Accurate and readily available documentation of childcare expenses simplifies tax preparation for families and can contribute to significant savings. This organized record allows for easy substantiation of claimed expenses, reducing the likelihood of audits and facilitating a smoother tax filing process. Ultimately, it empowers families to maximize eligible tax benefits related to childcare.

The following sections explore the key components of these essential documents, legal requirements, and best practices for both providers and recipients.

1. Provider Information

Accurate provider information is fundamental to a valid daycare year-end tax statement. This information allows tax authorities to verify the legitimacy of the childcare provider and ensures compliance with regulatory requirements. Without complete and correct provider details, the tax statement may be rejected, potentially jeopardizing tax benefits for the recipient.

- Legal Name and Business AddressThe officially registered name and physical address of the daycare facility are crucial for identification and verification. This information distinguishes the specific provider and ensures proper record-keeping. For instance, a parent using a shortened or informal name for the daycare could lead to processing issues. Accurate business details are essential for official documentation.

- Tax Identification Number (TIN)The provider’s TIN (typically an Employer Identification Number (EIN) or Social Security Number (SSN)) is paramount for tax purposes. This unique identifier links the financial transactions to the specific business entity. Omitting or incorrectly recording the TIN can render the statement unusable, preventing families from claiming deductions. Accurate TIN documentation is non-negotiable for tax compliance.

- License or Registration InformationIncluding the daycare’s license or registration number demonstrates adherence to state and local regulations. This information provides assurance of the provider’s legitimacy and compliance with operational standards. While not always mandatory on tax statements, including this information reinforces the provider’s credibility. This can be especially relevant in cases of audits or disputes.

- Contact InformationProviding a phone number and email address facilitates communication between the provider and recipient, especially if questions arise regarding the statement. This contact information streamlines clarification of discrepancies or requests for additional documentation. Accessible contact information demonstrates transparency and professionalism, promoting trust and efficient communication.

Complete and accurate provider information reinforces the validity and usability of the daycare year-end tax statement. These details are crucial not only for tax processing but also for maintaining transparency and accountability within the childcare industry. This meticulous approach ultimately benefits both providers and recipients in navigating the complexities of tax season.

2. Recipient Information

Accurate recipient information is crucial for linking childcare expenses to the correct taxpayer. The daycare year-end tax statement template must capture specific details to ensure proper tax reporting and enable families to claim eligible credits or deductions. Incomplete or inaccurate recipient information can lead to processing delays, rejected claims, or difficulties in verifying expenses during audits. For example, a misspelled name or incorrect address could create a mismatch between the tax statement and the taxpayer’s records, potentially flagging the claim for review.

Key recipient information includes the full legal name of the parent or guardian claiming the childcare expenses and their corresponding address. Consistency between this information and the tax return is vital. Using nicknames or variations in address formatting can introduce discrepancies that complicate verification. Consider a scenario where a parent uses their middle initial on the tax statement but omits it on their tax return; such a seemingly minor difference could trigger further scrutiny. Therefore, maintaining consistency in personal details is essential for seamless processing.

Precise recipient information ensures proper allocation of childcare expenses and facilitates accurate tax reporting. This accuracy benefits both families and tax authorities. For families, it streamlines the claim process and reduces the risk of audits. For tax authorities, accurate information ensures efficient processing and helps maintain the integrity of the tax system. Ultimately, accurate recipient information within the daycare year-end tax statement template serves as a cornerstone of a transparent and reliable childcare expense reporting process.

3. Payment Dates

Accurate payment dates are crucial for properly allocating childcare expenses to the correct tax year within a daycare year-end tax statement template. These dates determine which tax year the expenses can be claimed against, directly impacting the applicable tax benefits. Incorrect or missing payment dates can lead to inaccuracies in tax filings and potential complications with tax authorities. This underscores the importance of meticulous record-keeping and precise documentation of all payment transactions.

- Specificity of DatesRecording the exact date of each paymentmonth, day, and yearis essential for accurate tax reporting. Generalized date ranges or estimations can create ambiguity and potentially invalidate the claim. For example, stating “January 2024” instead of “January 15, 2024” lacks the necessary precision. Specific dates provide clarity and prevent discrepancies between the statement and tax filings.

