Utilizing such a structure allows for easier tracking of spending habits, identification of potential errors or discrepancies, and simplified reconciliation with other financial records. This can be particularly useful for budgeting, tax preparation, or when applying for loans or other forms of credit where proof of income or consistent financial activity is required. A well-organized financial summary can also be essential for dispute resolution or when substantiating specific transactions.

The subsequent sections will delve into creating and utilizing these organized financial summaries, covering topics such as accessing records, various formatting options, and practical applications for personal finance management. Specific examples and detailed instructions will be provided to guide users in effectively leveraging these tools for improved financial oversight.

1. Organized Transaction History

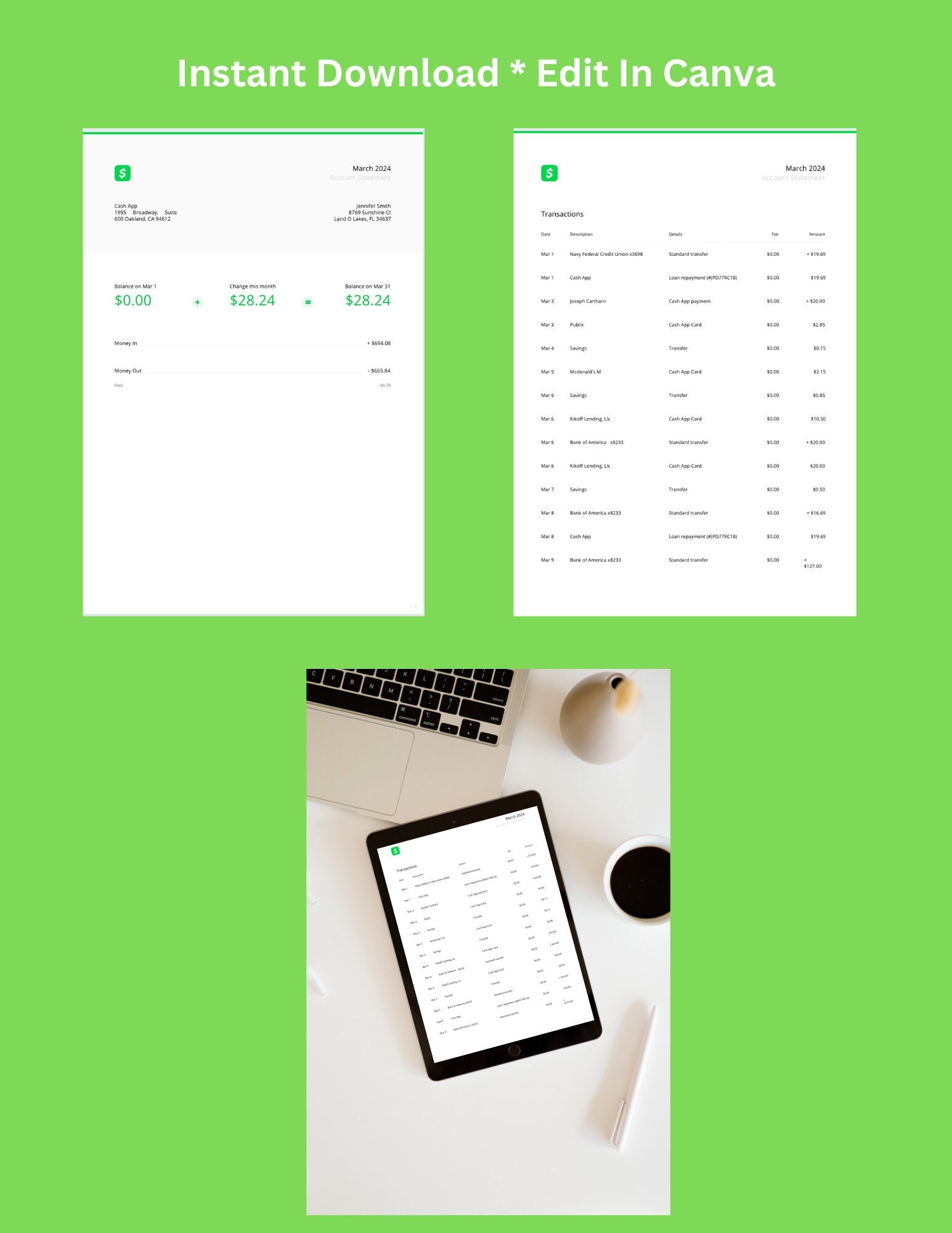

Organized transaction history forms the core value proposition of a structured financial record from a mobile payment platform. Without a methodical presentation of financial activity, the document loses its utility as a tool for managing personal finances. A chronologically ordered, clearly categorized record of transactions enables users to track spending patterns, identify irregularities, and reconcile balances effectively. This structured approach transforms raw transaction data into actionable financial insights.

