Utilizing this standardized form streamlines the insurance application process, potentially leading to expedited policy issuance and potentially more favorable premiums. It offers a clear and concise method for conveying loss history, reducing ambiguity and enhancing communication between insured parties and insurers. This can save valuable time and resources for both parties involved.

Further exploration of specific ACORD forms, their usage within different insurance contexts, and best practices for completion will provide a more comprehensive understanding of loss history documentation and its impact on insurance acquisition.

1. Standardized Form

Standardization plays a vital role in streamlining communication and enhancing efficiency within the insurance industry. The ACORD statement of no loss template exemplifies this principle, providing a structured format for conveying loss history information. This structured approach benefits both insurers and insured parties.

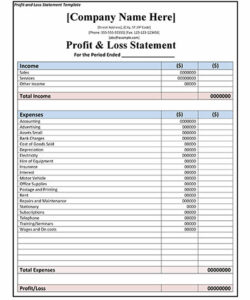

- Uniformity and ClarityA standardized form ensures consistent data presentation, minimizing ambiguity and potential misinterpretations. All parties involved understand the information being conveyed, as the format remains consistent across different instances and organizations. This clarity is crucial for accurate risk assessment and efficient processing.

- Simplified Data Collection and ProcessingStandardized fields facilitate automated data extraction and processing. This reduces manual data entry, minimizing errors and saving time. Automated processing also allows for faster underwriting decisions, benefiting both insurers and applicants. The consistent structure simplifies integration with existing systems.

- Improved Comparability and AnalysisStandardized data enables insurers to compare loss histories across different applicants and time periods more effectively. This facilitates data analysis and trend identification, contributing to more accurate risk assessment and pricing. The consistent format enhances statistical analysis and supports data-driven decision-making.

- Reduced Administrative BurdenBy providing a clear and concise format, the standardized form reduces the administrative burden on both insurers and insured parties. Less time is spent deciphering information or requesting clarification. This streamlined process increases efficiency and reduces operational costs.

The standardized nature of the ACORD statement of no loss template directly contributes to a more efficient and transparent insurance process. By promoting clarity, simplifying data handling, and enabling better comparability, this standardization ultimately benefits all stakeholders involved in the insurance transaction.

2. Loss History Reporting

Loss history reporting forms a cornerstone of the insurance underwriting process. It provides insurers with crucial information regarding an applicant’s prior claims experience, enabling accurate risk assessment and pricing. The ACORD statement of no loss template serves as a specific tool within this broader context of loss history reporting, specifically addressing situations where no losses have occurred. This specialized form streamlines communication and simplifies underwriting for zero-loss scenarios.

Accurate and comprehensive loss history reporting allows insurers to differentiate between applicants with varying risk profiles. For example, a business with a history of frequent claims presents a statistically higher risk than a similar business with no prior claims. This difference in risk directly influences premium calculations and underwriting decisions. The ACORD statement of no loss template, by confirming a clean loss history, can contribute to more favorable underwriting outcomes. Conversely, inaccurate or incomplete loss history reporting can lead to misclassification of risk, potentially resulting in inadequate premiums or even policy denial. Therefore, proper utilization of tools like the ACORD statement of no loss template is essential for both insurers and insured parties.

Understanding the role of the ACORD statement of no loss template within the broader framework of loss history reporting is crucial for effective insurance management. It represents a specialized mechanism for communicating a specific type of loss history the absence of any claims. This specialized function streamlines the underwriting process for applicants with clean loss histories, promoting efficiency and transparency within the insurance transaction. Utilizing standardized reporting mechanisms contributes to a more robust and reliable risk assessment process, benefiting the insurance industry as a whole.

3. Streamlined Communication

Efficient communication forms the bedrock of effective insurance processes. The ACORD statement of no loss template contributes significantly to streamlined communication between insured parties and insurers, specifically concerning loss history. This standardized form facilitates clear and concise information exchange, reducing ambiguity and enhancing overall efficiency.

- Reduced Processing TimeClear, standardized information reduces the time required for insurers to process applications. The template eliminates the need for back-and-forth communication to clarify loss history details, expediting underwriting decisions and policy issuance.

- Minimized Errors and MisinterpretationsThe structured format of the template minimizes the potential for errors and misinterpretations. Specific fields for relevant information ensure clarity and reduce the risk of ambiguity, leading to more accurate risk assessment.

- Enhanced TransparencyThe template promotes transparency by providing a standardized framework for disclosing loss history. All parties involved have access to the same clear and concise information, fostering trust and facilitating a smoother transaction.

- Improved Data ManagementStandardized data simplifies data management and analysis for insurers. The consistent format enables efficient data storage, retrieval, and analysis, contributing to better risk management and informed decision-making.

