision-making and ensuring financial stability. Within a structured prediction of future finances, outflows are categorized and analyzed, offering a detailed view of how resources are allocated and providing insights into cost management opportunities. Understanding and managing these projected outflows is fundamental to maintaining liquidity and achieving financial objectives.

- Operating ExpensesOperating expenses encompass the recurring costs associated with running a business. These include salaries, rent, utilities, marketing, and raw materials. Accurately forecasting these outflows is essential for determining profitability and setting realistic budgets. For example, a retail business must project inventory costs, staffing needs, and marketing campaigns to anticipate its operating expenses and ensure sufficient cash flow to cover these costs. Within a structured projection of future finances, operating expenses are meticulously tracked and analyzed, providing valuable insights into cost control measures and operational efficiency.

- Capital ExpendituresCapital expenditures represent investments in long-term assets, such as equipment, property, and technology. These outflows, while not recurring like operating expenses, are substantial and require careful planning. For instance, a manufacturing company investing in new machinery must accurately project the associated costs to ensure adequate funding and evaluate the potential return on investment. Within a structured projection of future finances, capital expenditures are distinctly categorized, allowing for strategic allocation of resources and assessment of long-term financial implications.

- Debt ServiceDebt service refers to the principal and interest payments required to service outstanding loans or debt obligations. Projecting these outflows is critical for managing financial leverage and ensuring timely debt repayment. A real estate developer, for example, must accurately project mortgage payments and interest expenses to maintain financial solvency and avoid default. Within a structured projection of future finances, debt service outflows are clearly delineated, facilitating effective debt management and informing refinancing decisions.

- Dividend Payments (if applicable)For companies that distribute dividends to shareholders, projecting these outflows is important for managing investor expectations and maintaining a consistent dividend policy. A publicly traded company, for example, must project dividend payments based on projected earnings and dividend payout ratios. Accurately forecasting these outflows helps maintain investor confidence and ensures adherence to established financial policies. Within a structured projection of future finances, dividend payments are explicitly accounted for, facilitating transparent financial reporting and informed investor relations.

Accurate projection of these various outflow categories provides a holistic view of future financial commitments. This detailed understanding, facilitated by the structured format of a projected future finance document, enables businesses to make informed decisions about resource allocation, cost management, and strategic investments. By carefully analyzing projected outflows, organizations can proactively manage their finances, optimize liquidity, and enhance their long-term financial stability.

3. Standardized Format

A standardized format is fundamental to the efficacy of a projection of future cash inflows and outflows. Consistency and comparability are crucial for effective financial analysis and communication. A standardized structure ensures that information is presented in a predictable and organized manner, facilitating interpretation and analysis by various stakeholders, including management, investors, and lenders. This standardized approach allows for efficient comparison across periods, identification of trends, and informed decision-making.

- Categorization of Cash FlowsA standardized format typically categorizes cash flows into operating, investing, and financing activities. This categorization provides a granular view of cash flow sources and uses, enabling a deeper understanding of business performance. For example, separating cash flows from core operations from those related to investments or financing provides insights into the sustainability and drivers of financial performance. This structured approach is crucial for assessing the long-term financial health of an organization.

- Consistent Time PeriodsStandardized formats utilize consistent time periods, such as monthly, quarterly, or annually. This consistency allows for accurate tracking of cash flow patterns over time and facilitates meaningful comparisons across different periods. For instance, analyzing quarterly cash flow statements over several years can reveal seasonal trends and inform strategic planning for working capital management. Consistent timeframes are essential for identifying patterns and anomalies in cash flow.

- Clear Presentation of Key MetricsKey metrics, such as beginning and ending cash balances, net cash flow for each category, and the overall net change in cash, are clearly presented within a standardized format. This clear presentation ensures that critical information is readily accessible and easily understood. For example, highlighting the net change in cash allows stakeholders to quickly assess the overall impact of cash flows on the company’s financial position. A clear presentation of key metrics facilitates efficient communication and informed decision-making.

