Utilizing a simplified balance sheet format allows for informed financial decision-making. Budgeting becomes more effective, and identifying areas for improvement, like reducing debt or increasing savings, becomes easier. This readily available information empowers users to take control of their finances and work towards achieving their financial goals.

This accessible approach to financial management provides a foundation for exploring deeper financial topics, including budgeting, debt management, and investment strategies. Understanding ones financial position is the first step toward building a secure financial future.

1. Accessibility

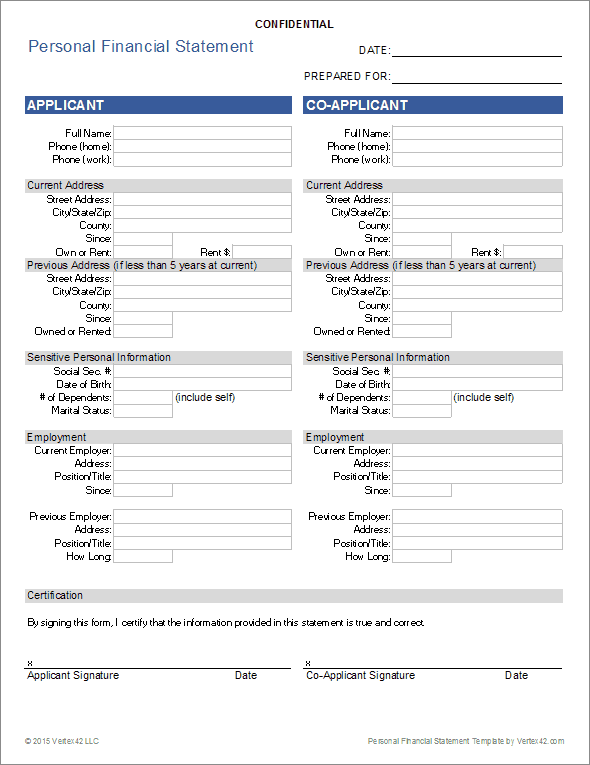

Accessibility plays a crucial role in the effectiveness of a simplified personal financial statement template. A truly accessible template removes barriers to entry, allowing individuals with varying levels of financial literacy to understand and utilize the tool effectively. This can involve clear, concise language, avoiding technical jargon, and providing straightforward instructions. An accessible template might also consider diverse learning styles, offering visual aids like charts and graphs alongside numerical data. For instance, a template that color-codes different spending categories or utilizes interactive elements can enhance comprehension and engagement. Removing these barriers promotes consistent financial tracking, a crucial habit for long-term financial health. Furthermore, accessibility promotes financial inclusion, empowering individuals across different socioeconomic backgrounds to take control of their finances.

Consider the difference between a complex spreadsheet filled with intricate formulas and a streamlined template with clearly labeled sections for income, expenses, and assets. The latter encourages engagement by reducing the intimidation factor often associated with financial management. An accessible template might also offer various formats, catering to different technological preferences. This could include downloadable spreadsheet versions, mobile-friendly apps, or even printable PDFs. The availability of multiple access points further contributes to user adoption and consistent usage.

Ultimately, accessibility ensures that the benefits of a simplified personal financial statement are available to everyone. By lowering the barriers to entry and promoting ease of use, these templates empower individuals to develop healthy financial habits, regardless of their prior knowledge or technological capabilities. This widespread adoption fosters greater financial awareness and contributes to improved financial well-being across communities.

2. Simplicity

Simplicity is a cornerstone of an effective personal financial statement template. A template overburdened with complex features or requiring intricate data entry discourages consistent use. The goal is to provide a clear, concise overview of one’s financial health, not to create another source of complexity. Simplicity fosters engagement by reducing the time and effort required for tracking finances. A simple template focuses on essential information income, expenses, assets, and liabilities presented in a readily understandable format. This allows individuals to quickly grasp their financial standing without getting bogged down in unnecessary details.

