Utilizing such a document offers several advantages. It provides a safe alternative to using authentic bank statements, protecting sensitive financial data from potential misuse. The ability to modify the content allows users to tailor the information for specific needs like budgeting exercises, software testing, or educational demonstrations. This flexibility and control empower users to generate realistic representations of financial records without compromising security.

Understanding the utility and benefits of such adaptable financial documents underscores the importance of exploring the available options and resources for creating and utilizing them effectively. The following sections will delve into practical applications, potential risks, and ethical considerations related to using these tools responsibly.

1. Customization

Customization lies at the heart of an editable SunTrust (now Truist) bank statement template’s utility. The ability to modify data within the template allows for its adaptation to a wide range of scenarios. This adaptability stems from the template’s inherent flexibility, enabling users to alter figures like account balances, transaction dates, and individual transaction amounts. For instance, a financial planner might adjust figures to project a client’s potential future savings, or a software developer could use a modified template containing specific transaction types to test the functionality of a new financial application.

The implications of this customization capacity are significant. It allows for the creation of hypothetical financial scenarios without compromising the security of real banking information. Consider a business owner needing to provide a proof of funds document. Using a customizable template allows them to present the necessary financial information without disclosing actual, sensitive account details. This safeguards their financial privacy while still fulfilling the requirement. Furthermore, educators can utilize these adaptable documents as teaching tools, modifying transactions to illustrate specific financial concepts or accounting principles.

However, the power of customization also necessitates responsible use. While offering substantial benefits in legitimate applications, the potential for misuse exists. Understanding the ethical boundaries and legal implications surrounding the modification and presentation of financial information is crucial for anyone utilizing these tools. Appropriate usage ensures that the benefits of customization are leveraged responsibly and ethically.

2. Financial Illustration

Financial illustration utilizes representations of financial data to clarify complex concepts or project potential outcomes. Within the context of editable bank statement templates, these illustrations serve as valuable tools for planning, analysis, and communication, offering a tangible representation of financial information without requiring disclosure of sensitive personal data.

- Scenario PlanningCreating hypothetical financial situations allows individuals and businesses to explore the potential impact of various decisions. A business owner might use a modified statement to visualize the financial implications of a new product launch, adjusting sales figures and expenses to project profitability. Similarly, individuals can model different savings and investment strategies to project long-term financial growth.

- Proof of ConceptDemonstrating financial capacity without revealing actual account details is often necessary in business transactions or grant applications. An editable template allows applicants to present a credible representation of their financial standing, fulfilling requirements while preserving privacy. This protects sensitive data and offers a standardized format easily interpreted by recipients.

- Educational ToolsEducators can employ modified statements to illustrate financial concepts, providing students with realistic examples for analysis. By manipulating transaction details and balances, instructors can demonstrate the effects of interest rates, budgeting decisions, or investment strategies. This interactive approach enhances understanding and practical application of financial principles.

- Software Testing & DevelopmentDevelopers creating financial software require realistic data to test functionality and identify potential issues. Editable templates provide a readily available source of structured financial data, allowing for comprehensive testing of transaction processing, balance calculations, and reporting features. This ensures software reliability and accuracy in handling real-world financial information.

The ability to adapt financial figures within these templates enhances the value of financial illustration, offering a powerful tool for various applications. However, ethical considerations remain paramount. Maintaining transparency about the illustrative nature of the information and refraining from misrepresenting data as factual is crucial for responsible and effective use.

3. Data Security Risks

Editable bank statement templates, while offering valuable functionality, introduce potential data security risks if not handled responsibly. The very features that make these templates usefulcustomizability and accessibilitycan also create vulnerabilities if security measures are overlooked or disregarded. Understanding these risks is crucial for mitigating potential harm and ensuring responsible usage.

- Unauthorized Access & ModificationTemplates stored insecurely, whether on personal devices or shared networks, can be accessed and modified without authorization. This can lead to the creation of fraudulent documents or the manipulation of financial information for malicious purposes. For example, a compromised template could be altered to create a false proof of funds document for fraudulent loan applications. Strong password protection, encryption, and restricted access controls are essential safeguards.

- Malware & Phishing RisksDownloading templates from untrusted sources exposes users to the risk of malware infections. Malicious actors can embed malware within seemingly innocuous template files, compromising user devices and potentially stealing sensitive information. Additionally, phishing scams may utilize fake template download links to lure individuals into providing login credentials or other personal data. Sticking to reputable sources and exercising caution when downloading files is crucial.

- Data Breaches & LeaksIf templates containing personal information are stored on shared drives or cloud services without adequate security measures, data breaches can occur. This exposes sensitive financial information to unauthorized access, potentially leading to identity theft or financial fraud. Implementing robust security protocols, such as two-factor authentication and data encryption, is vital for protecting sensitive data.

