Utilizing such a document provides significant advantages in situations where demonstrating financial standing is necessary. It allows for the creation of hypothetical scenarios for budgeting, financial forecasting, or educational purposes. Furthermore, it can facilitate testing software or training individuals on financial processes without jeopardizing real financial data.

This understanding of customizable financial documentation forms the basis for exploring its various applications, potential benefits, and ethical considerations.

1. Customization

Customization lies at the heart of an editable US bank statement template’s utility. The ability to modify figures within the template allows for its adaptation to a range of purposes, from personal budgeting to business projections. This adaptability distinguishes it from a static document, transforming it into a dynamic tool. For instance, entrepreneurs developing financial forecasts for a startup can adjust income and expense figures to model various growth scenarios. Similarly, financial educators can create examples illustrating the impact of different spending habits on account balances.

The extent of customization possible often includes altering transaction details, dates, and account balances. This granular control enables the creation of highly specific scenarios. Consider a software developer testing a new financial application; the ability to input precise transaction data is essential for verifying the software’s accuracy and functionality. Furthermore, individuals practicing personal finance management can use customized templates to simulate the impact of debt reduction strategies or investment returns.

Effective customization requires understanding the implications of data manipulation. While the flexibility offered by these templates provides significant advantages, responsible use is crucial. Misrepresenting financial information carries serious ethical and legal ramifications. Therefore, the focus should remain on legitimate applications, such as educational exercises, personal financial planning, and software testing. The power of customization should be harnessed responsibly to maximize its benefits while mitigating potential risks.

2. Data Simulation

Data simulation represents a core functionality offered by editable US bank statement templates. The ability to input hypothetical financial data allows users to model various scenarios without affecting real financial records. This capability has significant implications for financial planning, software development, and educational purposes. Cause and effect relationships within financial models can be explored safely and effectively, allowing users to understand the impact of different variables without real-world consequences.

Consider a financial advisor guiding a client through retirement planning. Utilizing an editable template, the advisor can simulate the client’s projected income and expenses over several decades, adjusting variables such as investment returns and inflation rates. This data simulation allows the client to visualize the potential impact of various investment strategies and make informed decisions about their future. Similarly, software developers can leverage these templates to create test cases for financial applications. By inputting specific data sets, developers can identify and rectify software bugs before deployment, ensuring accuracy and reliability. Furthermore, educators can use simulated bank statements to teach students about financial literacy, budgeting, and the interpretation of financial documents.

The practical significance of data simulation within these templates lies in the ability to explore complex financial scenarios in a risk-free environment. This allows for informed decision-making, rigorous software testing, and effective financial education. However, the ethical implications of data manipulation must be acknowledged. While data simulation offers valuable insights, the distinction between simulated and authentic financial information must remain clear. The responsible use of this functionality is paramount to maintain its integrity and avoid misrepresentation.

3. Financial Planning

Financial planning benefits significantly from the utilization of editable US bank statement templates. These templates provide a dynamic framework for projecting future financial scenarios, analyzing potential outcomes, and making informed decisions. By manipulating variables within a controlled environment, individuals and businesses can gain valuable insights into their financial health and develop strategies for achieving their goals. This proactive approach to financial management allows for informed decision-making and enhances preparedness for future challenges.

- Budgeting and ForecastingEditable templates enable accurate budgeting and forecasting by allowing users to project income and expenses over specific timeframes. This facilitates the identification of potential shortfalls or surpluses, enabling proactive adjustments. For example, a household can use a template to anticipate the financial impact of a new mortgage, adjusting spending habits accordingly. Businesses can model various revenue projections to assess the feasibility of expansion plans.

- Scenario PlanningThe ability to manipulate variables within a template facilitates scenario planning. By adjusting factors such as investment returns, interest rates, or unexpected expenses, individuals and businesses can evaluate the potential impact of various circumstances on their financial stability. This empowers users to develop contingency plans and mitigate potential risks. For instance, a business can model the financial impact of a supply chain disruption to develop strategies for minimizing losses.

- Goal Setting and TrackingFinancial goals, such as saving for a down payment or retirement, can be effectively tracked using these templates. By projecting future account balances based on different saving and investment strategies, individuals can monitor progress and make necessary adjustments to stay on track. This visual representation of financial progress motivates continued adherence to financial plans.

- Debt ManagementAnalyzing debt reduction strategies becomes more manageable with editable templates. Users can simulate the impact of different repayment plans on their overall debt burden and interest payments. This allows for informed decisions regarding debt consolidation, prioritization, and accelerated repayment strategies. Visualizing the long-term impact of various approaches empowers individuals to make effective choices for managing debt.

