Using a modifiable model provides several advantages. It allows individuals to explore different financial scenarios, understand the impact of changes in income or expenses, and practice managing finances without altering actual bank records. This can be particularly useful for educational purposes, financial planning, or testing different budgeting strategies. Moreover, such a tool offers a safe environment for experimenting with financial data before applying changes to real-world accounts.

The following sections delve deeper into the specific applications and considerations related to utilizing such tools for personal finance management, educational exercises, and other practical applications.

1. Customizable Fields

The power of an editable Regions Bank statement template lies in its customizable fields. These adaptable elements transform a static document into a dynamic tool for financial exploration and learning. Manipulating these fields allows users to model various financial scenarios and understand their implications.

- Transaction Descriptions:Modifying transaction descriptions provides context and clarity when constructing hypothetical scenarios. For example, changing “Grocery Store” to “Organic Groceries” allows for more granular budgeting and spending analysis within the template. This level of detail enhances the realism and practical application of the tool.

- Dates:Adjusting transaction dates allows users to simulate financial activity over different time periods. This feature is crucial for projecting future balances, analyzing spending patterns, and understanding the long-term impact of financial decisions. By manipulating dates, users can explore hypothetical scenarios that span months or years.

- Amounts:The ability to modify transaction amounts is central to the template’s functionality. Users can experiment with different income and expense levels to understand their impact on overall financial health. This feature is particularly useful for budgeting exercises, financial forecasting, and exploring the potential consequences of major financial decisions, like taking a loan or making a large investment.

- Account Balances:While a consequence of other inputs, the ability to observe the resulting account balance changes based on manipulated fields offers crucial feedback. This dynamic update provides a direct visual representation of how individual transactions and overall spending habits influence overall financial standing.

The flexibility offered by these customizable fields transforms a simple template into a powerful tool for financial education and planning. By manipulating these elements, users gain a deeper understanding of financial dynamics and develop informed decision-making skills applicable to real-world situations.

2. Financial Planning

Financial planning benefits significantly from the utilization of an editable Regions Bank statement template. The template provides a structured framework for projecting future finances based on hypothetical scenarios. By manipulating income, expenses, and other variables within the template, individuals can visualize the potential impact of financial decisions. This process allows for proactive adjustments to spending habits, saving strategies, and investment choices, optimizing financial outcomes. For example, exploring the effect of increased retirement contributions on long-term savings can inform current saving strategies. Similarly, analyzing potential debt reduction scenarios by adjusting payment amounts within the template can provide valuable insights for debt management planning.

The dynamic nature of an editable template allows for iterative adjustments and refinements to financial plans. Changes in life circumstances, financial goals, or market conditions can be incorporated by modifying the template’s variables. This adaptability ensures the financial plan remains relevant and effective over time. Consider a scenario where an individual anticipates a significant increase in income. Using the template, they can model the impact of this increased income on their savings goals, debt repayment timelines, and potential investment opportunities, enabling informed decisions aligned with their evolving financial landscape.

In summary, the editable template serves as a powerful tool for developing, refining, and maintaining robust financial plans. It facilitates informed decision-making, enhances financial foresight, and empowers individuals to adapt to changing financial circumstances. The template’s ability to model various scenarios contributes significantly to achieving long-term financial stability and achieving financial goals. By incorporating this tool into the financial planning process, individuals gain greater control and clarity over their financial future.

3. Educational Tool

An editable Regions Bank statement template functions as a powerful educational tool, bridging the gap between theoretical financial concepts and practical application. It provides a risk-free environment for exploring financial dynamics, allowing learners to manipulate variables and observe their impact on financial outcomes. This hands-on experience fosters a deeper understanding of budgeting, saving, investing, and debt management. For instance, students can experiment with different saving rates within the template to visualize how small changes accumulate over time, demonstrating the power of compound interest. Similarly, educators can utilize the template to illustrate the long-term implications of high-interest debt, guiding students toward responsible borrowing habits. The template’s adaptability allows it to cater to diverse learning styles and educational objectives, making complex financial concepts more accessible and engaging.

