Organizing financial information in this structured manner offers numerous advantages. It enables individuals to track progress toward financial goals, identify areas for improvement in spending habits, and prepare for future financial needs. This organized approach can also simplify loan applications, tax preparation, and estate planning. Furthermore, a clear understanding of one’s financial health can empower individuals to make more informed decisions about investments and other financial opportunities.

This structured approach to personal finance offers a solid foundation for exploring various aspects of financial management. The following sections will delve deeper into specific elements of creating and utilizing this comprehensive financial overview, including practical examples and detailed explanations.

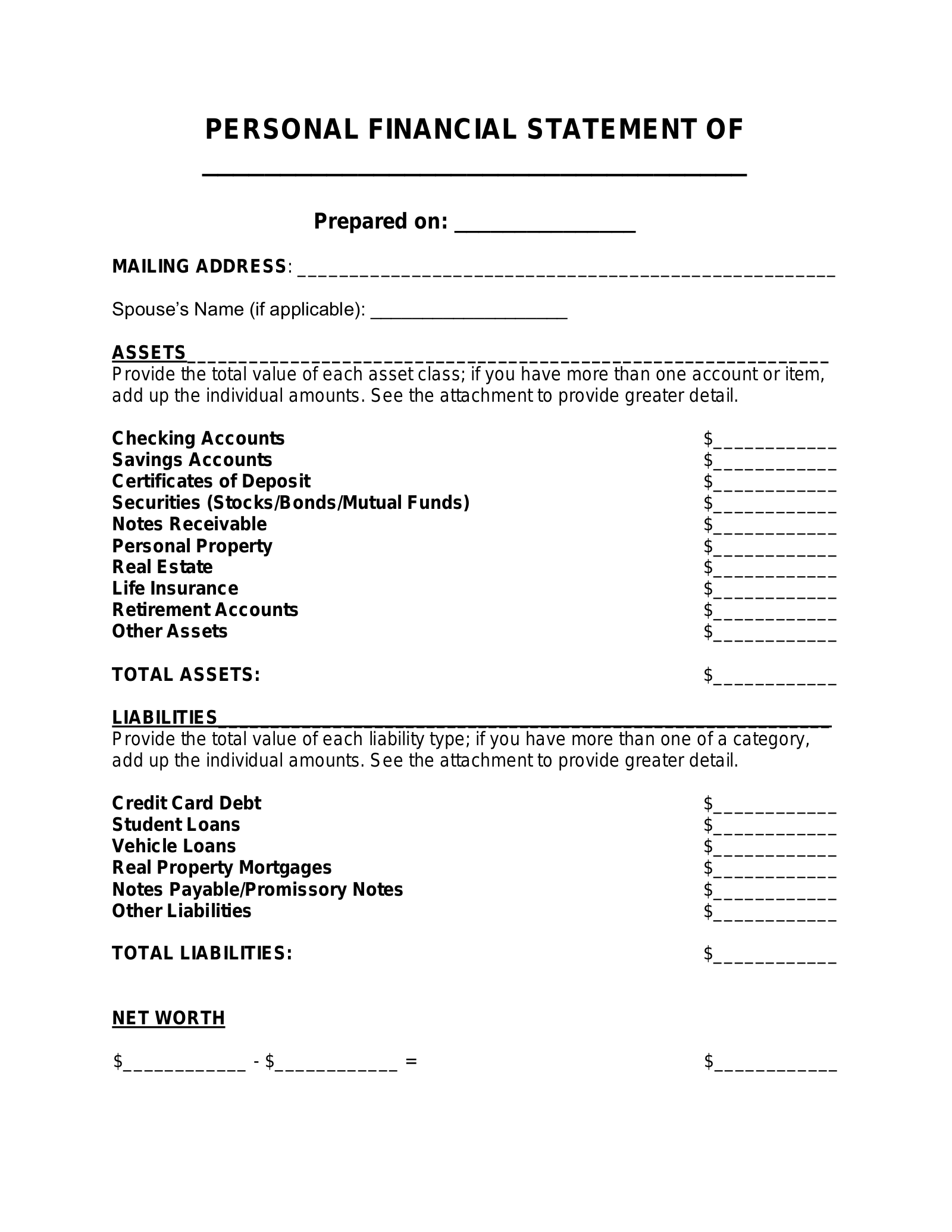

1. Assets

Accurate representation of assets within a comprehensive financial record is crucial for understanding one’s overall financial standing. A clear categorization and valuation of assets provide the foundation for calculating net worth and making informed financial decisions. This section explores key facets of asset documentation within such a record.

