Utilizing a flexible framework for creating these records offers several advantages. It streamlines the billing process, reduces administrative overhead, and minimizes the risk of errors. Furthermore, the ability to tailor the form to specific client needs enhances professionalism and reinforces a positive client relationship. This adaptability also allows businesses to incorporate branding elements and maintain a cohesive brand identity across all financial communications.

This foundational understanding of a customizable financial reporting tool sets the stage for a deeper exploration of its components, applications, and best practices for implementation. Subsequent sections will delve into specific features and offer practical guidance for leveraging its full potential to improve financial reporting efficiency and accuracy.

1. Customization

Customization lies at the heart of an effective adaptable framework for financial reporting. The ability to modify pre-existing templates allows businesses to tailor statements to individual client needs and circumstances. This might involve adjusting the level of detail presented, incorporating specific client references or project codes, or modifying the overall layout and design. For instance, a law firm might itemize billable hours for each legal activity undertaken, while a design agency might group expenses by project phase. This granular control ensures relevance and clarity, strengthening client relationships through personalized communication.

Furthermore, customization extends beyond mere content modification. Businesses can integrate their branding elements, such as logos, color schemes, and fonts, into the statement template. This reinforces brand identity and promotes a professional image. The ability to select preferred date formats, currencies, and tax calculations further enhances the template’s adaptability to diverse client portfolios and international operations. Such flexibility ensures compliance with regional requirements and simplifies financial reconciliation processes.

In essence, customization transforms a generic form into a powerful communication tool. It enables businesses to present complex financial information in a clear, concise, and client-centric manner. By leveraging customization features, organizations can enhance transparency, build stronger client relationships, and ultimately improve financial management practices. However, it is crucial to maintain a balance between customization and consistency to ensure all client communications adhere to established branding guidelines and regulatory standards. This balance ensures professional, accurate, and legally compliant financial reporting.

2. Professionalism

Professionalism in financial reporting significantly impacts client perception and business credibility. A polished, well-structured statement of account conveys competence and attention to detail, fostering trust and reinforcing a positive brand image. Conversely, a poorly formatted or error-ridden statement can undermine client confidence and damage reputation. An editable template provides the foundation for achieving this professionalism by ensuring consistency in formatting, branding, and terminology across all client communications. For example, a consistent logo placement, professional font usage, and clear presentation of payment terms contribute to a cohesive and credible brand identity. Consider a freelance consultant issuing invoices with inconsistent branding and varying levels of detail. This inconsistency may project an unprofessional image, potentially impacting client trust and future business opportunities. A standardized, editable template mitigates such risks.

Furthermore, professionalism extends beyond visual presentation. The accuracy and clarity of information presented are equally crucial. An editable template facilitates accuracy by reducing manual data entry and minimizing the risk of errors. Clear articulation of services rendered, applicable fees, and payment deadlines eliminates ambiguity, preventing potential misunderstandings and disputes. Imagine a software company issuing invoices with unclear service descriptions or incorrect billing amounts. This lack of clarity not only reflects poorly on their professionalism but can also lead to client dissatisfaction and delayed payments. A well-designed, editable template preemptively addresses these issues, promoting transparency and professionalism in financial interactions.

In conclusion, professionalism in financial reporting is paramount for maintaining a strong client relationship and a positive brand image. A customizable, editable template serves as a vital tool for achieving this professionalism. It ensures consistency, accuracy, and clarity in client communications, thereby promoting trust, minimizing disputes, and ultimately contributing to business success. Addressing potential challenges in template design and implementation, such as ensuring accessibility and accommodating diverse client needs, strengthens the effectiveness of this tool in upholding professional standards across all financial interactions.

3. Clarity

Clarity in financial documentation is paramount for effective communication and positive client relationships. An editable statement of account template contributes significantly to this clarity by offering a structured framework for presenting complex financial information. A well-designed template ensures consistent organization of data, making it easy for clients to understand charges, payments, and outstanding balances. Consider a scenario where a client receives a statement with disorganized information, inconsistent terminology, and unclear calculations. This lack of clarity can lead to confusion, frustration, and potentially disputes. A customizable template mitigates this risk by providing a clear and consistent structure, ensuring all essential information is presented logically and accessibly. This structure might include clearly labeled sections for transaction details, payment history, and outstanding balance summaries, promoting transparency and minimizing the potential for misinterpretation.

Furthermore, clarity is enhanced through the template’s adaptability. Customization features allow businesses to tailor the level of detail presented according to individual client needs. For example, a statement for a large corporation might require detailed breakdowns of individual transactions, whereas a smaller client might benefit from a simplified summary. This ability to adjust the level of detail ensures the statement remains concise and relevant, preventing information overload while maintaining transparency. Imagine a construction company billing a client for a complex project. Using a customizable template, they can itemize each phase of the project, detailing material costs, labor charges, and other expenses in a clear and organized manner, thus promoting understanding and avoiding potential disputes over billing accuracy.

