Utilizing a standardized structure offers several advantages. It facilitates clear tracking of financial health, enabling informed decision-making. This clarity also simplifies comparisons across different accounting periods, allowing for trend analysis and performance evaluation. Furthermore, a consistent format improves communication with stakeholders, providing a readily understandable view of financial standing.

This foundation in financial reporting allows for a deeper exploration of key concepts. Understanding revenue streams, cost structures, and the calculation of net income are vital for effective business management. The following sections delve into these aspects, providing practical insights and guidance.

1. Revenue

Revenue, the top line of a profit and loss statement, represents the total income generated from a company’s primary business activities. Within a standardized P&L framework, accurately recording revenue is crucial for determining overall profitability and financial health. Revenue figures directly impact subsequent calculations within the statement, including gross profit and ultimately, net income. A clear understanding of revenue sources and their accurate representation is fundamental for sound financial analysis. For instance, a software company’s revenue might primarily stem from subscription fees, while a retailer’s revenue would come from product sales. Accurately categorizing and recording these diverse revenue streams is essential for a comprehensive P&L.

Analyzing revenue trends within a P&L offers valuable insights into business performance. Consistent revenue growth often signals a healthy and expanding business, while declining revenue may indicate underlying issues requiring attention. Comparing revenue figures across different accounting periods allows stakeholders to assess growth trajectories and identify potential challenges. Furthermore, revenue data plays a critical role in forecasting future performance and making informed strategic decisions. For example, consistent growth in subscription revenue for a software company might justify investment in expanding development teams. Conversely, declining product sales for a retailer might necessitate adjustments in pricing strategies or marketing campaigns.

Accurate revenue recognition is paramount for a reliable P&L. Challenges can arise from complex revenue models, such as long-term contracts or subscription services. Applying appropriate accounting principles ensures that revenue is recorded in the correct period, reflecting the true financial performance of the business. Misrepresenting or manipulating revenue can lead to misleading financial statements and potentially severe legal consequences. Therefore, maintaining rigorous accounting practices and adhering to established standards is critical for the integrity and reliability of the P&L and overall financial reporting.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a basic profit and loss statement template, COGS plays a crucial role in determining gross profit and ultimately, net income. Accurate calculation of COGS is essential for understanding profitability and making informed business decisions. This figure encompasses expenses such as raw materials, direct labor, and manufacturing overhead. For a furniture manufacturer, COGS would include the cost of lumber, hardware, and the wages of craftspeople directly involved in production. For a software company selling a physical product, COGS might include duplication and packaging expenses. Without accurately tracking COGS, a business might overestimate its profitability, leading to potentially flawed financial strategies.

The relationship between COGS and revenue is fundamental to understanding a company’s financial health. A high COGS relative to revenue can indicate issues with production efficiency or pricing strategies. Analyzing trends in COGS over time provides insights into cost management effectiveness and can highlight areas for improvement. For instance, a rising COGS alongside stagnant revenue might suggest increasing raw material costs or declining production efficiency. This information allows businesses to make strategic adjustments, such as negotiating better supplier contracts or implementing process improvements. Conversely, a declining COGS relative to revenue might indicate successful cost-cutting measures or improved production processes. Understanding this relationship is crucial for making informed decisions about pricing, production, and resource allocation.

Accurate COGS calculation requires meticulous tracking of all direct costs associated with production. Challenges can arise in determining which costs are directly attributable to production versus indirect overhead expenses. Consistent application of accounting principles and a clear understanding of cost allocation methods are crucial for maintaining accuracy and consistency within the P&L. Inconsistent or inaccurate COGS calculations can distort profitability metrics and lead to flawed financial analysis. Therefore, maintaining detailed records and adhering to established accounting standards is essential for the integrity and reliability of the P&L and overall financial reporting.

3. Gross Profit

Gross profit, a key performance indicator within a basic profit and loss statement, represents the profitability of a company’s core business operations after accounting for the direct costs of producing goods or services. Calculated as revenue minus the cost of goods sold (COGS), this figure provides a crucial assessment of a company’s production efficiency and pricing strategies. Understanding gross profit is fundamental for evaluating financial health and making informed business decisions.