- Liquid AssetsLiquid assets, readily convertible to cash, include checking and savings accounts, money market funds, and certificates of deposit. These resources represent immediate financial availability and play a critical role in short-term financial planning. For instance, maintaining sufficient liquid assets ensures the ability to meet unexpected expenses without incurring debt.

- InvestmentsInvestment holdings, including stocks, bonds, mutual funds, and retirement accounts, represent resources allocated for long-term growth. Accurately documenting the current market value of these assets contributes significantly to a realistic net worth calculation. Diversification within investment portfolios, illustrated by holdings across different asset classes, mitigates risk and contributes to long-term financial stability.

- Real EstateReal estate holdings, encompassing primary residences, rental properties, and land, constitute significant assets. Accurate valuation, considering factors like market conditions and property improvements, is essential for a comprehensive financial overview. For example, understanding the equity held in a primary residence provides valuable insight into potential borrowing power.

- Personal PropertyPersonal property encompasses valuable items such as vehicles, jewelry, and artwork. While often less liquid than other asset classes, accurate documentation of these items, including appraisals where appropriate, contributes to a complete picture of ones financial holdings. These assets can also serve as collateral for secured loans.

Accurate and detailed documentation of these asset categories provides a robust foundation for financial planning, analysis, and decision-making. By understanding the composition and value of one’s assets, individuals can effectively manage resources and pursue financial goals.

2. Liabilities

Accurate representation of liabilities is essential within a detailed personal financial statement template. A clear understanding of outstanding debts provides a realistic assessment of one’s financial obligations and contributes to informed financial planning. This section explores key facets of liability documentation.

- Secured DebtSecured debt, typically tied to a specific asset, includes mortgages and auto loans. Detailed documentation of these obligations, including the outstanding principal, interest rate, and payment terms, is crucial for accurate financial assessment. For example, understanding the remaining balance on a mortgage helps assess overall net worth and potential borrowing capacity.

- Unsecured DebtUnsecured debt, not tied to a specific asset, includes credit card balances, student loans, and personal loans. Tracking these obligations, including minimum payments and interest rates, helps manage cash flow and prioritize debt reduction strategies. High-interest unsecured debt can significantly impact long-term financial health.

- Deferred LiabilitiesDeferred liabilities represent obligations due in the future, such as deferred taxes or lease payments. Including these future obligations provides a comprehensive view of long-term financial commitments. For example, understanding upcoming lease obligations allows for effective budgeting and resource allocation.

- Contingent LiabilitiesContingent liabilities represent potential future obligations dependent on specific events, such as co-signing a loan or pending lawsuits. While not always quantifiable, acknowledging these potential liabilities contributes to a complete understanding of financial risk. These liabilities, if realized, can significantly impact financial stability.

Thorough documentation of these liability categories contributes significantly to the accuracy and effectiveness of a detailed personal financial statement. This clear understanding of financial obligations facilitates informed decision-making regarding debt management, budgeting, and long-term financial planning.

3. Net Worth

Net worth represents a fundamental component of a detailed personal financial statement, providing a concise snapshot of one’s overall financial health. Calculated as the difference between total assets and total liabilities, this figure offers valuable insights into financial progress and stability. A positive net worth signifies assets exceeding liabilities, indicating a healthy financial position. Conversely, a negative net worth signifies liabilities outweighing assets, requiring strategic financial planning to address the imbalance. Consider an individual with $500,000 in assets and $300,000 in liabilities; their net worth is $200,000, demonstrating a positive financial standing.

Tracking net worth over time allows individuals to monitor financial progress and the effectiveness of financial strategies. An increasing net worth typically indicates sound financial management, while a declining net worth may signal the need for adjustments in spending or investment strategies. For example, consistent contributions to retirement accounts and debt reduction efforts generally contribute to a positive net worth trajectory. Analyzing the components contributing to net worth fluctuations provides further insights. A significant increase in asset value, for example, might reflect positive market conditions, whereas a substantial rise in liabilities could indicate increased borrowing. Understanding these fluctuations informs future financial decisions.

