Proper filing provides businesses with the authorization to conduct sales legally and remit the appropriate taxes. This process helps maintain accurate financial records, avoids potential penalties or legal complications, and facilitates transparency in business operations. It establishes a legitimate presence within the state and builds trust with customers and stakeholders.

This foundational element of legal and financial compliance is explored in greater detail in the following sections, which address specific aspects of completing and submitting the required documentation, along with resources and guidance for navigating the process effectively.

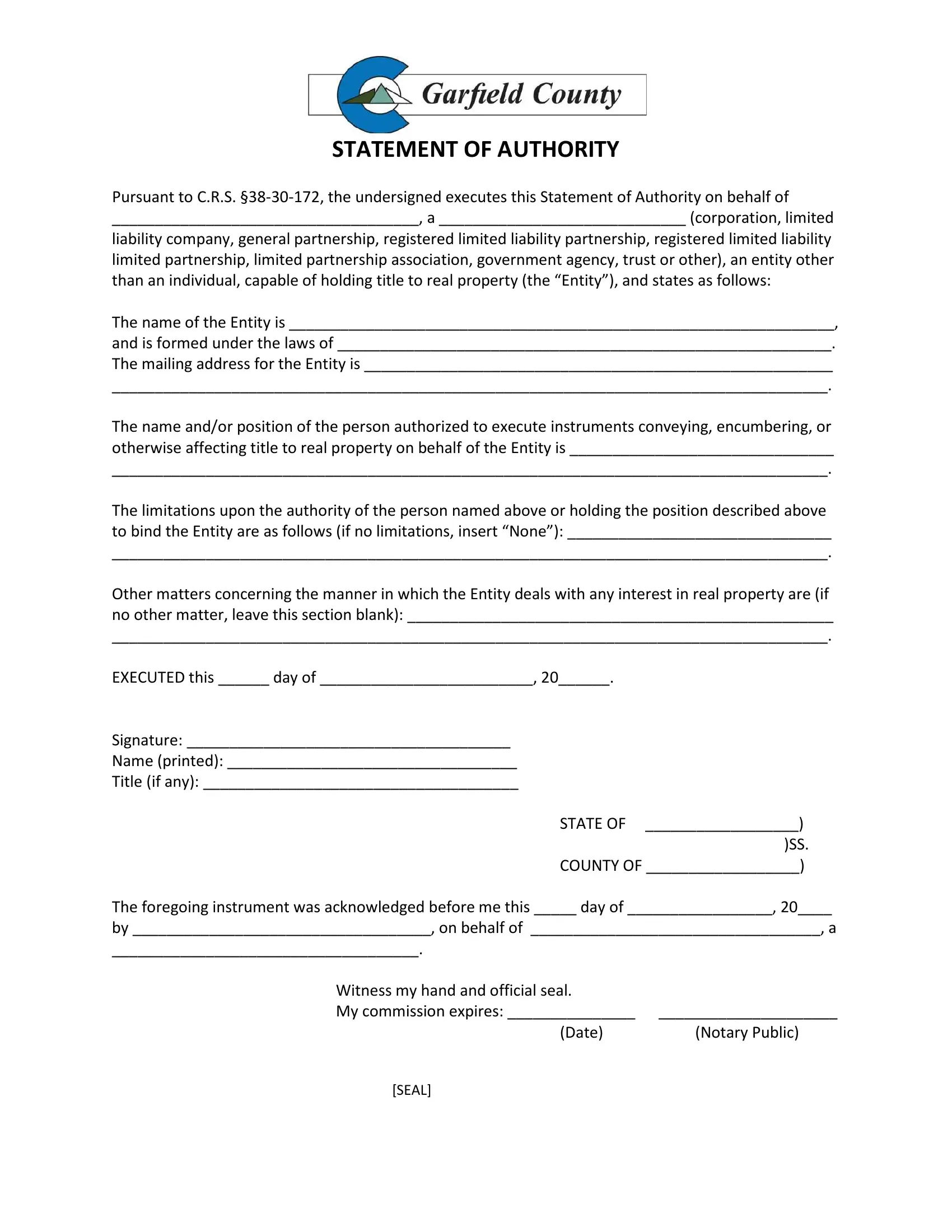

1. Legal Business Name

The legal business name, as registered with the Colorado Secretary of State, forms a cornerstone of the Colorado Statement of Authority template. This precise name identification ensures clear legal recognition and establishes accountability for tax purposes. Discrepancies between the registered name and the name used on the statement can lead to processing delays, rejection of the filing, and potential complications with tax compliance. A sole proprietorship using the owner’s name must ensure consistency with official records, while corporations, LLCs, and partnerships must use their exact, legally registered names. This consistency safeguards the business’s legal standing and ensures accurate tracking of tax obligations.