In conclusion, clarity in financial reporting is crucial for building trust and maintaining strong client relationships. An editable statement of account template serves as a powerful tool for achieving this clarity through consistent structure and adaptable detail presentation. By prioritizing clarity, businesses can minimize confusion, foster transparency, and ultimately enhance client satisfaction. Addressing challenges in achieving clarity, such as accommodating varying client literacy levels and ensuring accessibility for individuals with disabilities, further strengthens the template’s effectiveness as a communication tool.

4. Efficiency

Efficiency in financial processes is a critical driver of organizational productivity and profitability. An editable statement of account template plays a crucial role in enhancing this efficiency by streamlining the creation and distribution of client financial statements. Manual creation of these statements is time-consuming and prone to errors. An editable template automates many aspects of this process, allowing businesses to generate accurate statements quickly and consistently. Consider a subscription-based service with thousands of customers. Manually generating individual invoices would be a logistical nightmare. An editable template allows them to automate this process, populating client-specific data into a pre-designed format, dramatically reducing processing time and minimizing administrative overhead.

Furthermore, an editable template enhances efficiency beyond initial statement creation. The ability to store and retrieve client data, track payment history, and generate reports simplifies reconciliation processes and reduces the time spent on administrative tasks. This efficiency gain frees up valuable resources, allowing staff to focus on core business activities rather than tedious paperwork. For example, a wholesale distributor dealing with numerous retailers can use an editable template to automatically generate statements reflecting individual purchase histories, payment terms, and outstanding balances. This automation simplifies their accounting workflow, allowing for efficient tracking of receivables and proactive management of outstanding payments. This efficiency is further amplified by integration with accounting software, which automates data transfer and eliminates manual data entry.

In conclusion, an editable statement of account template is a vital tool for achieving efficiency in financial reporting. Automating statement creation, streamlining data management, and simplifying reconciliation processes contribute significantly to increased productivity and reduced administrative burden. Addressing potential challenges, such as ensuring data security and maintaining template integrity across multiple users, further enhances the template’s effectiveness in optimizing financial operations. This efficiency gain translates directly into cost savings, improved cash flow management, and ultimately, enhanced profitability.

5. Accuracy

Accuracy in financial reporting is paramount for maintaining client trust, complying with regulatory requirements, and ensuring the financial health of any organization. An editable statement of account template contributes significantly to accuracy by minimizing manual data entry, promoting consistency, and facilitating error detection. Inaccurate financial statements can lead to disputes, regulatory penalties, and misinformed business decisions. The following facets illustrate the connection between accuracy and the utilization of an editable template:

- Data IntegrityEditable templates often integrate with accounting software, allowing for automated data transfer. This reduces manual data entry, a major source of errors. For example, if a sales order is entered into the accounting system, the relevant information can automatically populate the statement of account, minimizing the risk of transcription errors. This automated data flow maintains data integrity and ensures consistency across all financial records.

- Error ReductionStandardized calculations within a template minimize mathematical errors. Pre-defined formulas for calculating taxes, discounts, and other charges ensure consistency and accuracy across all client statements. For instance, if a company offers tiered discounts based on purchase volume, the template can automatically apply the correct discount based on the order data, eliminating manual calculation errors. Furthermore, the template itself can be reviewed and tested for accuracy before deployment, reducing the likelihood of systemic errors affecting multiple clients.

- Version ControlEditable templates facilitate version control. Tracking changes and maintaining a history of revisions helps identify and rectify errors, ensuring that the most accurate version is always used. This is particularly important in collaborative environments where multiple users may access and modify the template. Version control also ensures compliance with auditing requirements by providing a clear audit trail of changes made to the template over time. This transparency fosters accountability and reinforces the accuracy of financial reporting.

- Validation and VerificationBuilt-in validation rules within an editable template can prevent data entry errors. For example, a template can be designed to reject invalid data formats, such as text in a numerical field or dates outside a specified range. This preemptive error detection minimizes the risk of inaccuracies propagating through the system. Furthermore, templates can be designed to facilitate verification procedures, allowing for independent review and confirmation of data accuracy before statement generation. This layered approach to error prevention significantly enhances the overall accuracy and reliability of financial reporting.

These facets demonstrate how an editable statement of account template contributes to accuracy in financial reporting. By minimizing manual intervention, promoting consistency, and facilitating error detection and prevention, the template enhances the reliability of financial data, fostering trust with clients, ensuring regulatory compliance, and ultimately contributing to sound financial management practices. Further considerations, such as data security measures and regular template reviews, strengthen the framework’s effectiveness in maintaining accuracy over time.

