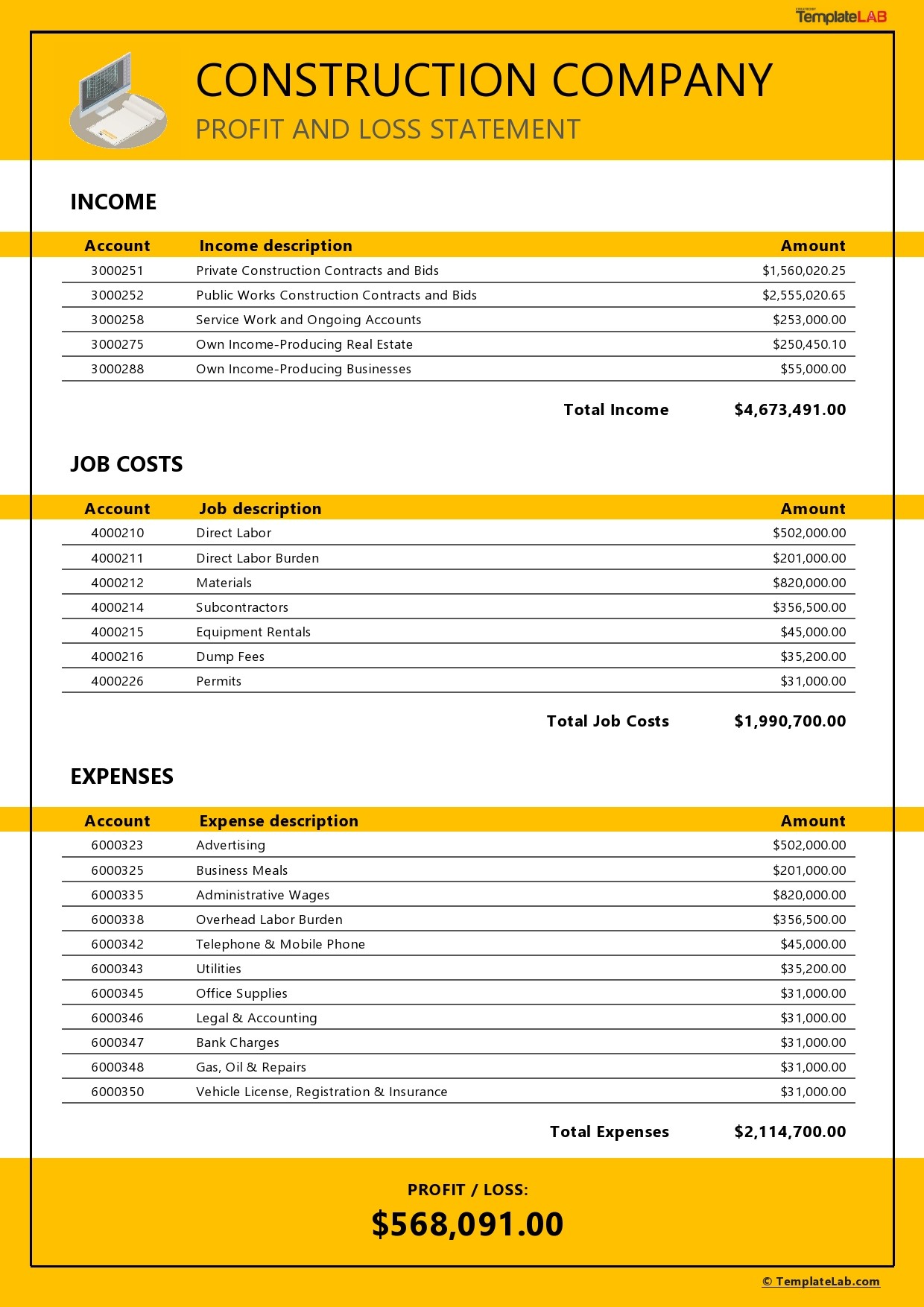

Utilizing such a report offers numerous advantages. It facilitates informed decision-making by providing a clear picture of project profitability and overall financial health. This allows for proactive adjustments to budgets and operations. Furthermore, it enables effective tracking of project costs against estimates, helping to identify potential overruns early on. This financial tool is also essential for securing financing, attracting investors, and fulfilling regulatory reporting requirements. Accurate and timely reporting contributes significantly to sound financial management and long-term business success in the construction industry.

