Utilizing such a structured financial overview allows farmers to track profitability, identify areas for improvement, and make informed decisions about future investments. This analysis can reveal cost-saving opportunities, highlight profitable enterprises, and facilitate better resource allocation. Moreover, a well-maintained record of income and expenses is essential for securing loans, attracting investors, and ensuring compliance with tax regulations.

The following sections will delve deeper into the key components of this financial tool, offering practical guidance on its creation and interpretation. Specific examples illustrating its application in various farming scenarios will also be provided.

1. Revenue

Revenue forms the cornerstone of a farm profit and loss statement template, representing the income generated from various agricultural activities. Accurate revenue recording is essential for determining a farm’s financial health and profitability. This includes income from crop sales, livestock sales, government subsidies, and other farm-related income sources. For example, a grain farm’s revenue would primarily consist of sales of wheat, corn, or soybeans, while a dairy farm’s revenue would be derived from milk sales and potentially sales of calves. Diversified farms may have a more complex revenue structure encompassing multiple income streams.

Accurately categorizing and recording revenue streams allows for precise profit calculations and informed business decisions. Understanding the contribution of each revenue stream to overall profitability enables farmers to identify strengths and weaknesses within their operations. For instance, if livestock sales consistently outperform crop sales on a diversified farm, this knowledge can inform future investment decisions, such as expanding livestock operations or optimizing crop production strategies to enhance profitability. Additionally, detailed revenue tracking simplifies tax reporting and assists in securing financing.

A thorough understanding of revenue and its impact on a farm’s financial position is crucial for long-term sustainability. Challenges such as fluctuating market prices and unpredictable weather patterns can significantly impact revenue. Analyzing historical revenue data within the context of a profit and loss statement can help farmers anticipate potential challenges, develop mitigation strategies, and make informed decisions to adapt to changing market conditions. This includes diversifying revenue streams, implementing risk management strategies, and optimizing production processes to enhance resilience and ensure long-term financial stability.

2. Expenses

A comprehensive understanding of expenses is fundamental to interpreting a farm profit and loss statement template. Accurate expense tracking allows for precise profit calculation, identification of cost-saving opportunities, and informed decision-making regarding resource allocation. Categorizing expenses provides valuable insights into the cost structure of the farm operation and its impact on overall profitability.

- Direct CostsDirect costs are directly associated with the production of agricultural goods. Examples include seed, fertilizer, pesticides, animal feed, veterinary care, and fuel. These costs fluctuate based on production volume and market prices for inputs. Accurately tracking direct costs helps assess the profitability of individual crops or livestock enterprises. Analyzing trends in direct costs can reveal opportunities for improved efficiency, such as optimizing fertilizer application or negotiating better prices for inputs.

- Indirect Costs/OverheadIndirect costs, also known as overhead, are not directly tied to specific production activities but are essential for farm operation. Examples include rent or mortgage payments, property taxes, insurance, depreciation of equipment, and administrative expenses. These costs are typically fixed or semi-fixed, meaning they do not fluctuate significantly with production volume. Monitoring indirect costs is crucial for identifying potential savings through refinancing, renegotiating insurance premiums, or improving administrative efficiency.

- Labor CostsLabor costs encompass wages paid to employees, as well as associated expenses such as payroll taxes and benefits. Labor can be a significant expense, especially for labor-intensive operations. Effective labor management is crucial for maximizing productivity and minimizing costs. Analyzing labor costs in relation to production output can help optimize staffing levels and identify opportunities for automation or process improvements.

- Interest ExpensesInterest expenses represent the cost of borrowing money to finance farm operations or capital investments. These costs depend on the amount borrowed, interest rates, and loan terms. Managing debt effectively is critical for long-term financial stability. Analyzing interest expenses helps assess the impact of debt on profitability and informs decisions regarding refinancing or debt reduction strategies.

By carefully tracking and analyzing these expense categories within the framework of a farm profit and loss statement template, agricultural producers can gain valuable insights into their financial performance and make informed decisions to improve profitability and long-term sustainability. Comparing expense ratios against industry benchmarks allows for identification of areas where performance lags and highlights opportunities for improvement. This data-driven approach is essential for navigating the complex financial landscape of modern agriculture.

3. Profitability

Profitability, a core component of any business analysis, is inextricably linked to the farm profit and loss statement template. This financial document serves as the primary tool for calculating and analyzing farm profitability. By providing a structured overview of revenue and expenses, the statement allows farmers to determine net income, a key indicator of financial success. Net income, calculated by subtracting total expenses from total revenue, represents the profit generated by the farm operation over a specific period. Understanding profitability is not merely about calculating a final number; it’s about gaining insights into the factors driving or hindering financial success.

