The ability to modify a document resembling an official financial record provides flexibility for financial planning and analysis. Users can experiment with different financial scenarios, project future balances, and gain a clearer understanding of their cash flow. This practical application makes these adaptable documents valuable tools for individuals and businesses alike.

Further exploration of personal finance management, budgeting strategies, and the ethical considerations surrounding the use of such documents will provide a more complete understanding of their potential benefits and risks.

1. Customization

Customization lies at the heart of an editable bank statement template’s utility. The ability to modify figures within a document mirroring a legitimate bank statement allows for hypothetical financial scenario planning. One can adjust income, expenses, and investment returns to project potential future financial positions. For example, an individual considering a large purchase can input the associated costs into the template to visualize its impact on their overall balance and budget. This allows for informed decision-making based on projected financial outcomes.

The degree of customization varies depending on the template’s design. Some offer basic adjustments to transaction amounts and dates, while others allow for modification of account details, interest rates, and other variables. This flexibility allows users to tailor the template to their specific financial circumstances and planning needs. A business, for instance, might use a customized template to project revenue and expenses under different market conditions, aiding in strategic planning and risk assessment.

While customization empowers users with greater control over their financial projections, it also necessitates a responsible approach. Manipulating figures to misrepresent one’s financial standing, even within a template, carries ethical implications and should be avoided. The true value of customization lies in its ability to facilitate accurate and insightful financial planning, enabling informed decisions and responsible financial management.

2. Financial Planning

Financial planning benefits significantly from the utilization of customizable bank statement templates. These templates offer a practical tool for visualizing and manipulating financial data, allowing for more informed decision-making and a clearer understanding of one’s financial position. By inputting projected income and expenses, individuals and businesses can develop more robust financial plans.

- Budgeting and Expense TrackingCustomizable templates provide a platform for creating and monitoring budgets. By inputting anticipated expenses and comparing them to projected income, users can identify potential shortfalls or areas for savings. For example, projecting monthly mortgage payments, utility bills, and grocery costs within a template allows for a comprehensive overview of essential expenditures and facilitates proactive budget adjustments.

- Goal Setting and Progress MonitoringFinancial goals, such as saving for a down payment or retirement, can be integrated into these templates. By projecting future income and savings contributions, individuals can visualize the timeline for achieving their goals. Tracking progress against these projections within the template allows for adjustments to savings strategies or spending habits as needed.

- Scenario Planning and Risk AssessmentThe flexibility of these templates enables users to explore various financial scenarios. For example, a business can project revenue and expenses under different market conditions, allowing for contingency planning and risk mitigation strategies. Similarly, individuals can assess the impact of unexpected expenses or income fluctuations on their financial stability.

- Debt Management and Reduction StrategiesTemplates can be utilized to model debt repayment strategies. By inputting loan details and projected payments, individuals can visualize the impact of different repayment plans on their overall financial health. This facilitates informed decisions regarding debt consolidation, prioritization of high-interest debts, and the development of effective debt reduction strategies.

Integrating these facets of financial planning within a customizable bank statement template provides a comprehensive and dynamic tool for managing personal or business finances. The ability to manipulate data and visualize potential outcomes empowers users to make more informed decisions, ultimately leading to greater financial stability and the achievement of long-term financial goals.

3. Illustrative Purposes

Editable templates resembling bank statements serve crucial illustrative functions, extending beyond practical financial planning. Their adaptability allows them to represent financial concepts, demonstrate financial processes, and provide visual aids for educational or explanatory purposes. This illustrative capacity enhances understanding and communication of financial information in various contexts.

- Educational ToolsTemplates can be utilized as educational tools to explain financial concepts, such as budgeting, saving, and investing. Educators can modify the template’s data to demonstrate the impact of different financial decisions. For example, a template could illustrate the growth of savings over time with varying interest rates, providing a visual representation of compound interest.

- Proof of Concept DemonstrationsIn business settings, these templates can serve as proof-of-concept demonstrations for financial projections. Startups seeking funding can utilize a template to illustrate projected revenue streams and expenses, providing potential investors with a tangible representation of their business model’s financial viability. This visual aid enhances the clarity and credibility of financial forecasts.

- Software Testing and DevelopmentSoftware developers creating financial applications can utilize templates for testing and quality assurance. By inputting a range of data points, developers can ensure that their applications accurately process and display financial information. This rigorous testing ensures the reliability and accuracy of the final product.

- Legal and Compliance DemonstrationsIn legal or compliance scenarios, templates can be adapted to illustrate financial discrepancies or demonstrate compliance with regulatory requirements. For example, a template could be used to visualize the impact of fraudulent activity on an account balance or demonstrate adherence to specific accounting practices. This visual representation of financial data strengthens legal arguments and simplifies complex financial information.