This understanding of the core function and inherent value of this specialized financial reporting lays the groundwork for a deeper exploration of its key components, practical applications, and best practices for implementation.

1. Revenue Recognition

Accurate revenue recognition is fundamental to a reliable construction profit and loss statement. Given the extended duration and inherent complexities of construction projects, revenue cannot simply be recognized upon completion. Instead, specific accounting methods must be employed to accurately reflect the financial progress of projects over time. Understanding these methods is crucial for stakeholders to assess the financial health and performance of a construction company.

- Percentage of Completion MethodThis method recognizes revenue based on the proportion of work completed. For example, if a project is 50% complete, 50% of the anticipated revenue is recognized. This requires reliable estimates of total project costs and progress measurements. Accuracy is vital as miscalculations can significantly impact reported profitability and potentially mislead investors.

- Completed Contract MethodThis method defers revenue recognition until the project is substantially complete. While simpler to implement, it can mask the ongoing financial progress of projects and may not accurately reflect the company’s financial position during multi-year projects. This method is typically used for shorter-duration projects or when the percentage of completion method is impractical to apply reliably.

- Impact on Project ProfitabilityThe chosen revenue recognition method directly impacts the reported profit on a project in any given period. Choosing the appropriate method is essential for accurate performance evaluation. Consistent application of the chosen method ensures comparability across reporting periods and allows for meaningful trend analysis. Inconsistent application can distort profitability trends and create challenges for stakeholders in assessing financial performance.

- Auditing and ComplianceRevenue recognition in construction is a key area of focus for auditors. Supporting documentation for cost estimates, progress measurements, and change orders is crucial for demonstrating compliance with accounting standards. Transparent and well-documented processes are essential for maintaining audit integrity and building stakeholder trust. Failure to adhere to appropriate standards can result in financial restatements and damage to a company’s reputation.

The selected revenue recognition method is a critical component of the construction profit and loss statement. Its proper application ensures the accurate portrayal of financial performance, enabling informed decision-making by management, investors, and other stakeholders. A clear understanding of these principles and their implications is vital for interpreting the financial health and prospects of any construction company.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with completing construction projects. Within a construction profit and loss statement, COGS holds significant weight, directly impacting profitability calculations. Accurate COGS determination is essential for understanding project financial performance and making informed business decisions. A well-defined COGS section provides insights into project cost management effectiveness and overall operational efficiency. Misrepresenting or inaccurately calculating COGS can lead to distorted profit margins, potentially misguiding investment decisions and hindering strategic planning.

Several factors contribute to COGS in construction. Direct material costs, encompassing lumber, concrete, steel, and other building materials, form a substantial portion. Direct labor costs, including wages for on-site workers directly involved in construction activities, constitute another significant component. Other direct costs, such as equipment rentals, subcontractor fees, and project-specific permits, also contribute to COGS. For instance, a project requiring specialized heavy equipment will likely reflect higher equipment rental costs within COGS compared to a project utilizing standard tools. Similarly, extensive subcontracting can significantly influence COGS. Tracking and allocating these costs accurately to individual projects is crucial for precise project profitability analysis. Consider a scenario where material costs are underestimated during the bidding process. This underestimation can lead to a higher actual COGS than initially projected, potentially reducing profit margins or even resulting in a loss.

Effective COGS management within the construction profit and loss statement requires meticulous cost tracking and allocation. Detailed record-keeping of material purchases, labor hours, and other direct costs is paramount. Leveraging project management software can streamline this process and improve accuracy. Furthermore, consistently applying accounting methods for overhead allocation ensures consistent and comparable COGS reporting across projects and periods. A comprehensive understanding of COGS components and their impact on profitability empowers construction companies to refine budgeting, bidding strategies, and project execution. This, in turn, contributes to improved financial performance and sustained business growth. Accurate COGS reporting not only provides a clear picture of current project profitability but also informs future project estimations and pricing strategies, leading to more accurate bidding and potentially higher profit margins over time. This ultimately contributes to a more sustainable and financially sound construction business.

