Utilizing such a document allows for informed decision-making related to loan applications, financial planning, and investment strategies. It enables farmers to track progress, identify areas for improvement, and benchmark performance against industry averages. This structured approach to financial management empowers agricultural producers to secure a stronger financial future.

The following sections will delve deeper into the components of this essential financial tool, offering practical guidance on its creation and utilization for improved farm management.

1. Assets (current)

Accurate representation of current assets is fundamental to a comprehensive farm net worth statement. These assets, readily convertible to cash within one year, provide insight into the operation’s short-term liquidity and financial flexibility. A clear understanding of these liquid holdings is essential for informed decision-making and financial planning.

- Cash on Hand and in AccountsThis includes checking and savings accounts, readily available funds, and short-term certificates of deposit. These resources represent the most liquid assets and are crucial for meeting immediate operational expenses and short-term debt obligations. Proper accounting for these funds provides a clear picture of the farm’s ability to cover immediate financial demands.

- Market LivestockAnimals raised for sale in the near term, such as feeder cattle ready for market or finished hogs, constitute market livestock. Their valuation, typically based on current market prices, reflects a significant portion of a farm’s short-term financial strength. Accurate assessment of market livestock value is crucial for determining overall net worth and potential income.

- Stored CropsHarvested crops held for sale within the next year, like grain in storage bins, represent stored crops. These commodities, valued at current market prices, contribute significantly to a farm’s current assets. Proper inventory management and valuation are essential for reflecting their contribution to the overall financial picture.

- Prepaid ExpensesPrepaid items like insurance premiums or seed purchases represent an investment in future productivity and are considered current assets. These reflect expenses paid in advance, providing a benefit within the coming year. Including these prepaid items ensures a more accurate portrayal of the operation’s short-term financial position.

Accurately accounting for current assets offers a critical understanding of an operation’s short-term financial health. This information is vital for making informed decisions regarding operating expenses, short-term debt management, and future investments, contributing significantly to the overall assessment provided by the farm net worth statement.

2. Assets (intermediate)

Intermediate assets play a crucial role within a farm net worth statement template. These assets, typically holding a useful life of one to ten years, represent a significant portion of a farm’s productive capacity. Properly accounting for these assets provides a realistic assessment of the operation’s ongoing value and potential for future income generation. Their inclusion bridges the gap between liquid, short-term assets and the long-term investments that form the foundation of the farm’s operational structure.

Examples of intermediate assets include machinery like tractors, harvesters, and planting equipment; breeding livestock such as dairy cows, beef cattle, or sheep; and specialized farm vehicles. These assets are essential for daily operations and contribute directly to the farm’s ability to generate income. Their value, depreciated over time, reflects their remaining useful life and contribution to the farm’s overall worth. For instance, a recently purchased tractor contributes more significantly to the net worth than an older model nearing the end of its functional lifespan. Similarly, a healthy, productive breeding herd holds greater value compared to animals approaching retirement. Understanding these distinctions allows for a more accurate representation of the farm’s productive capacity and financial health.

Accurate valuation of intermediate assets is essential for informed decision-making regarding equipment replacement, livestock management, and overall financial planning. Overestimating or underestimating these values can lead to distorted financial projections and potentially hinder the farm’s long-term viability. By meticulously tracking and assessing the value of intermediate assets, farmers gain a clearer understanding of their operational capacity and can make strategic decisions for future growth and sustainability.

3. Assets (long-term)

Long-term assets represent the foundation of most agricultural operations and hold significant weight within a farm net worth statement template. These assets, expected to provide benefits for more than ten years, typically include land, buildings, and permanent improvements. Understanding their contribution to overall net worth is crucial for long-term financial planning and strategic decision-making. The value of these assets often appreciates over time, contributing significantly to a farm’s equity and borrowing power. For example, farmland in a desirable agricultural region may see substantial increases in value over decades, reflecting both its productive capacity and its underlying market value. Similarly, well-maintained farm buildings, such as barns or storage facilities, contribute to the overall operational efficiency and long-term value of the farm.