6. Branding

Branding within financial documentation, often overlooked, represents a powerful tool for reinforcing corporate identity and fostering client recognition. An editable statement of account template provides a canvas for integrating consistent branding elements, ensuring every communication strengthens brand presence. This integration extends beyond simply adding a logo. Color palettes, typography choices, and even the layout itself can contribute to a cohesive brand experience. Consider a luxury brand; their statement of account might utilize elegant fonts, a minimalist layout, and a subtle color scheme reflecting their overall brand aesthetic. Conversely, a tech startup might opt for a modern, bold font, vibrant colors, and a dynamic layout. These choices, consistently applied through an editable template, ensure every statement reinforces the brand’s distinct identity.

This consistent brand presence within financial communications fosters professionalism and builds client trust. A recognizable and consistent brand experience across all touchpoints, including financial documentation, contributes to a sense of reliability and stability. Imagine receiving a statement from a financial institution with inconsistent branding or a generic, unbranded template. This lack of cohesive branding could inadvertently undermine client confidence. A well-branded statement, however, reinforces the institution’s professionalism and commitment to quality. Furthermore, consistent branding within financial documents enhances memorability. Each statement serves as a subtle brand reminder, strengthening brand recall and contributing to long-term brand recognition. This consistent exposure, even within the context of financial transactions, plays a crucial role in building brand equity.

A strategically branded statement of account template transcends mere visual appeal; it becomes a tangible expression of brand values. It communicates professionalism, reinforces brand recognition, and fosters client trust. However, maintaining brand consistency across all financial documentation requires careful template design and implementation. Considerations such as accessibility for individuals with visual impairments and adaptability for various document formats (print, digital) are crucial for ensuring brand integrity across all client interactions. Addressing these challenges strengthens the effectiveness of the template as a branding tool, maximizing its impact on client perception and brand equity.

Key Components of an Editable Statement of Account Template

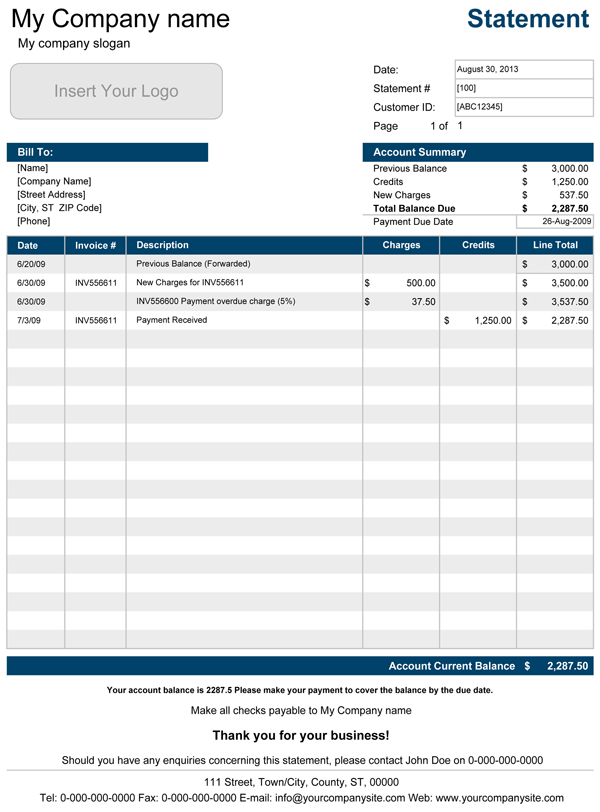

Essential elements comprise a comprehensive and effective editable statement of account template. These components ensure clarity, accuracy, and professionalism in client financial communications.

1. Header Information: Clear identification of both the issuing business and the client is paramount. This section typically includes company logos, contact information, and unique invoice or statement numbers. Accurate header information ensures proper record-keeping and facilitates efficient processing.

2. Client Information: Accurate client details are crucial. This includes the client’s name, billing address, and contact information. Accurate client data ensures proper delivery and facilitates communication regarding the statement.

3. Statement Date and Period: The statement must clearly indicate the date of issue and the billing period covered. This information provides context for the transactions listed and clarifies the relevant timeframe for payment.

4. Transaction Details: A detailed breakdown of individual transactions forms the core of the statement. This section includes descriptions of services rendered or products sold, quantities, unit prices, and applicable taxes or discounts. Clear and accurate transaction details are essential for transparency and client understanding.

5. Payment History: Recording payments received against previous invoices provides a clear overview of the client’s payment activity. This section details payment dates, amounts, and payment methods. A comprehensive payment history facilitates reconciliation and clarifies outstanding balances.

