Utilizing a pre-designed structure for this financial record offers numerous advantages. It ensures consistency in reporting, simplifies complex financial data, and promotes efficient communication among involved parties. A standardized format reduces the risk of errors and omissions, streamlines the probate process, and provides a clear audit trail. This structured approach ultimately saves time and resources while upholding fiduciary responsibilities.

The following sections delve into the key components of such structured summaries, offering practical guidance on their creation, utilization, and legal implications. Specific topics include asset valuation, debt settlement, tax implications, and distribution to beneficiaries.

1. Standardized Format

Standardized formats are essential for estate accounting. A consistent structure ensures clarity, facilitates review, and minimizes errors. Standardization allows for easy comparison across reporting periods, simplifies audits, and promotes efficient communication among stakeholders. A template provides this structure, ensuring essential information is consistently presented. For example, a standardized template might consistently locate asset details in section one, liabilities in section two, and income/expenses in section three, irrespective of the specific estate’s complexity. This predictability simplifies analysis and reduces the likelihood of overlooking crucial data.

Using a standardized template minimizes ambiguity and potential disputes. Consistent presentation of information, such as date formats, valuation methods, and terminology, reduces the risk of misinterpretation. This clarity is crucial for legal compliance and fosters trust among beneficiaries. Consider a scenario where two properties are held by the estate. A standardized template would ensure consistent reporting of each property’s valuation, acquisition date, and associated expenses, minimizing the potential for confusion or disagreement among inheritors.

Standardization offers significant practical advantages. It streamlines the probate process, reduces administrative burden, and supports informed decision-making. Templates often incorporate formulas and automated calculations, reducing manual effort and the potential for mathematical errors. Ultimately, a standardized format within a template enhances accuracy, efficiency, and transparency in estate administration. This promotes timely and equitable distribution of assets while minimizing potential conflicts.

2. Comprehensive Transactions

Accurate and detailed transaction records form the foundation of a reliable estate statement of account. Completeness and precision in documenting all financial activities are crucial for transparency, accountability, and legal compliance during estate administration. A comprehensive record enables informed decision-making by executors and provides beneficiaries with a clear understanding of the estate’s financial status.

- Income DocumentationAll income generated by the estate must be meticulously documented. This includes interest earned on accounts, dividends from investments, rental income from properties, and proceeds from asset sales. Each instance of income should be recorded with the date received, source, and amount. For example, if the estate holds shares that pay dividends, each dividend payment should be individually recorded, specifying the date, the number of shares, and the total dividend amount received. This precise recording ensures accurate calculation of the estate’s overall income and facilitates proper tax reporting.

- Expense TrackingA complete record of all estate expenses is equally crucial. This encompasses funeral costs, legal fees, administrative expenses, property maintenance, and debt payments. Each expense entry should detail the date incurred, payee, purpose, and amount. For instance, legal fees related to probate proceedings should be documented individually, specifying the date of service, the law firm’s name, and the amount billed. Meticulous expense tracking facilitates accurate accounting and provides justification for disbursements.

- Asset ManagementTransactions related to estate assets must be thoroughly documented. This includes purchases, sales, transfers, and valuations. Detailed records should be maintained for each asset, including its description, acquisition date, cost basis, and current market value. For example, if a property belonging to the estate is sold, the transaction record should include the sale date, sale price, associated closing costs, and the net proceeds received by the estate. This thorough documentation is essential for calculating capital gains and losses for tax purposes.

- Liability SettlementDocumentation of liability settlement is critical for accurate estate accounting. This includes recording payments made towards outstanding debts, mortgages, and other liabilities. Each payment should be documented with the date paid, creditor, and amount. For example, if the estate makes regular mortgage payments, each payment should be recorded, specifying the date, the amount paid towards principal and interest, and the remaining mortgage balance. This detailed record demonstrates responsible debt management and provides a clear picture of the estate’s liabilities.