The illustrative applications of customizable bank statement templates extend their utility beyond personal finance management. Their adaptability and capacity to represent complex financial information in a clear, visual format make them valuable tools for educational, business, technological, and legal contexts. By providing concrete examples and visual aids, these templates enhance understanding and facilitate effective communication of financial concepts and data.

4. Data Input

Data input is the foundational process that unlocks the utility of an editable bank statement template. The template itself serves as a structured framework, and its value is realized only when populated with relevant financial information. Accuracy and relevance of this data directly impact the reliability and usefulness of any subsequent analysis or projections derived from the template. For instance, inputting incorrect transaction amounts or dates will lead to flawed financial projections and potentially misinformed decisions. Conversely, accurately inputting historical financial data allows for realistic simulations of past performance and informs future financial strategies.

The type of data inputted depends on the intended purpose of the template. For personal budgeting, data might include income from various sources, recurring expenses like rent or mortgage payments, and discretionary spending. For business projections, data might encompass projected sales figures, operating costs, and investment returns. In either case, attention to detail is crucial. A misplaced decimal or an incorrect date can significantly alter the resulting calculations and lead to inaccurate conclusions. Using real-life examples, consider a scenario where an individual omits a recurring monthly expense when projecting their savings for a down payment. This omission will create an overly optimistic projection, potentially leading to disappointment or financial strain when the actual expense is incurred.

Understanding the critical role of accurate data input is essential for leveraging the full potential of an editable bank statement template. While the template provides the structure, the data provides the substance. Accurate, relevant, and meticulously inputted data transforms a static template into a dynamic tool for financial planning, analysis, and decision-making. Failure to appreciate this connection can lead to misinterpretations, flawed strategies, and ultimately, undermine the very purpose of using the template. It reinforces the crucial link between accurate data and reliable financial insights.

5. Format Accuracy

Format accuracy is paramount when utilizing a customizable bank statement template. The template’s effectiveness hinges on its ability to convincingly replicate the structure and presentation of a legitimate bank statement. Discrepancies in formatting can undermine the template’s credibility, rendering it unsuitable for illustrative purposes or potentially raising suspicion if used in scenarios requiring a degree of verisimilitude. Consider the placement of logos, the font used for transaction details, or the specific layout of account information. Each element contributes to the overall impression of authenticity. A misaligned logo or an unfamiliar font can immediately signal that the document is not a genuine bank statement. This can be detrimental in situations where a realistic representation is required, such as in software testing or educational demonstrations.

Maintaining format accuracy extends beyond mere visual resemblance. It also impacts the functionality and usability of the template. For example, if the columns for transaction dates, descriptions, and amounts are not aligned correctly, data entry and analysis become cumbersome and prone to errors. Similarly, incorrect formatting of date and currency fields can lead to compatibility issues with financial software or databases. Imagine attempting to import data from a template with incorrectly formatted dates into a budgeting application. The application might misinterpret the dates, leading to inaccurate financial reports and projections. Therefore, meticulous attention to format details is essential for ensuring the template’s practical utility.

Format accuracy, while seemingly a minor detail, is inextricably linked to the overall effectiveness and credibility of an editable bank statement template. It affects not only the visual authenticity but also the practical functionality of the template. Overlooking format accuracy can lead to misinterpretations, software compatibility issues, and a diminished sense of trust in the data presented. Achieving and maintaining format accuracy requires careful attention to detail and a thorough understanding of the specific formatting conventions used by the financial institution being emulated. This diligence ensures that the template serves its intended purpose effectively, whether for personal financial planning, business projections, or illustrative demonstrations. A template’s value hinges on its ability to accurately reflect the nuances of a real bank statement, from the placement of logos to the precise alignment of data fields.

6. Ethical Implications

Ethical considerations are paramount when discussing customizable documents resembling bank statements. While these templates offer legitimate applications for financial planning and illustrative purposes, the potential for misuse necessitates a careful examination of the ethical implications. Misrepresenting financial information, even within a template, carries significant risks and potential consequences. Understanding these ethical dimensions is crucial for responsible and appropriate utilization.

- Fraudulent MisrepresentationThe most serious ethical concern arises from the potential use of modified templates for fraudulent purposes. Creating a falsified document to misrepresent one’s financial standing for personal gain, such as obtaining a loan or securing employment, constitutes fraud and carries severe legal penalties. For instance, altering income figures or hiding debt within a template to present a more favorable financial picture to a lender is a deceptive practice with significant legal ramifications.