These facets of financial planning demonstrate the value of editable US bank statement templates as dynamic tools for informed financial management. The ability to manipulate data within a controlled environment empowers individuals and businesses to make proactive decisions, anticipate potential challenges, and achieve their financial goals with greater confidence. The insights gained from these simulations translate into more effective real-world financial strategies.

4. Educational Resource

Editable US bank statement templates offer significant value as educational resources, bridging the gap between theoretical financial concepts and practical application. These templates provide a risk-free environment for learners to interact with realistic representations of financial documents, fostering a deeper understanding of financial literacy and its real-world implications. The interactive nature of these templates encourages active learning and reinforces comprehension of key financial principles.

- Understanding Bank Statement StructureTemplates provide a clear visual representation of a typical bank statement layout, including common elements such as account details, transaction descriptions, dates, debits, credits, and running balances. This allows learners to familiarize themselves with the organization and information presented in an authentic statement, facilitating accurate interpretation and analysis. For example, students can identify the difference between a deposit and a withdrawal, understand how interest is calculated and applied, and learn how to reconcile transactions.

- Practical Application of Financial ConceptsEditable fields within the template allow learners to apply theoretical financial concepts in a practical setting. Concepts like budgeting, saving, and debt management can be explored by manipulating transaction data and observing the impact on the account balance. For instance, students can simulate the impact of regular savings contributions on their overall financial goals or explore the effects of different interest rates on loan repayment schedules.

- Financial Analysis and Decision-MakingBy manipulating data within the template, learners can analyze financial trends and make informed decisions based on hypothetical scenarios. This fosters critical thinking skills related to financial management and allows for the exploration of different financial strategies without real-world consequences. For example, students can analyze spending patterns to identify areas for potential savings or compare the long-term impact of different investment strategies.

- Preparation for Real-World Financial ResponsibilitiesInteracting with realistic bank statement templates prepares learners for the practicalities of managing personal finances. This familiarity reduces anxiety associated with financial documents and empowers individuals to confidently navigate real-world financial situations. For instance, understanding how to interpret bank statements allows individuals to detect errors, track expenses, and manage their finances effectively.

The educational benefits of editable US bank statement templates extend beyond theoretical knowledge, fostering practical skills and informed decision-making. By providing a safe and interactive learning environment, these templates empower individuals to confidently navigate the complexities of personal finance and develop sound financial habits. This practical experience translates into improved financial literacy and responsible financial management in real-world contexts.

5. Ethical Considerations

Ethical considerations are paramount when utilizing editable US bank statement templates. While these templates offer valuable functionalities for various legitimate purposes, the potential for misuse necessitates a clear understanding of ethical boundaries. Responsible use ensures the integrity of financial information and prevents the perpetuation of fraudulent activities. Navigating these ethical considerations requires careful attention to responsible data handling and a commitment to ethical principles.

- Misrepresentation of Financial InformationFabricating or altering financial information within a template to misrepresent one’s financial standing is unethical and potentially illegal. Such actions can have serious consequences, including legal penalties and damage to reputation. For example, submitting a falsified bank statement to obtain a loan constitutes fraud. The ethical obligation remains to use these templates for legitimate purposes, such as budgeting, forecasting, and software testing, never for deception.

- Protecting Personal Data PrivacyWhen using templates for educational or training purposes, ensuring the privacy of personal data is crucial. Real financial data should never be used without explicit consent. Instead, hypothetical data or anonymized information should be employed to protect individuals’ privacy. For instance, when creating training materials for bank employees, using fictional account numbers and names ensures data confidentiality.

- Transparency and DisclosureWhen sharing or presenting information derived from an editable template, transparency is essential. Clearly indicating that the data is simulated and not from an authentic bank statement prevents misinterpretation and maintains ethical standards. For example, when using a template for educational presentations, explicitly stating the simulated nature of the data prevents misleading the audience.

- Respecting Intellectual PropertyUtilizing templates obtained from reputable sources and respecting copyright regulations is crucial. Distributing or modifying copyrighted templates without permission infringes intellectual property rights. Ethical practice involves acquiring templates legally and adhering to licensing agreements. For example, using a pirated template for commercial purposes violates copyright laws and undermines ethical principles.