Consider the scenario of a user attempting to reconcile monthly expenses. A disorganized record, lacking chronological order or clear categorization, would make this task significantly more challenging. Identifying the source of a discrepancy or verifying a specific payment would become a time-consuming process. Conversely, a well-organized history, readily available through a standardized format, simplifies reconciliation and allows for efficient financial management. For example, categorizing transactions by type (e.g., food, transportation, entertainment) within a downloaded document allows for rapid analysis of spending habits and informed budget adjustments.

Effective financial management hinges on access to a clear, concise, and readily available record of transactions. A structured template ensures this accessibility, empowering users to gain control over their finances. Challenges such as resolving payment disputes, substantiating transactions for loan applications, or simply understanding spending patterns are significantly mitigated through organized transaction history. This structured approach provides the foundation for informed financial decision-making and facilitates a proactive approach to personal finance management.

2. Standardized Format

A standardized format is fundamental to the utility of a financial statement template. Consistency in structure ensures compatibility with various financial software, simplifies data analysis, and provides a familiar framework for users. Without standardization, the document loses its value as a reliable and easily interpretable financial record. The following facets illustrate the key components of a standardized format within the context of financial statements.

- Consistent Data FieldsConsistent data fields are crucial for automated processing and analysis. Fields such as “Date,” “Description,” “Amount,” and “Balance” must be uniformly presented across all transactions. This consistency allows for seamless integration with budgeting software, spreadsheet applications, and other financial tools. For example, importing a statement into personal finance software relies on predictable data fields for accurate categorization and analysis. Without consistent fields, manual data entry or complex data manipulation would be required, negating the benefits of a standardized template.

- Date FormattingUniform date formatting avoids ambiguity and ensures accurate chronological ordering. A standard format (e.g., YYYY-MM-DD) prevents misinterpretation and facilitates sorting and filtering of transactions. Imagine a statement with inconsistent date formats: some entries using MM/DD/YYYY and others using DD/MM/YYYY. This discrepancy could lead to errors in sorting and analysis, particularly when dealing with international transactions. A standardized date format eliminates this potential for confusion.

- Currency DenotationClear and consistent currency denotation is essential, particularly for international transactions or multi-currency accounts. A standardized format clarifies the currency used for each transaction, preventing misinterpretation and facilitating accurate accounting. For example, explicitly denoting the currency (e.g., USD, EUR, GBP) for each transaction eliminates ambiguity and ensures accurate calculations when dealing with multiple currencies. This clarity is crucial for accurate financial reporting and analysis.

- Transaction CategorizationWhile not always a direct feature of the template itself, consistent transaction categorization within the associated platform enhances the utility of the exported statement. Standardized categories (e.g., “Food,” “Travel,” “Utilities”) facilitate analysis of spending patterns and simplify budgeting. For example, if a user consistently categorizes restaurant expenses as “Food,” analyzing spending on dining becomes straightforward when reviewing the statement. Consistent categorization within the platform ensures meaningful analysis of exported data.

These standardized elements ensure that financial statements are easily interpretable, readily integrable with other financial tools, and ultimately provide a reliable foundation for informed financial management. The consistency offered by a standardized format transforms transaction data into a powerful tool for understanding and controlling personal finances. Deviation from these standards undermines the utility of the template and introduces potential for errors and inefficiencies in financial management.

3. Downloadable Document

The availability of a downloadable document is integral to the functionality of a cash app statement template. This feature transforms ephemeral transaction data within the application into a tangible, portable record. The downloaded file serves as a permanent archive, readily accessible for various financial purposes, irrespective of internet connectivity or application availability. This portability is crucial for situations requiring proof of funds, dispute resolution, or detailed financial analysis. Consider a scenario requiring loan application supporting documentation. A downloadable statement provides readily available proof of income and transaction history, facilitating the application process. Without this downloadable format, access to this crucial financial information would be contingent upon application functionality and internet access.

Several formats typically accommodate this download functionality, each offering specific advantages. Comma-separated values (CSV) files are universally compatible with spreadsheet software, enabling detailed analysis and manipulation of transaction data. Portable document format (PDF) files preserve visual formatting, making them ideal for printing and sharing while maintaining data integrity. The choice of format depends on the intended use; CSV for analysis, PDF for presentation. For example, analyzing spending patterns benefits from the CSV format’s compatibility with spreadsheet software, while submitting a formal record necessitates the preserved formatting of a PDF.

The ability to download a structured financial statement empowers users with data ownership and control. This downloaded record serves as a verifiable source of truth, crucial for navigating financial complexities. Challenges such as resolving payment disputes, substantiating transactions, or conducting comprehensive financial analysis are significantly simplified by having a readily available, portable document. The absence of this download functionality would restrict users to the application’s interface for accessing transaction history, limiting portability and long-term record keeping. This downloadable format is essential for empowering informed financial decision-making and proactive financial management.

