Utilizing such a structured report offers several advantages. It simplifies the process of compiling financial data, reducing the risk of errors and omissions. Furthermore, it provides a clear and concise overview of financial performance, enabling stakeholders to quickly grasp key metrics and make informed decisions. This standardized format also simplifies comparisons with previous years and industry benchmarks, facilitating trend analysis and performance evaluation.

The following sections will delve deeper into specific aspects of financial reporting, exploring best practices for data collection, analysis, and interpretation.

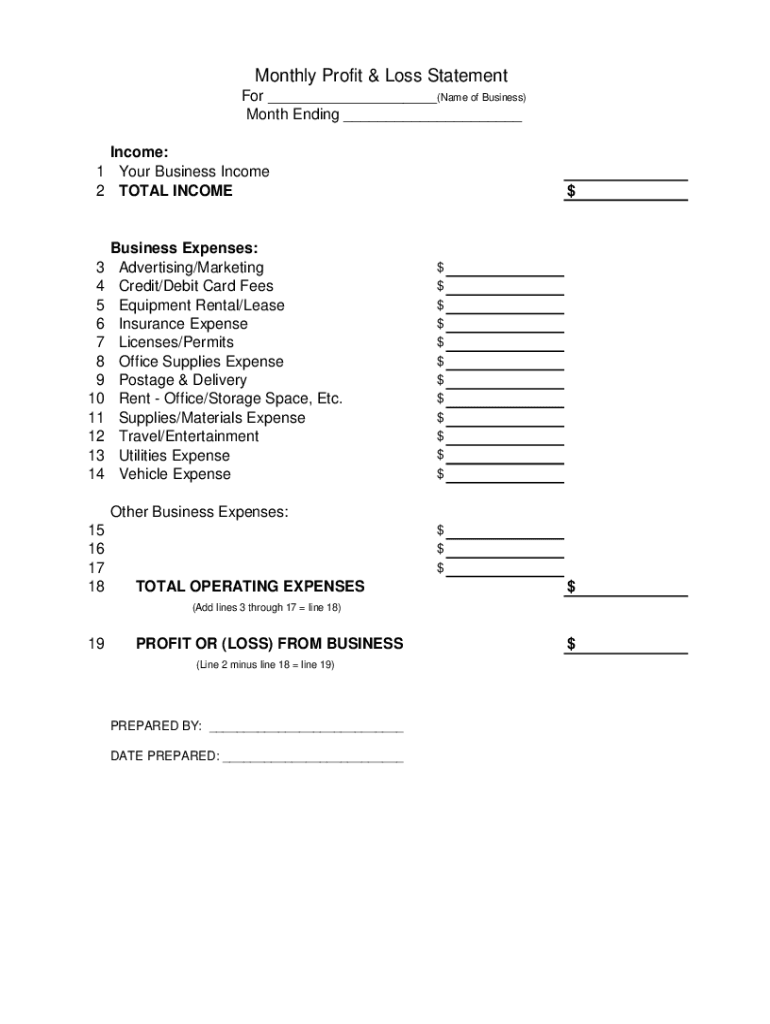

1. Standardized Format

Standardized formatting is fundamental to the utility of a yearly profit and loss statement. Consistency in presentation allows for straightforward comparison across reporting periods within an organization and facilitates benchmarking against competitors. A standardized structure ensures key financial metrics are consistently located, simplifying analysis and reducing the risk of overlooking critical data. For example, consistently placing revenue at the top, followed by cost of goods sold, operating expenses, and finally, net income, creates a predictable framework for understanding financial performance. Without such standardization, comparing performance across time or against other entities becomes significantly more complex and prone to error.

Consider two companies using different formats. One reports gross profit before operating expenses, while the other reports operating expenses first. Direct comparison of their profitability becomes difficult without reformatting one statement. A standardized template eliminates this issue, enabling efficient analysis and informed decision-making based on reliable, comparable data. This standardization also simplifies integration with financial software and databases, streamlining reporting processes and reducing manual data manipulation.

