Utilizing a customizable form offers several advantages. It provides a safe and efficient way to experiment with financial data without risking real accounts. The ability to manipulate figures within a realistic format enhances comprehension of financial statements and allows for practical application of budgeting and forecasting techniques. Furthermore, it can streamline the process of creating mock reports for presentations, proposals, or training materials.

The following sections will delve deeper into specific use cases, exploring how these adaptable forms can be employed in various contexts, along with practical guidelines for their creation and utilization. This will include best practices for ensuring accuracy and maintaining ethical considerations when working with simulated financial information.

1. Customization

Customization is a critical aspect of utilizing adaptable bank statement templates effectively. It empowers users to tailor the document to specific needs, transforming a generic form into a powerful tool for various applications. This adaptability enhances the practical value of the template, enabling diverse functionalities and catering to individual requirements.

- Data Input and ModificationControl over data fields allows users to input specific transaction details, amounts, dates, and account information relevant to the intended purpose. This could involve creating a hypothetical budget by projecting future income and expenses, or populating the template with historical data for analysis and reporting. This granular control ensures relevance and applicability to individual circumstances.

- Formatting AdjustmentsCustomization extends to the visual presentation of the document. Users can adjust fonts, colors, and layout to match specific branding or reporting requirements. For instance, a financial advisor might adapt the template to align with their company’s branding when presenting financial projections to clients. This flexibility ensures professional and consistent presentation.

- Scenario PlanningAdaptable templates empower users to explore various financial scenarios. By modifying income, expenses, or investment returns, one can analyze potential outcomes and make informed decisions. This is particularly useful for businesses developing financial forecasts or individuals evaluating investment strategies. The ability to manipulate variables and observe their impact facilitates insightful financial planning.

- Integration with Other ToolsSome customizable templates offer compatibility with other software or platforms. This allows for seamless data transfer and integration with existing workflows, enhancing efficiency and reducing manual data entry. For example, integration with budgeting software could enable direct import of simulated transactions for further analysis. This interoperability expands the template’s utility and streamlines financial management processes.

These facets of customization highlight the versatility and practical utility of adaptable bank statement templates. The ability to tailor data, formatting, and integration options unlocks a wide range of applications, empowering users to create dynamic and informative financial simulations for diverse purposes. This control transforms a static form into a dynamic tool for financial planning, analysis, and communication.

2. Data Accuracy

Data accuracy is paramount when utilizing customizable bank statement templates. While the flexibility of these templates offers significant advantages, maintaining accurate data is crucial for generating reliable simulations and drawing meaningful conclusions. Inaccurate data can lead to flawed analyses, misinformed decisions, and potentially detrimental outcomes. This section explores the critical facets of data accuracy within the context of these templates.

- Source VerificationThe foundation of accurate data lies in verifying the source. Whether replicating historical data or projecting future figures, confirming the reliability of the source information is crucial. Using unverified or unreliable data undermines the entire simulation, rendering any subsequent analysis or insights questionable. For example, using outdated market data to project investment returns can lead to unrealistic expectations and potentially flawed investment strategies.

- Data ValidationOnce data is entered into the template, validation processes are essential. This involves checks to ensure data integrity, such as verifying correct data types, identifying outliers, and cross-referencing information. For instance, validating transaction amounts against known income or expense limits can help identify potential errors or inconsistencies. This meticulous approach ensures the reliability of the simulated data.

- Consistent MethodologyMaintaining a consistent methodology for data entry and calculation is vital. This ensures uniformity and prevents discrepancies arising from inconsistent practices. For example, consistently using the same formula for calculating interest or applying consistent rounding rules prevents inconsistencies and enhances the comparability of different simulations. This rigorous approach ensures the integrity of the simulated data.

- Regular UpdatesData accuracy is not a static concept. Regularly updating data within the template ensures that simulations remain relevant and reflect current circumstances. For instance, using outdated income or expense figures can lead to inaccurate budget projections. Regularly updating these figures ensures that the simulation remains aligned with current financial realities and provides a reliable basis for decision-making.

These facets of data accuracy underscore the importance of meticulous data handling within customizable bank statement templates. By prioritizing source verification, data validation, consistent methodology, and regular updates, users can ensure the reliability and integrity of their simulations. This, in turn, enhances the value and trustworthiness of any insights derived from these templates, facilitating informed decision-making and sound financial planning.