For example, if “Mountain View Bakery LLC” is the official registered name, using “MVB” or “Mountain View Bakery” on the statement could cause issues. Similarly, a sole proprietor registered as “Jane Doe” should not use “Jane Doe’s Bakery” on the statement. Using a fictitious name without proper registration and linking it to the legal business name can also create complexities. Accurately representing the legal business name on the statement allows seamless integration with state databases and ensures proper identification across all official interactions.

Accurate completion of the legal business name within the Colorado Statement of Authority template is fundamental for legal compliance and efficient processing. This seemingly minor detail carries significant weight in establishing a clear legal identity for tax purposes. Attention to this detail, ensuring it precisely matches official state records, prevents complications and fosters a transparent and compliant business operation within Colorado.

2. Registered Agent Information

Registered agent information constitutes a critical component of the Colorado Statement of Authority template. A registered agent serves as the official point of contact for the business, receiving legal and tax documents on its behalf. This designated individual or entity must maintain a physical address within Colorado and be available during regular business hours. Accurate and complete registered agent information ensures the business receives crucial legal and tax notifications promptly, facilitating compliance and avoiding potential penalties. Failure to maintain a valid registered agent can lead to significant legal and financial repercussions, including potential revocation of the business’s authority to operate within the state. For example, a missed deadline for annual report filing due to incorrect registered agent information can result in penalties or even administrative dissolution.

Maintaining accurate registered agent details safeguards the business’s legal standing and facilitates communication with state authorities. A change in registered agent information requires prompt filing of an amendment to the Colorado Statement of Authority. This proactive approach ensures continuous compliance and avoids potential disruptions to business operations. For instance, if a business relocates its office or changes its registered agent service provider, updating this information with the state is crucial. Failure to do so could result in missed legal notices, default judgments, or other legal complications. The registered agent plays a vital role in maintaining the legal integrity and operational continuity of the business.

Accuracy and ongoing maintenance of registered agent information are paramount for businesses operating in Colorado. This seemingly administrative detail significantly impacts a business’s ability to receive official communications, maintain legal compliance, and avoid potential penalties. Businesses should prioritize the accurate completion and timely updates of registered agent information within the Colorado Statement of Authority template to ensure the smooth and legitimate operation within the state.

3. North American Industry Classification System (NAICS) Code

The North American Industry Classification System (NAICS) code, a crucial component of the Colorado Statement of Authority template, categorizes business activities for statistical data collection and analysis. Accurate selection of the appropriate six-digit NAICS code ensures proper classification within the state’s economic landscape, contributing to accurate economic reporting and analysis. This seemingly technical detail plays a significant role in understanding industry trends and informing policy decisions.

- Industry Classification:The NAICS code provides a standardized system for classifying businesses based on their primary economic activity. For example, a retail bakery would fall under NAICS code 445291 (Retail Bakeries), while a wholesale bakery would be classified under 311811 (Retail Bakeries). Correct classification ensures accurate representation within the state’s economic data, contributing to a comprehensive understanding of industry activity.

- Data Collection and Analysis:State agencies utilize NAICS codes to collect and analyze economic data, informing policy decisions and resource allocation. Accurate NAICS codes on the Colorado Statement of Authority template contribute to the accuracy and reliability of this data. For example, data collected based on NAICS codes can be used to track industry growth, identify emerging trends, and assess the impact of economic development initiatives.

- Potential Tax Implications:While not directly tied to tax rates, NAICS codes can sometimes be used to identify businesses eligible for specific tax incentives or programs. Understanding the potential tax implications associated with a specific NAICS code is essential for businesses seeking to optimize their tax strategies. For instance, certain industries may qualify for tax credits related to job creation or investment in specific areas.