In conclusion, adherence to a standardized format maximizes the value of profit and loss reporting. It fosters transparency, facilitates comparability, and ultimately enhances the ability of stakeholders to understand and act upon financial information. Challenges may arise in adapting existing reporting practices to a standardized format, but the long-term benefits of improved analysis and decision-making significantly outweigh these initial hurdles.

2. Revenue Categorization

Effective financial analysis requires a granular understanding of revenue streams. Within the structure of an annual profit and loss statement template, revenue categorization provides this essential detail. Categorizing revenue allows businesses to identify their most profitable areas, track performance trends within specific segments, and make informed decisions regarding resource allocation and future growth strategies.

- Sales RevenueThis category typically represents income generated from core business operations, such as the sale of goods or services. A retail business, for example, would categorize revenue from clothing sales separately from revenue generated by accessory sales. This distinction allows for analysis of individual product line performance and informs inventory management decisions.

- Investment IncomeRevenue generated from investments, including interest, dividends, and capital gains, falls under this category. Tracking investment income separately from operational revenue provides insights into the effectiveness of investment strategies and their contribution to overall profitability. For instance, a company might track returns from its stock portfolio separately from interest earned on cash reserves.

- Other RevenueThis category encompasses revenue streams outside core business operations and investments. Examples include licensing fees, royalties, or the sale of assets. Proper categorization of other revenue streams ensures transparency and allows for accurate assessment of their impact on overall financial performance. A software company might categorize revenue from software licenses separately from revenue earned through consulting services.

- Cost of Goods Sold (COGS)While not strictly revenue, COGS is intrinsically linked. It represents the direct costs associated with producing goods sold. Accurate categorization of COGS is crucial for calculating gross profit, a key indicator of operational efficiency. A manufacturer would include raw material costs, direct labor, and manufacturing overhead within COGS, enabling precise calculation of gross profit margins on finished goods.

Accurate revenue categorization within a standardized annual profit and loss statement template provides the foundation for robust financial analysis. This detailed breakdown allows businesses to understand the composition of their revenue streams, track performance trends, identify areas for improvement, and ultimately make informed strategic decisions to drive profitability and sustainable growth.

3. Expense Breakdown

A comprehensive understanding of expenses is crucial for sound financial management. Within the framework of an annual profit and loss statement template, a detailed expense breakdown provides insights into cost structures, operational efficiency, and profitability. This analysis enables informed decision-making regarding cost control, resource allocation, and strategic planning.

- Operating ExpensesThese expenses are incurred through normal business operations and include salaries, rent, utilities, marketing, and administrative costs. Categorizing and tracking these expenses allows businesses to identify areas of potential cost savings and improve operational efficiency. For example, a significant increase in marketing expenses without a corresponding increase in sales revenue might warrant further investigation and potential adjustments to marketing strategies. Accurate reporting of operating expenses is critical for assessing the profitability of core business activities.

- Cost of Goods Sold (COGS)While already discussed under revenue, COGS is also a critical expense category. It represents the direct costs associated with producing goods or services sold. Tracking COGS allows businesses to analyze production efficiency, identify potential cost reductions in the supply chain, and optimize pricing strategies. A rising trend in raw material costs, for example, might necessitate adjustments to product pricing or exploration of alternative suppliers to maintain profit margins.

- Interest ExpenseThis category reflects the cost of borrowing money. Monitoring interest expense is essential for managing debt levels and assessing the financial impact of financing decisions. A high interest expense burden can significantly impact profitability, and careful analysis within the profit and loss statement can inform decisions regarding refinancing or debt reduction strategies.

- Depreciation and AmortizationThese are non-cash expenses that represent the allocation of the cost of tangible and intangible assets over their useful lives. Accurately accounting for depreciation and amortization is crucial for reflecting the true cost of using these assets and for making informed decisions regarding asset replacement and capital expenditures. A company with significant investments in equipment, for instance, needs to accurately track depreciation to understand the true cost of production and plan for future equipment upgrades.