Accurate valuation of long-term assets is essential for a realistic representation of a farm’s financial position. This requires careful consideration of factors such as land quality, location, improvements, and market trends. For instance, irrigated land typically commands a higher value than non-irrigated acreage due to its increased productive potential. Similarly, a farm with modern, well-maintained buildings will likely hold a higher value than one with dilapidated structures. Regular assessments of these assets are critical, as fluctuations in land prices and the impact of depreciation on buildings can significantly influence overall net worth calculations. This accurate reflection of long-term asset values provides a stable basis for evaluating the farm’s financial health, informing long-term investment strategies, and securing financing.

Long-term assets form the backbone of agricultural operations, representing substantial investments that contribute to both current productivity and future growth. Accurately reflecting their value within a farm net worth statement is crucial for understanding the farm’s overall financial health and making informed decisions about future investments, expansion, or succession planning. This long-term perspective on asset management is essential for ensuring the sustainability and profitability of the farm for years to come.

4. Liabilities (current)

Current liabilities represent short-term financial obligations, due within one year, and play a crucial role within a farm net worth statement template. Accurate accounting for these liabilities provides a clear picture of short-term financial demands and informs decisions regarding cash flow management and operational expenses. These obligations, impacting the overall liquidity of the farm, are essential considerations for financial planning and lender assessments.

Examples of current liabilities include accounts payable to suppliers for inputs like feed, seed, or fertilizer; short-term loans due within the year, such as operating loans or lines of credit; and accrued expenses like wages, taxes, and interest payments. A farm with high current liabilities relative to its current assets may face challenges meeting immediate financial obligations. For instance, a large outstanding balance with a feed supplier coupled with a low cash balance could restrict the farm’s ability to purchase necessary inputs. Conversely, managing current liabilities effectively allows for greater financial flexibility and strengthens the farm’s financial standing. A farm consistently paying suppliers on time and maintaining a manageable debt load demonstrates sound financial practices, enhancing its credibility with lenders and suppliers.

Understanding current liabilities is essential for assessing a farm’s short-term financial stability and overall net worth. Accurately tracking and managing these obligations allows for proactive adjustments to operational expenses, debt management strategies, and input purchasing decisions. This meticulous attention to short-term financial health contributes to a more accurate net worth calculation and facilitates informed financial planning for the future. Effectively managing current liabilities ensures the farm maintains sufficient liquidity to meet immediate obligations and strengthens its overall financial position, as reflected within the farm net worth statement.

5. Liabilities (long-term)

Long-term liabilities represent financial obligations extending beyond one year and constitute a critical component of a farm net worth statement template. These obligations, typically associated with significant investments such as land acquisition or building construction, provide insights into the farm’s long-term financial commitments and capital structure. Accurately representing these liabilities is essential for understanding the farm’s overall financial health and its capacity for future investment.

Common examples of long-term liabilities include mortgages on farmland or buildings, equipment loans with extended repayment terms, and any other debt obligations not due within the next year. These long-term commitments influence a farm’s debt-to-asset ratio, a key metric used by lenders and financial analysts to assess financial stability. A farm with a high debt-to-asset ratio may face limitations in securing additional financing or weathering financial downturns. For instance, a substantial mortgage on a recently purchased parcel of land could restrict the farm’s ability to borrow additional funds for new equipment. Conversely, managing long-term debt effectively enhances financial flexibility and strengthens the farm’s overall financial outlook.

Understanding the impact of long-term liabilities is fundamental to interpreting a farm net worth statement. Accurately tracking these obligations, coupled with realistic projections of future income and expenses, allows for informed decisions regarding expansion, diversification, and succession planning. A farm with a manageable level of long-term debt and a clear plan for repayment demonstrates sound financial management. This strategic approach to long-term liabilities contributes to a more comprehensive understanding of the farm’s overall financial position and facilitates effective planning for future growth and stability. Accurate and transparent accounting for long-term liabilities provides a more accurate net worth calculation and allows for informed, data-driven decision-making crucial for the long-term success of the agricultural operation.