These comprehensive transaction records, meticulously maintained and categorized within the estate statement of account template, provide a transparent and auditable financial history. This detailed account serves as evidence of responsible estate administration and fosters trust among beneficiaries. Comprehensive transaction data is not merely a record-keeping exercise; it forms the bedrock of informed financial decisions, accurate tax reporting, and equitable distribution of assets.

3. Clear Asset Summary

A clear asset summary is integral to a comprehensive estate statement of account template. This summary provides a concise overview of all assets held by the estate, facilitating informed decision-making regarding asset management, valuation, and distribution. Its clarity is crucial for transparency and accountability during estate administration. Without a clear asset summary, beneficiaries may lack a complete understanding of the estate’s holdings, potentially leading to disputes or mismanagement.

A well-structured asset summary within the template typically categorizes assets for clarity. Categories might include real estate, securities, personal property, and financial accounts. Each asset listing should include a detailed description, current market value, and supporting documentation. For instance, a real estate listing would include the property address, legal description, appraised value, and any associated mortgage details. Similarly, securities would be listed with the company name, number of shares, and current market price. This detailed information enables accurate valuation of the estate and facilitates informed decisions regarding asset liquidation or distribution.

The practical significance of a clear asset summary lies in its contribution to efficient estate administration. It facilitates timely and equitable distribution of assets, minimizes potential conflicts among beneficiaries, and simplifies the probate process. Consider a scenario where an estate holds multiple properties in different locations. A clear asset summary within the statement of account template, detailing each property’s location, value, and ownership status, enables efficient management and distribution of these assets, minimizing potential disputes and streamlining the overall administration process. This clarity empowers beneficiaries to make informed decisions about their inheritance and promotes a smooth transition of ownership.

4. Detailed Liability Listing

A detailed liability listing is a critical component of a comprehensive estate statement of account template. This listing provides a transparent record of all outstanding debts and obligations of the deceased, enabling accurate assessment of the estate’s net value and facilitating informed decision-making regarding debt settlement and asset distribution. Without a comprehensive liability listing, the estate’s true financial position remains unclear, potentially leading to inadequate provision for debt repayment and complications in the distribution process. This detailed record ensures compliance with legal requirements and promotes equitable treatment of creditors and beneficiaries.

A well-structured liability listing within the template typically categorizes debts for clarity. Categories might include mortgages, secured loans, unsecured debts (such as credit card balances or medical bills), and tax liabilities. Each liability entry should specify the creditor, outstanding balance, interest rate, payment terms, and any associated collateral. For example, a mortgage listing would include the lender’s name, loan number, outstanding principal balance, interest rate, and payment due date. Similarly, a credit card debt would be listed with the card issuer, account number, and outstanding balance. This detailed information enables accurate calculation of the total liabilities and facilitates prioritization of debt repayment.

The practical significance of a detailed liability listing lies in its contribution to efficient and legally sound estate administration. It ensures that all valid debts are identified and addressed, protecting the estate’s assets from potential creditor claims. Consider a scenario where an estate holds valuable assets but also has significant outstanding debts. A comprehensive liability listing within the statement of account template allows the executor to prioritize debt repayment, potentially liquidating assets strategically to satisfy creditors while preserving as much value as possible for beneficiaries. This organized approach minimizes legal challenges, ensures compliance with probate procedures, and protects the interests of all stakeholders.

5. Regular Updates

Maintaining the accuracy and relevance of an estate statement of account requires regular updates. Timely revisions ensure all stakeholders have access to the most current financial information, facilitating informed decision-making and promoting transparency throughout the estate administration process. Without regular updates, the statement of account loses its value as a reliable reflection of the estate’s financial status, potentially leading to misunderstandings, disputes, and mismanagement.

- Frequency of UpdatesThe appropriate frequency of updates depends on the complexity of the estate and the volume of transactions. Simple estates with minimal activity might require updates only quarterly or semi-annually. However, more complex estates with frequent transactions, ongoing litigation, or active asset management may necessitate monthly or even more frequent updates. Establishing a clear update schedule at the outset of the administration process ensures consistency and predictability.

