Utilizing such a pre-designed structure offers several advantages. It facilitates efficient data organization, simplifies the process of tracking income and expenses, and promotes consistency in financial reporting. This consistency allows for year-over-year comparisons, trend analysis, and informed decision-making. Furthermore, this readily available format can save time and resources, ensuring accuracy and reducing the likelihood of errors.

Understanding the components and function of this financial tool is essential for effective financial planning and analysis. The following sections will delve deeper into the specific elements, offering practical guidance on its creation and interpretation for various business contexts.

1. Standardized Format

A standardized format is fundamental to the utility of an annual cash flow statement template. Consistency ensures comparability across reporting periods and facilitates analysis. Adherence to established accounting principles allows stakeholders to readily understand and interpret the financial health of an organization.

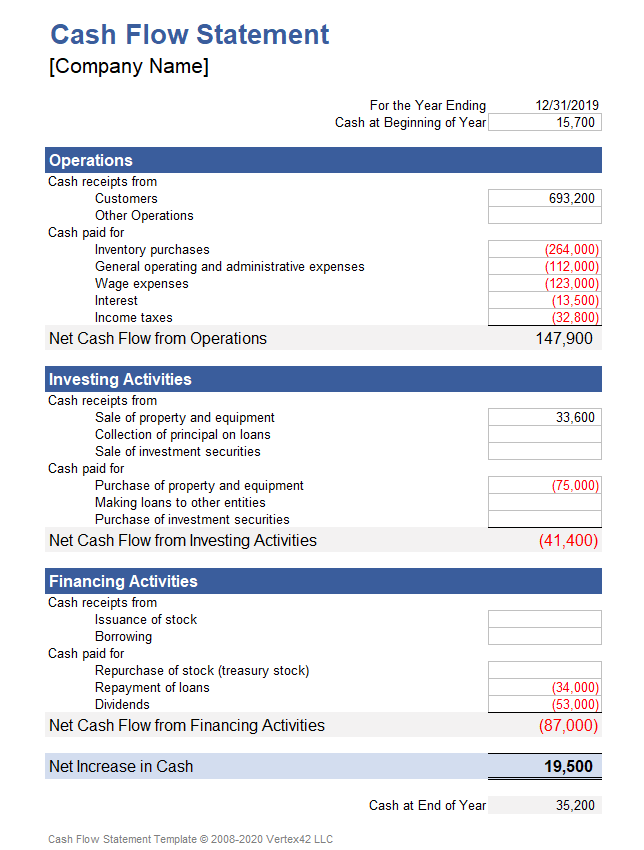

- Consistent StructureA standardized template provides a predefined structure for presenting cash flow information. This structure typically includes sections for operating activities, investing activities, and financing activities. Consistent categorization allows for clear comparisons between periods and across different organizations. For example, the consistent placement of net income at the beginning of the operating activities section allows for easy identification and analysis of its contribution to overall cash flow. This predictable structure simplifies analysis and reduces the risk of misinterpretation.

- Comparable ReportingStandardization enables direct comparison of cash flow data across multiple periods. This comparability is crucial for identifying trends, evaluating performance, and making informed decisions about future resource allocation. For instance, observing a consistent decline in cash flow from operating activities over several years signals potential operational issues that require attention. This longitudinal analysis is only possible with a standardized format.

- Compliance with Accounting PrinciplesStandardized templates generally adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). This adherence ensures that the information presented is reliable, transparent, and comparable across different entities. Compliance with these standards enhances the credibility of the financial information and facilitates external audits.

- Simplified Analysis and InterpretationA standardized format streamlines the analysis and interpretation of cash flow data. The predictable structure allows analysts and stakeholders to quickly identify key information and draw meaningful conclusions about an organization’s financial performance. This ease of interpretation enhances decision-making efficiency.

The standardized format of an annual cash flow statement template is thus integral to its effectiveness. By promoting consistency, comparability, and compliance with accounting standards, the standardized format facilitates meaningful analysis, supports informed decision-making, and enhances the overall utility of this essential financial tool.

2. Yearly Overview

The yearly overview provided by an annual cash flow statement template is crucial for understanding long-term financial trends and evaluating an organization’s overall financial health. Unlike shorter-term reports, an annual perspective offers a comprehensive view of cash inflows and outflows, allowing for more informed strategic planning and decision-making. This long-term perspective reveals patterns and trends that might be obscured by short-term fluctuations.