- Interagency Data Sharing:NAICS codes facilitate consistent data sharing between state and federal agencies, allowing for a more comprehensive understanding of economic activity across different jurisdictions. This standardization supports collaborative efforts in economic development and policymaking. For example, consistent NAICS code usage allows for comparisons of industry performance across different states and regions.

Accurate selection and application of the NAICS code within the Colorado Statement of Authority template ensures proper categorization within the state’s economic framework. This contributes to the integrity of economic data, informs policy decisions, and facilitates a deeper understanding of the state’s dynamic business landscape. Attention to this detail underscores a commitment to accurate reporting and contributes to a more informed and effective economic environment.

4. Tax Identification Numbers (TINs)

Tax Identification Numbers (TINs) form a critical link between businesses and the Colorado Department of Revenue, serving as a unique identifier for tax purposes within the Colorado Statement of Authority template. Accurate provision of the correct TIN is essential for proper tax administration, revenue collection, and compliance monitoring. This numerical identifier enables the state to track tax liabilities, process payments, and ensure adherence to tax regulations. The type of TIN required depends on the business structure. Sole proprietorships utilize Social Security Numbers (SSNs), while corporations, partnerships, and LLCs use Employer Identification Numbers (EINs) issued by the Internal Revenue Service (IRS). Providing an incorrect or mismatched TIN can lead to significant complications, including processing delays, penalties, and difficulties in reconciling tax liabilities.

For example, a sole proprietor mistakenly providing an EIN instead of their SSN, or an LLC using an outdated EIN, can disrupt the processing of the Colorado Statement of Authority. Such errors can trigger inquiries from the Department of Revenue, delaying the establishment of the business’s authority to collect sales tax and potentially leading to penalties. Similarly, using a personal SSN for a multi-member LLC or a corporation creates a mismatch with the IRS records, causing confusion and potential tax liabilities. Accurate TIN information ensures seamless integration with state and federal tax systems, facilitating accurate reporting and compliance.

Accurate TIN disclosure within the Colorado Statement of Authority template is fundamental for establishing a clear tax identity and ensuring compliance with state tax regulations. This seemingly simple numerical identifier plays a crucial role in the efficient administration of state taxes, enabling accurate tracking of liabilities and facilitating compliance monitoring. Attention to this detail, ensuring the provision of the correct and current TIN based on the business structure, avoids potential complications and establishes a foundation for responsible and compliant business operations within Colorado.

5. Signature of Authorized Representative

The signature of an authorized representative on the Colorado Statement of Authority template serves as a critical validation of the information provided, legally binding the business to the statements made. This signature signifies that the individual signing has the authority to act on behalf of the business and attests to the accuracy and completeness of the information submitted. This requirement ensures accountability and prevents fraudulent filings. Without a valid signature, the document is considered incomplete and will be rejected by the Colorado Department of Revenue. This signature transforms the document from a collection of data into a legally binding agreement between the business and the state of Colorado. For example, if an individual without proper authority signs the document, the filing could be deemed invalid, potentially leading to penalties or delays in obtaining the authority to collect sales tax.

Specific requirements for the signature may vary based on the business structure. For a sole proprietorship, the owner signs the document. In partnerships, an authorized partner’s signature is required. For corporations and LLCs, an officer or manager with the designated authority must sign. Utilizing a signature stamp or electronic signature may require prior approval from the Colorado Department of Revenue. Failure to adhere to these signature requirements can result in rejection of the form, delaying the process and potentially impacting the business’s ability to operate legally within the state. For example, if a limited liability company (LLC) submits a statement signed by an employee who is not a designated manager or officer, the filing may be rejected. Similarly, using a signature stamp without prior authorization could invalidate the submission.

The authorized representative’s signature on the Colorado Statement of Authority template finalizes the document and affirms the business’s commitment to comply with Colorado tax regulations. This signature carries significant legal weight, ensuring accountability and validating the information provided. Understanding the importance of this component, along with the specific requirements related to the business’s legal structure, is crucial for ensuring a smooth and successful filing process and maintaining compliant operations within Colorado. Failure to comply with these seemingly minor details can have significant repercussions, potentially disrupting business operations and leading to legal complications.

