Utilizing these standardized forms promotes clarity and facilitates effective communication between individuals and financial institutions or advisors. This structured approach allows for a more efficient analysis of financial health, streamlining loan applications, estate planning, and other financial processes. The consistent format also facilitates comparisons across time, enabling users to track financial progress and identify trends.

This foundation of organized financial data serves as a crucial starting point for various financial planning activities, such as developing investment strategies, securing financing, and managing risk. Understanding the components and proper utilization of these reporting tools is essential for informed financial decision-making. The following sections will explore specific aspects of personal financial statements and their practical applications.

1. Standardized Format

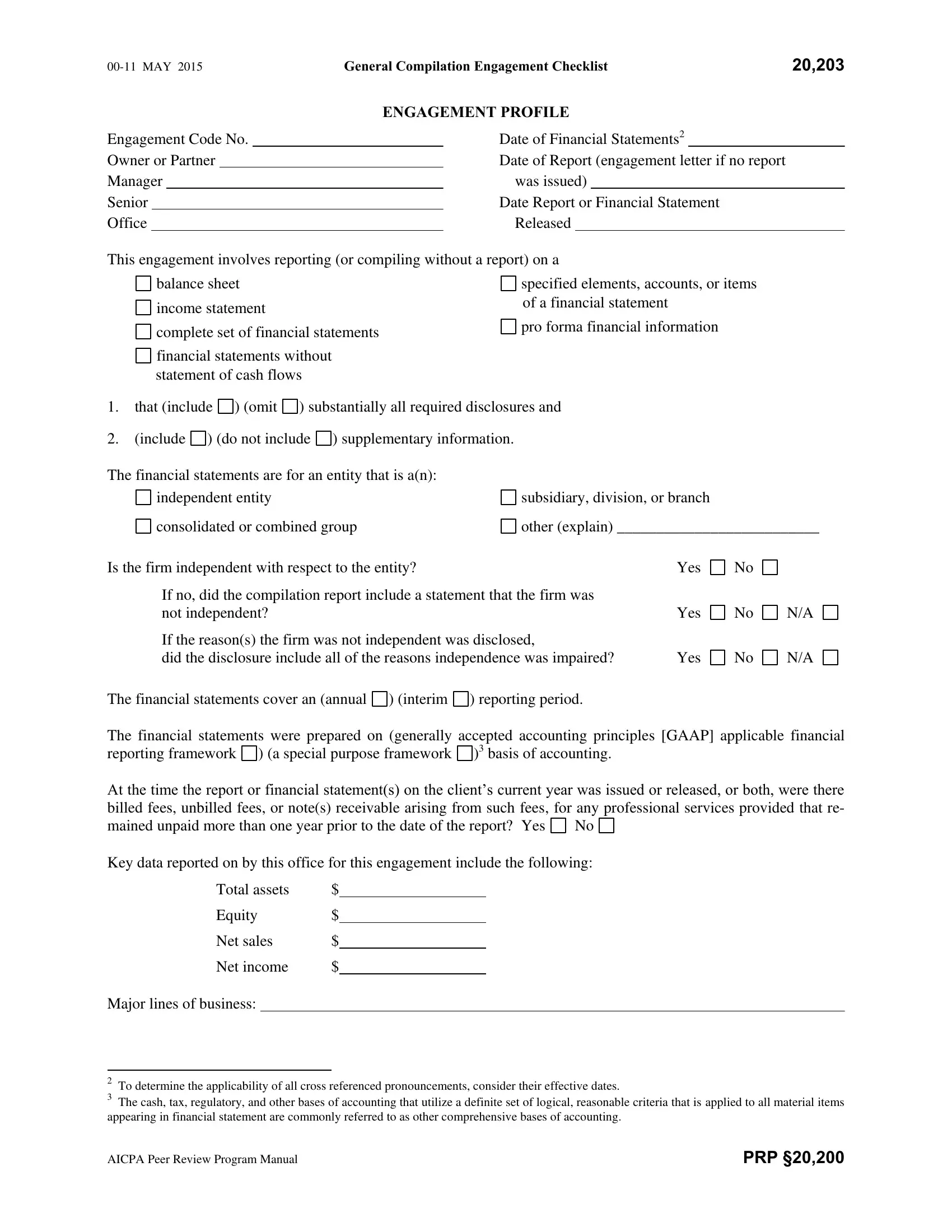

Standardized formatting is a cornerstone of the AICPA personal financial statement template. This structured approach ensures consistency and comparability across different individuals and time periods. By adhering to a predefined structure, financial information is presented in a logical and organized manner, facilitating efficient review and analysis by financial professionals. This consistency allows for easier identification of trends, strengths, and weaknesses within one’s financial position. For example, standardized placement of asset categories like liquid assets, investments, and real property ensures that reviewers can quickly locate and assess these key components.

