Utilizing structured formats for financial reporting offers several advantages. These formats promote clarity and comparability, allowing stakeholders to easily analyze financial data and track trends. They also streamline the reporting process, saving time and resources. Furthermore, standardized layouts facilitate compliance with accounting principles and regulatory requirements. Consistent reporting builds trust and credibility with investors, lenders, and other stakeholders, enabling informed decision-making.

This understanding of foundational financial reporting lays the groundwork for exploring more nuanced aspects of financial analysis. Topics such as ratio analysis, trend identification, and forecasting become more accessible with reliable and readily available financial data. The following sections delve deeper into these concepts, providing practical insights for interpreting and leveraging financial information.

1. Standardized Structure

Standardized structure is a cornerstone of effective financial reporting, providing a consistent framework for presenting financial data within balance sheets and profit and loss statements. This consistency is essential for comparability across periods, between companies, and for compliance with accounting standards. A structured approach simplifies the preparation and interpretation of these crucial financial documents.

- Consistent Presentation of Information:Standardized templates dictate the order and placement of information within the financial statements. For instance, assets within a balance sheet are typically presented in order of liquidity, beginning with cash and cash equivalents. This allows stakeholders to quickly locate and compare key figures across different reports. Consistent presentation promotes transparency and facilitates analysis by ensuring data is presented in a predictable manner.

- Predefined Categories and Classifications:Templates utilize established accounting categories, such as current assets, long-term liabilities, and operating expenses. This ensures data is appropriately categorized, reducing ambiguity and improving the accuracy of financial analysis. For example, classifying all short-term debts under “Current Liabilities” allows for accurate calculation of key ratios like the current ratio, a measure of short-term liquidity.

- Comparative Analysis Facilitation:A standardized structure allows for easy comparison of financial data across different reporting periods. By maintaining a consistent format, trends and changes in financial performance become more apparent. For example, observing a consistent increase in “Cost of Goods Sold” over several quarters signals a potential issue requiring further investigation.

- Compliance with Accounting Standards:Adhering to a standardized structure promotes compliance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). These standards provide a common language for financial reporting, ensuring consistency and comparability on a global scale. Using standard templates helps organizations meet these requirements, increasing transparency and building trust with stakeholders.

By enforcing a structured approach, balance sheet and profit and loss statement templates provide a foundation for accurate, reliable, and comparable financial reporting. This consistency is crucial for internal management decision-making, investor confidence, and regulatory compliance. The structured format enhances the value of these financial statements by making them more accessible and insightful for all stakeholders.

2. Formula Integration

Formula integration is a crucial aspect of balance sheet and profit and loss statement templates, automating calculations and enhancing accuracy and efficiency in financial reporting. Predefined formulas within these templates streamline the process of generating these essential financial statements, minimizing manual input and reducing the risk of errors. This automation frees up valuable time for analysis and decision-making.

- Automated Calculations:Templates embed formulas that automatically calculate key figures based on input data. For instance, in a profit and loss statement template, the gross profit is automatically calculated by subtracting the “Cost of Goods Sold” from “Revenue.” This automation eliminates manual calculations, saving time and reducing the potential for human error. It also ensures consistency in calculations across reporting periods.

- Interlinked Formulas and Dynamic Updates:Formulas within the template are often interlinked, meaning changes in one figure automatically update related calculations. For example, adjusting the “Depreciation Expense” in the profit and loss statement template will automatically impact the “Net Income” and subsequently the retained earnings on the balance sheet. This dynamic updating ensures consistency and accuracy across the financial statements.

- Ratio Calculations:Many templates include formulas for calculating key financial ratios. For example, a balance sheet template might automatically calculate the current ratio (current assets / current liabilities) and the debt-to-equity ratio (total debt / total equity). These automated calculations provide immediate insights into a company’s liquidity, solvency, and financial health, facilitating informed decision-making.

- Error Reduction and Increased Accuracy:By automating calculations, formula integration significantly reduces the risk of mathematical errors that can occur with manual data entry and calculations. This increased accuracy is essential for reliable financial reporting and informed decision-making. Accurate figures are crucial for internal management, investors, lenders, and regulatory compliance.

Formula integration in balance sheet and profit and loss statement templates significantly enhances the efficiency and accuracy of financial reporting. By automating calculations and ensuring consistency, these templates provide a reliable foundation for financial analysis and informed decision-making. This automation allows businesses to focus on interpreting financial data and developing strategies for growth and profitability, rather than on tedious and error-prone manual calculations.