Consider the difference between a template requiring detailed categorization of every small expense versus one that focuses on broader categories like housing, transportation, and food. The latter approach streamlines data entry and promotes consistent tracking. For instance, a busy professional might find it challenging to meticulously categorize every coffee purchase, but easily track overall spending on food and beverages. This simplified approach still provides valuable insights into spending patterns without demanding excessive time or effort. Simplicity also extends to the visual presentation of the data. Clear charts and graphs can communicate complex financial information more effectively than dense tables of numbers. Visual simplicity aids in identifying trends and potential areas for improvement.

Ultimately, a simple, user-friendly template encourages regular engagement with personal finances. This consistent interaction promotes financial awareness, leading to more informed decisions regarding budgeting, saving, and investing. While detailed financial analysis may be necessary periodically, a simplified approach offers a valuable tool for ongoing financial management, fostering better financial habits and outcomes over the long term. The ease of use provided by a simple template contributes significantly to its effectiveness in promoting long-term financial well-being. By reducing the barrier to entry, simplicity empowers individuals to take control of their financial lives and build a stronger financial future.

3. Clarity

Clarity serves as a critical component within a user-friendly personal financial statement template. A well-designed template prioritizes clear presentation of information, enabling users to quickly grasp their financial standing. This clarity manifests in several ways: logical organization of information, intuitive labeling of categories, and visually appealing presentation of data. A template lacking clarity can lead to confusion and misinterpretation, hindering effective financial management. Consider a template where asset and liability categories are poorly defined or intermingled. This lack of clarity can lead to inaccurate calculations of net worth and obscure opportunities for financial improvement. Conversely, a clearly structured template facilitates accurate data entry and informed decision-making.

Real-world examples underscore the importance of clarity. Imagine a template that uses ambiguous terms like “Account A” and “Account B” instead of clearly labeling checking and savings accounts. This ambiguity can cause users to misclassify transactions, leading to an inaccurate reflection of their financial reality. Alternatively, a template employing clear, descriptive labels ensures accurate data entry and provides a reliable snapshot of one’s finances. Furthermore, visual clarity through charts and graphs enhances understanding. A pie chart clearly showing the proportion of income allocated to different expense categories provides more immediate insight than a simple list of numbers. This visual clarity allows users to quickly identify areas of overspending and adjust their budgets accordingly.

In summary, clarity within a personal financial statement template is essential for effective financial management. Clear organization, labeling, and visual presentation facilitate accurate data entry, promote understanding, and empower informed financial decision-making. Addressing potential ambiguity within the template design ensures its usability and effectiveness in promoting sound financial practices. This ultimately contributes to improved financial outcomes for individuals utilizing these tools.

4. Comprehensiveness

Comprehensiveness within a personal financial statement template balances simplicity with the inclusion of all essential elements required for a thorough understanding of one’s financial position. While ease of use remains paramount, omitting crucial data points undermines the template’s effectiveness. A comprehensive template ensures no significant financial aspects are overlooked, enabling informed decision-making and accurate financial assessments. This balance between simplicity and thoroughness is crucial for fostering effective financial management practices.

- Asset CoverageA comprehensive template includes fields for all significant asset categories, from liquid assets like cash and checking accounts to long-term investments such as real estate and retirement accounts. Accurately capturing the full spectrum of assets is crucial for determining net worth and understanding overall financial health. Excluding certain asset classes, like valuable collections or intellectual property, can lead to an incomplete and potentially misleading picture of one’s financial standing.

- Liability DetailSimilar to asset coverage, a comprehensive template meticulously details all liabilities, ranging from short-term debts like credit card balances to long-term obligations such as mortgages and student loans. A comprehensive view of liabilities is crucial for accurate debt management and financial planning. Failing to include all outstanding debts can result in an overly optimistic view of one’s financial situation and hinder effective debt reduction strategies.

- Income StreamsBeyond simply recording overall income, a comprehensive template might also provide space to itemize various income sources. This detailed approach allows for a deeper understanding of income diversification and potential vulnerabilities. Distinguishing between earned income, investment income, and other sources provides valuable insights for financial planning and risk management. For example, understanding the proportion of income derived from a single source versus diversified streams can highlight potential financial risks.

- Expense TrackingComprehensiveness extends to expense tracking, ensuring all significant spending categories are represented within the template. While excessive detail can be counterproductive, capturing key areas like housing, transportation, food, and healthcare provides valuable insights into spending patterns. This data informs budgeting decisions and highlights potential areas for cost optimization. A template lacking comprehensive expense tracking hinders effective budget creation and financial control.

