Utilizing such a structured format facilitates informed decision-making. A clear understanding of revenue drivers, cost centers, and profit margins empowers businesses to identify areas for improvement, optimize resource allocation, and develop effective strategies for growth and profitability. This structured approach also simplifies financial reporting, enhances transparency for stakeholders, and improves the accuracy of financial projections and budgeting processes.

The following sections delve deeper into specific aspects of constructing and interpreting this valuable financial tool, offering practical guidance for leveraging its insights to drive business success.

1. Revenue Streams

A detailed profit and loss statement template provides a structured framework for analyzing revenue streams, which are the various sources of income generated by a business. Understanding these streams is crucial for assessing financial health and making informed strategic decisions. Accurately categorizing and analyzing individual revenue streams allows for a granular understanding of business performance.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retailer, this would be income from merchandise sales; for a software company, it would be license fees or subscription revenue. Tracking sales revenue within the statement allows businesses to monitor growth trends, identify potential weaknesses, and evaluate the effectiveness of sales strategies.

- Service RevenueThis pertains to income derived from providing services. Consulting firms, repair shops, and subscription-based services generate service revenue. Separating this from sales revenue allows for a more precise analysis of service-related performance and profitability. This is particularly relevant for businesses offering a mix of products and services.

- Investment IncomeThis encompasses earnings from investments, including interest income, dividends, and capital gains. While not directly related to core operations, investment income contributes to overall profitability and is a key component of a comprehensive profit and loss statement. This category provides insights into the effectiveness of investment strategies and their contribution to the overall financial picture.

- Other RevenueThis category captures income not derived from primary business activities or investments. Examples include revenue from licensing agreements, royalties, or the sale of assets. Including this information provides a complete financial overview and can highlight potential diversification opportunities or identify non-core revenue streams impacting profitability.

By meticulously categorizing and analyzing each revenue stream within the profit and loss statement, businesses gain a comprehensive understanding of their income generation dynamics, enabling more effective financial management and strategic decision-making. This granular approach allows for identifying strengths, weaknesses, and opportunities within each revenue channel, ultimately contributing to improved overall financial performance and long-term sustainability.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Its accurate representation within a detailed profit and loss statement template is crucial for determining gross profit and assessing overall profitability. Understanding COGS provides insights into production efficiency, pricing strategies, and inventory management.

- Direct MaterialsThis encompasses the raw materials and components directly used in production. For a furniture manufacturer, this would include wood, fabric, and hardware. Accurate tracking of direct material costs is essential for managing production budgets and ensuring appropriate pricing. Within the profit and loss statement, this component of COGS helps assess the efficiency of raw material sourcing and utilization.

- Direct LaborDirect labor costs comprise the wages and benefits paid to employees directly involved in the production process. Assembly line workers, machine operators, and quality control personnel in a manufacturing setting are examples. Analyzing direct labor costs helps evaluate labor efficiency and identify potential areas for optimization. In the context of the profit and loss statement, this element allows for an assessment of labor costs relative to revenue generated.

- Manufacturing OverheadThis category includes all other costs directly associated with the production process but not readily attributable to specific products. Examples include factory rent, utilities, and depreciation of manufacturing equipment. Understanding manufacturing overhead is crucial for accurate cost allocation and pricing decisions. Its inclusion in the profit and loss statement contributes to a comprehensive view of production costs and overall profitability.

- Inventory ChangesThe difference between beginning and ending inventory values reflects the cost of goods sold during the accounting period. An increase in inventory suggests less inventory was sold than produced, while a decrease indicates more sales than production. Tracking inventory changes is essential for understanding the flow of goods and managing working capital. Its inclusion in COGS within the profit and loss statement ensures an accurate representation of costs associated with goods actually sold during the period.

Accurate calculation and presentation of COGS within a detailed profit and loss statement are fundamental for evaluating a company’s operational efficiency and profitability. By analyzing the components of COGS, businesses can identify areas for cost reduction, optimize pricing strategies, and improve overall financial performance. This information is crucial for stakeholders in assessing the company’s financial health and making informed investment decisions.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). A detailed profit and loss statement template provides a structured framework for categorizing and analyzing these expenses, offering crucial insights into a company’s efficiency and profitability. Effective management and analysis of operating expenses are essential for sustainable financial health.

