Adaptable financial reporting offers several advantages. It facilitates accurate record-keeping, supports informed decision-making through readily available performance insights, and simplifies the process of generating reports for stakeholders or regulatory requirements. Customizable features offer flexibility for businesses of varying sizes and industries, enabling tailored reporting to specific needs.

The following sections will explore specific components commonly found within these financial tools, offering practical guidance on their utilization and demonstrating how they contribute to effective financial management.

1. Customization

Customization is a defining feature of effective profit and loss statement templates. Pre-built templates offer a basic framework, but their utility is significantly amplified through adaptability. Customization allows businesses to align the template with their specific chart of accounts, industry requirements, and reporting objectives. This ensures relevant data is captured and analyzed, enabling more insightful financial assessments. For example, a restaurant might require detailed tracking of food and beverage costs, while a manufacturing company needs to monitor raw material expenses. Customization enables both to tailor the template accordingly.

This adaptability extends beyond line items. Customizable templates often allow adjustments to reporting periods, currencies, and the inclusion of specific financial ratios or metrics. Such flexibility allows generation of reports tailored to specific stakeholder needs. Investors might require a focus on profitability ratios, while internal management may prioritize detailed operational expense breakdowns. A customizable template facilitates creation of both reports from a single data source.

Ultimately, customization empowers businesses to extract maximum value from profit and loss reporting. By tailoring the template to specific needs, organizations gain deeper insights into financial performance, enabling more informed decision-making and driving improved outcomes. Without customization, a profit and loss statement risks becoming a generic document with limited practical application. The ability to adapt and refine ensures its relevance and utility within diverse operational contexts.

2. Automated Calculations

Automated calculations represent a critical component of effective profit and loss statement management. Within editable templates, automated calculations streamline the process of deriving key financial metrics, minimizing manual data entry and reducing the risk of human error. This functionality significantly enhances the efficiency and accuracy of financial reporting, enabling more timely and reliable insights.

- Formula-driven calculationsModern templates utilize pre-built formulas to automatically calculate figures such as gross profit, operating income, and net income. These calculations dynamically update as underlying revenue and expense figures are adjusted. This eliminates the need for manual recalculations, saving time and ensuring accuracy. For example, changes to sales figures automatically trigger adjustments to gross profit, cascading through the entire statement. This real-time responsiveness provides immediate feedback on the financial impact of operational changes.

- Reduced error potentialManual calculations are inherently susceptible to human error. Automated calculations mitigate this risk by ensuring consistent and accurate application of formulas. This reliability is crucial for maintaining the integrity of financial data and informing sound business decisions. For instance, eliminating manual calculations minimizes the possibility of transposition errors or incorrect formula application, which could lead to misrepresented financial performance.

- Enhanced efficiency and time savingsAutomating calculations frees up valuable time previously spent on manual data entry and formula application. This increased efficiency allows finance professionals to focus on higher-value tasks, such as analysis and strategic planning. Rather than spending time on repetitive calculations, resources can be directed towards interpreting the data and identifying opportunities for improvement.

- Improved decision-makingAccurate and readily available financial data is essential for informed decision-making. Automated calculations ensure that key metrics are readily accessible, enabling businesses to quickly assess performance, identify trends, and make timely adjustments to strategy. For example, real-time insights into profitability margins allow for immediate adjustments to pricing or cost control measures, maximizing financial outcomes.

By automating these crucial calculations, editable profit and loss statement templates empower businesses to move beyond tedious manual processes and embrace data-driven decision-making. The resulting efficiency and accuracy contribute significantly to enhanced financial management and improved overall business performance.

3. Clear data presentation

Clear data presentation is essential for maximizing the utility of an editable profit and loss statement template. A well-structured, visually accessible presentation transforms raw financial data into actionable insights. Effective data presentation facilitates understanding of financial performance, supports informed decision-making, and enables effective communication with stakeholders. A cluttered or poorly organized statement, conversely, can obscure critical information and hinder effective analysis.

Several factors contribute to clear data presentation within a profit and loss statement. Logical categorization of revenues and expenses, consistent formatting, and clear labeling of all line items are fundamental. Visual aids, such as charts and graphs, can further enhance understanding, particularly when presenting complex data sets or highlighting key trends. For example, a line graph visualizing revenue growth over time can quickly communicate performance trends more effectively than a table of raw data. Similarly, using color-coding to differentiate between revenue streams or expense categories can improve visual clarity and facilitate rapid comprehension.

The practical significance of clear data presentation extends beyond internal analysis. A well-presented profit and loss statement is a crucial communication tool for external stakeholders. Investors, lenders, and regulatory bodies rely on these statements to assess financial health and make informed decisions. A clear and concise presentation builds confidence and credibility, while a disorganized or confusing statement can raise concerns and hinder effective communication. For instance, a clearly presented statement demonstrating consistent profitability and controlled expenses can positively influence investor confidence. Conversely, a poorly presented statement, even with underlying positive financial performance, can create an impression of disorganization and potentially undermine stakeholder trust. Therefore, clear data presentation is not merely an aesthetic consideration but a crucial element for effective financial management and communication.