Examining cash flow patterns over a full year reveals the seasonality of a business. For example, a retail business might experience higher cash inflows during the holiday season and lower inflows during other times of the year. A yearly overview helps in forecasting future cash flows and planning for periods of potential cash shortages. Similarly, capital expenditures, which are often infrequent but significant, are best understood within the context of a full year’s financial activity. This yearly perspective allows organizations to assess the long-term impact of these investments on their cash position.

The yearly overview also facilitates comparisons with previous years, enabling stakeholders to assess the effectiveness of operational strategies and identify areas for improvement. Consistent declines in operating cash flow, for instance, might indicate underlying operational issues, while consistent increases suggest growth and efficiency. Furthermore, comparing annual cash flow statements allows organizations to benchmark their performance against industry averages and identify potential competitive advantages or disadvantages. This analysis provides crucial insights for strategic planning, resource allocation, and long-term financial sustainability. Understanding the yearly dynamics of cash flow is thus indispensable for effective financial management and long-term organizational success.

3. Categorized Cash Flows

A core strength of an annual cash flow statement template lies in its structured categorization of cash flows. Dividing cash flows into operating, investing, and financing activities provides a granular understanding of an organization’s financial dynamics, enabling more effective analysis and decision-making than a simple aggregation of total cash flow. This categorization is essential for understanding the different sources and uses of cash within a business.

- Operating ActivitiesThis category encompasses cash flows directly related to the core business operations, such as sales revenue, payments to suppliers, and employee wages. Analyzing operating cash flow provides insights into the profitability and efficiency of the core business. For example, a consistent increase in cash flow from operations suggests a healthy and growing business, while a decrease might indicate declining sales or increasing operational costs. Understanding these trends is crucial for evaluating the long-term sustainability of the business.

- Investing ActivitiesInvesting activities include the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E), as well as investments in other companies. These cash flows reflect the organization’s strategic capital allocation decisions. For instance, significant cash outflows for purchasing new equipment might indicate expansion plans, while substantial cash inflows from selling assets might suggest a divestiture strategy. Analyzing these activities provides a clear picture of long-term investment strategies and their impact on the organization’s overall financial position.

- Financing ActivitiesFinancing activities involve transactions with lenders and investors, such as issuing debt, repaying loans, issuing stock, and paying dividends. These cash flows provide insights into the organization’s capital structure and its financial health. For example, increasing debt levels might suggest financial strain, while issuing new equity could indicate expansion plans or a need to strengthen the balance sheet. Careful analysis of financing activities is essential for understanding the long-term financial stability and risk profile of the organization.

- The Interplay of CategoriesWhile each category offers unique insights, their interplay is equally important. A strong positive cash flow from operations can fund investing activities, reducing the need for external financing. Conversely, weak operating cash flow might necessitate increased borrowing or equity issuance. Understanding the relationships between these categories provides a holistic view of the organizations financial management and overall sustainability. For example, a company consistently generating positive cash flow from operations and reinvesting it in new equipment demonstrates strong financial health and a focus on long-term growth. This comprehensive perspective is fundamental for making sound financial decisions.

The categorized presentation of cash flows within an annual cash flow statement template is therefore indispensable for comprehensive financial analysis. By separating cash flows into distinct categories, the template provides a deeper understanding of an organizations core business performance, investment strategies, and financing decisions. This structured approach enables more informed decision-making, contributes to more effective financial management, and promotes long-term financial health.

4. Financial Health Insights

An annual cash flow statement template provides crucial insights into an organization’s financial health. Analyzing the information within this template allows stakeholders to assess financial stability, profitability, and long-term sustainability. Understanding the various facets of financial health revealed by this statement is essential for informed decision-making and effective financial management.

- Liquidity AssessmentThe statement reveals an organization’s ability to meet short-term obligations. Positive cash flow from operating activities indicates sufficient cash generated from core business operations to cover expenses. Conversely, negative operating cash flow may signal potential liquidity issues, requiring reliance on external financing or asset sales. For example, a consistently negative operating cash flow might necessitate drawing down on a line of credit, increasing financial risk.