Consider a hypothetical scenario where two farms generate identical revenue. However, upon examining their respective profit and loss statements, it becomes evident that Farm A maintains significantly lower operating expenses than Farm B. This disparity in expense management directly impacts net income, revealing higher profitability for Farm A. This example highlights the importance of cost control and efficiency in achieving profitability. A detailed analysis of the profit and loss statement allows farmers to pinpoint areas where costs can be reduced without compromising production, thus enhancing overall profitability. Furthermore, analyzing profitability trends over time enables informed decision-making regarding investments, expansion plans, and resource allocation.

Analyzing profitability through a farm profit and loss statement facilitates proactive financial management. Identifying trends in revenue and expenses empowers farmers to anticipate potential challenges and implement strategies to mitigate risks. For instance, consistently declining profitability might signal the need to diversify revenue streams, adopt new technologies to improve efficiency, or renegotiate input costs. The profit and loss statement serves as a crucial decision-making tool, providing the necessary information to navigate market fluctuations, optimize resource utilization, and ensure the long-term financial health and sustainability of the farm operation. Furthermore, understanding and demonstrating profitability is essential for securing financing, attracting investors, and ensuring the continued viability of the agricultural business.

4. Time Period

The time period covered by a farm profit and loss statement template is a crucial determinant of the insights it provides. Selecting an appropriate time frame directly influences the analysis of revenue, expenses, and ultimately, profitability. Common time periods include monthly, quarterly, and annually, each offering a unique perspective on farm financial performance. Short-term periods, such as monthly statements, offer granular detail, allowing for close monitoring of operational efficiency and rapid identification of emerging trends. For example, a sudden spike in feed costs in a particular month can be readily identified and investigated, enabling prompt corrective action. Conversely, longer-term periods, like annual statements, provide a broader overview of the farm’s financial health, facilitating strategic planning and long-term investment decisions.

Comparing performance across different time periods adds depth to financial analysis. Analyzing year-over-year performance, for instance, reveals long-term trends in profitability, growth, and efficiency. This longitudinal perspective can highlight the impact of investments in new technologies, changes in market conditions, or the effectiveness of cost-saving initiatives. Furthermore, comparing performance against industry benchmarks within specific time frames allows farmers to assess their competitive standing and identify areas for improvement. For example, a farmer might discover that their operating expenses for a given quarter are significantly higher than the industry average, prompting a closer examination of cost structures and potential inefficiencies.

Selecting the appropriate time period for a farm profit and loss statement is a strategic decision influenced by specific analytical goals. Short-term statements facilitate operational adjustments, while long-term statements support strategic planning. Integrating both short-term and long-term analyses provides a comprehensive understanding of farm financial performance, enabling proactive management, informed decision-making, and enhanced long-term sustainability. This nuanced approach to time period selection empowers farmers to leverage the full potential of the profit and loss statement as a critical management tool.

