Utilizing a standardized structure offers numerous advantages. It enables users to quickly familiarize themselves with the layout and locate specific information efficiently. This predictable format simplifies reconciliation processes, assists in budgeting, and can be invaluable for tax preparation or auditing purposes. Moreover, a readily available framework can save time and effort compared to creating a document from scratch.

This foundation of understanding sets the stage for a deeper exploration of related topics, such as interpreting specific transaction codes, managing digital banking records, and utilizing financial management software. It also provides context for discussions about security measures and best practices for maintaining accurate financial records.

1. Structure

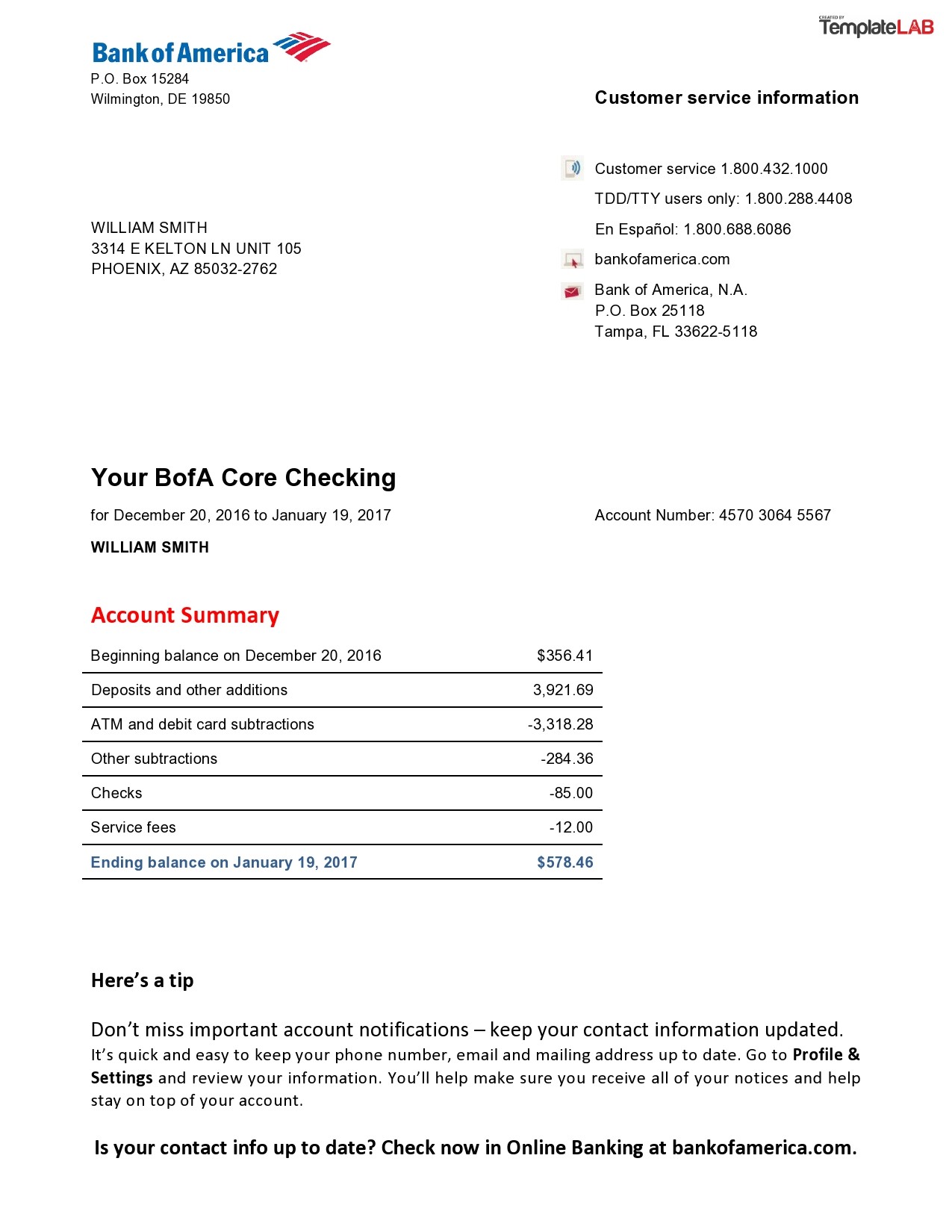

The structure of a standardized financial document, such as one provided by a major financial institution, is fundamental to its usability and purpose. A well-defined structure ensures consistent presentation of information, facilitating efficient data extraction and analysis. This structure typically involves a chronological arrangement of transactions, clearly delineated sections for account details, balance summaries, and other relevant information. Consider, for instance, how the consistent placement of the account holder’s name and account number in the header section allows for quick identification and reduces the risk of misinterpretation.

This organized presentation is crucial for several reasons. It allows individuals and businesses to reconcile transactions against their own records efficiently. The predictable format enables automated processing and integration with financial management software. Furthermore, a standardized structure aids in identifying discrepancies or unusual activity. For example, consistently locating debit transactions in a specific column simplifies tracking expenses and identifying potential areas of overspending.

In summary, the structure of a financial document is not merely a matter of formatting; it’s a critical component enabling effective financial management. Challenges such as navigating complex transaction histories or integrating data into budgeting tools are mitigated by a clear and consistent structure. This structured approach supports informed financial decision-making and underscores the importance of standardized formats in the broader context of financial literacy and responsible financial practices.

2. Transactions

Transactions form the core of any financial statement, representing the flow of funds into and out of an account. Within the context of a standardized bank statement, each transaction is meticulously documented, providing a detailed record of financial activity. This record typically includes the date of the transaction, a description, and the amount involved. For instance, a deposit might be described as “Payroll Deposit,” while a withdrawal might be listed as “ATM Withdrawal.” The specific format and level of detail within these descriptions often adhere to standardized banking practices, ensuring consistency and clarity across statements. The chronological presentation of transactions allows for the reconstruction of account activity over a given period, enabling users to track spending patterns and identify any irregularities.