- Correlation with Tax YearsPayment dates determine the tax year to which the expense is assigned. Expenses incurred between January 1 and December 31 of a given year are typically claimed on that year’s tax return. Clearly documenting payment dates ensures proper allocation to the correct tax year. For instance, a December 31, 2023 payment is attributed to the 2023 tax year, while a January 1, 2024 payment belongs to the 2024 tax year. This distinction is vital for accurate tax calculations.

- Impact on Tax Credits and DeductionsAccurate payment dates directly influence the calculation of eligible tax credits and deductions. These dates determine the total claimable expenses for a specific tax year, influencing the final tax liability. For example, incorrectly assigning a 2023 payment to 2024 could understate 2023 expenses and overstate 2024 expenses, leading to inaccurate tax benefit calculations. Accurate dating ensures the correct application of tax rules.

- Supporting DocumentationPayment dates on the statement should align with supporting documentation, such as bank statements, receipts, or cancelled checks. This consistency provides verifiable proof of payment and strengthens the credibility of the claimed expenses. In case of an audit, discrepancies between the statement and supporting documentation can raise red flags. Maintaining consistent records ensures transparency and facilitates a smooth audit process.

Precise payment dates within the daycare year-end tax statement template are integral to accurate tax reporting and claiming eligible benefits. They serve as the foundation for linking expenses to specific tax years and ensuring compliance with tax regulations. The meticulous documentation of payment dates benefits both families and childcare providers by promoting transparency, simplifying tax preparation, and minimizing the risk of discrepancies. This ultimately strengthens the integrity of the childcare expense reporting process.

4. Total Payments

The total payments figure within a daycare year-end tax statement template represents the cumulative amount paid for childcare services during the relevant tax year. This figure is crucial for accurately calculating claimable tax benefits. Understanding its components, ensuring accuracy, and its implications for tax filing are essential for both providers and recipients.

- Accuracy and VerificationAccurate calculation of total payments is paramount. Discrepancies between the reported amount and supporting documentation can trigger audits or delay processing. Providers must maintain meticulous records and ensure all payments are accurately reflected. Recipients should verify the total against their own records before filing taxes. For example, a mismatched total due to an unrecorded payment could lead to an inaccurate tax credit calculation.

- Itemization for TransparencyWhile not always mandatory, itemizing individual payments within the statement enhances transparency and allows for easier verification. This breakdown provides a clear audit trail, linking specific payments to dates of service. For instance, an itemized statement showing weekly payments provides greater clarity than a single lump-sum figure. Itemization strengthens the credibility of the documented expenses.

- Impact on Tax BenefitsThe total payments figure directly influences the calculation of eligible tax credits or deductions. A higher total generally translates to a larger potential tax benefit, up to applicable limits. Therefore, accurately documenting the full amount paid is essential for maximizing tax relief. For example, underreporting total payments could result in a smaller than eligible tax credit.

- Relationship to Other DocumentationThe total payments amount should reconcile with other financial records, including receipts, bank statements, and the provider’s accounting records. This consistency strengthens the validity of the tax statement and provides a solid foundation for substantiating claims. Discrepancies between the statement and supporting documentation can undermine the credibility of the reported expenses and invite scrutiny.

Accurate reporting of total payments within a daycare year-end tax statement is essential for claiming appropriate tax benefits and maintaining compliance. The total payment figure serves as a critical link between the cost of childcare and the potential tax relief available to families. Meticulous attention to detail and a commitment to accurate record-keeping are vital for ensuring a smooth and successful tax filing process.

5. Tax Identification Number

The Tax Identification Number (TIN) is a crucial element within the daycare year-end tax statement template, serving as the linchpin connecting the childcare provider to the tax system. This number allows for proper identification and verification of the provider, ensuring the legitimacy of claimed childcare expenses. Without a valid TIN, the tax statement loses its efficacy, potentially jeopardizing the taxpayer’s ability to claim applicable tax benefits. Therefore, understanding the TIN’s role, variations, and implications is essential for accurate and compliant tax reporting.

- Types of TINsDifferent types of TINs exist depending on the provider’s legal structure. Individuals typically use their Social Security Number (SSN) as their TIN, while businesses generally use an Employer Identification Number (EIN). Correctly identifying and utilizing the appropriate TIN is essential. For instance, a daycare operating as a sole proprietorship would use the owner’s SSN, whereas a daycare incorporated as a business would use an EIN. Using the wrong TIN can lead to processing errors and delays.