- Improper Disposal & Data RemnantsEven after a template is no longer needed, data remnants can persist on devices or storage media. Simply deleting a file does not guarantee complete data removal. Improper disposal of devices containing templates can lead to data recovery by unauthorized individuals. Secure data erasure methods, such as overwriting or physical destruction of storage media, are necessary to prevent data remnants from becoming a security risk.

The potential data security risks associated with editable bank statement templates underscore the need for cautious and responsible handling. Implementing strong security practices throughout the template’s lifecyclefrom creation and storage to usage and disposalis essential for mitigating these risks and safeguarding sensitive financial information. Neglecting these precautions can have serious consequences, highlighting the importance of prioritizing data security when utilizing these tools.

4. Ethical Implications

Ethical implications permeate the use of editable bank statement templates, demanding careful consideration. The ability to modify financial figures presents a significant ethical challenge. While legitimate applications exist, such as financial planning or educational exercises, the potential for misuse in misrepresenting financial status for fraudulent purposes is undeniable. This duality necessitates a strong ethical compass guiding template usage. For instance, altering a template to inflate income for loan applications constitutes fraud, carrying severe legal consequences. Even seemingly minor alterations, if presented as genuine financial records, can cross ethical boundaries. The difference between responsible application and unethical manipulation hinges on intent and transparency.

Maintaining ethical integrity requires transparency regarding the template’s nature. Disclosing that a document represents a hypothetical scenario or modified data is essential. Failing to do so misleads recipients, potentially influencing decisions based on falsified information. Consider a small business owner using a modified template to secure investment. Presenting the altered figures as actual financial performance deceives potential investors and undermines trust. Such actions erode confidence in financial documentation and can have far-reaching consequences. Furthermore, the availability of these templates online raises concerns about potential misuse by individuals seeking to engage in fraudulent activities. Promoting responsible usage and discouraging unethical applications through education and awareness is crucial.

Navigating the ethical landscape surrounding editable bank statement templates requires constant vigilance. Balancing the benefits of customization with the potential for misuse presents a significant challenge. Promoting ethical awareness, coupled with responsible development and distribution of these tools, can help mitigate risks and ensure their legitimate application. Ultimately, ethical considerations must remain paramount to prevent the misuse of these templates for fraudulent purposes and maintain trust in financial information. The responsibility for ethical usage rests with each individual employing these tools.

5. Practical Applications

Practical applications of editable bank statement templates, formerly associated with SunTrust (now Truist), span a range of activities, from personal finance to business operations and educational contexts. Understanding these diverse applications highlights the versatility of these tools while underscoring the importance of responsible and ethical usage. The following facets illustrate key practical applications and their implications.

- Financial Planning & BudgetingIndividuals can utilize editable templates to create personalized budgets, project future savings, and model various financial scenarios. By manipulating income and expense figures, users can visualize the impact of different financial decisions, aiding in informed decision-making. This application empowers individuals to take control of their finances and plan for future goals, such as retirement or large purchases. However, it is crucial to differentiate between projected figures and actual financial status.

- Business Projections & AnalysisBusinesses can employ templates to create projected financial statements, explore potential investment outcomes, and model the impact of business strategies. This enables informed decision-making regarding expansion plans, new product launches, or cost-cutting measures. For example, a startup might use a template to project revenue growth and demonstrate financial viability to potential investors. The ability to manipulate figures allows for sensitivity analysis, exploring various scenarios and their potential impact on the business’s financial health.

- Educational Demonstrations & TrainingEducational institutions and financial literacy programs can incorporate editable templates into curriculum to illustrate financial concepts and accounting principles. Modifying transactions and balances allows instructors to demonstrate the effects of interest rates, loan amortization, and investment returns in a practical, hands-on manner. This interactive approach enhances student understanding and reinforces learning through real-world examples.

- Software Testing & DevelopmentSoftware developers creating financial applications rely on realistic data for testing and quality assurance. Editable templates provide a structured format for generating test data, allowing developers to verify the accuracy and reliability of their software in handling various financial transactions and calculations. This ensures software robustness and minimizes the risk of errors in real-world usage.

The practical applications of editable bank statement templates demonstrate their utility across diverse fields. From personal finance to business operations and educational contexts, these tools offer valuable functionality. However, the potential for misuse necessitates a strong emphasis on ethical considerations and responsible application. Understanding the implications of manipulating financial data within these templates is crucial for leveraging their benefits while mitigating potential risks.

6. Template Sources

Template sources represent a critical factor influencing the legitimacy and utility of an editable bank statement template, particularly one mimicking the format of the institution formerly known as SunTrust (now Truist). The origin of a template directly impacts its accuracy, reliability, and legal compliance. Utilizing templates from untrusted sources carries significant risks, including inaccurate formatting, outdated information, and potential exposure to malware or phishing attempts. Conversely, reputable sources provide templates adhering to industry standards, ensuring accuracy and minimizing security risks. For example, a template sourced from a verified financial software provider is more likely to reflect current banking regulations and security protocols compared to one downloaded from an unverified online forum.

