Utilizing a pre-designed structure for this crucial report offers numerous advantages. It ensures consistency in reporting, simplifies the process of data entry and analysis, and reduces the risk of errors. A standardized format also facilitates comparisons across different accounting periods, enabling trend identification and informed forecasting. Furthermore, it promotes transparency and builds trust with stakeholders by presenting financial information in a clear and organized manner.

This overview establishes the foundation for a deeper exploration of various aspects related to constructing and interpreting these financial statements. The following sections will delve into specific components, best practices, and practical applications relevant to diverse business contexts.

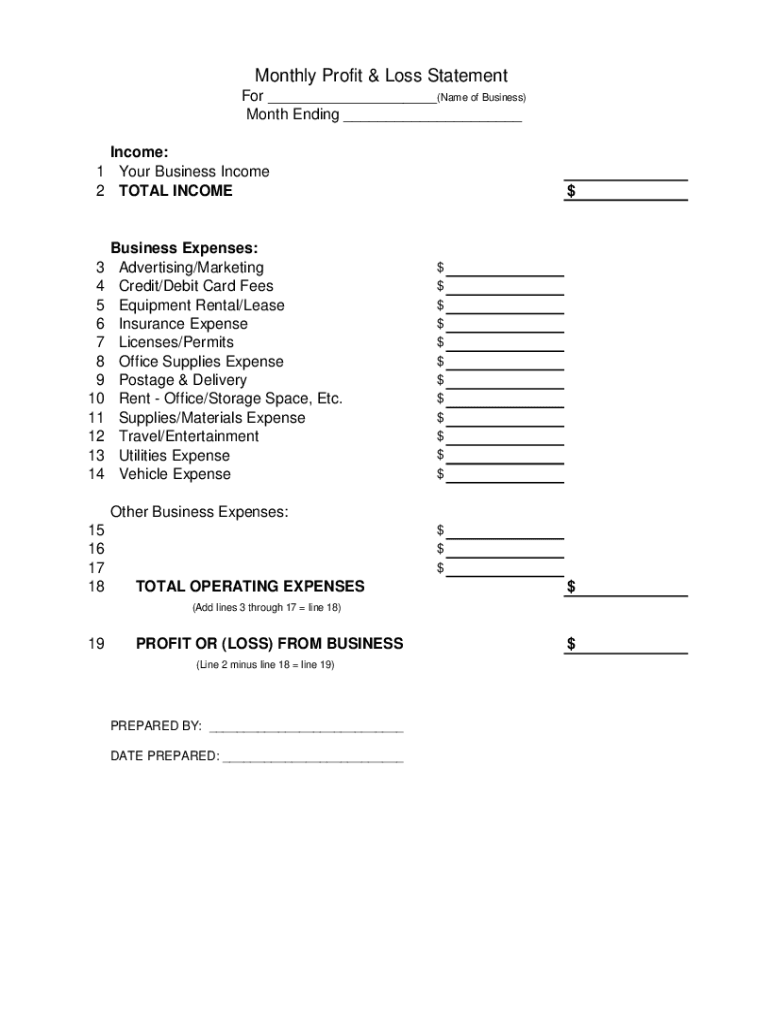

1. Standardized Format

Standardized formatting is a cornerstone of effective financial reporting, particularly within the context of profit and loss statements. A consistent structure ensures comparability across different reporting periods and facilitates analysis of financial trends. This standardization also simplifies auditing processes and reduces the likelihood of errors. Consistent placement of revenue streams, cost of goods sold, operating expenses, and net income/loss figures allows for quick identification and interpretation of key performance indicators. Without a standardized format, analyzing financial data becomes significantly more complex and time-consuming.

Consider a company that changes the presentation of its expenses each quarter. This lack of consistency makes it difficult to track changes in operating costs and identify potential inefficiencies. Conversely, a company that adheres to a standardized format can readily compare performance quarter-over-quarter or year-over-year, enabling data-driven decisions regarding resource allocation and cost management. This standardized approach also simplifies external analysis by investors and creditors, fostering transparency and trust. For instance, consistent reporting of earnings before interest, taxes, depreciation, and amortization (EBITDA) allows for straightforward comparison with industry benchmarks and competitor performance.

In conclusion, adhering to a standardized format is not merely a matter of aesthetic preference; it is a critical element ensuring the accuracy, interpretability, and comparability of financial data within a profit and loss statement. This consistency empowers both internal management and external stakeholders to make informed decisions based on reliable financial information. Challenges arise when standardization is neglected, potentially leading to misinterpretations, inefficiencies in analysis, and compromised trust in the reported financial performance.

