Such documentation offers increased transparency, fostering trust and open communication between organizations and their workforce. A well-designed format empowers individuals to fully grasp their overall reward package, facilitating informed financial planning and promoting a greater appreciation of the employer’s investment. It can also serve as a valuable tool for recruitment and retention, showcasing the complete value proposition offered to prospective and current employees.

This overview provides a foundation for further exploration of key topics related to compensation and benefits, including payroll administration best practices, strategic compensation planning, and legal compliance considerations.

1. Clarity

Clarity within a total compensation statement is paramount for effective communication of an employee’s overall rewards. A clear statement ensures employees can readily understand the various components of their compensation, fostering a sense of transparency and trust between the employer and the workforce. A lack of clarity can lead to confusion, misinterpretations, and potentially decreased employee satisfaction. For example, clearly labeling benefit deductions, such as retirement contributions and health insurance premiums, eliminates ambiguity and empowers employees to track their financial well-being accurately. Conversely, a poorly formatted statement with unclear terminology or complex calculations can create frustration and erode confidence in the organization’s compensation practices.

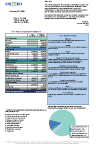

Achieving clarity necessitates careful consideration of language, formatting, and visual presentation. Using plain language, avoiding jargon, and defining technical terms ensures accessibility for all employees, regardless of their financial literacy. A well-structured layout with clear headings, subheadings, and consistent formatting facilitates easy navigation and comprehension. Visual aids, such as charts and graphs, can further enhance understanding, particularly when presenting complex data like retirement plan growth or variable compensation calculations. Imagine a statement that visually represents an employee’s total compensation over time, highlighting the growth of different components like base salary and bonuses such a visual representation immediately clarifies the overall value and progression of the employee’s rewards.

Prioritizing clarity within total compensation statements reinforces transparency, strengthens employee engagement, and ultimately contributes to a positive organizational culture. While achieving absolute clarity can be challenging, the benefits significantly outweigh the effort. Addressing potential ambiguities proactively through careful design and review processes can mitigate misunderstandings and foster a more informed and appreciative workforce. This emphasis on clear communication not only benefits individual employees but also strengthens the organization’s reputation for fair and transparent compensation practices.

2. Accuracy

Accuracy in a total compensation statement is fundamental for maintaining trust and ensuring compliance. Errors, regardless of size, can erode employee confidence, lead to payroll disputes, and potentially incur legal penalties. Ensuring accuracy requires meticulous attention to detail throughout the entire process, from data collection and calculation to verification and distribution.

- Data IntegrityAccurate data forms the bedrock of a reliable compensation statement. This includes accurate recording of base salary, bonuses, commissions, benefits deductions, and other relevant information. Data integrity relies on robust payroll systems, regular audits, and consistent data entry practices. For example, incorrect entry of an employee’s bonus amount can lead to underpayment and subsequent dissatisfaction. Regularly auditing payroll data against source documents can help identify and rectify such errors proactively.

- Calculation PrecisionAccurate calculations are essential for reflecting the true value of an employee’s total compensation. This involves precise calculation of taxes, deductions, benefit contributions, and any variable pay components. Using automated systems and established formulas minimizes the risk of human error. For instance, an error in calculating overtime pay can lead to legal issues and financial repercussions. Implementing automated timekeeping and payroll systems can significantly reduce such calculation errors.

- Verification ProceduresImplementing verification procedures adds another layer of assurance to the accuracy of compensation statements. This may involve independent review by a separate payroll team or automated system checks to flag discrepancies. For instance, a manager reviewing a team’s compensation statements can identify inconsistencies or unusual discrepancies, prompting further investigation and correction before distribution.

- Timely UpdatesMaintaining accurate records requires regular updates to reflect changes in compensation, benefits, or deductions. This ensures that statements always reflect the current status of an employee’s total compensation. For example, failing to update an employee’s health insurance deduction after a qualifying life event can result in inaccurate statements and potential financial complications. Regularly reviewing and updating employee data based on changes in employment status or benefit elections ensures ongoing accuracy.

These interconnected facets of accuracy contribute to the overall integrity and reliability of total compensation statements. By prioritizing accurate data, precise calculations, robust verification procedures, and timely updates, organizations can ensure that these statements serve as valuable tools for communication, transparency, and legal compliance. A commitment to accuracy not only fosters trust with employees but also mitigates potential risks and strengthens the organization’s reputation for fair and ethical compensation practices.

3. Comprehensive Details

A truly effective total compensation statement provides a comprehensive overview of all forms of remuneration and benefits provided to an employee. This comprehensive approach fosters transparency and empowers employees to fully understand their total reward package, promoting informed financial planning and a greater appreciation for the employer’s investment. Omitting key details can lead to misunderstandings and potentially diminish the perceived value of the overall compensation offered.