- Profitability EvaluationWhile not a direct measure of profitability, the cash flow statement complements the income statement by providing a cash-based perspective on operating performance. Strong and growing cash flow from operations often correlates with healthy profits and efficient operations. For instance, a company showing increasing operating cash flow year-over-year suggests effective cost management and strong revenue generation. Analyzing both statements together provides a more complete picture of financial performance.

- Investment Strategy AnalysisCash flow from investing activities reveals an organization’s investment strategy and capital allocation decisions. Significant cash outflows for capital expenditures may indicate investments in future growth, while large inflows from asset sales might signal a divestiture or restructuring strategy. For example, a technology company investing heavily in research and development demonstrates a commitment to innovation and future growth potential.

- Financial Risk AssessmentExamining financing activities provides insights into an organization’s financial risk profile. High levels of debt and corresponding interest payments increase financial risk, while reliance on equity financing can dilute ownership but reduce debt burdens. For example, a company consistently relying on debt financing to cover operating expenses might face challenges during economic downturns due to higher interest obligations and potential difficulties refinancing debt.

By providing a structured overview of these key aspects, the annual cash flow statement template facilitates a comprehensive assessment of financial health. This understanding is crucial for identifying strengths and weaknesses, evaluating performance trends, and making informed strategic decisions that contribute to long-term financial sustainability. Analyzing the statement in conjunction with other financial statements, such as the income statement and balance sheet, provides a holistic view of an organization’s financial position and its prospects for future success.

5. Simplified Reporting

An annual cash flow statement template significantly simplifies financial reporting processes. The structured format inherent in these templates streamlines data entry and organization, reducing the complexity associated with manual cash flow analysis. This simplification saves time and resources, allowing financial professionals to focus on higher-level analysis and strategic decision-making rather than tedious data compilation. Pre-defined categories for operating, investing, and financing activities ensure consistent data classification, reducing the likelihood of errors and promoting clarity in reporting. Furthermore, the standardized format facilitates automated report generation, further enhancing efficiency and reducing the potential for human error. For instance, a small business using a template can easily track its daily cash transactions and categorize them appropriately at the end of each month, leading to a readily available and accurate annual statement.

This streamlined reporting process also benefits external stakeholders. The consistent and readily understandable format of a template-based cash flow statement enhances transparency, making it easier for investors, lenders, and other stakeholders to assess an organization’s financial health. This transparency fosters trust and facilitates more informed decision-making by external parties. For example, a standardized presentation of cash flow data allows investors to quickly compare the performance of different companies and make more informed investment decisions. Moreover, simplified reporting reduces the burden on auditors, streamlining the audit process and potentially lowering audit costs. This efficiency translates into cost savings for the organization and promotes confidence in the reported financial information.

In conclusion, simplified reporting, facilitated by annual cash flow statement templates, represents a significant advantage for organizations of all sizes. Streamlined data entry and organization, reduced error potential, enhanced transparency, and facilitated external analysis contribute to more efficient and effective financial management. Leveraging these benefits empowers organizations to make data-driven decisions and achieve long-term financial success. This efficiency is particularly crucial for smaller businesses that may lack dedicated financial personnel, allowing them to manage their finances effectively without extensive accounting expertise. Ultimately, the streamlined reporting facilitated by these templates allows for a more focused approach to financial analysis, contributing to better decision-making and improved financial outcomes.

Key Components of an Annual Cash Flow Statement Template

A comprehensive understanding of key components is essential for effective utilization of an annual cash flow statement template. These components provide a structured framework for analyzing an organization’s financial performance and liquidity.

1. Operating Activities: This section details cash flows generated from the core business operations. Key elements include cash received from customers, cash paid to suppliers, and cash paid for salaries and wages. Analyzing this section reveals the profitability and efficiency of the core business activities.

2. Investing Activities: This section captures cash flows related to long-term investments. Key elements include purchases and sales of property, plant, and equipment (PP&E), acquisitions and divestitures of other businesses, and investments in securities. Analyzing this section provides insights into an organization’s capital allocation strategies and growth plans.

3. Financing Activities: This section details cash flows related to the organization’s capital structure. Key elements include proceeds from issuing debt or equity, repayment of debt, and payment of dividends. Analyzing this section provides insights into the organization’s financial risk profile and long-term financial stability.

