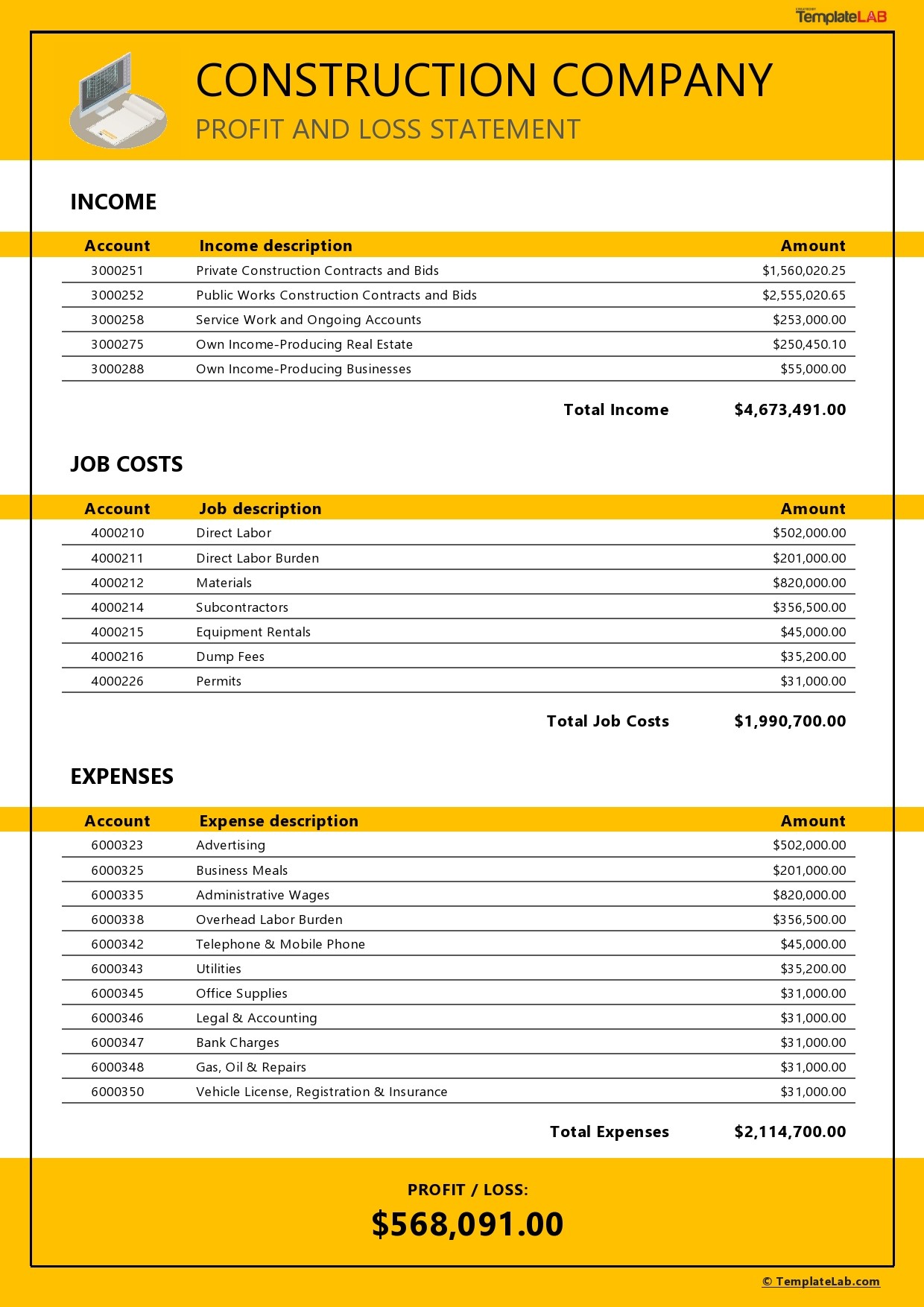

Utilizing such a standardized structure allows for accurate tracking of project profitability, insightful comparisons against past performance and industry benchmarks, and informed decision-making regarding future projects and overall business strategy. This structured approach facilitates efficient financial management, improves transparency for stakeholders, and strengthens the foundation for securing financing or attracting investors.

The following sections will delve deeper into the key components of this essential financial tool, exploring practical applications and offering guidance on its effective implementation within a construction business.

1. Revenue Recognition

Revenue recognition within a construction company income statement template presents unique challenges due to the long-term nature of projects. Unlike businesses with immediate sales cycles, construction companies must accurately reflect the ongoing progress of projects. The chosen method, often the percentage-of-completion method, directly impacts the reported financial performance. This method ties revenue recognition to measurable milestones, ensuring that reported income aligns with the actual work completed. For example, a company constructing a bridge might recognize 25% of the total project revenue upon completing the foundation, another 25% upon completing the main structure, and so forth. Accurately applying this method requires meticulous tracking of costs, labor, and materials used in each phase. Inaccurate revenue recognition can misrepresent the company’s financial position and lead to poor decision-making.

