Utilizing such a report allows construction businesses to track project profitability, identify areas of overspending, and make informed decisions regarding future projects and overall business strategy. This structured financial overview facilitates better cost management, improved bidding accuracy, and informed financial forecasting, which are essential for long-term success in the construction industry. It also provides crucial information for securing loans, attracting investors, and fulfilling tax obligations.

The following sections will delve deeper into the specific components of a construction-focused financial report, offering practical guidance on its creation and interpretation. Key areas of focus include revenue recognition methods appropriate for construction projects, cost allocation strategies, and the analysis of key performance indicators derived from the report.

1. Revenue Recognition

Revenue recognition plays a crucial role in accurately portraying the financial performance of construction companies. Unlike other industries where revenue is typically recognized upon product delivery or service completion, construction projects often span extended periods. Therefore, applying standard revenue recognition principles can misrepresent a company’s financial health. The percentage-of-completion method, a core component of a construction-specific profit and loss statement, addresses this challenge. This method allows revenue and associated costs to be recognized proportionally as a project progresses, based on measurable milestones or estimated completion percentages. This provides a more realistic view of a company’s financial standing throughout the project lifecycle.

Consider a two-year construction project with a total contract value of $2 million. Recognizing the entire revenue only upon completion would not reflect the ongoing work and value created during the project’s duration. Using the percentage-of-completion method, if the project is estimated to be 40% complete at the end of the first year, $800,000 in revenue (40% of $2 million) would be recognized in the first year’s profit and loss statement. This accurately represents the work performed and value delivered during that period. This practice is vital for stakeholders to understand the true financial position of the company and make informed decisions. It also helps to align financial reporting with the actual progress of the construction project.

Accurate revenue recognition, particularly through the percentage-of-completion method, is indispensable for generating reliable financial statements in the construction industry. This directly impacts the credibility and usefulness of the profit and loss statement, providing stakeholders with a transparent and accurate picture of financial progress. Challenges may arise in estimating the percentage of completion accurately, requiring careful cost tracking, progress monitoring, and professional judgment. However, mastering this aspect is crucial for sound financial management, informed decision-making, and sustained success in the construction business.

2. Direct Costs

Direct costs represent a critical component of a construction company profit and loss statement template. These costs are directly attributable to specific projects and provide essential insights into project profitability and overall financial performance. Accurately categorizing and tracking direct costs is fundamental for informed decision-making regarding pricing, resource allocation, and project management. A clear understanding of these costs allows construction companies to monitor project budgets effectively and identify potential cost overruns early on.

Examples of direct costs within the construction industry include:

- Materials: Concrete, lumber, steel, fixtures, and other physical components used in construction.

- Labor: Wages paid to construction workers directly involved in project execution, including carpenters, electricians, and plumbers.

- Equipment: Costs associated with operating or renting heavy machinery and specialized equipment required for the project.

- Subcontractor Costs: Payments made to specialized subcontractors engaged for specific tasks within the project.

Failing to accurately account for direct costs can lead to underestimation of project expenses, potentially impacting profitability and long-term financial stability. For example, if the cost of lumber for a housing project is underestimated, the actual profit margin may be significantly lower than projected, potentially leading to financial difficulties. Conversely, accurately tracking these costs allows construction companies to identify areas for potential cost savings and improve bidding accuracy on future projects.

Precisely capturing and analyzing direct costs within the profit and loss statement is essential for financial control and informed strategic planning in the construction industry. This detailed cost breakdown allows companies to assess the financial viability of projects, optimize resource allocation, and implement cost-saving measures where necessary. The insights gained from analyzing direct costs ultimately contribute to improved profitability, sustainable growth, and enhanced competitiveness within the construction market.

3. Indirect Costs

Indirect costs, while not directly tied to specific projects, constitute a significant portion of expenses within a construction company profit and loss statement template. These overhead costs are essential for business operations and must be carefully managed to maintain profitability. Understanding the composition and impact of indirect costs is crucial for accurate financial reporting, informed decision-making, and effective resource allocation. These costs are typically allocated across multiple projects based on predetermined methods, such as a percentage of direct costs, labor hours, or a combination of factors.