3. Report Automation

Report automation plays a crucial role in maximizing the efficiency and effectiveness of balance sheet and profit and loss statement templates. By automating the generation of these essential financial reports, businesses can significantly reduce manual effort, minimize errors, and gain faster access to critical financial insights. This automation allows for more timely analysis and informed decision-making.

- Data Integration and Consolidation:Automated reporting systems can integrate data from various sources, such as accounting software, point-of-sale systems, and inventory databases. This eliminates the need for manual data entry and ensures data consistency across the financial statements. For example, sales data from a retail company’s point-of-sale system can be automatically integrated into the revenue section of the profit and loss statement. This streamlined process eliminates the risk of transcription errors and saves significant time and resources.

- Scheduled Report Generation:Automated systems can generate financial reports on a predefined schedule, such as daily, weekly, monthly, or quarterly. This ensures timely access to up-to-date financial information, facilitating proactive monitoring of financial performance. For example, a business can schedule its balance sheet and profit and loss statement to be generated automatically at the end of each month. This eliminates delays associated with manual report preparation and allows management to quickly assess the company’s financial position.

- Customizable Report Formats:Report automation often allows for customization of report formats to meet specific reporting needs. Users can select which data points to include, adjust the layout, and apply specific formatting styles. This flexibility ensures that the generated reports are tailored to the needs of the intended audience. For instance, a company can customize its profit and loss statement to highlight key performance indicators (KPIs) relevant to its industry or specific business objectives.

- Enhanced Data Analysis and Visualization:Automated reporting systems often incorporate data analysis and visualization tools. These tools can generate charts, graphs, and other visual representations of financial data, making it easier to identify trends, patterns, and anomalies. For example, a business can use automated reporting to generate a trend analysis of its revenue and expenses over time. This visual representation of the data can provide insights into seasonal patterns, growth trends, and potential areas for cost optimization.

By automating the generation and analysis of balance sheets and profit and loss statements, businesses can streamline their financial reporting processes, improve accuracy, and gain valuable insights into their financial performance. This enhanced efficiency frees up time and resources, allowing management to focus on strategic decision-making and driving business growth. The ability to quickly access and analyze accurate financial data provides a significant competitive advantage in today’s dynamic business environment.

4. Error Reduction

Error reduction is paramount in financial reporting. Balance sheet and profit and loss statement templates contribute significantly to this objective by minimizing manual data entry and calculations, a common source of errors. Pre-defined formulas within these templates automatically compute key figures, reducing the risk of transposition errors, incorrect formulas, and other calculation mistakes. For example, automatically calculating gross profit by linking revenue and cost of goods sold fields eliminates potential errors arising from manual subtraction. This automation allows for a more accurate reflection of a company’s financial position.

Furthermore, structured data entry within templates enforces consistency and reduces the likelihood of omissions or inconsistencies. Templates typically categorize data into predefined fields, guiding users to input information in the correct location. This structured approach reduces the risk of omitting key figures or placing them in incorrect categories. For instance, a dedicated field for “Accrued Expenses” ensures this liability isn’t overlooked or misclassified. This standardized data entry process contributes to more reliable and auditable financial statements.

Accuracy in financial reporting is essential for informed decision-making by management, investors, and other stakeholders. Errors in balance sheets and profit and loss statements can lead to misinterpretations of financial performance and potentially flawed business decisions. Templates mitigate this risk by promoting accuracy and consistency. This ultimately supports sound financial analysis, better strategic planning, and increased stakeholder confidence. Implementing these templates represents a practical step towards ensuring reliable financial reporting and reducing the potential negative consequences of data errors.

5. Enhanced Analysis

Financial statement analysis gains significant depth and effectiveness through the utilization of balance sheet and profit and loss statement templates. These templates, by ensuring data consistency and accuracy, provide a robust foundation for insightful analysis. Standardized formatting and automated calculations streamline the process of extracting meaningful information, enabling stakeholders to move beyond basic data review and delve into deeper financial insights.

- Comparative Analysis Across Periods:Consistent formatting within templates facilitates seamless comparison of financial data across different reporting periods. Analyzing trends in key metrics like revenue growth, profitability margins, and debt levels over time provides valuable insights into a company’s performance trajectory. For example, tracking revenue growth year-over-year can reveal whether a company’s sales strategies are effective. Similarly, analyzing trends in profitability margins can identify potential cost control issues or pricing pressures. This comparative analysis enables proactive identification of potential challenges and opportunities.