- Profitability MeasurementGross profit serves as a direct indicator of a company’s production profitability. A higher gross profit margin suggests efficient production processes and effective pricing strategies. This metric allows stakeholders to assess the financial viability of a company’s core operations and provides insights into its ability to manage production costs. For example, a company with a gross profit margin of 60% retains $0.60 of every dollar of revenue after covering production costs, indicating a stronger profit position than a company with a 30% margin.

- Pricing Strategy EvaluationAnalyzing gross profit can reveal the effectiveness of pricing strategies. A low gross profit margin may indicate that prices are set too low relative to production costs, necessitating price adjustments or cost reduction measures. Conversely, a high gross profit margin could suggest opportunities for competitive pricing strategies or further investments in production efficiency. This information is invaluable for optimizing pricing models and maximizing profitability.

- Cost Management AnalysisChanges in gross profit over time can highlight trends in cost management effectiveness. A declining gross profit margin might signal rising production costs or inefficiencies in the supply chain. Conversely, an increasing gross profit margin could indicate successful cost-cutting measures or improved production processes. Monitoring gross profit trends allows businesses to identify areas for cost optimization and improve overall operational efficiency.

- Comparative AnalysisComparing gross profit margins across different companies within the same industry provides valuable benchmarking data. This analysis allows businesses to assess their performance relative to competitors and identify potential areas for improvement. Understanding industry averages and competitor performance provides context for evaluating a company’s own gross profit and making informed strategic decisions.

Within a basic profit and loss statement template, gross profit serves as a critical stepping stone towards calculating net income. Understanding its components, drivers, and implications is fundamental for comprehensive financial analysis and effective decision-making. By analyzing gross profit in conjunction with other key metrics within the P&L, stakeholders gain a holistic view of a company’s financial performance and its potential for future growth.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s day-to-day activities, excluding the direct costs of producing goods or services (COGS). Within a basic profit and loss statement template, these expenses are crucial for determining a company’s operating income and, ultimately, its net profit. A clear understanding of operating expenses is essential for assessing a company’s efficiency, profitability, and overall financial health. Careful management and analysis of these expenses are key for sustainable business growth.

- Selling, General, and Administrative Expenses (SG&A)SG&A encompasses a broad range of expenses related to sales, marketing, administrative functions, and general overhead. Examples include salaries of sales and marketing personnel, advertising costs, rent, utilities, and office supplies. These expenses are essential for running the business but are not directly tied to production. Within a P&L, SG&A is a significant component in calculating operating income. Analyzing trends in SG&A can reveal areas of potential cost savings or inefficiencies. For example, a rapid increase in SG&A relative to revenue might warrant a review of spending patterns and cost-cutting measures.

- Research and Development (R&D)R&D expenses represent investments in developing new products, services, or processes. These costs can include salaries of research personnel, laboratory equipment, and testing materials. While R&D is crucial for innovation and long-term growth, it represents a significant operating expense. Within a P&L, R&D spending provides insights into a company’s commitment to innovation. Analyzing R&D expenditure relative to revenue or industry benchmarks can help assess the effectiveness and potential return on these investments.

- Depreciation and AmortizationDepreciation and amortization reflect the allocation of the cost of long-term assets over their useful life. Depreciation applies to tangible assets like buildings and equipment, while amortization applies to intangible assets like patents and copyrights. These non-cash expenses are essential for accurately reflecting the declining value of assets over time. Within a P&L, depreciation and amortization impact operating income and provide insights into the age and utilization of a company’s assets.

- Other Operating ExpensesThis category encompasses various other expenses not readily categorized within SG&A, R&D, or depreciation/amortization. Examples include impairment charges, restructuring costs, and legal fees. While often non-recurring, these expenses can significantly impact operating income in a given period. Within a P&L, transparency in reporting these expenses is crucial for stakeholders to understand their nature and potential impact on future performance.

Effective management and analysis of operating expenses are vital for maximizing profitability and ensuring long-term financial sustainability. Within a basic profit and loss statement template, understanding the composition and trends of these expenses provides valuable insights into a company’s operational efficiency, cost structure, and overall financial performance. By carefully scrutinizing operating expenses, businesses can identify areas for improvement, optimize resource allocation, and enhance their bottom line.