Typical indirect costs in a construction company include:

- Salaries of administrative staff: Including office managers, accountants, and human resources personnel.

- Rent and utilities for office space: Essential operational expenses not directly linked to a single project.

- Insurance premiums: Covering general liability, property damage, and worker’s compensation.

- Marketing and advertising expenses: Costs associated with promoting the company and securing new projects.

- Depreciation of office equipment and vehicles: Accounting for the decrease in value of these assets over time.

For example, a company’s administrative salaries remain relatively constant regardless of the number or size of projects underway. These costs must be factored into the overall financial picture, even if they cannot be attributed to a specific project. Failing to accurately account for indirect costs can lead to an inaccurate representation of project profitability and potentially unsustainable business practices. Allocating indirect costs proportionally across projects allows for a more comprehensive understanding of true project costs and overall company profitability.

Accurate accounting and strategic management of indirect costs are pivotal for long-term financial health and effective decision-making in the construction industry. By analyzing trends in indirect costs, companies can identify areas for potential cost optimization and improve resource allocation. This understanding also contributes to more accurate bidding on future projects, ensuring competitive pricing while maintaining healthy profit margins. Regular review and analysis of indirect costs within the profit and loss statement allows for informed adjustments to overhead spending, contributing to sustained profitability and competitive advantage in the construction market.

4. Gross Profit

Gross profit serves as a key performance indicator within a construction company profit and loss statement template, revealing the profitability of projects before accounting for overhead expenses. This metric represents the revenue remaining after deducting the direct costs associated with project completion. Analyzing gross profit provides crucial insights into pricing strategies, cost management effectiveness, and the overall financial health of individual projects and the company as a whole. It forms the foundation for calculating net profit and plays a crucial role in assessing the financial viability and sustainability of the construction business.

- Calculation and InterpretationGross profit is calculated by subtracting direct costs (materials, labor, direct project equipment, and subcontractor costs) from project revenue. A higher gross profit margin generally indicates efficient cost management and effective project execution. For example, if a project generates $1 million in revenue and incurs $700,000 in direct costs, the gross profit is $300,000, representing a 30% gross profit margin. This margin allows for coverage of indirect costs and ultimately contributes to net profit. Monitoring gross profit trends helps identify potential issues in cost control or pricing strategies.

- Impact of Direct CostsDirect cost fluctuations directly impact gross profit. Increases in material prices, labor rates, or subcontractor fees can erode gross profit margins if not offset by adjustments in project pricing or cost-saving measures. Conversely, effective negotiation with suppliers, optimized labor utilization, and efficient project management can contribute to higher gross profit. Accurately tracking and analyzing direct costs within the profit and loss statement allows for informed decisions regarding resource allocation and cost control strategies.

- Relationship with Pricing StrategiesGross profit targets influence project bidding and pricing decisions. Construction companies typically establish desired gross profit margins based on historical data, market conditions, and project complexity. These target margins are factored into project bids to ensure adequate profitability. For example, if a company aims for a 25% gross profit margin, a project estimated to incur $800,000 in direct costs would be priced at $1,066,667 to achieve the desired margin. Balancing competitive pricing with desired profitability is crucial for securing projects and maintaining financial health.

- Indicator of Project HealthGross profit serves as an early indicator of project health. Consistently low or declining gross profit margins on a specific project may signal issues in cost control, inaccurate estimations, or unforeseen challenges. Monitoring gross profit throughout the project lifecycle enables timely intervention, corrective actions, and adjustments to mitigate potential losses. This proactive approach is critical for maintaining profitability and ensuring successful project completion.

Analyzing gross profit within the construction company profit and loss statement template provides essential insights into project performance, pricing effectiveness, and overall financial health. By understanding the factors influencing gross profit and regularly monitoring its trends, construction companies can make informed decisions regarding resource allocation, cost control, and project management, ultimately contributing to sustained profitability and long-term success in the competitive construction market. This metric, when analyzed in conjunction with other key financial indicators within the statement, provides a comprehensive view of the company’s financial performance and informs strategic planning for future growth.