2. Revenue Streams

Revenue streams represent the various sources of income generated by a business. Within the context of a profit and loss statement template, accurate and detailed reporting of these streams is crucial for understanding financial performance. A well-structured template facilitates the categorization and analysis of different revenue sources, enabling informed decision-making regarding resource allocation and strategic planning. For instance, a software company might categorize revenue streams by product subscriptions, licensing fees, and professional services. This granular approach allows for assessment of the performance of individual offerings and identification of growth opportunities. Conversely, an e-commerce business might categorize revenue by product categories, geographic regions, or sales channels. This segmented approach can reveal insights into customer behavior, market trends, and the effectiveness of various marketing strategies.

The cause-and-effect relationship between revenue streams and overall profitability is evident within the profit and loss statement. Increases in revenue, assuming costs remain stable or decrease, directly contribute to higher profits. Conversely, declines in revenue can negatively impact profitability. Understanding the composition of revenue streams is crucial for identifying potential vulnerabilities and mitigating risks. For example, a business heavily reliant on a single product or customer segment faces greater risk than a business with diversified revenue sources. Analyzing the relative contribution of each revenue stream to the overall total provides valuable insights into the stability and sustainability of the business model.

In conclusion, a comprehensive understanding of revenue streams is essential for accurate financial reporting and informed decision-making. A company profit and loss statement template provides the framework for organizing and analyzing these streams, enabling businesses to identify growth opportunities, manage risks, and optimize resource allocation. Challenges arise when revenue streams are not accurately categorized or analyzed, potentially leading to misinformed strategic decisions and an incomplete understanding of overall financial health. Accurately representing revenue streams allows stakeholders to gauge the current and future financial health of the organization, contributing to informed investment decisions and effective internal management strategies.

3. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a profit and loss statement template, COGS plays a crucial role in determining gross profit, a key indicator of operational efficiency and profitability. Accurate calculation and reporting of COGS are essential for understanding the relationship between production costs, revenue, and overall financial performance.

- Direct Material CostsThese costs encompass the raw materials used in the production process. For a furniture manufacturer, this would include the cost of wood, fabric, and hardware. Accurate tracking of these costs is crucial for determining the true cost of production and setting appropriate pricing strategies. Within the profit and loss statement, these costs directly impact gross profit margins, influencing profitability assessments.

- Direct Labor CostsDirect labor costs represent the wages and benefits paid to employees directly involved in production. In the furniture manufacturing example, this would include the wages of carpenters, upholsterers, and assembly line workers. These costs are sensitive to labor market conditions and can significantly impact COGS, particularly in labor-intensive industries. Effective management of direct labor costs is essential for maintaining healthy profit margins.

- Manufacturing OverheadThis category includes all other costs directly associated with the production process, such as factory rent, utilities, and depreciation of manufacturing equipment. While not directly tied to specific units of production, these costs are essential for the manufacturing process and must be accurately allocated to determine the full cost of goods sold. Analysis of manufacturing overhead can reveal opportunities for cost optimization and efficiency improvements.

- Inventory ValuationThe method used to value inventory (e.g., FIFO, LIFO, weighted average) directly impacts the reported COGS. Changes in inventory valuation methods can affect profitability metrics and should be disclosed within the financial statements. Understanding the chosen inventory valuation method is crucial for accurate interpretation of COGS and its impact on the overall financial performance reflected in the profit and loss statement.

Accurate COGS calculation is fundamental to a reliable profit and loss statement. By understanding the components of COGS and their relationship to other elements within the statement, such as revenue and gross profit, businesses can gain valuable insights into their operational efficiency, pricing strategies, and overall profitability. Misrepresentation or inaccurate calculation of COGS can lead to distorted profitability metrics and misinformed business decisions. Therefore, meticulous attention to detail and consistent application of accounting principles are essential for generating a reliable and informative profit and loss statement. This accuracy provides stakeholders with a clear picture of the financial health of the organization, informing investment decisions and strategic planning.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within a profit and loss statement template, operating expenses are a crucial component for determining a company’s operating income and ultimately, net income. Accurate categorization and reporting of these expenses are essential for assessing operational efficiency and profitability.

Several categories comprise operating expenses. Selling, General, and Administrative Expenses (SG&A) include salaries of administrative staff, marketing and advertising costs, rent, utilities, and office supplies. For example, a retail company’s SG&A might include the salaries of store managers, advertising campaigns, and lease payments for retail space. Research and Development (R&D) expenses cover costs associated with developing new products or services, such as salaries of research scientists and laboratory equipment. A pharmaceutical company, for instance, would typically have significant R&D expenditures. Other operating expenses may include depreciation and amortization of assets, legal fees, and bad debt expenses. Accurately classifying these expenses is crucial for evaluating performance and making informed decisions.