- Information Included in UpdatesEach update should incorporate all transactions that have occurred since the previous update. This includes income received, expenses incurred, asset valuations, debt payments, and any other relevant financial activity. Supporting documentation, such as receipts, invoices, and bank statements, should be retained to substantiate the updated information. For example, an update might reflect the sale of an estate property, including the sale price, closing costs, and net proceeds. This detailed information provides a transparent record of the transaction and its impact on the estate’s overall value.

- Communication of UpdatesUpdated statements of account should be distributed promptly to all beneficiaries and other relevant stakeholders, such as legal counsel and tax advisors. Clear communication channels should be established to ensure timely and efficient dissemination of information. This proactive communication fosters transparency and minimizes potential for misunderstandings or disputes regarding the estate’s financial status.

- Review and ReconciliationRegular reviews and reconciliations of the estate account are essential to maintain accuracy and identify any discrepancies. Bank statements, investment reports, and other financial records should be reconciled with the statement of account to ensure all transactions are accurately reflected. Any discrepancies should be investigated and resolved promptly to maintain the integrity of the financial records.

Regular updates to the estate statement of account are not merely a procedural formality; they are a critical function of responsible estate administration. They provide a dynamic and accurate reflection of the estate’s financial position, facilitating informed decision-making, promoting transparency, and ultimately contributing to the timely and equitable settlement of the estate. This diligent approach fosters trust among beneficiaries, minimizes potential conflicts, and ensures compliance with legal and fiduciary obligations.

6. Beneficiary Clarity

Beneficiary clarity within an estate statement of account template is paramount for efficient and equitable estate administration. A clearly defined list of beneficiaries, including their full legal names, contact information, and respective entitlements, ensures accurate and timely distribution of assets. Ambiguity surrounding beneficiary designations can lead to delays, disputes, and potentially costly legal challenges. A well-structured template provides dedicated sections for beneficiary information, minimizing the risk of misinterpretation or oversight. This clarity is not merely an administrative convenience; it is a legal and ethical imperative, ensuring that the deceased’s wishes are honored and that beneficiaries receive their rightful inheritance.

Consider a scenario where an estate includes multiple beneficiaries with similar names or varying degrees of relationship to the deceased. Without clear identification and documented entitlements within the statement of account, the distribution process becomes susceptible to errors and potential conflict. For instance, if the deceased intended to bequeath a larger share of the estate to a specific niece but the statement of account lacks clarity on beneficiary relationships, the executor might inadvertently distribute assets incorrectly. A well-designed template mitigates such risks by providing structured fields for detailed beneficiary information, ensuring accurate and legally sound distribution.

The practical significance of beneficiary clarity extends beyond accurate distribution. It also facilitates effective communication and promotes transparency throughout the estate administration process. A clear beneficiary list enables the executor to keep all parties informed of estate proceedings, provide regular updates on the status of asset liquidation and distribution, and address any beneficiary inquiries efficiently. This transparent communication fosters trust, minimizes potential disputes, and contributes to a smoother, more efficient estate settlement. Furthermore, accurate beneficiary information simplifies tax reporting requirements, ensuring compliance with relevant regulations and minimizing potential liabilities for the estate.

Key Components of an Estate Statement of Account Template

A well-structured template ensures consistent reporting and simplifies complex financial data, promoting efficient communication among stakeholders. Key components contribute to this structured approach.

1. Estate Identification: This section clearly identifies the estate, including the full legal name of the deceased, the date of death, and the jurisdiction of probate. Accurate estate identification is crucial for legal compliance and proper record-keeping.

2. Reporting Period: The statement of account covers a specific period, clearly indicated within the template. This defined timeframe allows for organized tracking of financial activity and facilitates comparison across periods.

