Utilizing a streamlined reporting framework offers several advantages. It saves time and resources by simplifying the process of organizing financial data. Accessibility is increased, allowing individuals with limited accounting expertise to grasp key financial indicators. This accessibility, in turn, promotes better communication and transparency among stakeholders. Furthermore, a simplified format can be readily adapted and customized to suit the specific needs of various businesses, regardless of size or industry.

This foundation of accessible financial reporting serves as a crucial starting point for deeper analysis. Subsequent sections will explore the core components of this reporting structure, offer practical guidance on its creation and utilization, and discuss strategies for leveraging these insights to improve financial outcomes.

1. Clear Revenue Categorization

Effective financial analysis hinges on accurate and organized data. Within a simplified profit and loss statement template, clear revenue categorization is fundamental to understanding the sources of income and their respective contributions to overall profitability. This clarity enables informed decision-making regarding pricing strategies, resource allocation, and business growth initiatives.

- Distinct Revenue StreamsSeparating revenue streams provides a granular view of income generation. For a retail business, this might involve categorizing sales by product line (e.g., clothing, accessories, electronics). For a consulting firm, it could involve distinguishing between project-based revenue and retainer fees. This differentiation allows businesses to assess the performance of each revenue stream and identify areas for potential growth or improvement.

- Sales Discounts and ReturnsAccurately accounting for sales discounts and returns ensures the revenue figures reflect actual income earned. Clearly separating these deductions from gross sales provides a more accurate representation of net revenue and prevents overstatement of profitability. This practice is crucial for maintaining financial transparency and generating reliable performance metrics.

- Revenue Recognition TimingProperly timing revenue recognition, particularly for subscription-based services or long-term contracts, ensures compliance with accounting principles and provides a realistic view of financial performance. This involves recognizing revenue when it is earned, not necessarily when cash is received. Clear categorization facilitates this process and prevents distortions in reported income.

- Analysis and Decision-MakingWell-categorized revenue data empowers businesses to analyze trends, identify top-performing products or services, and make data-driven decisions. This granular understanding of revenue sources informs strategic planning, marketing efforts, and resource allocation, ultimately contributing to improved profitability and sustainable growth.

By implementing clear revenue categorization within a simplified profit and loss statement template, businesses gain a comprehensive understanding of their income streams, which is essential for effective financial management, strategic planning, and informed decision-making. This structured approach allows for accurate performance evaluation and facilitates the identification of opportunities for growth and optimization.

2. Detailed Expense Breakdown

A detailed expense breakdown is integral to an effective profit and loss statement template. Its importance lies in providing a granular view of cost drivers, enabling informed decisions regarding resource allocation and cost optimization strategies. Without this detailed insight, opportunities for improved profitability may remain obscured.

Categorizing expenses into relevant groups, such as operating expenses (e.g., rent, utilities, salaries), marketing and advertising costs, and research and development expenditures, allows for targeted analysis. For example, a rising trend in marketing costs coupled with stagnant sales growth might signal the need to re-evaluate marketing campaign effectiveness. Similarly, comparing administrative expenses to industry benchmarks can reveal areas of potential overspending. A restaurant, for instance, might analyze food costs as a percentage of revenue to identify potential inefficiencies in inventory management or menu pricing. Manufacturing businesses can track direct material and labor costs to assess production efficiency and identify opportunities for cost reduction.

A comprehensive understanding of expense drivers is critical for sound financial management. A detailed breakdown within a simplified profit and loss statement template empowers businesses to identify areas for cost control, improve operational efficiency, and ultimately enhance profitability. This granular view allows for proactive adjustments to spending patterns and facilitates data-driven decision-making. Furthermore, this detailed analysis supports accurate forecasting, enabling businesses to anticipate future expenses and develop strategies to mitigate financial risks.

3. Calculated Gross Profit

Calculated gross profit represents a pivotal component within an easy profit and loss statement template. Derived by subtracting the cost of goods sold (COGS) from total revenue, this figure provides essential insights into a company’s production efficiency and pricing strategies. Understanding this metric is crucial for evaluating overall financial health and making informed business decisions. A consistent decline in gross profit margin, for instance, could signal issues with rising production costs, increased competition impacting pricing power, or inefficiencies within the supply chain. Conversely, a healthy and growing gross profit margin often suggests effective cost management and strong product/service demand.

Consider a furniture manufacturer. Analyzing the calculated gross profit can illuminate the relationship between production costs (raw materials, labor) and revenue generated from furniture sales. If material costs increase significantly while sales prices remain stagnant, gross profit will inevitably decrease. This scenario highlights the importance of regularly monitoring this metric to identify and address such challenges proactively. A software company, on the other hand, might experience a high gross profit margin due to lower COGS (primarily software development and maintenance) relative to revenue generated from software licenses and subscriptions. This understanding allows businesses to benchmark performance against industry averages and identify areas for improvement or competitive advantage.

