Utilizing such a document offers several advantages. It enables farmers to track profitability, identify potential cash shortages, and secure financing more easily. Furthermore, it helps in evaluating the financial impact of different operational strategies, optimizing expense control, and improving long-term planning. This enhanced financial awareness can lead to increased profitability and greater financial stability.

The following sections will delve deeper into the key components, practical applications, and diverse benefits of effective financial management in agriculture.

1. Income Tracking

Accurate income tracking forms the foundation of a reliable farm cash flow statement template. Meticulous recording of all revenue streamsincluding crop sales, livestock sales, government subsidies, and any other income generated by the farmis essential. This detailed record enables farmers to understand the true profitability of their operations. For example, a farm might appear profitable based on gross sales, but after accounting for all income sources and deducting expenses, the net profit might reveal a different picture. Without comprehensive income tracking, this critical insight would be missed.

Furthermore, income tracking facilitates effective financial planning and management. Knowing precisely how much revenue is generated and from which sources allows farmers to make informed decisions about resource allocation, investments, and expansion plans. For instance, if a specific crop consistently generates higher income than others, the farmer might consider allocating more resources to its production. Conversely, consistently low income from a particular source might signal the need for adjustments or discontinuation. This data-driven decision-making process is crucial for optimizing farm profitability and ensuring long-term financial stability.

In conclusion, meticulous income tracking is not merely a record-keeping exercise; it’s an indispensable component of effective farm financial management. It provides the basis for accurate cash flow projections, informs strategic decision-making, and ultimately contributes to the long-term success and sustainability of the farm business. The challenges of inconsistent income streams or fluctuating market prices can be better managed with a clear picture of revenue generation provided by comprehensive income tracking within a well-structured cash flow statement.

2. Expense Categorization

Expense categorization is fundamental to a comprehensive farm cash flow statement template. Categorizing expenses provides a granular view of where money is being spent, enabling informed decisions regarding cost control and resource allocation. Broad categories such as operating expenses, debt servicing, capital expenditures, and family living expenses provide a high-level overview. Further categorization within these broad areas offers a more detailed analysis. For instance, operating expenses can be further categorized into seed, fertilizer, fuel, labor, and repairs. This detailed breakdown allows farmers to identify areas of potential overspending or inefficiency. For example, if fuel costs consistently exceed projections, it might indicate the need to evaluate equipment efficiency or fuel purchasing strategies.

The practical significance of detailed expense categorization lies in its ability to empower data-driven decision-making. By understanding where money is going, farmers can make informed decisions about cost optimization. Suppose the cost of hired labor significantly impacts overall expenses. In that case, a farmer might explore alternative strategies such as investing in labor-saving equipment or adjusting planting schedules. Similarly, consistently high repair costs for specific machinery might justify replacing it with a newer, more reliable model. These decisions, based on concrete data derived from categorized expenses, contribute to improved financial performance and long-term sustainability.

Accurate expense categorization directly impacts the reliability and usefulness of a farm cash flow statement template. It allows for precise tracking of spending patterns, facilitates identification of areas for potential cost savings, and empowers strategic financial management. This granular understanding of expenses enables proactive adjustments to operational strategies, ultimately enhancing profitability and ensuring the long-term financial health of the farm business. Challenges such as unexpected equipment failures or rising input costs can be more effectively managed with a clear understanding of expense allocation facilitated by a well-structured cash flow statement.

3. Regular Monitoring

Regular monitoring of a farm cash flow statement template is crucial for maintaining financial health and making informed business decisions. It provides a dynamic view of the farm’s financial performance, enabling proactive adjustments to operational strategies and ensuring long-term stability. Consistent review allows for the identification of trends, potential issues, and opportunities for improvement.