3. Opening Balance: The starting balance of the estate at the beginning of the reporting period is documented. This figure provides a baseline for tracking changes in the estate’s value.

4. Asset Summary: This section provides a comprehensive overview of all assets held by the estate, categorized for clarity (e.g., real estate, securities, personal property). Each asset is listed with a detailed description and current market value.

5. Liability Listing: A detailed record of all outstanding debts and obligations of the estate, categorized for clarity (e.g., mortgages, loans, taxes). Each liability is listed with creditor information, outstanding balance, and payment terms.

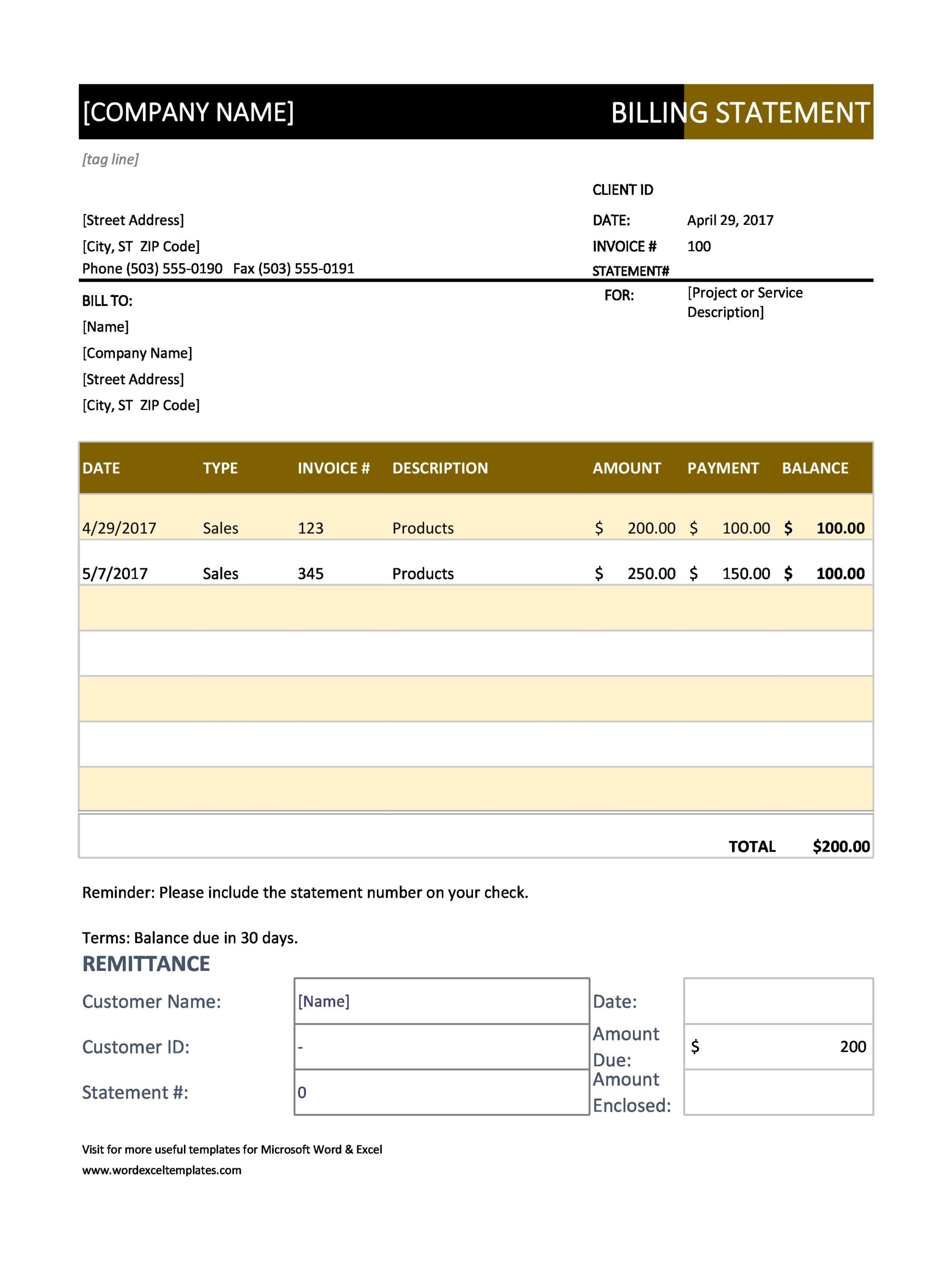

6. Income and Expense Details: A chronological record of all income generated and expenses incurred during the reporting period. Each entry includes date, description, payee/payer, and amount, providing a clear audit trail.

7. Closing Balance: The ending balance of the estate at the close of the reporting period, reflecting the net effect of all income, expenses, and changes in asset values. This figure provides a snapshot of the estate’s financial position at a specific point in time.

8. Beneficiary Information: A clear list of beneficiaries, including their full legal names, contact information, and their respective entitlements to the estate’s assets. This information is crucial for accurate distribution.

These components, working in concert, provide a transparent and comprehensive overview of the estates financial status, facilitating informed decision-making and promoting accountability throughout the administration process. Accuracy and completeness in each section are crucial for legal compliance and the protection of beneficiary interests.

How to Create an Estate Statement of Account Template

Creating a robust template ensures consistent reporting, simplifies complex financial data, and promotes efficient communication among stakeholders. The following steps outline the process:

1. Define the Reporting Period: Establish the timeframe covered by the statement. This might be monthly, quarterly, or annually, depending on the estate’s complexity and reporting requirements.

2. Estate Identification: Include fields for the deceased’s full legal name, date of death, and the jurisdiction of probate. Accurate identification is essential for legal compliance.

3. Opening Balances: Incorporate sections for recording the initial values of all assets and liabilities at the start of the reporting period. This provides a baseline for tracking changes.