Consider a scenario where a company prematurely recognizes revenue for a project experiencing unforeseen delays. This overstatement of income can create a misleading picture of financial health, potentially impacting investor confidence and leading to unsustainable dividend payouts or overly ambitious expansion plans. Conversely, understating revenue can unnecessarily limit access to financing and hinder growth opportunities. The complexity of construction projects necessitates rigorous adherence to accounting standards specific to long-term contracts. This ensures transparency and provides stakeholders with a reliable assessment of financial performance.

Accurate revenue recognition serves as a cornerstone of a reliable construction company income statement. Its proper application, aligned with industry best practices and relevant accounting standards, provides essential insights into project profitability, overall company performance, and long-term financial sustainability. Understanding this intricate relationship empowers stakeholders to make informed decisions and navigate the complexities of the construction industry.

2. Cost of Goods Sold

Within the framework of a construction company income statement template, Cost of Goods Sold (COGS) represents the direct costs associated with completing construction projects. Accurate COGS calculation is crucial for determining gross profit and ultimately, net income. A detailed understanding of its components provides valuable insights into project efficiency and overall financial performance.

- Direct MaterialsThis encompasses all materials incorporated into the final product, such as lumber, concrete, steel, and fixtures. Tracking material costs requires meticulous inventory management and precise documentation of usage per project. For instance, a company constructing a residential building would include the cost of framing lumber, roofing shingles, and plumbing pipes within direct materials. Overestimating or underestimating these costs can significantly skew profitability calculations and impact bidding strategies for future projects.

- Direct LaborDirect labor costs comprise the wages, benefits, and payroll taxes paid to employees directly involved in construction activities. This includes carpenters, electricians, plumbers, and other on-site personnel. Accurately allocating labor costs to specific projects necessitates robust timekeeping systems. For example, the hours a carpenter spends working on a specific house renovation are categorized as direct labor for that project. Precise labor cost allocation is essential for accurate project costing and informs decisions regarding labor productivity and resource allocation.

- Equipment CostsThis category includes expenses related to equipment used directly in construction, such as depreciation of heavy machinery, fuel costs, and maintenance expenses. Allocating these costs accurately requires tracking equipment usage per project. For example, the operating hours of an excavator used for site preparation are allocated to that specific projects COGS. Accurate equipment cost allocation enhances cost control measures and contributes to realistic project budgeting.

- Subcontractor CostsWhen specialized tasks are outsourced, the fees paid to subcontractors are included in COGS. This encompasses services such as plumbing, electrical work, and specialized installations. Maintaining clear agreements and invoices with subcontractors is essential for accurate cost tracking. For a commercial building project, payments to a plumbing subcontractor would be part of the project’s COGS. This ensures a complete picture of project costs, facilitating more effective cost management.

Accurately calculating COGS within a construction company income statement template allows for a realistic assessment of project profitability and informs strategic decision-making. By understanding and meticulously tracking each componentdirect materials, direct labor, equipment costs, and subcontractor costsconstruction companies gain valuable insights into their financial health, enabling data-driven decisions regarding pricing, resource allocation, and overall business strategy.

3. Gross Profit

Gross profit, a key component of a construction company income statement template, represents the financial gain remaining after deducting direct costsCost of Goods Sold (COGS)from project revenues. This metric provides a crucial assessment of project efficiency and pricing strategies. The relationship between gross profit and the income statement is fundamental, offering insights into a company’s ability to manage direct costs effectively. A healthy gross profit margin indicates efficient resource allocation and effective cost control measures. Consider a scenario where two construction companies complete similar projects with identical revenue. The company with a higher gross profit indicates superior cost management practices, translating to greater profitability.

Several factors influence a construction company’s gross profit. Accurate bidding practices, which reflect realistic cost estimations and competitive market pricing, play a vital role. Effective project management, encompassing efficient scheduling, resource allocation, and cost control, directly impacts gross profit. Material procurement strategies, focusing on cost-effective sourcing without compromising quality, also contribute to a healthy margin. For instance, a company negotiating favorable bulk discounts on lumber can significantly improve its gross profit compared to a competitor paying higher prices. Subcontractor management, ensuring competitive pricing and performance, is another critical factor. Choosing a less efficient, more expensive subcontractor can erode gross profit margins.

