Utilizing such a document provides several advantages. It allows for practical training in financial analysis and budgeting. Furthermore, it can assist in forecasting and planning, enabling individuals or businesses to model different financial outcomes. This capability supports better decision-making by visualizing the potential impact of various financial strategies.

This foundation of understanding the purpose and benefits of customizable financial documents provides a valuable context for exploring topics such as creating realistic mock statements, utilizing them for educational purposes, and the ethical considerations surrounding their use.

1. Customization

Customization is a critical aspect of an editable bank statement template, offering flexibility and utility across various applications. The ability to modify data fields within the template unlocks its true potential, transforming a static form into a dynamic tool.

- Data Input and ModificationUsers can input specific financial figures, dates, and transaction details, creating a personalized document that reflects a particular financial situation or hypothetical scenario. This allows for precise control over the information presented, enabling accurate simulations and projections. For example, adjusting income figures allows exploration of different budgeting strategies.

- Branding and FormattingWhile maintaining the general structure of an official document, some templates may allow for adjustments to fonts, logos, and other visual elements. This can be useful in educational settings or for businesses creating internal training materials. For instance, a financial literacy course might use a modified template bearing its logo.

- Scenario PlanningThe ability to alter data fields facilitates the creation of diverse financial scenarios. Users can model different investment outcomes, explore the effects of varying interest rates, or analyze the impact of unexpected expenses. This feature empowers informed decision-making by providing a platform for simulating potential financial realities.

- Educational ApplicationsCustomizable templates serve as valuable educational tools, enabling instructors to create realistic examples for financial literacy training. Students can practice analyzing financial data, identify trends, and develop budgeting skills using a practical, hands-on approach. The adaptable nature of the template allows for tailoring complexity to different learning levels.

These facets of customization demonstrate the versatility and practical value of an editable bank statement template. The ability to tailor the document empowers users in diverse contexts, ranging from individual financial planning to sophisticated business analysis and educational applications. The adaptable nature of these templates contributes significantly to their utility and relevance across various fields.

2. Financial Planning

Financial planning necessitates accurate data and forecasting capabilities. A customizable bank statement template provides a crucial tool for effective planning by enabling the creation of hypothetical financial scenarios and the exploration of various budgeting strategies. This facilitates informed decision-making and strengthens financial preparedness.

- Budgeting and Expense TrackingManipulating income and expense figures within a customizable template allows for the creation of realistic budgets and the tracking of spending habits. Analyzing hypothetical scenarios, such as unexpected expenses or income fluctuations, enhances preparedness and promotes responsible financial management. For instance, adjusting grocery expenses downwards within the template can illustrate the impact on overall savings.

- Goal Setting and Progress MonitoringFinancial goals, such as saving for a down payment or retirement, can be visualized within the template. By projecting future balances based on different saving and investment strategies, individuals can monitor progress toward their objectives and adjust their plans as needed. Simulating different investment returns within the template can demonstrate the long-term impact of various investment strategies.

- Debt Management and ReductionCustomizable templates facilitate the exploration of various debt reduction strategies. By manipulating loan balances, interest rates, and payment schedules, individuals can visualize the impact of different approaches and determine the most effective method for managing debt. For example, simulating larger monthly payments can illustrate the accelerated reduction in principal balance.

- Investment Analysis and Portfolio ManagementSimulating various investment scenarios within a customizable template aids in understanding the potential risks and rewards associated with different asset allocations. This allows individuals to make informed decisions about portfolio diversification and risk management strategies, ultimately contributing to a more robust and resilient investment portfolio. Modeling different asset allocations within the template can reveal the potential impact on overall portfolio returns and volatility.

The ability to manipulate financial data within a customizable template empowers informed decision-making and promotes sound financial practices. By providing a platform for exploring various scenarios and strategies, these templates become integral tools for effective financial planning and achieving long-term financial stability.

3. Educational Uses

Educational applications leverage the adaptable nature of customizable bank statement templates to provide practical, hands-on learning experiences. These templates become valuable tools in financial literacy programs, business courses, and other educational settings, bridging the gap between theoretical concepts and real-world financial documents.

The ability to manipulate figures within the template allows educators to create diverse scenarios, illustrating the impact of financial decisions. For example, students can analyze the effects of varying interest rates on loan repayments or explore the long-term implications of different investment strategies. This interactive approach fosters critical thinking and problem-solving skills. In a personal finance course, a template could demonstrate the cumulative effect of small, regular savings contributions over time. In a business accounting class, students might analyze a customized template reflecting the financial performance of a hypothetical company.