- Ratio Analysis and Performance Evaluation:Templates often incorporate automated calculations of key financial ratios, such as liquidity ratios, profitability ratios, and solvency ratios. These ratios provide a standardized framework for evaluating a company’s financial health and performance relative to industry benchmarks or competitors. For instance, a declining current ratio could indicate potential liquidity problems, while a high debt-to-equity ratio might suggest excessive reliance on borrowing. Such insights facilitate informed decision-making regarding resource allocation, investment strategies, and operational adjustments.

- Trend Identification and Forecasting:Consistent historical data, readily available through standardized templates, allows for robust trend identification. By analyzing historical patterns in key financial metrics, stakeholders can gain insights into future performance. This information is crucial for developing accurate financial forecasts, which inform budgeting, investment planning, and overall strategic decision-making. For example, identifying a consistent upward trend in sales can inform projections for future revenue growth. These forecasts play a crucial role in shaping business strategies and resource allocation.

- Benchmarking and Industry Comparisons:Standardized financial data facilitated by templates enables meaningful benchmarking against industry peers or competitors. This comparative analysis provides insights into a company’s relative strengths and weaknesses, highlighting areas for improvement and potential competitive advantages. For example, comparing a company’s profitability margins to industry averages can reveal whether its cost structure is competitive. Such benchmarking provides valuable context for evaluating performance and identifying areas for strategic focus.

By providing a structured and reliable framework for data analysis, balance sheet and profit and loss statement templates empower stakeholders to extract meaningful insights from financial data. This enhanced analysis facilitates informed decision-making, improved strategic planning, and ultimately, stronger financial performance. The ability to readily analyze trends, calculate key ratios, and benchmark against competitors provides a significant advantage in today’s competitive business landscape.

Key Components of Financial Statement Templates

Effective financial statement templates incorporate key components that ensure clarity, accuracy, and ease of use. These components contribute to the overall value and functionality of the templates, facilitating informed financial analysis and decision-making.

1. Standardized Structure: A predefined structure ensures consistency in the presentation of financial information. This includes the order of items, categorization, and use of standard accounting terminology. Consistent structure promotes comparability across reporting periods and facilitates analysis.

2. Formula Integration: Embedded formulas automate calculations, minimizing manual input and reducing the risk of errors. These formulas automatically update related figures when changes are made, ensuring data integrity and saving significant time.

3. Chart of Accounts Integration: Direct integration with a company’s chart of accounts ensures accurate and consistent categorization of financial data. This integration streamlines the process of mapping data to the appropriate accounts, reducing the risk of misclassification.

4. Customizable Reporting Periods: Templates offer flexibility in defining reporting periods, allowing users to generate reports for specific dates, months, quarters, or years. This customization enables analysis of financial performance over various timeframes to suit specific business needs.

5. Data Validation and Error Checks: Built-in data validation rules and error checks ensure the accuracy and integrity of financial data. These features help prevent incorrect data entry, reducing the risk of errors and ensuring the reliability of financial reports.

6. Report Export Options: Templates typically offer various export options, such as exporting to Excel, PDF, or other formats. This allows for easy sharing and distribution of financial reports with stakeholders and facilitates integration with other business applications.

7. Audit Trail Functionality: A robust audit trail feature tracks changes made to the template and the data entered. This enhances transparency and accountability, allowing users to trace the source of information and identify any modifications made over time.

8. User Permissions and Access Control: Features that manage user access and permissions ensure data security and confidentiality. Controlling who can view, edit, and export financial information safeguards sensitive data and maintains data integrity.

These components work together to provide a comprehensive and reliable framework for financial reporting. The integration of these features within well-designed templates contributes significantly to the efficiency, accuracy, and analytical capabilities of financial reporting processes.

How to Create a Balance Sheet and Profit & Loss Statement Template

Creating effective templates for these crucial financial statements involves careful planning and consideration of key structural elements and functionalities. A well-designed template ensures data accuracy, consistency, and facilitates efficient analysis. The following steps outline the process of developing robust and user-friendly templates.

1. Determine the Reporting Period: Define the timeframe for the financial statements, whether it’s monthly, quarterly, or annually. This sets the boundaries for data inclusion and influences subsequent calculations.

2. Establish the Chart of Accounts: Utilize a comprehensive chart of accounts to categorize financial data consistently. Ensure appropriate classifications for assets, liabilities, equity, revenue, and expenses.