A detailed expense breakdown within the annual profit and loss statement template provides a comprehensive view of cost drivers and their impact on profitability. This analysis allows businesses to identify areas for cost optimization, improve operational efficiency, and make informed decisions regarding resource allocation, pricing strategies, and long-term financial planning. By understanding the relationship between revenue and expenses, businesses can develop strategies to maximize profitability and achieve sustainable growth.

4. Calculating Net Income/Loss

The core purpose of an annual profit and loss statement template is to determine net income or loss. This calculation represents the bottom line the overall profitability of an organization over a fiscal year. Accurate calculation of net income/loss is fundamental for assessing financial performance, making informed business decisions, and meeting regulatory reporting requirements. Understanding this calculation provides crucial insights into an organization’s financial health and sustainability.

- Revenue RecognitionAccurate revenue recognition is the foundation of net income calculation. Revenue should be recognized when earned, not necessarily when cash is received. For example, a company that delivers a service in December but invoices the client in January recognizes the revenue in December, reflecting the period in which the service was performed. Consistent application of revenue recognition principles ensures accurate representation of financial performance within the profit and loss statement.

- Expense MatchingThe matching principle requires expenses to be recognized in the same period as the revenue they generate. This ensures accurate reflection of profitability. For example, the cost of goods sold is recognized in the period the goods are sold, not when they are purchased or manufactured. Matching expenses with corresponding revenue provides a clear picture of the profit generated from specific activities.

- Gross Profit CalculationGross profit, calculated as revenue minus cost of goods sold, provides a key measure of operational efficiency. This metric reveals the profitability of core business operations before considering other operating expenses. Analyzing gross profit trends within the annual profit and loss statement can identify areas for cost optimization or pricing adjustments.

- Net Income DeterminationSubtracting all expenses, including operating expenses, interest, taxes, depreciation, and amortization from gross profit yields net income. This final figure represents the overall profitability of the organization after all costs are considered. Net income is a critical indicator of financial health and a key factor in investment decisions and valuations.

Accurate calculation of net income/loss within a standardized annual profit and loss statement template is paramount for assessing financial performance and making strategic decisions. A clear understanding of revenue recognition, expense matching, and the components of the net income calculation provides stakeholders with the insights necessary to evaluate profitability, identify trends, and make informed decisions regarding resource allocation, growth strategies, and overall financial management.

5. Year-over-Year Comparison

Analyzing financial performance over time is crucial for understanding trends and making informed strategic decisions. Year-over-year comparison, facilitated by the consistent structure of an annual profit and loss statement template, provides a powerful mechanism for evaluating growth, identifying potential issues, and assessing the effectiveness of business strategies. This comparative analysis reveals the impact of decisions made in prior periods and informs future planning.

- Revenue Growth AnalysisComparing revenue figures from consecutive years reveals top-line growth trends. Consistent increases indicate positive market reception and effective sales strategies, while declines may signal market saturation, increased competition, or ineffective marketing efforts. A company observing consistent revenue growth in its software sales, for example, can infer successful product development and marketing initiatives. Conversely, declining revenue in hardware sales might prompt a review of product competitiveness and market demand.

- Expense Trend IdentificationAnalyzing expense trends year-over-year helps identify areas of increasing or decreasing costs. Rising operating expenses, for instance, might indicate inefficiencies or increased investment in growth initiatives. A consistent rise in raw material costs, as revealed through year-over-year comparison within the cost of goods sold section, might prompt exploration of alternative suppliers or adjustments to product pricing. Identifying these trends allows for proactive cost management and optimization.

- Profitability AssessmentComparing net income or loss across multiple years provides insights into the long-term profitability of an organization. Consistent profitability demonstrates sustainable business practices, while fluctuating or declining profits may signal underlying issues requiring attention. A company experiencing declining net income despite increasing revenue, for example, needs to carefully examine its expense structure to identify areas of inefficiency or escalating costs.