The template’s value as an educational tool extends beyond individual learning. Instructors can integrate it into classroom activities, group projects, and case studies, fostering collaborative learning and critical thinking. Simulating real-world financial scenarios within the template allows students to analyze complex situations, develop problem-solving skills, and make informed financial decisions. For example, a group project could involve analyzing different investment strategies using the template, encouraging collaborative decision-making and financial analysis. This practical application of financial principles prepares students for real-world financial challenges and empowers them to make informed choices in their personal and professional lives.

Leveraging the template as an educational resource cultivates financial literacy, a critical skill for navigating modern financial landscapes. By providing a safe space for experimentation and exploration, the template empowers learners to develop a strong foundation in financial management. This understanding contributes to improved financial well-being, responsible decision-making, and greater economic stability. The template’s accessibility and adaptability make it a valuable asset in promoting financial education and empowering individuals to take control of their financial futures.

4. Hypothetical Scenarios

The ability to construct and analyze hypothetical scenarios forms a cornerstone of an editable Regions Bank statement template’s utility. This functionality allows users to explore the potential impact of financial decisions without real-world consequences. By manipulating variables such as income, expenses, and investment returns within the template, individuals can model various financial situations and observe their effects on overall financial health. This process facilitates informed decision-making, enabling proactive adjustments to financial strategies. For example, an individual considering a large purchase can model its impact on their savings and debt levels within the template, assessing its long-term financial implications before committing to the purchase. Similarly, exploring the effects of different investment strategies allows for informed investment choices aligned with individual risk tolerance and financial goals.

The exploration of hypothetical scenarios using the template extends beyond individual financial planning. Businesses can leverage this functionality to assess the financial viability of projects, model the impact of market fluctuations, and explore different budgeting strategies. For instance, a business considering expansion can utilize the template to project revenue and expenses under various market conditions, informing strategic decisions related to investment and resource allocation. This capacity for scenario planning enhances financial foresight and enables proactive adaptation to changing economic landscapes. Furthermore, educational institutions can utilize the template to provide students with practical experience in financial analysis and decision-making, bridging the gap between theoretical concepts and real-world applications.

In summary, the ability to construct and analyze hypothetical scenarios within an editable Regions Bank statement template represents a powerful tool for financial planning, business analysis, and educational purposes. It empowers individuals and organizations to explore potential financial outcomes, make informed decisions, and adapt proactively to evolving financial circumstances. This capacity for strategic foresight enhances financial stability and contributes to achieving long-term financial goals. By leveraging this functionality, users gain valuable insights into the complex interplay of financial variables and develop the skills necessary to navigate complex financial landscapes.

5. Budgeting Practice

Effective budgeting forms the cornerstone of sound financial management. An editable Regions Bank statement template provides a practical tool for developing, refining, and practicing budgeting skills. By utilizing the template as a simulated financial environment, individuals can experiment with different budgeting strategies, track hypothetical spending, and analyze the impact of financial decisions without real-world consequences. This fosters financial literacy and promotes responsible financial behavior.

- Income and Expense TrackingThe template allows users to input and track various income sources and expense categories. This detailed tracking facilitates a comprehensive understanding of cash flow, enabling identification of areas for potential savings and expense reduction. For example, visualizing discretionary spending on entertainment or dining within the template can highlight opportunities for budget adjustments and increased savings. This practical application of budgeting principles promotes financial awareness and control.

- Scenario PlanningBudgeting involves anticipating future financial needs and allocating resources accordingly. The editable template allows users to model different financial scenarios, such as unexpected expenses or changes in income. This forward-looking approach strengthens financial preparedness and enables proactive adjustments to budgeting strategies. For example, simulating a scenario with reduced income allows individuals to identify essential expenses and develop contingency plans to maintain financial stability during challenging times.

- Goal Setting and Progress MonitoringFinancial goals, such as saving for a down payment or paying off debt, require structured budgeting. The template facilitates goal setting by allowing users to allocate funds towards specific objectives and track progress over time. Visualizing progress within the template reinforces positive financial behavior and motivates continued adherence to budgeting plans. For instance, tracking savings progress towards a down payment goal within the template provides tangible evidence of progress, encouraging continued saving efforts.