The accurate and comprehensive recording of transactions is paramount for several reasons. Reconciling these transactions against personal or business records helps ensure accuracy and identify potential discrepancies. This detailed record also serves as crucial supporting documentation for tax purposes or in cases of disputes. Furthermore, analyzing transaction data reveals valuable insights into spending habits, facilitating better budgeting and financial planning. For example, consistently recurring transactions for specific services might highlight areas where expenses could be reduced. The ability to categorize and analyze transactions empowers informed financial decision-making.

Understanding the significance of transactions within the structure of a bank statement is fundamental to financial literacy. This granular view of financial activity empowers individuals and businesses to maintain accurate records, track spending, and identify opportunities for financial optimization. Challenges such as managing cash flow or identifying fraudulent activity are more readily addressed with a comprehensive understanding of transaction data. This knowledge is integral to responsible financial management and contributes to a more informed and proactive approach to personal or business finances.

3. Balance details

Balance details within a standardized financial document, such as one provided by a major financial institution, are crucial for understanding the overall financial status reflected in the statement. These details typically include the opening balance, the closing balance, and any running balances throughout the statement period. The opening balance represents the state of the account at the beginning of the period, while the closing balance reflects the net result of all transactions during that period. Running balances, often provided after each transaction, offer a dynamic view of how the account balance fluctuates over time. For example, tracking the running balance can help identify the point at which an account reached a specific threshold, providing insights into spending patterns and cash flow management.

The relationship between the opening and closing balances, mediated by the transactions listed on the statement, provides a comprehensive picture of account activity. This relationship is fundamental to reconciliation efforts, where the closing balance on the statement is compared against independently maintained records. Discrepancies between these balances can indicate errors, unauthorized transactions, or outstanding items requiring further investigation. For instance, a lower-than-expected closing balance might reveal an unrecorded debit transaction. Furthermore, balance details are crucial for financial planning and analysis. Trends in closing balances over multiple statements can inform budgeting decisions and investment strategies. Observing a consistently increasing closing balance might suggest positive financial momentum, while a decreasing trend could signal the need for adjustments to spending habits.