5. Net Profit/Loss

The net profit or loss, located at the bottom line of a construction company profit and loss statement template, represents the ultimate measure of a company’s financial performance over a specific period. This figure encapsulates the overall profitability of the business after all revenues and expenses have been accounted for. Understanding the components contributing to net profit/loss is critical for assessing financial health, making informed business decisions, and charting a course for future growth and sustainability within the competitive construction landscape.

- Relationship to Gross ProfitNet profit is derived from gross profit, which represents revenue less direct costs. After deducting indirect costs, including overhead expenses such as administrative salaries, rent, and marketing, the resulting figure is the net profit or loss. This relationship highlights the importance of managing both direct and indirect costs to maximize profitability. A healthy gross profit can be significantly diminished by excessive overhead, emphasizing the need for efficient cost control across all aspects of the business.

- Impact of Indirect CostsIndirect costs play a significant role in determining net profit. While these costs are not directly tied to specific projects, they are essential for business operations and must be carefully managed. High indirect costs can erode profitability, even if gross profit margins are healthy. Analyzing indirect costs within the profit and loss statement allows for identification of areas for potential cost optimization, such as streamlining administrative processes or renegotiating lease agreements. This analysis is crucial for maximizing net profit and ensuring long-term financial stability.

- Indicator of Overall Financial HealthNet profit serves as the ultimate indicator of a construction company’s financial health and sustainability. Consistent profitability demonstrates effective cost management, sound financial planning, and successful project execution. Conversely, recurring losses signal underlying issues that require immediate attention, such as inadequate pricing strategies, cost overruns, or inefficient operations. Tracking net profit trends over time provides valuable insights into the company’s financial trajectory and informs strategic decision-making for future growth.

- Implications for Business DecisionsNet profit figures directly influence key business decisions, including investment strategies, expansion plans, and resource allocation. Healthy profits provide opportunities for reinvestment in equipment, technology, or employee development, fostering future growth and enhancing competitiveness. Conversely, losses may necessitate cost-cutting measures, restructuring, or adjustments to pricing strategies. The net profit figure serves as a critical input for financial planning, informing decisions regarding resource allocation, project selection, and overall business strategy.

The net profit/loss figure within the construction company profit and loss statement template provides a concise yet comprehensive view of the company’s overall financial performance. By understanding the factors influencing this bottom-line figure and analyzing its trends over time, construction companies can gain valuable insights into their financial health, identify areas for improvement, and make informed decisions to drive profitability, sustainability, and long-term success within the construction industry. Regular review and analysis of the profit and loss statement, with a focus on net profit, are essential for effective financial management and informed strategic planning.

6. Project Tracking

Project tracking forms an integral component of a comprehensive construction company profit and loss statement template. Integrating project-specific data within the statement allows for granular analysis of individual project performance, offering insights beyond overall company profitability. This detailed tracking enables construction companies to identify profitable projects, pinpoint areas of cost overruns or inefficiencies within specific projects, and make informed decisions regarding resource allocation and future project bidding. By linking financial data to individual projects, companies can isolate the factors contributing to both successes and failures, fostering continuous improvement and enhanced financial control.

Consider a company simultaneously undertaking multiple residential construction projects. While the overall profit and loss statement may indicate overall profitability, it masks the individual performance of each project. Project tracking within the statement allows for a separate analysis of each project’s revenue, direct costs, and resulting gross profit. This may reveal that while some projects are exceeding profitability targets, others are operating at a loss. Pinpointing these underperforming projects enables targeted interventions, such as reassessing cost estimations, optimizing resource allocation, or implementing corrective measures in project management. Without project-level tracking, these issues might remain hidden, potentially impacting overall company profitability.

Effective project tracking within the profit and loss statement provides invaluable data for informed decision-making and enhanced financial control. By analyzing project-specific performance, construction companies can refine cost estimation processes, optimize resource allocation strategies, and improve project management practices. This granular level of analysis fosters continuous improvement, enhances profitability, and strengthens the company’s competitive position within the construction market. The insights derived from project tracking are essential for proactive financial management and informed strategic planning, leading to greater financial success and sustained growth.