- Selling, General, and Administrative Expenses (SG&A)SG&A encompasses a broad range of expenses related to sales, marketing, administrative functions, and general overhead. Examples include salaries of sales and marketing personnel, advertising costs, office rent, utilities, and legal fees. Detailed tracking of SG&A within a profit and loss statement provides insights into the cost-effectiveness of sales and marketing efforts, as well as the efficiency of administrative functions. Understanding and managing these costs are crucial for optimizing resource allocation and improving profitability.

- Research and Development (R&D) ExpensesR&D expenses represent investments in developing new products, services, or processes. These costs can include salaries of research personnel, laboratory equipment, and patent filing fees. While R&D is often essential for long-term growth, its impact on current profitability needs careful monitoring within the profit and loss statement. Analyzing R&D expenditure helps assess its alignment with business strategy and its potential to generate future revenue streams.

- Depreciation and AmortizationDepreciation reflects the allocation of the cost of tangible assets (e.g., buildings, equipment) over their useful lives, while amortization applies to intangible assets (e.g., patents, trademarks). These non-cash expenses represent the gradual reduction in the value of these assets over time. Their inclusion in the profit and loss statement provides a more accurate representation of the true cost of using these assets in generating revenue.

- Impairment ChargesImpairment charges represent a reduction in the carrying value of an asset when its market value declines significantly below its book value. This can occur due to various factors, including technological obsolescence, changes in market conditions, or damage to the asset. Recording impairment charges within the profit and loss statement reflects a more realistic valuation of assets and impacts profitability in the period the impairment is recognized.

Careful analysis of operating expenses within a detailed profit and loss statement allows businesses to identify areas for cost optimization, improve operational efficiency, and enhance overall profitability. Understanding the relationship between these expenses and revenue generation is essential for informed decision-making and long-term financial sustainability. By comparing operating expenses across periods and against industry benchmarks, businesses can identify trends, evaluate performance, and develop strategies for improved financial performance.

4. Non-Operating Income

Non-operating income encompasses revenue and gains derived from activities outside a company’s core business operations. Its inclusion in a detailed profit and loss statement template provides a comprehensive view of a company’s financial performance beyond its primary revenue streams. Understanding non-operating income is crucial for assessing overall profitability and identifying potential sources of income diversification.

- Investment IncomeInvestment income represents earnings generated from investments in securities, such as stocks and bonds, or other financial instruments. This can include dividends from equity holdings, interest earned on debt securities, and realized gains from the sale of investments. Within a detailed profit and loss statement, investment income provides insights into the returns generated from non-operating assets and their contribution to overall profitability. For example, a company holding a significant portfolio of marketable securities might report substantial dividend income and interest income within this category.

- Interest IncomeInterest income specifically refers to earnings generated from lending activities or interest-bearing accounts. This can include interest earned on loans extended to customers, interest on cash deposits held in bank accounts, or interest received on notes receivable. Separately presenting interest income in the profit and loss statement allows for a clear understanding of its contribution to overall financial performance. A financial institution, for instance, would likely report a significant portion of its non-operating income as interest income earned on loans.

- Gains on Sale of AssetsGains on the sale of assets represent the profit realized from selling non-current assets, such as property, plant, and equipment (PP&E), or other long-term investments. This gain is calculated as the difference between the sale price and the asset’s book value. Including this information in the profit and loss statement reflects the impact of asset disposals on profitability. For example, a manufacturing company selling a piece of machinery for more than its depreciated value would record a gain in this category.

- Other Non-Operating IncomeThis category encompasses various other sources of income not directly related to core business operations or investments. Examples include income from lawsuit settlements, insurance proceeds, foreign exchange gains, or one-time gains from discontinued operations. Including these items in the profit and loss statement provides a comprehensive picture of all income sources, even those outside the usual course of business. A company receiving a settlement from a legal dispute, for instance, would categorize this income as other non-operating income.

Accurately categorizing and reporting non-operating income within a detailed profit and loss statement provides valuable insights for stakeholders. By understanding the composition and variability of non-operating income, analysts can assess a company’s overall financial health, evaluate its diversification strategies, and make more informed projections about future performance. This information is crucial for differentiating between core business profitability and income derived from other sources, enabling a more nuanced understanding of a company’s financial position.

5. Net Income/Loss

Net income, or net loss, represents the ultimate bottom line in a detailed profit and loss statement template. It signifies the residual earnings after all revenues and gains have been considered and all expenses and losses have been deducted. This figure encapsulates the overall profitability of a business during a specific accounting period. A positive net income indicates profitability, while a negative figure signifies a net loss. The detailed profit and loss statement provides the granular data required to arrive at this crucial metric, enabling a thorough understanding of the factors contributing to profit or loss. For example, a retail business might achieve high sales revenue, but if its cost of goods sold and operating expenses are also high, the resulting net income could be low or even negative. Conversely, a service-based business with lower revenue might exhibit higher profitability due to tightly controlled expenses, resulting in a positive net income.