- Verification of Provider IdentityThe TIN allows tax authorities to verify the legitimacy of the childcare provider and ensure compliance with regulations. This verification process protects taxpayers from fraudulent claims and ensures the integrity of the tax system. For example, if a taxpayer submits a statement with a fictitious TIN, the IRS can identify the discrepancy and prevent an improper deduction. TIN verification strengthens the accountability of both providers and recipients.

- Linking Expenses to the Correct EntityThe TIN directly links childcare payments to the specific provider, enabling accurate tracking and reporting of expenses. This clear linkage is crucial for reconciling payments and ensuring proper allocation of tax benefits. For example, if a family uses multiple childcare providers, distinct TINs on each statement allow for proper categorization of expenses and accurate calculation of applicable credits. This prevents commingling of expenses and ensures proper tax reporting.

- Importance for Claiming Tax BenefitsInclusion of the correct TIN on the daycare year-end tax statement is mandatory for claiming childcare-related tax benefits. Omitting or incorrectly reporting the TIN can result in rejected claims, potentially leading to loss of valuable tax relief. Imagine a scenario where a parent forgets to include the daycare’s EIN on the statement. This oversight could lead to the IRS disallowing the claimed expenses, resulting in a higher tax liability. Accurate TIN reporting is non-negotiable for accessing tax benefits.

The TIN’s role within the daycare year-end tax statement template is pivotal for ensuring accurate, compliant, and verifiable reporting of childcare expenses. It acts as a unique identifier, linking financial transactions to specific providers, facilitating proper allocation of tax benefits, and upholding the integrity of the tax system. Accurate TIN documentation is therefore not merely a formality, but a fundamental requirement for accessing childcare-related tax relief and ensuring a smooth and successful tax filing process.

Key Components of a Daycare Year-End Tax Statement

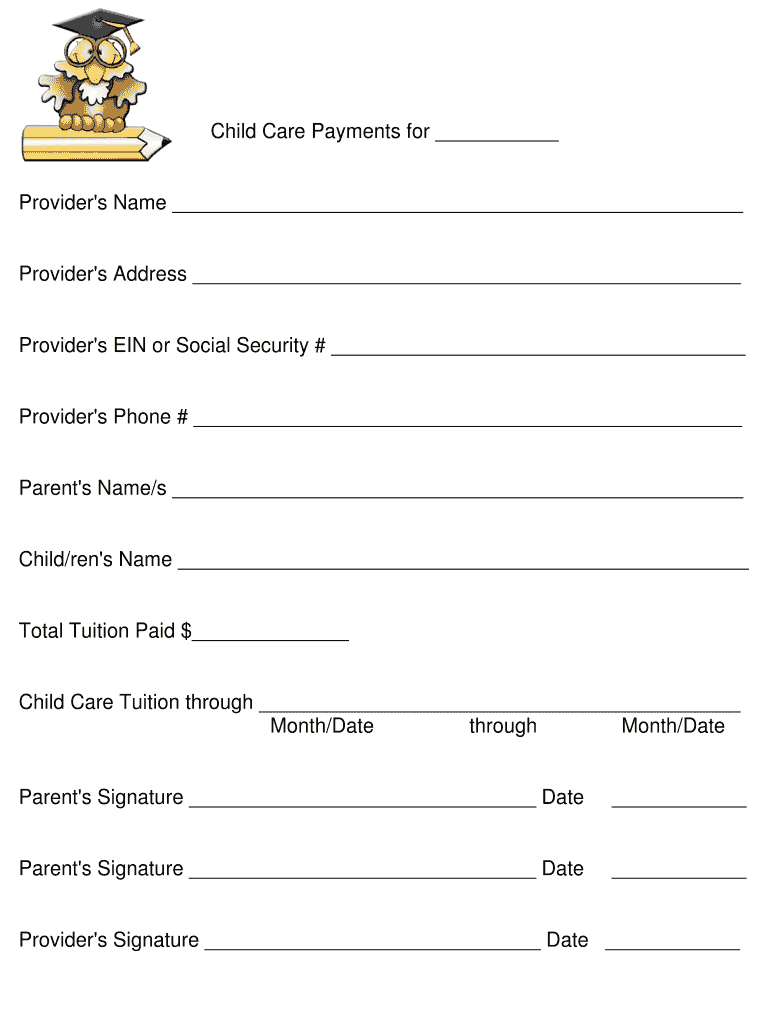

A comprehensive daycare year-end tax statement requires specific components to ensure accurate reporting and facilitate proper tax filing. Each element plays a critical role in validating expenses and enabling families to claim applicable tax benefits. Omitting or incorrectly documenting any of these components can lead to processing delays, rejected claims, or difficulties during audits.