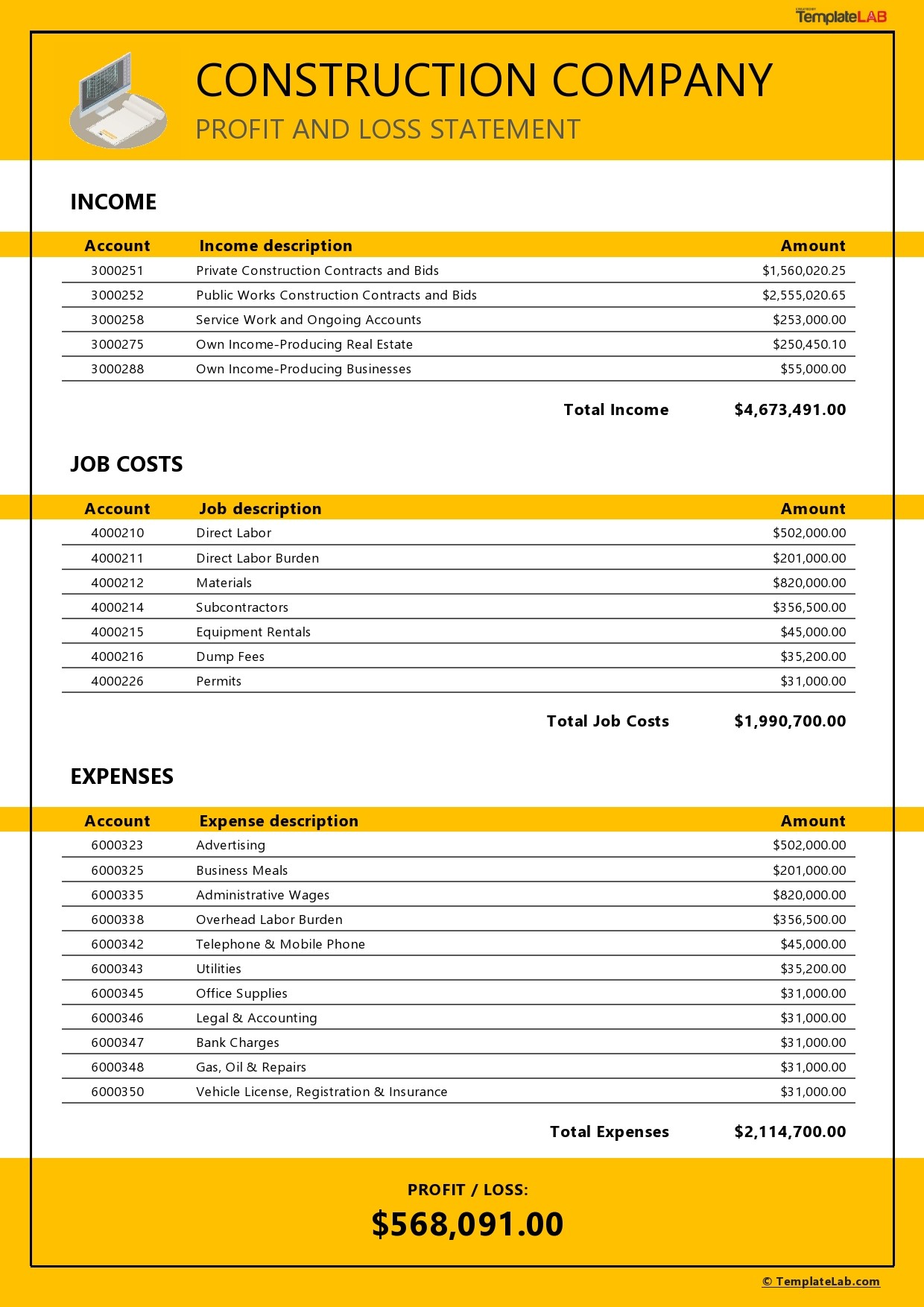

Key Components of a Construction Company Profit and Loss Statement Template

A well-structured profit and loss statement provides a comprehensive overview of a construction company’s financial performance. Key components offer insights into revenue generation, cost management, and overall profitability. Understanding these components is crucial for informed decision-making, effective financial planning, and sustained success within the construction industry.

1. Project Revenue: This section details income generated from completed projects and change orders. Accurate revenue recognition, often using the percentage-of-completion method, is crucial for reflecting the financial progress of long-term projects.

