Utilizing such a framework allows for clearer financial oversight, facilitating budgeting, expense tracking, and tax preparation. It can streamline the process of generating reports and analyses, ultimately contributing to improved financial decision-making. The accessibility of a free template removes a potential financial barrier, making organized financial management available to a wider audience.

This structured overview of financial transactions allows for deeper exploration of topics like budgeting strategies, expense analysis, and effective methods for demonstrating financial stability.

1. Accessibility

Accessibility plays a vital role in the utility of a complimentary Cash App statement template. Removing financial barriers associated with paid financial management tools allows a broader user base to benefit from organized financial record-keeping. This is particularly crucial for individuals with limited resources or those just beginning their financial management journey. Increased access empowers more people to take control of their finances.

- Cost-EffectivenessFree access eliminates a significant barrier to entry, making organized financial management achievable for everyone, regardless of income level. This democratizes access to tools often only available through paid services, contributing to greater financial inclusion.

- Ease of AcquisitionDownloadable templates are generally readily available online, simplifying the process of acquiring and implementing a financial tracking system. This ease of access encourages adoption and promotes proactive financial management.

- Device CompatibilityTemplates in commonly used formats (e.g., spreadsheets) are typically compatible with various devices (computers, tablets, smartphones), allowing users to access and manage their financial data on their preferred platform. This flexibility supports diverse user needs and preferences.

- User-Friendly DesignWell-designed templates are structured for intuitive use, even for individuals with limited technical expertise. Clear labels, straightforward data entry fields, and pre-built formulas simplify the process of tracking and analyzing financial information.

The accessibility of these free templates significantly contributes to their overall value. By removing financial and technical obstacles, these tools empower individuals to take control of their finances, regardless of their background or resources. This wider accessibility ultimately promotes greater financial literacy and well-being.

2. Format consistency

Standardized structure within a complimentary Cash App statement template ensures data clarity and interoperability with other financial tools. Consistent formatting allows for efficient analysis, simplifies data import/export processes, and facilitates comparison across different periods or financial sources. This predictability is crucial for generating reliable insights and managing financial information effectively.

- Standardized Date FormatA consistent date format (e.g., YYYY-MM-DD) prevents ambiguity and ensures accurate sorting and filtering of transactions. This is particularly important when analyzing spending patterns over time or preparing tax documentation. Using a standardized format avoids potential errors and misinterpretations caused by variations in date representation.

- Uniform Transaction DescriptionsClear, concise, and uniform transaction descriptions provide readily understandable information about each entry. For instance, using consistent labeling for recurring expenses (e.g., “Rent,” “Utilities”) facilitates automated categorization and analysis. This structured approach improves data clarity and simplifies budgeting efforts.

- Consistent Numerical FormattingConsistent use of decimal places and currency symbols eliminates confusion and ensures accurate calculations. This precision is essential for reconciling transactions, generating reports, and making informed financial decisions. Standardized numerical formatting prevents errors and ensures data integrity.

- Structured Data FieldsDesignated fields for specific data points (e.g., date, description, amount, category) enable efficient data organization and analysis. This structured approach simplifies sorting, filtering, and generating reports, enhancing the overall utility of the template. Consistent data fields allow for easier integration with other financial software or tools.

The consistent formatting within these complimentary templates fosters efficient data management, enabling users to gain clearer insights into their financial activities. This structured approach supports informed decision-making and contributes to improved financial well-being by providing a reliable framework for tracking, analyzing, and managing financial data.

3. Data organization

Effective data organization is paramount for leveraging the full potential of a complimentary Cash App statement template. A well-organized template provides a clear structure for recording and categorizing financial transactions, facilitating insightful analysis and informed financial decision-making. This structured approach transforms raw transaction data into a usable tool for understanding spending habits, tracking income streams, and managing personal finances effectively.