Analyzing gross profit within the context of a construction company income statement template provides critical insights into financial health and operational efficiency. Regular monitoring of this metric allows management to identify potential cost overruns, evaluate pricing strategies, and implement corrective measures to enhance profitability. Furthermore, comparing gross profit margins against industry benchmarks provides valuable context and informs strategic decision-making for future projects. Consistent attention to gross profit contributes to long-term financial stability and sustainable growth within the competitive construction landscape.

4. Operating Expenses

Operating expenses represent the indirect costs incurred in running a construction business, distinct from the direct costs associated with individual projects. Within a construction company income statement template, these expenses are subtracted from gross profit to arrive at net income. Careful management and analysis of operating expenses are essential for sustained profitability and informed financial decision-making.

- Administrative and Office ExpensesThese costs encompass essential administrative functions, including salaries of office staff, rent, utilities, office supplies, and communication expenses. For example, rent for the company’s headquarters, salaries for administrative assistants, and internet service fees all fall under this category. Efficient management of these expenses is critical for maintaining overall profitability. Uncontrolled administrative costs can significantly reduce net income, even with successful project execution.

- Sales and Marketing ExpensesExpenses related to business development and marketing activities, such as advertising, promotional materials, and salaries of sales personnel, are categorized here. For instance, the cost of online advertising campaigns, printed brochures, or salaries for business development managers are included. Effective sales and marketing strategies are crucial for securing new projects, but careful budget management is essential to ensure these activities contribute positively to the bottom line.

- Insurance and Legal ExpensesThis category includes premiums for various insurance policies, such as general liability, workers’ compensation, and property insurance, as well as legal fees. For example, annual premiums for liability insurance and legal fees for contract negotiations are considered operating expenses. Adequate insurance coverage and legal counsel are vital for risk management, but these costs must be carefully monitored and managed to ensure they align with the company’s financial goals.

- Depreciation and AmortizationThis accounts for the decrease in value of assets over time. Depreciation applies to tangible assets like vehicles and equipment, while amortization applies to intangible assets like software licenses. For example, the annual depreciation of a company-owned truck used for transporting materials is an operating expense. Accurately accounting for depreciation and amortization provides a realistic picture of asset values and their impact on profitability over time.

Understanding and managing these operating expenses within the framework of a construction company income statement template provides essential insights into overall financial performance. By analyzing these costs in relation to revenue and gross profit, construction companies can identify areas for potential cost optimization, improve budgeting practices, and ultimately enhance profitability. This detailed analysis empowers informed decision-making, supporting long-term financial stability and sustainable growth.

5. Net Income

Net income, the ultimate measure of profitability, represents the financial gain remaining after all expenses, both direct and indirect, are subtracted from total revenues. Within a construction company income statement template, net income occupies a crucial position, providing a comprehensive overview of financial performance over a specific period. This bottom-line figure serves as a key indicator of a company’s financial health and its ability to generate profit after covering all costs associated with operations.

- Profitability AssessmentNet income provides a direct measure of a company’s profitability. A positive net income indicates that the company’s revenues exceed its total expenses, generating profit. Conversely, a negative net income, or net loss, signals that expenses outweigh revenues. This assessment of profitability is crucial for evaluating the financial sustainability of the business. For example, a construction company consistently reporting positive net income demonstrates its ability to manage costs and generate profit from its projects, signifying financial strength.

- Impact of Revenue and ExpensesNet income is directly influenced by both revenue generation and cost management. Increases in revenue, assuming expenses remain constant or decrease, contribute to higher net income. Effective cost control measures, even with stable or slightly decreased revenue, can also positively impact net income. For instance, a construction company successfully negotiating lower material costs can improve net income even if project revenue remains consistent. Analyzing the interplay between revenue and expenses provides valuable insights into operational efficiency and financial performance.

- Financial Health IndicatorNet income serves as a crucial indicator of a company’s overall financial health. Consistently positive and growing net income reflects strong financial performance and sustainable growth potential. This positive trajectory can attract investors, enhance access to financing, and contribute to a positive brand reputation. Conversely, declining or consistently negative net income can signal financial distress, potentially hindering access to capital and impacting investor confidence.

- Basis for Financial RatiosNet income forms the basis for calculating key financial ratios, such as profit margin and return on equity. These ratios provide deeper insights into a company’s financial performance and are often used by investors and lenders to assess financial stability and growth potential. A high profit margin, calculated by dividing net income by revenue, indicates strong profitability. Consistently strong net income figures contribute to favorable financial ratios, which enhance a company’s attractiveness to investors and lenders.

Within the context of a construction company income statement template, net income provides a crucial summary of financial performance. Analyzing net income trends over time, in conjunction with other financial metrics, provides valuable insights for strategic decision-making, financial planning, and overall assessment of a construction company’s long-term sustainability and success. This holistic understanding of net income and its implications empowers stakeholders to make informed decisions, optimize financial strategies, and navigate the dynamic landscape of the construction industry.