2. Direct Costs: These costs are directly attributable to project execution, including materials, labor, equipment rentals, and subcontractor fees. Precise tracking of direct costs is essential for accurate project budgeting and cost control.

3. Indirect Costs (Overhead): These costs are necessary for business operations but not directly tied to specific projects. Examples include administrative salaries, office rent, insurance, and marketing expenses. Proper allocation of indirect costs across projects ensures accurate profitability assessment.

4. Gross Profit: Calculated as project revenue less direct costs, gross profit represents the profitability of projects before accounting for overhead. Analyzing gross profit margins helps assess project efficiency and pricing strategies.

5. Operating Expenses: These expenses are related to the overall administration and operation of the business, including salaries of non-project personnel, office supplies, and professional fees. Managing operating expenses efficiently contributes to overall profitability.

6. Net Profit/Loss: This bottom-line figure represents the overall profitability of the company after all revenues and expenses have been accounted for. Net profit/loss is a critical indicator of financial health and sustainability.

7. Project-Specific Data: Incorporating project-level details within the statement enables analysis of individual project performance, facilitating targeted interventions and improved resource allocation. This granular view complements the overall financial picture and allows for refined project management.

Careful analysis of these components provides invaluable insights into a construction company’s financial performance, enabling informed decision-making regarding pricing strategies, cost control measures, resource allocation, and overall business strategy. Regular review of the profit and loss statement, with attention to these key components, is crucial for effective financial management and sustained success in the construction industry.

How to Create a Construction Company Profit and Loss Statement

Creating a profit and loss statement requires a systematic approach to accurately capture financial performance. The following steps outline the process of developing this essential financial report for construction companies.

1. Choose a Reporting Period: Select a specific timeframe for the statement, such as a month, quarter, or year. Consistent reporting periods facilitate trend analysis and performance comparisons.

2. Calculate Project Revenue: Determine revenue earned from completed projects and ongoing projects using the appropriate revenue recognition method (e.g., percentage-of-completion). Accurate revenue reporting is crucial for reflecting the financial progress of construction projects.

3. Itemize Direct Costs: Categorize and record all direct costs associated with projects. This includes materials, labor, equipment rentals, and subcontractor fees. Meticulous tracking ensures accurate cost allocation and project profitability assessment.

4. Calculate Gross Profit: Subtract total direct costs from project revenue to determine gross profit. This key metric reveals project profitability before accounting for overhead expenses.

5. Account for Indirect Costs: Identify and allocate indirect costs (overhead expenses) such as administrative salaries, rent, insurance, and marketing. Proper allocation across projects is essential for a complete financial picture.

6. Determine Operating Expenses: Include all operating expenses, such as salaries of non-project personnel, office supplies, and professional fees. Managing these expenses efficiently contributes to overall profitability.

7. Calculate Net Profit/Loss: Subtract total indirect costs and operating expenses from gross profit to arrive at the net profit or loss. This bottom-line figure reflects the overall financial performance of the company during the reporting period.

8. Incorporate Project-Specific Details: Include project-level data within the statement, enabling analysis of individual project performance. This granular view aids in identifying areas for improvement, optimizing resource allocation, and enhancing project management.

Accurate data entry and consistent reporting practices are crucial for generating a reliable and informative profit and loss statement. This financial document provides essential insights for informed decision-making, effective financial planning, and sustained success within the construction industry.

Financial reporting tailored for the construction industry provides essential insights into project profitability, cost management, and overall financial health. Accurate revenue recognition, meticulous cost tracking, and the inclusion of both direct and indirect expenses are crucial for generating a comprehensive and reliable statement. Project-level tracking within the statement allows for granular analysis of individual project performance, informing targeted interventions and resource allocation decisions. Analysis of key metrics, including gross profit and net profit/loss, provides critical insights into financial performance and guides strategic planning.

Effective utilization of a construction-specific financial report is paramount for informed decision-making, efficient resource allocation, and the long-term financial sustainability of construction businesses. Regular review and analysis of this report, coupled with proactive adjustments to cost control measures and pricing strategies, contribute significantly to sustained profitability and competitive advantage within the dynamic construction landscape. This structured financial overview empowers construction companies to navigate challenges, capitalize on opportunities, and achieve long-term success.