The choice of template source significantly influences the ethical implications of template use. Templates acquired through illegitimate means, such as those designed for fraudulent purposes, inherently carry ethical baggage. Utilizing such templates reinforces unethical practices and exposes users to potential legal repercussions. Conversely, reputable sources offering templates designed for legitimate applications, like financial planning or educational purposes, promote ethical use. Furthermore, understanding the terms of use associated with different template sources is crucial. Some sources may impose restrictions on commercial usage or modification, impacting the template’s applicability for specific purposes. Due diligence in evaluating template sources safeguards against legal and ethical pitfalls.

Selecting appropriate template sources is paramount for ensuring the responsible and effective use of editable bank statement templates. Evaluating source credibility, verifying information accuracy, and understanding terms of use are crucial steps in mitigating risks and maximizing the benefits of these tools. Failure to exercise caution in selecting template sources can undermine the intended purpose and expose users to potential legal and ethical challenges. The provenance of a template is intrinsically linked to its value and legitimacy, underscoring the importance of careful source selection.

Key Components of an Editable Bank Statement Template

Understanding the core components of an editable bank statement template, particularly one modeled after the former SunTrust Bank (now Truist), is crucial for effective and ethical utilization. These components dictate the template’s functionality and inform its appropriate applications.

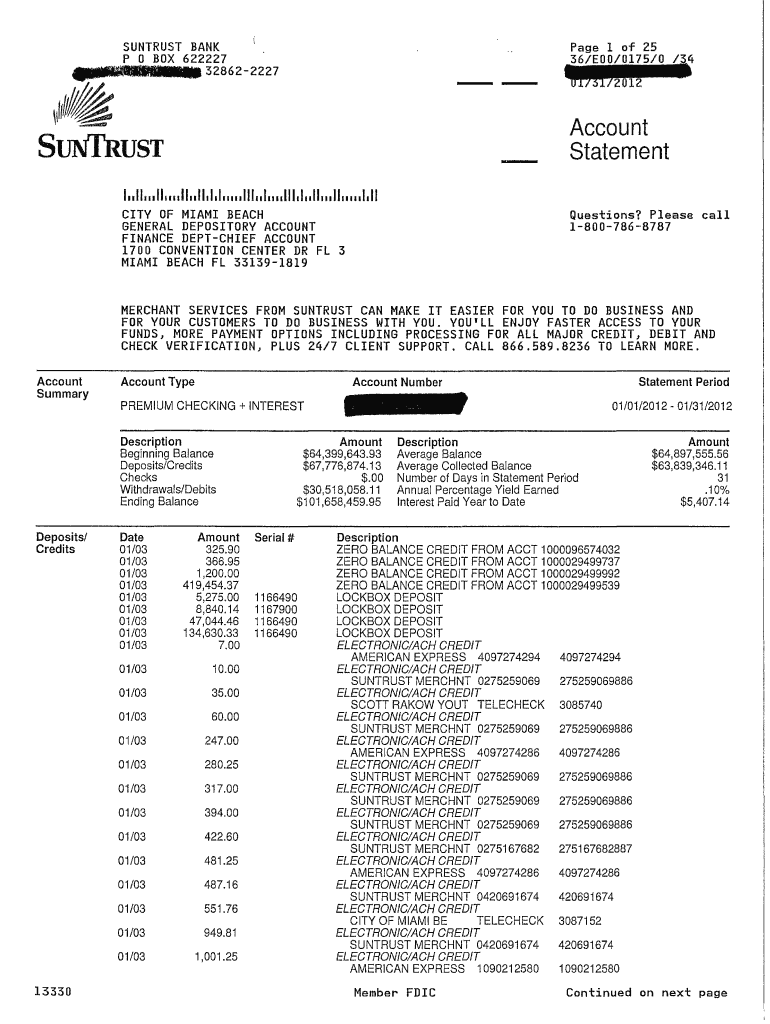

1. Account Information: This section replicates the account holder’s details as they would appear on an authentic bank statement. Crucially, this includes the account number, account holder name, and the bank’s name and logo. Accuracy in replicating these details is essential for creating a realistic representation, although using fictitious information for privacy is recommended in most cases.

2. Statement Period: The statement period defines the timeframe covered by the represented financial activity. This typically includes a start and end date, mirroring the monthly or quarterly cycle of genuine bank statements. Accurate representation of the statement period is crucial for contextualizing the transaction data and ensuring consistency.

