Utilizing this standardized reporting offers significant advantages for financial analysis. It enhances the understanding of cost structures, profit margins, and overall financial health. This improved comprehension enables more effective benchmarking against competitors and facilitates informed decision-making regarding resource allocation and strategic planning.

Further exploration will delve into the creation and interpretation of these standardized statements, showcasing practical applications and demonstrating the value they bring to financial analysis and business management.

1. Percentage of Revenue

The core principle of a standardized income statement lies in expressing each item as a percentage of revenue. This foundational element facilitates meaningful comparisons and insightful analysis. Instead of focusing solely on absolute dollar amounts, which can be misleading when comparing companies of different scales, the percentage of revenue approach reveals the underlying proportions and relationships within the financial structure. For instance, if a company’s cost of goods sold represents 60% of revenue, this signifies that for every dollar earned, 60 cents are attributed to the direct costs of producing goods or services. This metric becomes invaluable when compared across different periods or against competitors.

Consider two companies: Company A with $1 million in revenue and $500,000 in marketing expenses, and Company B with $10 million in revenue and $2 million in marketing expenses. While Company B’s marketing spend is significantly higher in absolute terms, expressing these figures as percentages of revenue reveals that Company A allocates 50% of its revenue to marketing, while Company B allocates only 20%. This standardized perspective highlights the relative investment in marketing for each company, providing a clearer picture of strategic priorities and resource allocation. This allows analysts to quickly grasp the relative importance of different expenses within each company’s operations.

Understanding the percentage of revenue for each line item offers critical insights into operational efficiency, profitability, and financial health. By analyzing trends in these percentages, one can identify areas of strength and weakness. For example, a consistently decreasing gross profit margin percentage might signal pricing pressure or increasing production costs. Conversely, a steadily rising operating income percentage could indicate improving operational efficiency. This focus on percentages, rather than absolute figures, unlocks a deeper understanding of financial dynamics and facilitates informed decision-making. It empowers stakeholders to identify potential issues, benchmark performance, and make strategic adjustments to optimize financial outcomes.

2. Standardized Format

The standardized format is the cornerstone of a common size income statement. Expressing each line item as a percentage of revenue creates a uniform structure, enabling direct comparison across different periods for the same company or between different companies, regardless of size or industry. This eliminates the distortion caused by variations in absolute monetary values, providing a clearer picture of financial performance. Without standardization, comparing a small startup’s income statement with that of a multinational corporation would be like comparing apples and oranges. The standardized format provides a common denominator revenue allowing for meaningful analysis and benchmarking.

Consider a company analyzing its operating expenses over several years. While the absolute values might have increased, the standardized format could reveal that operating expenses as a percentage of revenue have actually decreased. This indicates improved operational efficiency despite the increase in absolute spending. Similarly, comparing gross profit margins across competitors requires a standardized format. If Company A reports a gross profit of $1 million and Company B reports $2 million, it’s impossible to determine which company is more profitable without knowing their respective revenues. However, if Company A’s gross profit margin is 60% and Company B’s is 50%, it becomes clear that Company A is generating a higher profit relative to its revenue.

The standardized format is crucial for identifying trends, benchmarking performance, and making informed business decisions. It facilitates a deeper understanding of financial dynamics, enabling stakeholders to pinpoint areas of strength and weakness, track progress over time, and compare performance against industry averages or competitors. This consistent framework empowers analysts and investors to make more accurate assessments of financial health and make more strategic decisions. Without this standardized approach, financial analysis would be significantly more complex and less insightful.

3. Comparative Analysis

Comparative analysis thrives on the standardized format provided by common size income statements. This standardization facilitates meaningful comparisons of financial performance across different periods within the same company, between companies of varying sizes, and even across different industries. By eliminating the distortions caused by differing revenue scales, the percentage-of-revenue approach allows analysts to focus on the underlying proportions and relationships within financial data, revealing insightful trends and anomalies. For instance, observing a consistently increasing percentage of cost of goods sold over several years within a single company signals a potential issue with production efficiency or rising input costs. This observation would be difficult to discern by simply looking at the absolute cost figures.

