Utilizing a pre-designed structure offers several advantages. It streamlines the process of compiling financial data, reducing the risk of errors and omissions. The standardized format enhances clarity and comprehensibility for stakeholders, enabling them to quickly grasp the financial position of the entity. Moreover, it simplifies tracking financial progress and identifying potential issues, contributing to informed decision-making.

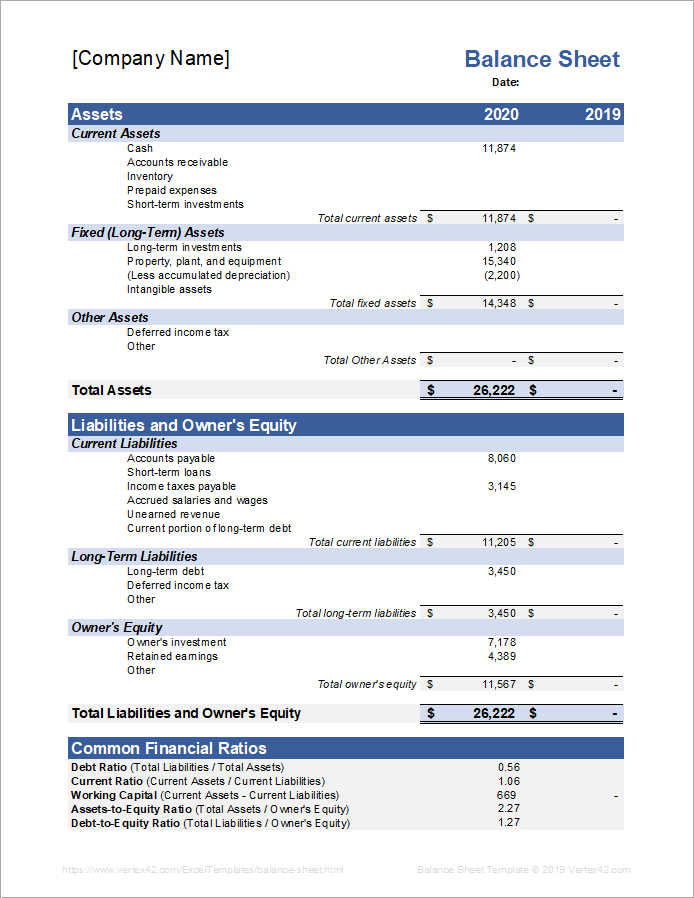

This foundational understanding of a standardized financial reporting structure allows for a deeper exploration of its core components: assets, liabilities, and equity. Subsequent sections will delve into each of these elements, providing a comprehensive overview of their roles and significance in assessing financial standing.

1. Standardized Structure

Standardized structure is fundamental to the efficacy of a balance sheet template. A consistent format ensures comparability across reporting periods and between different entities. This uniformity facilitates trend analysis, performance benchmarking, and informed decision-making by stakeholders. Without a standardized framework, analyzing financial data becomes significantly more complex, hindering effective interpretation and increasing the risk of misinterpretation.

Consider two companies using different formats for their balance sheets. Direct comparison becomes challenging, requiring manual adjustments and reformatting. A standardized template eliminates this hurdle. For example, the consistent placement of assets, liabilities, and equity sections allows for immediate comparison of key financial metrics, regardless of the specific company. This standardization allows analysts to quickly identify areas of strength and weakness, facilitating informed investment decisions and strategic planning.

In conclusion, a standardized structure provides the backbone for meaningful analysis and interpretation of financial data presented within a balance sheet template. This consistency is crucial not only for internal financial management but also for external stakeholders who rely on these reports to assess financial health and make informed decisions. Adherence to a standardized structure promotes transparency and fosters trust in the reported financial information, contributing to the overall stability and efficiency of financial markets.

2. Pre-built Formulas

Pre-built formulas constitute a critical component of effective balance sheet templates. These embedded calculations automate key financial ratios and metrics, significantly reducing the risk of manual calculation errors. Accuracy in financial reporting is paramount; inaccuracies can lead to misinformed decisions and potentially serious financial consequences. Pre-built formulas ensure consistency and reliability in derived figures, contributing to the overall integrity of the balance sheet.