These facets of streamlined communication, facilitated by the ACORD statement of no loss template, contribute to a more efficient and transparent insurance process. By reducing processing time, minimizing errors, and enhancing transparency, the template benefits both insured parties and insurers. This ultimately contributes to a smoother and more effective insurance transaction.

4. Expedited Underwriting

Expedited underwriting represents a significant advantage within the insurance industry, enabling faster policy issuance and reducing administrative delays. The ACORD statement of no loss template plays a crucial role in facilitating this expedited process, particularly for applicants with clean loss histories. By providing standardized confirmation of no prior losses, the template streamlines the underwriting process, allowing insurers to assess risk and issue policies more efficiently.

- Reduced Information GatheringThe template preemptively addresses a key underwriting requirement confirming the absence of prior losses. This reduces the need for extensive investigations or additional documentation requests, allowing underwriters to focus on other aspects of the application. For instance, instead of requesting loss runs or contacting previous insurers, underwriters can readily proceed with the application process, streamlining the overall timeline.

- Simplified Risk AssessmentA clean loss history, as confirmed by the template, simplifies the risk assessment process. Applicants with no prior claims generally present a lower risk profile, allowing underwriters to expedite the evaluation process. This simplification can lead to quicker decisions and faster policy issuance, benefiting both the applicant and the insurer.

- Automated ProcessingThe standardized format of the ACORD statement of no loss template is conducive to automated processing. Insurers can integrate the template data directly into their underwriting systems, reducing manual data entry and accelerating decision-making. This automation further streamlines the underwriting process, minimizing delays and improving efficiency.

- Improved Customer ExperienceExpedited underwriting, facilitated by the template, contributes to an improved customer experience. Faster policy issuance reduces applicant wait times, providing quicker access to necessary insurance coverage. This streamlined process enhances customer satisfaction and strengthens the insurer-client relationship.

The ACORD statement of no loss template functions as a catalyst for expedited underwriting, enabling faster policy issuance and a more efficient process for all stakeholders. By reducing information gathering, simplifying risk assessment, and facilitating automated processing, the template contributes significantly to a streamlined and improved insurance experience. This efficiency ultimately benefits both applicants seeking coverage and insurers managing risk.

5. Potential Premium Impact

A key aspect of the ACORD statement of no loss template lies in its potential influence on insurance premiums. Insurers utilize loss history as a significant factor in determining risk profiles and calculating premiums. A clean loss history, as evidenced by the ACORD statement, often contributes to more favorable premium rates. This correlation stems from the reduced risk associated with insuring entities without prior claims. Insurers interpret a clean loss history as an indicator of lower future claim probability. This reduced risk translates into potentially lower premiums for the insured.

For example, two businesses seeking identical coverage may receive different premium quotes based on their respective loss histories. The business presenting an ACORD statement of no loss may qualify for a lower premium compared to a business with a history of claims. This difference highlights the practical significance of maintaining a clean loss history and effectively communicating it through the ACORD statement. Conversely, inaccurate or incomplete loss history reporting can negatively impact premium calculations. Even a single unreported claim can lead to higher premiums than warranted, underscoring the importance of accurate and thorough documentation.

Understanding the potential premium impact associated with the ACORD statement of no loss underscores its importance within the insurance process. Proper utilization of this template can contribute to significant cost savings for insured parties. This potential impact reinforces the need for accurate and diligent loss history reporting. Furthermore, it emphasizes the value of proactive risk management practices that minimize the likelihood of future claims, thereby preserving a clean loss history and its associated premium benefits.