The standardized format also simplifies the process of comparing financial statements from different individuals or entities. This comparability is essential for lenders evaluating loan applications, investors assessing investment opportunities, and individuals benchmarking their financial progress against peers or industry averages. Moreover, consistent reporting over time allows for the identification of changes in financial health, enabling proactive adjustments to financial strategies. Imagine tracking net worth over several years; a standardized format allows for clear visualization of growth or decline, highlighting the impact of financial decisions.

In summary, the standardized format of AICPA personal financial statements provides a critical framework for clear, concise, and comparable financial reporting. This structure allows for efficient analysis, informed decision-making, and effective communication between individuals and financial stakeholders. While navigating complex financial landscapes, adherence to this standardized format provides a crucial foundation for understanding and managing personal finances effectively.

2. Assets and Liabilities

A clear understanding of assets and liabilities is fundamental to utilizing an AICPA personal financial statement template effectively. These two components provide the foundation for calculating net worth and offer a comprehensive snapshot of an individual’s financial position. Accurate reporting of assets and liabilities is crucial for informed financial decision-making, loan applications, estate planning, and other financial processes.

- Categorization of AssetsAssets, representing what an individual owns, are categorized within the template based on their liquidity and nature. Common categories include liquid assets (cash, checking accounts), investments (stocks, bonds), and fixed assets (real estate, personal property). For example, a primary residence is classified as a fixed asset, while a savings account falls under liquid assets. Accurate categorization ensures clear presentation of financial holdings and facilitates analysis of investment diversification and overall financial stability.

- Classification of LiabilitiesLiabilities represent what an individual owes to others. They are categorized within the template based on their terms and nature. Common classifications include short-term liabilities (credit card debt, upcoming bills) and long-term liabilities (mortgages, student loans). For instance, an outstanding credit card balance is a short-term liability, while a mortgage is a long-term obligation. Proper classification allows for a clear understanding of debt obligations and their potential impact on financial well-being.

- Valuation of Assets and LiabilitiesAccurate valuation of assets and liabilities is critical for a reliable representation of financial standing. Assets are typically valued at their fair market value, while liabilities are reported at their outstanding principal balance. For example, a publicly traded stock is valued at its current market price, while a mortgage is valued at the remaining loan balance. Accurate valuation ensures the integrity of the financial statement and provides a realistic picture of financial health.

- Impact on Net WorthAssets and liabilities are essential for calculating net worth, a key metric reflecting overall financial health. Net worth is calculated by subtracting total liabilities from total assets. A positive net worth indicates that assets exceed liabilities, while a negative net worth suggests the opposite. Understanding the interplay between assets and liabilities and their impact on net worth is crucial for assessing financial progress and making informed financial decisions. For example, paying down a mortgage reduces liabilities and increases net worth, demonstrating the dynamic relationship between these components.

Accurate and comprehensive reporting of assets and liabilities within the AICPA personal financial statement template provides a solid foundation for understanding one’s financial position. This clear overview of financial holdings and obligations allows for informed decision-making related to budgeting, investing, and overall financial planning. By meticulously documenting and categorizing these components, individuals can gain valuable insights into their financial health and work toward achieving their financial goals.

3. Net Worth Calculation

Net worth calculation forms the core of an AICPA personal financial statement template. It provides a concise summary of an individual’s financial position by quantifying the difference between total assets and total liabilities. This calculation serves as a key indicator of financial health and is essential for various financial planning activities, from loan applications to estate management. A robust understanding of net worth calculation within the context of these standardized templates is crucial for informed financial decision-making.