- Comparability and BenchmarkingThe standardized format facilitates comparability both within the organization and against industry benchmarks. Internally, consistent formatting allows for analysis of trends and performance across different departments or business units. Externally, it enables benchmarking against competitors or industry averages, providing insights into relative financial performance. This comparability supports strategic decision-making and identification of areas for improvement.

The standardized format of a projection of future cash inflows and outflows is essential for effective financial management. It promotes transparency, facilitates analysis, and supports informed decision-making. By adhering to a standardized structure, organizations can enhance communication with stakeholders, improve financial planning, and drive sustainable growth. This structured approach is a cornerstone of sound financial practice, enabling organizations to effectively manage their cash resources and achieve their financial objectives.

4. Financial Planning Tool

A projection of future cash inflows and outflows serves as a crucial financial planning tool. It provides a structured framework for anticipating and managing future financial performance. Understanding its role as a planning tool is essential for effective resource allocation, strategic decision-making, and overall financial health. Its utility lies in its ability to offer insights into future liquidity, potential financial challenges, and opportunities for growth.

- Proactive Liquidity ManagementThe template allows organizations to anticipate potential cash shortages or surpluses. This foresight enables proactive management of working capital, ensuring sufficient liquidity to meet operational needs and capitalize on investment opportunities. For example, a seasonal business can anticipate periods of high and low cash flow, allowing for adjustments in inventory management and short-term borrowing strategies. This proactive approach mitigates the risk of financial distress and supports strategic growth initiatives.

- Informed Decision-MakingBy providing a clear picture of future financial performance, the template empowers informed decision-making. Investment decisions, pricing strategies, and operational adjustments can be evaluated based on their projected impact on cash flow. For instance, a company considering a capital expenditure can assess the project’s feasibility and potential return by incorporating its projected cash flows into the overall financial forecast. This data-driven approach minimizes financial risks and maximizes the potential for successful outcomes.

- Performance Monitoring and ControlThe template serves as a benchmark against which actual performance can be measured. Regular comparison of actual cash flows against projected figures allows for timely identification of variances and implementation of corrective actions. For example, if actual sales revenue consistently falls short of projections, the organization can investigate the underlying causes and adjust sales strategies or marketing efforts accordingly. This continuous monitoring and control process enhances financial discipline and improves overall performance.

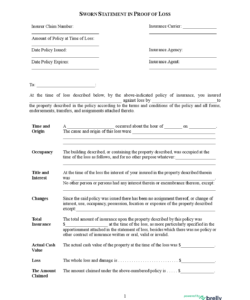

- Communication with StakeholdersThe template facilitates communication with key stakeholders, such as investors, lenders, and board members. It provides a clear and concise representation of the organization’s financial plans and projected performance, fostering transparency and building confidence. A startup seeking venture capital funding, for example, can use the template to demonstrate its financial viability and growth potential to potential investors. This clear communication enhances credibility and strengthens stakeholder relationships.

These facets highlight the integral role of a projection of future cash inflows and outflows as a dynamic financial planning tool. By providing a structured framework for anticipating, managing, and communicating financial performance, it empowers organizations to make informed decisions, optimize resource allocation, and achieve sustainable financial health. Its value extends beyond mere forecasting, serving as a cornerstone of proactive financial management and strategic decision-making.

5. Spreadsheet Software Usage

Spreadsheet software plays a crucial role in creating and managing projections of future cash inflows and outflows. Its inherent functionalities, such as formulas, functions, and formatting capabilities, significantly enhance the efficiency and accuracy of financial forecasting. The dynamic nature of spreadsheet software allows for real-time adjustments and scenario analysis, making it an indispensable tool for financial planning and decision-making.

The structured nature of spreadsheet software aligns seamlessly with the standardized format of financial projections. Rows and columns provide a clear framework for organizing data by time period and cash flow category (operating, investing, financing). Formulas and functions automate calculations, minimizing manual errors and ensuring accuracy in projecting net cash flow. For instance, the `SUM` function can automatically calculate total cash inflows or outflows for a given period, while more complex functions can be used to calculate discounted cash flows or perform sensitivity analysis. Furthermore, spreadsheet software facilitates scenario planning by allowing users to easily adjust input variables and observe the impact on projected cash flow. This capability is invaluable for assessing the potential financial impact of various business strategies or economic conditions.