- Frequency of ReviewEstablishing a regular review schedule, whether weekly, monthly, or quarterly, is essential. The frequency should align with the farm’s operational cycle and financial complexity. A dairy farm with daily income might benefit from weekly reviews, while a seasonal crop farm might find monthly or quarterly reviews sufficient. Consistent monitoring enables timely identification of deviations from projected cash flow, allowing for prompt corrective action. For instance, a consistent shortfall in cash flow from milk sales could prompt an investigation into production issues or market price fluctuations.

- Variance AnalysisComparing actual cash flow against projected figures is a critical aspect of regular monitoring. Significant variances, whether positive or negative, warrant further investigation. A positive variance in crop sales could indicate higher yields or favorable market conditions, while a negative variance might signal lower than expected production or unfavorable pricing. Analyzing these variances provides insights into the factors influencing financial performance and informs future projections.

- Trend IdentificationRegular monitoring allows for the identification of trends in income and expenses. For example, consistently rising input costs, such as fertilizer or fuel, could necessitate adjustments to operational strategies or pricing models. Similarly, identifying a downward trend in crop yields might prompt an investigation into soil health or pest management practices. Recognizing these trends enables proactive interventions and informed decision-making.

- Adaptive ManagementThe insights gained through regular monitoring empower adaptive management strategies. Identifying potential cash flow shortfalls allows for proactive measures such as securing financing, adjusting production plans, or exploring alternative revenue streams. Conversely, periods of positive cash flow can create opportunities for investments in infrastructure, equipment, or expansion. This dynamic approach to financial management, informed by continuous monitoring, enhances resilience and promotes long-term sustainability.

In conclusion, regular monitoring of the farm cash flow statement template is not merely a bookkeeping exercise but a vital management tool. It provides the basis for data-driven decision-making, enabling farmers to adapt to changing market conditions, optimize resource allocation, and ensure the long-term financial health of their operations. By integrating regular monitoring into their financial management practices, farmers can enhance profitability, mitigate risks, and achieve greater financial stability.

4. Projection analysis

Projection analysis, a critical component of effective farm financial management, utilizes a farm cash flow statement template as its foundation. By forecasting future income and expenses, projection analysis empowers informed decision-making, enhances preparedness for financial challenges, and facilitates strategic planning for long-term growth and stability. Understanding the intricacies of projection analysis is essential for optimizing farm profitability and navigating the complexities of agricultural economics.

- Scenario PlanningDeveloping multiple projection scenariosoptimistic, pessimistic, and most likelyallows farmers to anticipate various potential outcomes. For instance, an optimistic scenario might assume favorable weather conditions and high market prices, while a pessimistic scenario might factor in potential drought or disease outbreaks. This range of projections allows for better preparedness and risk mitigation. Understanding the potential financial implications of different scenarios enables proactive adjustments to operational strategies and financial planning.

- Sensitivity AnalysisAnalyzing the impact of changes in key variables, such as crop yields, input costs, or interest rates, on projected cash flow enhances understanding of financial vulnerability. For example, if a slight decrease in crop yield significantly impacts projected profitability, it highlights the need for strategies to mitigate production risks. This analysis informs decisions regarding crop diversification, insurance coverage, or cost reduction measures.

- Investment EvaluationProjection analysis plays a crucial role in evaluating the financial viability of potential investments, such as new equipment, infrastructure improvements, or land acquisition. By projecting the impact of these investments on future cash flow, farmers can make informed decisions about capital allocation. For instance, investing in irrigation infrastructure might require significant upfront costs but could lead to increased yields and profitability in the long run. Projection analysis helps quantify these potential benefits and informs investment decisions.

- Debt ManagementProjecting future cash flow is essential for effective debt management. By forecasting income and expenses, farmers can determine their ability to service existing debt and make informed decisions about future borrowing. This analysis helps avoid overextending financially and ensures the long-term sustainability of the farm business. For example, projecting a potential cash flow shortfall might necessitate restructuring debt or exploring alternative financing options.