- Performance BenchmarkingYear-over-year comparisons provide a baseline for evaluating the effectiveness of implemented strategies. If a company implemented a new marketing campaign in the current year, comparing performance metrics with the previous year’s results can assess the campaign’s impact on revenue and overall profitability. This data-driven approach to performance evaluation allows for informed adjustments to future strategies and resource allocation.

Utilizing an annual profit and loss statement template as a framework for year-over-year comparison provides valuable insights into financial performance trends. This analysis enables organizations to identify strengths, weaknesses, and areas for improvement, ultimately leading to more informed strategic decision-making, enhanced operational efficiency, and sustainable growth. By understanding past performance, businesses can better position themselves for future success.

6. Financial Health Assessment

A comprehensive financial health assessment is crucial for understanding an organization’s stability, profitability, and growth potential. The annual profit and loss statement template serves as a foundational tool for this assessment, providing key data points for evaluating performance and identifying areas for improvement. Analyzing this statement offers critical insights into an organization’s ability to generate revenue, manage expenses, and achieve sustainable profitability.

- Profitability AnalysisProfitability analysis, a cornerstone of financial health assessment, leverages data from the profit and loss statement to evaluate an organization’s ability to generate profit. Key metrics such as gross profit margin, operating profit margin, and net profit margin provide insights into operational efficiency and pricing strategies. For example, declining profit margins over several years, as revealed through analysis of consecutive annual profit and loss statements, might indicate pricing pressure, increasing costs, or declining operational efficiency, signaling potential financial health concerns.

- Liquidity AssessmentWhile the profit and loss statement doesn’t directly reveal cash flow, it informs liquidity assessment by providing insights into revenue generation and expense management. Consistently low or negative net income can signal potential liquidity challenges, impacting an organization’s ability to meet short-term obligations. Analyzing the relationship between revenue and expenses within the statement offers valuable context for understanding liquidity risks. For instance, rapidly increasing operating expenses coupled with stagnant revenue growth could foreshadow future liquidity constraints.

- Operational Efficiency EvaluationAnalyzing trends in cost of goods sold and operating expenses within the annual profit and loss statement offers insights into operational efficiency. Rising COGS as a percentage of revenue might indicate inefficiencies in production processes or supply chain management. Similarly, increasing operating expenses without corresponding revenue growth could signify operational inefficiencies requiring attention. This evaluation is crucial for assessing an organization’s ability to control costs and maximize profitability.

- Debt Management AnalysisInterest expense, reported within the profit and loss statement, provides insights into an organization’s debt burden. A high interest expense relative to revenue can signal over-reliance on debt financing, posing potential risks to financial health. Monitoring interest expense trends year-over-year allows for assessment of debt management strategies and their impact on profitability. A company consistently refinancing debt at higher interest rates, for example, may face increasing financial strain, impacting long-term sustainability.

The annual profit and loss statement serves as a critical tool for assessing an organization’s financial health. By analyzing profitability, liquidity, operational efficiency, and debt management through the lens of this statement, stakeholders gain a comprehensive understanding of financial performance, enabling informed decision-making and strategic planning for long-term stability and growth. This analysis provides a foundation for proactive financial management and mitigation of potential risks, contributing to the overall financial well-being of the organization.

Key Components of an Annual Profit and Loss Statement

A standardized annual profit and loss statement provides a structured overview of financial performance. Key components ensure consistent reporting and facilitate analysis.

1. Revenue: This section details all income generated from various sources, including sales, services, and investments. Accurate revenue recognition, based on established accounting principles, is crucial for reflecting true financial performance. Clear categorization of revenue streams allows for analysis of individual performance drivers.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. Accurate calculation of COGS, which includes direct materials, labor, and manufacturing overhead, is essential for determining gross profit and assessing operational efficiency. Tracking COGS trends helps identify potential areas for cost optimization.

3. Gross Profit: Calculated as revenue minus COGS, gross profit represents the profitability of core business operations before considering other operating expenses. Analyzing gross profit margins helps assess pricing strategies and production efficiency. This metric provides a key indicator of an organization’s ability to generate profit from its core activities.