- Debt ManagementManaging debt effectively requires careful budgeting and allocation of funds towards debt repayment. The template can be used to explore various debt repayment strategies, such as the snowball or avalanche methods, and visualize their impact on debt reduction timelines. This empowers individuals to make informed decisions about debt management and accelerate progress towards becoming debt-free. Modeling different payment scenarios within the template allows for optimized debt repayment plans and enhanced financial stability.

By integrating an editable Regions Bank statement template into budgeting practice, individuals gain valuable experience in managing finances, making informed decisions, and achieving financial goals. The templates dynamic nature and adaptability provide a practical and engaging platform for developing strong budgeting skills, promoting financial literacy, and building a solid foundation for long-term financial well-being.

Key Components of an Editable Regions Bank Statement Template

Understanding the core components of an editable Regions Bank statement template is essential for effective utilization. The following elements highlight its structure and functionality.

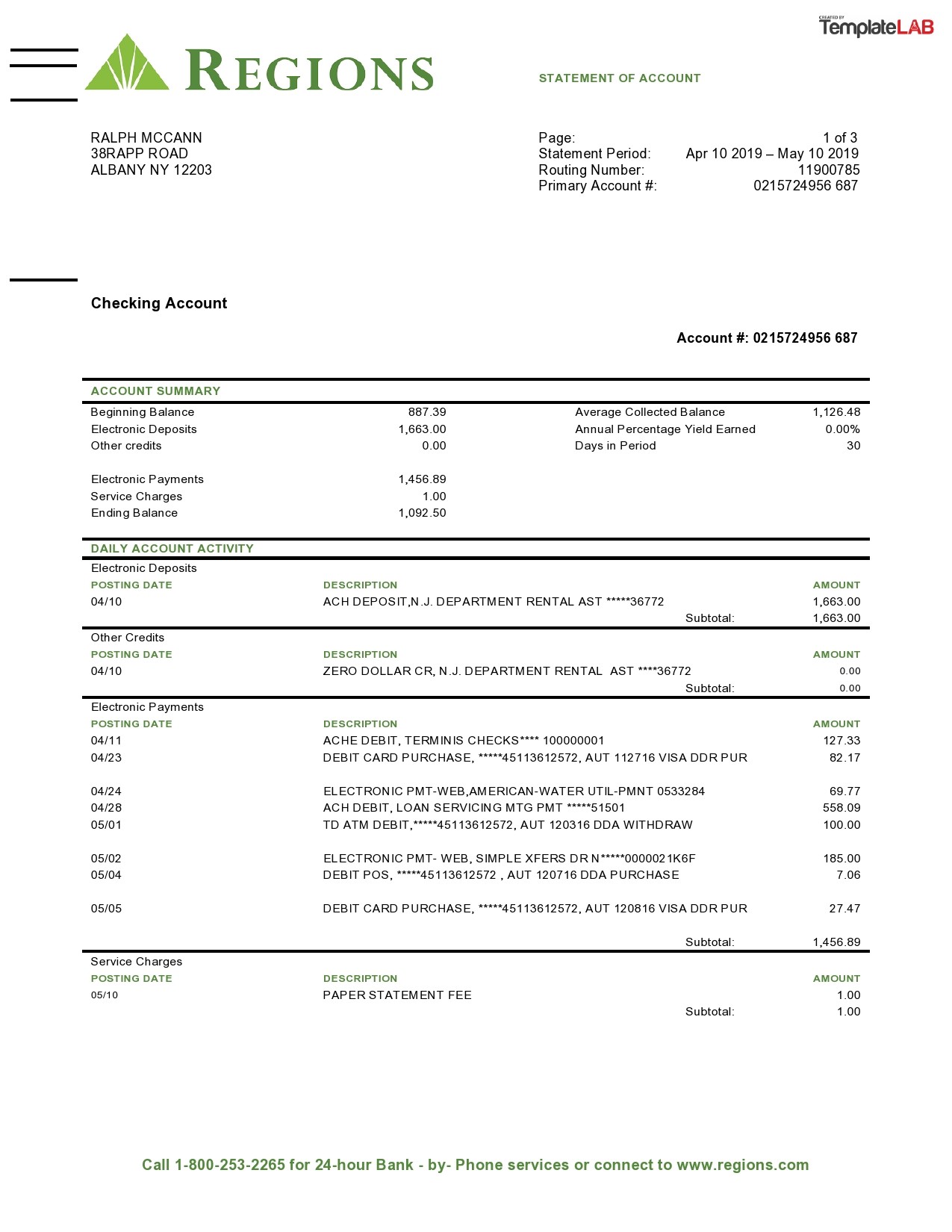

1. Account Information: This section typically includes the account holder’s name, account number, and statement period. Accurate representation of this information is crucial for maintaining consistency and relevance within the template.

