Utilizing a standardized format for these summaries offers numerous advantages. It facilitates clear communication and helps maintain organized financial records for both businesses and their clients. This clarity can reduce disputes stemming from misunderstandings, improve payment efficiency, and foster stronger business relationships built on transparency and trust. Consistent documentation also simplifies reconciliation processes and supports accurate financial reporting.

This foundation of understanding is crucial for exploring the key components and best practices associated with generating and utilizing these summaries effectively. The following sections delve into the essential elements, design considerations, and legal implications that contribute to creating a robust and beneficial system for managing client financial interactions.

1. Clarity

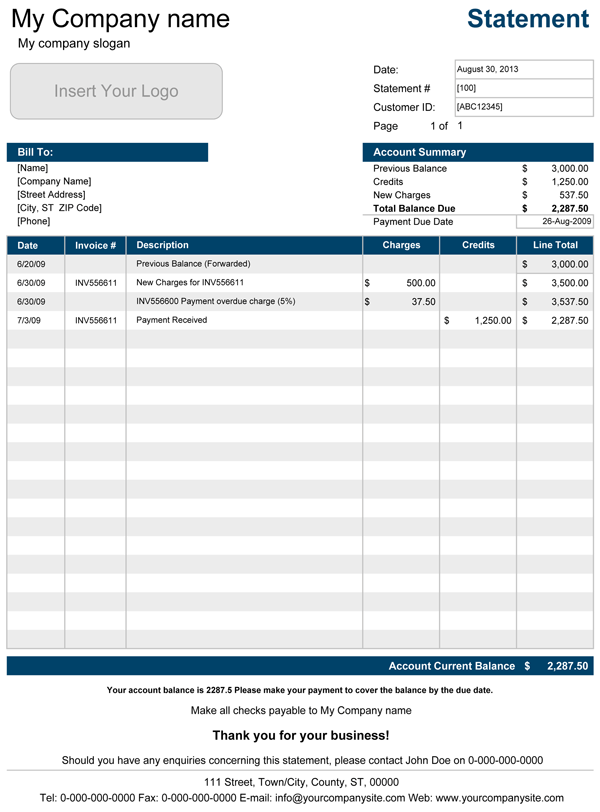

Clarity stands as a cornerstone of effective account statements. A clear statement ensures clients can readily understand the information presented, fostering trust and minimizing potential disputes. This clarity stems from several factors, including a logical structure, unambiguous language, and visually appealing presentation. A disorganized or convoluted statement can lead to confusion and frustration, potentially damaging client relationships and hindering prompt payment. For instance, a statement using vague descriptors like “Misc. Charges” instead of specific item descriptions obscures transaction details, potentially prompting client inquiries and delaying payment.

Consider a statement displaying transactions chronologically, with clear headings for dates, descriptions, debits, credits, and running balances. Such a structure facilitates quick comprehension, allowing clients to effortlessly track their financial activity. Furthermore, utilizing plain language, avoiding technical jargon or abbreviations, enhances understanding. Instead of “EOM Balance,” using “End of Month Balance” improves comprehension for a wider audience. Visual cues like clear spacing, distinct font sizes for headings and body text, and appropriate use of white space also contribute significantly to readability. A cluttered statement can overwhelm clients, while a well-organized one promotes efficient review and understanding.

Achieving clarity requires careful consideration of both content and presentation. The selection of relevant information, its logical arrangement, and its clear articulation contribute to a transparent and readily understandable document. Ultimately, a clear statement empowers clients with the information needed to manage their accounts effectively, contributing to smoother financial interactions and stronger client relationships. Lack of clarity, conversely, can erode trust and create unnecessary friction, highlighting the crucial role of clear communication in financial documentation.

2. Accuracy

Accuracy in account statements is paramount for maintaining client trust and ensuring smooth financial operations. Inaccurate information can lead to disputes, damage client relationships, and necessitate costly corrections. A commitment to accuracy reflects professionalism and underscores the business’s commitment to sound financial management. This involves meticulous attention to detail in recording transactions, applying payments, and calculating balances.

- Transaction DetailsAccurate recording of individual transactions forms the foundation of a reliable statement. This includes correctly capturing the date, description, and amount of each transaction. For example, misrepresenting a purchase date or incorrectly entering the amount can lead to client confusion and potential disputes. Precise transaction details enable clients to reconcile their records with the statement effortlessly and identify any discrepancies promptly.

- Payment ApplicationPayments must be applied accurately to the corresponding invoices or charges. Misapplication of payments can result in incorrect outstanding balances and potentially lead to unwarranted late payment fees or collection actions. Clear identification of the invoice or charge being paid ensures proper allocation of funds and accurate reflection of the client’s current balance. For instance, applying a payment to the wrong invoice can create an inaccurate record of outstanding debt, potentially impacting the client’s credit standing.