5. Net Income

Net income, often referred to as the “bottom line,” represents the ultimate measure of a company’s profitability after all revenues and expenses have been accounted for within a given period. Within a basic profit and loss statement template, net income serves as the culminating figure, summarizing the overall financial performance of the business. Understanding net income is crucial for assessing financial health, making investment decisions, and evaluating the effectiveness of business strategies. This figure reflects the residual earnings available to shareholders after all obligations have been met.

- Profitability MeasurementNet income provides a direct measure of a company’s overall profitability. A positive net income indicates that the company generated more revenue than it incurred in expenses, while a negative net income (a net loss) signifies the opposite. This metric is a fundamental indicator of financial success and sustainability. Analyzing net income trends over time allows stakeholders to assess the company’s financial trajectory and identify potential challenges or opportunities. For example, consistently increasing net income might indicate effective management and growth potential, while declining net income could signal underlying operational or market issues.

- Financial Health IndicatorNet income serves as a key indicator of a company’s financial health and stability. Consistent profitability is essential for attracting investors, securing loans, and ensuring long-term business viability. Creditors and investors often scrutinize net income figures to assess a company’s creditworthiness and investment potential. A healthy net income demonstrates financial strength and the ability to generate returns, while persistent losses can raise concerns about a company’s long-term prospects.

- Impact of Expenses and RevenuesNet income reflects the combined impact of all revenue streams and expense categories within a business. Changes in revenue, cost of goods sold (COGS), operating expenses, and non-operating items all directly affect the net income figure. Analyzing the interplay of these factors provides insights into the drivers of profitability and allows for targeted strategies to improve financial performance. For instance, increasing revenue while controlling expenses can lead to higher net income. Conversely, rising expenses without a corresponding increase in revenue can erode profitability.

- Basis for Financial RatiosNet income serves as a crucial component in various financial ratios used to evaluate a company’s performance. Metrics such as return on equity (ROE) and earnings per share (EPS) rely on net income to assess profitability and shareholder value. These ratios provide valuable benchmarks for comparing a company’s performance to industry averages and competitors. Understanding the relationship between net income and these key financial ratios is essential for comprehensive financial analysis and informed decision-making.

Within a basic profit and loss statement template, net income serves as the final outcome of all operational and financial activities. It provides a concise summary of a company’s financial performance and offers valuable insights for stakeholders. By analyzing net income trends, drivers, and its relationship to other key financial metrics, investors, creditors, and management can gain a comprehensive understanding of a company’s financial health, profitability, and potential for future growth.

Key Components of a Basic Profit and Loss Statement

A standardized profit and loss statement provides a structured overview of a company’s financial performance. Understanding the key components is crucial for accurate interpretation and analysis.