3. Realistic Formatting

Realistic formatting is a critical aspect of effective customizable bank statement templates. The verisimilitude of the document enhances its utility across various applications, from training and education to financial planning and analysis. A template that accurately reflects the structure and presentation of an authentic bank statement provides a more credible and practical tool for users. This section explores the key components of realistic formatting and their impact on the template’s efficacy.

- Layout and StructureAccurately replicating the layout and structure of an actual bank statement is fundamental. This includes the placement of key information such as account details, transaction history, and balance summaries. A realistic layout ensures familiarity and facilitates seamless navigation within the document. For example, accurately positioning the date, description, debit, credit, and balance columns mirrors a genuine statement, enhancing user comprehension and usability.

- Typography and FontThe choice of typography and font contributes significantly to the realism of the template. Utilizing fonts and styles consistent with those used by financial institutions enhances the document’s authenticity. For instance, employing a common banking font like Arial or Calibri adds to the template’s professional appearance and reinforces its credibility. Subtle details like font size and spacing further contribute to the overall realism.

- Logo and Branding Elements (Optional)While optional, incorporating relevant logo and branding elements can enhance the template’s visual fidelity, particularly for training or demonstration purposes. Replicating the logo and color scheme of a specific financial institution can create a more immersive and realistic experience, although ethical considerations regarding misrepresentation must be carefully observed. For instance, using a bank’s logo for internal training purposes can enhance realism, but using it for external presentations could be misleading.

- Terminology and LanguageUsing accurate financial terminology and language is crucial for maintaining realism. Employing terms commonly found on authentic bank statements, such as “opening balance,” “transaction date,” and “closing balance,” ensures clarity and reinforces the template’s professional appearance. Consistent use of standard financial language enhances the document’s credibility and facilitates user comprehension.

These elements of realistic formatting contribute significantly to the overall effectiveness of customizable bank statement templates. By meticulously replicating the visual and structural elements of an authentic bank statement, these templates offer a more practical and credible tool for various applications. This attention to detail enhances user experience, improves comprehension, and ultimately strengthens the template’s value as a tool for financial planning, analysis, and education.

4. Practical Applications

Customizable bank statement templates offer a wide range of practical applications across various fields. Their adaptability makes them valuable tools for financial planning, education, and analysis. Understanding these applications provides insight into the versatility and utility of these templates. The following facets illustrate key practical uses and their respective benefits.

- Budgeting and Financial PlanningIndividuals and businesses can utilize customizable templates to create realistic budget projections. By inputting projected income and expenses, users can visualize their financial outlook, identify potential shortfalls, and adjust spending habits accordingly. This allows for proactive financial management and informed decision-making. For example, a household can use a template to simulate the impact of a new mortgage on their monthly expenses.

- Educational PurposesThese templates serve as valuable educational tools for teaching financial literacy. Students and trainees can gain practical experience in interpreting and analyzing financial statements within a risk-free environment. The ability to manipulate data and observe the impact on balances and other figures provides a dynamic learning experience. For instance, accounting students can use templates to practice analyzing transaction data and reconciling accounts.

- Software Testing and DevelopmentSoftware developers can utilize customizable templates for testing financial applications. By inputting various data sets and scenarios, developers can ensure that their software accurately processes and displays financial information. This rigorous testing helps identify and rectify potential bugs or errors before deployment. For example, a developer creating a budgeting app can use a template to test the accuracy of its calculations.

- Illustrative Purposes in Presentations and ProposalsCustomizable templates can be used to create illustrative financial scenarios in presentations and proposals. This allows stakeholders to visualize potential financial outcomes based on different assumptions or projections. This visual representation enhances understanding and facilitates informed decision-making. For example, a business owner can use a template to demonstrate the potential financial impact of a new marketing campaign to potential investors.

These practical applications demonstrate the versatility and utility of customizable bank statement templates. Their adaptability allows them to serve as valuable tools across various fields, empowering individuals, businesses, and educators to enhance financial planning, learning, and analysis. The ability to manipulate data within a realistic format provides a safe and effective means of exploring financial scenarios and making informed decisions.