Key Components of a Colorado Statement of Authority Template

Accurate completion of the Colorado Statement of Authority template requires careful attention to several key components. These elements ensure proper identification, legal compliance, and efficient processing by the Colorado Department of Revenue.

1. Legal Business Name: The exact legal business name, as registered with the Colorado Secretary of State, must be provided. Discrepancies can lead to processing delays and potential legal issues. Accuracy ensures proper identification and compliance.

2. Registered Agent Information: Current and accurate details of the registered agent, including a physical Colorado address, are essential for receiving legal and tax notifications. This ensures prompt communication and facilitates compliance.

3. North American Industry Classification System (NAICS) Code: The six-digit NAICS code categorizes the business’s primary economic activity. Accurate selection contributes to statistical data collection and potential identification of applicable tax incentives.

4. Tax Identification Numbers (TINs): The correct TIN (SSN for sole proprietors, EIN for other structures) is crucial for tax administration and compliance. Accurate provision ensures proper tracking of tax liabilities and facilitates efficient processing.

5. Signature of Authorized Representative: The signature of an authorized representative validates the information provided and legally binds the business to the statement. This confirms the accuracy of the submitted data and authorizes the filing.

These elements collectively ensure the accurate and complete filing of the Colorado Statement of Authority template, establishing the business’s legal presence and authority to operate within the state. Attention to detail in completing each component facilitates compliance, avoids potential penalties, and ensures effective communication with the Colorado Department of Revenue.

How to Create a Colorado Statement of Authority

Creating a Colorado Statement of Authority requires careful attention to detail and adherence to specific guidelines. Following a structured approach ensures accurate completion and facilitates timely processing by the Colorado Department of Revenue.

1. Obtain the Correct Form: Access the official Colorado Statement of Authority form (DR 0100) from the Colorado Department of Revenue website. Using outdated or unofficial forms can lead to rejection.

2. Legal Business Name: Enter the precise legal business name as registered with the Colorado Secretary of State. Verify accuracy against official registration documents to avoid discrepancies.

3. Registered Agent Details: Provide the complete name and physical Colorado address of the registered agent. This individual or entity will receive official legal and tax documents on behalf of the business.

4. NAICS Code Selection: Identify the six-digit North American Industry Classification System (NAICS) code that most accurately reflects the business’s primary activity. Consult the official NAICS code manual for precise categorization.

5. Tax Identification Number (TIN): Enter the correct TIN. Sole proprietors use their Social Security Number (SSN). Corporations, partnerships, and LLCs use their Employer Identification Number (EIN). Ensure accuracy to avoid processing delays.

6. Authorized Signature: An authorized representative of the business must sign the form. Requirements vary depending on the legal structure (owner for sole proprietorships, partner for partnerships, officer/manager for corporations/LLCs). Confirm signing authority aligns with the business’s governing documents.

7. Review and Submission: Thoroughly review the completed form for accuracy and completeness before submission. Double-check all information to minimize the risk of rejection or delays. Submit the form according to the instructions provided by the Colorado Department of Revenue, which may include online submission, mailing, or faxing.

Accurate completion of each component ensures efficient processing and establishes the business’s legal authority to operate and collect sales tax within Colorado. This structured approach minimizes potential errors and facilitates compliance with state regulations.

Accurate and complete submission of the Colorado Statement of Authority template is fundamental for businesses seeking to operate legally within the state. This document establishes the business’s authority to collect sales tax and ensures compliance with state regulations. Key components, including accurate legal business name, registered agent information, NAICS code, tax identification number, and authorized signature, require meticulous attention to detail. Understanding the purpose and requirements of each component facilitates a smooth and efficient filing process, minimizing potential complications and ensuring compliance. Utilizing available resources and adhering to provided instructions streamlines the process and strengthens the business’s legal standing within Colorado.

Maintaining accurate and up-to-date information on the Colorado Statement of Authority is an ongoing responsibility, reflecting a commitment to transparency and compliance. Proactive adherence to these requirements contributes to a stable and predictable business environment, fostering trust with stakeholders and ensuring the long-term success of business operations within Colorado. This foundational document serves as a cornerstone of legal and financial integrity, supporting responsible business practices and contributing to the overall economic health of the state.