Understanding the components contributing to net income/loss is crucial for informed financial analysis. The detailed breakdown within the statement allows for pinpointing specific areas impacting profitability. This granular view enables management to make strategic decisions regarding pricing, cost control, and resource allocation. For instance, if a company’s net income is declining despite increasing sales, a detailed analysis of the statement might reveal escalating operating expenses as the culprit. This insight could lead to initiatives aimed at cost optimization. Further, analyzing net income trends over multiple periods provides valuable insights into a company’s financial trajectory and its ability to generate sustainable profits. Comparing net income figures against industry benchmarks offers a competitive perspective on a company’s performance.

The net income/loss figure, derived from a detailed profit and loss statement, serves as a critical performance indicator for various stakeholders. Investors and creditors rely on this figure to assess a company’s financial health and its ability to generate returns. Management utilizes net income information for internal performance evaluation, strategic planning, and resource allocation. Furthermore, net income plays a significant role in determining a company’s tax obligations. Therefore, accurate and comprehensive reporting within the detailed profit and loss statement is essential for transparency, informed decision-making, and compliance with regulatory requirements. Challenges can arise when interpreting net income in isolation. Non-recurring items, such as asset sales or restructuring charges, can distort the true picture of ongoing profitability. Therefore, a thorough analysis of the entire detailed statement, considering all contributing factors, is necessary for a comprehensive understanding of a company’s financial performance and its ability to generate sustainable earnings.

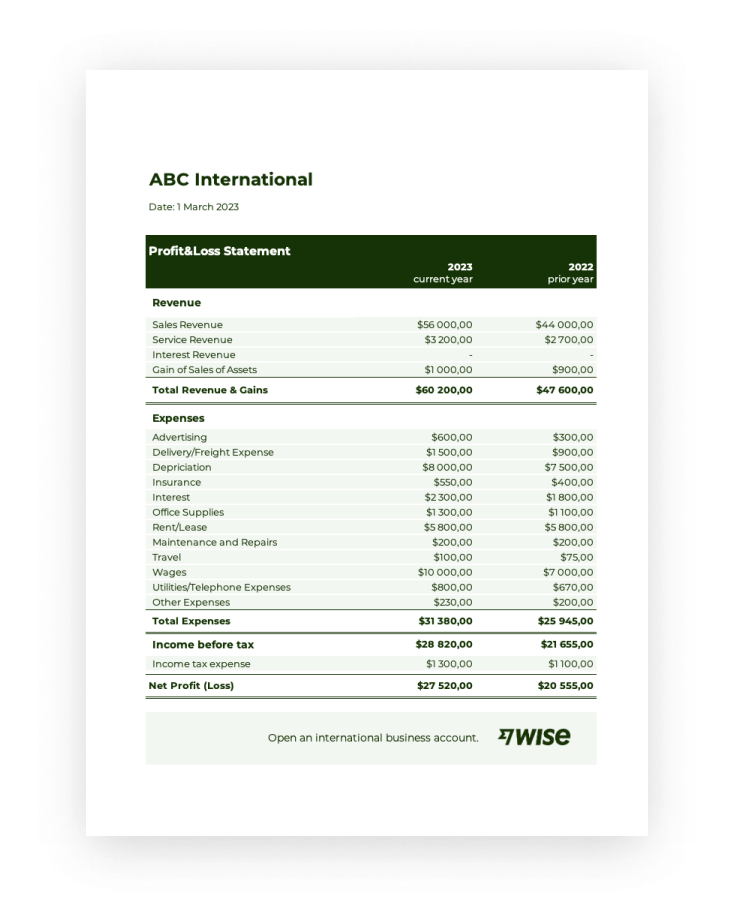

Key Components of a Detailed Profit and Loss Statement Template

A comprehensive understanding of key components within a detailed profit and loss statement template is essential for robust financial analysis. These elements provide a structured overview of a company’s performance and profitability.

1. Revenue: This section details all sources of income generated by the business. It typically includes separate line items for different revenue streams, such as sales revenue, service revenue, and investment income. Granular reporting of revenue allows for analysis of sales trends and identification of key revenue drivers.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold by the company. This includes direct materials, direct labor, manufacturing overhead, and inventory changes. Accurate COGS calculation is crucial for determining gross profit and assessing production efficiency.