Comparing performance across companies highlights relative strengths and weaknesses. Consider two retail companies: one with a gross profit margin of 30% and another with 45%. This difference reveals crucial information about pricing strategies, cost control, and competitive positioning. Furthermore, comparing a company’s performance to industry benchmarks provides context and identifies areas for potential improvement. If a company’s operating expense percentage is significantly higher than the industry average, it may indicate inefficiencies that warrant further investigation. Without the standardized framework of a common size income statement, such comparisons would be significantly less informative.

The ability to conduct meaningful comparative analysis is essential for informed decision-making. Identifying trends, understanding competitive landscapes, and benchmarking performance are all crucial aspects of strategic planning and resource allocation. The standardized format allows stakeholders to quickly grasp the relative importance of different financial elements, identify potential risks and opportunities, and make data-driven decisions to enhance profitability and long-term sustainability. This analytical power underscores the value and importance of common size income statements as a core tool for financial analysis.

4. Trend Identification

Trend identification is a crucial aspect of financial analysis, and common size income statements provide a powerful tool for this purpose. By expressing each income statement item as a percentage of revenue, these statements facilitate the recognition of patterns and trends over time. This allows analysts to understand how a company’s financial performance is evolving and to identify potential issues or opportunities. Examining trends in key metrics like gross profit margin, operating expenses, and net income margin can reveal insights into a company’s operational efficiency, pricing strategies, and overall profitability. For example, a consistent decline in gross profit margin over several years could indicate increasing competition, rising production costs, or ineffective pricing strategies.

Consider a company that observes a steady increase in its selling, general, and administrative expenses (SG&A) as a percentage of revenue over several reporting periods. While absolute SG&A costs may appear reasonable in isolation, the upward trend revealed by the common size analysis could signal underlying inefficiencies, excessive spending, or inadequate cost control measures. This early identification allows management to investigate the drivers of this trend and take corrective action before it significantly impacts profitability. Conversely, a consistent upward trend in operating income margin could indicate successful cost-cutting initiatives, improved pricing power, or increased operational efficiency.

Effective trend identification through common size income statements allows for proactive management and informed decision-making. Recognizing negative trends early on enables timely interventions, while identifying positive trends can highlight successful strategies to be reinforced. This analysis is essential for developing accurate forecasts, setting realistic budgets, and making strategic adjustments to optimize financial performance. Failure to leverage trend identification can lead to missed opportunities, delayed responses to emerging challenges, and ultimately, suboptimal financial outcomes.

5. Benchmarking Tool

Common size income statements serve as a powerful benchmarking tool, enabling meaningful comparisons of a company’s financial performance against competitors, industry averages, and internal targets. By standardizing financial data as percentages of revenue, these statements facilitate objective assessments of relative strengths and weaknesses. Analyzing key metrics like gross profit margin, operating margin, and net income margin in a standardized format allows for direct comparisons, revealing valuable insights into a company’s competitive positioning and operational efficiency. For instance, a company with a lower gross profit margin than its competitors might indicate challenges in cost control, pricing strategies, or product differentiation. Conversely, a higher operating margin could suggest superior operational efficiency and cost management.

Consider a company operating in the retail industry. Benchmarking its performance against industry averages using common size income statements can reveal crucial information. If the company’s operating expenses as a percentage of revenue are significantly higher than the industry average, it suggests potential areas for cost optimization. This could involve streamlining operations, negotiating better supplier contracts, or improving inventory management. Similarly, if the company’s net income margin is consistently below the industry average, it might indicate issues with pricing strategies, product mix, or overall profitability. This targeted analysis allows management to identify specific areas for improvement and develop strategies to enhance competitiveness.