Accurate calculation and interpretation of gross profit are fundamental for sustainable business growth. Within the context of an easy profit and loss statement template, this metric offers a clear indicator of profitability before considering operating expenses and other costs. Monitoring trends in gross profit enables businesses to assess the effectiveness of pricing strategies, manage production costs, and maintain healthy profit margins. This knowledge ultimately empowers informed decision-making, allowing for proactive adjustments and optimized resource allocation to ensure long-term financial stability and success.

4. Precise Net Income/Loss

Precise net income/loss calculation represents the culmination of an easy profit and loss statement template, providing a definitive measure of a company’s profitability over a specific period. This bottom-line figure, derived after deducting all expenses from total revenue, offers critical insights into financial performance and sustainability. Accuracy in this calculation is paramount; even minor discrepancies can lead to misinformed decisions and inaccurate assessments of financial health. For instance, a retail business might show a net loss due to increased operating expenses, such as rent and utilities, despite a rise in sales revenue. This highlights the importance of examining both net income/loss and its contributing factors to gain a comprehensive understanding of financial performance. A seemingly profitable venture might mask underlying inefficiencies if solely relying on top-line revenue figures.

Consider a subscription-based software company. While recurring subscription revenue might appear robust, a detailed profit and loss statement, accurately calculating net income/loss, would account for customer acquisition costs, research and development expenses, and other operational costs. This comprehensive view reveals true profitability, allowing for informed decisions regarding pricing strategies, expansion plans, and resource allocation. A manufacturing company, on the other hand, might experience a temporary decrease in net income due to investments in new equipment or expansion efforts. While this short-term impact might appear negative, accurate net income/loss reporting within the context of the overall business strategy provides valuable insights for long-term growth and sustainability.

The significance of precise net income/loss calculation within an easy profit and loss statement template lies in its ability to provide a clear and accurate representation of a company’s financial performance. This precise figure serves as a critical performance indicator, influencing investment decisions, strategic planning, and overall business trajectory. Understanding this bottom-line result, in conjunction with the components contributing to it, empowers informed decision-making and fosters long-term financial health.

5. Defined Reporting Period

A defined reporting period is a crucial element within an easy profit and loss statement template. A specified timeframe, whether monthly, quarterly, or annually, provides the necessary structure for analyzing financial performance. This defined period ensures data consistency and allows for meaningful comparisons across different periods, enabling trend analysis and informed decision-making. Without a consistent reporting period, comparing financial data becomes challenging, hindering accurate performance evaluation and potentially obscuring emerging trends. For instance, comparing a three-month period against a five-month period would yield skewed insights, making it difficult to assess genuine progress or decline. A clearly defined timeframe acts as a control, ensuring data comparability and facilitating accurate trend identification.

Consider a retail business analyzing sales performance. Utilizing a consistent monthly reporting period allows for the identification of seasonal sales patterns, the impact of marketing campaigns, and the effectiveness of inventory management strategies. This regular, structured reporting fosters timely insights, enabling proactive adjustments to maximize profitability. Similarly, an annual reporting period, often used for tax purposes and external reporting, provides a comprehensive overview of a company’s financial performance throughout the year. This aggregated data is essential for assessing overall profitability, evaluating long-term trends, and making strategic decisions regarding future investments and growth initiatives.

Establishing a defined reporting period is fundamental for generating meaningful insights from an easy profit and loss statement template. Consistency in reporting allows for accurate trend analysis, performance benchmarking, and ultimately, data-driven decision-making. This structured approach ensures data comparability, facilitating a clear understanding of financial performance and providing a solid foundation for strategic planning and sustainable growth. Challenges may arise when comparing data across companies using different reporting periods, underscoring the importance of standardized reporting within specific industries or regulatory frameworks. Understanding the significance of this component within a simplified profit and loss statement empowers businesses to leverage financial data effectively and make informed decisions aligned with their overall objectives.

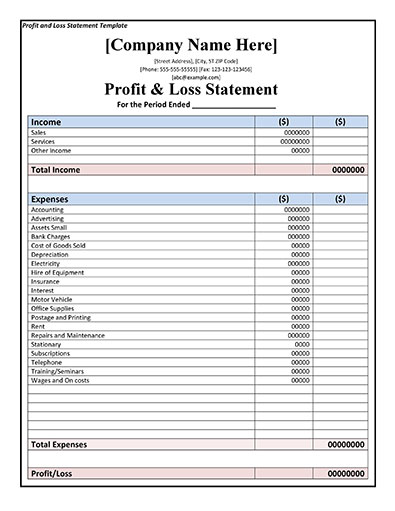

Key Components of a Simplified Profit and Loss Statement Template

A well-structured template ensures clarity and accessibility, facilitating informed financial decision-making. Key components contribute to this streamlined reporting structure, providing a comprehensive overview of financial performance.