- Misleading Information and DeceptionEven when not used for outright fraud, modified templates can be misused to create misleading financial impressions. Sharing an altered template with business partners or investors, even without explicit intent to deceive, can create misunderstandings and damage trust. For example, presenting projected figures within a template as actual financial results can lead to misinformed business decisions and damage professional relationships.

- Privacy Concerns and Data SecurityWhile templates themselves don’t contain personal financial data, the act of inputting such data into a template raises privacy concerns. Users must exercise caution regarding the storage and sharing of templates containing sensitive financial information. Storing a completed template on an unsecured device or sharing it via unencrypted email increases the risk of data breaches and identity theft. Protecting the confidentiality of financial information is paramount, even within a simulated environment.

- Erosion of Trust in Financial DocumentationThe potential for misuse of these templates can contribute to a broader erosion of trust in financial documentation. As falsified documents become more prevalent, skepticism towards legitimate financial statements may increase. This erosion of trust can complicate financial transactions and undermine confidence in the integrity of financial institutions. Maintaining the integrity of financial documentation is essential for the smooth functioning of financial systems.

The ethical implications associated with customizable bank statement templates underscore the importance of responsible usage. While these templates offer valuable tools for financial planning and illustration, their potential for misuse necessitates a cautious approach. Balancing the benefits of these templates with the ethical considerations ensures their appropriate and responsible application. Prioritizing ethical conduct, respecting privacy, and adhering to legal guidelines are crucial for maintaining the integrity of financial information and upholding trust in financial systems. Ultimately, ethical awareness and responsible usage are essential for maximizing the benefits of these templates while mitigating potential risks.

Key Components of a Customizable Bank Statement Template

Understanding the core components of a customizable bank statement template is crucial for effective and responsible utilization. These components work together to provide a framework for manipulating and analyzing financial data.