6. Equity (Net Worth)

Equity, representing the residual ownership interest in farm assets after all liabilities have been deducted, serves as the cornerstone of a farm net worth statement template. It provides a crucial indicator of financial health, reflecting the cumulative result of past financial decisions and the current financial standing of the operation. Understanding equity is fundamental to interpreting the statement and making informed decisions regarding future investments, expansion, and succession planning. This crucial metric provides a snapshot of the farm’s financial strength and its capacity to absorb potential losses or leverage future opportunities.

- Calculation of EquityEquity is calculated by subtracting total liabilities from total assets. This straightforward calculation provides a clear picture of the farm’s net worth at a specific point in time. A positive equity indicates that the farm’s assets exceed its liabilities, while a negative equity signifies that liabilities exceed assets. For example, a farm with $2 million in assets and $1 million in liabilities has an equity of $1 million. This positive equity position demonstrates financial stability and provides a cushion against potential financial challenges. Regularly calculating and tracking equity allows farmers to monitor their financial progress and make informed adjustments to their operational strategies.

- Relationship to SolvencyEquity directly reflects a farm’s solvency, its ability to meet long-term financial obligations. A strong equity position indicates a higher degree of solvency and a greater capacity to withstand financial downturns. For instance, a farm with a high equity position is better equipped to absorb unexpected losses from crop failures or market fluctuations. Conversely, a low equity position increases vulnerability to financial distress. Maintaining a healthy equity position is crucial for long-term financial stability and provides a buffer against unforeseen circumstances.

- Impact of Asset and Liability ChangesChanges in asset values and liability balances directly impact equity. An increase in asset values, such as land appreciation, increases equity, while an increase in liabilities, such as taking on a new loan, decreases equity. For example, rising land values in a particular region can significantly increase a farm’s equity without any additional investment. Similarly, paying down existing debt reduces liabilities and increases equity, strengthening the farm’s financial position. Understanding these dynamics is crucial for managing both assets and liabilities effectively to maximize equity growth.

- Importance for Lending and InvestmentEquity plays a critical role in securing financing and attracting potential investors. Lenders often use equity as a key factor in loan approval decisions, as a higher equity position reduces lending risk. Investors also consider equity when evaluating potential investment opportunities, viewing it as an indicator of financial stability and growth potential. A strong equity position enhances a farm’s ability to access capital for expansion, modernization, or other strategic investments. Building and maintaining a healthy equity position through sound financial management practices is essential for long-term financial success and attracting potential investors.

Equity serves as a crucial indicator of financial health, reflecting the cumulative impact of operational and financial decisions. Regularly monitoring and analyzing equity within the context of a farm net worth statement template empowers agricultural producers to make informed decisions, optimize financial strategies, and ensure the long-term viability and prosperity of their operations.

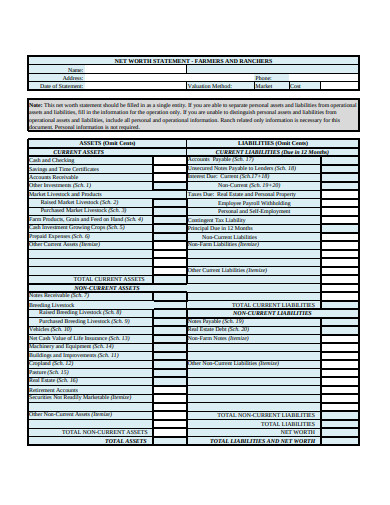

Key Components of a Farm Net Worth Statement

A comprehensive farm net worth statement requires careful consideration of several key components, providing a holistic view of an operation’s financial standing. These components, encompassing both assets and liabilities, offer valuable insights for informed decision-making and long-term financial planning.

1. Current Assets: Liquid assets readily convertible to cash within one year. Examples include cash, market livestock, stored crops, and prepaid expenses. These represent the resources available to meet immediate financial obligations and operational expenses.