5. Ethical Considerations

Ethical considerations are paramount when utilizing customizable bank statement templates. While these templates offer valuable functionalities for various applications, responsible and ethical usage is crucial to prevent misuse and potential harm. Understanding the ethical implications associated with these templates ensures their appropriate and beneficial application.

- Misrepresentation and FraudA primary ethical concern is the potential for misrepresentation and fraud. Fabricating or altering financial information within these templates for deceptive purposes, such as loan applications or financial reporting, constitutes unethical and potentially illegal activity. The ease with which data can be manipulated necessitates a strong ethical compass and adherence to legal and regulatory guidelines. For example, inflating income figures on a simulated statement for loan approval is a fraudulent misrepresentation of financial status.

- Privacy and Data SecurityWhen utilizing templates containing personal financial information, data privacy and security are critical. Sharing or distributing such information without proper authorization violates privacy and can expose individuals to potential risks. Implementing appropriate security measures, such as password protection and secure storage, is essential to safeguard sensitive data and maintain ethical practices. For example, sharing a simulated statement containing another individual’s financial details without their consent is a breach of privacy.

- Transparency and DisclosureTransparency and disclosure are crucial when using simulated financial statements. Clearly communicating the simulated nature of the document to any relevant parties prevents misunderstandings and ensures ethical conduct. Failure to disclose the simulated nature of the information can lead to misinformed decisions and erode trust. For example, presenting a simulated statement as genuine documentation in a business proposal is a deceptive practice that undermines transparency.

- Professional ResponsibilityIndividuals utilizing these templates in a professional capacity bear a responsibility to uphold ethical standards. This includes using the templates for legitimate purposes, maintaining data accuracy, and refraining from any activities that could mislead or deceive others. Adhering to professional codes of conduct and ethical guidelines ensures responsible and trustworthy use of these tools. For example, a financial advisor using a manipulated template to guarantee unrealistic investment returns violates professional ethics and client trust.

These ethical considerations underscore the importance of responsible usage when working with customizable bank statement templates. Prioritizing ethical conduct, data integrity, and transparency ensures that these tools are utilized for their intended purposes and contribute positively to financial planning, analysis, and education. Ignoring these ethical implications can lead to detrimental consequences for individuals and organizations alike, highlighting the crucial role of ethical awareness and responsible practices in utilizing these powerful tools effectively and beneficially.

6. Security

Security is a critical aspect when considering customizable bank statement templates. Because these templates often contain sensitive financial information, robust security measures are essential to prevent unauthorized access, misuse, and potential fraud. Protecting the integrity and confidentiality of the data within these templates is paramount for maintaining trust and mitigating risks.

- Password ProtectionImplementing strong password protection is a fundamental security measure. Passwords should be complex, regularly updated, and adhere to best practices, such as including a combination of uppercase and lowercase letters, numbers, and symbols. This prevents unauthorized individuals from accessing and potentially manipulating the data within the template. For example, using a simple password like “password123” compromises security, while a more complex password significantly reduces vulnerability.

- Access ControlRestricting access to the templates is crucial for maintaining security. Limiting access to only authorized personnel reduces the risk of data breaches and misuse. Access control can be implemented through user permissions, file encryption, and secure storage solutions. For example, storing templates on a shared drive without access restrictions increases vulnerability, whereas utilizing a secure cloud storage solution with individual user permissions enhances security.

- Secure StorageSecure storage solutions are essential for protecting the confidentiality and integrity of the data within the templates. This includes using encrypted storage devices, secure cloud platforms, or password-protected folders. Choosing a reputable and secure storage solution minimizes the risk of data breaches and ensures data integrity. For example, storing templates on an unencrypted USB drive poses significant security risks, whereas utilizing an encrypted cloud storage service with robust security protocols offers greater protection.

- Regular Audits and MonitoringRegular audits and monitoring of access logs and data modifications are crucial for detecting and mitigating potential security breaches. Tracking user activity and changes to the templates allows for early identification of suspicious activity and prompt intervention. This proactive approach strengthens security and minimizes potential damage. For instance, regularly reviewing access logs can reveal unauthorized access attempts, enabling timely implementation of preventative measures.