3. Project Tracking

Project tracking forms an integral link between operational performance and the financial reporting reflected in a construction profit and loss statement. Effective project tracking provides the granular data necessary to accurately assess cost of goods sold, revenue recognition, and ultimately, project profitability. Without robust project tracking, the construction profit and loss statement becomes a less reliable tool for management decision-making and stakeholder analysis.

- Cost ControlMonitoring expenses throughout a project lifecycle enables proactive cost control. Tracking actual costs against budgeted amounts allows for early identification of potential overruns. For example, tracking material usage on a foundation project might reveal higher-than-expected concrete consumption, triggering an investigation into potential waste or design discrepancies. This early detection allows corrective action before cost overruns significantly impact project profitability. This real-time cost data feeds directly into the cost of goods sold on the profit and loss statement, ensuring accuracy and enabling informed financial decisions.

- Progress MonitoringTracking project milestones and completion percentages is essential for accurate revenue recognition, especially when using the percentage of completion method. Suppose a highway project is scheduled to be 60% complete by a specific date, but actual progress is only 40%. This discrepancy signals a potential delay and necessitates an adjustment in revenue recognition on the profit and loss statement. Accurate progress monitoring allows for realistic revenue projections and prevents overstatement of financial performance.

- Resource AllocationEffective project tracking facilitates efficient resource allocation. Monitoring labor hours, equipment usage, and material consumption allows for optimization of resource deployment across multiple projects. If project tracking reveals consistent underutilization of excavators across several sites, it may signal an opportunity to reduce equipment rentals and improve cost efficiency. Optimized resource allocation directly impacts project costs, which, in turn, affect the accuracy of the profit and loss statement.

- Variance AnalysisComparing actual project performance against planned budgets and schedules reveals critical variances. These variances provide insights into areas requiring management attention and corrective action. For instance, a significant variance in labor costs on a framing project could indicate issues with productivity or wage rate discrepancies. Analyzing and addressing these variances contributes to improved cost control and more accurate forecasting, enhancing the reliability of the construction profit and loss statement as a management tool.

The insights derived from meticulous project tracking serve as the foundation for a reliable and insightful construction profit and loss statement. By accurately capturing project costs, progress, and resource utilization, project tracking enables informed decision-making, improved financial control, and ultimately, enhanced profitability within the construction industry. This connection highlights the crucial role of robust project tracking systems in ensuring the accuracy and relevance of the financial information presented in the profit and loss statement.

4. Overhead Allocation

Overhead allocation plays a crucial role in the accuracy and completeness of a construction profit and loss statement. Overhead expenses, such as rent, utilities, administrative salaries, and insurance, are not directly tied to specific projects but are essential for business operations. Accurately distributing these costs across projects ensures a true reflection of project profitability and overall company performance. Without proper overhead allocation, project costs can be understated, leading to inaccurate profit margins and potentially misinformed business decisions.

Several methods exist for allocating overhead, each with its own implications. The simplest method allocates overhead based on direct labor hours. For example, if a project consumed 20% of total direct labor hours, it would be allocated 20% of total overhead costs. Alternatively, overhead can be allocated based on direct material costs. This method assigns overhead proportionate to the material costs consumed by each project. More complex methods, such as activity-based costing, allocate overhead based on the activities driving those costs. For instance, the costs of the bidding department might be allocated based on the number of bids prepared for each project. Selecting an appropriate allocation method depends on the specific nature of the construction business and the drivers of overhead costs.

Accurate overhead allocation is essential for several reasons. First, it provides a more complete picture of project profitability. By including a share of indirect costs, the true cost of executing a project becomes apparent. This allows for more informed bidding and pricing decisions. Second, accurate overhead allocation facilitates better cost control. By understanding how overhead costs are distributed, management can identify areas for potential cost reduction. Finally, proper overhead allocation ensures compliance with accounting standards and provides a more accurate representation of the company’s financial position for stakeholders. Failure to allocate overhead appropriately can lead to distorted financial reporting and potentially mislead investors and lenders. A construction company with consistently underestimated overhead allocation might appear more profitable than it actually is, hindering accurate performance evaluation and strategic planning.