A clear understanding of net worth within the context of a detailed personal financial statement facilitates informed financial decision-making and effective goal setting. It allows individuals to realistically assess their financial capacity for major purchases, investments, or retirement planning. Furthermore, monitoring net worth provides a measurable metric for evaluating the effectiveness of financial strategies and making necessary adjustments to achieve long-term financial goals. Challenges in accurately calculating net worth often arise from fluctuating asset valuations or overlooking certain liabilities. Consistent and meticulous record-keeping, including regular asset valuation updates, addresses these challenges, ensuring a reliable representation of one’s financial position.

4. Income Sources

A comprehensive understanding of income sources forms a critical component of a detailed personal financial statement. Accurate documentation of all income streams provides a clear foundation for budgeting, financial planning, and informed decision-making. This detailed record facilitates analysis of income stability, diversification, and potential growth opportunities. Cause-and-effect relationships between income sources and financial stability become apparent through this documentation. For instance, reliance on a single income source presents greater financial vulnerability compared to multiple diversified streams. A sudden job loss would have a significantly greater impact on an individual with a single income source than on someone with diverse income streams, including rental income or investment dividends.

Documenting income sources within a structured financial statement requires meticulous categorization and consistent tracking. Salaries, wages, investment income, rental income, and business profits should be clearly identified and recorded. This granular approach enables precise calculation of total income and facilitates analysis of individual income stream contributions. Real-life examples illustrate this significance. An individual seeking mortgage approval benefits from demonstrating stable and diversified income sources, enhancing loan application credibility. Similarly, understanding the proportion of income derived from investments versus employment informs investment strategy adjustments and retirement planning.

Accurate and comprehensive documentation of income sources empowers informed financial management. It facilitates realistic budgeting, informed investment decisions, and proactive planning for future financial goals. Challenges in accurately representing income might arise from fluctuating income streams, such as freelance work or commission-based earnings. Implementing robust tracking systems and averaging income over time mitigates these challenges. This thorough approach ensures a reliable representation of income, contributing to the overall accuracy and effectiveness of the detailed personal financial statement. Understanding the relationship between income sources and other financial statement components, such as expenses and net worth, allows for a holistic assessment of financial health and facilitates effective long-term financial planning.

5. Expense Tracking

Expense tracking forms an integral component of a detailed personal financial statement template. Meticulous recording of all expenditures provides crucial insights into spending patterns, facilitates informed budgeting, and contributes to effective financial management. This detailed record enables identification of areas for potential cost savings and informs resource allocation decisions. Cause-and-effect relationships between spending habits and financial outcomes become evident through consistent expense tracking. For instance, consistently exceeding budgeted amounts in discretionary spending categories can impede progress toward savings goals or lead to increased debt. Conversely, disciplined tracking and management of expenses can free up resources for investment or debt reduction.

Integrating expense tracking within a structured financial statement requires a systematic approach. Categorizing expenses, such as housing, transportation, food, and entertainment, provides a granular view of spending patterns. Utilizing budgeting software or spreadsheets facilitates this process and allows for analysis of spending trends over time. Real-life examples illustrate the practical significance. An individual aiming to reduce debt can identify non-essential expenses through detailed tracking and implement targeted spending adjustments. Similarly, tracking business-related expenses allows for accurate tax reporting and informed profit analysis. Consider someone consistently spending more on dining out than anticipated; detailed tracking reveals this pattern, prompting adjustments to align spending with financial goals.

Comprehensive expense tracking empowers informed financial decision-making and contributes to long-term financial well-being. It provides a clear understanding of where money is being spent, facilitating proactive budgeting and resource allocation. Challenges in accurate expense tracking often arise from inconsistent recording habits or overlooking small, frequent expenditures. Employing dedicated budgeting tools and establishing regular tracking routines mitigates these challenges. This rigorous approach ensures a reliable representation of spending, contributing to the overall accuracy and effectiveness of the detailed personal financial statement. Understanding the interplay between expense tracking, income sources, and net worth provides a holistic view of financial health and empowers individuals to make informed decisions to achieve financial objectives.