The relationship between operating expenses and profitability is inversely proportional. Higher operating expenses, assuming revenue remains constant, lead to lower operating income and net income. Conversely, effective management and reduction of operating expenses can significantly improve profitability. Analyzing operating expenses as a percentage of revenue provides valuable insights into cost control and efficiency. A company with consistently high operating expenses relative to revenue may need to implement cost-cutting measures or improve operational efficiency to enhance profitability. Understanding this relationship is critical for evaluating a company’s financial health and making strategic decisions about resource allocation and growth strategies. Misrepresenting or inaccurately reporting operating expenses can lead to a distorted picture of profitability and hinder effective decision-making.

5. Net Income/Loss Calculation

Net income/loss, often referred to as the “bottom line,” represents the ultimate measure of a company’s profitability over a specific period. Within the context of a profit and loss statement template, it is the culminating figure derived from the interplay of revenues, cost of goods sold (COGS), and operating expenses. The calculation itself is straightforward: Net Income = (Total Revenues – COGS) – Operating Expenses. This resulting figure signifies the residual earnings after all expenses have been deducted from revenue. A positive net income indicates profitability, while a negative figure signifies a net loss. This calculation is fundamental to understanding a company’s financial performance and informs crucial decisions regarding resource allocation, investment strategies, and future operational planning.

The importance of net income/loss calculation as a component of a profit and loss statement template cannot be overstated. It provides a concise summary of a company’s financial health, reflecting the effectiveness of its operational strategies and its ability to generate profit. Consider a manufacturing company that reports high revenues. However, if the COGS and operating expenses are also proportionally high, the resulting net income might be minimal or even negative. This scenario highlights the importance of considering all elements of the profit and loss statement, not just top-line revenue. Conversely, a company with moderate revenue but excellent cost control might exhibit a healthy net income, demonstrating the impact of efficient operations on overall profitability. Investors and creditors rely heavily on net income figures to assess a company’s financial viability and its potential for future growth. Internal management uses this figure to evaluate performance, identify areas for improvement, and make informed decisions about future investments and strategic initiatives.

Accurate and reliable net income/loss calculation is paramount for informed decision-making by both internal and external stakeholders. Challenges arise when any of the contributing factors revenues, COGS, or operating expenses are misrepresented or inaccurately calculated. Such inaccuracies can lead to a distorted view of a company’s financial health, potentially resulting in misguided investments, unsustainable operational practices, and compromised financial stability. Therefore, meticulous attention to detail, adherence to accounting principles, and consistent application of the chosen profit and loss statement template are crucial for generating a trustworthy and informative financial statement. This accuracy fosters transparency, builds stakeholder confidence, and provides the foundation for sound financial decision-making.

6. Time Period Specification

Time period specification is a crucial element within a company profit and loss statement template. Defining a specific timeframe, whether it’s a month, quarter, or year, provides the necessary context for interpreting the financial data presented. This specification allows for analysis of performance trends, identification of seasonal patterns, and comparison with previous periods. Without a clearly defined time period, the financial figures lack meaning and become practically useless for analysis and decision-making. The choice of time period influences the insights derived. For instance, a monthly profit and loss statement offers a granular view of short-term performance, useful for tracking sales cycles and managing cash flow. A quarterly statement provides a broader perspective, enabling assessment of progress towards strategic goals. An annual statement presents a comprehensive overview of the entire fiscal year’s performance, suitable for evaluating long-term trends and making strategic adjustments.

Consider a retail business experiencing fluctuating sales throughout the year. Analyzing monthly profit and loss statements reveals peak sales periods, perhaps coinciding with holidays or promotional campaigns. This information informs inventory management decisions, ensuring sufficient stock during peak demand while minimizing storage costs during slower periods. Conversely, analyzing annual profit and loss statements for the same business provides a holistic view of overall profitability, independent of short-term fluctuations. This broader perspective facilitates long-term planning, investment decisions, and assessment of overall financial health. Furthermore, comparing current period performance with corresponding periods from previous years allows for identification of growth trends, detection of potential issues, and informed forecasting. For example, consistent declines in quarterly profits over several years might signal underlying operational problems requiring immediate attention. Conversely, consistent annual profit growth indicates a healthy and sustainable business trajectory.