Furthermore, the use of realistic templates familiarizes students with the format and content of actual bank statements. This exposure demystifies financial documents and prepares individuals for managing their finances effectively in real-world situations. The templates also serve as valuable practice tools for tasks like balancing a checkbook or reconciling transactions. This practical application reinforces learning and builds confidence in handling financial matters. For aspiring entrepreneurs, working with customized templates can provide insights into business financial management and the interpretation of financial statements.

The integration of customizable bank statement templates into educational curricula enhances financial literacy and equips individuals with the skills necessary for responsible financial management. By providing a tangible link between theory and practice, these templates contribute significantly to a more comprehensive and impactful educational experience. However, it is crucial to emphasize the ethical use of such templates and differentiate them clearly from genuine financial documents to prevent misuse.

4. Hypothetical Scenarios

Hypothetical scenarios represent a crucial application of customizable bank statement templates. The ability to manipulate data within these templates allows for the construction and analysis of various financial situations, providing a safe and controlled environment for exploring potential outcomes and developing informed strategies.

- Financial Planning and BudgetingCustomizable templates enable the creation of hypothetical budgets reflecting different income and expense levels. This allows individuals to explore the impact of lifestyle changes, potential job transitions, or unexpected expenses on their financial stability. Analyzing these scenarios fosters proactive financial management and informed decision-making. For instance, one might model the impact of a salary increase on saving for a down payment.

- Investment Strategies and Risk AssessmentModeling various investment portfolios within a customizable template allows for the assessment of potential returns and risks associated with different asset allocations. This facilitates informed investment decisions and the development of robust, long-term investment strategies. One could, for example, simulate the effects of diversifying a portfolio across different asset classes.

- Debt Management and Repayment StrategiesExploring different debt repayment scenarios within a template aids in understanding the long-term implications of various repayment methods. This empowers individuals to make informed choices about managing debt and accelerating the repayment process. Simulating different loan repayment schedules, for example, can illustrate the impact on total interest paid.

- Business Financial Projections and AnalysisCustomizable templates can be utilized to create pro forma financial statements for businesses, projecting potential revenue, expenses, and profitability under different market conditions. This facilitates strategic planning and informed business decisions. For instance, a business might model the financial impact of launching a new product line.

The ability to construct and analyze hypothetical scenarios within customizable bank statement templates provides a powerful tool for financial planning, risk assessment, and informed decision-making across various contexts. This functionality enhances financial literacy and empowers individuals and businesses to navigate complex financial situations with greater confidence and foresight.

5. Data Manipulation

Data manipulation within the context of customizable bank statement templates refers to the ability to alter figures, dates, and transaction details within the document. This functionality, while offering valuable benefits for legitimate purposes such as financial planning and education, also presents potential risks related to misuse and fraudulent activities. Understanding the implications of data manipulation is crucial for responsible and ethical use.

- Legitimate ApplicationsData manipulation within customizable templates facilitates financial planning, budgeting, and educational exercises. Adjusting income and expense figures, for example, allows individuals to explore hypothetical scenarios and develop informed financial strategies. In educational settings, manipulating data within templates can illustrate the impact of various financial decisions.

- Potential for MisuseThe ability to alter financial information raises ethical concerns regarding potential misuse. Creating fabricated bank statements for fraudulent purposes, such as loan applications or financial fraud, represents a significant risk. Safeguards and responsible usage are paramount to mitigate this risk.

- Detecting ManipulationIdentifying manipulated data within bank statements requires careful scrutiny. Inconsistencies in formatting, transaction details, or chronological order can indicate potential manipulation. Verification with the issuing financial institution is crucial for confirming the authenticity of a bank statement.

- Ethical ConsiderationsEthical use of customizable templates necessitates a clear understanding of the implications of data manipulation. Templates should be used solely for legitimate purposes, such as personal financial planning or educational demonstrations. Misrepresenting manipulated data as genuine financial records constitutes fraudulent activity.

The capacity for data manipulation within customizable bank statement templates presents both opportunities and risks. While offering valuable benefits for legitimate applications, the potential for misuse underscores the importance of responsible usage, ethical considerations, and awareness of the potential implications of manipulating financial data. Understanding these facets is crucial for leveraging the benefits of customizable templates while mitigating the associated risks.

6. Ethical Implications

Ethical considerations are paramount when utilizing customizable bank statement templates. While these templates offer valuable benefits for legitimate purposes like financial planning and education, the potential for misuse in fraudulent activities necessitates careful attention to responsible and ethical practices. Understanding these implications is crucial for mitigating risks and ensuring appropriate use.