4. Beginning Cash Balance: This crucial starting point represents the cash available at the beginning of the reporting period. It provides context for subsequent cash inflows and outflows, and forms the basis for calculating the ending cash balance.

5. Ending Cash Balance: This figure represents the cash available at the end of the reporting period. It is calculated by adding net cash flow from all activities to the beginning cash balance. This ending balance is a key indicator of an organization’s liquidity and its ability to meet short-term obligations.

6. Non-Cash Transactions: While not directly impacting cash flow, significant non-cash transactions are often disclosed in a supplemental section. Examples include converting debt to equity or exchanging assets. These disclosures provide a more complete picture of an organizations financial activities.

7. Supplemental Disclosures: This section provides additional context and detail about specific cash flow items. These disclosures might include details about significant investing or financing activities, further enhancing transparency and understanding.

Careful analysis of these components provides a comprehensive view of an organization’s financial performance, liquidity, and long-term sustainability. Understanding these elements is essential for effective financial management and informed decision-making.

How to Create an Annual Cash Flow Statement

Creating an annual cash flow statement requires a systematic approach. The following steps outline the process of developing this crucial financial document.

1. Gather Necessary Information: Begin by collecting all relevant financial records for the fiscal year. These records include income statements, balance sheets, bank statements, and investment records. Comprehensive data collection ensures accuracy and completeness.

2. Determine the Beginning Cash Balance: Establish the cash balance at the start of the fiscal year. This figure serves as the foundation for calculating subsequent cash flows. This information is readily available from the previous period’s closing balance.

3. Calculate Cash Flow from Operating Activities: Start with net income and adjust for non-cash items like depreciation and amortization. Then, analyze changes in working capital accounts, such as accounts receivable, inventory, and accounts payable, to determine their impact on cash flow. Increases in assets typically represent cash outflows, while increases in liabilities represent cash inflows.

4. Calculate Cash Flow from Investing Activities: Document all cash flows related to investments, including purchases and sales of long-term assets like property, plant, and equipment (PP&E), as well as investments in other companies. Cash inflows result from asset sales, while outflows result from acquisitions.

5. Calculate Cash Flow from Financing Activities: Record cash flows related to financing the business, such as proceeds from issuing debt or equity, loan repayments, and dividend payments. Proceeds increase cash flow, while repayments and dividends decrease it.

6. Calculate the Ending Cash Balance: Sum the net cash flows from operating, investing, and financing activities and add this total to the beginning cash balance. This final figure represents the cash on hand at the end of the fiscal year.

7. Prepare Supplemental Disclosures: Include any relevant non-cash transactions, such as debt-to-equity conversions or asset exchanges. These disclosures provide a more comprehensive understanding of the organization’s financial activities. Additional explanations or details regarding significant transactions may also be included to enhance clarity.

8. Review and Verify: Thoroughly review the completed statement for accuracy and consistency. Ensure all calculations are correct and all necessary information is included. Verification ensures the reliability and integrity of the financial information presented. This process might involve independent review by another financial professional.

A meticulously prepared annual cash flow statement provides a clear and comprehensive overview of an organization’s financial performance. This information is essential for effective financial management, informed decision-making, and communicating financial health to stakeholders. Following these steps promotes accuracy and consistency, enhancing the reliability and utility of this critical financial document. This structured approach ensures compliance with accounting principles and facilitates informed financial analysis.

Careful analysis of standardized annual reporting structures for cash flow offers invaluable insights into an organization’s financial health, operational efficiency, and strategic direction. Understanding the components, creation process, and interpretative value of such structured formats is essential for effective financial management. From assessing liquidity and profitability to evaluating investment strategies and financial risks, these structured overviews provide a crucial foundation for informed decision-making.

Leveraging the insights provided by these standardized formats empowers stakeholders to make data-driven decisions, optimize resource allocation, and navigate the complexities of the financial landscape. The ability to analyze historical trends, benchmark against industry peers, and project future performance based on these structured reports is crucial for long-term financial sustainability and achieving strategic objectives. A proactive approach to cash flow analysis, facilitated by standardized annual templates, is therefore not merely a best practice but a necessity for organizations striving for financial success in a dynamic and competitive environment.