4. Asset Recording: Create structured sections for listing each asset, including detailed descriptions, acquisition dates, and current market valuations. Categorize assets for clarity (e.g., real estate, securities, personal property).

5. Liability Documentation: Designate sections for recording all outstanding debts, including creditor names, loan numbers, outstanding balances, interest rates, and payment terms. Categorize liabilities appropriately (e.g., mortgages, loans, taxes).

6. Income and Expense Tracking: Incorporate sections for chronological recording of all income generated and expenses incurred during the reporting period. Include fields for date, description, payee/payer, and amount.

7. Calculating Closing Balances: Include formulas or mechanisms for calculating the closing balances of assets, liabilities, and the overall estate value at the end of the reporting period. This reflects the net effect of all transactions.

8. Beneficiary Designation: Create a dedicated section for listing all beneficiaries, including their full legal names, contact information, and their respective entitlements to the estate’s assets. This ensures accurate distribution.

A well-designed template, incorporating these elements, facilitates accurate accounting, promotes transparency, and supports informed decision-making during estate administration. Regular review and refinement of the template may be necessary to adapt to changing circumstances and regulatory requirements.

Accurate and comprehensive accounting is paramount in estate administration. Structured documentation, provided by a well-designed template, ensures transparency, accountability, and facilitates informed decision-making. Key aspects include meticulous record-keeping of all transactions, clear asset and liability summaries, regular updates reflecting the estate’s evolving financial status, and unambiguous beneficiary designations. These elements contribute to a legally sound and efficient estate settlement process, protecting the interests of all stakeholders.

Effective estate administration requires more than just fulfilling legal obligations; it demands a commitment to clarity, accuracy, and open communication. Utilizing a robust template provides a framework for responsible financial management, minimizing potential disputes and ensuring the deceased’s wishes are carried out ethically and efficiently. This structured approach ultimately contributes to a smoother transition of assets and provides closure during a challenging time.