- Misrepresentation and FraudThe ability to manipulate data within these templates creates a risk of fraudulent misrepresentation. Altering figures to create a false impression of financial stability for loan applications, investment opportunities, or other financial dealings constitutes a serious ethical breach and potential legal violation. For example, inflating account balances or fabricating transactions to misrepresent financial health is deceptive and unethical.

- Identity Theft and Privacy ConcernsCustomizable templates often resemble authentic bank statements, raising concerns about potential misuse for identity theft. If these templates fall into the wrong hands, personal information could be exploited for malicious purposes. Protecting the privacy and security of personal data is crucial when using or sharing these templates. Sharing templates containing fabricated but realistic-looking personal information poses significant privacy risks.

- Transparency and DisclosureEthical use requires transparency regarding the nature of the document. Clearly distinguishing customizable templates from genuine bank statements is essential to prevent misinterpretation and potential misuse. Disclosing the hypothetical nature of the data within the template is crucial for maintaining ethical standards. Failing to disclose that a document is a customizable template and not an official record is misleading and unethical.

- Responsible Use and EducationPromoting responsible use and education about the ethical implications of these templates is crucial. Educating users about the potential risks of misuse, emphasizing the importance of data integrity, and advocating for transparent practices contribute to a responsible and ethical environment. Openly discussing the ethical implications with users reinforces responsible practices and mitigates the risk of misuse.

The ethical implications associated with customizable bank statement templates underscore the importance of responsible usage and a clear understanding of the potential risks. Prioritizing ethical considerations, promoting transparency, and fostering education about proper use are crucial for maximizing the benefits of these templates while mitigating the potential for misuse and harm. Balancing the utility of these tools with ethical considerations ensures responsible and beneficial application.

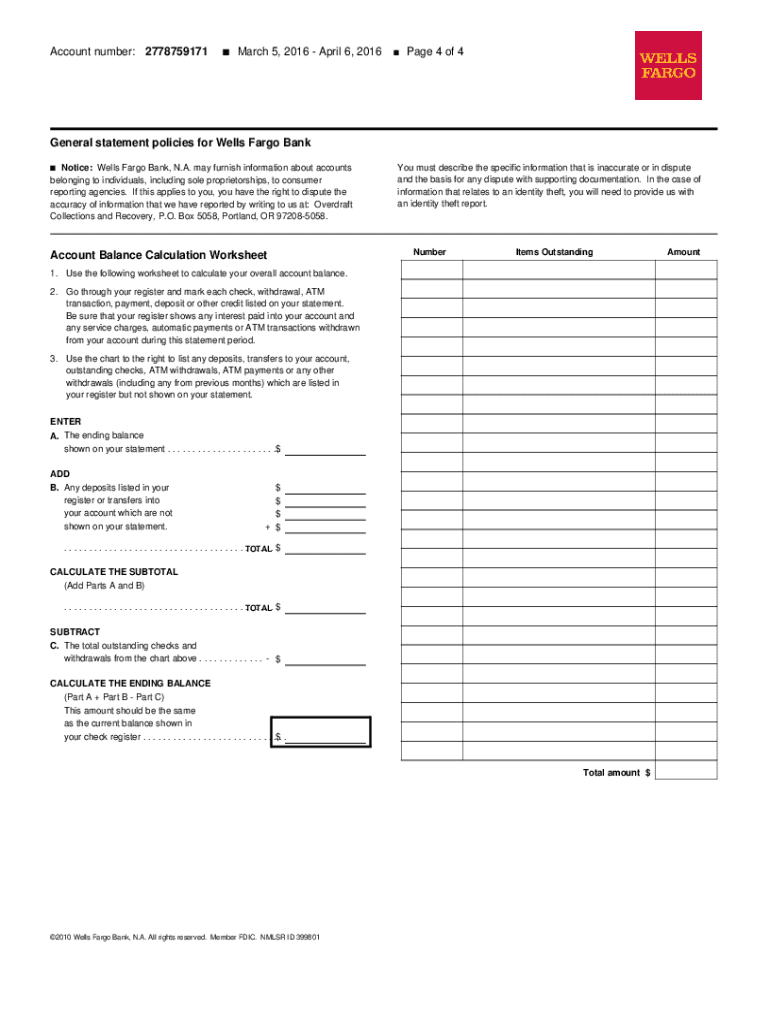

Key Components of an Editable Bank Statement Template

Understanding the core components of an editable bank statement template is crucial for effective utilization. The following points highlight key structural elements and data fields typically found within such a template.