The template facilitates accurate net worth calculation by providing a structured framework for reporting assets and liabilities. Accurate categorization and valuation of these components, as guided by the template, ensure the reliability of the resulting net worth figure. For example, clearly distinguishing between short-term and long-term liabilities ensures a precise representation of outstanding debt obligations. Similarly, accurately valuing assets, such as real estate holdings at fair market value, contributes to a realistic assessment of net worth. This structured approach allows for consistent tracking of net worth over time, enabling individuals to monitor financial progress and identify trends. Imagine an individual consistently reducing mortgage debt and increasing investment portfolio value; the template provides a clear mechanism to quantify these changes and reflect their positive impact on net worth.

Understanding the relationship between individual entries within the template and the resulting net worth calculation is essential for strategic financial management. Recognizing how changes in asset values or liability balances impact net worth allows for proactive adjustments to financial strategies. For instance, understanding the impact of paying down a large debt on overall net worth can incentivize debt reduction strategies. Similarly, recognizing the potential growth of investments within the context of overall net worth can inform investment decisions. In conclusion, the AICPA personal financial statement template serves as a crucial tool for calculating and interpreting net worth, providing individuals with valuable insights into their financial standing and empowering them to make informed decisions toward achieving their financial objectives.

4. Periodic Updates

Maintaining current financial information is crucial for the ongoing utility of an AICPA personal financial statement template. Regular updates ensure the template accurately reflects an individual’s financial position, enabling informed decision-making and effective financial management. Without periodic updates, the template loses its value as a reliable tool for assessing financial health and planning for the future.

- Frequency of UpdatesThe appropriate frequency of updates depends on individual circumstances and financial activity. While annual updates may suffice for individuals with relatively stable finances, more frequent updates, such as quarterly or semi-annually, may be necessary for those experiencing significant financial changes, such as acquiring new assets or incurring substantial debt. For example, a significant change in investment portfolio value warrants a prompt update to accurately reflect current net worth. Aligning update frequency with the pace of financial activity ensures the template remains a relevant and reliable tool.

- Triggers for UpdatesSpecific financial events can trigger the need for template updates. These triggers include major purchases or sales of assets (real estate, vehicles), significant changes in investment values, or the accumulation or payoff of substantial debt. For example, refinancing a mortgage requires updating the corresponding liability information to accurately reflect new loan terms and balances. Prompt updates following these events ensure the template’s ongoing accuracy and relevance for financial planning.

- Maintaining AccuracyAccurate record-keeping is essential for ensuring the reliability of updated information. Maintaining organized financial records, such as bank statements, investment reports, and loan documents, simplifies the update process and reduces the risk of errors. Imagine tracking investment income across multiple accounts; organized records facilitate accurate reporting of dividends, interest, and capital gains, contributing to a precise net worth calculation. Meticulous record-keeping supports the integrity of the template and its value as a financial management tool.

- Utilizing Updated InformationUpdated templates provide a dynamic view of financial health, enabling informed decisions related to budgeting, investing, and other financial matters. Regularly reviewing the updated template allows individuals to track progress toward financial goals, identify potential risks, and make necessary adjustments to financial strategies. For instance, observing a consistent increase in net worth over time affirms the effectiveness of current financial strategies. Conversely, a decline in net worth might prompt a review of spending habits or investment choices. Periodic updates empower individuals to proactively manage their finances and make informed decisions based on a clear understanding of their current financial position.

Periodic updates are essential for maintaining the accuracy and relevance of an AICPA personal financial statement template. By diligently updating the template, individuals ensure it remains a valuable tool for assessing financial health, tracking progress, and making informed decisions to achieve financial objectives. This ongoing process of updating financial information empowers individuals to maintain control over their financial well-being and navigate the complexities of personal finance effectively.

5. Professional Guidance

Professional guidance plays a crucial role in maximizing the effectiveness of AICPA personal financial statement templates. While the standardized format provides a valuable framework, navigating the complexities of financial reporting often requires expert insights. Financial advisors, certified public accountants (CPAs), and other qualified professionals can offer valuable support in various aspects of utilizing these templates, ensuring accuracy, completeness, and strategic application of the information gathered.

One key area where professional guidance proves invaluable is in the accurate valuation of assets. Determining the fair market value of complex assets, such as real estate holdings, business interests, or unique collectibles, can be challenging. Professionals possess the expertise and resources to conduct thorough valuations, ensuring the reported values accurately reflect market conditions and regulatory requirements. For example, a certified appraiser can provide an objective valuation of a real estate property, while a business valuation specialist can assess the value of a privately held business. Accurate valuations are critical for a reliable net worth calculation and informed financial decision-making. Furthermore, professional guidance can assist in the proper categorization and reporting of liabilities. Understanding the nuances of debt classifications, such as differentiating between secured and unsecured loans or properly accounting for contingent liabilities, ensures a comprehensive and accurate representation of financial obligations.