6. Outstanding Balance: Clearly displaying the total amount owed by the client is critical. This figure should reflect all unpaid invoices and accrued charges, clearly distinguishing between current and overdue amounts. A prominent display of the outstanding balance encourages timely payment.

7. Payment Terms and Instructions: Clearly stated payment terms, including due dates, accepted payment methods, and late payment penalties, are essential. Providing clear payment instructions simplifies the payment process and reduces potential delays. This might include details for online payments, bank transfers, or check payments.

8. Footer Information: The footer often includes additional information such as terms and conditions, disclaimers, or contact information for inquiries. This section provides important legal and practical details for both the business and the client.

These components, working in concert, provide a comprehensive overview of client financial activity, promoting transparency and facilitating efficient financial management. A well-designed template ensures these elements are presented clearly, consistently, and professionally, enhancing client communication and contributing to positive business relationships. Omitting or neglecting any of these elements can lead to confusion, disputes, and ultimately, damage the business’s reputation.

How to Create an Editable Statement of Account Template

Creating a professional, adaptable statement of account template requires careful planning and attention to detail. A well-structured template streamlines financial reporting, enhances client communication, and reinforces brand identity. The following steps outline the process:

1. Choose a Software Application: Select appropriate software based on specific business needs and technical proficiency. Options range from spreadsheet software like Microsoft Excel or Google Sheets for basic templates to dedicated accounting software or document creation platforms for more advanced features. Spreadsheet software offers simplicity and accessibility, while dedicated platforms provide enhanced automation and integration capabilities. The choice depends on factors such as budget, technical expertise, and desired level of customization.

2. Design the Layout: A clear, organized layout is crucial for readability. Establish distinct sections for header information, client details, transaction details, payment history, outstanding balance, payment terms, and footer information. Consider incorporating visual elements like lines or shading to separate sections and improve visual clarity. Prioritize a logical flow of information to guide the reader’s eye through the document.

3. Incorporate Branding Elements: Integrate company logos, color palettes, and typography to reinforce brand identity. Consistent branding across all financial communications enhances professionalism and strengthens brand recognition. Ensure brand elements are incorporated tastefully and do not compromise the document’s clarity or readability.

4. Define Data Fields: Clearly define fields for all essential information. Use descriptive labels and ensure appropriate data formats for numerical values, dates, and currencies. Consider incorporating drop-down menus or pre-defined lists for standardized data entry, reducing the risk of errors and ensuring consistency. This structured approach simplifies data entry and improves data integrity.

5. Implement Formulas and Calculations: Utilize formulas and functions to automate calculations for taxes, discounts, and outstanding balances. Automated calculations minimize manual data entry, reducing the risk of errors and improving efficiency. Thoroughly test all formulas to ensure accuracy before deploying the template.

6. Incorporate Payment Instructions: Provide clear instructions for various payment methods, including online payment portals, bank transfers, and mailing addresses for check payments. Clear payment instructions facilitate timely payments and reduce inquiries related to payment procedures.

7. Test and Refine: Thoroughly test the template with sample data to ensure all formulas and functions work correctly. Review the layout for clarity and readability. Solicit feedback from relevant stakeholders to identify areas for improvement and refine the design based on user experience. This iterative process ensures the final template meets the needs of the business and its clients.

8. Implement Version Control: Establish a system for version control to track changes and maintain a history of revisions. Version control facilitates error tracking, ensures consistency, and supports compliance with auditing requirements. This practice preserves the integrity of the template over time and simplifies future updates.

A well-designed template ensures consistent, accurate, and professional client communication, thereby strengthening relationships, improving efficiency, and contributing to sound financial management. Regular review and updates based on evolving business needs and best practices ensure the template remains a valuable tool for financial reporting.

Customizable, adaptable frameworks for generating statements of account represent a significant advancement in financial reporting. They provide businesses with the tools to generate accurate, professional, and consistent financial documentation, enhancing client communication, improving efficiency, and minimizing errors. From streamlining billing processes to reinforcing brand identity, the benefits of utilizing such a structured approach are substantial. Key takeaways include the importance of clear communication, accurate data presentation, consistent branding, and efficient workflows within financial reporting. The adaptability of these frameworks empowers businesses to tailor communications to individual client needs, further strengthening relationships and fostering transparency.

Effective financial reporting is not merely a matter of compliance; it is a strategic imperative for any successful organization. Leveraging the capabilities of a customizable framework for statements of account contributes significantly to achieving this objective. As business practices evolve and technological advancements continue, embracing adaptable and efficient solutions for financial communication will become increasingly critical for maintaining a competitive edge and fostering long-term success. The ongoing development of these tools promises further enhancements in automation, data analysis, and integration capabilities, paving the way for even greater efficiency and transparency in financial reporting.