5. Profitability Analysis

Profitability analysis stands as a cornerstone of financial management in the construction industry, relying heavily on the data presented within the construction profit and loss statement template. This analysis provides crucial insights into project financial performance, informing strategic decision-making and contributing to long-term business success. Without a thorough profitability analysis, construction companies operate with limited visibility into the financial drivers of their operations, hindering effective resource allocation and potentially jeopardizing long-term viability.

- Project-Level ProfitabilityExamining profitability at the individual project level is paramount. This involves analyzing revenue, direct costs, and allocated overhead for each project to determine its gross and net profit margins. For instance, comparing the profitability of two residential construction projects might reveal that one achieved a significantly higher margin due to more efficient subcontractor management. This granular analysis allows management to identify best practices, pinpoint areas for improvement, and refine bidding strategies for future projects.

- Overall Company ProfitabilityAnalyzing the aggregated data from all projects provides a comprehensive view of overall company profitability. This analysis reveals trends in revenue generation, cost management, and overall financial performance. Declining profitability over several quarters, despite consistent project completion rates, could indicate escalating material costs or declining bid competitiveness. Understanding these trends enables management to implement corrective actions, such as adjusting pricing strategies or streamlining internal processes.

- Key Performance Indicators (KPIs)Utilizing KPIs, such as gross profit margin, net profit margin, and return on investment, provides benchmarks for evaluating financial performance. Tracking these KPIs over time allows for trend analysis and performance comparison against industry averages. A consistently low gross profit margin compared to competitors might indicate inefficiencies in cost estimation or project execution. Monitoring these KPIs within the context of the profit and loss statement enables data-driven decision-making and performance optimization.

- Forecasting and BudgetingHistorical profitability data from the construction profit and loss statement serves as a crucial input for forecasting future performance and developing realistic budgets. Analyzing past project profitability trends helps refine cost estimations and revenue projections for upcoming projects. For example, if historical data reveals consistent cost overruns in excavation activities, future budgets should incorporate more conservative estimates for this cost category. This data-driven approach to forecasting and budgeting enhances accuracy and improves financial planning.

Profitability analysis, grounded in the data presented within the construction profit and loss statement, is essential for informed decision-making, effective resource allocation, and ultimately, the sustained success of any construction enterprise. By providing a comprehensive understanding of financial performance, both at the project and company levels, profitability analysis empowers construction companies to identify strengths, address weaknesses, and navigate the complexities of the construction industry with greater financial acumen. The construction profit and loss statement serves as the foundational document for this critical analysis, enabling data-driven insights that contribute to informed strategic planning and enhanced profitability.

Key Components of a Construction Profit and Loss Statement

A well-structured profit and loss statement provides a comprehensive overview of a construction company’s financial performance. Understanding its key components is crucial for accurate reporting, informed decision-making, and effective financial management. These components work together to provide a clear picture of revenue generation, cost management, and ultimately, profitability.

1. Project Revenue: This section details income generated from completed projects and work in progress. Accurate revenue recognition, based on the chosen accounting method (percentage of completion or completed contract), is crucial for reflecting true financial performance. Clear documentation supporting revenue recognition is essential for audit trails and stakeholder confidence.

2. Direct Costs: These costs are directly attributable to specific projects. Direct material costs include expenditures on lumber, concrete, steel, and other building materials. Direct labor costs encompass wages for on-site workers engaged in construction activities. Other direct costs include subcontractor fees, equipment rentals, and project-specific permits. Accurate tracking and allocation of these costs are fundamental for determining project profitability.

3. Indirect Costs (Overhead): Indirect costs are essential business expenses not directly tied to individual projects. These include rent, utilities, administrative salaries, insurance, and marketing expenses. A systematic method for allocating overhead across projects is crucial for determining true project costs and overall company profitability. The chosen allocation method should reflect the drivers of overhead costs within the specific business context.