These security measures are essential for ensuring the responsible and ethical use of customizable bank statement templates. Implementing robust security protocols protects sensitive financial information, maintains data integrity, and mitigates the risks of fraud and misuse. Prioritizing security enhances trust and reinforces the value of these templates as reliable tools for financial planning, analysis, and education.

Key Components of an Editable Bank Statement Template

Understanding the core components of an editable bank statement template is crucial for effective utilization. The following points highlight key structural elements typically found within such a template.

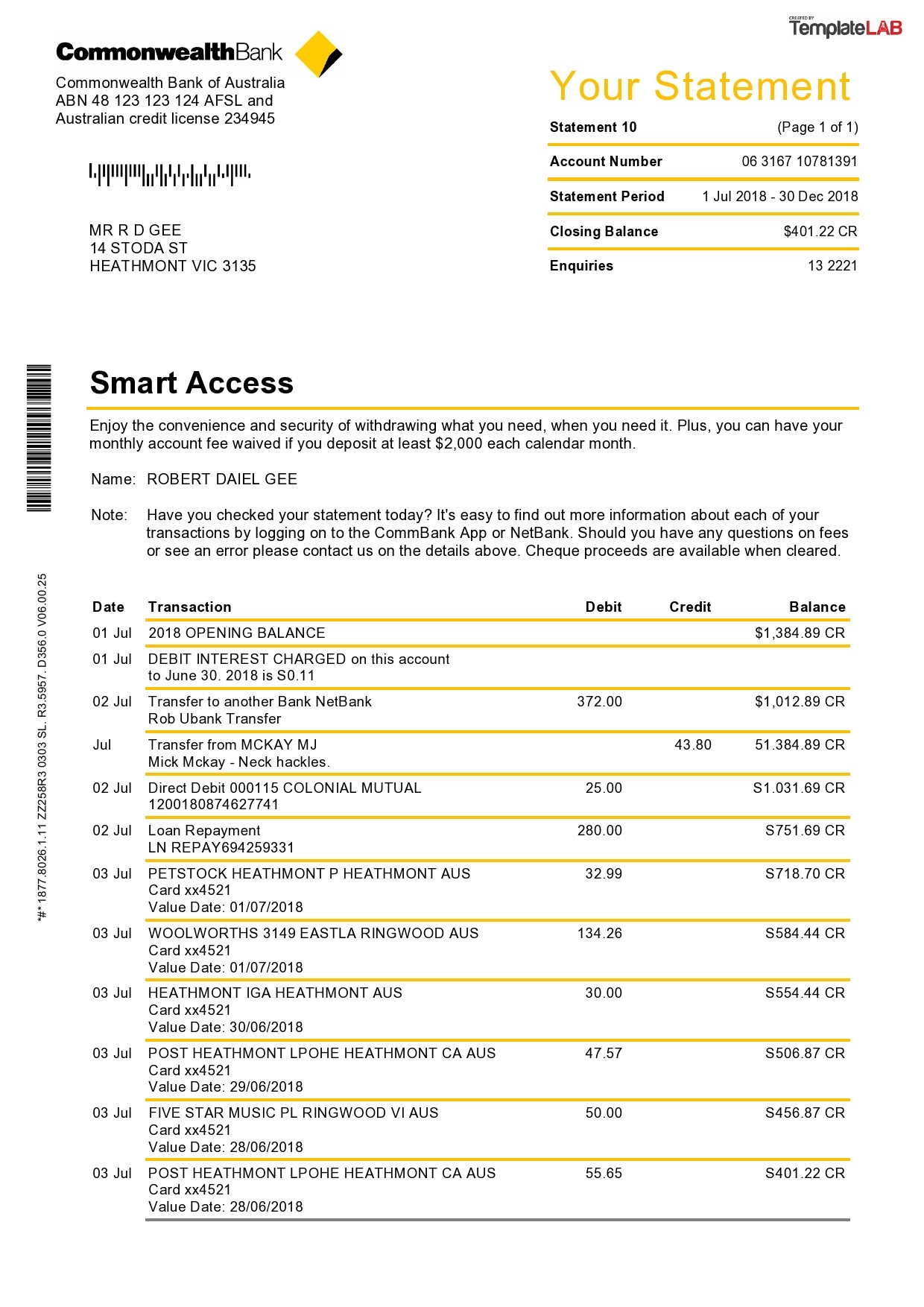

1. Account Information: This section identifies the account holder, account number, and bank branch. Accurate representation of this information is crucial for maintaining realism and relevance in simulations.