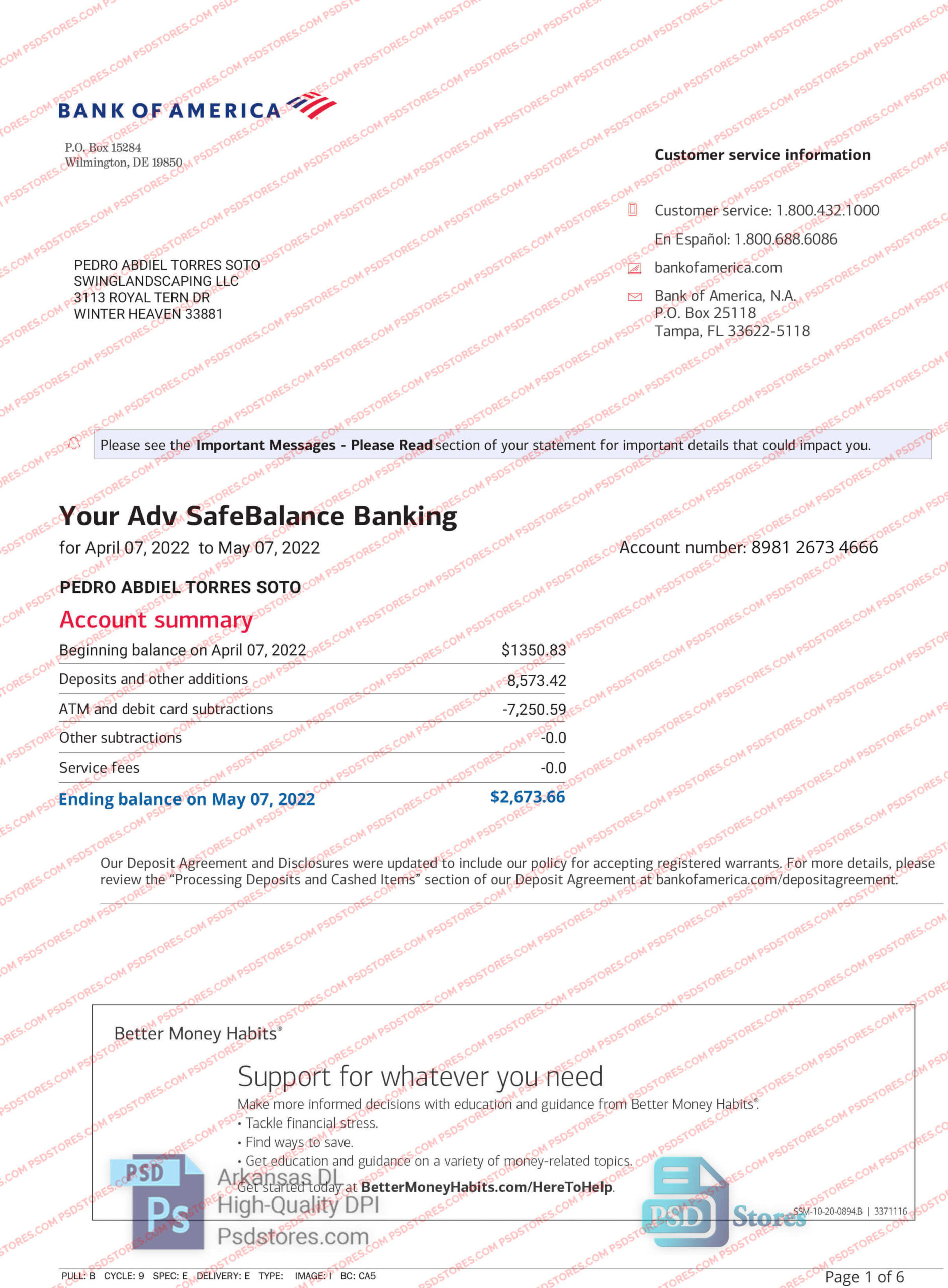

1. Account Information: Accurate representation of account details, including account holder name, account number, and bank name, is essential. This information establishes the context of the financial data presented within the template.

2. Statement Period: A clearly defined statement period, typically one month, provides the timeframe for the transactions and balances presented. This allows for accurate tracking and analysis of financial activity within a specific period.

3. Transaction Details: Detailed transaction records, including date, description, and amount, form the core of the template. Accurate and comprehensive transaction details are crucial for meaningful financial analysis and projections.

4. Balance Information: Beginning and ending balances provide a snapshot of the account’s financial status during the statement period. These balances serve as reference points for tracking financial progress and identifying trends.

5. Editable Fields: The ability to modify transaction details, balances, and other data points is the defining feature of a customizable template. This functionality allows users to simulate different financial scenarios and project potential outcomes.

6. Format Consistency: Maintaining consistent formatting with legitimate bank statements ensures the template’s credibility and usability. Accurate formatting facilitates data entry, analysis, and integration with financial software.

These interconnected elements form the foundation of a customizable bank statement template. Accurate data input, consistent formatting, and responsible usage are crucial for leveraging the template’s potential while upholding ethical considerations.

How to Create an Editable Bank Statement Template

Creating a customizable document that resembles a bank statement requires careful attention to detail and an understanding of the key components of such documents. The following steps outline the process of creating a template for personal use, emphasizing the importance of ethical considerations and responsible application.

1: Software Selection: Choosing appropriate software is the first step. Spreadsheet software provides the necessary functionality for data manipulation and formatting. Word processing software can also be utilized, though it offers less flexibility for complex calculations.

2: Replicating the Format: Obtaining a legitimate bank statement (with personal information redacted) serves as a visual guide. Replicating the layout, font styles, and logo placement within the chosen software ensures a realistic representation. However, avoid reproducing security features to prevent misuse.

3: Data Entry and Field Creation: Inputting placeholder data creates a functional framework. Essential fields include date, transaction description, debit/credit amounts, and running balance. Formulas within spreadsheet software automate balance calculations as transactions are added or modified.

4: Customization and Flexibility: Implementing editable fields allows for modification of transaction details and other data points. Dropdown menus or data validation features enhance user experience and maintain data integrity.

5: Verification and Testing: Thoroughly testing the template with various data scenarios ensures accuracy and functionality. Verifying the accuracy of formulas and calculations prevents errors in financial projections.

6: Ethical Considerations: A clear understanding of the ethical implications associated with using such templates is paramount. The template should never be used for fraudulent purposes, and users must exercise caution when sharing or storing templates containing sensitive financial information.

Building a functional and ethical template involves a meticulous approach to design, data entry, and testing, coupled with a strong awareness of ethical responsibilities. Focusing on accurate representation while upholding ethical considerations ensures responsible and effective application of the created template.

Customizable documents resembling financial statements from major banking institutions offer valuable tools for financial planning, illustrative purposes, and various other applications. Understanding the core components, data input requirements, formatting accuracy, and ethical implications associated with these templates is crucial for responsible and effective use. From budgeting and scenario planning to educational demonstrations and software testing, these adaptable documents empower users with the ability to manipulate and analyze financial data in a controlled environment. However, the potential for misuse necessitates a strong ethical compass and adherence to legal guidelines.

The ability to accurately represent financial information carries significant responsibility. While customizable templates offer powerful tools for financial management and understanding, their ethical implications must remain at the forefront of every application. Striking a balance between leveraging the benefits of these tools and upholding ethical principles ensures their continued value in an increasingly complex financial landscape.