Key Components of a Detailed Personal Financial Statement Template

A comprehensive personal financial statement requires careful attention to several key components. Accurate and thorough documentation in these areas provides a robust foundation for financial analysis, planning, and decision-making.

1. Assets: A complete listing of all owned assets, categorized and valued appropriately. This includes liquid assets (cash, savings accounts), investments (stocks, bonds), real estate (property, land), and personal property (vehicles, valuables). Accurate valuation is crucial for determining net worth and understanding overall financial standing.

2. Liabilities: A comprehensive record of all outstanding debts and financial obligations. This encompasses secured debt (mortgages, auto loans), unsecured debt (credit cards, personal loans), and other liabilities like deferred taxes or contingent obligations. Understanding the nature and extent of liabilities is essential for effective debt management.

3. Net Worth: The difference between total assets and total liabilities, representing a snapshot of one’s overall financial position. Tracking net worth over time provides insights into financial progress and the effectiveness of financial strategies. A positive net worth indicates financial health, while a negative net worth signifies opportunities for improvement.

4. Income Sources: Detailed documentation of all income streams, including salaries, wages, investment income, rental income, and business profits. Understanding the stability and diversification of income sources is crucial for budgeting and financial planning.

5. Expenses: Meticulous tracking of all expenditures, categorized for analysis and budgeting purposes. This includes essential expenses like housing and transportation, as well as discretionary spending on entertainment and leisure. Detailed expense tracking reveals spending patterns and informs strategies for cost optimization.

These interconnected components provide a holistic view of an individual’s financial status. Accurate and consistent documentation within each category empowers informed financial decision-making, facilitates effective planning, and contributes to long-term financial well-being.

How to Create a Detailed Personal Financial Statement

Creating a detailed personal financial statement involves a systematic approach to organizing financial data. This structured process provides a comprehensive overview of one’s financial position, facilitating informed decision-making and effective financial planning.

1. Gather Necessary Documents: Begin by collecting all relevant financial documents. These include bank statements, investment account statements, loan documents, pay stubs, tax returns, and any records of valuable assets. Comprehensive documentation ensures accuracy and completeness.

2. List Assets: Categorize and list all owned assets, including liquid assets, investments, real estate, and personal property. Determine the current market value for each asset. Online resources, appraisals, or recent sales data can assist with valuation.

3. Document Liabilities: Compile a comprehensive list of all outstanding debts and financial obligations. Include details such as current balances, interest rates, and payment terms for each liability.

4. Calculate Net Worth: Subtract total liabilities from total assets to determine net worth. This key figure represents overall financial health and provides a benchmark for tracking progress over time.

5. Detail Income Sources: List all sources of income, including salaries, wages, investment income, rental income, and business profits. Document the frequency and consistency of each income stream.

6. Track Expenses: Record all expenditures, categorizing them for analysis and budgeting. Utilize budgeting software, spreadsheets, or dedicated expense tracking tools to facilitate this process.

7. Organize the Information: Consolidate all gathered information into a structured format, using a spreadsheet, personal finance software, or a template. A well-organized statement facilitates easy review and analysis.

8. Review and Update Regularly: Regularly review and update the financial statement, preferably monthly or quarterly. This consistent practice ensures accuracy and allows for timely adjustments to financial strategies based on evolving circumstances.

A detailed personal financial statement provides a clear and comprehensive overview of one’s financial position. This organized approach empowers informed financial decision-making, facilitates effective planning, and contributes to long-term financial well-being. Regular review and updates ensure the statement remains a relevant and valuable tool for managing personal finances.

A structured record of assets, liabilities, income, and expenses provides a crucial foundation for informed financial management. Understanding the components and their interrelationships allows for clear assessment of one’s current financial standing and facilitates effective planning for future goals. Accurate and consistent documentation within a standardized framework enables meaningful analysis of spending patterns, investment performance, and overall financial health. This structured approach empowers informed decision-making regarding budgeting, debt management, and investment strategies.

Leveraging a comprehensive financial overview empowers individuals to take control of their financial well-being. Regular review and analysis of this documented financial information facilitates proactive adjustments to spending habits, investment strategies, and overall financial planning. This proactive approach contributes significantly to long-term financial stability and the achievement of financial objectives. Consistent engagement with a detailed record fosters financial awareness and promotes responsible financial behavior.