Consider the calculation of the current ratio, a key indicator of short-term liquidity. A pre-built formula automatically divides current assets by current liabilities, providing this crucial metric without manual intervention. This automation not only saves time but also eliminates the possibility of human error in the calculation process. Another example is the debt-to-equity ratio, a vital indicator of financial leverage. A pre-built formula automatically calculates this ratio by dividing total debt by total equity, offering immediate insight into a company’s capital structure and risk profile. Such automated calculations are essential for efficient analysis and informed decision-making.

In summary, incorporating pre-built formulas within a balance sheet template significantly enhances accuracy and efficiency in financial reporting. The automation of key calculations minimizes the risk of human error and ensures consistency in derived metrics. This reliability is fundamental for sound financial analysis, strategic planning, and stakeholder confidence in the reported financial position. Furthermore, the time saved through automation allows for more focused analysis and interpretation of the financial data, ultimately contributing to more informed and effective business decisions.

3. Clear data input fields

Clear data input fields are essential for the accurate and efficient population of a balance sheet financial statement template. Well-defined fields guide users, minimizing the risk of data entry errors. Clear labels, appropriate data validation rules, and logical organization contribute to a streamlined data entry process. Ambiguous or poorly designed input fields can lead to incorrect data, impacting the reliability of the entire financial statement. The consequences of such errors can range from misinformed internal decisions to misrepresentation of financial health to external stakeholders.

Consider a balance sheet template with a clearly labeled field for “Cash and Cash Equivalents.” This unambiguous labeling ensures that users understand precisely what data should be entered in that field. Contrast this with a vaguely labeled field such as “Current Assets – Other.” This ambiguity can lead to confusion and potential misclassification of assets, ultimately affecting the accuracy of the reported financial position. Furthermore, input fields with integrated data validation, such as restricting input to numerical values or setting limits on data ranges, help prevent errors at the point of entry, further enhancing data integrity. For instance, a field for “Accounts Receivable” should ideally only accept numerical values and potentially have a maximum limit to prevent overly inflated entries.

In conclusion, the clarity and structure of data input fields within a balance sheet template directly impact the accuracy and reliability of the reported financial information. Well-designed input fields facilitate efficient data entry and minimize the potential for errors, contributing to the overall integrity of the financial statement. This accuracy is crucial for informed decision-making, both internally and by external stakeholders who rely on the accuracy and reliability of the reported financial position. Therefore, careful attention to the design and implementation of clear data input fields is essential for effective financial reporting and sound financial management.

4. Automated Calculations

Automated calculations are integral to the efficacy of a balance sheet financial statement template. They streamline the process of deriving key financial metrics and ratios, minimizing manual effort and significantly reducing the risk of human error. This automation ensures accuracy and consistency in reported figures, contributing to the overall reliability and integrity of the financial statement. The following facets explore the crucial role of automated calculations within the context of a balance sheet template.

- Real-time UpdatesAutomated calculations facilitate real-time updates to the balance sheet upon data entry. As figures for assets, liabilities, or equity are entered, dependent calculations, such as totals and ratios, are automatically updated. This dynamic updating eliminates the need for manual recalculations, saving time and ensuring that the balance sheet always reflects the most current information. For example, if the value of “Accounts Receivable” is adjusted, the “Total Current Assets” figure will automatically reflect this change, along with any related ratios like the current ratio.

- Error ReductionAutomated calculations drastically reduce the potential for human error in deriving key financial metrics. Manual calculations are prone to mistakes, particularly with complex formulas or large datasets. Automation eliminates this risk, ensuring accuracy and consistency in reported figures. For instance, calculating the debt-to-equity ratio manually involves multiple steps and can be error-prone. Automated calculation ensures this crucial metric is derived accurately and consistently, regardless of the complexity of the underlying data.

- Formula IntegrityTemplates with embedded formulas maintain the integrity of calculations. These formulas are pre-designed and tested, ensuring they adhere to accepted accounting principles and best practices. This consistency eliminates discrepancies that can arise from using different formulas or calculation methods, improving the reliability and comparability of financial statements. For example, a template using a standardized formula for calculating working capital ensures consistency across reporting periods and different entities, enhancing comparability and facilitating trend analysis.