Integrating projection analysis into farm financial management, using a well-structured cash flow statement template, provides a powerful tool for strategic decision-making. By forecasting future financial performance and analyzing potential risks and opportunities, farmers can enhance profitability, mitigate financial challenges, and ensure the long-term viability and success of their agricultural operations. This forward-looking approach empowers farmers to navigate the complexities of agricultural economics and achieve greater financial stability and growth.

5. Informed Decisions

A well-maintained farm cash flow statement template empowers informed decision-making, a cornerstone of successful agricultural operations. By providing a clear and comprehensive overview of financial performance, it facilitates strategic planning, risk management, and optimization of resource allocation. Understanding the connection between informed decisions and this financial tool is crucial for maximizing farm profitability and ensuring long-term sustainability.

- Strategic PlanningAccurate cash flow projections, derived from the statement template, inform strategic planning processes. Forecasting future income and expenses enables farmers to make informed decisions about crop selection, livestock management, and investment strategies. For example, projected cash flow shortfalls might necessitate diversifying income streams or adjusting production plans. Conversely, periods of positive cash flow can create opportunities for expansion or investment in new technologies.

- Risk ManagementAnalyzing historical and projected cash flow data allows for proactive risk management. Identifying potential financial vulnerabilities, such as reliance on a single crop or fluctuating market prices, enables farmers to implement mitigation strategies. For instance, diversifying crop production or utilizing hedging strategies can minimize the impact of market volatility on overall financial performance. The statement template facilitates informed decisions about risk mitigation, enhancing resilience and long-term stability.

- Resource AllocationUnderstanding cash flow patterns enables optimal resource allocation. By identifying periods of high and low cash flow, farmers can make informed decisions about capital expenditures, debt management, and operational expenses. For example, prioritizing essential repairs during periods of positive cash flow and deferring non-essential expenditures during lean periods optimizes resource utilization and minimizes financial strain.

- Financial Performance EvaluationThe farm cash flow statement template serves as a valuable tool for evaluating financial performance. Comparing actual results against projected figures allows for identification of areas of strength and weakness. This analysis informs decisions about operational adjustments, cost control measures, and pricing strategies. Consistent monitoring of cash flow and subsequent adjustments based on data-driven insights contribute to improved profitability and financial stability.

The farm cash flow statement template is not merely a record-keeping tool; it’s a dynamic instrument for informed decision-making. By providing a comprehensive view of financial performance, it empowers farmers to make strategic choices that optimize resource allocation, mitigate risks, and enhance profitability. This data-driven approach to farm management is essential for navigating the complexities of agricultural economics and ensuring long-term success and sustainability.

Key Components of a Farm Cash Flow Statement Template

A comprehensive farm cash flow statement template comprises several key components, each contributing to a thorough understanding of the financial status of an agricultural operation. These components provide a structured framework for tracking, analyzing, and projecting cash flow, enabling informed financial management.