1. Account Information: This section identifies the account holder, account number, and the statement period. Accurate representation of this information is crucial for maintaining context and relevance within the template.

2. Beginning Balance: The starting balance for the statement period provides a foundation for tracking transactions and calculating the ending balance. This figure is essential for accurate financial analysis and projection.

3. Deposits and Credits: This section details all deposits and credits made to the account during the statement period. Accurate recording of these transactions is vital for maintaining a balanced and accurate record.

4. Withdrawals and Debits: This section itemizes all withdrawals and debits made from the account during the statement period, including checks, ATM withdrawals, and electronic transactions. Precise documentation of these transactions is crucial for comprehensive financial tracking.

5. Transaction Descriptions: Clear and concise descriptions accompanying each transaction provide context and facilitate accurate categorization and analysis of financial activity. Detailed descriptions are essential for understanding the purpose and nature of each transaction.

6. Transaction Dates: Accurate recording of transaction dates ensures chronological order and facilitates the identification of trends and patterns in financial activity. Precise dating is critical for maintaining a verifiable and reliable record.

7. Running Balance: The running balance, updated after each transaction, provides a continuous snapshot of the account balance throughout the statement period. This real-time view of account activity facilitates ongoing monitoring and analysis.

8. Ending Balance: The closing balance for the statement period represents the net result of all transactions during that time. This figure is a key indicator of financial health and serves as the starting point for the subsequent statement period.

These components work together to provide a comprehensive overview of financial activity within a given period. Accurate representation of these elements within an editable template is fundamental for effective financial planning, analysis, and education. Careful attention to these details ensures the template’s utility and relevance for various applications.

How to Create an Editable Bank Statement Template

Creating an editable bank statement template requires careful attention to formatting and data representation to ensure accuracy and utility. The following steps outline the process of creating a functional and effective template.

1: Software Selection: Choose appropriate software. Spreadsheet programs offer robust functionality for data manipulation and calculations, while word processing software allows for detailed formatting and customization. Select the software best suited to the intended use of the template.

2: Replicating the Format: Obtain a genuine bank statement as a reference. Replicate the layout, including headers, footers, and the arrangement of data fields. Accurate replication ensures the template mirrors the structure of an authentic document.

3: Data Fields: Identify key data fields such as account information, transaction dates, descriptions, and amounts. Establish clear labels for each field to maintain organization and clarity within the template. Precise labeling ensures accurate data entry and interpretation.

4: Formulas and Functions: Utilize formulas and functions within spreadsheet software to automate calculations. Implement formulas for running balances, totals, and other relevant calculations to ensure accuracy and efficiency. Automated calculations reduce manual effort and minimize the risk of errors.

5: Formatting and Customization: Adjust fonts, font sizes, and spacing to match the original statement. Customize the template with relevant logos or branding elements if necessary, while maintaining a professional and consistent appearance. Appropriate formatting enhances readability and professionalism.

6: Testing and Verification: Input sample data and verify the accuracy of calculations and formatting. Thorough testing ensures the template functions correctly and produces accurate results. Rigorous testing identifies and corrects potential errors.

7: Ethical Considerations: Clearly distinguish the template from a genuine bank statement. Include disclaimers or watermarks indicating its hypothetical nature to prevent misuse. Ethical considerations are paramount to prevent fraudulent activity.

Careful attention to these steps ensures the creation of a functional and ethical template. Accurate replication of formatting, precise data field representation, and robust formulas ensure the template’s utility for financial planning, analysis, and education. Ethical considerations and clear disclaimers mitigate the risk of misuse and promote responsible application.

Customizable financial document templates, modeled after official banking records, offer valuable tools for various applications, including financial planning, educational exercises, and hypothetical scenario analysis. Understanding the core components, data fields, and functionalities of these templates is crucial for effective utilization. Customization capabilities enable users to manipulate data, explore different financial outcomes, and develop informed strategies. However, ethical considerations surrounding data manipulation and the potential for misuse necessitate responsible practices and transparent disclosure. Accurate replication of formatting, precise data representation, and robust formulas are essential for ensuring the template’s accuracy and utility.

The ability to model financial scenarios and explore various outcomes empowers individuals and businesses to make informed decisions and navigate complex financial situations with greater confidence. However, the potential for misuse underscores the importance of ethical considerations, responsible data handling, and a commitment to transparency. Balancing the utility of these tools with ethical practices ensures responsible application and mitigates the risks associated with data manipulation. Continued emphasis on ethical considerations and responsible usage will contribute to the beneficial application of these customizable financial documents while safeguarding against potential misuse.