2. Statement Period: The specified date range covered by the statement is essential for contextualizing the transaction data and understanding the financial activity within that period. Accuracy in this field is critical for accurate analysis.

3. Opening and Closing Balances: These figures represent the starting and ending account balances for the statement period. Accurate representation of these balances is foundational for calculating net changes and assessing financial progress.

4. Transaction History: This section details individual transactions, including date, description, debit, and credit amounts. Comprehensive transaction details are crucial for understanding cash flow and identifying specific financial activities.

5. Transaction Summary: A summarized view of transaction totals, categorized by type (e.g., deposits, withdrawals, fees), provides a concise overview of financial activity during the statement period. This summary facilitates quick analysis of spending patterns and income sources.

6. Currency and Units: Clearly specifying the currency and units used throughout the statement ensures clarity and prevents misinterpretations. Consistency in currency and units is crucial for accurate calculations and comparisons.

7. Statement Generation Date: The date the statement was created is distinct from the statement period and provides a temporal reference for the document itself. This information is important for record-keeping and audit trails.

These core components work together to provide a comprehensive and structured overview of financial activity within a given period. Accurate representation of these elements within an editable template ensures the reliability and practical utility of the simulated data for various applications.

How to Create an Editable Bank Statement Template

Creating an editable bank statement template requires careful consideration of structure, data accuracy, and ethical implications. The following steps outline the process of developing a functional and reliable template.

1. Software Selection: Choose appropriate software. Spreadsheet applications like Microsoft Excel or Google Sheets offer robust functionalities for creating and manipulating data tables, formulas, and formatting. Word processors can be suitable for simpler templates but may lack the advanced calculation capabilities of spreadsheets.

2. Replicate Structure: Replicate the structure of an authentic bank statement. This includes incorporating key sections such as account information, statement period, opening/closing balances, transaction history, and a summary section. Accurate replication ensures realism and facilitates practical application.

3. Data Input Fields: Designate specific cells or fields for data input. Clearly label each field to indicate the type of data required (e.g., date, description, debit, credit). This organized structure facilitates accurate data entry and prevents errors.

4. Formulas and Calculations: Implement formulas for automated calculations. For instance, formulas can be used to calculate running balances, transaction totals, and other relevant figures. Automated calculations ensure accuracy and efficiency.

5. Formatting: Apply appropriate formatting for clarity and readability. Use clear fonts, consistent formatting styles, and appropriate spacing to enhance visual presentation. Consistent formatting enhances professionalism and improves comprehension.

6. Testing and Validation: Thoroughly test the template with various data sets to ensure accurate calculations and functionality. Testing identifies potential errors and ensures the reliability of the template for intended applications.

7. Security Considerations: Implement security measures to protect sensitive data if the template contains or will contain real financial information. Password protection, access control, and secure storage are essential for preventing unauthorized access and misuse.

8. Ethical Use: Always adhere to ethical guidelines when using the template. Avoid misrepresenting data, protect privacy, and ensure transparency in usage. Ethical considerations are paramount for responsible and beneficial application.

By following these steps, one can create a robust and functional editable bank statement template suitable for various applications while upholding ethical considerations and ensuring data accuracy and security.

Customizable documents modeled after financial institution records provide valuable tools for various applications, ranging from financial planning and educational exercises to software testing and illustrative presentations. Careful consideration of data accuracy, realistic formatting, and ethical implications ensures responsible and effective utilization. Security measures, including password protection and secure storage, are paramount for safeguarding sensitive information and preventing misuse. Understanding the core components, creation process, and ethical considerations associated with these adaptable documents empowers users to leverage their functionality while upholding ethical practices and data integrity.

The ability to manipulate financial data within a controlled environment offers significant benefits for enhancing financial literacy, improving planning processes, and facilitating informed decision-making. However, the potential for misuse underscores the importance of ethical awareness and responsible practices. As technology continues to evolve, the role of these customizable tools is likely to expand, demanding continued emphasis on data security, ethical considerations, and responsible application for individual and organizational benefit.