Accurate and readily accessible balance details are essential for sound financial management. Challenges such as detecting fraudulent activity or maintaining accurate budgetary control are mitigated by a clear understanding of these figures and their relationship to transaction data. This understanding enables informed financial decision-making, promotes responsible financial practices, and contributes to a more comprehensive view of one’s overall financial health. Balance details, therefore, are not merely static figures; they are dynamic indicators of financial activity, playing a critical role in effective financial management.

4. Account Information

Account information forms a critical component of any financial statement, serving as the identifying foundation upon which all transactional data is contextualized. Within the framework of a standardized bank statement, such as one provided by a major financial institution, account information typically includes the account holder’s name, account number, and often the branch address associated with the account. This information unequivocally links the statement to a specific individual or entity, ensuring that the financial activity detailed within pertains to the correct account. Accurate account information is paramount for proper record-keeping, reconciliation processes, and for accessing online banking platforms. For instance, an incorrect account number can lead to misdirected deposits or withdrawals, highlighting the practical significance of accurate identification within the statement.

The inclusion of accurate and complete account information facilitates several key functions. It allows financial institutions to correctly process transactions and apply them to the appropriate account. It enables individuals and businesses to verify the authenticity of the statement and ensure it corresponds to their records. Moreover, clear account information simplifies communication between the account holder and the financial institution. For example, when contacting customer service regarding a specific transaction, providing the correct account number streamlines the inquiry process. The presence of this information also contributes to security, making it more difficult for unauthorized individuals to access or manipulate account details. Furthermore, consistent placement and formatting of account information across multiple statements simplify record-keeping and facilitate comparisons over time, aiding in financial analysis and trend identification.

In conclusion, account information is not merely a static identifier but a dynamic component integral to the functionality and security of a bank statement. Challenges such as identity theft or misdirected funds are mitigated by accurate and readily accessible account information. This seemingly basic component plays a crucial role in maintaining the integrity of financial records and ensuring the smooth operation of financial transactions. Understanding its significance within the broader context of financial management empowers individuals and businesses to maintain accurate records, protect their financial interests, and engage in informed financial decision-making.

5. Period Covered

The “Period Covered” designation within a standardized financial document, such as one provided by a major financial institution, defines the specific timeframe for the reported financial activity. This defined timeframe is essential for accurate reconciliation, analysis, and record-keeping. Understanding the period covered is fundamental to interpreting the financial data presented and ensuring its relevance to a specific accounting or reporting cycle.

- Date Range DefinitionThe period covered is typically expressed as a precise date range, clearly indicating the start and end dates of the statement period. This explicit definition ensures that all transactions falling within that timeframe are included and that the balance details accurately reflect the account’s status for that specific period. For example, a statement covering January 1st to January 31st would include all transactions processed during January, providing a comprehensive monthly overview.

- Reconciliation and AccuracyThe period covered serves as a critical parameter for reconciliation processes. Matching the statement’s date range with corresponding internal records or other financial documents ensures that all relevant transactions are accounted for and that any discrepancies are identified. This alignment is fundamental for maintaining accurate financial records and detecting potential errors or unauthorized activity. For instance, a discrepancy between a statement’s period and internal records might reveal missing transactions or timing differences requiring investigation.

- Financial Analysis and ReportingThe period covered provides the necessary context for interpreting financial trends and performance. Analyzing data within a defined timeframe enables meaningful comparisons across different periods, facilitating the identification of spending patterns, revenue fluctuations, or other financial changes. For example, comparing monthly statements allows for the tracking of expenses over time, revealing seasonal variations or long-term trends. This analysis is fundamental for budgeting, forecasting, and making informed financial decisions.

- Regulatory and Compliance RequirementsThe specified timeframe plays a crucial role in meeting regulatory requirements and adhering to compliance standards. Financial statements, with their clearly defined periods, serve as essential documentation for tax reporting, audits, and other regulatory filings. Maintaining accurate records for specific periods is often legally mandated and essential for demonstrating financial transparency and accountability. For instance, businesses often require financial statements covering specific fiscal periods to comply with tax regulations.