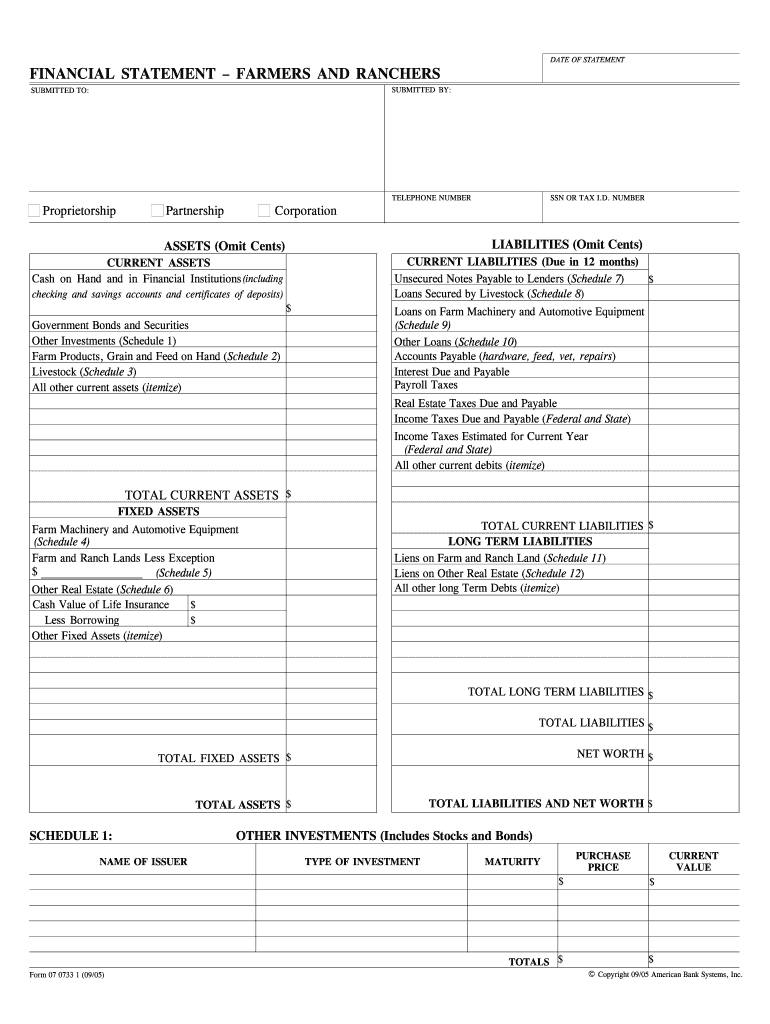

5. Standardized Format

A standardized format is essential for maximizing the utility of a farm profit and loss statement template. Consistency in structure and categorization ensures comparability across different time periods and facilitates benchmarking against industry averages. A standardized template typically includes sections for revenue, categorized by source (e.g., crop sales, livestock sales); operating expenses, categorized by type (e.g., feed, fertilizer, labor); and non-operating income and expenses (e.g., interest income, loan payments). This structured approach allows for a clear and concise overview of financial performance, enabling accurate profit calculation and insightful trend analysis. For instance, consistent categorization of expenses allows for year-over-year comparisons of feed costs, revealing potential inefficiencies or the impact of changing market prices. Without standardization, comparing financial performance across different periods becomes challenging, hindering effective decision-making.

Consider a scenario where a farm uses different expense categories each year. One year, fuel costs might be categorized under “operating expenses,” while the next year, they might be included under “vehicle maintenance.” This inconsistency makes it difficult to track trends in fuel consumption and identify potential cost savings. A standardized format ensures that data is consistently categorized, allowing for meaningful comparisons and informed decision-making. Furthermore, using a standardized template facilitates communication with stakeholders, such as lenders and investors, who rely on consistent financial reporting to assess risk and make investment decisions. A standardized profit and loss statement presents a clear and professional image of the farm operation, enhancing credibility and facilitating access to financial resources.

Standardization in a farm profit and loss statement template is not merely about consistency; it’s about enabling effective financial management. It empowers informed decision-making through accurate data analysis, trend identification, and performance benchmarking. By adhering to a standardized format, farmers gain valuable insights into their operations, enabling them to optimize resource allocation, control costs, and enhance long-term profitability. This structured approach to financial reporting is crucial for navigating the complexities of modern agriculture and ensuring the continued success of the farm business.

6. Actionable Insights

A farm profit and loss statement template’s ultimate value lies in its ability to generate actionable insights. These insights, derived from the analysis of revenue and expenses, empower informed decision-making and drive improvements in farm operations. A well-structured statement transcends mere financial reporting; it becomes a strategic tool for enhancing profitability, optimizing resource allocation, and ensuring long-term sustainability. The connection between the statement and actionable insights is a direct one: the data within the statement informs specific actions aimed at improving financial performance. For instance, if the statement reveals consistently high feed costs relative to livestock sales, a farmer might explore alternative feed sources, adjust feeding practices, or investigate potential health issues impacting herd productivity. These targeted actions, informed by data, are the essence of actionable insights.

Consider a scenario where a farm experiences declining profitability despite steady revenue. Analysis of the profit and loss statement reveals a significant increase in labor costs. This insight prompts the farm manager to evaluate labor efficiency, potentially identifying opportunities for automation, process improvement, or workforce restructuring. Alternatively, if the statement reveals a substantial portion of revenue comes from a single crop susceptible to market fluctuations, this insight might lead to diversification efforts, reducing reliance on a single income source and mitigating risk. These examples demonstrate the practical significance of deriving actionable insights from the profit and loss statement. The ability to translate financial data into concrete actions is crucial for navigating the complexities of agricultural economics and ensuring long-term business viability.

Extracting actionable insights requires a thorough understanding of the farm operation and the ability to interpret financial data within the context of specific production practices and market conditions. While the statement provides the raw data, critical thinking and analytical skills are essential for translating numbers into meaningful actions. This process often involves identifying underlying causes of financial performance issues, evaluating potential solutions, and implementing changes strategically. Successfully leveraging the farm profit and loss statement as a tool for generating actionable insights empowers farmers to make data-driven decisions, optimize resource allocation, and enhance the long-term profitability and sustainability of their operations.