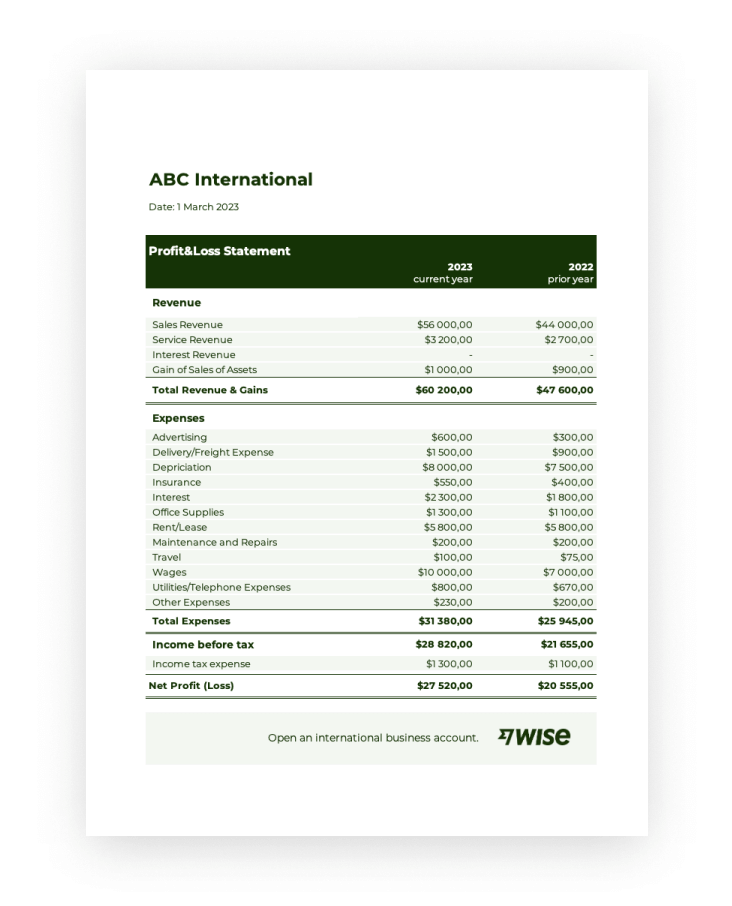

1. Revenue: This represents the total income generated from a company’s primary business activities, such as sales of goods or services. Accurate revenue recognition is critical for a reliable P&L.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing the goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as revenue minus COGS, gross profit reflects the profitability of a company’s core operations before accounting for other expenses. This metric provides insights into production efficiency and pricing strategies.

4. Operating Expenses: These expenses represent the costs incurred in running a business’s day-to-day operations, excluding COGS. Examples include salaries, rent, marketing expenses, and research and development costs. Operating expenses are subtracted from gross profit to arrive at operating income.

5. Operating Income: This figure represents the profit generated from a company’s core business operations after accounting for both COGS and operating expenses. It provides a clear picture of the profitability of the company’s operating activities.

6. Other Income/Expenses: This category includes income or expenses not directly related to the company’s core operations, such as interest income, investment gains or losses, and gains or losses from the sale of assets.

7. Income Before Taxes: This represents the company’s income after considering all operating and non-operating income and expenses but before accounting for income tax expenses.

8. Net Income: Often referred to as the “bottom line,” net income represents the final profit after all expenses, including taxes, have been deducted from revenues. This figure is a key indicator of a company’s overall profitability and financial health.

Accurate reporting and analysis of these components are essential for informed financial decision-making and a comprehensive understanding of a company’s financial position.

How to Create a Basic Profit and Loss Statement

Creating a basic profit and loss statement involves organizing financial data into a structured format. The following steps outline the process of developing this essential financial report.

1. Choose a Reporting Period: Define the timeframe for the P&L, such as a month, quarter, or year. Consistent reporting periods allow for accurate comparison and trend analysis.

2. Calculate Revenue: Determine total revenue generated from sales of goods or services during the chosen period. Ensure accurate revenue recognition according to accounting principles.

3. Determine Cost of Goods Sold (COGS): Calculate all direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead.

4. Calculate Gross Profit: Subtract COGS from revenue to arrive at gross profit. This figure represents the profitability of core operations before other expenses.

5. Itemize Operating Expenses: List all operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation/amortization.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This reflects profitability from core business operations.

7. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income, investment gains/losses, and extraordinary items.

8. Calculate Income Before Taxes: Add other income and subtract other expenses from operating income to arrive at income before taxes.

9. Determine Income Tax Expense: Calculate the income tax expense based on applicable tax rates and regulations.

10. Calculate Net Income: Subtract income tax expense from income before taxes to arrive at net income, the final measure of profitability.

A well-structured P&L provides a clear and concise overview of financial performance, enabling informed decision-making and effective financial management. Utilizing a consistent format facilitates comparison across periods and allows for trend analysis.

A standardized profit and loss statement template provides a crucial framework for understanding financial performance. From revenue generation and cost management to the calculation of net income, each component contributes to a comprehensive overview of a company’s financial health. Utilizing a consistent structure facilitates clear analysis, enabling informed decision-making and effective communication with stakeholders. Accurate data entry and consistent application of accounting principles are paramount for ensuring the reliability and integrity of the information presented. A well-constructed profit and loss statement offers valuable insights into profitability, operational efficiency, and areas for potential improvement, forming a cornerstone of sound financial management.

Financial statements remain indispensable tools for navigating the complexities of the business landscape. Regular review and analysis of profit and loss statements, combined with a thorough understanding of underlying financial drivers, are essential for sustained growth and long-term success. Leveraging this knowledge empowers businesses to make informed strategic decisions, optimize resource allocation, and navigate the evolving economic environment with greater clarity and confidence. The ability to interpret and act upon the information provided within these statements remains a critical skill for achieving financial stability and realizing long-term objectives.