Beyond technical expertise in completing the template, financial professionals offer strategic insights derived from the information reported. Analyzing the completed template, professionals can identify potential financial risks and opportunities, offering tailored advice on debt management, investment strategies, and other financial planning matters. They can also assist in developing realistic financial goals and creating actionable plans to achieve them. For instance, a financial advisor can analyze spending patterns revealed within the template and recommend strategies for optimizing cash flow and increasing savings. Moreover, professionals can provide guidance on navigating complex financial situations, such as estate planning or business succession, ensuring alignment between financial goals and long-term objectives. In conclusion, while the AICPA personal financial statement template provides a valuable structure for organizing financial information, professional guidance enhances its utility significantly. Expert insights ensure accuracy, facilitate strategic interpretation of financial data, and empower individuals to make informed decisions, ultimately leading to more effective financial management and goal attainment.

6. Financial Clarity

Financial clarity, a critical component of sound financial management, is significantly enhanced through the utilization of AICPA personal financial statement templates. These templates provide a structured framework for organizing and understanding one’s financial position, fostering informed decision-making and promoting financial well-being. By offering a standardized approach to reporting assets, liabilities, and net worth, these templates empower individuals to gain a comprehensive and accurate view of their financial health.

- Comprehensive OverviewAICPA templates provide a holistic view of financial standing. By consolidating information on assets, liabilities, and net worth in a standardized format, the template offers a single, comprehensive snapshot of one’s financial picture. This consolidated view facilitates a clear understanding of the interplay between various financial components, such as the impact of debt on net worth or the contribution of different asset classes to overall wealth. For example, an individual can readily assess the proportion of their net worth tied to real estate holdings versus liquid assets, informing investment diversification strategies.

- Informed Decision-MakingClarity in financial matters empowers informed decision-making. The organized information presented within the template allows individuals to make sound judgments regarding budgeting, investing, and other financial matters. For instance, a clear understanding of current debt levels, facilitated by the template, can inform decisions about taking on additional debt, such as a mortgage or car loan. Similarly, accurate knowledge of asset allocation can guide investment decisions toward greater diversification and risk management. The template serves as a crucial tool for aligning financial decisions with personal goals and circumstances.

- Objective AssessmentAICPA templates promote an objective assessment of financial health. By adhering to a standardized format and valuation principles, the template reduces subjective biases and promotes an objective evaluation of one’s financial position. This objective assessment is crucial for identifying areas of financial strength and weakness, enabling informed adjustments to financial strategies. For example, a clear depiction of high-interest debt within the template can prompt strategies for debt reduction, while a significant increase in net worth might encourage increased investment activity. The template facilitates data-driven decision-making, minimizing emotional influences and promoting rational financial choices.

- Effective CommunicationClear and organized financial information facilitates effective communication with financial stakeholders. Whether communicating with lenders during a loan application process, working with financial advisors on investment strategies, or discussing financial matters with family members during estate planning, the standardized format of the AICPA template ensures clear and consistent communication. For example, providing a completed template to a mortgage lender streamlines the loan application process, while sharing the template with a financial advisor facilitates productive discussions about investment strategies. The template serves as a common language for discussing financial matters, promoting transparency and understanding among all parties involved.

In conclusion, the AICPA personal financial statement template serves as a cornerstone for achieving financial clarity. By providing a structured framework for organizing and understanding financial information, these templates empower individuals to make informed decisions, communicate effectively with financial stakeholders, and take control of their financial well-being. The insights gained from these templates promote a proactive approach to financial management, leading to greater financial stability and the achievement of long-term financial goals.

Key Components of AICPA Personal Financial Statements

Accurate and comprehensive personal financial statements rely on several key components. Understanding these components is crucial for effectively utilizing the standardized format provided by the AICPA.

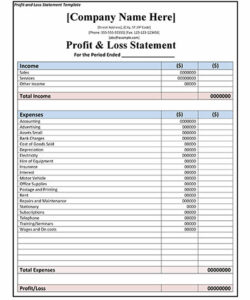

1. Statement of Financial Position: This statement provides a snapshot of an individual’s financial standing at a specific point in time. It details assets (what is owned), liabilities (what is owed), and calculates net worth (assets minus liabilities). Accurate valuation of assets and liabilities is paramount for a reliable net worth calculation.