The “Period Covered” designation acts as a cornerstone of a bank statement, providing the temporal framework for all reported financial activity. Its precise definition is crucial not only for accurate record-keeping and reconciliation but also for meaningful financial analysis, informed decision-making, and compliance with regulatory requirements. Understanding this fundamental element allows for a more comprehensive and nuanced interpretation of the financial data presented, contributing to greater financial clarity and control.

6. Standard Format

Standard formatting is integral to the utility and interpretation of financial documents like those provided by major financial institutions. A standardized format ensures consistency in the presentation of information, facilitating efficient processing, analysis, and comparison across multiple statements or periods. This consistency is achieved through the structured arrangement of key elements such as account information, transaction details, and balance summaries. For example, the consistent placement of the account number in the header section allows for quick identification and reduces the risk of misinterpretation. Similarly, the standardized format for recording transactions, including date, description, and amount, ensures clarity and enables efficient sorting and filtering of data. This predictability is crucial for automated processing and integration with financial management software. Consider how software relies on the consistent placement of data fields to import and categorize transactions accurately.

The advantages of a standardized format extend beyond mere convenience. It simplifies reconciliation processes, enabling users to quickly compare statements against their own records. A consistent structure aids in identifying discrepancies or unusual activity, enhancing fraud detection and prevention. Moreover, standardized formats facilitate communication between financial institutions and their customers. A clear and predictable layout reduces the likelihood of misunderstandings and streamlines inquiries related to specific transactions or account details. For instance, standardized error codes on a statement can quickly convey the reason for a declined transaction, facilitating prompt resolution. Furthermore, the consistent presentation of information supports financial analysis and trend identification. Comparing data across multiple statements with identical formats allows for the clear observation of changes in spending patterns, income fluctuations, or other key financial indicators. This, in turn, empowers informed financial decision-making and contributes to more effective financial planning.

In conclusion, the standard format of a financial document is not merely a matter of aesthetics; it is a functional requirement that underpins accuracy, efficiency, and transparency in financial management. Challenges such as data integration, error detection, and financial analysis are mitigated by adherence to established formatting conventions. This structured approach ensures the reliability and comparability of financial data, contributing to a more informed and proactive approach to personal or business finances. A deep understanding of the significance of standard formatting empowers individuals and businesses to effectively utilize financial statements as tools for informed decision-making and responsible financial practices.

Key Components of a Bank of America Bank Statement Template

Understanding the core components of a standardized financial document from Bank of America provides a foundation for effective financial management. The following key aspects illuminate the structure and utility of such a template.

1. Account Information: This section unequivocally identifies the account holder and the specific account. It typically includes the account holder’s name, the full account number, and potentially the associated branch information. This data is crucial for accurate record-keeping and ensures transactions are applied to the correct account, preventing errors and facilitating communication with the bank.

2. Statement Period: The statement period defines the precise timeframe covered by the document. This typically appears as a date range, clearly demarcating the start and end dates. This explicit timeframe is essential for accurate reconciliation, analysis, and reporting. It allows for the isolation of financial activity within a specific period, facilitating comparison across different timeframes and ensuring alignment with specific reporting cycles.

3. Opening and Closing Balances: These figures represent the account’s financial status at the beginning and end of the statement period, respectively. The opening balance sets the baseline, while the closing balance reflects the net effect of all transactions during the specified period. These balances are essential for reconciliation and provide a high-level overview of account activity.

4. Transaction Details: This section comprises the core of the statement, detailing each individual transaction processed during the statement period. Each transaction entry typically includes the date, a description of the transaction (e.g., “ATM Withdrawal,” “Direct Deposit”), and the corresponding debit or credit amount. This detailed record enables tracking of financial activity, identification of spending patterns, and detection of potential discrepancies.

5. Running Balance: Often displayed after each transaction, the running balance provides a dynamic view of the account’s balance fluctuations throughout the statement period. This allows for a granular understanding of how each transaction impacts the available funds and facilitates more precise tracking of account activity.