2. Intermediate Assets: Assets with a useful life of one to ten years, essential for ongoing operations. Examples include machinery, breeding livestock, and farm vehicles. Their value depreciates over time, reflecting their remaining productive capacity.

3. Long-Term Assets: Assets providing benefits for more than ten years, forming the foundation of the operation. Examples include land, buildings, and permanent improvements. These assets often appreciate in value and contribute significantly to long-term financial stability.

4. Current Liabilities: Short-term financial obligations due within one year. Examples include accounts payable, short-term loans, and accrued expenses. Managing these obligations effectively is crucial for maintaining short-term liquidity.

5. Long-Term Liabilities: Financial obligations extending beyond one year, often associated with significant investments. Examples include mortgages and long-term loans. These liabilities impact the farm’s debt structure and long-term financial stability.

6. Equity (Net Worth): Calculated by subtracting total liabilities from total assets, representing the owner’s residual interest in the farm. This crucial metric reflects the overall financial health and solvency of the operation, serving as a key indicator for lenders and investors.

Accurate accounting for these interconnected components provides a comprehensive financial overview, enabling informed decision-making for improved farm management, financial planning, and long-term sustainability. This structured approach to financial assessment empowers agricultural producers to navigate financial complexities and secure a stronger financial future.

How to Create a Farm Net Worth Statement

Creating a farm net worth statement involves a systematic approach to organizing financial information. This process provides a clear snapshot of the farm’s financial position at a specific point in time, enabling informed decision-making and effective financial planning.

1. Choose a Date: Specify the date for the statement, ensuring all information reflects the financial status on that particular date. This allows for accurate tracking of financial progress over time.

2. List Current Assets: Itemize all current assets, including cash, market livestock, stored crops, and prepaid expenses. Obtain current market values for livestock and crops to ensure an accurate representation of these liquid holdings.

3. List Intermediate Assets: Document all intermediate assets, such as machinery, breeding livestock, and farm vehicles. Depreciate these assets appropriately based on their age and remaining useful life. Utilize reliable valuation methods to reflect accurate market values.

4. List Long-Term Assets: Include all long-term assets, primarily land, buildings, and permanent improvements. Obtain appraisals or use comparable sales data for accurate valuation of these significant holdings.

5. List Current Liabilities: Itemize all current liabilities, including accounts payable, short-term loans, and accrued expenses. Ensure accurate recording of outstanding balances on these short-term obligations.

6. List Long-Term Liabilities: Document all long-term liabilities, such as mortgages and long-term loans. Verify outstanding principal balances on these long-term debts.

7. Calculate Total Assets and Total Liabilities: Sum the values of all asset categories and all liability categories to determine overall totals.

8. Calculate Net Worth (Equity): Subtract total liabilities from total assets to arrive at the net worth figure. This key metric represents the owner’s equity in the farm operation.

Regularly updating the statement, typically annually, allows for tracking financial progress and identifying areas for improvement. This organized approach to financial management empowers agricultural producers to make data-driven decisions, optimize resource allocation, and plan for long-term financial success.

Accurate and consistent utilization of a farm net worth statement template provides an invaluable tool for assessing financial health, informing strategic decision-making, and planning for long-term financial stability within agricultural operations. This structured approach to financial management facilitates informed decisions regarding investments, debt management, and operational adjustments. The statement provides a clear snapshot of assets, liabilities, and overall equity, enabling farmers to monitor progress, identify areas for improvement, and benchmark performance against industry averages. This comprehensive understanding of financial position empowers agricultural producers to navigate financial complexities, mitigate risks, and secure a stronger financial future.

Regularly reviewing and updating this essential financial document allows for proactive adaptation to changing market conditions and informed responses to emerging financial challenges. This commitment to diligent financial management is crucial for ensuring the long-term viability and prosperity of agricultural operations, contributing to a more resilient and sustainable agricultural sector. The farm net worth statement serves not only as a record of past performance but also as a roadmap for future financial success.