2. Statement of Cash Flow: This statement tracks cash inflows and outflows over a specific period. It categorizes cash flow into operating activities (income and expenses), investing activities (buying and selling assets), and financing activities (debt and equity). Analyzing cash flow helps understand spending patterns and identify potential areas for improvement.

3. Supporting Schedules: These schedules provide detailed information supporting the main financial statements. Examples include schedules of investments, real estate holdings, and personal property. These schedules offer a granular view of assets and liabilities, facilitating a thorough understanding of financial holdings. They also aid in accurate valuation and substantiation of reported figures.

4. Notes to the Financial Statements: These notes provide additional context and explanations regarding the information presented in the financial statements. They might include details about accounting methods used, assumptions made, or contingent liabilities. These notes enhance transparency and offer a more complete picture of an individual’s financial situation.

5. Account Reconciliation: Regular reconciliation of financial accounts, such as bank statements and investment accounts, with the information reported in the template ensures accuracy and identifies any discrepancies. This process is crucial for maintaining data integrity and reliability.

These components work together to provide a comprehensive and structured representation of personal finances. Accurate reporting, regular updates, and professional guidance enhance the value of these statements for informed financial decision-making.

How to Create an AICPA Personal Financial Statement

Creating a comprehensive personal financial statement requires a structured approach and meticulous attention to detail. Adhering to established standards, such as those provided by the AICPA, ensures clarity, consistency, and comparability.

1. Gather Necessary Documentation: Collect all relevant financial records, including bank statements, investment account statements, loan documents, real estate appraisals, and records of personal property values. Organized documentation streamlines the process and ensures accuracy.

2. Choose the Appropriate Template: Select the AICPA template that aligns with the intended purpose of the statement. Different templates cater to specific needs, such as applying for a loan, seeking professional financial advice, or planning for estate purposes.

3. Complete the Statement of Financial Position: Accurately list all assets at their fair market value and all liabilities at their outstanding principal balance. Categorize assets and liabilities according to the template’s instructions. Calculate net worth by subtracting total liabilities from total assets.

4. Prepare the Statement of Cash Flow: Document all cash inflows and outflows over the chosen reporting period. Categorize cash flows into operating, investing, and financing activities. This statement provides insights into spending and saving patterns.

5. Develop Supporting Schedules: Create detailed schedules for significant asset and liability categories, such as investments, real estate holdings, and personal property. These schedules offer supporting documentation for the figures presented in the main statements.

6. Include Notes to the Financial Statements: Provide any necessary explanations or clarifications regarding the information reported. These notes might detail accounting methods used, assumptions made, or significant contingencies.

7. Review and Reconcile: Thoroughly review the completed statement for accuracy and completeness. Reconcile reported information with supporting documentation to identify and correct any discrepancies.

8. Seek Professional Guidance: Consult with a qualified financial advisor or CPA for guidance and review. Professional insights can enhance the accuracy and utility of the statement, ensuring compliance with relevant standards and providing valuable financial planning advice.

Meticulous preparation and adherence to established reporting standards are essential for creating a robust and informative personal financial statement. A well-prepared statement provides valuable insights into financial health, supports informed decision-making, and facilitates effective communication with financial stakeholders.

AICPA personal financial statement templates provide a standardized, crucial framework for organizing and understanding personal finances. Utilizing these templates facilitates clear communication with financial professionals, aids in securing loans, assists with estate planning, and promotes informed financial decision-making. Accuracy, thoroughness, and regular updates are essential for maximizing the utility of these templates. Professional guidance enhances the value of these statements, providing expert insights and ensuring compliance with relevant reporting standards. Key components, including the statement of financial position, statement of cash flow, supporting schedules, and explanatory notes, contribute to a comprehensive view of financial health. Understanding and utilizing these components effectively are essential for sound financial management.

Effective financial management hinges on a clear understanding of one’s financial position. AICPA personal financial statement templates offer a valuable tool for achieving this clarity, empowering individuals to take control of their financial well-being and pursue long-term financial objectives. Regularly reviewing and updating these statements, combined with seeking professional guidance when necessary, fosters a proactive approach to financial planning and contributes to greater financial stability and success.