4. Accessibility

Accessibility, in the context of editable profit and loss statement templates, refers to the ease with which authorized users can access, utilize, and share the document. This encompasses various aspects, from file format compatibility and cloud storage integration to user permissions and mobile device accessibility. Ensuring seamless access is crucial for efficient financial management, collaboration, and informed decision-making.

- File Format CompatibilityCompatibility with various file formats, such as .xlsx, .csv, and .pdf, ensures that the template can be opened, edited, and shared across different software platforms and operating systems. This eliminates the need for specialized software and facilitates collaboration among users with varying technical resources. For instance, sharing a .pdf version with stakeholders who may not have spreadsheet software allows broader access to the information.

- Cloud Storage IntegrationIntegration with cloud storage platforms, like Google Drive or Dropbox, offers several accessibility advantages. It allows real-time collaboration among team members, provides a centralized repository for version control, and enables access from any device with an internet connection. This is particularly valuable for businesses with remote teams or those requiring access to financial data while traveling. For example, multiple users can simultaneously update a cloud-based template, ensuring everyone works with the most current information.

- User Permissions and SecurityAccessibility must be balanced with security. Editable templates often incorporate user permission settings, allowing control over who can view, edit, or share the document. This ensures data integrity and prevents unauthorized access to sensitive financial information. For example, restricting editing permissions to specific finance team members while granting viewing access to other stakeholders ensures data accuracy and maintains control over the document.

- Mobile Device AccessibilityIn today’s mobile-first world, access to financial data on smartphones and tablets is increasingly important. Templates optimized for mobile devices allow users to view and, in some cases, edit profit and loss statements on the go. This facilitates timely decision-making and ensures access to critical information regardless of location. For example, a business owner could review the company’s financial performance while traveling without needing access to a laptop.

These facets of accessibility, when combined, contribute to a more efficient and collaborative financial management process. Easy access to data, regardless of location or software limitations, empowers informed decision-making and promotes transparency within an organization. A readily accessible, well-maintained profit and loss statement template becomes a valuable tool for driving financial health and achieving business objectives.

5. Time-saving efficiency

Time-saving efficiency represents a significant advantage of utilizing editable profit and loss statement templates. Manual creation and management of these statements involve time-consuming processes, including data entry, calculations, and formatting. Editable templates streamline these tasks, freeing up valuable time for analysis and strategic decision-making. Consider the scenario of a financial analyst manually compiling a profit and loss statement from various sources. This process might involve gathering data from different departments, consolidating information into a spreadsheet, performing calculations, and formatting the final report. An editable template, pre-populated with formulas and formatting, automates a substantial portion of this workflow, allowing the analyst to focus on interpreting the data rather than compiling it.

This efficiency gain has several practical implications. Faster report generation allows for more frequent performance monitoring, enabling businesses to react quickly to changing market conditions or internal performance fluctuations. Reduced time spent on manual tasks allows finance professionals to dedicate more resources to strategic activities like financial forecasting, budgeting, and performance analysis. For example, instead of manually calculating key metrics like gross profit margin, an analyst can utilize the template’s automated calculations to instantly access these figures, allowing more time for analyzing trends and identifying areas for improvement. Furthermore, automated reporting reduces the risk of human error associated with manual data entry and calculations, improving the accuracy and reliability of financial information.

In summary, time-saving efficiency facilitated by editable templates is not merely a matter of convenience. It’s a strategic advantage that empowers businesses to enhance financial management practices. By automating routine tasks, these templates free up valuable time and resources, allowing finance professionals to focus on strategic activities that drive business growth and profitability. The ability to generate accurate and timely reports allows for proactive decision-making, improved financial control, and ultimately, a stronger bottom line. Addressing potential challenges like ensuring data accuracy and maintaining template integrity further enhances the value of this time-saving tool.