- CategorizationCategorizing transactions (e.g., “Food,” “Transportation,” “Rent”) provides a granular view of spending patterns. This allows users to identify areas of overspending, track budget adherence, and make informed adjustments to financial habits. For example, categorizing all food-related expenses reveals the proportion of income allocated to dining out versus groceries, enabling data-driven decisions about budgeting for meals.

- Chronological OrderingPresenting transactions in chronological order creates a clear timeline of financial activity. This facilitates tracking income and expenses over specific periods, identifying trends, and reconciling transactions with bank records. Chronological ordering allows for efficient review of past spending and identification of recurring payments.

- Data Filtering and SortingTemplates often include features for filtering and sorting transactions based on specific criteria (e.g., date, category, amount). This functionality allows users to isolate specific transactions, analyze spending within particular categories, and generate customized reports tailored to individual needs. For instance, filtering by a specific date range facilitates analysis of spending during a vacation or holiday period.

- Data ConsolidationA well-organized template facilitates consolidation of financial data from multiple sources. This enables users to gain a holistic view of their financial situation, even if they utilize multiple payment platforms or accounts. Consolidating data allows for comprehensive budgeting and financial planning by providing a single, unified view of all income and expenses.

These organizational features within complimentary Cash App statement templates transform raw transaction data into actionable financial insights. By providing a structured framework for recording, categorizing, and analyzing transactions, these templates empower users to make informed financial decisions, track progress toward financial goals, and improve overall financial well-being.

4. Transaction Tracking

Comprehensive transaction tracking is a cornerstone of effective financial management, and a complimentary Cash App statement template serves as a valuable tool for achieving this. Accurate and detailed records of financial activities provide the foundation for informed budgeting, expense analysis, and overall financial awareness. Utilizing a template facilitates systematic tracking, enabling users to understand where their money is going and make data-driven decisions about their finances.

- Real-Time MonitoringTemplates designed to mirror Cash App statements allow for near real-time monitoring of transactions as they occur. This provides immediate insight into spending patterns, enabling users to identify potential overspending quickly and adjust habits accordingly. For instance, tracking daily coffee purchases can reveal a surprising cumulative expense, prompting a reevaluation of spending habits.

- Categorization and AnalysisTemplates often provide fields for categorizing transactions (e.g., groceries, transportation, entertainment). This facilitates detailed analysis of spending within specific categories, revealing areas where adjustments might be needed. Categorizing transactions allows for targeted budget adjustments and identification of areas for potential savings.

- Historical Record KeepingA structured template serves as a repository of historical transaction data. This readily accessible record simplifies budgeting, expense analysis, tax preparation, and provides valuable documentation for financial planning. Historical data allows users to track financial progress over time and identify long-term trends in spending and saving.

- Reconciliation and AccuracyUsing a template encourages regular reconciliation of transactions, ensuring accuracy and identifying any discrepancies promptly. This meticulous approach fosters financial responsibility and provides a reliable basis for financial planning. Regular reconciliation reduces the risk of errors and provides a clear picture of financial health.

Systematic transaction tracking, facilitated by a complimentary Cash App statement template, empowers individuals to gain a deeper understanding of their financial flows. This organized approach provides the foundation for informed financial decision-making, enabling users to optimize spending, achieve financial goals, and cultivate responsible financial habits. The insights derived from detailed transaction tracking contribute significantly to improved financial well-being.

5. Financial Overview

A comprehensive financial overview is crucial for informed financial management. A complimentary Cash App statement template facilitates this overview by providing a structured framework for consolidating and analyzing transaction data. This structured approach allows users to gain a clear understanding of their financial health, identify trends, and make data-driven decisions.

- Income and Expense TrackingTemplates provide designated areas for recording income and expenses, enabling users to track cash flow effectively. This detailed tracking allows for precise budgeting and identification of areas for potential savings. For example, a user can readily identify the proportion of income allocated to housing, transportation, or entertainment, facilitating informed budget adjustments. This granular view of income and expenses is fundamental to sound financial planning.