Key Components of a Construction Company Income Statement Template

A well-structured income statement template tailored for the construction industry provides crucial insights into financial performance. Understanding its key components is essential for effective financial management and informed decision-making.

1. Project Revenue: This section details income generated from completed projects and work in progress, often utilizing the percentage-of-completion method to recognize revenue based on project milestones.

2. Direct Costs (Cost of Goods Sold): This encompasses all direct costs related to project execution, including materials, labor, equipment, and subcontractor expenses. Accurate tracking of these costs is vital for determining gross profit.

3. Gross Profit: Calculated as project revenue less direct costs, gross profit reflects the profitability of core construction activities. Analyzing gross profit margins helps assess project efficiency and pricing strategies.

4. Indirect Costs (Operating Expenses): These are expenses not directly tied to specific projects but essential for running the business. Examples include administrative overhead, marketing and sales costs, insurance, and depreciation.

5. Operating Income: This represents the profit generated from core business operations after deducting both direct and indirect costs. It reflects the company’s profitability before considering non-operating income and expenses.

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core construction activities, such as interest income, gains or losses from asset sales, or one-time extraordinary items.

7. Net Income: This bottom-line figure represents the final profit or loss after considering all revenues and expenses. Net income is a key indicator of overall financial performance and sustainability.

Careful analysis of these components within a construction company income statement template provides a comprehensive understanding of financial health, enabling informed decisions regarding project management, cost control, and overall business strategy. This structured approach facilitates effective financial planning and contributes to long-term success in the construction industry.

How to Create a Construction Company Income Statement Template

Creating a tailored income statement template requires careful consideration of the specific needs of a construction business. A well-structured template facilitates accurate financial reporting and informed decision-making. The following steps outline the process.

1. Define Reporting Period: Specify the timeframe covered by the income statement, whether monthly, quarterly, or annually. Consistent reporting periods allow for accurate tracking of financial performance over time.

2. Structure Revenue Section: Organize revenue recognition by project, clearly identifying completed projects and work in progress. Implement the percentage-of-completion method for ongoing projects, accurately reflecting earned revenue based on measurable milestones.

3. Categorize Direct Costs: Establish clear categories for direct costs (Cost of Goods Sold), including materials, labor, equipment, and subcontractor expenses. Detailed tracking within each category enables precise calculation of gross profit and identification of potential cost overruns.

4. Itemize Indirect Costs: Create a comprehensive list of indirect costs (Operating Expenses), encompassing administrative overhead, sales and marketing expenses, insurance, depreciation, and other general business expenses. Accurate categorization facilitates analysis of overhead costs and their impact on profitability.

5. Calculate Gross and Operating Profit: Calculate gross profit by subtracting direct costs from revenues. Then, calculate operating income by subtracting indirect costs from gross profit. These calculations provide essential insights into the profitability of core construction activities and overall operational efficiency.

6. Account for Other Income/Expenses: Include a section for other income and expenses not directly related to core operations, such as interest income, gains or losses from asset sales, or one-time events. This ensures a complete and accurate representation of the company’s financial performance.

7. Determine Net Income: Calculate net income by adding other income and subtracting other expenses from operating income. This bottom-line figure provides the ultimate measure of profitability, reflecting the company’s financial performance after all revenues and expenses are considered.

8. Format for Clarity: Present the information in a clear, organized format. Use headings and subheadings to delineate sections, ensuring readability and ease of interpretation. Consistent formatting enhances transparency and facilitates comparison across different reporting periods.

A well-designed construction company income statement template provides a structured overview of financial performance, enabling informed decision-making, accurate cost management, and effective financial planning. Consistent use of a tailored template contributes to long-term financial stability and success within the dynamic construction industry.

Effective financial management within the construction industry necessitates a thorough understanding and diligent application of specialized income statement templates. These structured reports provide essential insights into project profitability, cost management effectiveness, and overall financial health. From revenue recognition principles tailored to long-term projects to meticulous tracking of direct and indirect costs, each component contributes to a comprehensive financial overview. Analyzing gross profit margins, operating expenses, and ultimately, net income, allows for data-driven decision-making, informing strategic adjustments to project execution, resource allocation, and overall business strategy.

Accurate and consistent utilization of construction-specific income statement templates empowers stakeholders to navigate the complexities of the industry’s financial landscape. This proactive approach to financial management fosters informed decisions, enhances transparency, and strengthens the foundation for long-term stability and sustainable growth within the competitive construction market. Leveraging these financial insights provides a critical advantage in achieving financial objectives and navigating the dynamic challenges inherent in the construction industry.