In conclusion, accurate time period specification is essential for the effective utilization of a company profit and loss statement template. It provides the temporal context necessary for meaningful interpretation of financial data, enabling trend analysis, performance evaluation, and informed decision-making. Challenges arise when time periods are not clearly defined or when comparisons are made across inconsistent timeframes. Such inconsistencies can lead to misinterpretations of financial performance and hinder the ability to make sound strategic decisions. Therefore, meticulous attention to time period specification is crucial for generating a reliable, informative, and actionable profit and loss statement. This accuracy ensures that stakeholders can accurately assess the company’s financial performance within the relevant timeframe, facilitating informed decisions and strategic planning.

Key Components of a Profit and Loss Statement Template

A profit and loss statement template provides a structured framework for reporting financial performance. Understanding its key components is essential for accurate reporting and analysis.

1. Revenue: This section details all income generated from sales of goods or services. It may be further categorized by product line, geographic region, or other relevant segments. Accurate revenue reporting is fundamental to assessing overall financial performance.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit and assessing production efficiency.

3. Gross Profit: Calculated as Revenue – COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. This metric is essential for evaluating the profitability of products or services.

4. Operating Expenses: These expenses encompass costs associated with running the business, including selling, general, and administrative expenses (SG&A), research and development (R&D), and other operational costs. Careful management of operating expenses is crucial for maximizing profitability.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income reflects the profitability of core business operations after accounting for all operating costs. This figure provides a clear view of operational efficiency.

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time charges. Including these items provides a comprehensive picture of financial performance.

7. Income Before Taxes: This figure represents the company’s earnings before accounting for income tax expense. It provides a measure of profitability before the impact of tax regulations.

8. Net Income: Calculated as Income Before Taxes – Income Tax Expense, net income is the “bottom line” the ultimate measure of profitability after all expenses and taxes have been deducted. This figure is crucial for evaluating overall financial performance and informing strategic decisions.

These components work together to provide a comprehensive overview of a company’s financial performance. Accurate data entry and consistent application of accounting principles are critical for generating a reliable and informative profit and loss statement.

How to Create a Company Profit and Loss Statement Template

Creating a robust template ensures consistent and accurate financial reporting. The following steps outline the process of developing a comprehensive template.

1. Define the Reporting Period: Specify the timeframe covered by the statement (e.g., month, quarter, year). This establishes the temporal context for the financial data.

2. Structure the Revenue Section: Categorize revenue streams based on relevant criteria (e.g., product lines, service types, geographic regions). This facilitates analysis of revenue sources and identification of growth opportunities.

3. Detail the Cost of Goods Sold (COGS) Section: Include categories for direct materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

4. Outline Operating Expenses: Categorize operating expenses into relevant groups, such as Selling, General, and Administrative (SG&A), Research and Development (R&D), and other operational costs. This detailed breakdown facilitates cost management and analysis.

5. Calculate Gross Profit and Operating Income: Deduct COGS from Revenue to arrive at Gross Profit. Subtract Operating Expenses from Gross Profit to calculate Operating Income. These metrics provide insights into core business profitability.

6. Incorporate Other Income and Expenses: Account for non-operational income and expenses, such as interest income, investment gains/losses, and extraordinary items. This provides a comprehensive view of financial performance.

7. Include Income Tax Expense: Deduct income tax expense from income before taxes to arrive at net income. This reflects the impact of tax obligations on profitability.

8. Calculate Net Income/Loss: The final calculation, net income or loss, represents the overall profitability after all revenues and expenses have been considered. This “bottom line” figure is a key indicator of financial health.

9. Format for Clarity and Consistency: Employ clear labels, consistent formatting, and logical organization to ensure readability and facilitate analysis. Consider using a tabular format for easy visual comparison across periods.

A well-designed template ensures consistency, accuracy, and comparability in financial reporting, enabling informed decision-making and effective communication with stakeholders. Regular review and adaptation of the template to evolving business needs contribute to its ongoing effectiveness.

Profit and loss statement templates provide a crucial framework for understanding financial performance. From revenue streams and cost of goods sold to operating expenses and net income calculation, each component contributes to a comprehensive overview of an organization’s financial health. Standardized templates ensure consistency, accuracy, and comparability in reporting, enabling effective analysis, informed decision-making, and transparent communication with stakeholders. Developing a well-structured template and adhering to sound accounting principles are essential for generating reliable financial statements that reflect the true financial position of a company.

Effective utilization of these templates empowers organizations to navigate the complexities of financial reporting, identify areas for improvement, and make data-driven decisions to achieve sustainable growth and profitability. Regular review and adaptation of templates to evolving business needs and accounting standards ensure their continued relevance and effectiveness in providing valuable insights into financial performance. This ongoing process of refinement and analysis positions organizations for long-term success in a dynamic and competitive business environment.