Consider a retail business projecting its cash flow for the next quarter. Spreadsheet software enables the business to input projected sales figures, cost of goods sold, operating expenses, and other relevant data. Formulas can then be used to calculate gross profit, operating income, and net cash flow for each month of the quarter. The software also allows for the incorporation of assumptions about sales growth, cost increases, or changes in payment terms, enabling the business to model different scenarios and assess their potential impact on cash flow. This dynamic interaction between data and formulas empowers informed decision-making and enhances the accuracy and utility of financial projections. The ability to visualize data through charts and graphs further enhances the analytical capabilities of spreadsheet software, enabling stakeholders to quickly grasp key trends and insights. Ultimately, leveraging spreadsheet software enhances the effectiveness of financial forecasting, contributing significantly to informed decision-making, proactive liquidity management, and the achievement of financial objectives.

6. Operating, Investing, Financing Activities

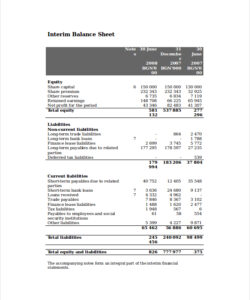

The categorization of cash flows into operating, investing, and financing activities forms the core structure of a projection of future cash inflows and outflows. This structured approach provides a comprehensive view of a business’s financial activities, allowing for detailed analysis of cash flow sources and uses. Understanding the interplay between these three categories is crucial for assessing financial health and making informed decisions.

Operating activities represent the cash flows generated from a business’s core operations, such as sales revenue, inventory purchases, and operating expenses. Analyzing operating cash flow reveals the profitability and sustainability of a business’s core business model. Investing activities encompass cash flows related to the acquisition and disposal of long-term assets, including property, plant, and equipment (PP&E) and investments. Analyzing investing cash flows offers insights into a company’s growth strategy and capital allocation decisions. Financing activities involve cash flows related to debt, equity, and dividends. Analyzing financing cash flows provides insights into a company’s capital structure and its ability to meet its financial obligations.

For example, a rapidly growing technology company might exhibit negative cash flow from investing activities due to significant investments in research and development and new equipment. This negative cash flow, however, might not be a cause for concern if the company demonstrates strong positive cash flow from operating activities and has access to external financing. Conversely, a mature company in a stable industry might exhibit positive cash flow from operating activities and minimal investment activity, using excess cash to pay down debt or distribute dividends to shareholders, reflected in its financing activities.

Analyzing the interplay between these three categories within a structured format reveals valuable insights into a company’s financial health. A consistent positive cash flow from operating activities is generally considered a sign of a healthy and sustainable business. Significant investments in long-term assets, reflected in negative cash flow from investing activities, can indicate a focus on future growth. Understanding how these activities interact within the template provides a comprehensive and nuanced perspective on a company’s financial performance, enabling informed decision-making and strategic planning. It allows stakeholders to assess not only the current financial state but also the trajectory of future financial performance.

Key Components of a Forecasted Cash Flow Statement Template

A comprehensive understanding of key components is essential for effective utilization of a forecasted cash flow statement template. These components provide a structured framework for projecting and analyzing future cash flows.

1. Beginning Cash Balance: The starting point for the projected period, representing the cash on hand at the beginning of the forecast. Accurate reflection of this balance is crucial for the overall accuracy of the projection.

2. Cash Inflows: Represent all anticipated cash receipts during the projected period. These inflows are typically categorized by source, such as sales revenue, investments, or financing activities. Detailed and realistic projections of cash inflows are essential for accurate forecasting.

3. Cash Outflows: Represent all anticipated cash disbursements during the projected period. Similar to inflows, outflows are categorized by type, including operating expenses, capital expenditures, and debt service. Accurate outflow projections are crucial for anticipating potential liquidity challenges.

4. Net Cash Flow: Calculated as the difference between cash inflows and outflows for each period within the forecast. This metric provides a clear picture of the net change in cash position during each period.