4. Operating Expenses: This section details expenses incurred through normal business operations, including salaries, rent, utilities, marketing, and administrative costs. Careful tracking and analysis of operating expenses are crucial for identifying areas of potential cost savings and improving operational efficiency. Understanding operating expense trends helps assess cost control measures and resource allocation.

5. Operating Income: Calculated as gross profit minus operating expenses, operating income reflects the profitability of core business operations after considering all operating costs. This metric provides a clear picture of an organization’s ability to generate profit from its day-to-day activities. Analyzing operating income trends helps assess the effectiveness of operational strategies.

6. Other Income/Expenses: This section includes income and expenses not directly related to core business operations, such as interest income, interest expense, gains or losses from investments, and other non-operating items. Accurate reporting of these items provides a complete picture of an organization’s overall financial performance beyond its core activities.

7. Income Before Taxes: This represents the organization’s income after considering all operating and non-operating items but before accounting for income tax expense. This metric provides a clear view of profitability before the impact of tax obligations.

8. Net Income: Calculated as income before taxes minus income tax expense, net income represents the final bottom line the overall profit or loss generated by the organization over a given period. This crucial metric reflects the cumulative impact of all revenue and expense items and serves as a key indicator of financial health and sustainability.

These interconnected components provide a structured framework for understanding financial performance. Analysis of these elements enables informed decision-making, effective resource allocation, and strategic planning for long-term financial health.

How to Create an Annual Profit and Loss Statement

Creating a standardized annual profit and loss statement involves a structured approach to ensure accuracy and comparability. The following steps outline the process:

1. Choose a Reporting Period: Select a consistent 12-month period (fiscal year) for the statement. This ensures comparability across different periods.

2. Gather Financial Data: Collect all relevant financial records, including sales invoices, expense receipts, bank statements, and payroll records. Accurate data collection is crucial for reliable reporting.

3. Structure the Statement: Utilize a standard template format, ensuring consistent placement of key components such as revenue, cost of goods sold, operating expenses, and net income. This facilitates analysis and comparison.

4. Categorize Revenue: Clearly categorize different revenue streams (e.g., product sales, service revenue, investment income). This detailed breakdown allows for analysis of individual revenue drivers.

5. Itemize Expenses: Provide a detailed breakdown of all expenses, categorizing them by type (e.g., salaries, rent, marketing, utilities). This granular view facilitates cost analysis and control.

6. Calculate Gross Profit: Subtract the cost of goods sold from total revenue to arrive at gross profit. This metric reflects the profitability of core business operations before considering operating expenses.

7. Calculate Net Income/Loss: Subtract total expenses (including operating expenses, interest, taxes, depreciation, and amortization) from gross profit to determine net income or loss. This bottom-line figure represents the overall profitability for the reporting period.

8. Review and Verify: Thoroughly review the statement for accuracy and completeness. Verify calculations and ensure consistency with previous periods. This final review ensures the reliability and integrity of the financial information presented.

A well-structured annual profit and loss statement provides a clear and concise overview of financial performance, enabling informed decision-making, effective resource allocation, and strategic planning for long-term financial health. Consistent application of these steps ensures accurate, comparable reporting and facilitates meaningful analysis of financial trends.

Careful construction and analysis of a standardized yearly summary of financial performance offers invaluable insights into an organization’s operational efficiency, profitability, and overall financial health. From revenue categorization and expense breakdowns to calculating net income and conducting year-over-year comparisons, each component contributes to a comprehensive understanding of financial trends and drivers. Leveraging this structured approach enables informed decision-making regarding resource allocation, pricing strategies, cost optimization, and long-term growth initiatives. This structured approach facilitates transparency, accountability, and data-driven strategic planning, ultimately contributing to sustainable financial success.

Accurate and consistent reporting forms the bedrock of sound financial management. Regular review and analysis of these standardized reports empowers organizations to identify areas for improvement, adapt to changing market conditions, and navigate financial complexities with greater confidence. This commitment to rigorous financial analysis fosters a culture of informed decision-making, positioning organizations for long-term stability and sustainable growth in the face of evolving economic landscapes.