- EarningsDetailed presentation of all earnings is crucial. This encompasses not only base salary but also any additional earnings such as overtime pay, bonuses, commissions, and profit-sharing contributions. For example, a statement should clearly differentiate between regular salary and a one-time bonus earned for exceeding performance targets. Clearly outlining each earning component allows employees to understand the sources and composition of their overall income.

- BenefitsA comprehensive statement details both employer-paid and employee-paid benefits. This includes health insurance premiums, retirement plan contributions, paid time off accruals, life insurance coverage, and other applicable benefits. For example, a statement might detail the employer’s contribution to a health savings account alongside the employee’s contribution. This comprehensive approach provides employees with a clear understanding of the full range of benefits offered and their associated costs.

- Taxes and DeductionsTransparency regarding taxes and deductions is essential for a complete picture of take-home pay. A statement should clearly outline federal, state, and local taxes withheld, as well as other deductions such as garnishments or voluntary contributions to charitable organizations. For instance, clearly itemizing deductions for retirement savings and health insurance allows employees to reconcile their net pay with their gross earnings.

- Explanatory InformationIncluding explanatory information enhances understanding and minimizes potential confusion. This might include definitions of terms, explanations of calculation methods, or contact information for further inquiries. For example, a statement might include a brief explanation of how paid time off accrues or how retirement plan matching contributions are calculated. Providing such information empowers employees to interpret their statement accurately and confidently.

By combining these facetsdetailed earnings, comprehensive benefits information, transparent presentation of taxes and deductions, and clear explanatory informationa total compensation statement provides a holistic view of the employee’s total rewards. This holistic approach not only fosters transparency and trust but also empowers employees to make informed financial decisions and appreciate the full value proposition offered by their employer. Ultimately, comprehensive detail strengthens the employer-employee relationship and contributes to a positive organizational culture.

4. Accessibility

Accessibility, in the context of total compensation statements, refers to the ease with which employees can access and understand these crucial documents. It represents a critical component of effective compensation communication, directly impacting employee engagement, satisfaction, and overall financial well-being. Accessible statements ensure that all employees, regardless of technical proficiency or physical limitations, can readily review and comprehend their total rewards.

Several factors contribute to statement accessibility. Providing multiple delivery formats, such as online portals, printable PDFs, and mailed paper copies, caters to diverse preferences and needs. A well-designed online portal, for example, allows employees to securely access their statements anytime, anywhere, offering convenience and flexibility. For employees who prefer physical copies or lack reliable internet access, printed or mailed statements remain essential. Furthermore, ensuring compatibility with assistive technologies, such as screen readers for visually impaired employees, is crucial for inclusivity. A statement designed with accessibility in mind might use clear headings, alt text for images, and keyboard navigation to ensure usability for all individuals. Consider a scenario where an employee uses a screen reader due to a visual impairment; an accessible online statement allows them to navigate the information independently and understand their compensation details fully.

Beyond format and delivery, the clarity and simplicity of the statement itself significantly impact accessibility. Using plain language, avoiding jargon, and presenting information in a concise, organized manner ensures ease of understanding for all employees. In contrast, a statement filled with technical terminology and complex calculations can create barriers to comprehension, particularly for those unfamiliar with financial jargon. Think of an employee whose primary language is not English; a statement translated into their native language significantly enhances accessibility and comprehension. Ultimately, accessible total compensation statements empower employees to take control of their financial well-being, foster transparency between employer and employee, and contribute to a more inclusive and equitable workplace. Addressing accessibility demonstrates a commitment to employee well-being and strengthens the organization’s reputation as a responsible and considerate employer.

5. Regular Updates

Maintaining current and accurate information within total compensation statements necessitates regular updates. These updates are essential for reflecting changes in an employee’s earnings, benefits, deductions, and other relevant details. The frequency of updates depends on the nature of the changes and organizational policies, but regular review and revision are crucial for ensuring accuracy and relevance. For instance, changes in salary due to a promotion, adjustments to health insurance premiums during open enrollment, or accrual of paid time off require timely updates to the compensation statement. Failure to implement regular updates can lead to discrepancies, misunderstandings, and potential payroll disputes. Imagine a scenario where an employee’s bonus, awarded in the first quarter, isn’t reflected on their subsequent compensation statements. This omission could create confusion and erode trust in the accuracy of the provided information.

Regular updates involve a systematic process of reviewing and modifying the compensation statement template to reflect current data. This often entails integration with payroll systems, human resources databases, and benefits administration platforms. Automated data feeds can streamline the update process, minimizing manual entry and reducing the risk of errors. However, manual verification steps remain crucial for ensuring data integrity. Consider a company implementing a new benefits program; the compensation statement template must be updated to reflect the new benefit options and associated costs. This update requires careful coordination between human resources, payroll, and potentially external benefits providers. Thorough testing and verification ensure the updated template accurately reflects the new benefit offerings.