1. Revenue: Accurate revenue reporting forms the foundation of a reliable profit and loss statement. This section details all income generated from sales, services, or other operational activities. Clear categorization of revenue streams, distinguishing between product lines or service types, enhances analysis and facilitates informed resource allocation.

2. Cost of Goods Sold (COGS): For businesses selling tangible products, COGS represents the direct costs associated with production, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit and assessing production efficiency.

3. Gross Profit: Calculated by subtracting COGS from revenue, gross profit reflects the profitability of core business operations before considering operating expenses. Analyzing gross profit margins assists in evaluating pricing strategies and identifying potential production inefficiencies.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Categorizing operating expenses (e.g., rent, salaries, marketing) allows for detailed analysis of cost drivers and identification of areas for potential cost optimization.

5. Operating Income: Operating income represents profitability after accounting for both COGS and operating expenses. This metric provides insights into the efficiency of core business operations and management’s ability to control costs.

6. Other Income/Expenses: This category includes income or expenses not directly related to core operations, such as interest income, investment gains/losses, or one-time expenses. Including these items provides a comprehensive view of overall financial performance beyond core business activities.

7. Net Income/Loss: This bottom-line figure represents the final profit or loss after considering all revenue and expenses. Accurate net income/loss calculation is crucial for assessing overall financial health and making informed strategic decisions.

8. Reporting Period: Clearly defining the reporting period (monthly, quarterly, or annually) ensures data consistency and enables meaningful comparisons across different periods. This defined timeframe facilitates trend analysis and enhances the accuracy of performance evaluations.

These components provide a framework for understanding financial performance, enabling data-driven decisions and contributing to long-term financial health. Analysis of these elements, individually and collectively, provides a comprehensive understanding of profitability, cost structures, and overall financial sustainability.

How to Create an Easy Profit and Loss Statement Template

Creating a simplified profit and loss statement involves organizing key financial data into a structured format. This process facilitates clear understanding of financial performance and supports informed decision-making.

1: Define the Reporting Period: Specify a clear timeframe for the statement, such as a month, quarter, or year. Consistent reporting periods enable accurate comparisons and trend analysis over time.

2: Categorize Revenue Streams: List all sources of revenue, separating them into distinct categories (e.g., product sales, service fees, subscriptions). This detailed breakdown provides insights into the performance of individual revenue streams.

3: Calculate Cost of Goods Sold (COGS): If applicable, determine the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead.

4: Determine Gross Profit: Subtract COGS (if applicable) from total revenue to calculate gross profit. This metric reflects profitability before accounting for operating expenses.

5: Itemize Operating Expenses: List all expenses incurred in running the business, excluding COGS. Categorize these expenses (e.g., rent, salaries, marketing, utilities) for detailed analysis and cost control.

6: Calculate Operating Income: Subtract total operating expenses from gross profit to arrive at operating income. This figure reflects the profitability of core business operations.

7: Account for Other Income/Expenses: Include any income or expenses not directly related to core operations, such as interest income or investment gains/losses. This provides a holistic view of financial performance.

8: Calculate Net Income/Loss: Subtract all expenses (including other income/expenses) from total revenue to determine the final net income or loss for the reporting period.

A structured approach, utilizing a defined reporting period and clear categorization of revenue and expenses, facilitates accurate calculation of gross profit, operating income, and net income/loss, providing valuable insights into financial performance and supporting data-driven decision-making.

Simplified profit and loss statement templates offer accessible and efficient financial reporting, providing crucial insights into revenue streams, expense management, and overall profitability. Understanding the core components, from revenue categorization and expense breakdowns to the calculation of gross profit and net income/loss, empowers informed decision-making. Utilizing a structured approach with a defined reporting period ensures data consistency, enabling accurate trend analysis and performance evaluation. This streamlined reporting facilitates clear communication among stakeholders and provides a solid foundation for strategic planning.

Effective financial management hinges on accurate and accessible data. Leveraging simplified profit and loss statement templates enables businesses to gain a comprehensive understanding of their financial performance, identify areas for improvement, and make data-driven decisions to optimize profitability and achieve sustainable growth. Regular review and analysis of these statements are essential for navigating the complexities of the business landscape and ensuring long-term financial health.