5. Ending Cash Balance: Represents the projected cash on hand at the end of each period, calculated by adding the net cash flow to the beginning cash balance. Monitoring the ending cash balance is crucial for managing liquidity and ensuring sufficient funds to meet operational needs.

6. Time Period: The forecasted cash flow statement template is typically structured across specific time periods, such as monthly, quarterly, or annually. The chosen time period should align with the business’s operating cycle and planning horizon.

7. Assumptions and Notes: Documenting key assumptions underlying the projections, such as sales growth rates or interest rates, is crucial for transparency and interpretation. Including notes explaining significant variances or unusual items further enhances the understandability of the forecast.

These interconnected components provide a structured and comprehensive view of projected future cash flows, enabling informed financial decision-making and proactive liquidity management. The accuracy and detail incorporated into each component directly impact the reliability and utility of the overall forecast.

How to Create a Forecasted Cash Flow Statement Template

Creating a robust template requires a structured approach and careful consideration of key components. The following steps outline the process of developing a template suitable for effective financial planning.

1. Define the Reporting Period: Establish the timeframe for the forecast, whether monthly, quarterly, or annually. The chosen period should align with the organization’s operating cycle and planning horizon.

2. Determine Key Cash Inflow Categories: Identify and categorize the primary sources of cash inflows, such as sales revenue, investment income, or financing proceeds. Granular categorization provides a clearer picture of cash flow drivers.

3. Project Cash Inflows: Develop realistic projections for each inflow category, incorporating historical data, market trends, and relevant business assumptions. Accuracy in inflow projections is crucial for the reliability of the overall forecast.

4. Determine Key Cash Outflow Categories: Identify and categorize the primary sources of cash outflows, such as operating expenses, capital expenditures, debt service, and dividend payments. Categorization allows for detailed analysis of cash flow usage.

5. Project Cash Outflows: Develop realistic projections for each outflow category, considering historical spending patterns, contractual obligations, and planned investments. Accurate outflow projections are crucial for anticipating potential liquidity challenges.

6. Calculate Net Cash Flow: Determine the net cash flow for each period by subtracting projected cash outflows from projected cash inflows. This calculation reveals the net change in cash position during each period.

7. Determine Beginning Cash Balance: Establish the starting cash balance for the first period of the forecast. This balance represents the cash on hand at the beginning of the projection.

8. Calculate Ending Cash Balance: Calculate the ending cash balance for each period by adding the net cash flow to the beginning cash balance. Monitoring the ending cash balance is essential for liquidity management.

9. Document Assumptions and Notes: Clearly document all key assumptions underlying the projections, such as sales growth rates, cost inflation, or interest rates. Include explanatory notes for significant variances or unusual items. Transparency in assumptions enhances the credibility and interpretability of the forecast.

10. Review and Refine: Regularly review and refine the template as new information becomes available or business conditions change. A dynamic forecasting process is essential for maintaining accuracy and relevance.

A well-structured template, incorporating these components, provides a robust framework for projecting and analyzing future cash flows, enabling proactive liquidity management and informed decision-making.

Effective financial management hinges on the ability to anticipate and manage future cash flows. A structured projection of future cash inflows and outflows provides the necessary framework for this critical function. From facilitating proactive liquidity management to informing strategic investment decisions, the documented financial projection serves as an indispensable tool for organizations of all sizes. Understanding its structure, components, and development process is essential for leveraging its full potential. Accurate and detailed projections, categorized by operating, investing, and financing activities, empower informed decision-making, enhancing financial stability and driving sustainable growth. Regular review and refinement of projections, incorporating evolving business conditions and updated assumptions, ensure the ongoing relevance and reliability of this crucial financial planning tool.

In an increasingly complex and dynamic business environment, the ability to anticipate and navigate financial challenges and opportunities is paramount. Mastering the utilization of structured financial projections is not merely a best practice; it is a necessity for long-term success. Organizations that prioritize and effectively implement robust financial planning processes are better positioned to navigate uncertainty, capitalize on opportunities, and achieve their strategic objectives. The disciplined and informed approach to financial management, facilitated by the utilization of detailed financial projections, is a cornerstone of sustainable growth and long-term financial health.