Key Components of a Farm Profit and Loss Statement Template

Essential elements comprise a comprehensive farm profit and loss statement template, providing a structured view of financial performance. Understanding these components is crucial for informed decision-making and effective farm management.

1. Farm Identification: Clearly identifies the farm or agricultural business, including name, address, and reporting period. This ensures accurate record-keeping and facilitates comparison across multiple periods or entities.

2. Revenue Section: Details all income generated from farm operations. Categorization by sourcecrop sales, livestock sales, government subsidies, and other incomeenables detailed analysis of revenue streams and their contribution to overall profitability.

3. Operating Expenses Section: Itemizes all costs directly associated with running the farm. Categorization by typefeed, fertilizer, labor, fuel, repairs, and other operating costsfacilitates cost control and identification of potential inefficiencies.

4. Gross Profit: Calculated by subtracting total operating expenses from total revenue. This key metric reflects the profitability of core farm operations before accounting for non-operating income and expenses.

5. Non-Operating Income and Expenses: Includes income and expenses not directly related to core farm operations, such as interest income, loan payments, and depreciation. These items impact overall profitability and provide insights into the farm’s financial structure.

6. Net Profit/Loss: Represents the final profitability calculation, derived by subtracting total expenses (operating and non-operating) from total revenue. This bottom-line figure indicates the overall financial success or challenge of the farming operation during the specified period.

Accurate data entry and consistent categorization within these components allow for meaningful analysis of farm financial performance. This data-driven approach empowers informed decision-making regarding resource allocation, cost management, and strategic planning, ultimately contributing to enhanced profitability and long-term sustainability.

How to Create a Farm Profit and Loss Statement Template

Creating a farm profit and loss statement requires a systematic approach to ensure accuracy and facilitate meaningful analysis. The following steps outline the process of developing a comprehensive template.

1. Define the Reporting Period: Specify the time frame covered by the statement (e.g., month, quarter, year). This timeframe determines the scope of the financial data included.

2. Categorize Revenue Streams: Establish clear categories for all sources of farm income. Typical categories include crop sales, livestock sales, government payments, and other income. This categorization enables detailed analysis of revenue contributions.

3. Categorize Operating Expenses: Create categories for all farm operating costs. Common categories include feed, seed, fertilizer, labor, fuel, repairs, and depreciation. Detailed categorization facilitates cost control and identification of potential inefficiencies.

4. Establish a Standardized Format: Use a consistent format for presenting revenue and expense categories. This ensures comparability across different reporting periods and facilitates trend analysis. A standardized format also improves clarity for stakeholders.

5. Gather Financial Data: Collect all relevant financial records, including invoices, receipts, bank statements, and sales records. Accurate data collection is fundamental to a reliable profit and loss statement.

6. Input Data into the Template: Populate the template with the collected financial data, ensuring accurate placement within the designated categories. Meticulous data entry minimizes errors and ensures the integrity of the financial analysis.

7. Calculate Key Metrics: Calculate gross profit (total revenue minus total operating expenses) and net profit/loss (gross profit plus non-operating income minus non-operating expenses). These metrics provide insights into overall profitability.

8. Analyze the Results: Review the completed statement to identify trends, areas for improvement, and potential cost-saving opportunities. Compare results against previous periods and industry benchmarks to assess performance.

A well-constructed farm profit and loss statement provides a crucial foundation for informed financial management. Accurate data collection, consistent categorization, and a standardized format are essential for generating meaningful insights and enhancing the long-term sustainability of the farm operation.

Effective farm management hinges on a clear understanding of financial performance. A structured financial document tailored to agricultural businesses provides the necessary framework for analyzing revenue, expenses, and profitability. From detailed categorization of income streams and operating costs to the calculation of key metrics like gross and net profit, this document empowers data-driven decision-making. Standardization ensures comparability across reporting periods, facilitating trend analysis and benchmarking. Ultimately, the value of such a document lies in its ability to generate actionable insights for optimizing resource allocation, controlling costs, and enhancing long-term sustainability.

In the complex landscape of modern agriculture, informed financial management is paramount. Leveraging the insights provided by this structured financial tool allows agricultural producers to navigate market fluctuations, mitigate risks, and make strategic decisions that drive profitability and ensure the continued viability of their operations. The consistent application and thoughtful analysis of this document are essential for achieving long-term success in the agricultural industry.