4. Gross Profit: Calculated as project revenue minus direct costs, gross profit represents the profitability of construction activities before considering indirect expenses. Analyzing gross profit helps assess the efficiency of project execution and cost management. Consistent monitoring of gross profit margins helps identify trends and potential areas for improvement in operational processes.

5. Net Profit: Derived by subtracting indirect costs from gross profit, net profit represents the overall profitability of the construction company after accounting for all expenses. Net profit is a key indicator of financial health and sustainability. Analyzing net profit trends provides insights into the company’s overall financial performance and its ability to generate profit after covering all operational expenses.

6. Other Income/Expenses: This section captures income or expenses not directly related to core construction activities, such as interest income, investment gains or losses, and asset sales. Including these items provides a comprehensive view of the company’s overall financial performance beyond core operations.

These interconnected components provide a comprehensive financial picture, enabling informed decision-making and effective financial management within the construction industry. Accurate and consistent reporting of these elements is crucial for stakeholders to assess the financial health and future prospects of a construction company.

How to Create a Construction Profit and Loss Statement

Creating a construction profit and loss statement requires a systematic approach to ensure accuracy and completeness. The following steps outline the process of developing this crucial financial report.

1. Define the Reporting Period: Specify the timeframe covered by the statement, whether it’s a month, quarter, or year. A consistent reporting period allows for meaningful comparison and trend analysis across periods.

2. Gather Revenue Data: Compile data on completed projects and work in progress. Ensure accurate revenue recognition based on the chosen accounting method (percentage of completion or completed contract). Maintain detailed documentation supporting revenue figures.

3. Compile Direct Costs: Collect information on all direct costs associated with projects, including material costs, labor costs, and other direct expenses such as subcontractor fees and equipment rentals. Organize these costs by project for accurate tracking and allocation.

4. Calculate Gross Profit: Determine gross profit by subtracting total direct costs from total project revenue. This metric reflects the profitability of construction activities before considering indirect expenses.

5. Allocate Overhead Costs: Allocate indirect costs, such as rent, utilities, and administrative salaries, across projects using a consistent methodology. The chosen method should reflect the drivers of overhead within the organization. Accurate overhead allocation is essential for a complete picture of project profitability.

6. Calculate Net Profit: Subtract total allocated overhead costs from gross profit to arrive at net profit. Net profit represents the overall profitability of the construction company after all expenses are considered.

7. Include Other Income/Expenses: Incorporate any other income or expenses not directly related to core construction operations, such as interest income or investment gains/losses. This provides a comprehensive view of the company’s overall financial position.

8. Review and Verify: Thoroughly review the statement for accuracy and completeness. Ensure all data is properly documented and calculations are verified. This final step is crucial for maintaining the integrity and reliability of the financial report.

A well-constructed profit and loss statement provides a critical tool for evaluating financial performance, informing strategic decisions, and ensuring the long-term financial health of a construction company. Consistent application of these steps promotes accurate reporting and facilitates meaningful analysis of financial trends.

Accurate financial reporting is paramount for sustained success in the competitive construction landscape. A properly utilized construction profit and loss statement template provides the framework for capturing essential financial data, enabling informed decision-making across all levels of an organization. From project-specific cost analysis to overall company profitability assessments, this financial tool empowers stakeholders with the insights necessary to navigate the complexities of the construction industry. A thorough understanding of revenue recognition principles, cost of goods sold components, project tracking methodologies, and overhead allocation methods is fundamental to leveraging the full potential of this reporting structure. Furthermore, consistent and meticulous data entry, coupled with rigorous review processes, ensures the accuracy and reliability of the information presented, fostering trust among stakeholders and contributing to informed financial strategies.

Effective utilization of a construction profit and loss statement template contributes significantly to informed financial management, enabling construction companies to make data-driven decisions that enhance profitability, mitigate risks, and foster sustainable growth within a dynamic and demanding industry. The insights gleaned from this financial report provide a roadmap for optimizing resource allocation, refining bidding strategies, and ultimately achieving long-term financial stability and success. Continued refinement of reporting practices and a commitment to data-driven decision-making will remain crucial for navigating the evolving challenges and capitalizing on emerging opportunities within the construction sector.