6. Interest Earned (if applicable): For interest-bearing accounts, this section details any interest accrued during the statement period. This information is essential for tracking earnings and understanding the overall return on the account.

7. Fees and Charges (if applicable): This section outlines any fees or charges incurred during the statement period, such as monthly maintenance fees or overdraft charges. Understanding these costs is crucial for managing account expenses and ensuring accurate financial planning.

These components work in concert to provide a comprehensive and structured representation of financial activity within a defined period. This structure enables efficient analysis, informed decision-making, and contributes to responsible financial management. A thorough understanding of these components empowers account holders to effectively utilize their statements for monitoring transactions, reconciling balances, and maintaining accurate financial records.

How to Create a Bank of America Bank Statement Template

Replicating the format of a Bank of America bank statement requires careful attention to detail and adherence to a consistent structure. While creating a perfect replica is complex due to security features and proprietary software, a functional template can be constructed for personal use, focusing on the core elements and their organization. This process facilitates understanding of the statement structure and aids in personal financial management.

1. Software Selection: Spreadsheet software (e.g., Microsoft Excel, Google Sheets) or word processing software with table functionality offers the necessary tools for creating a structured document. Spreadsheet software is generally preferred due to its inherent grid-like structure and formula capabilities, which can be useful for calculations and automated updates.

2. Header Section: The header should contain key identifying information. This includes fields for the account holder’s name, the full account number, and the statement period, typically represented as a date range (e.g., “Statement Period: 2024-01-01 to 2024-01-31”). Consistent placement of this information in the top section mirrors the standard format.

3. Transaction Table: Create a table with columns for the date, transaction description, debit amount, credit amount, and running balance. This structure allows for a chronological record of transactions and provides a clear overview of account activity. Accurate data entry and consistent formatting are crucial for maintaining the template’s integrity.

4. Balance Summary: Below the transaction table, include a summary section displaying the opening balance and the closing balance. These figures provide a concise overview of the net change in the account balance during the statement period. Calculating the closing balance based on transactions ensures accuracy and provides a valuable check against errors.

5. Additional Sections (Optional): Depending on the desired level of detail, additional sections can be included for interest earned, fees and charges, or other relevant information. These additions enhance the template’s functionality and provide a more comprehensive overview of account activity. However, they may not be necessary for basic tracking and reconciliation purposes.

6. Formatting and Consistency: Maintaining consistent formatting throughout the template ensures clarity and facilitates easy interpretation. Use clear labels for each section and column, apply consistent date formatting, and align numerical data appropriately. These practices enhance readability and reduce the risk of misinterpretation.

7. Data Entry and Validation: Accurate and consistent data entry is crucial for the template’s reliability. Regularly review and validate entered data against official bank statements to ensure accuracy and identify any discrepancies. This diligence maintains the integrity of the template and its usefulness for financial management.

By adhering to these steps and maintaining meticulous attention to detail, a functional template can be created to mirror the key elements and organizational structure of a Bank of America bank statement. This tool can be utilized for personal financial tracking, reconciliation, and analysis, contributing to a more organized and informed approach to financial management. However, its essential to recognize that this template serves as a personal tool and does not replicate the official security features of a genuine bank statement.

Careful examination of the structure and components of a standardized financial document, such as one provided by Bank of America, reveals its significance as a comprehensive record of financial activity. Understanding the consistent placement of account information, the chronological presentation of transactions, the dynamic nature of running balances, and the importance of the statement period empowers informed interpretation and effective utilization of this crucial financial tool. The standard format, though seemingly simple, facilitates efficient reconciliation, insightful analysis, and ultimately, more proactive financial management.

Effective financial management hinges on accurate record-keeping and insightful analysis. Leveraging the structured information provided within standardized bank statements offers a powerful tool for achieving these goals. Individuals and businesses are encouraged to actively engage with their financial records, utilizing the insights gleaned from these documents to inform financial decisions, optimize spending habits, and cultivate a more secure financial future.