3. Gross Profit: Calculated as Revenue less COGS, gross profit reflects the profitability of a company’s core business operations before considering operating expenses. This metric is essential for evaluating pricing strategies and production efficiency.

4. Operating Expenses: This section details all costs incurred in running the business’s core operations, excluding COGS. Key categories include selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation, and amortization. Analyzing operating expenses provides insights into cost management and operational efficiency.

5. Operating Income: Calculated as Gross Profit less Operating Expenses, operating income represents the profitability of a company’s core business operations. This metric reflects the effectiveness of cost management and operational strategies.

6. Non-Operating Income and Expenses: This section includes income and expenses not directly related to core business operations, such as interest income, investment gains, and interest expenses. These items provide a comprehensive view of a company’s overall financial performance.

7. Income Before Taxes: This represents a company’s earnings before considering income tax expense. It’s a key indicator of a company’s profitability before tax obligations.

8. Income Tax Expense: This section details the income tax expense incurred by the company based on applicable tax regulations. It reflects the impact of taxation on a company’s earnings.

9. Net Income: This is the ultimate bottom line, reflecting the residual earnings after all revenues, gains, expenses, and losses have been considered. Net income represents a company’s overall profitability during a specific accounting period.

Careful analysis of these interconnected components within a detailed profit and loss statement provides crucial insights into a company’s financial health, operational efficiency, and profitability. This granular approach facilitates informed decision-making, strategic planning, and performance evaluation.

How to Create a Detailed Profit and Loss Statement Template

Constructing a detailed profit and loss statement requires a systematic approach to ensure accuracy and completeness. The following steps outline the process:

1. Define the Reporting Period: Specify the timeframe for the statement, whether it’s a month, quarter, or year. This ensures consistency and allows for period-over-period comparisons.

2. Structure the Template: Establish the core sections of the statement: Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, Operating Income, Non-Operating Income and Expenses, Income Before Taxes, Income Tax Expense, and Net Income. Subheadings within each section can provide further detail.

3. Gather Financial Data: Collect all relevant financial records, including sales invoices, purchase orders, expense reports, and bank statements. Ensure data accuracy and completeness for reliable reporting.

4. Populate Revenue Section: Itemize all revenue streams, including sales revenue, service revenue, and any other income generated from core business operations. Provide sufficient detail to allow for analysis of individual revenue sources.

5. Calculate Cost of Goods Sold: Determine COGS by summing direct materials, direct labor, manufacturing overhead, and accounting for changes in inventory. Accurate COGS calculation is crucial for gross profit determination.

6. Itemize Operating Expenses: Categorize and list all operating expenses, including SG&A, R&D, depreciation, and amortization. Provide a detailed breakdown for each expense category to facilitate cost analysis.

7. Include Non-Operating Income and Expenses: Account for any non-operating income or expenses, such as interest income, investment gains or losses, and any other income or expense not directly related to core operations.

8. Calculate Income Tax Expense: Determine the income tax liability based on applicable tax regulations and the company’s pre-tax income. This is a crucial step for arriving at net income.

9. Compute Net Income: Calculate net income by subtracting total expenses (including COGS, operating expenses, and income tax expense) from total revenues. This figure represents the overall profitability for the defined reporting period.

10. Review and Verify: Thoroughly review the completed statement for accuracy and consistency. Verify all calculations and ensure proper categorization of income and expenses. This final step is crucial for reliable financial reporting.

A meticulously constructed detailed profit and loss statement provides valuable insights into financial performance. Consistent formatting and accurate data are essential for effective analysis and informed decision-making.

Comprehensive income statement templates offer an invaluable tool for financial analysis, providing a structured view of revenue streams, costs, and profitability. Understanding the components within these statements, including revenue categorization, cost of goods sold, operating expenses, and non-operating income, allows for a detailed assessment of a company’s financial health. Accurate data and meticulous categorization within the template facilitate informed decision-making regarding pricing strategies, cost optimization, and resource allocation.

Leveraging these detailed statements empowers businesses to identify trends, evaluate performance against benchmarks, and develop proactive strategies for sustained growth and profitability. Effective utilization of this financial tool enables stakeholders to gain a deeper understanding of a company’s financial position, fostering transparency and informed financial management. Continued refinement and analysis of these statements remain crucial for navigating the complexities of the business landscape and achieving long-term financial success.