4. Proof of Funds

A cash app statement template plays a crucial role in providing proof of funds, a critical requirement in various financial contexts. Demonstrating the availability of sufficient financial resources is often necessary for securing loans, rental agreements, visa applications, and other financial transactions. A structured, verifiable record of transactions, readily available through a downloadable template, provides the necessary documentation to substantiate financial capacity.

- Loan ApplicationsLoan applications often necessitate proof of steady income and responsible financial management. A cash app statement template, providing a chronological record of transactions, can serve as supporting documentation for loan applications. This documented history allows lenders to assess an applicant’s financial stability and repayment capacity. For instance, a consistent record of incoming deposits and controlled spending patterns can strengthen a loan application. Without a readily available, organized statement, demonstrating financial capability becomes significantly more challenging.

- Rental AgreementsLandlords frequently require proof of funds to ensure prospective tenants can meet rental obligations. A downloaded cash app statement, demonstrating sufficient financial resources, can satisfy this requirement. This record offers landlords assurance of a tenant’s ability to pay rent consistently. Providing such documentation streamlines the rental application process and strengthens a prospective tenant’s credibility.

- Visa ApplicationsCertain visa applications necessitate proof of funds to demonstrate an applicant’s ability to support themselves financially during their stay. A cash app statement template, offering a verifiable record of transactions and account balances, can fulfill this requirement. This documentation assures immigration authorities of the applicant’s financial self-sufficiency, a critical factor in visa approvals. Without such a record, visa applications may be delayed or rejected.

- Business TransactionsIn various business contexts, demonstrating financial capacity is essential for securing contracts or establishing partnerships. A cash app statement template can provide the necessary documentation to substantiate financial claims. This record offers assurance to potential business partners or clients of financial stability and capability to fulfill contractual obligations. For example, when negotiating a business deal, a readily available statement can facilitate trust and expedite the agreement process.

The ability to generate a structured, downloadable financial statement via a cash app template is essential for various financial interactions requiring proof of funds. This accessible record empowers users to readily demonstrate their financial capacity, facilitating loan applications, rental agreements, visa applications, and business transactions. Without this readily available proof, navigating these financial processes becomes significantly more complex. The cash app statement template, therefore, becomes a crucial tool for managing and demonstrating financial stability in diverse situations.

5. Financial Analysis Aid

A cash app statement template serves as a crucial aid in financial analysis. The structured format, encompassing dates, descriptions, and amounts of transactions, provides the raw data necessary for assessing financial health. This organized record allows for the identification of spending patterns, income trends, and potential financial anomalies. Without this structured data, comprehensive financial analysis becomes significantly more challenging. The ability to download the statement in various formats, such as CSV, further enhances its analytical potential. Importing transaction data into spreadsheet software or financial management tools unlocks advanced analytical capabilities, including trend analysis, budgeting projections, and expense categorization. For example, analyzing monthly expenditures on dining becomes straightforward when transaction data is readily available in a spreadsheet format.

Consider a scenario where an individual seeks to understand their spending habits. A cash app statement template, providing a chronologically ordered record of transactions, allows for the identification of recurring expenses, areas of overspending, and potential savings opportunities. This insight can inform budgeting decisions, leading to more responsible financial management. Furthermore, the ability to categorize transactions within the cash app platform, reflected in the downloaded statement, enhances analytical granularity. For instance, categorizing transactions as “Groceries,” “Transportation,” or “Entertainment” provides a nuanced view of spending patterns, enabling more effective budget allocation. Analyzing these categorized transactions over time can reveal trends, such as increasing transportation costs, prompting further investigation and potential adjustments in commuting habits.

Effective financial planning relies on accurate and accessible financial data. The cash app statement template, by providing a structured, downloadable record of transactions, empowers users to conduct meaningful financial analysis. This analysis, in turn, informs budgeting decisions, identifies potential financial risks, and facilitates informed financial goal setting. Challenges such as understanding spending patterns, tracking income trends, and identifying areas for financial improvement are significantly mitigated through the analytical capabilities afforded by a well-structured transaction record. Therefore, the cash app statement template serves as a foundational tool for proactive and informed financial management.

Key Components of a Cash App Statement Template

Understanding the core components of a standardized Cash App statement is crucial for effective financial management. The following elements provide a foundational understanding and enable users to leverage the full potential of these records.

1. Transaction Date: Each transaction entry includes the precise date it occurred. This chronological record enables accurate tracking of financial activity and facilitates reconciliation with other financial records. Accurate dating is essential for identifying specific transactions and understanding spending patterns over time.