Adhering to these ethical considerations ensures the responsible use of editable US bank statement templates. By prioritizing ethical principles, individuals and organizations can leverage the benefits of these templates while mitigating potential risks and maintaining the integrity of financial information. Ethical awareness fosters trust and promotes responsible financial practices in all contexts.

Key Components of an Editable US Bank Statement Template

Understanding the core components of an editable US bank statement template is crucial for effective utilization. These components represent the fundamental data fields that constitute a realistic representation of an authentic bank statement.

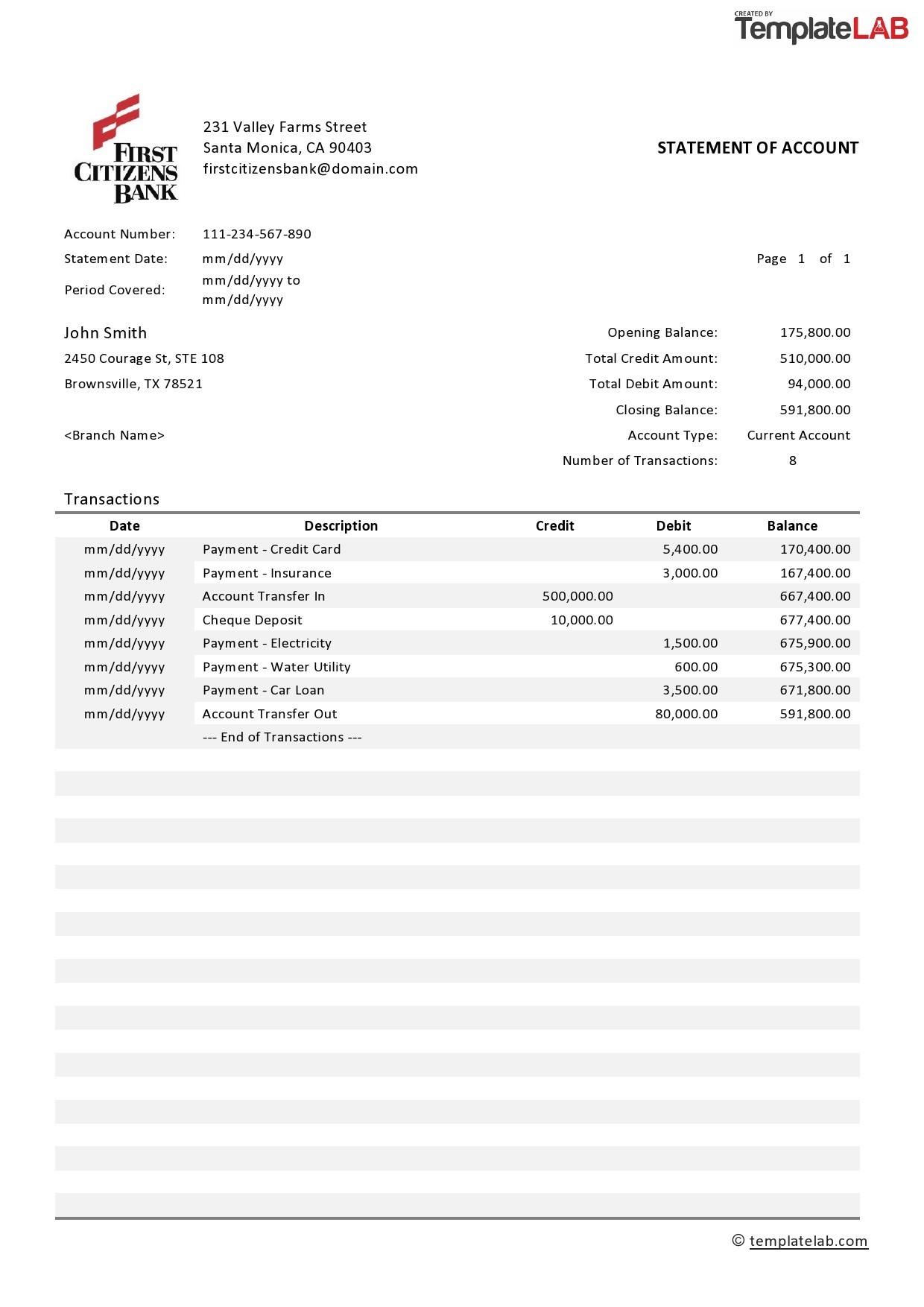

1. Account Information: This section typically includes the account holder’s name, address, account number, and the statement period covered. Accurate representation of this information is essential for maintaining the template’s realism and utility in various applications.