Effective benchmarking through common size income statements allows companies to identify best practices, set realistic performance targets, and drive continuous improvement. Understanding how a company’s financial performance stacks up against competitors and industry standards provides valuable context for strategic planning, resource allocation, and performance evaluation. This data-driven approach empowers management to make informed decisions to enhance profitability, operational efficiency, and long-term sustainability. Failure to utilize benchmarking tools can lead to complacency, missed opportunities, and a decline in competitive advantage.

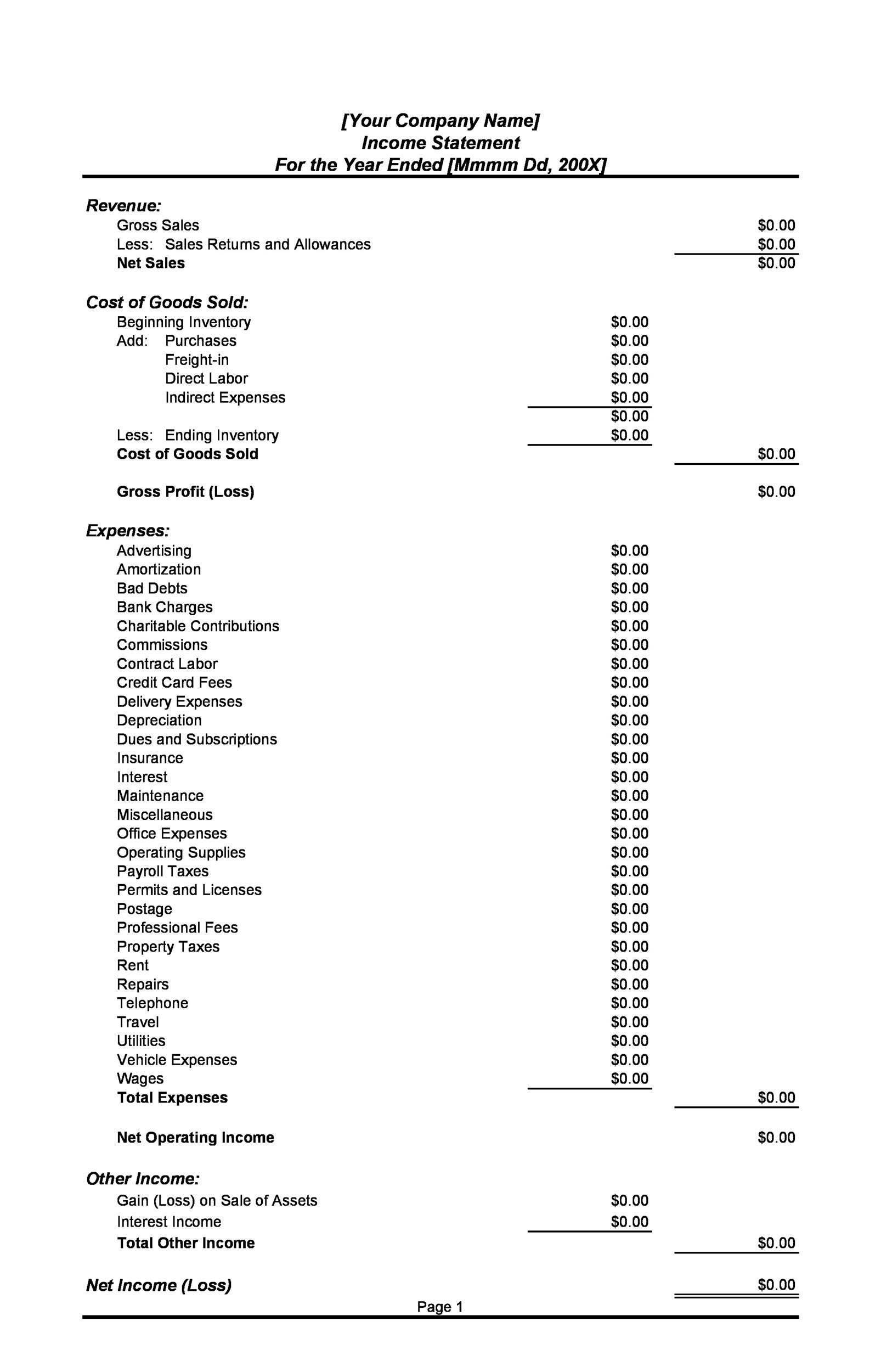

Key Components of a Standardized Income Statement

A standardized income statement, presenting all figures as percentages of revenue, relies on several key components for effective analysis and interpretation. These components provide a structured framework for understanding financial performance and facilitating comparisons.