- Balance CalculationAccurate calculation of both opening and closing balances is essential for a reliable statement. This requires precise accounting for all transactions, payments, and credits applied during the statement period. Errors in balance calculations can lead to significant discrepancies and undermine client confidence in the business’s financial management. Ensuring the closing balance of one statement accurately reflects the opening balance of the next contributes to a seamless and reliable financial record.

- Data ValidationImplementing robust data validation processes helps prevent errors from entering the system in the first place. This might involve automated checks to ensure data integrity, manual reviews by trained personnel, and reconciliation with other financial records. For example, validating customer account numbers before processing transactions can prevent payments from being applied to the wrong account. These validation steps minimize the risk of inaccuracies and contribute to the overall reliability of the statement.

These facets of accuracy are integral to producing reliable and trustworthy account statements. Such statements contribute to positive client relationships, efficient financial management, and a strong reputation for financial integrity. Negligence in any of these areas can undermine client trust and create operational challenges. Therefore, maintaining accuracy serves as a critical operational priority and a cornerstone of effective client communication.

3. Conciseness

Conciseness in a customer statement of account template contributes significantly to clarity and efficiency. Presenting information succinctly, without unnecessary jargon or excessive detail, allows clients to quickly grasp key financial information. Overly detailed or verbose statements can overwhelm clients and obscure essential data, hindering efficient review and potentially leading to misunderstandings. A concise statement, conversely, facilitates rapid comprehension and promotes timely action, whether it involves making a payment or addressing a discrepancy.

Consider a scenario where a statement includes lengthy descriptions for each transaction, incorporating internal codes or technical terminology irrelevant to the client. Such detail can bury crucial information like the transaction amount and date, making it difficult for the client to quickly assess their balance or identify specific payments. A more concise approach would utilize brief, yet descriptive, transaction summaries, focusing on information directly relevant to the client. For instance, instead of “INV#20231027-A001 – Service Charge – Project Alpha Phase 1,” a concise description like “Project Alpha Service Charge” would suffice, assuming the invoice number and date are clearly presented elsewhere in the statement.

Conciseness extends beyond individual transaction details. The overall structure and layout of the statement should also prioritize essential information. Clear headings, logical grouping of transactions, and appropriate use of white space can enhance readability without sacrificing necessary detail. Avoiding redundant information, such as repeating the same address multiple times within a single statement, further contributes to a streamlined and efficient document. The goal is to provide all necessary information in a clear, concise format that empowers clients to understand and act upon their financial obligations efficiently. This approach benefits both the client, who can manage their account effectively, and the business, which can expect more timely payments and reduced inquiries related to statement interpretation.

4. Professionalism

A professional customer statement of account template reflects the business’s commitment to quality and fosters client trust. It communicates financial information clearly and respectfully, reinforcing a positive brand image and contributing to a stronger business-client relationship. A professionally designed statement avoids ambiguity and promotes efficient communication, reducing the likelihood of misunderstandings and disputes. Conversely, a poorly designed statement can convey a lack of professionalism, potentially damaging the business’s reputation and eroding client confidence.

- BrandingIncorporating consistent branding elements, such as the company logo, color scheme, and font, reinforces brand identity and contributes to a cohesive professional image. A statement that adheres to brand guidelines appears more polished and trustworthy than a generic, unbranded document. For example, using the company’s official logo and color palette in the statement header creates a visually appealing and recognizable document that aligns with the overall brand identity.

- Layout and FormattingA well-organized layout with clear headings, appropriate spacing, and a logical flow enhances readability and professionalism. A cluttered or disorganized statement can appear unprofessional and make it difficult for clients to locate essential information. Using a clear and consistent font, appropriate margins, and visually distinct sections for different types of information contributes to a polished and professional appearance. For example, grouping related transactions together and using clear headings for each section, such as “Account Summary,” “Transactions,” and “Payment Information,” improves readability.

- Language and ToneEmploying clear, concise, and respectful language contributes to a professional tone. Avoiding jargon, technical terms, or overly casual language ensures the statement is easily understood and maintains a professional demeanor. Using a formal, yet approachable, tone demonstrates respect for the client and reinforces the business’s commitment to clear communication. For instance, using “Thank you for your prompt payment” instead of “Thanks for paying up” maintains a professional and courteous tone.

- Contact InformationProviding clear contact information allows clients to easily reach out with questions or concerns. Including a customer service phone number, email address, and mailing address demonstrates accessibility and fosters a sense of transparency. This accessibility contributes to a positive client experience and reinforces the business’s commitment to client satisfaction. Clearly displaying contact information also facilitates efficient communication, allowing clients to quickly resolve any issues or inquiries related to their account.