Regularly updating compensation statements offers significant benefits. It fosters transparency by providing employees with a clear and accurate view of their total rewards, strengthening trust and open communication. Accuracy in compensation information contributes to smoother payroll processes, minimizing discrepancies and potential disputes. Furthermore, maintaining up-to-date statements supports legal compliance by ensuring accurate reporting of earnings, deductions, and benefits. In conclusion, regular updates are not merely a procedural task but a crucial element of effective compensation management. They contribute to transparency, accuracy, and compliance, ultimately fostering a positive and productive relationship between the organization and its workforce.

Key Components of a Total Compensation Statement

A well-structured total compensation statement provides a comprehensive overview of an employee’s earnings and benefits. Key components ensure clarity, accuracy, and a complete understanding of the total reward package.

1. Earnings: This section details all forms of compensation received, including base salary, overtime pay, bonuses, commissions, and profit-sharing contributions. Clear differentiation between recurring and non-recurring earnings is essential. Precise figures and payment frequency should be clearly stated.

2. Benefits: A comprehensive breakdown of employee benefits, both employer-paid and employee-paid, is crucial. This includes health insurance premiums, retirement plan contributions, paid time off accruals, life insurance, disability coverage, and other applicable benefits. The statement should clearly outline the value of each benefit and the employee’s cost, if any.

3. Taxes and Deductions: Transparent reporting of all applicable taxes and deductions is essential. This includes federal, state, and local income taxes, Social Security and Medicare taxes, and any other deductions such as wage garnishments or voluntary contributions. Clear itemization allows employees to reconcile their gross pay with their net take-home pay.

4. Paid Time Off (PTO): This section outlines the employee’s accrued, used, and remaining paid time off, including vacation, sick leave, and holidays. Clear presentation of PTO balances empowers employees to plan time off effectively.

5. Retirement Plan Information: Details regarding the employee’s retirement plan, including contribution amounts, employer matching contributions (if applicable), vesting status, and investment allocation, are essential. This section provides valuable insights into long-term financial planning and security.

6. Explanatory Information: Inclusion of explanatory notes, definitions of terms, and contact information for further inquiries enhances understanding. This may include explanations of calculation methods, benefit plan details, or links to relevant resources. Clear and concise explanations promote transparency and minimize potential confusion.

These components, when presented clearly and accurately, empower employees to understand and appreciate the full value of their total compensation. This fosters transparency, builds trust, and contributes to a positive employer-employee relationship.

How to Create an Employee Total Compensation Statement Template

Creating a clear and comprehensive total compensation statement template requires careful planning and consideration of key elements. A well-designed template ensures consistent presentation of information, facilitates accurate calculations, and promotes transparency for employees.

1. Define Scope and Objectives: Determine the specific information to be included in the statement. Consider legal requirements, organizational policies, and employee needs. Clearly defined objectives ensure the template meets its intended purpose.

2. Gather Data Points: Identify the necessary data points for each compensation component. This includes earnings, benefits, taxes, deductions, and paid time off. Ensure access to reliable data sources for accurate population of the template.

3. Design the Layout: Structure the template logically, using clear headings, subheadings, and consistent formatting. Consider visual elements such as tables, charts, and graphs to enhance readability and comprehension.

4. Develop Calculation Formulas: Incorporate accurate formulas for calculating gross pay, net pay, deductions, and benefit contributions. Automated calculations minimize errors and ensure consistency.

5. Select Delivery Method: Choose an appropriate delivery method for the statements, considering factors such as employee access to technology, security requirements, and printing capabilities. Options include online portals, printable PDFs, and mailed paper copies.

6. Implement Version Control: Establish a version control system to track changes and revisions to the template. This ensures accurate record-keeping and facilitates audits.

7. Test and Refine: Thoroughly test the template with sample data to identify and correct any errors or inconsistencies. Gather feedback from stakeholders and refine the template as needed.

8. Communicate and Train: Clearly communicate the purpose and use of the total compensation statement to employees. Provide training on how to access and interpret the information presented.

A well-designed template, combined with accurate data and effective communication, provides employees with a clear understanding of their total rewards. This promotes transparency, builds trust, and supports informed financial decision-making. Regular review and updates of the template ensure continued accuracy and relevance.

Accurate and comprehensive documentation of total compensation represents a cornerstone of effective human resource management. Standardized templates facilitate clear communication of complex compensation and benefits information, fostering transparency and trust between organizations and their workforce. Key elements, including detailed earnings breakdowns, comprehensive benefits summaries, clear explanations of taxes and deductions, and accessible delivery methods, contribute to the overall effectiveness of these statements. Regular updates and meticulous attention to accuracy ensure the ongoing relevance and reliability of the information provided.

Leveraging well-designed templates empowers organizations to effectively communicate the full value of their employee compensation packages, promoting employee engagement, satisfaction, and informed financial planning. This, in turn, contributes to a positive organizational culture, strengthens employer-employee relationships, and supports long-term organizational success. A strategic approach to compensation communication, facilitated by robust and adaptable templates, positions organizations for continued growth and success in a competitive talent market.