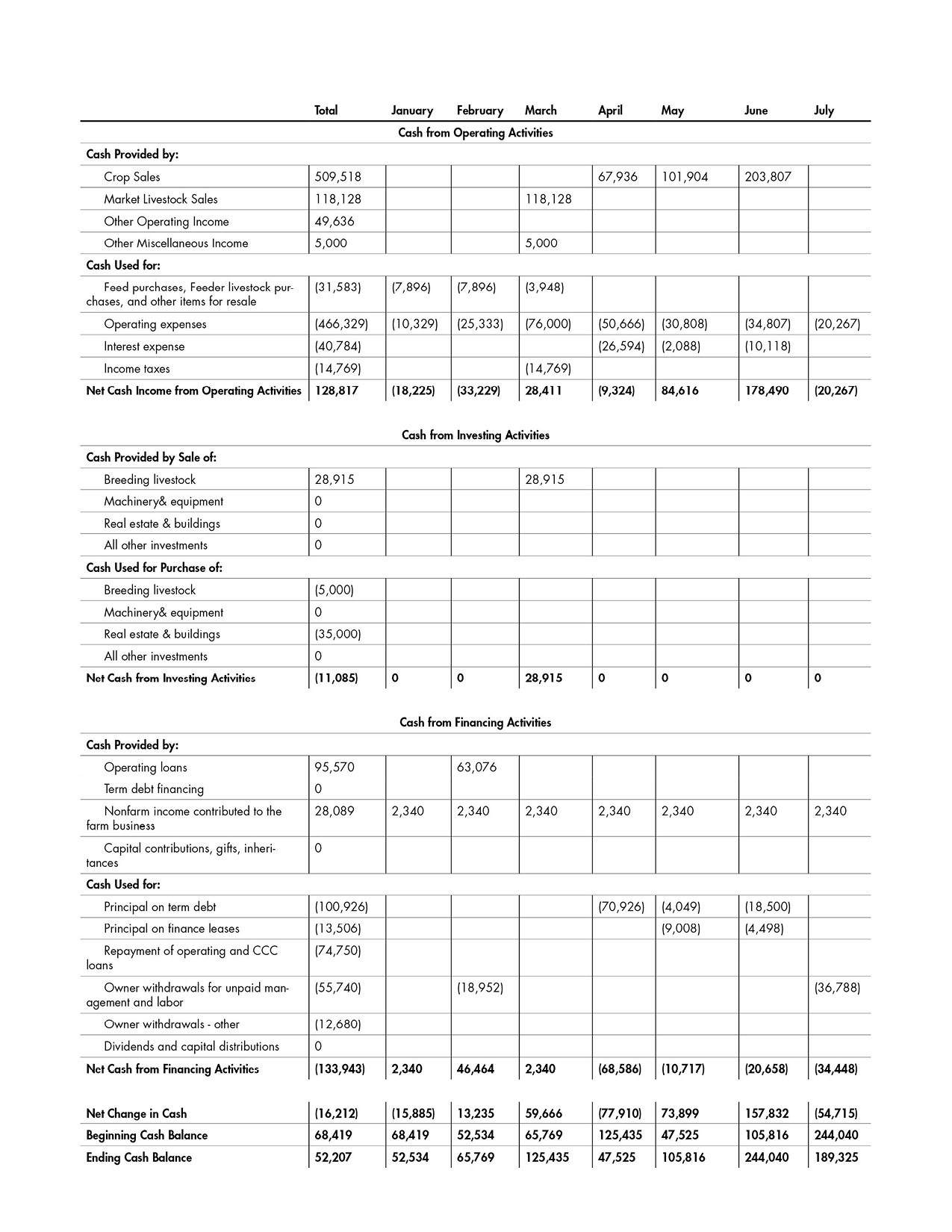

1. Operating Activities: This section details cash inflows and outflows directly related to the farm’s core production activities. Cash inflows typically include revenue from crop and livestock sales, government subsidies, and other agricultural income. Cash outflows encompass operating expenses such as feed, seed, fertilizer, labor, veterinary services, fuel, and repairs.

2. Investing Activities: This section captures cash flows related to the acquisition and disposal of long-term assets. Purchases of land, machinery, and breeding livestock represent cash outflows, while proceeds from the sale of these assets constitute cash inflows. Tracking these activities provides insights into long-term capital investments and their impact on overall cash flow.

3. Financing Activities: This component details cash flows related to debt, equity, and other financing arrangements. New loan proceeds represent cash inflows, while principal and interest payments constitute cash outflows. This section also includes any cash flows related to owner’s contributions or withdrawals. Understanding financing activities is crucial for assessing debt levels and overall financial stability.

4. Beginning Cash Balance: The starting cash balance for the chosen period, whether a month, quarter, or year, provides a baseline for tracking cash flow changes. This figure represents the cash available at the beginning of the period and is essential for calculating the ending cash balance.

5. Net Cash Flow: This crucial figure represents the difference between total cash inflows and total cash outflows during the specified period. A positive net cash flow indicates that the farm generated more cash than it spent, while a negative net cash flow signifies the opposite. Understanding net cash flow is fundamental to assessing financial performance.