These elements of professionalism combine to create a customer statement of account template that reflects positively on the business. A professional statement not only conveys essential financial information effectively but also contributes to a positive client experience, strengthening the business-client relationship and fostering trust. Investing in a professional and well-designed statement demonstrates a commitment to quality and underscores the business’s dedication to providing excellent client service. This attention to detail ultimately benefits both the business and its clients, contributing to smoother financial interactions and a more positive overall experience.

5. Timeliness

Timely delivery of customer statements is crucial for effective financial management and maintaining positive client relationships. Prompt delivery allows clients to reconcile their records, identify discrepancies, and make timely payments. Delayed statements can disrupt client budgeting, hinder financial planning, and potentially lead to late payment penalties. This underscores the importance of establishing efficient processes for generating and distributing statements within a predictable timeframe. For instance, a business consistently delivering statements on the last day of the month enables clients to integrate these statements into their monthly financial review processes. Conversely, inconsistent or delayed delivery can disrupt these processes and create uncertainty.

The consequences of untimely statements can extend beyond individual client inconvenience. Delayed statements can hinder a business’s ability to accurately forecast cash flow and manage its own financial obligations. This can impact operational efficiency and potentially lead to financial instability. Moreover, consistently late statements can damage a business’s reputation and erode client trust. Clients may perceive late statements as a sign of disorganization or lack of professionalism, potentially impacting their willingness to do business with the company in the future. Consider a scenario where a client consistently receives statements late, leading to missed payment deadlines and accruing late fees. This negative experience can damage the client relationship and potentially lead to the client seeking alternative service providers.

Timely statement delivery is not merely a matter of convenience; it is a critical component of sound financial management and professional client service. Establishing clear delivery schedules and adhering to them consistently demonstrates respect for clients and reinforces a commitment to efficient and transparent financial practices. This reliability builds trust and contributes to stronger, more sustainable business-client relationships. Therefore, prioritizing timely statement delivery should be a key operational objective for any business seeking to maintain healthy financial relationships with its clients. This proactive approach mitigates potential financial and reputational risks associated with delayed or inconsistent statement delivery. Ultimately, consistent timeliness reflects a commitment to professionalism and contributes to a more positive and productive client experience.

6. Accessibility

Accessibility in the context of customer statement of account templates refers to the ease with which clients can access, understand, and utilize the information provided. This encompasses various aspects, including the format of the statement, the delivery method, and the availability of support resources. Accessible statements empower clients to manage their financial interactions effectively, regardless of their individual circumstances or preferences. Lack of accessibility, conversely, can create barriers to understanding, leading to frustration, disputes, and potentially impacting client relationships. For example, a client with visual impairments might struggle to access a statement delivered solely as a PDF without appropriate accessibility features.

Several factors contribute to statement accessibility. Offering statements in multiple formats, such as PDF, HTML, or braille, caters to diverse client needs and preferences. Providing accessible online portals with features like screen reader compatibility and keyboard navigation enhances accessibility for clients with disabilities. Ensuring clear and concise language, avoiding technical jargon or complex terminology, promotes understanding for all clients. Offering multilingual statements caters to diverse client populations and expands accessibility across language barriers. Providing readily available customer support channels, such as phone, email, or chat, allows clients to seek clarification or assistance when needed. For instance, a business offering statements in both print and digital formats, with online portals optimized for screen readers, demonstrates a commitment to accessibility.

Prioritizing accessibility in statement design demonstrates a commitment to inclusivity and client-centric service. Accessible statements foster transparency, empower clients to manage their finances effectively, and contribute to stronger client relationships. Furthermore, adhering to accessibility guidelines ensures compliance with relevant regulations and demonstrates social responsibility. Failure to prioritize accessibility can not only alienate clients but also expose a business to legal and reputational risks. Therefore, businesses should view accessibility not merely as a compliance requirement but as a core component of effective client communication and a key driver of positive client experiences. This proactive approach benefits both the business and its clients, fostering a more inclusive and equitable financial ecosystem. It also allows businesses to tap into a wider client base and reinforces their reputation for responsible and client-focused practices.

Key Components of a Customer Statement of Account Template

Essential elements ensure clarity, accuracy, and functionality within a well-designed customer statement of account. These components contribute to transparent financial communication and facilitate efficient reconciliation processes.

1. Account Information: This section identifies both the business issuing the statement and the client to whom it is addressed. Key details typically include the business’s name, address, and contact information, along with the client’s name, account number, and address. Accurate account information ensures proper identification and facilitates efficient communication.

2. Statement Period: The statement period specifies the timeframe covered by the transactions listed in the statement. This usually encompasses a specific date range, such as a month or a billing cycle. A clearly defined statement period facilitates reconciliation and allows clients to track their financial activity within a specific timeframe.

3. Opening Balance: The opening balance represents the outstanding amount at the beginning of the statement period. It serves as the starting point for calculating the current balance based on subsequent transactions. A clear representation of the opening balance ensures continuity and accurate tracking of account activity.