- Spending Pattern AnalysisCategorizing transactions within a template allows for analysis of spending patterns over time. This reveals trends in spending habits, highlighting areas of potential overspending or opportunities for increased savings. Identifying recurring subscriptions or frequent dining-out expenses can prompt adjustments to achieve financial goals. Understanding spending patterns is key to optimizing financial resources.

- Budgeting and ForecastingA clear financial overview, facilitated by a template, provides the necessary data for effective budgeting and forecasting. Historical spending data informs realistic budget creation, enabling users to allocate funds strategically and anticipate future expenses. This forward-looking approach promotes financial stability and reduces the risk of overspending.

- Financial Goal Setting and TrackingA comprehensive financial overview allows users to set realistic financial goals and track progress towards achieving them. By monitoring income, expenses, and savings within a structured template, individuals can assess their financial trajectory and make necessary adjustments to stay on track. This data-driven approach promotes financial responsibility and increases the likelihood of achieving financial objectives.

Utilizing a complimentary Cash App statement template provides the structured framework necessary for creating a comprehensive financial overview. This empowers individuals to gain a clear understanding of their financial health, make informed decisions about spending and saving, and achieve greater financial well-being. The insights gained from a detailed financial overview are essential for effective financial management and long-term financial success.

6. Budgeting Assistance

Effective budgeting relies on accurate and organized financial data. A complimentary Cash App statement template provides a valuable tool for achieving this, facilitating informed budget creation and adherence. The template’s structure allows users to transform raw transaction data into actionable insights, supporting responsible financial planning and decision-making.

- Expense Tracking and CategorizationTemplates designed to mimic Cash App statements often include fields for categorizing transactions (e.g., groceries, transportation, entertainment). This allows for granular analysis of spending within specific categories, revealing areas of potential overspending and informing targeted budget adjustments. For example, categorizing all food-related expenses can reveal the proportion of income allocated to dining out versus groceries, prompting data-driven decisions about meal budgeting. This granular insight is essential for effective budget management.

- Income Monitoring and AllocationTracking income alongside expenses within the template provides a holistic view of cash flow. This facilitates strategic allocation of funds across different budget categories, ensuring sufficient resources are available for essential expenses while also accounting for savings goals and discretionary spending. Understanding the relationship between income and expenses is fundamental to sound budgeting practices.

- Historical Spending AnalysisThe historical transaction data captured within the template offers valuable insights into past spending patterns. This information informs realistic budget creation by providing a basis for projecting future expenses and identifying recurring costs. Analyzing past spending trends allows for more accurate budgeting and reduces the likelihood of unexpected financial shortfalls. Historical data also facilitates identification of seasonal variations in spending, enabling proactive budget adjustments.

- Budget Adherence MonitoringBy comparing actual spending against budgeted amounts within the template, users can monitor their budget adherence effectively. This real-time feedback mechanism allows for prompt identification of deviations from the budget, enabling timely adjustments to spending habits and ensuring financial goals remain achievable. Regular monitoring of budget adherence is crucial for maintaining financial stability and achieving long-term financial objectives.

A complimentary Cash App statement template enhances budgeting efforts by providing a structured framework for organizing, analyzing, and interpreting financial data. This empowers individuals to create realistic budgets, track spending effectively, and make informed adjustments to achieve their financial goals. The template’s accessibility further democratizes access to crucial budgeting tools, fostering greater financial literacy and responsibility.