6. Ending Cash Balance: Calculated by adding the net cash flow to the beginning cash balance, this figure represents the cash available at the end of the period. This ending balance serves as the beginning cash balance for the subsequent period, ensuring continuity in cash flow tracking.

7. Non-Cash Transactions: While not directly impacting cash flow, certain non-cash transactions, such as depreciation and changes in inventory, are often included in the statement for informational purposes. These transactions provide a more comprehensive view of the farm’s overall financial position and can influence future cash flow projections.

These interconnected components provide a holistic view of the farm’s financial health, enabling proactive management of cash resources and informed decision-making for long-term success.

How to Create a Farm Cash Flow Statement Template

Creating a farm cash flow statement template requires a systematic approach to ensure accuracy and comprehensiveness. The following steps outline the process of developing a template tailored to the specific needs of an agricultural operation.

1. Define the Reporting Period: Specify the timeframe for the cash flow statement, whether monthly, quarterly, or annually. The chosen period should align with the farm’s operational cycle and financial reporting requirements. A shorter reporting period provides more frequent insights into cash flow dynamics, while a longer period offers a broader overview.

2. Categorize Income Sources: List all potential sources of farm income, including crop sales, livestock sales, government subsidies, custom work, and other revenue streams. Detailed categorization enables precise tracking of income and facilitates analysis of revenue trends.

3. Itemize Operating Expenses: Create a comprehensive list of all operating expenses, including feed, seed, fertilizer, chemicals, fuel, labor, repairs, veterinary services, and other costs directly associated with production activities. Accurate expense tracking is crucial for identifying areas of potential cost savings.

4. Include Investing Activities: Account for cash flows related to the purchase and sale of long-term assets such as land, machinery, and breeding livestock. Tracking these investments provides insights into capital expenditures and their impact on overall cash flow.

5. Incorporate Financing Activities: Detail cash flows related to debt financing, including loan proceeds, principal payments, and interest payments. Also, include any cash flows related to owner’s contributions or withdrawals. This section is essential for assessing debt levels and overall financial stability.

6. Calculate Beginning and Ending Cash Balances: Establish the starting cash balance for the reporting period and calculate the ending balance by adding the net cash flow (total inflows minus total outflows) to the beginning balance. These figures provide a clear picture of cash flow changes over time.

7. Consider Non-Cash Transactions: While not directly affecting cash flow, include non-cash transactions such as depreciation and changes in inventory for informational purposes. These items offer a more comprehensive understanding of the farm’s financial position.

8. Utilize Spreadsheet Software: Employ spreadsheet software to create the template, allowing for easy data entry, calculations, and generation of reports. Spreadsheet software also facilitates scenario planning and sensitivity analysis.

A well-structured template facilitates accurate tracking of cash inflows and outflows, provides insights into financial performance, supports informed decision-making, and enhances the long-term financial stability of the farm operation. Regularly updating and analyzing the statement ensures its effectiveness as a management tool.

Effective financial management is paramount to the success and sustainability of any agricultural operation. A farm cash flow statement template provides the necessary framework for tracking, analyzing, and projecting cash flow, enabling informed decision-making regarding resource allocation, debt management, and investment strategies. From meticulous income tracking and detailed expense categorization to regular monitoring and insightful projection analysis, each component contributes to a comprehensive understanding of the farm’s financial health. Utilizing such a template empowers agricultural producers to navigate the complexities of fluctuating market conditions, optimize operational efficiency, and enhance long-term profitability.

The insights derived from a diligently maintained cash flow statement are not merely historical records but rather essential tools for future planning and growth. By embracing proactive financial management practices, agricultural businesses can enhance their resilience, mitigate risks, and achieve greater financial stability in the face of an ever-evolving agricultural landscape. The adoption and consistent utilization of a farm cash flow statement template represent a commitment to data-driven decision-making and a proactive approach to ensuring the long-term viability and prosperity of the agricultural operation.