- Efficiency and AnalysisAutomated calculations significantly enhance efficiency in financial reporting. By automating tedious calculations, templates free up time for analysis and interpretation of the financial data. This shift in focus from manual calculations to strategic analysis empowers informed decision-making. For example, by automating the calculation of key ratios like profitability and liquidity metrics, analysts can dedicate more time to understanding the underlying trends and drivers of these metrics, leading to more insightful financial analysis and strategic planning.

In conclusion, automated calculations are essential for optimizing the use and effectiveness of a balance sheet financial statement template. By ensuring accuracy, consistency, and efficiency, automated calculations empower users to focus on what truly matters: analyzing financial data, understanding trends, and making informed decisions that drive financial health and success. This automation transforms the balance sheet from a static document into a dynamic tool for financial management and strategic planning.

5. Comparative Analysis Facilitation

Comparative analysis is crucial for understanding financial performance trends and overall financial health. A balance sheet financial statement template facilitates this analysis by providing a structured framework for comparing financial data across different reporting periods or against industry benchmarks. This structured approach enables stakeholders to identify significant changes, assess progress towards financial goals, and make informed decisions based on historical data and projected future performance.

- Trend IdentificationTemplates often incorporate features that facilitate trend analysis. By comparing balance sheet data across multiple reporting periods, stakeholders can identify trends in key financial metrics such as asset growth, debt levels, and equity changes. For example, consistently increasing current liabilities might indicate potential liquidity issues, while steadily growing retained earnings suggests positive financial performance. Identifying these trends enables proactive management and informed decision-making.

- Performance BenchmarkingStandardized balance sheet templates allow for benchmarking against industry averages or competitors’ performance. Comparing key ratios and metrics, such as profitability margins or leverage ratios, provides insights into an entity’s relative financial standing within its industry. For instance, a company with a higher return on assets compared to its competitors demonstrates superior asset utilization and profitability. This benchmarking allows for identification of areas for improvement and strategic adjustments to enhance competitiveness.

- Variance AnalysisTemplates support variance analysis by enabling comparison of actual financial results against budgeted or projected figures. This comparison helps identify discrepancies and understand the underlying factors driving these variances. For example, a significant variance in sales revenue compared to the budget could indicate market fluctuations, pricing strategy issues, or operational inefficiencies. Analyzing these variances provides valuable insights for corrective actions and future planning.

- Investment EvaluationFor investors and lenders, comparative analysis facilitated by standardized balance sheets is crucial for evaluating investment opportunities and creditworthiness. Comparing financial performance across time and against industry benchmarks provides a comprehensive understanding of an entity’s financial health and stability. Consistent profitability, manageable debt levels, and positive equity growth are key indicators of financial strength and contribute to informed investment decisions.

In conclusion, the ability to conduct comparative analysis is significantly enhanced by the utilization of a balance sheet financial statement template. The structured format, combined with features that support trend identification, benchmarking, and variance analysis, empowers stakeholders to gain valuable insights into financial performance, assess financial health, and make informed decisions that contribute to long-term financial success. The template serves as a crucial tool for effective financial management, strategic planning, and investment evaluation, ultimately fostering financial stability and growth.

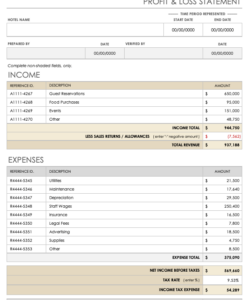

Key Components of a Balance Sheet Financial Statement Template

A well-structured balance sheet template comprises several key components that ensure accurate and comprehensive financial reporting. These components work together to provide a clear snapshot of an entity’s financial position.

1. Assets: This section details everything a company owns with monetary value. Assets are categorized as current (easily converted to cash within one year) and non-current (long-term holdings). Examples include cash, accounts receivable, inventory, property, plant, and equipment.

2. Liabilities: This section outlines a company’s financial obligations to external parties. Liabilities are also classified as current (due within one year) and non-current (long-term obligations). Examples include accounts payable, salaries payable, short-term loans, and long-term debt.

3. Equity: This section represents the residual interest in the assets of the entity after deducting liabilities. It reflects the owners’ stake in the company. Components of equity include common stock, retained earnings, and additional paid-in capital.