A comprehensive, yet user-friendly, personal financial statement template provides individuals with a powerful tool for understanding and managing their finances effectively. The inclusion of all significant assets, liabilities, income streams, and expense categories, while maintaining simplicity, ensures a holistic and accurate representation of one’s financial position. This comprehensive overview empowers informed decision-making, enabling individuals to pursue their financial goals with greater confidence and control. It creates a solid foundation for long-term financial health and stability.

5. Usability

Usability stands as a critical factor determining the effectiveness of an easy personal financial statement template. A template, regardless of its comprehensiveness or clarity, fails to serve its purpose if individuals find it difficult to use or navigate. Usability encompasses several key aspects: intuitive design, ease of data entry, accessibility across different devices, and efficient report generation. A usable template encourages regular engagement, fostering consistent financial tracking and informed decision-making. Conversely, a poorly designed template, however well-intentioned, can become another obstacle to effective financial management, often abandoned due to frustration or complexity.

Consider the impact of a template requiring manual calculations for net worth versus one that automatically updates these figures upon data entry. The latter significantly enhances usability, reducing the likelihood of errors and promoting consistent usage. Similarly, a template optimized for mobile devices caters to today’s on-the-go lifestyles, allowing users to track finances conveniently. Real-world examples demonstrate the practical significance of usability. A small business owner, pressed for time, benefits from a template offering quick access to key financial metrics, enabling swift, informed decisions. Conversely, a complex, multi-page template requiring extensive data entry is likely to be neglected, hindering effective financial management.

In conclusion, usability represents a crucial bridge connecting the theoretical benefits of a personal financial statement template with its practical application. A well-designed, user-friendly template fosters consistent engagement, promotes accurate financial tracking, and empowers informed decision-making. Prioritizing usability ensures that the template serves as a valuable tool for individuals striving to achieve their financial goals. Failing to address usability undermines the template’s purpose, rendering it an ineffective instrument for financial management, regardless of its other merits. Templates must seamlessly integrate into users lives to facilitate proactive financial behavior and improve long-term financial outcomes.

6. Actionable Insights

Actionable insights represent the ultimate objective of an easy personal financial statement template. While organized data provides a foundation, the true value lies in the ability to extract meaningful information that drives positive financial changes. An effective template facilitates this process by presenting data in a clear, concise manner, enabling users to identify trends, pinpoint areas for improvement, and make informed decisions regarding budgeting, saving, and investing. The connection between the template and actionable insights lies in the template’s ability to transform raw data into usable knowledge. Without this transformative process, the template remains a static record, failing to catalyze meaningful financial progress.

Consider the scenario of an individual consistently tracking expenses within a user-friendly template. Over time, patterns emerge, revealing a significant portion of income allocated to dining out. This insight, readily apparent due to the template’s clear presentation of data, empowers the individual to make informed choices. They might decide to reduce restaurant spending, redirecting those funds towards debt reduction or increased savings. This real-life example demonstrates the practical significance of actionable insights derived from a well-designed template. Without the readily available data, the individual might remain unaware of their spending habits, hindering their ability to achieve financial goals. Another example could involve tracking investment performance within a template. Clear visualization of returns, readily accessible through the template, allows individuals to assess the effectiveness of their investment strategies and make necessary adjustments. This data-driven approach empowers informed decision-making, maximizing investment returns and contributing to long-term financial well-being.

In summary, actionable insights derived from an easy personal financial statement template serve as the catalyst for positive financial change. The template’s ability to transform raw data into usable knowledge empowers individuals to identify areas for improvement, make informed decisions, and ultimately achieve their financial objectives. Failing to extract actionable insights renders the template a passive record-keeping tool, neglecting its potential to drive meaningful financial progress. The true power of a well-designed template resides in its capacity to facilitate informed action, leading to improved financial outcomes and long-term financial health.

Key Components of a Simplified Personal Financial Statement Template

Effective personal financial management hinges on understanding key financial data. A streamlined personal financial statement template provides this understanding through several crucial components.