2. Transaction Description: A concise description accompanies each transaction, providing context and aiding in identifying the nature of the transaction. Clear descriptions are crucial for differentiating between similar transactions and understanding the purpose of each entry. This clarity is particularly important when reviewing past spending or identifying potential errors.

3. Transaction Amount: The monetary value of each transaction is clearly indicated, specifying whether it represents a debit or credit. Accurate transaction amounts are fundamental for calculating account balances and understanding the overall flow of funds. This precision is essential for accurate budgeting and financial analysis.

4. Running Balance: After each transaction, the updated account balance is displayed. This running balance allows for real-time monitoring of available funds and facilitates reconciliation with external records. Tracking the running balance is crucial for avoiding overdrafts and maintaining awareness of financial standing.

5. Statement Period: The statement covers a specific period, clearly indicated on the document. This defined timeframe allows for focused analysis of financial activity within a particular timeframe. Specifying the statement period is essential for generating reports for specific periods, such as monthly or quarterly reviews.

6. Account Information: Key account details, such as the account holder’s name and account number, are typically included on the statement. This information is crucial for identifying the account and ensuring the statement’s accuracy and relevance to the specific user. Accurate account information is essential for record-keeping and linking the statement to the correct financial account.

7. Downloadable Format: The availability of the statement in downloadable formats (e.g., CSV, PDF) provides flexibility and portability. This feature allows for integration with other financial tools and ensures access to financial records independent of the application interface. Downloadable formats are essential for archiving, sharing, and in-depth analysis of financial data.

These components work together to provide a comprehensive and organized overview of financial activity within a given period. This structured approach facilitates informed financial decision-making, accurate record-keeping, and efficient management of personal finances. Understanding these elements empowers users to effectively utilize cash app statements for various financial purposes, from budgeting and expense tracking to providing proof of funds and resolving transaction disputes.

How to Create a Cash App Statement

Generating a Cash App statement provides a consolidated record of transactions, facilitating financial analysis and various administrative tasks. The following steps outline the process of creating these statements.

1: Access the Cash App Application: Begin by opening the Cash App application on a mobile device. Ensure the application is updated to the latest version for optimal functionality and access to all features.

2: Navigate to the Activity Tab: Locate and select the “Activity” tab within the application. This tab typically displays a chronological list of recent transactions.

3: Specify the Statement Period: While Cash App doesn’t offer a dedicated “statement” generation feature in the traditional sense, users can effectively create a statement by specifying a date range. This can often be achieved through filtering or transaction history export options. Select the desired start and end dates to define the statement period. This period should align with the required timeframe for the intended purpose of the statement, such as monthly budgeting or providing proof of funds for a specific period.

4: Export Transaction History: Utilize the export or download functionality within the application to save the transaction history for the specified period. Cash App typically offers export options in formats such as CSV or PDF. The choice of format depends on the intended use of the statement. CSV is suitable for spreadsheet analysis, while PDF preserves formatting for printing or sharing.

5: (Optional) Format and Organize Data: If exported as a CSV file, the data can be further organized and formatted within spreadsheet software. This allows for the creation of custom reports, charts, and visualizations for deeper financial analysis. Adding categories or applying filters can provide valuable insights into spending patterns.

6: (Optional) Convert to PDF (if necessary): If a PDF format is required for specific purposes, such as official documentation, convert the exported file or spreadsheet data into a PDF document. This ensures consistent formatting and facilitates printing or sharing.

Accessing transaction history through these steps allows for a comprehensive review of financial activity within Cash App. The exported data provides a valuable resource for budgeting, expense tracking, and various financial management tasks. Leveraging available export options and formatting tools empowers users to tailor these records to specific needs and gain deeper insights into their financial activities.

A structured financial record from a mobile payment platform offers significant utility in managing personal finances. From providing proof of funds for loan applications and rental agreements to facilitating detailed analysis of spending habits and income trends, a well-organized record of transactions empowers informed financial decision-making. Understanding the components of these records, including transaction dates, descriptions, amounts, and running balances, enables users to extract valuable insights from their financial data. The availability of downloadable formats, such as CSV and PDF, further enhances the utility of these records by enabling integration with other financial management tools and providing portable documentation for various financial purposes. A structured financial record is not merely a record of past transactions; it is a tool for understanding financial behavior and making proactive decisions for a more secure financial future.

Effective financial management necessitates access to clear, concise, and readily available financial data. Leveraging the capabilities of structured financial records empowers individuals to take control of their finances, identify areas for improvement, and make informed decisions toward achieving financial goals. As financial technology continues to evolve, utilizing available tools for organizing and analyzing financial data will become increasingly crucial for navigating the complexities of personal finance. Proactive engagement with these tools fosters financial awareness, promotes responsible spending habits, and ultimately contributes to long-term financial well-being.