1. Provider Information: This section identifies the childcare provider and establishes their legitimacy. It includes the daycare’s full legal name, registered business address, tax identification number (TIN), and ideally, licensing or registration information. Accurate provider information is crucial for verifying the provider’s standing and ensuring compliance with regulations.

2. Recipient Information: This section identifies the individual claiming the childcare expenses. It must include the parent or guardian’s full legal name and address, consistent with their tax return information. Accurate recipient details link expenses to the correct taxpayer and prevent processing errors.

3. Payment Dates: Precise payment dates are crucial for assigning expenses to the correct tax year. Each payment date should be documented with the specific month, day, and year. Accurate payment dates ensure proper allocation of expenses and accurate calculation of tax benefits.

4. Payment Amounts: Every individual payment amount should be clearly documented. This detailed breakdown provides transparency and facilitates verification against supporting documentation like bank statements or receipts. This level of detail strengthens the credibility of the reported expenses.

5. Total Payments: This figure represents the cumulative amount paid for childcare services during the given tax year. Accuracy is paramount, as this figure directly influences the calculation of eligible tax benefits. The total should reconcile with the sum of individual payment amounts and supporting financial records.

Accurate and complete documentation within a daycare year-end tax statement is fundamental for both tax compliance and efficient processing. These key components contribute to a transparent record of childcare expenses, enabling families to confidently claim eligible tax benefits and simplifying the tax filing process.

How to Create a Daycare Year-End Tax Statement Template

Creating a standardized template ensures consistency, accuracy, and ease of use when generating year-end tax statements for childcare services. A well-designed template benefits both providers and recipients by streamlining tax preparation and supporting accurate reporting of expenses.

1. Software Selection: Choose appropriate software. Spreadsheet programs, word processors, or dedicated accounting software can be utilized. Selecting software that allows for calculations, formatting, and data storage facilitates efficient template creation and subsequent statement generation.

2. Provider Information Section: Designate a section for provider details. Include fields for the daycare’s legal name, full business address, and tax identification number (TIN). Optionally, add fields for license or registration information and contact details.

3. Recipient Information Section: Create a dedicated section for recipient details. Include fields for the parent or guardian’s full legal name and address. Emphasize the importance of consistency with the information on their tax return.

4. Payment Details Section: Structure a section for payment details, including columns for the date of each payment and the corresponding amount. This allows for itemization of payments, providing transparency and facilitating verification.

5. Total Payments Calculation: Integrate a formula to automatically calculate the total amount paid for the year based on entered individual payments. This automation minimizes manual calculation errors and ensures accuracy.

6. Clear Labeling and Instructions: Use clear and concise labels for each field. Consider including brief instructions or explanations to guide users in accurately completing the template. Clear guidance reduces ambiguity and promotes accurate data entry.

7. Review and Testing: Thoroughly review the completed template for accuracy and completeness. Test the template by populating it with sample data to ensure calculations and formatting function correctly. Testing identifies potential errors and ensures the template’s usability.

8. Accessibility and Storage: Save the template in an easily accessible and secure location. Consider using a standardized file format compatible with various software applications. Secure storage preserves the template’s integrity and ensures its availability for future use.

A well-designed template incorporating these elements promotes accurate record-keeping, simplifies tax reporting, and facilitates a smooth tax filing process for both childcare providers and families.

Accurate and comprehensive daycare year-end tax statement templates are essential tools for navigating the complexities of tax season. These documents provide a standardized format for reporting childcare expenses, enabling families to claim applicable tax benefits and simplifying the tax filing process. Key components such as provider information, recipient details, payment dates, and total amounts must be meticulously documented to ensure compliance and facilitate efficient processing. Utilizing well-designed templates and adhering to best practices benefits both childcare providers and recipients by promoting transparency, accuracy, and accountability within the childcare expense reporting process.

Careful attention to detail and a commitment to accurate record-keeping are paramount when preparing and utilizing these crucial documents. Proper utilization of these templates contributes to a more efficient and equitable tax system, supporting families and childcare providers alike. This ultimately reinforces the importance of these documents within the broader context of financial planning and tax compliance within the childcare industry.