3. Transaction Details: This section forms the core of the statement, detailing individual transactions within the specified period. Key elements include transaction dates, descriptions, and the corresponding debit or credit amounts. The ability to customize these details allows for creating various financial scenarios for planning, analysis, or illustrative purposes.

4. Balance Information: Accurate representation of the account balance is crucial. This includes the starting balance at the beginning of the statement period, the running balance after each transaction, and the ending balance at the close of the period. Correctly calculating and displaying these balances ensures the template’s integrity and reflects realistic financial activity.

5. Summary Information: Often included is a summary section providing an overview of account activity during the statement period. This may include totals for deposits, withdrawals, and any applicable fees or interest earned. A summary provides a concise overview of the financial activity depicted within the template.

6. Bank Contact Information: Replicating the bank’s contact information, including customer service numbers and branch addresses, enhances the template’s realism. However, it’s important to differentiate between a genuine statement and a template, especially when sharing with others. Misrepresenting a template as a real bank statement carries ethical and potentially legal implications.

7. Disclaimer (Crucial for Ethical Use): Perhaps the most important component for responsible use is a clear disclaimer explicitly stating the document’s nature as a template, not an authentic bank statement. This disclaimer mitigates the risk of misuse and promotes transparency, emphasizing ethical considerations. Including a disclaimer underscores the difference between legitimate application and potential misrepresentation.

Careful consideration of these components and their implications is crucial for utilizing editable bank statement templates responsibly and ethically. Accuracy, transparency, and a clear understanding of the template’s purpose ensure that these tools serve as valuable resources without compromising ethical standards or legal compliance. Responsible usage hinges on informed application, prioritizing data privacy and ethical considerations.

How to Create an Editable Bank Statement Template

Creating an editable bank statement template requires careful attention to detail and a strong emphasis on ethical considerations. The process involves replicating the format and components of a legitimate bank statement while ensuring clear differentiation to prevent misuse. Note: This information pertains to creating a template, not forging a document; fraudulent activity carries serious legal consequences.

1. Define the Purpose: Begin by clearly defining the intended purpose of the template. Whether for budgeting, software testing, or educational purposes, a clear objective guides the creation process and ensures appropriate design choices.

2. Obtain a Legitimate Statement Sample (Optional): A sample statement from the target institution (in this case, the former SunTrust, now Truist) can serve as a visual guide for replicating the layout and formatting. However, this is optional and ethical considerations must be observed ensure the sample statement is legally obtained and utilized solely for formatting reference.

3. Choose Software: Select appropriate software for creating the template. Spreadsheet software (like Microsoft Excel or Google Sheets) offers flexibility for calculations and data manipulation, while word processing software (like Microsoft Word or Google Docs) provides greater control over formatting.

4. Replicate the Layout: Carefully recreate the layout and structure of the bank statement, including sections for account information, statement period, transaction details, balance information, and any relevant disclaimers.

5. Populate Data Fields: Use placeholder data for all fields, ensuring the data type matches the corresponding field. For instance, dates should be formatted as dates, and currency values should be formatted as numbers. Placeholder data ensures the template is functional and ready for customization.

6. Implement Formulas (for Spreadsheets): If using spreadsheet software, incorporate formulas for calculating running balances, totals, and other relevant figures. This automates calculations and ensures accuracy when the template is populated with actual data. Ensure formula integrity for reliable results.

7. Incorporate a Disclaimer: Prominently display a clear and unambiguous disclaimer stating that the document is a template and not an authentic bank statement. This is crucial for ethical use and prevents misrepresentation.

8. Test and Refine: Thoroughly test the template by entering sample data and verifying the accuracy of calculations and formatting. Refine the template as needed to ensure functionality and ease of use. Rigorous testing ensures the template’s reliability.

Creating an effective and ethical editable bank statement template demands careful attention to structure, data accuracy, and, importantly, responsible use. Implementing a clear disclaimer and utilizing the template solely for legitimate purposes ensures compliance with ethical and legal standards. Diligence in design and a commitment to ethical practices are paramount throughout the creation process.

Templates replicating the style of former SunTrust Bank (now Truist) statements offer valuable tools for various applications, from financial planning and educational demonstrations to software testing. However, the inherent ability to modify financial data necessitates careful consideration of ethical implications and potential risks. Understanding the components, creation process, and responsible usage of these templates is crucial for maximizing their benefits while mitigating potential harm. Balancing utility with ethical considerations remains paramount.

The increasing accessibility of such tools underscores the growing need for responsible digital literacy. Promoting ethical awareness and providing educational resources on proper usage safeguards against potential misuse and ensures that these templates serve as valuable resources for legitimate purposes, contributing positively to financial literacy and responsible financial practices. The future of these tools relies heavily on responsible development, distribution, and user practices. Continued emphasis on ethical considerations and data security will shape their role in the evolving financial landscape.