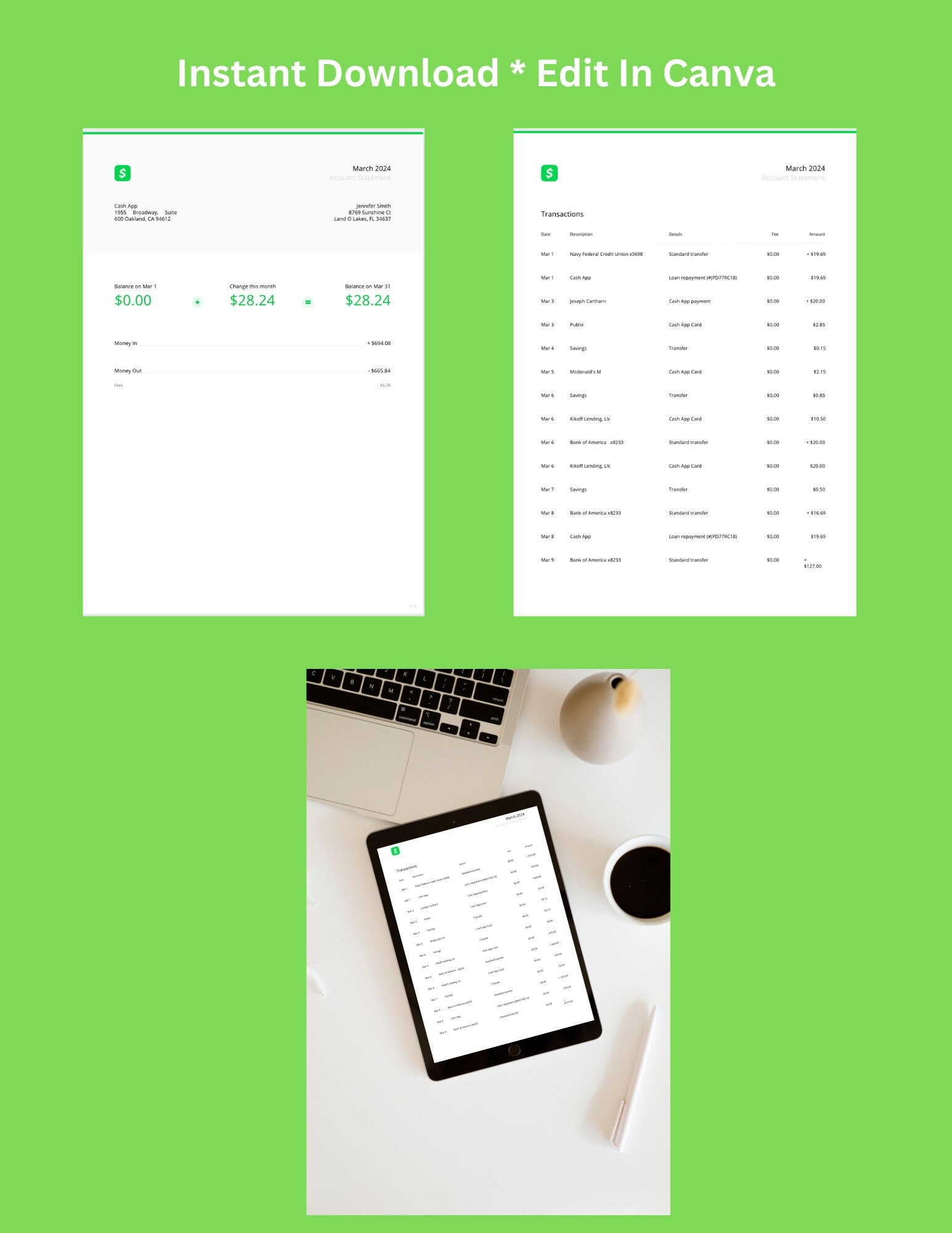

Key Components of a Complimentary Cash App Statement Template

Understanding the core components of a complimentary Cash App statement template is crucial for leveraging its full potential for financial management. The following elements contribute significantly to the template’s utility and effectiveness.

1. Date: Accurate date recording for each transaction is fundamental for chronological tracking and analysis of financial activity. Precise dating allows for clear identification of spending patterns over time and facilitates reconciliation with other financial records. This precision is essential for accurate financial reporting and analysis.