2. Transaction Details: This component forms the core of the statement, detailing individual transactions. Editable fields within this section typically include date, description, amount, and transaction type (credit or debit). The ability to manipulate these fields allows for the creation of diverse financial scenarios.

3. Balance Information: This section displays the beginning and ending balance for the statement period. The ending balance dynamically updates based on the entered transaction data, providing immediate feedback on the impact of changes.

4. Summary Information: This section may include summary data such as total credits, total debits, and average daily balance. These aggregated figures offer valuable insights into overall financial activity within the specified period.

5. Customizable Features: Key to the template’s utility is the capacity to customize fields. This allows users to adapt the template to specific needs, creating realistic simulations for various financial planning or educational purposes.

6. Data Formatting: Consistent data formatting, mirroring the structure of an actual bank statement, ensures clarity and facilitates accurate interpretation of financial information. This includes consistent date formats, currency symbols, and numerical representation.

Effective utilization of the template hinges on understanding the interplay of these components. Manipulating transaction details, observing the impact on balance information, and interpreting summary data empowers users to gain valuable insights into financial dynamics and apply these insights to real-world financial management.

How to Create an Editable Regions Bank Statement Template

Creating an editable Regions Bank statement template requires careful consideration of structure and functionality. The following steps outline the process of developing a template suitable for various applications, from personal finance management to educational exercises.

1: Obtain a Sample Statement: Acquire a legitimate Regions Bank statement, either a blank template if available or a redacted personal statement. This serves as the foundation for replicating the structure and formatting.

2: Choose a Software: Select appropriate software for creating the editable template. Spreadsheet software like Microsoft Excel or Google Sheets is recommended due to their robust data manipulation capabilities and formula functions.

3: Replicate the Structure: Reproduce the layout and formatting of the sample statement within the chosen software. This includes accurate placement of headers, labels, and data fields. Pay close attention to font styles, sizes, and spacing.

4: Establish Editable Fields: Identify the data fields that require editing, such as transaction dates, descriptions, and amounts. Ensure these fields are designated as editable within the software, allowing for user manipulation.

5: Incorporate Formulas: Implement formulas to automate calculations, such as updating the running balance based on entered transactions. This dynamic functionality is essential for accurate representation of financial activity.

6: Validate Accuracy: Thoroughly test the template by entering sample data and verifying the accuracy of calculations and dynamic updates. This ensures the template functions as intended and provides reliable information.

7: Protect Non-Editable Fields: Safeguard static information, such as account details and headers, by protecting these cells from accidental modification. This preserves the template’s structure and integrity.

Replicating the structure and incorporating dynamic functionality, such as automated calculations and editable fields, allows users to manipulate data, model scenarios, and gain valuable financial insights. Thorough testing and validation ensure the template’s reliability and effectiveness as a tool for financial management and education.

Customizable Regions Bank statement templates offer a powerful tool for financial management, education, and analysis. Their adaptability allows users to explore hypothetical scenarios, practice budgeting techniques, and gain a deeper understanding of financial dynamics. Key features, such as customizable fields for transaction details and automated balance updates, facilitate realistic simulations and accurate financial projections. Understanding the structure and components of these templates, along with responsible usage, empowers individuals and organizations to make informed financial decisions and achieve financial goals. Furthermore, the educational applications of these templates contribute significantly to enhanced financial literacy and responsible financial behavior.

Effective financial management requires informed decision-making and proactive planning. Leveraging tools such as customizable financial statement templates provides a practical and accessible means of achieving greater financial control and stability. Continued exploration and utilization of these resources will contribute to improved financial well-being and a more secure financial future. The ability to model and analyze financial data empowers individuals and organizations to navigate complex financial landscapes and achieve long-term financial success.