3. Structure the Balance Sheet: Organize the balance sheet according to accounting principles, presenting assets, liabilities, and equity in the standard order. Include subcategories for greater detail and clarity.

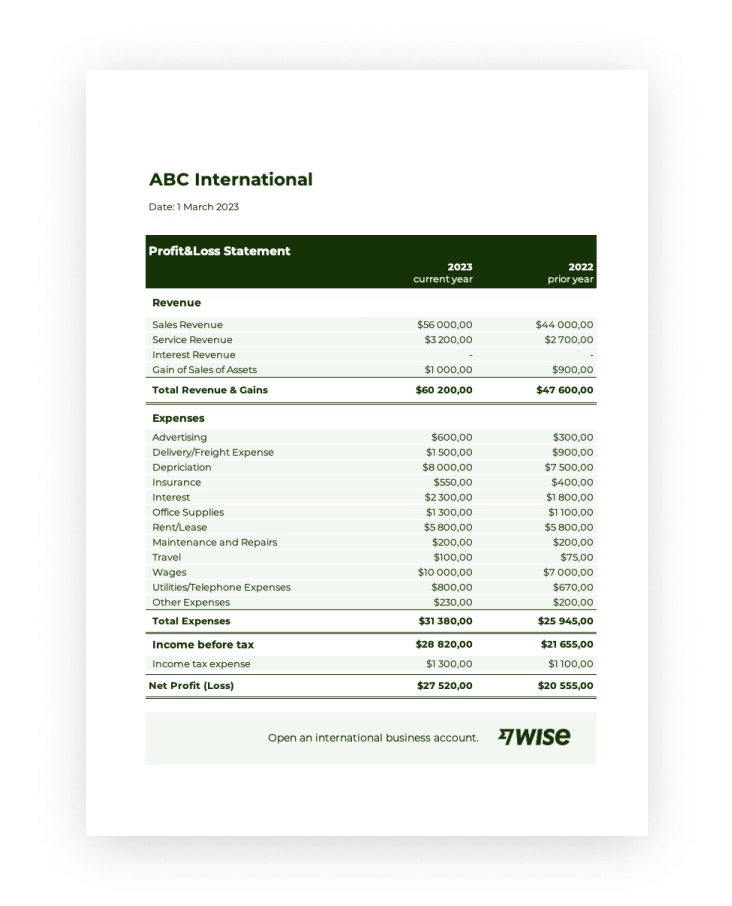

4. Design the Profit & Loss Statement: Structure the profit & loss statement to present revenue, cost of goods sold, gross profit, operating expenses, and net income in a clear and logical sequence.

5. Incorporate Formulas and Calculations: Integrate formulas for automated calculations of key figures, such as gross profit, net income, totals, and subtotals. This reduces manual effort and minimizes errors.

6. Implement Data Validation: Incorporate data validation rules to ensure data accuracy and consistency. Restrict input to appropriate data types and ranges to prevent invalid entries.

7. Enable Report Export Options: Offer export options in various formats (e.g., Excel, PDF) to facilitate sharing and further analysis. This ensures compatibility with different software and reporting requirements.

8. Design for Clarity and Readability: Use clear labels, consistent formatting, and appropriate spacing to enhance readability. A well-designed layout facilitates understanding and interpretation of the data.

Developing effective balance sheet and profit & loss statement templates requires a structured approach, focusing on accuracy, automation, and clear presentation. These templates serve as crucial tools for monitoring financial health, tracking performance, and making informed business decisions. Careful consideration of these steps ensures the creation of templates that meet specific reporting needs and promote effective financial management.

Standardized formats for summarizing assets, liabilities, and equity, along with reports detailing revenues, expenses, and resulting profit or loss, are fundamental tools for financial management. Leveraging these structured formats enables efficient and accurate reporting, reduces errors, and provides a solid basis for informed decision-making. Formula integration, automated report generation, and standardized data entry contribute significantly to enhanced accuracy and streamlined reporting processes. These efficiencies free up resources for more in-depth financial analysis, including trend identification, ratio analysis, and performance benchmarking.

Accurate and accessible financial information is paramount for navigating the complexities of the business landscape. Adopting robust, standardized reporting practices, through well-designed templates, empowers organizations to make informed decisions, optimize resource allocation, and enhance financial performance. The ability to quickly generate, analyze, and interpret financial data provides a critical advantage in today’s dynamic market, fostering sustainable growth and long-term success. Continual refinement of financial reporting processes and effective utilization of available tools remain crucial for achieving financial objectives and maintaining a competitive edge.