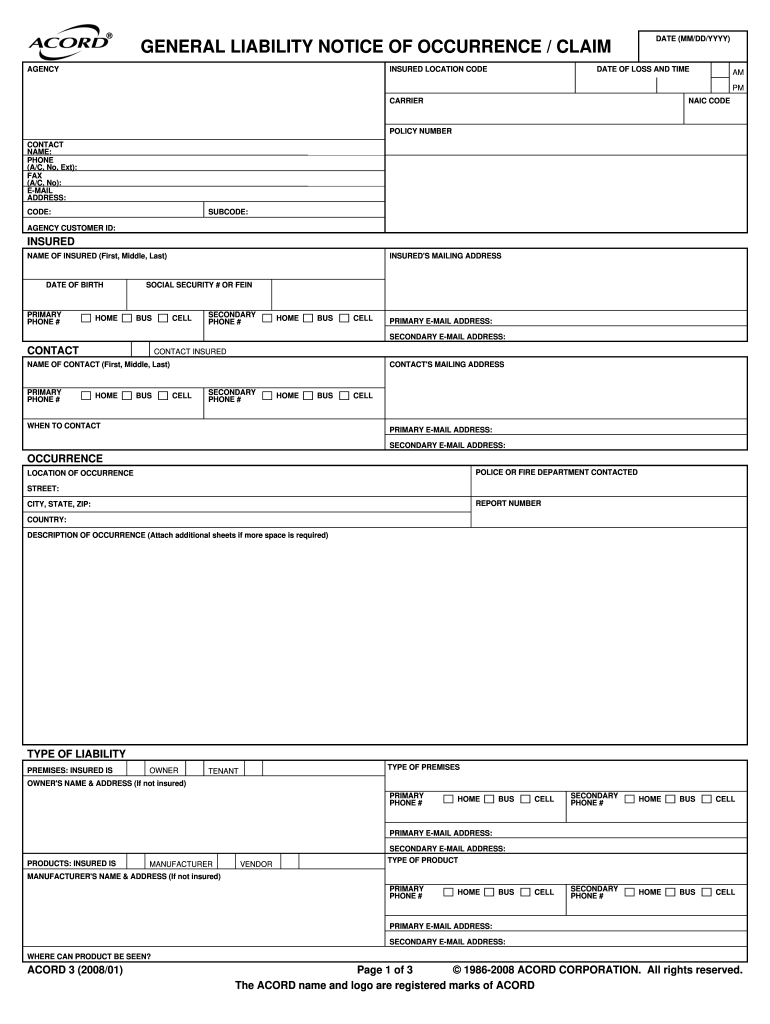

Key Components of an ACORD Statement of No Loss Template

Understanding the core components of an ACORD statement of no loss template is crucial for accurate and efficient insurance processing. The following points delineate essential elements within this standardized form.

1. Identification Information: This section identifies the insured party, including name, address, and policy number. Accurate identification information ensures proper association of the document with the relevant insurance application.

2. Reporting Period: The template specifies a defined period for which the no-loss declaration applies. This timeframe is crucial for insurers to assess the relevant loss history within the specified duration.

3. Declaration of No Loss: This section contains an explicit statement affirming that no losses or claims have occurred within the specified reporting period. This declaration forms the core purpose of the document.

4. Signature and Authorization: The insured party’s signature authorizes the information provided within the template. This signature validates the accuracy and authenticity of the no-loss declaration.

5. Contact Information: The template typically includes contact information for the insured party or their representative. This facilitates communication between the insurer and the insured if further clarification or information is required.

These components work together to provide a standardized, verifiable record of an insured’s claim-free period, facilitating efficient underwriting and transparent communication within the insurance process. Accuracy in completing each section ensures proper processing and contributes to a smoother insurance transaction.

How to Create an ACORD Statement of No Loss

Creating an accurate and comprehensive ACORD statement of no loss is crucial for efficient insurance processing. The following steps outline the process of generating this document.

1: Obtain the Correct Form: Begin by acquiring the appropriate ACORD statement of no loss form. Specific forms exist for various insurance types (e.g., commercial, personal). Consult an insurance broker or the ACORD website to obtain the correct version.

2: Identify the Insured Party: Accurately complete the identification section with the insured’s legal name, address, and policy number. Accurate identification is essential for proper document association.

3: Specify the Reporting Period: Clearly define the reporting period for which the no-loss declaration applies. This period should align with the insurer’s requirements or the relevant policy timeframe.

4: Declare No Losses: Formally declare that no losses or claims have occurred within the specified reporting period. This explicit statement forms the core of the document.

5: Authorize with Signature: The insured party or an authorized representative must sign and date the document. This signature validates the information provided and confirms the no-loss declaration.

6: Provide Contact Information: Include accurate contact information for the insured party or their representative. This facilitates communication and allows insurers to request clarification if needed.

7: Review for Accuracy: Before submitting the form, thoroughly review all information for accuracy and completeness. Errors or omissions can delay processing.

8: Submit the Form: Submit the completed and signed form to the requesting insurance provider. Retain a copy for records.

Accurate completion of each component ensures efficient processing and contributes to a streamlined insurance transaction. Following these steps helps create a valid and effective ACORD statement of no loss, facilitating clear communication between insured parties and insurers.

Accurate and efficient communication of loss history is paramount within the insurance industry. Standardized forms, such as the ACORD statement of no loss template, provide a crucial mechanism for conveying this information, specifically regarding the absence of prior claims. Utilization of this template streamlines communication, expedites underwriting processes, and can potentially influence premium calculations. Understanding the components, creation process, and implications of this document is essential for both insured parties and insurance providers.

Effective management of loss history documentation contributes to a more transparent and efficient insurance landscape. Proactive utilization of tools like the ACORD statement of no loss template, coupled with diligent risk management practices, fosters a more robust and reliable insurance process, ultimately benefiting all stakeholders within the industry. Accurate and readily available loss history information empowers informed decision-making, contributing to a more stable and sustainable insurance ecosystem.