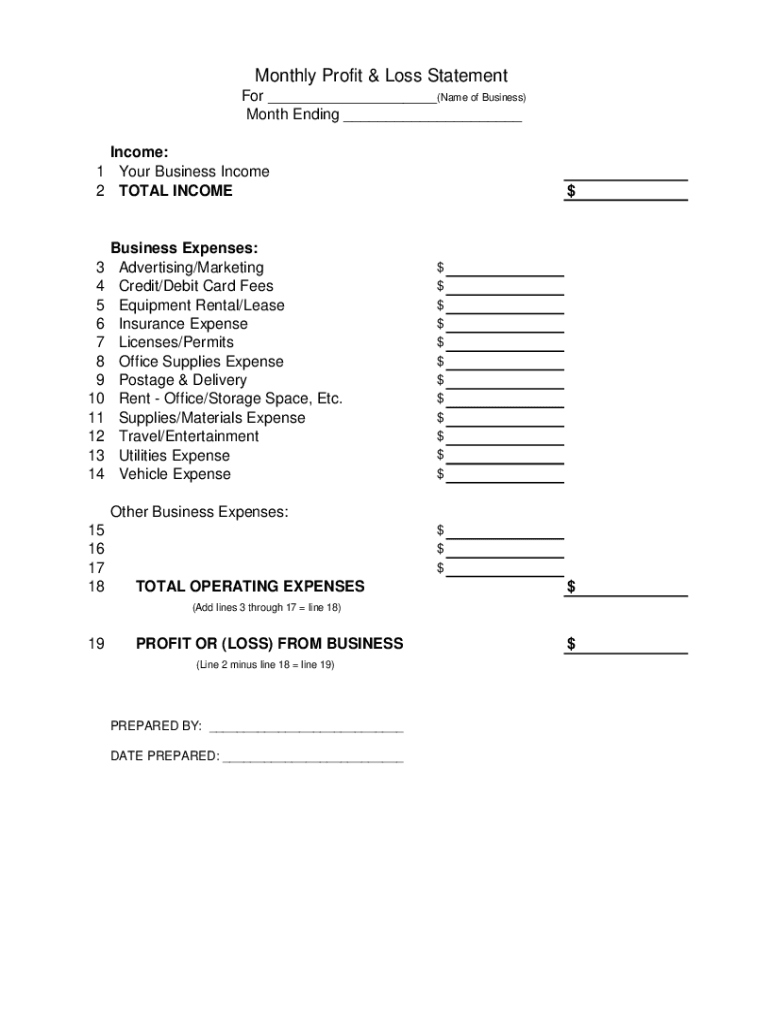

Key Components of an Editable Profit and Loss Statement Template

Essential elements comprise a robust and effective profit and loss statement template. Understanding these components is crucial for accurate financial reporting and analysis.

1. Revenue Streams: Clear delineation of all revenue sources is paramount. This includes detailed categorization, such as product-specific sales, service fees, or interest income. Accurate revenue reporting forms the foundation of a reliable profit and loss statement.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with production. Accurate tracking of COGS is crucial for determining gross profit and understanding product profitability.

3. Operating Expenses: This category encompasses all expenses incurred through normal business operations. Examples include rent, salaries, marketing costs, and administrative expenses. Categorization should be detailed and consistent.

4. Gross Profit: Calculated as revenue less COGS, gross profit represents the profitability of core business operations before accounting for operating expenses.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the business after accounting for day-to-day operational costs.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains, or losses from asset sales.

7. Net Income: Representing the bottom line, net income is the ultimate measure of profitability, calculated by adding other income and subtracting other expenses from operating income.

8. Reporting Period: Clear specification of the reporting period, whether monthly, quarterly, or annually, is essential for accurate temporal analysis and comparison of financial performance.

Comprehensive and accurate data within these categories provides a clear picture of financial health, enabling informed decision-making and strategic planning. Detailed tracking of each component ensures a reliable foundation for evaluating performance and guiding future business strategies.

How to Create an Editable Profit and Loss Statement Template

Creating a robust and adaptable profit and loss statement template requires careful planning and execution. The following steps outline the process, ensuring a functional and effective tool for financial management.

1: Choose a Software Platform: Select appropriate software. Spreadsheet software offers flexibility and formula functionality. Dedicated accounting software provides more advanced features but may require specific expertise.

2: Define Reporting Periods: Establish clear reporting periods (monthly, quarterly, annually). Consistent periods enable effective performance comparison over time.

3: Structure Revenue Categories: Create detailed categories for all revenue streams. Granular categorization enables precise revenue tracking and analysis.

4: Outline Cost of Goods Sold (COGS): If applicable, meticulously detail all direct costs associated with product creation. Accurate COGS tracking is essential for calculating gross profit margins.

5: Categorize Operating Expenses: Systematically list all operating expenses, including rent, salaries, marketing, and administrative costs. Consistent categorization supports meaningful analysis and budgeting.

6: Incorporate Automated Calculations: Leverage formulas to automate key calculations, such as gross profit, operating income, and net income. Automated calculations ensure accuracy and save time.

7: Design for Clarity and Accessibility: Implement clear formatting, logical structure, and appropriate labeling. Consider visual aids, such as charts and graphs, to enhance data interpretation.

8: Test and Refine: Thoroughly test the template with sample data to ensure accurate calculations and identify any structural or formatting issues. Regular review and refinement maintain template effectiveness over time.

A well-structured template incorporating these elements provides a robust foundation for financial analysis, supporting informed decision-making and contributing to effective business management. Regular review and adaptation based on evolving business needs ensure ongoing utility and relevance.

Editable profit and loss statement templates provide a crucial framework for understanding financial performance. Their adaptability allows tailoring to specific business needs, enabling accurate tracking of revenue streams, cost of goods sold, and operating expenses. Automated calculations ensure accuracy and efficiency, while clear data presentation facilitates informed decision-making. Accessibility features promote collaboration and data sharing, contributing to a more comprehensive view of financial health. Time-saving automation allows focus to shift from tedious manual tasks to strategic analysis and planning.

Effective financial management hinges on accurate, accessible, and actionable information. Leveraging the capabilities of editable profit and loss statement templates empowers organizations to move beyond basic record-keeping and embrace data-driven insights. Continuous refinement and adaptation of these tools, alongside a commitment to data integrity, will remain essential for navigating the complexities of the modern business landscape and achieving sustainable financial success.