1. Asset Summary: Accurate representation of all owned assets, categorized for clarity. This includes liquid assets (cash, checking/savings accounts), investments (stocks, bonds, retirement accounts), and tangible assets (real estate, vehicles). Clear categorization allows for a comprehensive overview of asset allocation and net worth calculation.

2. Liability Detail: Complete disclosure of all outstanding debts and financial obligations. This encompasses short-term liabilities (credit card balances, personal loans) and long-term liabilities (mortgages, student loans). Accurate liability tracking is crucial for debt management and financial planning.

3. Income Sources: Detailed recording of all income streams. This includes salary, investment income, rental income, and any other sources of revenue. Understanding income sources allows for analysis of income diversification and stability.

4. Expense Breakdown: Categorized tracking of all expenses, including essential expenses (housing, food, transportation) and discretionary expenses (entertainment, travel). Detailed expense tracking provides insights into spending patterns and informs budget creation.

5. Net Worth Calculation: Automated calculation of net worth (assets minus liabilities). This key metric provides a snapshot of overall financial health and progress over time. Regular net worth tracking enables informed financial decision-making.

6. Report Generation: Ability to generate concise reports summarizing financial data. Reports facilitate easy analysis of financial trends and inform future financial strategies. Regular report generation promotes proactive financial management.

A well-designed template facilitates informed financial decisions through accurate data representation, enabling effective planning and progress toward financial goals.

How to Create an Easy Personal Financial Statement Template

Creating a streamlined personal financial statement involves organizing key financial data into a clear, accessible format. This process facilitates better understanding of one’s financial position and empowers informed decision-making.

1. Choose a Format: Select a format suitable for individual needs and technological proficiency. Options include spreadsheet software, dedicated budgeting apps, or even a simple handwritten document. The chosen format should facilitate easy data entry and clear presentation.

2. List Assets: Thoroughly document all owned assets, categorized for clarity. Include liquid assets (cash, checking/savings accounts), investments (stocks, bonds, retirement accounts), and tangible assets (real estate, vehicles, valuable possessions). Assign accurate current market values to each asset.

3. Detail Liabilities: Meticulously record all outstanding debts and financial obligations. Include short-term liabilities like credit card balances and personal loans, along with long-term liabilities such as mortgages and student loans. Ensure accurate representation of outstanding balances.

4. Summarize Income: Document all sources of income. This includes salary, investment income, rental income, and any other sources of revenue. Accurate income reporting ensures a complete financial picture.

5. Categorize Expenses: Track all expenses, categorized for analysis. Include essential expenses (housing, food, transportation) and discretionary expenses (entertainment, travel). Categorization facilitates identification of spending patterns.

6. Calculate Net Worth: Subtract total liabilities from total assets to determine net worth. This key metric provides a snapshot of overall financial health. Regularly calculating net worth allows tracking of financial progress.

7. Generate Reports (Optional): Consider generating reports to summarize key financial data. Reports can provide visual representations of spending habits, asset allocation, and net worth trends over time. This facilitates proactive financial management.

8. Regular Updates: Maintain the template by regularly updating information, ideally monthly. Consistent updates ensure accuracy and provide a current view of financial standing, enabling informed decisions and proactive financial management.

A well-structured template empowers informed financial decisions and progress toward financial goals. Regular review and updates ensure the template remains a relevant and effective tool for long-term financial health.

Streamlined personal balance sheet templates offer a crucial foundation for effective financial management. By providing a clear, concise overview of assets, liabilities, income, and expenses, these templates empower informed decision-making. Accessibility, simplicity, clarity, comprehensiveness, usability, and actionable insights represent key characteristics of effective templates, ensuring these tools translate financial data into usable knowledge. Understanding these core elements allows individuals to leverage these templates effectively, transforming raw data into a roadmap for financial success.

Financial well-being hinges on proactive engagement with one’s financial data. Adopting a streamlined personal balance sheet template represents a significant step toward achieving financial goals. Regular utilization of these templates, coupled with consistent data updates, fosters financial awareness and empowers informed choices regarding budgeting, saving, and investing. This proactive approach to financial management builds a foundation for long-term financial health and security, enabling individuals to navigate financial complexities with greater confidence and control.