1. Revenue: The foundation of the standardized income statement, representing the total sales or income generated during a specific period. All other items are expressed as a proportion of this figure.

2. Cost of Goods Sold (COGS): Presented as a percentage of revenue, this reveals the proportion of sales consumed by the direct costs of producing goods or services. A lower percentage generally indicates higher profitability.

3. Gross Profit: Calculated as revenue minus COGS, and expressed as a percentage of revenue. This represents the profit generated after accounting for the direct costs of production.

4. Operating Expenses: This category, encompassing expenses like selling, general, and administrative costs, is expressed as a percentage of revenue. Analyzing this component reveals the proportion of sales allocated to running the business.

5. Operating Income: Calculated as gross profit minus operating expenses, and presented as a percentage of revenue. This metric reflects the profitability of core business operations.

6. Other Income/Expenses: This component accounts for income or expenses not directly related to core operations, such as interest income or expense, and is presented as a percentage of revenue.

7. Income Before Taxes: Calculated as operating income plus/minus other income/expenses, this figure represents the company’s earnings before accounting for income tax obligations, also shown as a percentage of revenue.

8. Net Income: The final component, representing the company’s profit after all expenses and taxes, expressed as a percentage of revenue. This is a key indicator of overall profitability.

Analyzing these interconnected components, each expressed relative to revenue, provides a comprehensive understanding of financial performance, facilitates comparisons across periods or companies, and enables informed decision-making.

How to Create a Common Size Income Statement

Creating a common size income statement involves a straightforward process of converting traditional income statement figures into percentages of revenue. This standardization allows for easier analysis and comparison of financial performance.

1: Gather Financial Data: Obtain the company’s income statement for the period being analyzed. This statement should include all relevant revenue and expense items.

2: Calculate the Common Size Percentage for Each Line Item: Divide each individual line item (e.g., cost of goods sold, operating expenses, net income) by the total revenue figure. Multiply the result by 100 to express it as a percentage.

3: Present the Data in a Standardized Format: Create a new income statement format. List each line item description alongside its corresponding common size percentage. Ensure clear labeling to distinguish between absolute values and percentages.

4: Analyze and Interpret the Results: Compare the percentages across different periods or against industry benchmarks to identify trends, assess financial health, and inform strategic decision-making.

Example: If a company’s total revenue is $1,000,000 and its cost of goods sold is $600,000, the common size percentage for cost of goods sold would be calculated as ($600,000 / $1,000,000) * 100 = 60%.

This standardized approach simplifies financial analysis by providing a clear and consistent view of a company’s performance regardless of its size or the absolute values on its income statement. This facilitates more effective benchmarking, trend analysis, and informed decision-making.

Standardized income statement analysis, through expressing each component as a percentage of revenue, provides a crucial tool for understanding financial performance. This methodology facilitates clear comparisons across reporting periods, between companies of varying scales, and against industry benchmarks. The ability to identify trends in key metrics like gross profit margin, operating expenses, and net income provides valuable insights into operational efficiency, pricing strategies, and overall profitability. Leveraging this standardized approach empowers stakeholders to make data-driven decisions regarding resource allocation, strategic planning, and performance evaluation.

Adoption of this standardized analytical framework is essential for informed financial management and enhanced competitiveness. The insights gleaned from this analysis enable proactive responses to changing market conditions, identification of areas for improvement, and ultimately, the achievement of sustainable financial success. Continued utilization and refinement of these techniques will remain critical for navigating the complexities of the business landscape and driving long-term value creation.