4. Transactions: This section details all financial activities occurring during the statement period. Each transaction typically includes the date, description, amount, and whether it represents a debit or credit. Detailed transaction information enables clients to review their activity and identify any discrepancies.

5. Payments and Credits: This section records all payments received and credits applied to the account during the statement period. Clear documentation of payments and credits ensures accurate balance calculations and provides clients with a transparent record of their financial interactions.

6. Closing Balance: The closing balance reflects the total amount owed or due at the end of the statement period. This crucial figure summarizes the net effect of all transactions, payments, and credits during the specified timeframe.

7. Payment Instructions: This section provides clear guidance on how to make payments, including accepted payment methods, remittance addresses, and any relevant deadlines. Clear payment instructions facilitate timely payments and minimize potential confusion.

8. Contact Information: This section reiterates the contact information for customer support or inquiries related to the statement. Providing readily accessible contact information promotes efficient communication and enhances client service.

These components work together to provide a comprehensive and transparent overview of a client’s financial activity with a business over a specific period. Accurate and well-organized presentation of these elements facilitates efficient reconciliation, promotes clear communication, and fosters stronger business-client relationships.

How to Create a Customer Statement of Account Template

Creating a professional and effective customer statement of account template requires careful planning and attention to detail. A well-structured template ensures clarity, accuracy, and promotes positive client relationships. The following steps outline the process of developing a robust template.

1. Define the Purpose and Scope: Clarify the specific objectives of the statement. Determine the target audience and their informational needs. Consider the frequency of statement generation and the period it will cover. For instance, a monthly statement for retail customers will differ from a quarterly statement for wholesale clients.

2. Gather Required Information: Identify the essential data points to include. This typically involves account information for both the business and the client, the statement period, opening balance, transaction details, payments, credits, closing balance, payment instructions, and contact information. Ensuring access to this data is crucial for accurate statement generation.

3. Choose a Suitable Format: Select a format that aligns with business needs and client preferences. Options include spreadsheet software, dedicated accounting software, or custom-developed solutions. The chosen format should facilitate efficient data entry, accurate calculations, and professional presentation.

4. Design the Layout: Create a clear and organized layout that prioritizes readability and accessibility. Utilize clear headings, logical grouping of information, and consistent formatting. Consider incorporating branding elements for a professional and cohesive look. The layout should facilitate quick comprehension of key information.

5. Implement Calculations: Incorporate formulas and functions to automate calculations such as running balances, totals, and any applicable taxes or fees. Automated calculations minimize manual data entry and reduce the risk of errors. Accuracy in these calculations is critical for maintaining client trust.

6. Incorporate Payment Instructions: Provide clear and concise instructions on accepted payment methods, remittance addresses, and payment deadlines. This clarity facilitates timely payments and minimizes potential client confusion. Multiple payment options cater to diverse client preferences.

7. Test and Refine: Thoroughly test the template with sample data to ensure accuracy and functionality. Solicit feedback from relevant stakeholders, including accounting personnel and client representatives. Refine the template based on feedback to optimize its effectiveness and usability. Ongoing review and refinement ensure the template remains relevant and effective.

8. Ensure Accessibility: Consider accessibility requirements for clients with disabilities. Offer the statement in multiple formats, ensure compatibility with assistive technologies, and provide clear and concise language. Prioritizing accessibility demonstrates inclusivity and enhances client experience. Adhering to accessibility guidelines also ensures compliance with relevant regulations.

Developing a robust customer statement of account template involves a systematic approach encompassing planning, design, implementation, and ongoing refinement. A well-designed template contributes to efficient financial management, strengthens client relationships, and promotes transparency in business operations. Regular review and updates ensure the template remains relevant and adaptable to evolving business needs and industry best practices. Attention to detail and a focus on client needs are crucial for creating a template that effectively serves its purpose.

Careful consideration of a customer statement of account template’s structure, content, and delivery method is essential for effective financial communication. Key components, including accurate transaction details, clear payment instructions, and accessible formats, contribute to transparency and client empowerment. A well-designed template streamlines reconciliation processes, reduces disputes, and fosters positive client relationships. Accuracy, clarity, conciseness, professionalism, timeliness, and accessibility are paramount for achieving these objectives and ensuring the template serves as a valuable tool for both businesses and their clients.

Effective management of financial interactions forms a cornerstone of successful business operations. A robust customer statement of account template provides a crucial framework for achieving this objective. Continuous evaluation and refinement of template design, informed by evolving client needs and industry best practices, will ensure its ongoing effectiveness as a communication tool and contribute to sustainable, positive client relationships. This proactive approach strengthens financial transparency and reinforces a commitment to client-centric service, ultimately benefiting both the business and its valued clients.