4. Header: The header clearly identifies the company name, the statement title (“Balance Sheet”), and the reporting date. This information is crucial for context and proper identification of the financial statement.

5. Formatting: Consistent formatting, including clear labels, appropriate spacing, and logical grouping of items, enhances readability and comprehension. A well-formatted template promotes clarity and facilitates efficient analysis of the information.

6. Formulas and Calculations: Pre-built formulas and automated calculations ensure accuracy and efficiency in deriving key financial metrics from the entered data. These automated features minimize manual effort and reduce the risk of errors.

7. Data Input Fields: Clearly defined input fields with appropriate labels guide users in entering data accurately and consistently. Data validation rules within these fields further enhance data integrity by preventing invalid entries.

Accurate representation of assets, liabilities, and equity within a structured framework provides a clear and concise overview of financial health, enabling informed decision-making by stakeholders. The template’s standardized structure, combined with automated calculations and clear data input fields, ensures accuracy and facilitates analysis, ultimately contributing to sound financial management.

How to Create a Balance Sheet Financial Statement Template

Creating a robust template ensures consistent and accurate representation of financial position. The following steps outline the process of developing a balance sheet template suitable for various entities.

1. Define the Reporting Period: Specify the timeframe for the balance sheet. This could be a specific date (e.g., December 31, 2024) for an annual balance sheet or the end of a specific period (e.g., Quarter 1, 2024) for an interim balance sheet. A clearly defined reporting period is essential for accurate representation and comparability.

2. Structure the Template: Organize the template into the fundamental sections: Assets, Liabilities, and Equity. Within each section, further categorize items into current and non-current classifications. This structured approach enhances clarity and facilitates analysis.

3. Incorporate Data Input Fields: Create clearly labeled input fields for each balance sheet item. Implement data validation rules to ensure data integrity and prevent incorrect entries. For example, fields for monetary values should only accept numerical data.

4. Implement Formulas and Calculations: Embed formulas to automate calculations of key metrics such as totals, subtotals, and financial ratios. Automated calculations enhance accuracy and efficiency in deriving crucial financial insights.

5. Design for Comparative Analysis: Incorporate columns or sections for comparing data across multiple reporting periods. This feature enables trend analysis and performance evaluation over time. Consider including fields for variance calculations.

6. Include a Header: Clearly identify the entity’s name, the statement title (“Balance Sheet”), and the specific reporting date in the header section. This information provides context and ensures proper identification.

7. Ensure Formatting Consistency: Employ consistent formatting throughout the template, including clear labels, appropriate spacing, and logical grouping of items. Consistent formatting enhances readability and facilitates efficient review.

8. Test and Refine: Thoroughly test the template with sample data to verify the accuracy of formulas and calculations. Refine the template based on testing results and user feedback to ensure optimal functionality and usability.

A well-designed template, incorporating these elements, streamlines financial reporting, enhances accuracy, and provides valuable insights for informed decision-making. Its structured format facilitates consistent data entry, automated calculations ensure data integrity, and comparative analysis features enable effective performance evaluation over time. This structured approach empowers stakeholders to gain a comprehensive understanding of financial position and make informed decisions.

Accurate and accessible financial information is fundamental to sound financial management. A balance sheet financial statement template provides the necessary framework for organizing and presenting key financial data, ensuring consistency, accuracy, and comparability. Its structured approach, coupled with automated calculations and clear data input fields, streamlines the reporting process and minimizes the risk of errors. The ability to conduct comparative analysis within the template empowers stakeholders to identify trends, assess performance, and make informed decisions based on a clear understanding of an entity’s financial position. From facilitating internal financial control to informing external investment decisions, a well-designed template serves as a crucial tool for navigating the complexities of financial reporting and analysis.

Effective utilization of a balance sheet financial statement template contributes significantly to financial transparency and informed decision-making. By providing a standardized framework for reporting financial position, the template fosters trust among stakeholders and promotes financial stability. As financial landscapes continue to evolve, leveraging such tools becomes increasingly critical for navigating complexities and ensuring sustainable financial health. A robust, adaptable template not only addresses current reporting needs but also positions organizations for future financial success by enabling proactive management and strategic planning based on accurate and accessible financial information.