2. Description: Clear and concise transaction descriptions provide context and facilitate categorization. Detailed descriptions enable efficient identification of individual transactions and contribute to a comprehensive understanding of spending habits. This clarity is crucial for effective budget management and expense analysis.

3. Amount: Accurate recording of transaction amounts, including both debits and credits, is paramount for maintaining a balanced and accurate financial record. Precise amounts are essential for calculating totals, tracking cash flow, and generating reliable financial reports. This precision forms the basis of sound financial management.

4. Category: Assigning categories to transactions (e.g., “Food,” “Transportation,” “Rent”) allows for granular analysis of spending patterns and facilitates budget management. Categorization enables identification of areas of overspending and supports informed financial decision-making. This structured approach promotes efficient allocation of resources.

5. Balance: Tracking the running balance after each transaction provides a real-time view of available funds and overall financial standing. Maintaining an accurate balance is critical for avoiding overdrafts, managing cash flow effectively, and making informed financial decisions. This awareness is essential for responsible financial management.

These core components provide a structured framework for recording and analyzing financial transactions within a complimentary Cash App statement template. This organized approach empowers individuals to gain valuable insights into their spending habits, track financial progress, and make informed decisions to achieve financial well-being. The template’s utility stems from its ability to transform raw transaction data into actionable financial intelligence.

How to Create a Cash App Statement Template

Creating a complimentary template for organizing Cash App transactions involves structuring a spreadsheet or document to mirror a bank statement format. This enables efficient tracking and analysis of financial activity. The following steps outline the process.

1. Open a Spreadsheet Program: Begin by opening a spreadsheet program like Google Sheets, Microsoft Excel, or Apple Numbers. These programs offer the necessary functionality for creating structured templates.

2. Create Column Headers: In the first row, create column headers for essential data points: “Date,” “Description,” “Amount,” “Category,” and “Balance.” These headers provide a clear structure for recording transaction details.

3. Format Columns: Format the “Date” column for date values, the “Amount” column for currency, and the “Balance” column for numerical values. Consistent formatting ensures data integrity and facilitates accurate calculations.

4. Input Initial Balance (Optional): If desired, input the starting balance in the first cell of the “Balance” column. This establishes a baseline for tracking transactions and calculating the running balance.

5. Enter Transaction Data: Enter each Cash App transaction, including the date, a concise description, the amount (positive for credits, negative for debits), and assign a relevant category (e.g., “Food,” “Transportation”). Accurate data entry is crucial for reliable analysis.

6. Calculate Running Balance: In the “Balance” column, calculate the running balance after each transaction. Use a formula that adds the “Amount” to the previous row’s “Balance.” This provides a real-time view of available funds.

7. Implement Data Validation (Optional): For enhanced data integrity, implement data validation rules within the spreadsheet. This ensures data consistency and reduces the risk of input errors, particularly in the “Date” and “Amount” columns.

8. Save the Template: Save the file in a readily accessible location. Consider using a descriptive file name for easy identification. Regular backups are recommended to prevent data loss.

A structured template, incorporating these elements, facilitates organized tracking and analysis of Cash App transactions, promoting informed financial management. This approach allows for clear visualization of spending patterns, simplifies budgeting, and contributes to improved financial awareness.

Access to complimentary Cash App statement templates offers a valuable opportunity for enhanced financial management. Utilizing a structured framework for recording, categorizing, and analyzing transactions empowers individuals to gain a clearer understanding of their financial activities. This structured approach facilitates informed budgeting, expense tracking, and overall financial awareness, contributing to improved financial well-being. The accessibility of these free resources democratizes access to essential financial management tools, promoting greater financial literacy and responsibility.

Leveraging these readily available resources allows individuals to take proactive steps toward achieving financial goals. Organized financial management is crucial for navigating an increasingly complex financial landscape. Adopting a structured approach to tracking and analyzing financial data empowers individuals to make informed decisions, optimize spending, and build a more secure financial future.