2. Beginning Balance: The starting balance for the statement period provides a foundation for tracking financial activity. This figure serves as the initial point for calculating subsequent transactions and determining the ending balance.

3. Transaction Details: This component comprises the core of the bank statement, detailing individual transactions. Each transaction entry typically includes the date, description, amount, and transaction type (debit or credit). Accurate and detailed transaction information is crucial for simulating real-world financial activity.

4. Running Balance: The running balance updates after each transaction, reflecting the cumulative impact of debits and credits. This dynamic element provides a continuous overview of the account’s financial status throughout the statement period.

5. Ending Balance: The final balance at the end of the statement period represents the net result of all transactions. This figure is essential for reconciliation and provides a snapshot of the account’s financial position at a specific point in time.

6. Bank Information: This section typically includes the name, address, and logo of the financial institution. Accurate representation of bank details adds to the template’s authenticity and reinforces its realism.

7. Customizable Fields: The ability to modify data within these fields is the defining characteristic of an editable template. This flexibility allows users to tailor the information to specific needs, facilitating various applications from budgeting to software testing.

These components work in concert to create a comprehensive and dynamic representation of a US bank statement. Accurate representation of these elements ensures the template’s utility and reinforces its value in various applications, including financial planning, education, and software development. The ability to customize these fields allows for realistic simulation of financial scenarios, enabling users to gain valuable insights and make informed decisions.

How to Create an Editable US Bank Statement Template

Creating an editable US bank statement template requires careful consideration of the key components and their accurate representation. Several methods facilitate this process, each offering varying degrees of control and complexity.

1: Spreadsheet Software: Spreadsheet applications offer a readily accessible method. Creating a new spreadsheet and structuring columns to represent the essential data fields (date, description, debit, credit, balance) allows for basic functionality. Formulas can be implemented to automatically calculate the running balance. However, design limitations may restrict the template’s visual resemblance to an authentic bank statement.

2: Word Processing Software: Word processors provide greater control over formatting, enabling closer replication of a genuine bank statement’s appearance. Tables can be used to organize data fields, and text boxes allow for the inclusion of static information like account details and bank information. However, automating calculations, such as the running balance, requires more advanced features or manual entry.

3: Dedicated Template Software: Specialized template software offers pre-built bank statement templates, simplifying the creation process. These often include advanced features like automated calculations, customizable logos, and precise formatting options. However, such software may involve a financial investment.

4: Online Template Resources: Numerous online platforms offer free or paid downloadable bank statement templates in various formats. These can provide a convenient starting point, but customization options may be limited depending on the chosen format and source.

5: Replicating an Existing Statement: An existing bank statement can serve as a blueprint. By redacting sensitive information and converting the document to an editable format (e.g., a word processor document), one can create a template based on a real-world example. However, ensuring all personal data is thoroughly removed is crucial.

6: Consider Key Components: Regardless of the chosen method, incorporating all essential components account information, beginning balance, transaction details, running balance, ending balance, and bank information is crucial. Accurate representation of these elements ensures the template’s realism and utility.

7: Thorough Testing and Review: Once created, the template should undergo rigorous testing to ensure accuracy, particularly in automated calculations. Verifying data integrity and functionality is essential before utilizing the template for any intended purpose. Reviewing the template for completeness and accuracy ensures its reliability.

8: Ethical Considerations: Always prioritize ethical considerations. Templates should never be used to misrepresent financial information or engage in fraudulent activities. Transparency about the simulated nature of the data is crucial.

Creating effective editable US bank statement templates involves selecting an appropriate method, incorporating essential components, and ensuring accuracy and ethical use. The chosen approach depends on specific needs and resources. Diligence in construction and adherence to ethical guidelines maximize the template’s utility while mitigating potential risks.

Customizable US bank statement templates offer a powerful tool for various applications, ranging from personal financial planning and educational exercises to software testing and business projections. Understanding their core components, creation methods, and ethical implications is crucial for responsible and effective utilization. The ability to manipulate financial data within a controlled environment provides valuable insights for informed decision-making, but ethical considerations must remain paramount to prevent misuse and misrepresentation of financial information. Accurate replication of authentic bank statement structure, combined with responsible data handling, ensures the integrity and utility of these templates.

As financial technology continues to evolve, the role of customizable financial documents will likely expand. Therefore, promoting ethical awareness and responsible practices in their use is essential. The ability to harness the power of these tools while upholding ethical principles will contribute to a more informed and financially responsible society, fostering greater transparency and understanding in the complex world of personal and business finance.